How to Reduce Employee Turnover in Your Bank

Brian's Banking Blog

High employee turnover is not an HR issue; it is a direct threat to your bank's profitability, client stability, and strategic growth. A reactive approach is insufficient. The only effective strategy is data-driven: diagnosing the root causes of attrition, benchmarking compensation and culture against direct competitors, and implementing targeted changes with a measurable return on investment.

The Hidden Costs of Employee Turnover

Employee turnover is a silent drain on a bank's P&L, stability, and client relationships. The direct costs of recruitment and training are merely the surface. The substantive damage lies in the erosion of institutional knowledge and operational efficiency.

When a seasoned lender or operations manager departs, they take with them years of accumulated institutional capital—nuanced client histories, undocumented processes, and critical relationships. This knowledge is irreplaceable and its loss creates immediate operational friction.

The disruption cascades through the remaining team. Staff are burdened with additional responsibilities while attempting to onboard new hires, a process that invariably slows productivity and increases the risk of error.

Quantifying the Financial Drag

Consider a community bank with $500 million in assets. A seemingly modest 5% increase in annual turnover can quietly drain over $250,000 in indirect costs from the P&L.

This financial leakage manifests in several areas:

- Operational Inefficiency: Delays in loan processing, increased compliance errors, and diminished customer service quality become more frequent as new employees navigate steep learning curves.

- Strategic Stagnation: Key initiatives stall. Business development slows as management focus shifts from growth to backfilling critical roles.

- Erosion of Client Trust: High turnover in client-facing roles signals instability. It causes high-value clients to question the bank's long-term reliability.

This is a strategic risk that demands executive attention. A significant portion of this financial bleed is the often-underestimated recruitment cost per hire, which becomes a recurring liability when key positions are in constant flux.

From Anecdote to Actionable Intelligence

To effectively manage turnover, executive teams must move beyond anecdotal exit interview feedback and into rigorous data analysis. With replacement costs often exceeding 100% of an employee's annual salary, the financial imperative is clear.

The first step is to establish a baseline. Is your 15% turnover rate a five-alarm fire, or is it market-competitive? Without context, the number is meaningless. Data provides that context.

By leveraging peer data, executives can benchmark critical metrics—from turnover rates to compensation expenses—against a curated group of peer institutions comparable in asset size and geography. This analysis determines whether the issue is an internal cultural deficiency or a broader industry trend.

This is precisely where a data intelligence platform like Visbanking delivers its value. It cuts through market noise, providing a clear, comparative analysis of your bank's performance against the competition, transforming vague concerns into a decisive action plan.

