Data-Driven Bank Strategic Planning: A Framework for Executive Leadership

Brian's Banking Blog

For bank executives and board members, strategic planning is no longer an annual, check-the-box exercise. Relying on last year's performance to set this year's goals is a direct path to falling behind. A modern bank strategic planning process must be a forward-looking framework—one that shifts critical decisions from intuition to evidence-backed intelligence.

Moving Beyond Traditional Bank Strategic Planning

In an environment defined by digital disruption and economic volatility, legacy planning methods are inadequate. This is not a theoretical risk; regulators are taking enforcement action. The OCC's recent consent order against a New York-based bank for unsafe practices, tied directly to deficient strategic planning and earnings oversight, serves as a stark warning for the entire industry.

This guide provides a framework for building institutional resilience and capitalizing on market shifts. The objective is to convert granular market and competitive intelligence into a primary strategic asset, enabling leadership to act on opportunities before competitors recognize they exist.

The Shift to Proactive Intelligence

Effective planning requires abandoning the rearview mirror. Instead of rehashing historical performance, leadership teams must address forward-looking questions informed by real-time market dynamics.

- How is our Net Interest Margin trending against our top three regional competitors?

- Where are peer banks gaining deposit share, and which specific products are fueling that growth?

- Based on current economic signals, what are the primary credit risks emerging in our core lending markets?

Answering these questions requires a sophisticated, outside-in view of the competitive landscape, a perspective unattainable through standard internal reports. This discipline grounds a strategic plan in market reality, ensuring it is not just ambitious, but achievable.

This data-driven approach ensures that every strategic decision—from capital allocation to product development—is deliberate and defensible. By integrating a deep understanding of the competitive environment with precise data tools, you build not just a plan, but an actionable roadmap for sustainable growth. At Visbanking, we provide the data intelligence platform to help you benchmark performance and inform your next strategic move.

Defining Your Strategic Pillars with Market Intelligence

A robust bank strategic plan is built upon a foundation of clear, distinct pillars—the five to seven high-level goals that guide all major decisions. These pillars cannot be conceived in a boardroom vacuum; they must be forged from hard market intelligence. This is the discipline that transforms aspirational goals into a data-backed mandate for action.

Grounding strategy in external evidence is what separates market leaders from the rest. It prevents the allocation of capital to initiatives based on institutional habit rather than clear market signals. Without external data, a strategic plan is merely an internal conversation.

From Vague Notions to Concrete Opportunities

The strategic process begins by shifting focus from internal metrics to competitive benchmarks. For instance, your bank’s 2% loan growth might appear acceptable in isolation. However, if direct peers averaged 7% growth over the same period, that "acceptable" performance is revealed as a significant market share loss. This forces a more critical line of inquiry.

Consider this scenario: A community bank's leadership believes its core strength lies in commercial real estate (CRE) lending, supported by internal reports showing modest growth. When external market data is introduced, the perspective changes dramatically.

- The Internal View: Our CRE portfolio grew by $15 million last year.

- The Market Intelligence View: Our market share in CRE declined by 0.5% because competitors grew their portfolios by an average of $40 million.

- The Deeper Insight: Further analysis reveals a significant regional surge in demand for small business lines of credit under $250,000—a product segment the bank has historically underserved.

This intelligence reframes the strategic conversation entirely. The pillar is no longer a generic "Grow our CRE portfolio." It becomes a precise and powerful objective: "Become the market leader for small business credit in our primary counties."

Building Pillars on Competitor Weakness and Untapped Markets

The most effective strategic pillars are often built in the gaps competitors leave open. This requires granular data—from their deposit mix to loan pricing strategies within your specific markets.

A strategic pillar is more than a goal; it is a defensible market position. Market intelligence provides the evidence that makes it defensible, turning a strategic bet into a calculated investment.

