A Guide to Modern Banking Risk Assessment

Brian's Banking Blog

At the end of the day, a bank's ability to weather financial storms comes down to one critical skill: banking risk assessment. Think of it as the ongoing process of spotting potential icebergs—things like loan defaults or market shocks—and figuring out their real impact before you hit them. It’s all about making smart, informed moves to protect the bank's assets, keep things stable, and hold onto the public's trust.

What Is Banking Risk Assessment

Let's use an analogy. A banking risk assessment is like the high-tech navigation system on a modern ship crossing a dangerous ocean. It’s the radar, the sonar, and the real-time weather forecasts all rolled into one, helping the captain see and steer clear of hazards. This isn't just about ticking boxes on a checklist; it's a living, breathing strategy for handling uncertainty.

This proactive mindset is absolutely fundamental to a bank's survival, let alone its success. It lets the institution get ahead of potential losses instead of just reacting to them after the fact. The whole point is to build a framework that not only safeguards depositors and shareholders but also gives the bank the confidence to chase smart growth opportunities without betting the farm.

The Strategic Importance of Risk Assessment

A solid risk assessment program is so much more than a regulatory headache. It becomes the very backbone of the bank's strategic thinking. When you truly understand your unique vulnerabilities, you can put your capital to work more efficiently, price your loans and services more accurately, and build a business that can hold its own through good times and bad.

This function has come a long way. Not too long ago, "risk" was a pretty narrow conversation, usually just about the credit risk on the loan book. Today, it’s a whole different ballgame. We're dealing with a complex web of interconnected threats from every direction.

A well-built risk assessment framework takes the scary, unpredictable nature of risk and turns it into something you can measure and manage. It's the difference between navigating with a detailed map and just sailing into the fog hoping for the best.

This shift changes everything. Risk assessment stops being a restrictive, compliance-driven chore and becomes a powerful tool for building a tougher, more forward-looking bank. It’s about creating a culture where everyone, at every level, understands, measures, and intelligently manages risk.

