A Guide to Commercial Real Estate Lending

Brian's Banking Blog

Commercial real estate lending is a cornerstone of institutional banking, but the market dynamics are fundamentally shifting. Winning in this environment is no longer about managing risk by interpreting lagging indicators; it's about identifying opportunities with forward-looking data. This guide is for bank executives and directors who understand that navigating today's market demands precision, not intuition.

Redefining Commercial Real Estate Lending

The traditional rules of CRE lending are insufficient for the current operating environment. Macroeconomic headwinds, volatile interest rates, and evolving borrower expectations create significant risks—and substantial advantages for institutions prepared to act decisively.

Yesterday’s playbook, built on static quarterly reports and broad market assumptions, is too slow for the speed at which capital and risk now move. Waiting for delinquency reports to identify portfolio weakness means you are already behind. The critical strategic shift is from a reactive posture to a predictive one.

The Shift to Data-Driven Decisions

This pivot is fueled by granular data. Top-performing banks are no longer just collecting data; they are weaponizing it to drive strategy. Consider a common scenario: a bank prices its multifamily loans within a consistent statewide band. With precise competitive intelligence, its leadership could discover their yields are 35 basis points below the peer average in specific high-growth submarkets. That delta represents millions in forgone interest income annually.

The challenge for bank executives is not a lack of information but a surplus of noise. The objective is to isolate the signals that matter—from sector-specific performance trends to hidden concentration risks—that will determine portfolio resilience and profitability.

This guide provides a framework for embedding a data-first methodology into CRE lending operations. We will analyze key market trends and demonstrate how robust analytics illuminate both hidden risks and overlooked opportunities.

This new approach requires leadership to answer critical questions with confidence:

- Where are the genuine pockets of opportunity in our target markets?

- How does our CRE loan performance truly stack up against key competitors?

- Are our underwriting standards aligned with forward-looking market realities?

By leveraging a platform like Visbanking’s Bank Intelligence and Action System (BIAS), your team can transition from observing dashboards to making decisive moves. A logical first step is to benchmark your CRE portfolio performance. Understand your competitive position and identify your next strategic imperative.

Navigating the Current CRE Lending Market

In today's commercial real estate market, a high-level view is insufficient for intelligent capital allocation. To outperform, institutions must move beyond broad strokes and utilize specific data that illuminates the pathways to both risk and opportunity.

The market is not monolithic; it is a complex mosaic of sectors and submarkets, each with unique dynamics. Industrial and multifamily continue to exhibit strong fundamentals. The office sector, however, is still grappling with profound structural shifts in work patterns. Applying a uniform strategy across this landscape is a recipe for underperformance.

A Tale of Two Loans

Consider two loan applications: one for a $15,000,000 logistics warehouse adjacent to a major e-commerce hub, and the other for a $12,500,000 Class B office building in a downtown core with rising vacancy.

Based on historical financials alone, both might appear viable. Data-driven analysis, however, reveals a starkly different risk profile for each.

- The Warehouse: A robust pro forma, validated by local market data, projects annual rent growth of 4.5%. The debt service coverage ratio (DSCR) is a comfortable 1.45x. Furthermore, peer institution data from Visbanking shows significant capital allocation to this segment on favorable terms, signaling strong market confidence.

- The Office Building: While currently stable, regional data reveals deteriorating tenant demand. Average lease terms have compressed by 18 months, and the 1.25x DSCR, while technically acceptable, provides a thin margin for error if tenant improvement costs and leasing commissions escalate as projected.

This comparison demonstrates how granular data transforms underwriting from a static snapshot into a forward-looking risk assessment, enabling precise pricing based on true asset potential.

Capitalizing on Market Momentum

The broader CRE lending market is showing signs of renewed activity. In the second quarter of 2025, government agency lending for multifamily properties reached $28.9 billion—a 31% increase from the prior quarter.

The CBRE Lending Momentum Index, a reliable indicator of origination volume, surged 45% year-over-year, climbing to 275 by June 2025—well above its pre-pandemic average. This rebound, particularly in the industrial and multifamily sectors, confirms that capital is actively seeking solid, risk-adjusted returns.

