Bank Stress Testing Models: Essential Risk Assessment Tools

Brian's Banking Blog

Understanding Bank Stress Testing Models That Actually Work

Many descriptions of bank stress testing models are confusing and overly technical. In reality, their purpose is straightforward: they are advanced early warning systems that help banks prepare for and survive financial crises before they happen. Think of it like a structural engineer simulating a powerful hurricane against a bridge design before a single piece of steel is laid. The point isn't just to check a box; it's to find hidden vulnerabilities in a bank's capital and risk strategies before a real storm hits.

Many descriptions of bank stress testing models are confusing and overly technical. In reality, their purpose is straightforward: they are advanced early warning systems that help banks prepare for and survive financial crises before they happen. Think of it like a structural engineer simulating a powerful hurricane against a bridge design before a single piece of steel is laid. The point isn't just to check a box; it's to find hidden vulnerabilities in a bank's capital and risk strategies before a real storm hits.

These models go far beyond typical financial projections by introducing extreme—but possible—negative scenarios. For instance, a model could simulate the combined impact of a sudden recession, a spike in unemployment, and a collapse in real estate prices. By applying these pressures to a bank's balance sheet, risk managers can see precisely how their loan portfolios, investments, and income would hold up. This process uncovers critical weaknesses that would otherwise stay hidden during periods of economic stability. It’s a proactive drill in financial readiness.

The Human Element in Modeling

While these models are built on data, their real power is unlocked by human insight. Seasoned risk professionals don't just blindly accept the computer's output. They dig into the results, challenge the underlying assumptions, and apply their experience to make tough decisions. This human judgment is what turns a simple compliance task into a genuine risk management advantage. It’s the art of translating raw numbers into clear, actionable advice for the board and regulators.

