Improving Customer Lifetime Value: A Strategic Imperative for Banks

Brian's Banking Blog

Sustainable growth in banking is not driven by transactions, but by relationships. The executive focus must shift from chasing short-term acquisition volume to a disciplined strategy of improving customer lifetime value. This is not a marketing initiative; it is a fundamental reorientation of the business model around long-term profitability.

This requires a rigorous, data-driven understanding of the total profit potential of each customer relationship over its entire duration. Every strategic decision, from product development to customer service investment, must be guided by its impact on the lifetime value of the bank's most important asset: its customer base.

Moving Beyond Transactions to True Lifetime Value

Historically, banking has operated on a transactional model where success was measured by new accounts opened or loans originated. This approach is obsolete. In today's competitive landscape, a singular focus on acquisition is an inefficient allocation of capital.

The definitive measure of a bank's health and future profitability is its ability to deepen and expand existing customer relationships.

This is the strategic importance of Customer Lifetime Value (CLV). CLV is not a marketing metric; it is a core financial calculation representing the total net profit a bank can expect from a customer throughout their entire relationship—from an initial deposit account to a mortgage, commercial loan, and wealth management services.

Redefining Profitability Through a CLV Lens

Adopting a CLV framework fundamentally changes executive-level conversations.

Instead of asking, "How many mortgages did we close this quarter?" the question becomes, "What is the projected lifetime profitability of these new mortgage clients, and what is our strategy to secure their primary banking relationship?" This shift is critical.

Consider the data: increasing customer retention by a mere 5% can increase profits by 25% to 95%. The evidence is clear—retaining and expanding existing relationships delivers a superior return on investment. The full research on how retention impacts profitability validates this imperative.

For bank leadership, this perspective reframes customer service from a cost center into a direct profit driver. It transforms marketing from a broad acquisition tool into a precision instrument for targeted, profitable engagement with high-value segments.

The objective is to stop viewing customers through the narrow keyhole of individual product profitability. The institution must see the complete picture of their potential value. This requires an unwavering commitment to data-driven decision-making.

To execute this strategy, the metrics used to measure success must evolve accordingly.

Key Metrics Shifting from Acquisition to Lifetime Value

This table contrasts the legacy acquisition-focused model with the modern CLV-centric approach.

| Metric Focus | Traditional Metric (Acquisition-Focused) | Modern Metric (CLV-Focused) | Strategic Implication for Banks |

|---|---|---|---|

| Growth | New Accounts Opened | Customer Lifetime Value (CLV) | Prioritizes long-term relationship profitability over short-term volume. |

| Customer Health | Account Balance | Customer Satisfaction (CSAT) & Net Promoter Score (NPS) | Measures loyalty and advocacy, which are leading indicators of retention. |

| Efficiency | Cost Per Acquisition (CPA) | Retention Rate & Churn Rate | Shifts focus from the cost of acquiring a customer to the value of keeping one. |

| Engagement | Number of Transactions | Products Per Customer & Cross-Sell Ratio | Focuses on deepening relationships and increasing share-of-wallet. |

| Profitability | Product-Level Profit | Customer Profitability Segments | Allows for targeted investment in high-value customer relationships. |

The strategic shift is from counting transactions to cultivating value.