As you navigate the specifics of today’s market, a comprehensive understanding of all commercial property financing options is also crucial.

The key takeaway for leadership is that market momentum is not evenly distributed. The ability to dissect lending activity by geography, asset class, and loan type is what separates market leaders from the rest of the pack.

This is precisely where data intelligence becomes a strategic asset. By benchmarking your institution’s lending activity against specific peer groups, you can identify where capital is flowing and—more importantly—why. Are competitors gaining market share in high-growth industrial corridors while you remain overexposed to office? Answering that question with data is the first step toward building a resilient and profitable portfolio.

Moving from Reactive to Predictive Underwriting

For decades, prudent underwriting has been the foundation of a healthy commercial real estate loan portfolio. This process has traditionally operated as a reactive cycle: tightening standards when the market cools and loosening them when it heats up.

Today, that binary approach is obsolete. The most successful lenders are shifting to a more strategic, forward-looking model.

Recent Federal Reserve data indicates an easing of standards. The April 2025 Senior Loan Officer Opinion Survey shows only 9.0% of banks reported tightening CRE underwriting, a dramatic decrease from 67.4% in April 2023. While this may signal a return to normalcy, it should prompt every bank director to ask: is this a healthy normalization, or the formation of a blind spot? In this environment, predictive capability is paramount.

Underwriting with Foresight, Not Hindsight

Consider a loan application for a well-occupied retail center. A traditional, backward-looking underwriting process, focused on historical financials, would likely approve it. This is underwriting with hindsight.

A data-first, predictive process provides a more complete picture. What if competitive intelligence reveals that three new, large-scale retail developments are breaking ground within a five-mile radius? And that two have already signed anchor tenants that compete directly with the property's primary rent-payers? The risk profile of the loan changes instantly.

The shift from reactive to predictive underwriting is not about finding more reasons to decline loans. It's about pricing risk with surgical precision and structuring deals to withstand future market shocks. It is how you protect the bank’s capital while serving creditworthy clients.

The Role of Granular Data

This transition requires a commitment to integrating granular data into the daily underwriting workflow. For a deeper look at the fundamentals, a comprehensive guide on commercial real estate underwriting covers the essentials.

It is no longer sufficient to analyze only property-level financials and high-level market reports. Effective decision-making requires:

- Submarket-Specific Data: How are vacancy rates and rent growth trending in this specific neighborhood, not just the broader metropolitan area?

- Competitive Landscape: Who are the current and future competitors that could impact tenant retention and cash flow?

- Peer Lending Activity: How do your proposed loan terms compare to what competitors are offering for similar properties in the same market?

When this level of intelligence is embedded into your process, underwriting evolves from a compliance function into a strategic advantage. This is what Visbanking’s BIAS delivers—the real-time peer and market data needed to underwrite with confidence and build a portfolio prepared for the future.

Uncovering Hidden Portfolio-Level Risks

A diversified portfolio can create a false sense of security. In commercial real estate lending, true portfolio strength is not just about spreading loans across different buildings; it is about understanding the correlated risks that lie beneath the surface. For bank executives, identifying these hidden concentrations is one of the most critical challenges in today's market.