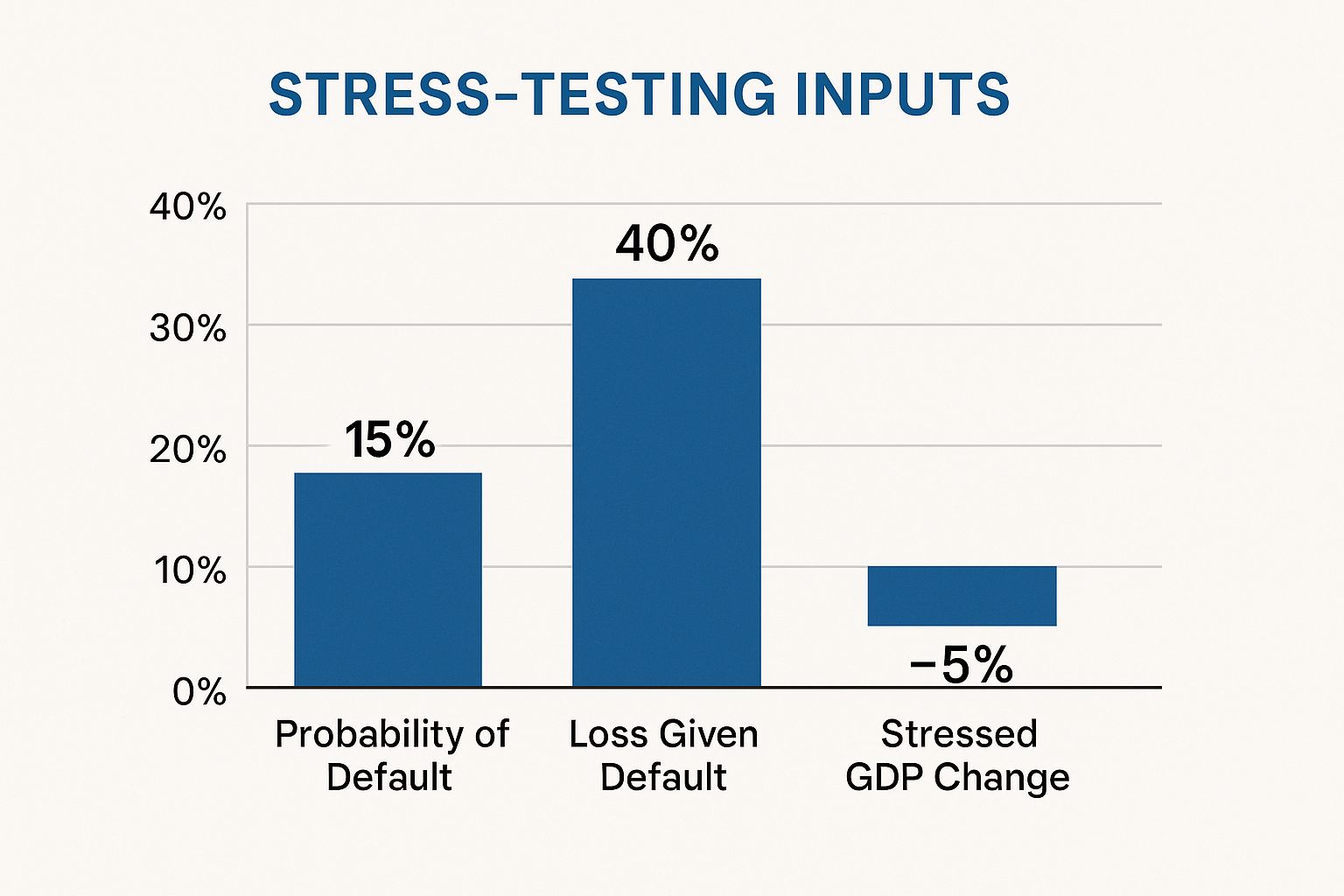

This diagram shows how different inputs, from macroeconomic data to specific bank portfolios, are run through stress testing models. The results, like capital adequacy ratios and risk-weighted assets, are not the final answer but the starting point for a much deeper conversation about a bank's ability to withstand shocks.

A Tool Forged in Crisis

The widespread use of these models is a direct lesson learned from past failures. Though early forms of stress testing have been around for a while, they became a global standard after the Great Financial Crisis of 2007–2009 revealed deep-seated problems across the banking system. Before the crisis, such tests were often inconsistent and lacked teeth. Today, they are a mandatory and essential tool for preserving financial stability worldwide. You can read more about their development in a report on the FSI's insights into stress testing frameworks. By understanding what these models can—and cannot—do, banks can turn a regulatory requirement into a powerful strategic asset.

The Crisis That Changed Everything: How Stress Testing Evolved

Before the Global Financial Crisis of 2008, stress testing felt more like a theoretical exercise than a serious diagnostic tool. Banks conducted these tests, but the process was often fragmented and inconsistent across the industry. It lacked the coordinated, tough approach needed to spot dangers that could threaten the entire financial system.

The crisis was a painful lesson. It showed that individual banks could look perfectly fine on their own, even while the system as a whole was quietly heading for a cliff. This catastrophe completely changed the role of bank stress testing models, shifting them from a quiet risk management activity to a central pillar of global financial stability.

The wake-up call of 2008 brought a new guiding principle: it's better to prevent a fire than to fight one. Regulators, led by the Federal Reserve in the U.S., started requiring mandatory, system-wide stress tests. These were no longer just practice drills; they became high-stakes exams with serious consequences. The results directly influence a bank's Stress Capital Buffer (SCB)—the extra cushion of capital it must keep to weather a severe economic storm. This forced banks to treat modeling and risk assessment with newfound seriousness.

A New Era of Transparency and Scrutiny

Another major change was the demand for more openness. The European Banking Authority’s (EBA) landmark 2011 stress test, for instance, revealed major capital gaps and required a level of public disclosure that was once unheard of in the typically private world of banking. The goal wasn't to shame banks but to rebuild market confidence by proving that regulators were finally taking a hard look under the hood.

This intense focus continues today. Regulators now create increasingly harsh—but still believable—economic disaster scenarios. For a closer look at how these scenarios are built, you can see our breakdown of the latest Fed bank stress test scenarios. The modern method now includes:

- System-wide scenarios: Hitting all major banks with the same severe economic shock to see how they fare.

- Public disclosure: Sharing key results to keep investors and the public informed.

- Dynamic modeling: Constantly updating models to account for new and evolving risks.

Getting here wasn't easy. The journey involved pushback from the industry and long negotiations with regulators. But the story is clear: the 2008 crisis permanently raised the importance of stress testing. The lessons learned from that failure are now built into the very DNA of modern banking.

Top-Down vs Bottom-Up: Choosing Your Stress Testing Approach

When figuring out how resilient a bank is, you can look at the problem from two different angles. Think of it like checking a city’s preparedness for an earthquake. You could use satellites to get a big-picture view of the whole region (a top-down approach), or you could send inspectors to check the foundation of every single building (a bottom-up approach).

In finance, bank stress testing models use these same core strategies. Neither one is automatically better than the other; their real strength comes from how they work together to paint a complete picture of risk.

The Bird's-Eye View: Top-Down Models

The top-down approach is usually run by regulators or a bank's central risk management team. It applies broad economic scenarios—like a sudden drop in GDP or a surge in unemployment—to the bank's high-level, combined financial data.