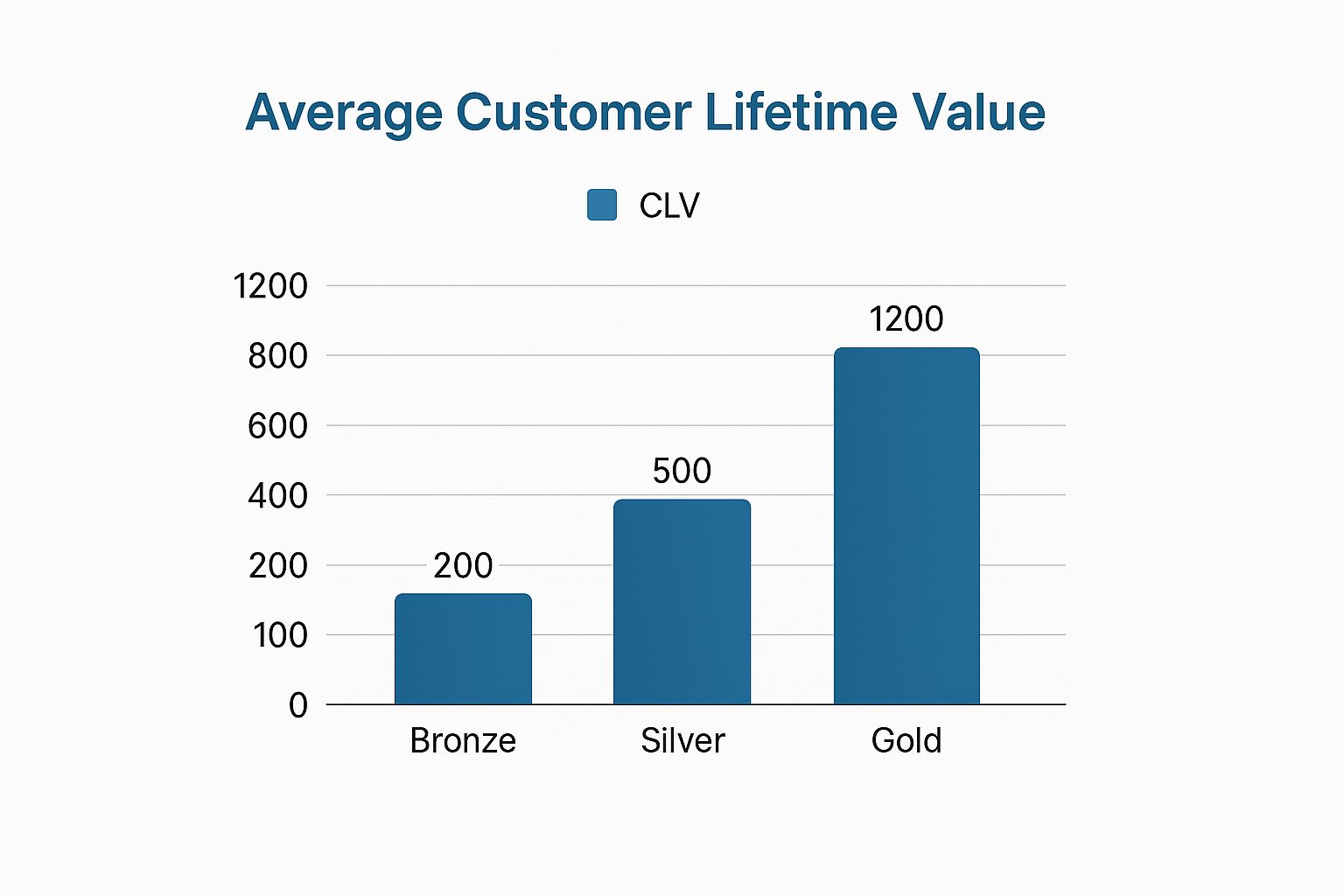

The chart below illustrates the significant value disparity across a typical customer base, underscoring the inadequacy of a uniform strategy.

As shown, a 'Gold' customer can be worth six times more than a 'Bronze' customer, demanding a proportionally greater investment in retention and personalized service.

Making these distinctions is impossible without a robust data intelligence engine. A platform like Visbanking’s BIAS is essential, providing the clarity to transform raw data into a strategic roadmap for growing CLV. Before you can improve, you must have an accurate baseline.

Putting Your Data to Work with Smart Segmentation

A one-size-fits-all customer strategy is not just outdated; it is a significant misallocation of resources. The key to improving lifetime value is to leverage the institution's data—transactional records, digital behavior, and product holdings—to drive strategy.

This data, when properly analyzed, allows a bank to move beyond broad, ineffective categories and understand its customers based on behavior and potential value.

Finding the Groups That Matter

Effective segmentation is not an academic exercise; it transforms complex data into a clear strategic framework. It allows leadership to see distinct customer groups with specific needs, behaviors, and opportunities. For a deeper analysis of this discipline, refer to our guide on effective bank customer segmentation.

Consider these practical, data-driven segments:

- High-Value Depositors with a Single Product: These customers have already placed significant trust in the institution. Holding only one product, such as a mortgage, represents a clear cross-sell opportunity for wealth management, investment services, or a HELOC. Their financial stability is proven; the next step is to deepen the relationship.

- Digitally Engaged, Early-Career Professionals: While their current balances may be modest, their high engagement with digital banking platforms signals their future potential. This segment is ideal for automated savings tools, introductory investment products, and credit cards designed to grow with them. Nurturing this group builds a long-term pipeline of high-value clients.