For example, analysis of call report data might reveal a large regional competitor is actively shedding non-interest-bearing deposits to optimize its balance sheet. This is not merely a tactical maneuver on their part; for you, it is a strategic opening. Your bank can construct a pillar around capturing these displaced commercial deposits with a high-touch service model, directly capitalizing on a rival’s strategic decision.

This disciplined approach aligns with industry best practices. A global survey of central banks found that most strategic plans are built around an average of 6.1 pillars. This indicates that a focused commitment to a handful of high-impact goals is a hallmark of a well-managed institution. You can review the findings and what they mean for setting goals.

Translating Data Into Actionable Pillars

With these insights, the final step is to refine them into clear, concise strategic pillars. These statements become the guiding principles for resource allocation, technology investments, and talent acquisition for the next three to five years.

The following table illustrates the evolution from generic goals to sharp, actionable directives informed by data:

| Traditional Pillar | Data-Informed Pillar |

|---|---|

| "Grow deposits." | "Capture $50M in new commercial operating accounts by targeting businesses with $2M - $10M in annual revenue." |

| "Improve lending." | "Achieve a 15% market share in small business lines of credit within our three core counties." |

| "Enhance digital services." | "Launch and drive adoption of a digital treasury management platform to capture 25% of new commercial clients." |

Each refined pillar is specific, measurable, and directly tied to a data-identified market opportunity. They provide unambiguous direction for the entire organization.

The foundation of a resilient bank strategic planning framework is not just having goals, but having the right goals. Using comprehensive benchmarking platforms like Visbanking ensures your strategic pillars are not merely ambitious, but are rooted in the competitive reality of your market. See how Visbanking’s data can provide the insights needed to build your next strategic plan.

Setting Meaningful KPIs with Competitive Benchmarks

Once strategic pillars are defined, they must be translated into quantifiable targets. A goal like "increase profitability" lacks the specificity required for accountability and execution. A data-driven bank strategic planning process demands Key Performance Indicators (KPIs) that are precise, measurable, and—most critically—benchmarked against the market, not just internal history.