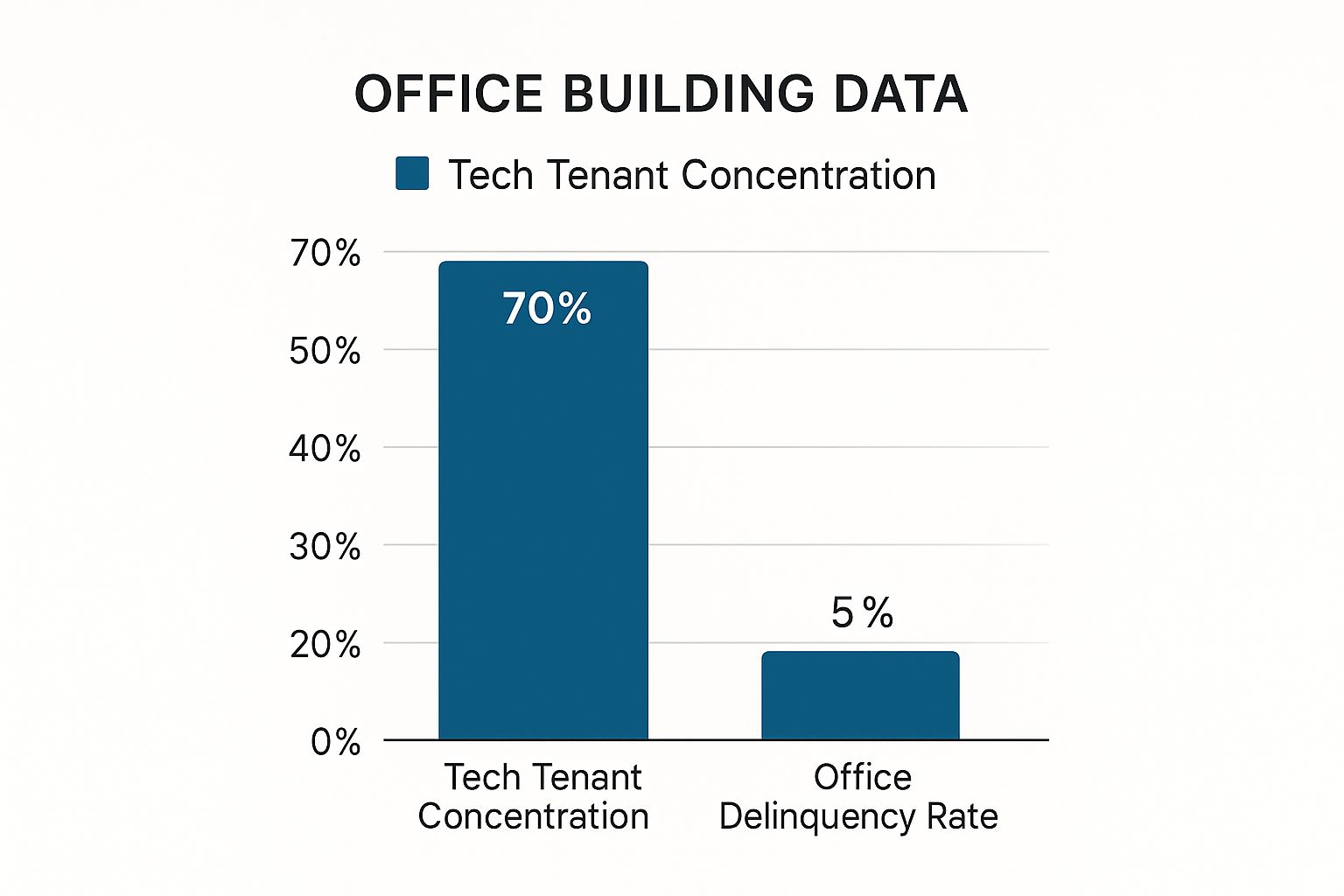

The office sector provides a stark example. A bank may hold loans on ten different office properties, assuming diversification. However, a deeper analysis might reveal that 70% of the tenants across those buildings are concentrated in the tech industry. This is not diversification; it is a significant, hidden concentration risk that standard reports will miss. A downturn in that single industry could trigger a cascade of defaults across what appeared to be a stable set of assets.

This demonstrates how a single point of failure can jeopardize a seemingly sound office loan portfolio.

Beyond Static Risk Reporting

The legacy method of reviewing a portfolio with static, backward-looking reports is no longer adequate. To accurately assess risk, you must shift to dynamic, forward-looking stress testing. This means moving beyond simple asset-class diversification to dissect the economic drivers underpinning your portfolio.

A robust stress-testing framework must answer the hard questions: What is the impact on our portfolio if vacancy rates in a key submarket increase by 10%? What is the fallout if a single major employer in our footprint announces layoffs? Answering these questions requires real-time data, not last quarter's figures.