- Affluent Retirees with Decreasing Activity: This high-value segment presents a significant retention risk. A sudden drop in direct deposits or a series of large outward transfers are critical warning signals of potential attrition. This group requires proactive, personal outreach from a trusted banker, not a generic email campaign, to preempt competitive encroachment.

This is precisely where modern business intelligence platforms provide their value. They enable the real-time identification of these segments and trends, moving beyond static reports to flag both risk and opportunity.

From Insight to Action

Identifying these segments is only the first step. The next is to translate that insight into targeted, profitable action. A platform like Visbanking’s BIAS helps quantify the potential value within each segment.

For example, an analysis revealing that 20% of your 'High-Value Depositors' hold zero investment products with your bank is not merely an observation; it represents a potential $75 million in new assets under management.

This becomes a measurable target around which a strategy can be built. It provides leadership with the necessary clarity to direct relationship managers toward the most significant opportunities, creating a direct link between data intelligence and bottom-line results.

To lead the market, a bank must understand its customers with surgical precision. Explore Visbanking’s BIAS platform to see how we help you uncover the value hidden within your own data.

Architecting Personalized Customer Journeys

Identifying high-value customer segments is the diagnostic phase. The financial returns are realized when this knowledge is converted into strategic action.

Generic, mass-market messaging is ineffective. Meaningful personalization is no longer about using a customer's first name in an email; it is about anticipating their needs based on data and positioning the bank as an essential partner in their financial life.

This is not a "soft" initiative; it has a direct impact on profitability. Research confirms that 80% of customers are more likely to do business with companies that offer personalized experiences. Proactive, data-driven engagement directly influences the bottom line.

From Data Insights to Proactive Intervention

Execution depends on data triggers. Monitoring transactional and behavioral patterns allows your team to identify opportune moments to intervene with relevant, value-added offers.

Consider these real-world scenarios:

- The International Traveler: Data flags a customer initiating frequent international wire transfers. Instead of allowing them to incur standard fees, a relationship manager proactively calls: "I noticed you're conducting more international business. Our premium account offers preferential forex rates and waives wire fees. Let's get you set up." The bank earns a relationship fee of $50 per month, the customer saves over $200 in monthly fees, and loyalty is solidified.

- The Unexpected Windfall: A direct deposit significantly larger than the customer's typical salary—an inheritance or bonus—is flagged. This triggers a financial advisor to offer a consultation on investment options or high-yield savings products, capturing an average of $250,000 in new assets under management per conversion.

- The Aspiring Entrepreneur: An account shows a new pattern of payments to web hosting services and SaaS companies. This is a clear indicator of a nascent business. The bank should proactively offer a consultation on business banking, small business loans, or merchant services before the customer seeks these services from a competitor.

This is the strategic shift: from a passive utility to a proactive advisor. By actively helping customers optimize their financial position, a bank builds loyalty that is difficult for competitors to disrupt.

Systematizing Personalized Engagement

Consistent execution requires more than skilled bankers; it requires a system that automatically surfaces these opportunities. A robust business intelligence platform connects transaction history, product holdings, and digital activity to create a unified customer view.

A modern approach to customer relationship management for banks is critical. It enables the institution to systematically identify and act on these moments, converting routine interactions into opportunities that significantly increase CLV.

The objective is to create a banking experience so seamless and valuable that clients would not consider an alternative. A data intelligence platform like Visbanking’s provides your team with the tools to act with this level of precision.

Putting Smart Cross-Selling Frameworks into Action

Effective cross-selling is not about pushing products. It is the natural result of a trusted advisory relationship built on a deep, data-backed understanding of a customer’s needs.

For banking executives, this distinction is paramount. A poorly timed, generic offer erodes trust and diminishes customer lifetime value. In contrast, a relevant, needs-based recommendation solidifies the bank's role as the primary financial partner. The strategy must shift from selling products to solving financial problems, a transition fueled entirely by data intelligence.

A sophisticated approach identifies specific life-stage triggers within customer data. These are moments of financial change that create a natural opening for a proactive, helpful conversation.

Spotting the Key Life-Stage Triggers

Instead of executing broad campaigns, focus resources on these high-probability events. A strong analytics platform can flag these moments automatically, converting raw transaction data into actionable opportunities for relationship managers.

Consider these data-driven scenarios:

- A large, non-payroll deposit appears in an account: This is a trigger. An inheritance or the sale of a business warrants an immediate, personal conversation about investment services or private banking, not a generic marketing email.