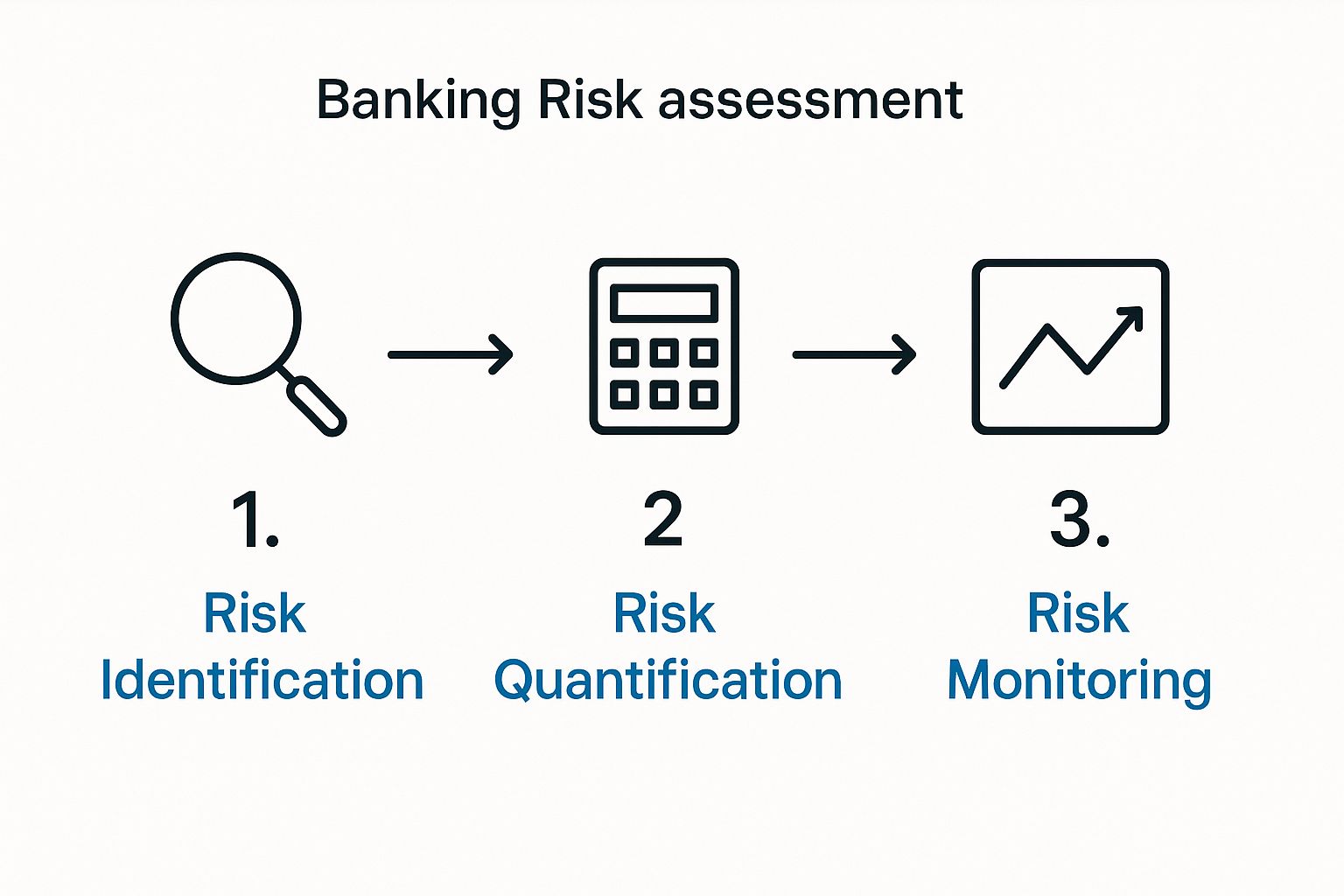

The Core Pillars of Assessment

A truly comprehensive risk assessment is built on a few non-negotiable pillars. Each one represents a key area of focus, and when you put them all together, you get a complete picture of the institution's risk profile. This structure makes sure nothing important falls through the cracks.

After all, just spotting a risk isn't enough. The bank needs a clear, repeatable way to analyze its potential financial hit and how likely it is to actually happen. A structured approach is what makes the process consistent and allows for real, apples-to-apples comparisons between different kinds of risks.

The table below breaks down these essential components.

Core Pillars of Banking Risk Assessment

This table outlines the essential components that form a comprehensive risk assessment framework for any banking institution.

| Pillar | Objective | Key Activities |

|---|---|---|

| Risk Identification | To uncover all potential risks across the bank's operations, products, and systems. | Conducting departmental reviews, analyzing historical loss data, and scenario planning for emerging threats. |

| Risk Analysis | To understand the nature, likelihood, and potential consequences of identified risks. | Performing qualitative and quantitative analysis, and stress testing various economic scenarios. |

| Risk Evaluation | To compare the results of the analysis against the bank's predefined risk appetite. | Determining which risks are acceptable and which require treatment or mitigation. |

| Risk Mitigation | To design and implement controls and strategies to manage unacceptable risks. | Developing internal controls, purchasing insurance, or avoiding certain high-risk activities. |

Taken together, these pillars provide a roadmap for moving from simply identifying a threat to actively managing it. This isn't just theory; it's the practical foundation of sound banking.

Diving into the Major Types of Banking Risk

To get a handle on risk, you first need to know what you’re up against. Think of it like a doctor trying to make a diagnosis—they can’t treat the illness until they recognize the symptoms. The same goes for banking. A solid risk assessment starts by clearly identifying the different threats a bank faces every single day.

These aren't just abstract ideas; they're real-world challenges. Let's break down the main categories to see how they actually play out.

Credit Risk: The Classic Banking Gamble

Credit risk is the original, most fundamental risk in banking. It’s simple, really: it’s the chance you won't get your money back when you lend it out. Every single loan a bank makes comes with this risk attached.

Let's look at a couple of everyday examples:

- A Small Business Loan: Your bank lends $250,000 to a local restaurant that wants to expand. The risk is tied up in how well that restaurant does, the local economy, and if the owners know what they're doing. A surprise recession could hit their profits hard, and suddenly, they can't make their payments.

- A Home Mortgage: A couple gets a $400,000 loan to buy their dream home. This is generally seen as lower risk because the house itself is collateral. But what if the housing market tanks, or the borrowers lose their jobs? That security can vanish quickly.

Figuring out credit risk is all about digging into a borrower's financials, checking their track record, and seeing what they've put up as collateral. It's the art of predicting whether someone can—and will—pay you back.