Stress Testing in a Volatile Market

The commercial real estate market is bifurcated. While sectors like multifamily and industrial remain resilient, others face immense pressure. Bank-held CRE loans grew to a record $3.2 trillion by late 2024, but the office sector is a particular point of concern, accounting for nearly a quarter of all 2025 maturities.

The commercial mortgage-backed securities (CMBS) delinquency rate for office properties reached a historic high of 11.01% at the end of 2024, a clear signal of severe strain. You can discover more insights in the 2025 FDIC risk review for a complete analysis.

To put this bifurcated market into perspective, the following table shows how different sectors are faring across key risk indicators.

CRE Sector Risk Indicator Snapshot

| Metric | Office Sector | Industrial Sector | Multifamily Sector | Retail Sector |

|---|---|---|---|---|

| Delinquency Rate | Very High (11.01% CMBS) | Low | Low to Moderate | Moderate |

| Vacancy Rate | High & Rising | Very Low | Low | Stable to Improving |

| Rent Growth | Negative | Strong | Moderate | Flat to Modest |

| 2025 Maturities | High Concern | Low Concern | Moderate Concern | Moderate Concern |

The data clearly illustrates the divergence: Industrial and Multifamily are resilient, while the Office sector exhibits major warning signs. This is precisely why a one-size-fits-all approach to risk management is destined to fail.

Modern data intelligence platforms transform risk management from a passive, historical review into an active, strategic discipline. Instead of waiting for a loan to become 90 days past due, you can receive alerts when a property’s key tenant—or its entire industry—shows signs of distress. With a tool like Visbanking’s BIAS, executives can benchmark portfolio concentrations against peers, identify outliers, and proactively mitigate risks before they become write-offs. How does your institution's portfolio hold up under that level of scrutiny?

Using Data Intelligence as a Competitive Weapon

Identifying portfolio risks is a defensive necessity, but the true power of data intelligence lies in its offensive capabilities. In commercial real estate lending, this means transforming raw data from a reporting tool into a competitive weapon that actively shapes strategy and drives profitability.

The objective is to move beyond reacting to the last quarter and begin dictating the next one. This is no longer a function for the analytics department; it is a core operational requirement for any bank or credit union serious about outperforming the market.

Turning Insight into Actionable Strategy

Imagine having the ability to benchmark your institution's entire CRE loan performance—yields, delinquency rates, market share—against a curated peer group of your direct competitors in real time. This is the new standard for strategic planning, enabling you to surgically identify weaknesses and, more importantly, high-value opportunities.

Consider a practical example. A mid-sized regional bank is satisfied with its multifamily lending program. Internal quarterly reports show steady growth, and by all internal measures, the division is performing well.

Using a data intelligence platform, they benchmark their portfolio against five direct competitors in their primary markets. The results are immediate and revealing.

While loan volume is strong, the bank’s average yield on new multifamily originations is 50 basis points below the peer average. This single data point quantifies a significant revenue leak—a performance gap completely invisible in their internal reporting.

This is not an academic exercise; it is an action signal. It triggers an immediate, data-backed review of pricing models, underwriting guidelines, and loan officer performance. It forces the critical question: are we sacrificing margin to win deals that should be priced more aggressively?

Outmaneuvering the Competition

This is where data becomes a strategic map, not just a mirror. The bank can now dissect the competitive landscape with unprecedented detail.

- Peer Pricing Analysis: They can identify precisely which competitors are compressing margins in specific submarkets. Is it one aggressive player, or is the entire market engaged in a race to the bottom?

- Risk-Adjusted Return: By layering in peer delinquency and charge-off data, they can determine if competitors are accepting significantly more risk to offer lower yields.

- Strategic Repositioning: Armed with this intelligence, the bank can execute a calculated pivot. They might choose to de-emphasize hyper-competitive, low-margin segments and redirect capital and talent toward underserved niches where they can command superior pricing.

This entire strategic evolution—from discovery to execution—is driven by objective, real-time data, not intuition. Data intelligence is no longer about creating reports for board meetings; it's about making decisions that directly improve profitability and secure market position.

The goal is to equip your leadership with the foresight to not just react to the market, but to shape it. The first step is to benchmark your institution’s performance against the competitors that matter. Identify where you lead, where you lag, and where your next strategic opportunity lies.