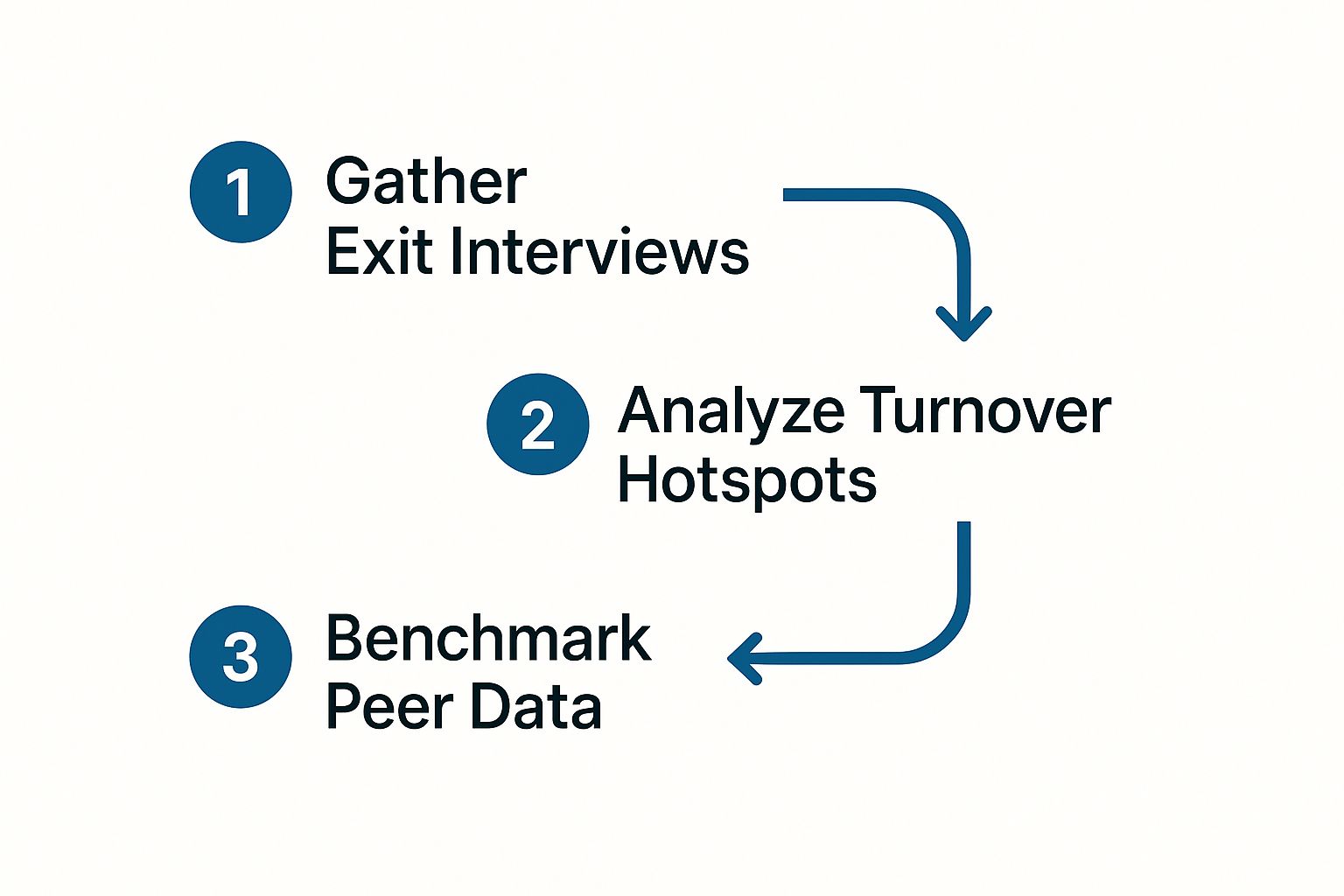

Before allocating capital to retention initiatives, a precise diagnosis is required. The following sections outline how to use data to uncover the true drivers of turnover within your institution.

Diagnosing Turnover with Precision Data

You cannot solve a problem you do not fundamentally understand. Banks frequently misallocate capital on retention bonuses or across-the-board raises, only to see attrition rates remain unchanged. This is the result of guesswork, not strategy.

Effective retention begins with a precise diagnosis. Blanket solutions are inefficient. A data-driven approach is required to identify the specific reasons employees are leaving, ensuring that every dollar invested in retention yields a measurable return.

Your bank is already a repository of critical data. The process starts with an internal analysis of exit interviews, performance reviews, and employee surveys—often underutilized yet highly revealing sources of intelligence.

Pinpointing Internal Turnover Drivers

A bank-wide turnover percentage is a vanity metric; it provides no actionable insight. The critical questions are granular: Is the bank losing its best junior lenders after three years? Is one branch a revolving door for tellers? Does the highest-performing manager also have the highest team attrition rate? Answering these questions transforms an ambiguous problem into a solvable one.

Disaggregate your data to reveal the underlying narrative.

- By Tenure: If employees consistently depart around the 18-month mark, it may indicate a flawed onboarding process or a misalignment between recruitment promises and operational reality.

- By Role and Performance: The loss of top-quartile loan officers is a critical business risk. The loss of chronic underperformers may be a net positive. It is essential to differentiate.

- By Department or Branch: Isolate the hotspots. If one branch exhibits double the turnover rate of all other locations, the problem is localized—likely stemming from management, team culture, or specific market pressures.

This granular analysis converts raw data into a clear narrative about who is leaving and why, providing a precise target for corrective action.

This structured internal review is the foundation. It prepares you for the next critical step: benchmarking your performance against the competition.

Gaining Perspective with External Benchmarking

Internal data reveals what is happening. External peer data determines if it is a problem. This is where a platform like Visbanking provides a decisive strategic advantage, converting isolated statistics into actionable intelligence.

An internal turnover rate of 12% is merely a data point. However, if your direct market competitors average 8%, you have a significant problem. Conversely, if their average is 16%, your bank is outperforming the market, and resources can be allocated elsewhere. Context is everything.

Imagine discovering your salary expenses are at the 50th percentile for your peer group. If compensation is competitive, the root cause of turnover is likely not financial. The problem is more likely embedded in your culture, management practices, or lack of defined career pathways.

Without this benchmark, the default action is often to increase compensation—a costly and ineffective solution to the wrong problem.

The following framework outlines the data points required to build a comprehensive diagnostic picture.