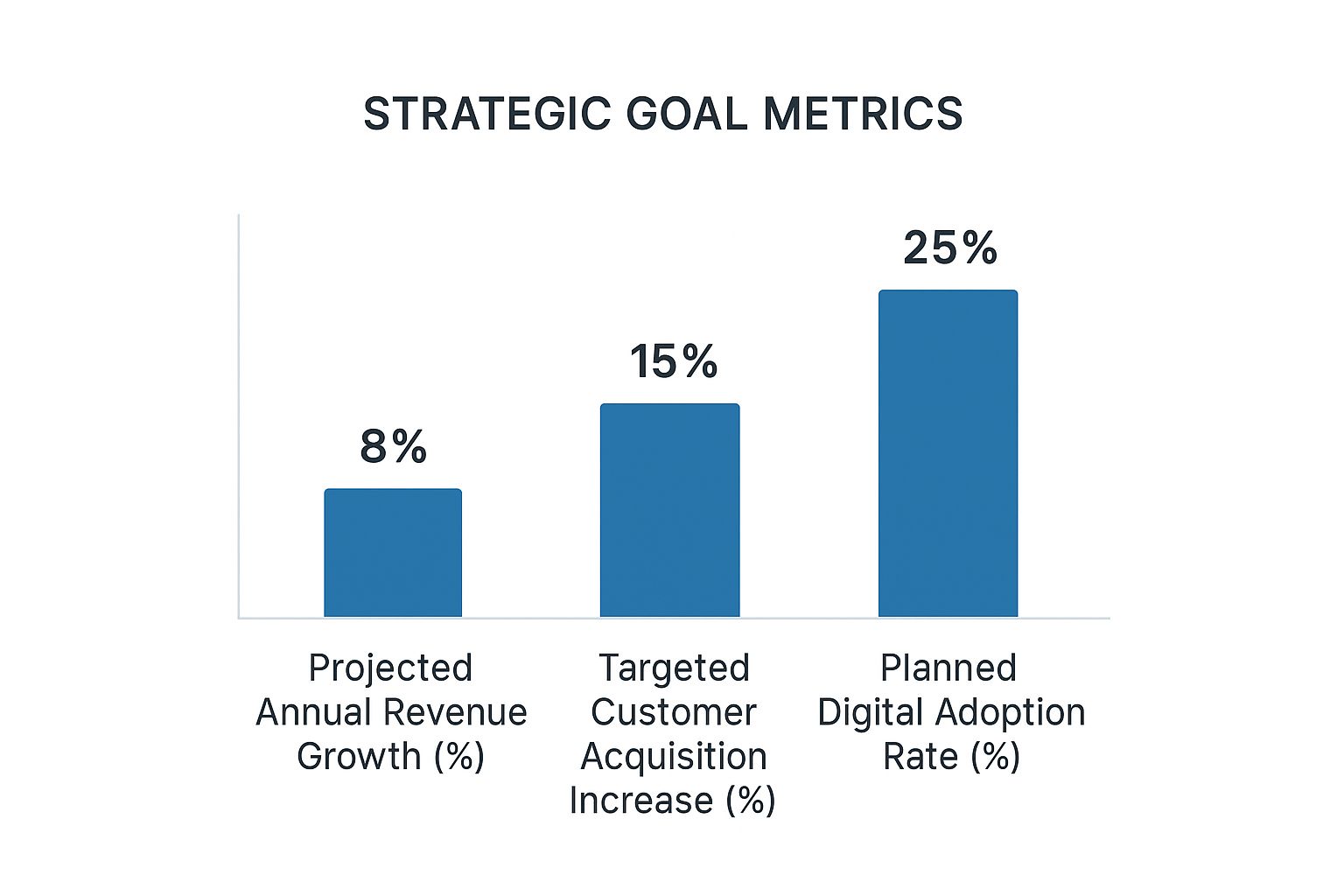

The chart below illustrates how high-level goals can be broken down into tangible targets for revenue, customer growth, and digital adoption, making strategy measurable and actionable.

This process represents a commitment to measurable outcomes that align the entire organization.

Moving from Internal Goals to Market-Beating Targets

A common strategic error is setting KPIs in an internal vacuum. For example, a 5% growth target for a commercial and industrial (C&I) loan portfolio may seem reasonable compared to last year's performance. However, if top-quartile banks in your market are achieving 12% growth, your "reasonable" goal ensures you lose market share. Effective KPIs are designed not just to surpass past performance, but to outperform the competition.

An effective KPI is a direct challenge to the status quo, informed by what is possible in your market. It should make your leadership team slightly uncomfortable, pushing the organization beyond incremental improvements and toward superior performance.

The objective should be reframed. A far more powerful, data-driven KPI is: "Achieve 15% year-over-year growth in C&I loans, outperforming the peer median of 10%." This transforms a simple task into a competitive mission and cultivates a culture where success is measured against market realities.

Translating Strategic Pillars into Data-Driven KPIs

Applying a benchmark-driven approach fundamentally changes how success is defined. This requires access to clean, reliable peer data to set targets that are both ambitious and grounded in reality. The table below demonstrates how to convert vague goals into sharp, data-informed KPIs.

| Strategic Pillar | Vague (Traditional) Goal | Specific (Data-Driven) KPI Example |

|---|---|---|

| Enhance Profitability | "Improve our Net Interest Margin." | "Increase NIM by 25 basis points to reach the 75th percentile of our asset-based peer group." |

| Drive Operational Efficiency | "We need to reduce costs this year." | "Lower the efficiency ratio to 55%, closing the gap with the top-quartile peer average of 52% within two years." |

| Accelerate Core Deposit Growth | "Focus on growing our core deposits." | "Increase non-interest-bearing deposits by $100 million, capturing 5% market share from regional competitors." |

Each of these examples is specific, measurable, and benchmarked against the competitive landscape. There is no ambiguity; they define the finish line for your team. This level of precision is enabled by robust financial data integration, the backbone of rigorous peer analysis.