Market Risk: Riding the Economic Waves

Market risk comes from the unpredictable swings in market prices. This is a big one, covering everything from interest rates and foreign currency values to stocks and commodities. You can think of it as your bank being tossed around by the tides of the global economy.

A perfect example is interest rate risk. Imagine your bank has a portfolio full of long-term government bonds bought when rates were rock bottom. If the Fed suddenly jacks up rates to fight inflation, the value of your older, lower-paying bonds plummets. You haven't sold anything, but on paper, your balance sheet just took a major hit.

This is exactly why a good risk assessment needs to game out how different market shocks could rock your bank's assets and liabilities.

Operational Risk: When Things Go Wrong Internally

Operational risk is the danger of losing money because your internal processes, people, or systems fail. Sometimes, it's just about things going wrong inside the bank.

Here are a few ways this can bite you:

- System Meltdown: The bank's core system crashes right in the middle of a busy day. Customers can't get their money, and chaos ensues.

- Internal Fraud: An unhappy employee figures out how to siphon money from accounts, flying under the radar for months.

- Simple Human Error: A loan officer reads the numbers wrong and greenlights a huge loan for a company that was never going to pay it back.

It’s no surprise that a recent survey from Central Banking found that cybersecurity is now the top worry for bank risk managers. That just shows how much tech-related operational risks dominate the conversation now.

Liquidity Risk: The Cash Flow Crisis

Liquidity risk is the scary possibility that a bank can't cover its immediate bills without taking a huge financial hit. It’s like a popular store with a warehouse full of goods but no cash in the register to pay its staff.

A bank can be solvent—meaning its assets are worth more than its liabilities—but if it can't turn those assets into cash fast enough to handle withdrawals, it’s facing a full-blown liquidity crisis.

A classic bank run is the ultimate nightmare scenario here, where panic sends depositors rushing to pull their money out all at once. When looking at liquidity risk, it's vital to understand a client's own cash flow situation. Banks will often look at a borrower's strategies for improving cash flow and liquidity as part of their own due diligence.

Reputational and Strategic Risks

Beyond the big four, other major risks are always lurking. Reputational risk is the threat of your bank's good name being dragged through the mud. This can be triggered by anything from a data breach to an ethics scandal. A single bad story going viral can destroy public trust in a matter of hours.

Then there's strategic risk, which comes from making bad business decisions or just failing to keep up with the times. For example, a bank that stubbornly ignores the move to digital banking is taking a huge strategic risk as its customers flock to competitors with better apps and online services.

How Global Crises Shaped Modern Risk Regulation

History has a way of forcing our hand, and in banking, nothing has been a more powerful teacher than a full-blown crisis. The way we approach banking risk assessment today wasn't dreamed up in a quiet boardroom—it was forged in the fire of global economic meltdowns. These painful events ripped the curtain back, exposing just how vulnerable banks were and forcing a complete rewrite of the rules.

The 2008 global financial crisis was the earthquake that shook the entire system to its foundations. It became terrifyingly clear that many of the world's biggest banks were running on fumes, with nowhere near enough capital or liquidity to weather a real storm. The domino effect was breathtaking, revealing a financial ecosystem that was far more fragile and interconnected than anyone wanted to admit. This wasn't just a bump in the road; it was a systemic failure that demanded a systemic fix.

The Rise of Basel III

In the aftermath, regulators from around the world got together to build a stronger, more resilient framework. The result was Basel III, a landmark set of international reforms designed to prevent the 2008 disaster from ever happening again. The core mission was to shore up bank defenses with much tougher rules on capital and liquidity.

The idea was simple but powerful: banks needed a much bigger cushion to absorb losses when the economy turned sour. To make this happen, Basel III set specific, non-negotiable minimums. It required banks to hold a Common Equity Tier 1 (CET1) capital ratio of at least 4.5%, a Tier 1 capital ratio of 6%, and a total capital ratio of 8%—plus extra buffers on top of that. These weren’t just random numbers; they were carefully calculated thresholds meant to ensure banks could survive a severe downturn without taxpayers footing the bill.

The lesson from 2008 was painfully clear: a bank’s ability to survive a crisis is directly linked to the strength of its capital. Basel III turned that lesson into a global standard.

This regulatory overhaul forced a massive shift in thinking. Suddenly, rigorous quantitative analysis and a forward-looking, "what-if" mindset became central to everyday banking, completely changing the game for risk assessment.

