How To Call BMO Harris Bank: Expert Contact Guide

Brian's Banking Blog

Finding The Right BMO Harris Bank Phone Number For Your Needs

Calling BMO Harris Bank can sometimes feel overwhelming. Finding the correct phone number is the first step to a positive customer experience. Let's explore how to easily find the right contact information and connect with the right department the first time.

Identifying Your Specific Banking Need

Before dialing, take a moment to determine why you're calling. Are you checking on a recent transaction? Do you need to report a lost or stolen card? Or are you looking for information about loan products? Understanding your reason for calling helps you find the correct department. For instance, personal banking questions are handled by a different team than business banking inquiries.

BMO Harris Bank Contact Numbers by Service Type

To streamline the process, BMO Harris Bank offers several phone numbers for various services. This ensures your call reaches the appropriate specialist. The table below provides a quick reference for key contact points.

To help you quickly find the right number, we've compiled the following table:

BMO Harris Bank Contact Numbers by Service Type Quick reference for all BMO Harris Bank phone numbers organized by department and service category

| Service Type | Phone Number | Hours | Best For |

|---|---|---|---|

| Personal Banking | 1-888-340-2265 | 24/7 | Account balances, transactions, general inquiries |

| Credit Card Support | 1-800-274-4266 | 24/7 | Card activation, payments, lost/stolen card reporting |

| Business Banking | 1-888-603-4001 | Mon-Fri 8am-5pm CT | Business account management, loan inquiries |

| Mortgage Services | 1-800-989-2661 | Mon-Fri 8am-8pm CT | Mortgage applications, payments, loan information |

| Wealth Management | 1-800-770-7080 | Mon-Fri 8am-5pm CT | Investment services, financial planning |

This table offers a helpful overview of the main contact numbers. Remember to double-check the hours of operation for each department.

Utilizing Online Resources For Locating Phone Numbers

In addition to the table, the BMO Harris Bank website offers a comprehensive directory of contact information. This online resource may provide more specialized numbers depending on your location or specific product. Using the website's search bar or browsing the "Contact Us" section is a great way to find the most current and direct phone numbers. This helps connect you with the right department, improving efficiency and providing a smoother customer service experience.

Knowing the right number to call saves you time and prevents unnecessary transfers. By using these resources and tips, you can navigate the BMO Harris Bank phone system effectively and resolve your banking needs efficiently.