This method is great for a few reasons:

- Consistency: It creates a level playing field, allowing for direct comparisons across different banks since everyone is tested with the same model and assumptions.

- Speed: Because it uses high-level data, it’s a quick way to get a read on system-wide weaknesses.

- Systemic Risk Focus: It's especially good at showing how major economic shocks could spread through the entire financial system.

The downside is that this high-level view can miss important, bank-specific risks buried deep within individual loan portfolios or business units.

The Ground-Level View: Bottom-Up Models

On the flip side, the bottom-up approach starts from the smallest details. Individual business units inside the bank apply the stress scenarios to their own specific portfolios—like residential mortgages, commercial loans, or trading accounts. They estimate potential losses using their in-depth knowledge of the assets and customers.

This approach offers:

- Granularity: It gives a very detailed and specific view of risk, taking into account the unique qualities of a bank's holdings.

- Ownership: It makes business line managers directly responsible for understanding and managing their own risks.

Of course, this detailed process takes more time and resources. It can also be tricky to combine all the separate results into a single, clear picture of the bank's total risk.

To help clarify the differences, let's compare these two methodologies side-by-side.

Top-Down vs Bottom-Up Stress Testing Methodologies

Comparison of key characteristics, advantages, and applications of both stress testing approaches

| Methodology | Data Source | Scope | Key Advantages | Primary Use Cases |

|---|---|---|---|---|

| Top-Down | Aggregated, bank-level financial data (e.g., total loans, total deposits) | Macro, system-wide | Fast, consistent across banks, good for assessing systemic risk. | Regulatory oversight (e.g., CCAR, EBA stress tests), rapid assessment of system-wide vulnerabilities. |

| Bottom-Up | Granular, portfolio-level data (e.g., individual loans, securities) | Micro, bank-specific | Detailed, captures unique risks, promotes risk ownership at the business-unit level. | Internal capital planning (ICAAP), detailed risk management, validating regulatory model results. |

Ultimately, one approach gives you a wide-angle view of the forest, while the other gives you a close-up of each tree. Both perspectives are needed for a full understanding.

Creating a Hybrid Approach for Complete Insight

The most effective strategy is to blend both methods. Regulators often use top-down models for system-wide tests while also making banks run their own detailed, bottom-up analyses. This dual approach has become a key part of modern bank supervision.

After the European Central Bank took charge of supervising major eurozone banks in 2014, combining both methodologies became the standard. Austria’s central bank was ahead of the curve, pioneering a dual system as early as 2007. They had banks conduct bottom-up tests that ran alongside the central bank's own top-down models. You can explore Austria's approach to stress testing to see how these practices have developed.

This hybrid model truly offers the best of both worlds: a consistent, high-level view from the top and a detailed, nuanced risk assessment from the ground up.

Global Stress Testing: How Different Countries Play The Game

Banking regulation isn't a one-size-fits-all game. The way different countries approach stress testing reveals a lot about their national priorities, regulatory philosophies, and appetite for risk. Think of it as different coaches preparing their teams for a championship; each has a unique playbook designed to counter specific threats. These variations in bank stress testing models create entirely different competitive landscapes across the globe.

Here is a look at the Federal Reserve's stress test and capital planning requirements, which form the heart of the U.S. approach.

The image above outlines how the Dodd-Frank Act Stress Tests (DFAST) and the Comprehensive Capital Analysis and Review (CCAR) work together. These two processes are the primary tools used to determine a bank's capital requirements and assess the strength of its financial planning.

The American Gauntlet vs. The European Marathon

The United States and Europe offer a great example of these contrasting philosophies. The U.S. system is a high-stakes, regulator-driven annual test. Under the Dodd-Frank Act, the Federal Reserve runs annual stress tests for banks with over $100 billion in assets. This test involves a single, severely adverse scenario applied over a nine-quarter horizon. The Fed uses its own supervisory models, which keeps the process consistent but can feel like a black box for the banks being tested. To see how this approach stacks up globally, you can explore these global stress testing differences for a deeper understanding.

Across the Atlantic, the European Banking Authority (EBA) runs more of a marathon than a sprint. Their stress tests are typically held every two years and cover a longer, three-year period. While the EBA defines the methodology and scenarios, the banks themselves do much of the modeling work in a bottom-up approach. This gives institutions more ownership, but European regulators often have to push back against overly optimistic projections to ensure the results are credible.