Turnover Diagnostic Framework Key Data Points

| Data Category | Specific Metrics | Diagnostic Question Answered |

|---|---|---|

| Internal Quantitative | Turnover Rate (by tenure, role, dept.), Avg. Employee Performance Rating (of leavers vs. stayers) | Who is leaving, and from where? |

| Internal Qualitative | Exit Interview Themes (compensation, management, culture), Employee Engagement Survey Scores | Why are they telling us they are leaving? |

| External - Peer Comp | Peer Turnover Rates, Peer Salary & Benefits as % of Assets | Is our turnover rate a material problem compared to peers? |

| External - Market | Generational Workforce Trends, Regional Job Market Data, Competitor Hiring Activity | What external market forces are impacting our workforce? |

This framework shifts the focus from simple tracking to strategic interpretation.

Broader market trends must also be considered. Data indicates that 40% of Gen Z workers and 25% of millennials intend to leave their jobs within two years. You can learn more about these employee turnover statistics to understand how these generational shifts may be impacting your institution.

This is the methodology for moving from reactive measures to proactive solutions. It provides the executive team and the board with confidence that the bank's retention strategy is built not on assumptions, but on a rigorous, comparative analysis of its competitive position.

Winning the Talent War with Strategic Compensation

A strong culture and defined career paths are essential, but if your compensation package is not competitive, you will lose top talent. In banking, high-performers have options, and your competitors are actively recruiting them. A strategic approach to total rewards is no longer defensive; it is a core component of your growth strategy.

Effective compensation strategy requires moving beyond generic salary surveys. It demands a forensic analysis of your entire rewards structure—base pay, incentive compensation, benefits, and long-term incentives—benchmarked against a curated peer group of banks comparable in asset size, geography, and business model.

This is how you identify the vulnerabilities that lead to high-value departures. The objective is not to be the highest bidder for every role, but to be strategic and surgical in your capital allocation.

It's Not Just About the Base Salary

A singular focus on base salary is a common and costly mistake. While important, it is only one component of the total rewards package. Your top loan officers, wealth managers, and business bankers are driven by incentive compensation. A non-competitive bonus structure can render a competitive base salary irrelevant.

Consider this scenario: a $750 million community bank discovers its teller salaries are at the 75th percentile relative to its peers. However, a deeper data analysis reveals its commercial loan officer incentive plan pays out, on average, 20% below the market median. This single data point explains the bank's inability to retain its most critical revenue-producers. Without this insight, the board might have approved a costly, bank-wide salary increase, completely missing the actual problem.

A data intelligence platform like Visbanking provides this level of granular insight. It allows you to stop relying on generalized survey data and start comparing specific compensation metrics against the institutions you directly compete with for talent.

The Financial Sustainability Test

An aggressive compensation strategy must be financially sustainable. The goal is to balance talent acquisition with operational efficiency. The key metric for every executive to monitor is personnel expenses as a percentage of average assets.

This ratio is the ultimate litmus test of your compensation philosophy. If your personnel expense ratio is significantly higher than your peers' yet your turnover remains high, it is a clear indicator of a misaligned strategy. You are spending the money, but it is not delivering the desired outcome.

For example, if your bank's ratio is 1.45% while your peer average is 1.20%, yet you continue to lose seasoned lenders, the issue is not how much you are spending, but how you are spending it. This insight enables a surgical response—adjusting incentive plans, re-evaluating benefits, or restructuring compensation in specific departments rather than implementing broad, expensive changes that fail to address the root cause.

Building a Rewards Strategy That Actually Works

To design a compensation plan that reduces attrition, you must have a complete picture of the competitive landscape.

- Role-Specific Benchmarking: Do not rely on bank-wide averages. Compare compensation for key roles—loan officers, branch managers, compliance specialists—against the appropriate peer group.

- Incentive Plan Analysis: Go beyond base salary. How do your bonus and commission structures for revenue-generating roles compare to the market?

- Benefits Competitiveness: Quantify the value of your health insurance, retirement contributions, and paid time off. A superior benefits package can be a powerful retention tool, but only if its value is effectively communicated.

- Long-Term Incentives: For the executive team, are your equity or phantom stock plans competitive? This is non-negotiable for retaining senior leadership.

When your compensation strategy is anchored in hard data, it transitions from a reactive expense to a proactive investment. This ensures every dollar spent on personnel is optimized to attract, motivate, and—most importantly—retain the talent required to win.

Building a Culture That Retains Top Performers

A strategic compensation plan is a necessary defense against poaching. However, to decisively win the talent war and reduce turnover, you must build a culture that makes high-performers want to stay.

For ambitious banking professionals, a clear path for advancement and a sense of being valued are often more powerful motivators than marginal increases in compensation. Your culture is your most defensible competitive advantage. A competitor can always offer more money; they cannot replicate a superior work environment.