Establishing the Right Cadence for Measurement

With benchmarked KPIs established, the next step is implementing a disciplined tracking rhythm. Annual reviews are obsolete in a fast-moving market. A quarterly review cadence, supported by real-time dashboards, is essential to keep strategy relevant and actionable.

Goal-setting methodologies like OKR frameworks are effective tools for this process, breaking down multi-year strategic goals into quarterly objectives and key results that maintain focus and alignment.

Ultimately, your KPIs should answer a simple question: are you gaining ground, holding steady, or losing market share? By benchmarking every significant goal, you ground your strategy in reality and execute a plan designed to win.

Aligning Technology Investments with Strategic Priorities

Technology represents one of the largest expenditures for any bank, yet its impact is often diluted or misaligned with strategic goals. A forward-thinking bank strategic planning process views technology not as a cost center, but as the primary engine for growth. The executive mandate is to ensure every dollar of IT investment directly fuels a core strategic pillar and delivers a measurable return.

"Run the Business" vs. "Change the Business"

A critical distinction must be made between "run-the-business" (RTB) costs and "change-the-business" (CTB) investments. RTB spending maintains operations—core systems, maintenance, and regulatory compliance. CTB investment is what drives competitive advantage—enabling new products, superior customer experiences, and meaningful operational efficiencies. The challenge is that RTB budgets consistently crowd out CTB initiatives.

The global banking industry is projected to spend $176 billion on IT by 2025. Despite this massive outlay, estimates show only 39% will be dedicated to "change the business" initiatives. The remainder is allocated to maintenance. You can explore more insights into banking technology trends for a complete analysis. For any institution not actively managing this balance, the imbalance represents a significant strategic vulnerability.

From Disconnected Budgeting to Strategic Allocation

An effective strategic plan does not allocate a generic budget to the IT department. It mandates the specific technological capabilities required to achieve each strategic objective. This shifts the conversation from "How much does IT need?" to "What technology is required to achieve our goals?"

Consider a strategic pillar to "Deepen customer relationships and increase wallet share."

The Traditional Approach: The plan might vaguely mention "investing in a new CRM" with a $500,000 budget. The IT department owns the project, and success is defined by on-time, on-budget deployment.

The Strategic Approach: The plan funds the entire data ecosystem required for the CRM to deliver value. This includes investments in data hygiene, a cloud infrastructure designed for analytics, and API integrations with the core system. The initiative becomes a $1.5 million investment measured by a 10% increase in products per household—a KPI owned by the Chief Revenue Officer.

This linkage ensures technology spending is inextricably tied to a business outcome.

Your AI-Ready Data Infrastructure is Non-Negotiable

A strategic plan that ignores the need for an AI-ready data foundation is already obsolete. Predictive analytics, intelligent automation, and personalized digital experiences are no longer aspirational concepts; they are baseline customer expectations.

A modern bank strategic plan must treat data infrastructure as a non-negotiable prerequisite for future growth. Failing to invest in clean, accessible, and well-governed data is a direct decision to fall behind competitors who are already monetizing their intelligence.

Planning sessions must therefore include frank discussions on data infrastructure:

- Data Governance: Who owns the data? How is its quality ensured?

- Cloud Capabilities: Do we possess the scalable infrastructure to support advanced analytics and machine learning?

- Talent: Do we have the data scientists and analysts capable of converting raw data into actionable intelligence?

An objective to "Optimize our branch network for profitability" is not achievable without the data infrastructure to analyze transaction patterns, customer demographics, and product profitability by location. The technology investment must precede the operational decision.