Stress Testing Becomes Standard Practice

One of the most important tools to come out of this new era was stress testing. Before 2008, it was a niche exercise for the big players. After the crisis, it became a mandatory, cornerstone practice for practically everyone.

Think of stress testing as a fire drill for a bank's balance sheet. Regulators and banks work together to imagine worst-case scenarios—a deep recession, a housing market collapse, a sudden spike in unemployment—and then model how the bank would hold up. It answers the one question that keeps every CFO up at night: "If the worst happens, can we make it through?"

This process forces banks to stare their biggest weaknesses right in the face. It shines a spotlight on vulnerable loan portfolios, tests liquidity reserves, and checks if capital is truly sufficient. Our guide on https://visbanking.com/stress-testing-for-banks/ explains how this has become such a critical part of modern risk management. The results aren't just for show; regulators scrutinize them to ensure the whole system is ready for the next shock. Furthermore, looking at banks' debt management strategies during global crises offers even more context on how institutions have learned to adapt under extreme pressure.

A Practical Framework for Risk Assessment

A solid risk assessment in banking isn't some abstract theory you learn in a textbook; it's a structured, repeatable process that helps turn uncertainty into something you can actually manage. Think of it like building a house. You don’t just start nailing boards together. You need a detailed blueprint.

This framework is that blueprint. It's a cyclical, five-step method that any bank can adapt, no matter its size or how complex its operations are. Following these steps brings logic and order to the process, creating a defensible assessment. Of course, to get started, it's wise to get a handle on the bigger picture by understanding various risk management frameworks, which set the stage for these day-to-day activities.

Step 1: Risk Identification

First things first, you have to uncover every single risk the bank might face. This is the detective phase. You're searching every corner of the institution for clues, aiming to build a complete list of all possible threats, no matter how small they seem at first glance.

This isn't just about brainstorming in a conference room. To do it right, you need to dig deeper:

- Talk to the experts: Sit down with the heads of lending, IT, operations, and treasury. They're on the front lines and know the specific risks they deal with every single day.

- Look at the past: Analyze historical data. What incidents, losses, or even "near misses" have happened before? This helps you spot recurring issues.

- Think about the future: Run through "what-if" scenarios. What happens if there's a sudden recession? A sophisticated cyberattack? Outlining these potential events helps you see the risks before they materialize.

This master list of risks is the foundation for everything else. If you skimp on identification, you're leaving the bank exposed to threats you never even saw coming.

Step 2: Risk Analysis

Once you've got your list, it’s time to analyze each risk. This is where you shift from asking "what could happen?" to "how bad would it be?" The idea is to truly understand the nature of each risk by looking at its potential impact and how likely it is to occur.

Here, we break each risk down into two key pieces:

- Probability: What are the odds of this risk actually happening? You can describe this as low, medium, or high, or get more specific with a number, like a 5% chance in the next year.

- Impact: If it does happen, what's the damage? This is usually measured in financial terms but can also include reputational or operational harm.

A minor data entry error, for example, has a high probability but a low impact. That gets analyzed very differently from a major system failure, which might have a low probability but a catastrophic impact. This step gives you the hard data you need to start prioritizing.

Step 3: Risk Evaluation

With your analysis in hand, it's time to evaluate. This is where you compare your findings against the bank's predefined risk appetite—basically, the amount and type of risk the institution is willing to take on to meet its goals. This is a critical moment of judgment.

The key question here is: "Is this risk more than we're willing to handle?" You're essentially mapping out your risks. Anything that falls within the bank's comfort zone might be accepted as is. But anything that crosses the line needs immediate attention.

A well-defined risk appetite is your north star for making decisions. It ensures everyone in the organization is on the same page about risk-taking and that it all aligns with the board's strategic vision.

This evaluation step is what transforms a simple list of worries into an actual, actionable plan. It cuts through the noise and directs focus where it's truly needed.

Step 4: Risk Treatment

For any risks you've flagged as unacceptable, the next move is treatment. This is all about developing and implementing strategies to control or modify those risks, bringing them back down to a level the bank can live with.

You generally have four main options:

- Mitigate: Put controls in place to lower the probability or impact. A classic example is installing top-tier cybersecurity software to lessen the risk of a data breach.

- Transfer: Shift the financial fallout to someone else. Buying insurance is the most common way to do this.

- Avoid: Stop doing the activity that creates the risk in the first place. For instance, a bank might decide to exit a particularly high-risk lending market.