This requires moving beyond the perfunctory annual review. Your high-potential employees are constantly evaluating their career trajectory. If they cannot see a clear path forward within your institution, they will find one elsewhere.

Architecting Meaningful Career Paths

Hope is not a strategy. Vague promises of future opportunities are no longer sufficient. Your top talent requires a transparent roadmap detailing the specific skills, experiences, and performance metrics required to achieve their next promotion.

Contrast two approaches:

- Bank A (The Traditional Model): Relies on informal discussions and annual reviews. Junior lenders have no clear understanding of the criteria for promotion to Vice President. They become frustrated and depart for competitors where the path to advancement is more clearly defined.

- Bank B (The Strategic Model): Implements a formal career pathing program. Every role has a documented competency model and a realistic timeline for progression. Junior analysts are paired with senior leaders in a structured mentorship program, providing them with guidance and executive exposure.

The result: Bank B’s turnover among high-potential employees is 40% lower than Bank A’s. The investment in this program is minimal compared to the significant and recurring cost of replacing key talent. A critical component of this is learning how to foster a positive workplace culture where employees feel invested in the institution's success.

The Powerful ROI of Recognition

While career paths provide a long-term vision, consistent recognition addresses the immediate human need to feel valued. This is not primarily about financial rewards. In fact, non-monetary recognition is one of the highest-ROI retention activities an organization can undertake.

It costs virtually nothing, yet directly counteracts the feeling of being "just a number" that often drives employees to seek opportunities elsewhere.

A culture of recognition is not about handing out plaques. It is about building a system where exceptional work is consistently and publicly celebrated, reinforcing the specific behaviors that drive the bank's success.

This means acknowledging smaller victories as well. Recognize the compliance officer who identified a critical risk in a team meeting. Celebrate the branch team that exceeded its deposit growth targets. These consistent, small acts of acknowledgment build a sense of loyalty that a paycheck alone cannot.

Data intelligence platforms like Visbanking can help identify your top-performing branches and teams. By linking this performance data to your internal recognition efforts, you can draw a direct correlation between a culture of appreciation and tangible business results.

The data will confirm what effective leaders already know: investing in your people is a direct investment in your bank's future.

Measuring the ROI of Your Retention Strategy

To secure board approval for retention initiatives, you must speak the language of finance. This means framing your strategy as a smart investment with a tangible return.

Without quantifiable proof of financial upside, your initiative is merely another line-item expense—an easy target during the next budget cycle. The ability to measure the impact of your retention efforts is essential for making sound, long-term decisions about human capital.

A successful retention strategy does not simply lower the turnover rate; it creates positive ripple effects across the organization. It is your responsibility to connect these effects directly to the bottom line.

Key Metrics for Proving Financial Impact

To build a compelling business case, focus on a few high-impact KPIs. These metrics will paint a clear before-and-after picture, translating your efforts into cost savings and efficiency gains.

The numbers that matter most to the board are:

- Turnover Rate Reduction: This is the headline metric, but its true value is in the details. Focus on the reduction among critical roles and top performers, where attrition is most costly.

- Time-to-Fill for Open Positions: A more stable workforce naturally reduces hiring demand. A shorter time-to-fill minimizes operational disruption and reduces burnout among remaining staff.

- Recruitment Cost Savings: This is straightforward arithmetic. Quantify the savings on recruiter fees, job board advertising, and the internal HR hours dedicated to sourcing candidates.

- Improved Employee Engagement Scores: While seemingly "soft," this metric is a powerful leading indicator of future turnover and productivity.

National turnover statistics provide general context but are often too broad to be actionable. Knowing the U.S. voluntary turnover rate was recently 13.0% is less useful than understanding that some sectors experience attrition as high as 26.7%. This is why generic benchmarks are insufficient. You can discover more insights about workforce turnover trends to see the significant variation by industry.

A Real-World Look at Quantifiable Success

Consider a regional bank with $1.2 billion in assets. Using Visbanking, they identify a critical problem: the turnover rate for their commercial lenders with less than five years of tenure is an alarming 25%, significantly above the peer average of 15%. They calculate that the replacement cost for each lender is $150,000.

Leadership implements a targeted initiative with a one-time budget of $200,000, allocated to strategic salary adjustments for this group and a new mentorship and career development program.

After 18 months, the bank's tracking shows the turnover rate for this cohort has fallen from 25% to 21.5%—a 3.5 percentage point reduction.

The following table demonstrates the return on this investment.