By framing technology as a direct enabler of strategy, it transitions from a reactive support function to a proactive competitive weapon. This requires the discipline to measure ROI not by system uptime, but by market share gained and strategic objectives met.

Navigating Economic and Regulatory Headwinds

A strategic plan designed for a benign environment will fail under stress. Today’s landscape of volatile interest rates, uncertain economic growth, and heightened regulatory scrutiny demands a plan that is not a static roadmap but a resilient, adaptable framework. The five-year forecast is a relic; agility is the new imperative.

Effective bank strategic planning embeds the capacity to absorb shocks directly into the operating model. It is about building a balance sheet and an operational structure that can withstand adversity, not just perform well in favorable conditions. Rigorous, data-driven scenario analysis is the essential tool for this purpose.

From Forecasting to Stress-Testing Your Strategy

The critical mindset shift is from asking, "What do we expect to happen?" to "How will our institution perform if the unexpected occurs?" This separates banks that thrive through economic cycles from those that merely survive them. Board-level discussions must evolve from simple projections to dynamic stress-testing.

Granular data intelligence is required to answer the critical questions:

- Interest Rate Sensitivity: What is the impact of a sudden 50-basis-point rate hike on our Net Interest Margin compared to our top five peers? Are we disproportionately exposed?

- Credit Quality Under Duress: If unemployment in our core market increases by 1.5%, which commercial loan segments will be impacted first?

- Liquidity Strain: In a deposit run-off scenario, what is our operational runway before we must access emergency funding?

These are not academic exercises. They are essential simulations that identify vulnerabilities before they become material threats. The ability to model these scenarios distinguishes proactive leaders from reactive managers. For a deeper analysis, review our guide on stress-testing for banks.

Integrating Macroeconomic Intelligence

A strategic plan cannot exist in a vacuum; it must be connected to real-world economic conditions. An institution with heavy concentration in construction lending must incorporate regional housing forecasts and supply chain cost projections into its capital allocation strategy.

Consider a community bank that uses peer data to observe competitors tightening underwriting standards for agricultural loans. Simultaneously, macroeconomic reports signal potential instability in commodity prices.

A data-informed leadership team sees this not as a problem, but as a strategic inflection point. They can proactively adjust their own risk appetite, reassess concentration limits, and reallocate resources toward a more stable C&I sector before a downturn materializes.

This proactive stance is becoming the industry standard. The 2025 banking outlook forecasts a challenging environment of slowing growth and shifting rates. It is no surprise that over 75% of banks are increasing investment in data management and cloud computing—a clear indication that data-driven resilience is the new strategic priority. You can gain further perspective by reading the full 2025 banking outlook.

ESG as a Strategic and Risk Management Imperative

Regulatory and market pressures are expanding beyond pure financials. Environmental, Social, and Governance (ESG) factors are moving from the periphery to the core of strategic planning. This is a matter of both risk and opportunity.

Regulators are focused on climate-related financial risks. A strategic plan that ignores the potential impact of a severe weather event on collateral values is dangerously incomplete.

Conversely, a forward-looking plan recognizes ESG as a source of competitive differentiation. Banks can build strategic pillars around sustainable finance—developing new products for green energy projects or offering preferential loan terms for businesses meeting sustainability targets. This approach addresses regulatory expectations while attracting a growing customer segment that values corporate responsibility.

By integrating robust economic and regulatory intelligence, your bank can anticipate market shifts, adjust its asset-liability mix to hedge against rate changes, or launch new initiatives to capture market share. The objective is not merely to survive economic cycles, but to emerge stronger from them.

Driving Execution and Performance Monitoring

A brilliant strategy is worthless without execution. The most detailed bank strategic planning document is meaningless without a rigorous, disciplined implementation process. This is where leadership must convert ambition into action.

The process begins with establishing a relentless cadence for performance reviews. Annual check-ins are a relic of a slower era. A quarterly rhythm is the new standard, forcing the leadership team to confront hard data and make decisions based on what is actually happening in the market, not on prior assumptions.