Smart Timing Strategies For Faster BMO Harris Bank Service

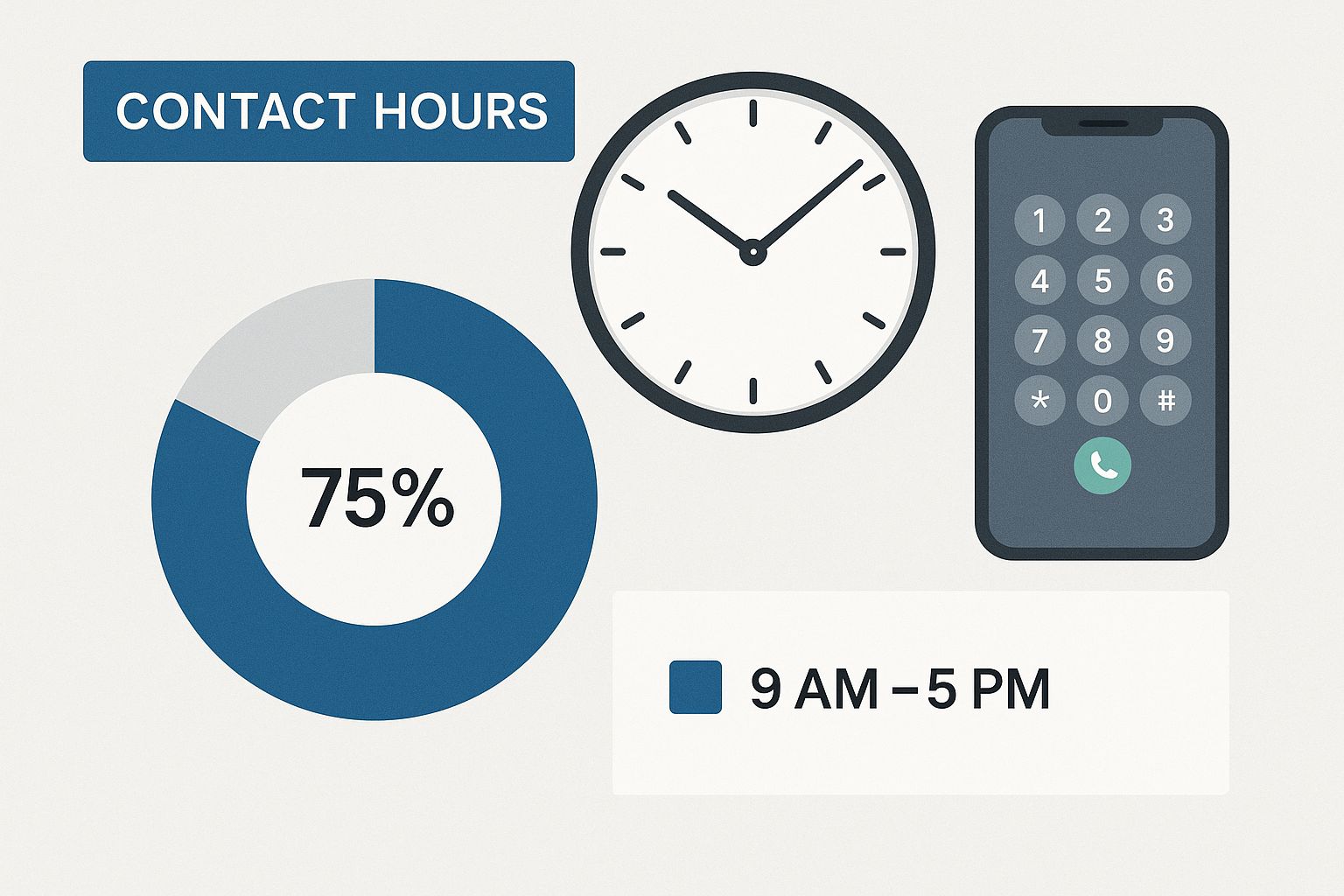

This infographic shows the best times to call BMO Harris Bank. It uses a clock and smartphone image to visually represent optimal contact hours. As you can see, calling outside of peak times, like early morning or late afternoon, can really cut down your wait time. For a broader perspective on business communication, check out this article on the best time to send cold emails.

Understanding Peak Call Times

BMO Harris Bank, like any business, has periods of high call volume. Lunchtime, typically between 12 PM and 2 PM, is one of these busy periods. The end of the workday, from 4 PM to 6 PM, also sees a surge in callers. Calling during these times often means a longer wait. Knowing this helps you plan your calls more effectively.

Targeting Off-Peak Hours for Faster Service

Calling outside of peak times significantly increases your chances of connecting quickly. The early morning, from 8 AM to 9 AM, before most people start their workday, is often a good time to call. The late afternoon, between 2 PM and 4 PM, after the lunch rush but before the end-of-day peak, can also offer shorter wait times. These off-peak hours give you the best chance to minimize hold time and connect with a BMO Harris representative quickly.

Leveraging Days of the Week

The day of the week matters too. Mondays are usually busy as customers catch up on weekend banking matters. Fridays also see a lot of activity as people prepare for the weekend. Calling mid-week – on Tuesdays, Wednesdays, or Thursdays – might mean shorter wait times. Smart timing can really improve your banking experience.

To help illustrate the best times to call, let's take a look at the data:

Call Volume and Wait Time Analysis Data showing average wait times throughout the day and week to help you choose the best time to call

| Time Period | Average Wait Time | Call Volume | Recommendation |

|---|---|---|---|

| 8 AM - 9 AM | 5 minutes | Low | Recommended |

| 9 AM - 12 PM | 10 minutes | Medium | Okay |

| 12 PM - 2 PM | 15 minutes | High | Not Recommended |

| 2 PM - 4 PM | 8 minutes | Medium | Recommended |

| 4 PM - 6 PM | 20 minutes | High | Not Recommended |

As you can see from the table, calling between 8-9 AM or 2-4 PM offers the shortest wait times.

Navigating Seasonal Variations

Remember that seasonal factors can also impact call volumes. The end of the year, tax season, and major holidays are typically busy times for banks. During these periods, consider using alternative contact methods. Secure online messaging or the BMO Harris mobile app might be faster options than calling. Using these strategies can help you minimize wait times and improve your experience with BMO Harris Bank.

Why BMO Harris Bank's Market Position Matters For Your Calls

When calling BMO Harris Bank, your experience goes beyond just the individual representative. The bank's market standing significantly influences the quality of support. A strong market presence often means more resources dedicated to customer service. Calling BMO Harris Bank means tapping into a robust infrastructure built to handle inquiries efficiently.

How Market Position Influences Customer Service

A bank's market position often reflects its financial health and resources. This financial strength allows investments in training, technology, and specialized teams. For instance, BMO Harris Bank NA holds an estimated 2.4% of the total U.S. commercial banking industry revenue. This demonstrates significant market share and growth, establishing them as a strong player. Find more detailed statistics here. This enables BMO Harris Bank to invest in better representative training, equipping them to handle complex questions and deliver effective solutions.