- A customer consistently maximizes retirement contributions: An individual hitting their 401(k) or IRA limits annually has additional investment capacity. This is a clear opening to discuss brokerage accounts or other wealth-building strategies.

- A recent graduate's first direct deposit is received: This marks the beginning of a long financial journey. While a mortgage is not an immediate need, a credit-building credit card, an auto loan, or an introduction to a simplified investment platform are timely and relevant offers.

The core insight is this: your data is already signaling your customers' next financial needs. The challenge is having the systems in place to listen and act on those signals with speed and precision.

This is where data transitions from a passive asset to a revenue-generating engine.

Imagine an analysis shows that 35% of your prime mortgage holders have zero investment products with your bank. This is not just a statistic—it is a significant, multi-million-dollar opportunity. If the average untapped investment potential is $100,000 per household in this segment of 500 customers, you are sitting on a potential $50 million in new assets under management.

This is a concrete metric that justifies investment in superior data intelligence. It provides the clarity needed to allocate resources effectively, transforming the bank from a reactive service provider into a proactive growth engine.

Winning in this environment requires knowing how your cross-selling efforts compare to the market. A critical first step is to explore how Visbanking’s data can show you where your biggest opportunities for improving customer lifetime value truly lie.

Modernizing Loyalty to Boost Customer Retention

Transactional, points-based loyalty programs are relics of a bygone era. For banking leaders, the objective is not merely to reward a transaction but to build unwavering brand allegiance.

A modern loyalty strategy is a direct investment in improving customer lifetime value. It is about constructing a competitive moat that makes your best clients resistant to competitor solicitations.

When executed correctly, a sophisticated loyalty program deepens the entire banking relationship. It moves beyond superficial rewards to create tangible value that strengthens the bank’s market position.

From Points to Privileges

The most effective loyalty programs are built on a foundation of data-driven segmentation. The motivators for a high-net-worth individual differ entirely from those of an emerging professional. The strategy is to craft tiered experiences that reflect a customer's total relationship value, not just their latest transaction.

Consider implementing these data-informed strategies:

- Relationship-Based Pricing: Offer preferential rates on loans and deposits to customers who consolidate their financial life with your bank. For example, a client with a mortgage, an investment account, and a high-balance checking account should automatically qualify for a 0.25% rate reduction on their next auto loan.

- Exclusive Access: Provide top-tier clients with a dedicated senior banker or invitations to exclusive wealth management seminars. This is not just a perk; it reinforces their value and delivers substantive financial guidance.

- Curated Lifestyle Partnerships: Form alliances with brands that your high-value segments frequent, such as offering airport lounge access or preferred pricing at premium retailers.

This strategic approach is central to any serious effort for boosting customer retention in banking. It transforms loyalty from a cost center into a powerful profit driver.

A modern loyalty program should function less like a rewards system and more like a privileged membership. It is an acknowledgment of the customer's total value and a clear signal of the institution's investment in their long-term financial success.

Market trends confirm this direction. The loyalty management market, a key lever for improving CLV, is valued at $13.31 billion in 2024 and is projected to reach $41.21 billion by 2032. Investment in this area is accelerating.

The Defensibility of Deep Relationships

Executing this strategy requires a clear, real-time view of your customer base. Business intelligence platforms are non-negotiable for identifying which clients qualify for which tiers and, crucially, for tracking the ROI of these loyalty investments.

Imagine your data flags that 15% of your top-tier clients have experienced a decline in average monthly deposits over the last quarter. This is a critical retention risk signal. A modern loyalty framework enables a proactive response, such as offering a personalized bonus rate or a complimentary financial review, thereby mitigating potential attrition.

Ultimately, a well-designed loyalty program is a powerful defensive tool. It creates a value proposition so strong that it becomes exceedingly difficult for competitors to replicate.

The first step is to understand your current position. To see how your retention and loyalty metrics stack up, explore Visbanking’s data and benchmark your performance against your peers.

Benchmarking Your Performance for Market Leadership

Executing data-driven segmentation, personalization, and retention is no longer optional; it is the core discipline of modern banking. Improving customer lifetime value is not a finite project but a continuous strategic cycle. The banks that master this discipline will dominate the market.

These pillars—customer understanding, tailored journeys, and modern loyalty—are interconnected. A deficiency in one area compromises the entire strategy. A bank that excels at segmentation but fails at personalization is merely producing insightful reports with no financial impact.