- Accept: For smaller risks that are comfortably within the bank's appetite, you might make a conscious decision to just accept them and move on.

The strategy you choose has to be practical, cost-effective, and in line with the bank's big-picture goals. A great way to structure this entire process is by using our ready-to-use bank risk assessment template as a starting point.

Step 5: Monitoring and Review

Finally, a risk assessment isn't something you do once and then file away. The last step—monitoring and review—is a continuous loop. The world of risk is always shifting, so your assessment needs to be a living, breathing document.

This final stage means regularly tracking the risks you’ve identified, checking to see if your treatment plans are actually working, and always scanning the horizon for new threats. A strong monitoring program keeps your risk framework sharp and relevant, ready to adapt to whatever comes next.

Analyzing the Current US Banking Risk Landscape

It’s one thing to talk about risk frameworks in the abstract, but it’s another thing entirely to see how they play out in the real world. To really get a feel for the health of the industry, you have to look at the numbers. They tell a story about where the system is resilient and where the new stress points are starting to pop up.

A deep dive into the data isn't just for regulators. It's a critical part of a bank's own strategic planning, showing exactly how things like capital levels and problem bank trends reflect the real pressures in the financial system.

A Snapshot of Industry Health

So, what's the latest? Recent FDIC data gives us a pretty clear picture. The industry's total equity capital jumped by a hefty $118.9 billion, which is a 5.2% increase from the previous year. That’s a good thing—it means banks have a stronger buffer to absorb potential losses from economic shocks. You can dig into all the details in the FDIC’s latest risk review.

This capital boost signals a more resilient system overall. But you can't just look at one number and call it a day; a proper banking risk assessment means seeing the whole field.

While robust capital is the bedrock of a stable banking system, it doesn’t render institutions immune to failure. It provides the capacity to absorb losses, but ongoing credit, operational, and market risks still require vigilant management.

Even with solid capital, the data shows that stress is popping up in specific areas. This is exactly why a continuous, multi-faceted approach to risk assessment isn't just a "nice-to-have"—it's a "must-do" for any modern bank.

Interpreting the Warning Signs

If you look just below the surface of that strong capital, you'll see some other indicators flashing. The number of banks on the FDIC’s "Problem Bank List" climbed from 52 to 66. Now, this is still only about 1.5% of all banks—a pretty typical number for non-crisis times—but the upward trend is a clear signal that some institutions are struggling with credit or operational issues.

On top of that, two bank failures occurred during this period. These events are a powerful reminder of a few key truths:

- Risk is ever-present: A well-capitalized industry doesn't mean individual banks are invincible. Specific weaknesses or poor management can still bring a bank down.

- Concentration matters: Risk isn't spread out evenly. A small group of banks can be in serious trouble while the rest of the industry looks perfectly healthy.

- Assessment is proactive: The whole point of risk assessment is to spot the problems that could land a bank on the "problem" list—or worse—long before the situation becomes critical.

This data really drives home how dynamic the financial world is. For banking leaders, these trends aren't just statistics to glance at. They are direct inputs for sharpening their own internal banking risk assessment processes, tweaking strategic priorities, and making sure their own institution stays standing, no matter what threats come next.

Navigating Today's Emerging Threats in Banking

The old world of banking risk was pretty straightforward. It was all about credit and market swings. But things have changed. A modern banking risk assessment has to look far beyond the balance sheet to a new landscape of complex, fast-moving threats. The whole conversation has shifted from purely financial numbers to technology-driven and geopolitical dangers that can knock an institution off its feet overnight.

These new threats demand a completely different, forward-looking playbook. While the classic risks are still on the table, the sheer intensity and speed of today's challenges have forced a major rethink for risk managers everywhere. The defensive strategies that worked yesterday just won't cut it against the sophisticated and interconnected dangers we face now.

The New Heavyweights: Cyber and Geopolitical Risks

Leading the charge are cyber threats. Cyber-attacks aren't just random pranks anymore; they're highly organized, often state-sponsored operations designed to steal data, shut down services, and shatter public trust. Banks are a top-tier target, which is why we're seeing massive investments in defensive tech and expert teams to guard the digital vaults.

At the same time, geopolitical risk has shot up the list of concerns. Global conflicts, trade wars, and economic sanctions create instant, high-stakes volatility. These events can freeze cross-border transactions in a heartbeat, trigger asset seizures, and create compliance nightmares for any bank with an international footprint. A bank's stability is now directly tied to global political stability.