The Benefits of Calling a Market Leader

Calling a bank with a strong market presence, such as BMO Harris Bank, often means encountering knowledgeable representatives. They are well-versed in various banking products and services. Furthermore, these institutions typically offer more comprehensive support systems. These systems are designed to efficiently address a wider range of customer needs. For instance, they may have teams dedicated to specific products, enabling you to connect directly with a specialist. You might be interested in: How to master stress testing for banks.

From Runarounds to Resolutions

This specialized support reduces transfers and encounters with uninformed representatives. It leads to quicker resolutions and less frustration. Instead of endless transfers and explanations, you're more likely to get informed answers and efficient solutions. Also, a bank's commitment to maintaining market leadership often translates to a focus on customer satisfaction, creating a positive feedback loop. Strong market positioning encourages banks to constantly improve customer service, ensuring you receive the best possible support.

How BMO's Global Banking Infrastructure Benefits Your Experience

Calling BMO Harris Bank isn't just about reaching a local branch. It's about connecting to a wide network of financial experts and resources. This access to a larger, global banking infrastructure significantly improves the support you receive.

Specialized Expertise and Resources

Large financial institutions like BMO Harris Bank invest heavily in specialized training for their customer service representatives. This means when you call, you're more likely to connect with someone who has the specific knowledge to handle your banking needs. This focused training results in more efficient problem-solving and fewer transfers. You might be interested in: How to master bank liquidity management.

BMO Harris Bank also leverages the resources of its parent company, BMO Financial Group. This provides access to a broader range of experts and specialized departments to handle complex questions.

Advanced Technology and Systems

BMO's financial strength allows investment in cutting-edge technology for their phone systems and customer service platforms. This could include features like advanced call routing, directing your call to the most appropriate representative. This reduces wait times and improves efficiency.

Robust online banking systems, integrated with phone support, give representatives real-time access to your account information. This allows for faster and more accurate responses to your questions.

Comprehensive Service Capabilities

A global banking infrastructure often means more comprehensive service options. This can include dedicated support teams for specific products or services. For example, you can contact a specialized team for questions about a mortgage or business loan.

One of BMO Harris Bank’s key strengths is leveraging BMO Financial Group's global presence. With total assets of $1.41 trillion as of 2024, BMO is the eighth largest bank in North America. It offers a robust infrastructure across Canada and the U.S. Explore this topic further here. This expansive reach provides international banking expertise and resources, even for local banking needs, leading to more sophisticated solutions and faster problem resolution.

Enhanced Problem Resolution

Ultimately, the advantages of BMO's global infrastructure contribute to enhanced problem resolution. By combining specialized training, advanced technology, and comprehensive service offerings, BMO Harris Bank provides a more efficient and effective customer service experience. This means fewer transfers, shorter wait times, and more accurate answers when you call, leading to quicker resolution of your banking issues. This dedication to customer service shows the bank’s understanding that satisfied customers are essential for continued success in the competitive financial industry.

The Trust Factor: BMO Harris Bank's Proven Track Record

When you call BMO Harris Bank, you're connecting with more than just a call center. You're tapping into a deep well of experience that shapes every interaction, building a foundation of trust and stability.

Over Two Centuries of Banking Expertise

BMO Harris Bank's parent company, BMO Financial Group, boasts a history stretching back to 1817. This impressive two-century legacy offers a unique perspective on the financial world. It signifies the bank's successful navigation of countless economic cycles, fostering a profound understanding of evolving customer needs. This deep understanding becomes a valuable asset when you require support.

Adapting to Customer Needs Across Economic Cycles

Over time, BMO Harris Bank has refined its ability to meet diverse customer needs. This includes providing dependable service through various economic landscapes, from prosperous growth periods to times of financial uncertainty. This experience translates into a customer-focused approach, prioritizing solutions and stability.

Strategic Growth and Enhanced Service Capabilities

BMO Harris Bank's strategic acquisitions have broadened its reach and service offerings, enabling the bank to serve a wider customer base across multiple states and diverse banking situations. These acquisitions have infused the bank with specialized expertise and resources to handle a variety of needs, ranging from commercial loans to wealth management services. This expanded capacity means more personalized support when you call BMO Harris Bank.

Institutional Knowledge Empowering Representatives

The bank's long-standing presence in the financial industry has cultivated extensive institutional knowledge. When you call BMO Harris Bank, representatives have access to established protocols and proven solutions, equipping them to handle a wide array of challenges. From simple account inquiries to complex financial questions, this deep knowledge base translates into quicker resolutions and a more satisfying customer service experience. This means that regardless of your banking issue, the representative you speak with has likely encountered a similar situation before.