From Static Reports to Dynamic Dashboards

This disciplined review process requires the right information architecture: dynamic dashboards, not static, month-old reports. The leadership team needs real-time intelligence to answer critical questions immediately. For example: How is our Net Interest Margin tracking against our top-quartile peers this week? Is our new digital account opening initiative gaining traction relative to the competition?

This continuous feedback loop is a key differentiator for high-performing banks, enabling decisive course corrections before minor issues escalate.

Consider this practical example: A bank sets a strategic goal to grow its small business loan portfolio, with a target of $50 million in new originations for the year. The primary KPI is benchmarked against a peer average growth rate of 8%.

- At the Q1 review: The dashboard shows originations are at $8 million, lagging the quarterly goal of $12.5 million. More importantly, peer data from a platform like Visbanking reveals competitors are achieving a 9.5% growth rate.

The data immediately exposes the underperformance. Instead of waiting a full year to recognize strategic failure, the executive team can act now—reallocating marketing resources, retraining lenders, or revising its tactical approach.

The right data doesn't just inform your plan; it drives its execution. It transforms performance monitoring from a historical exercise into a forward-looking strategic weapon, ensuring accountability is woven into the fabric of the organization.

Building an Agile, Accountable Organization

Leading with data cultivates a culture of accountability. When performance is transparent and measured against objective market benchmarks, there is no ambiguity. Underperforming initiatives are identified by the numbers, enabling clear-eyed, strategic decisions about where to deploy capital and talent.

The objective is not simply to be well-planned, but to be intensely agile. The strategic plan must be a living document, constantly refined by real-world data. This ensures the bank remains focused on execution and prepared to move faster than the competition. It begins with a clear understanding of where you stand relative to your peers. See how benchmarking your performance with Visbanking can provide the clarity needed to drive superior execution and convert strategic vision into measurable results.

Burning Questions on Bank Strategic Planning

Even the most seasoned executives face questions when shifting to a modern, data-first approach to bank strategic planning. This is a fundamental change, moving from high-level goals to executing on granular, evidence-backed initiatives.

How Do I Get the Board on Board with a Data-Driven Strategy?

Board members are focused on two primary mandates: mitigating risk and ensuring a clear return on investment. Therefore, this shift should not be framed as a "cost," but as an essential defense against regulatory action and competitive displacement.

Present a clear business case. A $50,000 investment in a competitive intelligence platform is not an expense; it is a strategic asset. Illustrate how that platform could be used to identify an underperforming loan category, allowing the bank to proactively adjust its portfolio and potentially avoid $500,000 in future losses. This reframes the conversation from cost to strategic necessity.

How Often Should We Really Be Looking at Our Strategic Plan?

The static five-year plan is obsolete. While a long-term vision serves as a North Star, the operational path to achieving it must be flexible.

A formal, deep-dive review of the strategic plan must occur annually. However, performance against core KPIs must be tracked on a quarterly basis. This cadence enables agile, intelligent adjustments based on real-time market conditions, not on last year's assumptions.

Where Can I Get My Hands on Good Competitive and Market Data?

Internal data provides only half the picture. A winning strategy must be benchmarked against the external environment using trusted data sources. While regulatory filings like call reports are available, manually extracting and synthesizing this data is inefficient, and the insights are often stale by the time they are compiled.

Specialized bank intelligence platforms are no longer a luxury; they are essential infrastructure. These platforms perform the heavy lifting of aggregating and cleaning vast amounts of data, delivering the actionable insights required to benchmark key metrics like Net Interest Margin, efficiency ratios, and deposit growth against your true peers. Without this external validation, goal-setting is merely guesswork.

At Visbanking, we transform complex market data into the clear, actionable intelligence your leadership team requires to build a winning plan. See how our platform can help you benchmark performance and identify your next strategic opportunity. Explore the data at https://www.visbanking.com.