This isn't just a feeling; the industry data paints a clear picture.

A recent survey confirmed that cybersecurity remains the largest current concern for bank risk managers. But what’s really telling is that geopolitical risk was named the fastest-rising threat category, signaling a dramatic shift in the risk environment.

This data tells us one thing loud and clear: risk managers are scrambling to retool their frameworks to deal with these evolving threats.

Adapting to the New Reality

The proof is in the pudding—risk management is changing, and it's changing fast. An incredible 82.5% of central banks reported reviewing their risk management frameworks in just the last year, driven mostly by these new threats. This shows a massive, system-wide push to get ahead of dangers that can pop up with almost no warning. You can discover more about these risk management benchmarks and see exactly how institutions are responding.

For banks on the ground, this means a few things have to become second nature:

- Constant Vigilance: You have to actively track geopolitical shifts and the ever-changing tactics of cybercriminals. It’s a 24/7 job.

- Fire Drills for New Dangers: It's about stress-testing for non-financial shocks. What happens if we have a major data breach? What's the plan if sudden international sanctions are imposed?

- A Unified Front: Technology, operational, and strategic risk can't live in their own silos anymore. They must be woven together into a single, cohesive view of the bank's total vulnerability.

At the end of the day, navigating this new world takes more than just a few updated policies. It requires a fundamental shift in culture towards proactive awareness, where anticipating the next threat is every bit as important as managing the ones you can already see.

Common Questions About Banking Risk Assessment

Even after getting a handle on the frameworks and potential threats, a few practical questions always seem to pop up. Let's tackle these head-on to clear up any lingering confusion and make sure you can apply these principles effectively in the real world.

What Is the Difference Between Risk Assessment and Risk Management?

It's really easy to mix these two up, but they're distinct parts of a bigger picture. Think of it like a doctor's appointment.

Risk assessment is the diagnostic phase. It’s all about identifying what could go wrong and figuring out how likely it is to happen and how bad the damage could be. It's the part where the doctor runs tests and asks, "What are the symptoms and potential problems?"

Risk management is the complete treatment plan that follows. It takes that initial assessment and then builds out strategies, puts controls in place, and keeps a constant watch on those risks. This is where the doctor says, "Okay, we know the issue. Here's the prescription, the lifestyle changes, and the follow-up plan."

A solid banking risk management framework weaves both the diagnosis and the treatment plan into one cohesive strategy.

How Often Should a Bank Conduct a Risk Assessment?

There's no magic number here. The right frequency depends entirely on the bank's size, its complexity, and the specific risk you're talking about.

A comprehensive, bank-wide risk assessment is usually done annually. But think of that as the bare minimum. Fast-moving risks need a much closer look, much more often.

For certain risks, the schedule has to be more fluid:

- Cybersecurity Threats: This isn't a quarterly review; it's a continuous, real-time monitoring job.

- Market Risk: In volatile markets, this should be on the table monthly, if not more frequently.

- Regulatory Changes: The minute a new rule is even hinted at, an assessment should be triggered.

Bottom line: risk assessment isn't just an item on a calendar. It should be an automatic reflex to any major change—whether that's launching a new product, a sudden economic downturn, or a shift in the competitive landscape.

What Role Does Technology Play in Modern Risk Assessment?

Technology has completely changed the game. It's transformed risk assessment from a static, backward-looking chore into a dynamic, forward-looking strategic advantage.

AI and machine learning are now indispensable. These systems can chew through massive datasets to find subtle patterns and red flags that no human team could ever spot. They can predict potential loan defaults or flag fraudulent activity with incredible speed and accuracy. Think about modeling the ripple effects of a sudden interest rate hike or catching a suspicious transaction in the blink of an eye—that's the power of modern tech.

It’s not just about prediction, either. Technology automates the grind. It handles the tedious but critical tasks like checking for compliance with new regulations, generating risk reports for the board, and providing that constant monitoring of key risk indicators. This automation makes the whole process sharper, stronger, and fundamentally more proactive.

Empower your institution with the intelligence to anticipate, analyze, and act on risk. Visbanking's Bank Intelligence and Action System (BIAS) provides the data-driven insights needed to build a proactive and resilient risk assessment strategy. Discover how Visbanking can sharpen your competitive edge.