The End of Guesswork in Commercial Lending

The era of basing multi-million-dollar commercial real estate lending decisions on relationships and intuition is over. For bank executives, the future is defined not by who you know, but by what you know—and that knowledge must be rooted in hard data at every stage, from macro-level strategy to individual deal structuring.

Success is no longer reactive. It is achieved through precision, foresight, and acting on market signals before competitors even detect them.

Data-driven decisions are the only currency that matters for a healthy and profitable CRE portfolio. Relying on outdated assumptions or lagging indicators is a critical vulnerability in a volatile market. The imperative is to stop managing risk and start actively shaping outcomes.

This requires a fundamental shift in mindset, grounded in three core principles:

- Go Granular or Go Home: Statewide assumptions are obsolete. Understanding performance at the submarket level is where you will uncover opportunity and avoid risk.

- Underwrite the Future, Not the Past: A loan's true risk profile is determined by where the market is headed, not where it has been. This is how you protect the balance sheet.

- Know Thy Competitor: How do your rates, terms, and portfolio concentrations truly compare to the competition? This data is not just informational; it is an offensive weapon.

Moving from theory to practice is the essential next step. Market leadership in commercial real estate lending will be defined not by those who possess the most data, but by those who can translate it into decisive, profitable action with speed and confidence.

Where does your institution truly stand? It’s time to find out. The logical next step is to see how robust analytics can benchmark your performance and illuminate your next strategic move.

Wrapping Up: Your Top Questions Answered

Integrating new data tools can seem like a significant undertaking. Here are answers to common questions from executives navigating this shift.

How Can We Bring In Data Intelligence Without Blowing Up Our Current Process?

Start with a targeted, high-impact use case. Identify a specific pain point—such as portfolio risk analysis or competitive benchmarking for new originations—and run a focused pilot. Demonstrating a clear, measurable ROI in a controlled setting is the most effective way to secure broader buy-in. The best data intelligence platforms are designed for seamless integration, delivering immediate insights without requiring a complete operational overhaul.

What Are the Most Critical Metrics for Monitoring a CRE Portfolio Right Now?

Delinquency rates are lagging indicators; they report problems that have already occurred. Focus on leading indicators.

Closely monitor debt service coverage ratio (DSCR) trends by property type. Analyze tenant concentration risk to identify overexposure to a single industry. Track shifts in local vacancy rates with vigilance. For new originations, you must benchmark your loan-to-value (LTV) ratios and interest rate spreads against your direct peers. It is the only way to ensure you are both competitive and prudent.

How Do We Stay Competitive Without Taking on Dumb Risk?

The answer is to replace intuition with granular, data-backed analysis. Use competitive intelligence to understand market pricing, but always overlay that information with your own objective risk assessment. If market pressure is driving down prices, do not react blindly. For an industrial property in a thriving logistics corridor, the data may support aggressive pricing. For a speculative office deal in a challenged submarket, the data will confirm that the risk demands a higher return. Let the numbers guide your capital allocation decisions.

It's time to move from dashboards to decisive action. With Visbanking, you can benchmark your CRE portfolio against the competition and find the signals that actually predict performance. You'll have everything you need to target growth, manage risk, and lead with confidence. Explore the Bank Intelligence and Action System (BIAS) today.

Similar Articles

Visbanking Blog

"Ever wondered how businesses fuel their dreams? 🚀"

Visbanking Blog

Capital Banking in the USA: An Overview of Investment Services, Financial Instruments, and Regulations

Visbanking Blog

In our rapidly evolving digital age, traditional banking models are being overturned

Visbanking Blog

FDIC Announces Increased Focus on Lenders’ Commercial Real Estate Loans

Visbanking Blog

Office buildings, once bustling, now echoing with silence.

Visbanking Blog

Navigating the Future: Decoding Financial Trends with VISBANKING Data Analytics

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

Optimizing Commercial Banks with Visbanking Intelligence

Visbanking Blog

Explore Banking Data: Financial Analysis with VISBANKING

Visbanking Blog