The table below provides a clearer picture of how these frameworks compare on key attributes across major jurisdictions.

| Jurisdiction | Test Frequency | Scenario Horizon | Number of Scenarios | Model Source | Results Transparency |

|---|---|---|---|---|---|

| United States (Fed) | Annual | 9 quarters | 2 (Baseline, Severely Adverse) | Primarily Regulator-driven (top-down) | High (Detailed public disclosure) |

| European Union (EBA) | Biennial | 3 years | 2 (Baseline, Adverse) | Primarily Bank-driven (bottom-up) | High (Bank-level results published) |

| United Kingdom (BoE) | Annual | 5 years | 2 (Baseline, Annual Cyclical Scenario) | Hybrid (Regulator and bank models) | High (Aggregate and bank-level results) |

| Japan (BoJ/FSA) | Annual/Biennial | 3-5 years | Multiple (Macro & market-specific) | Primarily Bank-driven (bottom-up) | Lower (Primarily aggregate results) |

This comparison shows a clear divergence. The U.S. favors frequent, regulator-controlled tests with high transparency. In contrast, Europe and Japan lean on the banks themselves to perform the analysis, though the frequency and level of public disclosure can vary.

Contrasting Philosophies in Asia

The differences extend globally. In Japan, the approach is even more collaborative. The Bank of Japan and the Financial Services Agency provide the scenarios, but banks are largely responsible for creating and running their own models. This method relies heavily on the banks' internal risk management skills and fosters a culture of self-assessment rather than a top-down regulatory mandate.

These distinct approaches highlight a fundamental trade-off. The U.S. model prioritizes consistency and regulatory control, ensuring a standardized benchmark across its largest banks. In contrast, the European and Japanese systems focus on bank-specific details and internal accountability, trusting that the institutions have the deepest insight into their own unique risks. Each method has its pros and cons, but together they contribute to a stronger, more adaptable global financial system.

Implementation Strategies That Actually Work In Practice

Owning sophisticated bank stress testing models is like having a Formula 1 car; it’s impressive but useless without a skilled driver and a world-class pit crew. The real challenge isn’t just building the models but successfully implementing them within the messy reality of a banking institution. This means navigating everything from data quality issues to internal politics and regulatory pressures.

Successful implementation goes far beyond the technical side of modeling. It’s about creating a strong governance framework that clearly defines roles, responsibilities, and decision-making processes. It involves transforming abstract model outputs into concrete strategic actions that the board and senior management can understand and act upon. This isn't just about compliance; it's about embedding risk management into the core of the business.

From Compliance Burden to Business Intelligence

The most effective banks view stress testing not as a regulatory chore, but as a source of valuable business intelligence. They use the results to inform critical decisions that go far beyond just capital planning. For example, insights from stress tests can guide:

- Strategic Planning: Identifying which business lines are most vulnerable to economic downturns and which are resilient, helping to shape long-term strategy.

- Capital Allocation: Directing capital toward more resilient and profitable activities identified through scenario analysis.

- Product Development: Designing new products with risk characteristics that align with the bank's overall risk appetite.

- Risk Mitigation: Proactively adjusting loan underwriting standards or hedging strategies in response to potential threats revealed by the models.

This strategic mindset turns a mandatory exercise into a competitive advantage. For a deeper look into how this works, read our guide on stress testing for banks.

Key Pillars of a Successful Implementation

Turning theory into practice requires focusing on several key pillars that support the entire stress testing program.

Model Validation and Governance

A common point of failure is weak model validation. Think of this as the quality control check for your financial crystal ball. Models must be regularly and independently reviewed to ensure they are accurate, reliable, and fit for purpose. This isn't just a box-ticking exercise; it’s a crucial defense against flawed assumptions. A strong governance structure ensures that validation findings are taken seriously and lead to real improvements.

Data Quality and Management

Stress testing models are only as good as the data they consume. Institutions often struggle with data quality nightmares, pulling information from disconnected legacy systems. A successful program requires a serious, long-term commitment to data integrity, including solid processes for data aggregation, cleansing, and management. Garbage in, garbage out is a principle that applies perfectly here.

Translating Complexity into Clarity

Perhaps the most overlooked skill is the ability to communicate complex results effectively. Risk managers must translate dense statistical outputs into clear narratives that executives and board members can grasp. This involves using plain language, visual aids, and focusing on the "so what"—the real-world business implications of the test results. Without this crucial step, even the most accurate models will fail to drive meaningful action.

Technology Integration: Modern Tools That Change The Game

The days of wrestling with giant, clunky spreadsheets to perform stress tests are thankfully behind us. Today, bank stress testing models are powered by specialized analytical platforms that can chew through massive datasets with impressive speed and precision. This isn't just about working faster; it's about gaining a much deeper, more dynamic picture of risk.