Established Protocols for Virtually Any Banking Challenge

BMO Harris Bank's experience has also fostered the development of robust internal processes. These protocols ensure consistency and structure in handling customer inquiries. This streamlined approach promotes efficient service, allowing representatives to address your concerns swiftly. This organized system benefits customers by providing clear expectations and reliable solutions, underscoring the value BMO Harris Bank places on building long-term customer relationships.

Beyond Phone Calls: Exploring All BMO Harris Bank Contact Options

Sometimes, picking up the phone just isn't the easiest or quickest way to get things done. Thankfully, BMO Harris Bank understands this and provides a variety of contact methods to fit your needs. Let's explore these alternatives and see how they can be helpful.

Digital Contact Methods for Quick Solutions

BMO Harris Bank offers several digital channels that can often provide faster solutions than a traditional phone call. For simple questions, the website's FAQ section and online help center are great places to start. This self-service approach empowers you to quickly find what you need without waiting.

For more personalized help, try the live chat feature on their website. This connects you with a representative in real-time for quick answers to simple questions.

Secure Online Messaging: This allows you to send secure messages directly to customer service. It's perfect for issues that need more explanation or don't require an immediate response.

Mobile App Assistance: The BMO Harris mobile app provides direct access to certain support features. You might be able to view transactions, lock your card, or even deposit checks, all without a phone call.

Email Support for Non-Urgent Matters

Email support can be a good way to connect with BMO Harris Bank for non-urgent issues. While not as fast as live chat or a phone call, email provides a written record of your communication. This can be especially helpful for complex questions or sensitive information. Be clear and concise in your email, including all the important details to help the bank process your request efficiently.

In-Person Branch Visits for Complex Issues

While many banking tasks can be handled remotely, sometimes an in-person visit is the best solution. For complex financial matters or personalized advice, visiting your local BMO Harris Bank branch offers valuable face-to-face interaction. This allows for clearer communication, especially regarding sensitive financial details. Scheduling an appointment beforehand can minimize wait times.

Escalating Issues Across Channels

It's important to know how to escalate issues if you aren't getting the help you need. If your initial online chat or secure message doesn't resolve the issue, consider calling the appropriate phone number. Have your account information ready to expedite the process. For very sensitive or unresolved issues, a branch visit or formal complaint might be the next step.

Choosing the Right Contact Method: A Quick Guide

For quick answers, the website's FAQ section or live chat are your best options. For non-urgent inquiries, secure messaging or email are suitable. If you need immediate support for more complex issues, calling BMO Harris Bank is a reliable solution. For significant or unresolved problems, an in-person branch visit often provides the most personalized help. By understanding these options, you can choose the right contact method for your specific needs, saving time and ensuring a smoother banking experience.

Maximizing Your Call Success: Preparation and Communication Tips

Calling BMO Harris Bank can be a smooth and efficient experience with a little preparation. The difference between a frustrating call and a productive one often hinges on how well you organize your information and communicate your needs. These tips will help you get the most out of your call.

Gathering Essential Documents and Information

Before dialing, gather all relevant documents and information. This might include your account number, recent statements, transaction details, or any correspondence related to your inquiry. Having this information readily available saves time and prevents unnecessary back-and-forth during the call.

This preparation also helps the representative quickly understand your situation and provide accurate assistance. A little organization goes a long way!

Clearly Articulating Your Needs

Clearly stating your reason for calling and your desired outcome is crucial. Instead of saying "I have a problem with my account," be specific. Explain the exact issue you're experiencing.

This allows the representative to understand your request immediately and direct you to the appropriate resources. Clear communication is key to a productive call.

Effective Communication Techniques

When explaining complex issues, break them down into smaller, manageable parts. This makes it easier for the representative to follow along. Use concise language and avoid jargon or technical terms they might not understand.

Focus on solutions instead of dwelling on the problem. Clearly expressing your desired outcome helps the representative understand your goal and work towards it efficiently.

Active Listening and Note-Taking

Actively listen to the representative and take detailed notes during the call. Note any actions they take, instructions they provide, reference numbers, or commitments made. These notes serve as a valuable record of the conversation for future reference or follow-up. You might be interested in: How to master financial reporting automation.

Taking thorough notes can save you time and effort later on.

Understanding Your Options and Ensuring Follow-Up

Before ending the call, ensure you understand the presented options and any necessary next steps. Ask clarifying questions if anything is unclear. If a follow-up is promised, note the timeline and how you will be contacted.

For alternative ways to reach BMO Harris Bank, consider their general contact information: Contact Us. This proactive approach helps manage expectations and ensures a smooth resolution.

By following these preparation and communication tips, your calls to BMO Harris Bank will be more productive and less stressful. Streamlining the process benefits both you and the representative, leading to quicker resolutions and a more positive banking experience. Ready to elevate your bank's decision-making? Explore Visbanking today at https://www.visbanking.com and discover how their Bank Intelligence and Action System can transform your operations.