Conversely, a bank that sends personalized offers without a robust retention strategy is chasing short-term sales while ignoring long-term profitability and ceding market share. Market leadership is achieved when these functions are integrated into a single, data-powered growth engine.

Measuring Your Position in the Market

Internal progress tracking is essential, but it is insufficient. The critical question for every bank executive is: How does our performance compare to our direct competitors?

An internal increase in CLV is positive, but if peers are growing it twice as fast, you are falling behind.

Competitive intelligence is the missing piece for many institutions. Without it, strategic decisions are made in a vacuum. You must know your market position before you can chart a course for leadership.

Consider this common scenario:

- Your bank increases its average products per high-value household from 2.5 to 2.7 over the year—an internal success.

- However, market data reveals your top competitor in the same region increased its average from 2.6 to 3.1 during the same period.

That internal victory is now reframed as a competitive threat. It indicates a rival’s strategy for deepening relationships is outperforming yours. This is the type of insight that creates the urgency to re-evaluate and refine your own strategy.

Understanding your current standing is the non-negotiable first step toward market leadership. You cannot win a race without knowing where the finish line is and who else is on the track.

This is precisely why benchmarking is so critical. It provides an objective, external view of your performance and exposes strategic gaps. It is the difference between guessing and knowing, between reacting and leading.

The strategies discussed are the tools. Competitive benchmarking is the compass that ensures they are being used to move in the right direction. To see how your institution's performance truly measures up, it is time to look at the hard data.

See how your CLV efforts compare to your peers. Explore Visbanking’s competitive intelligence data and get the clarity you need to lead your market.

Answering Your Top Questions About CLV

When leadership shifts from legacy metrics to a CLV-focused strategy, critical questions inevitably arise. This transition is not about tracking a new number; it's about re-engineering how the entire organization creates long-term value.

Here are direct answers to the most common questions from bank executives.

What’s the Absolute First Thing We Should Do?

Before launching any campaign or retention offer, you must get your data house in order. The single most critical first step is to build a clean, reliable data infrastructure that enables accurate customer segmentation.

You must be able to confidently identify your high-value clients, your core customer base, and those exhibiting attrition risk.

Without this foundational clarity, any strategic initiative is guesswork—a recipe for wasted marketing spend and missed opportunities. This is not an IT project; it is the bedrock of a successful CLV strategy.

How Do We Actually Measure the ROI on This?

To measure the ROI of CLV initiatives, you must move beyond bank-wide metrics and track performance within specific customer segments before and after a strategic action.

For example, if you launch a campaign to cross-sell investment products to your 'High-Value Depositors' segment, you would measure success by tracking that specific cohort over the subsequent six months, looking for metrics such as:

- The average products per customer increasing from 2.1 to 2.4.

- A 15% increase in the average investment balances held by those customers.

- The churn rate for that high-value segment decreasing from 3% to 1.5%.

This provides a clear, defensible narrative to the board, demonstrating precisely how these efforts are impacting the bottom line.

Who Needs to Be on Board for This to Work?

Attempting to implement a CLV strategy from a single department is a guaranteed path to failure. It cannot be siloed within marketing. Success requires a dedicated, cross-functional commitment.

You need active participation from Marketing, Retail Banking, Lending, Customer Service, Data Analytics, and Product Development.

Most importantly, the shift must be championed from the top down. When the executive team establishes that the entire organization’s mandate is to cultivate long-term value, not just process transactions, the institution aligns and begins to win.

Guessing what works is a losing strategy. Market leaders do not rely on internal assumptions; they measure themselves against objective, hard data.

If you want to see how your CLV efforts truly stack up against your peers, you need competitive intelligence. Get the clarity you need to lead your market with Visbanking. Explore what's possible at https://www.visbanking.com.

Similar Articles

Visbanking Blog

What was the last financial service you bought?<br>Why did you buy it?

Visbanking Blog

Make More Informed Decisions with BIAS, the Data-Driven Banking Solution

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

Explore Banking Data: Financial Analysis with VISBANKING

Visbanking Blog

Navigating the Future: Decoding Financial Trends with VISBANKING Data Analytics

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

Outperform with Confidence: How Visbanking's Performance Tool Transforms Banking Strategy

Visbanking Blog

The Future of Financial Analytics: Solutions by VISBANKING

Visbanking Blog

Imagine being able to cut through the noise and directly access the most relevant, reliable and recent banking data in real time

Visbanking Blog