Sample ROI Calculation for a Retention Initiative

This table shows a hypothetical ROI calculation for a bank that invested in a targeted program to reduce turnover among its commercial lenders.

| Metric | Before Initiative | After Initiative | Financial Impact |

|---|---|---|---|

| Annual Turnover Rate (Target Group) | 25.0% | 21.5% | -3.5 percentage points |

| Number of Lenders in Group | 80 | 80 | N/A |

| Annual Departures | 20 | 17 | 3 fewer departures |

| Cost Per Replacement | $150,000 | $150,000 | N/A |

| Total Annual Replacement Cost | $3,000,000 | $2,550,000 | $450,000 Savings |

| Initiative Investment (One-Time) | N/A | N/A | -$200,000 |

| Net Savings (First Year) | N/A | N/A | $250,000 |

This example clearly demonstrates how a well-placed investment can yield significant financial returns, far outweighing the initial cost.

By preventing just three lender departures annually, the bank avoided $450,000 in replacement costs. After subtracting the $200,000 program investment, the net savings in the first year alone was $250,000.

This is the kind of data-driven proof that elevates a one-time project into a core component of your talent strategy. Continuous analysis allows you to validate these wins and justify future investments, shifting your approach from reactive problem-solving to building a resilient, high-performance organization.

Answering Your Top Questions on Bank Employee Turnover

As a bank executive, managing human capital is a primary responsibility. Retaining top talent is critical to achieving strategic objectives. Here are direct answers to the most common questions regarding employee turnover.

What’s Considered a "High" Turnover Rate for a Community Bank?

There is no single "high" number. The figure is only meaningful in context.

An annual turnover rate of 15% may seem concerning. However, if your direct peer group—banks of similar asset size and in the same geographic market—is averaging 20%, your institution is actually outperforming.

Conversely, if that peer average is 10%, your 15% rate is a significant red flag demanding immediate investigation.

Key Takeaway: Cease comparing your bank to generic national averages. The only metrics that matter are your own internal trends and your performance relative to a carefully selected peer group. This is how a simple data point becomes a powerful diagnostic tool.

How Do We Figure Out if a Manager Is the Problem?

A combination of quantitative and qualitative analysis is required.

Begin with the data. Generate turnover reports by department or branch. If one manager consistently exhibits a higher attrition rate than their peers, that is your quantitative indicator.

However, do not stop there. Corroborate this data with confidential employee engagement surveys and skip-level interviews. Ask direct questions regarding management style, team support, and the overall work environment. When this qualitative feedback aligns with the quantitative data and exit interview themes, you have a complete picture. This allows you to address an isolated leadership issue before it negatively impacts the broader culture.

What's the Best Retention Strategy When Our Budget Is Tight?

When capital is constrained, focus on high-impact, low-cost strategies. Two of the most effective initiatives require minimal financial outlay:

- A Structured Recognition Program: This is not about generic "employee of the month" awards. It is about the public and genuine acknowledgment of top performers. This costs very little but significantly boosts morale by demonstrating that excellence is seen and valued.

- A Transparent Career Path: Clearly document the path to advancement for key roles. Show employees the exact criteria required to reach the next level. When ambitious individuals see a tangible future within your organization, they have a powerful incentive to stay that often outweighs a modest salary increase from a competitor.

These cultural investments build loyalty in a way that marginal compensation adjustments cannot.

We Think Pay Is Our Main Problem. Where Do We Even Start?

Do not act on a hunch. Begin with data.

Initiate a detailed total compensation analysis, benchmarking your bank against the specific competitors to whom you are losing talent. This analysis must include base salary, incentive compensation, benefits, and any long-term incentive plans.

You may find that your base salaries are competitive, but your loan officer incentive plan is 15% below the market median. This single insight identifies a primary driver of revenue-generating talent attrition. This targeted, data-backed approach prevents the misallocation of capital and ensures that every dollar invested in your team has the maximum strategic impact.

Ready to move from guesswork to data-driven decision-making for your workforce? Visbanking provides the peer benchmarks and talent analytics you need to pinpoint the true drivers of turnover and build a retention strategy that delivers a measurable ROI. Explore our platform today.

Similar Articles

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

Revolutionize Your Bank's Performance with BIAS: Unlocking the Future of Visual Banking Data

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

In the world of banking, digital transformation is no longer a 'nice-to-have'. It's a necessity

Visbanking Blog

BIAS: Your Competitive Edge in Banking Data Driven Strategy

Visbanking Blog

Make More Informed Decisions with BIAS, the Data-Driven Banking Solution

Visbanking Blog

Outperform with Confidence: How Visbanking's Performance Tool Transforms Banking Strategy

Visbanking Blog

How Bank Efficiency Ratios Reveal Hidden Operational Costs

Visbanking Blog

Banking Talent Crisis: Why Top Professionals Are Leaving

Visbanking Blog