The Rise of Intelligent Modeling

Artificial intelligence and machine learning (AI/ML) are leading this charge. These technologies are completely changing how banks conduct stress tests by enabling more complex, forward-looking analysis. Instead of just looking at what happened in the past, AI-powered models can spot intricate, non-linear patterns in the data, which leads to far more realistic and detailed projections.

This is especially critical for modeling Pre-Provision Net Revenue (PPNR), a key component that has often been a major source of unpredictability in older stress tests. As you can explore in our guide on predictive analytics in banking, these modern tools help build more precise and granular forecasts.

Key advancements shaping the field include:

- Automated Data Aggregation: New platforms can automatically gather and clean data from different sources, fixing one of the biggest headaches and time-sinks in the stress testing workflow.

- Dynamic Scenario Generation: AI can help banks create and test a much broader range of custom "what-if" scenarios, going beyond the standard regulatory ones to find their own unique weak spots.

- Real-Time Risk Assessment: Modern tools provide the ability to evaluate risk almost instantly. This shifts stress testing from a periodic, backward-glancing chore into a continuous, forward-looking strategic activity.

The animated dashboard below shows how today's platforms can display complex banking intelligence in a clear, easy-to-understand way.

This interface demonstrates how integrated systems, like Visbanking’s BIAS, can visualize key performance metrics and peer comparisons, turning mountains of raw data into actionable strategic insights.

Integrated Platforms: The Future of Stress Testing

The most important development is the shift toward fully connected platforms. These systems link every single step of the stress testing cycle—from gathering data and running models to analyzing results and preparing regulatory reports.

By creating a single source of truth, platforms like Visbanking’s BIAS break down the walls between data silos. This promotes seamless collaboration between a bank's risk, finance, and business teams. This integration does more than just ensure consistency and accuracy; it turns a compliance task into a powerful tool for making smarter strategic decisions, helping banks prepare for whatever challenges lie ahead.

Key Takeaways: Your Roadmap To Stress Testing Success

Understanding bank stress testing models is more than just checking a regulatory box; it's about building genuine financial strength. Think of it as a fire drill for your bank's balance sheet. This plan breaks down the most important strategies into simple, actionable steps for risk managers, executives, and tech leaders. When done right, this required exercise becomes a powerful tool for strategic planning.

Evolving Risks and Future Trends

The world of risk never stands still, and stress tests need to keep up. The next set of challenges will require models to look beyond typical economic downturns. Here are a few major trends that will shape the future of stress testing:

- Climate Risk Integration: How would your bank hold up against physical risks like extreme weather events? What about the transition risks that come from shifting to a greener economy? These are the new questions models must answer.

- Cyber Risk Assessment: The threat of a major cyber-attack is always looming. The next generation of stress tests will need to model the potential capital and operational losses from a sophisticated digital breach.

- Artificial Intelligence: AI isn't just for making models more accurate. It can be used to generate more creative and forward-thinking "what-if" scenarios, uncovering weak spots you never knew you had.

Banks that get ahead of these trends will be far better positioned for whatever shocks come next.

An Action Plan for Improving Your Models

Making your organization's stress testing better requires a focused, multi-part approach. Here are specific actions you can take to improve your process and stay ahead of what regulators expect.

For Risk Managers and Analysts

Your biggest challenge is to fight the "momentum" effect, where last year's good times make this year's projections overly optimistic. Research shows that high-level Pre-Provision Net Revenue (PPNR) models are often too influenced by past data, making them unreliable. A 2024 analysis pointed to this as a key reason for higher capital requirements. To fix this:

- Push for Granularity: Argue for more detailed models. Instead of looking at revenue as one big number, break it down into its core components.

- Challenge Assumptions: Always ask the tough questions. Why should recent performance be the main guide for how you'll fare in a serious economic storm?

- Strengthen Data Governance: A model is only as good as the data it's fed. Make sure your data is clean, consistent, and well-documented.

For Banking Executives and Boards

Your job is to treat stress testing as a strategic asset, not just a line item on the budget. Capital requirements can swing wildly—sometimes jumping by 2 to 10 percentage points for a bank in just two years. This volatility shows why you need a stable, understandable process.

- Demand Clarity: Ask your risk teams to explain model results and major changes in plain English, focusing on the business impact.

- Invest in Technology: Support investments in modern platforms that bring data and analytics together. Tools like Visbanking's BIAS can create a single, reliable source of information for everyone.

- Promote a Risk-Aware Culture: Create an environment where people feel safe to challenge model results and talk openly about potential weaknesses.

By following these strategies, your institution can build a more durable and insightful stress testing program. Find out how Visbanking’s powerful BIAS platform can give you the clarity and control to manage today’s complex risks and turn your data into a true advantage.