A Guide to the Bank Risk Management Framework

Brian's Banking Blog

At its core, a bank risk management framework is the game plan. It’s the collection of strategies, policies, and nuts-and-bolts processes a bank uses to spot, size up, and handle the risks it faces every single day.

Think of it like the detailed blueprint for a skyscraper. You wouldn't build one without knowing exactly how it will stand up to high winds, earthquakes, or other potential disasters. That blueprint includes the architectural plans and the emergency protocols, all designed to keep the building sound, no matter what storm comes its way.

What Is a Bank Risk Management Framework?

Imagine a bank trying to navigate today's markets without a solid plan for things like market crashes, widespread loan defaults, or a major cyberattack. It would be like a ship captain trying to cross treacherous seas with no rudder, no map, and no one in the crow's nest. It’s not a question of if a storm will hit, but when.

A bank risk management framework is that sophisticated navigation system. It helps the institution steer clear of obvious hazards, manage the storms it can't avoid, and ultimately reach its goals safely. This isn’t some dusty rulebook that sits on a shelf; it’s a living, breathing system built to protect the bank, its customers, and the entire financial ecosystem.

The framework pulls risk management out of the reactive, "firefighting" mode and turns it into a proactive, forward-looking discipline. By setting clear guidelines, it ensures every single decision—from approving a small business loan to trading billions in complex securities—is made with a full understanding of the bank's appetite for risk.

The Foundational Pillars of Risk Management

Every solid framework is built on a few essential pillars that work in tandem. These pillars provide the necessary structure for a complete and robust approach to overseeing risk. Each one tackles a different part of the risk lifecycle, from spotting a potential problem to ongoing governance.

The table below breaks down the four foundational pillars that form the bedrock of any successful bank risk management framework.

The Four Pillars of a Bank Risk Management Framework

This table summarizes the four essential pillars that form the foundation of any effective bank risk management framework.

| Pillar | Description | Key Function |

|---|---|---|

| Risk Governance | The overall system of rules, practices, and processes that directs and controls the bank. It defines roles, responsibilities, and accountability from the board down to the front line. | Establishes crystal-clear lines of authority and ensures senior management has its eyes on the ball. |

| Risk Identification & Assessment | The process of methodically finding potential risks across the entire organization and then analyzing their potential impact and how likely they are to happen. | This is where you answer the critical questions: "What could go wrong, and how bad could it be?" |

| Risk Control & Mitigation | The actions and strategies put in place to either reduce the chance of a risk event happening or to soften the blow if it does. | Creates the operational playbook for handling known threats and staying within the bank's established risk limits. |

| Risk Monitoring & Reporting | The continuous tracking of risk exposures and the performance of mitigation efforts, with regular, clear reporting to key decision-makers. | Provides the real-time dashboard needed for smart decisions and quick course corrections when things go off track. |

These pillars give banks the tools they need to build a comprehensive defense against uncertainty.

This visual from Wolters Kluwer is a great illustration of how these concepts are often put into practice, highlighting the famous "Three Lines of Defense" model that is central to strong risk governance.

The diagram breaks it down perfectly. The first line (the business units actually taking the risks) owns it. The second line (your risk management function) provides expert oversight. And the third line (internal audit) delivers independent, unbiased assurance. It’s a powerful, layered defense system that, when working correctly, is tough to beat.

Understanding the Core Components

Think of a solid bank risk management framework like a high-performance car engine. It's not just one big part; it's a collection of critical, interconnected components all firing in perfect sequence. To really get how it shields a bank from harm, we need to pop the hood and see how these individual parts work together as a single, unified machine.

Let’s say your bank is gearing up to launch a new digital lending app. It’s an exciting new venture, but it’s also riddled with potential landmines. This is exactly where the framework’s core components prove their worth, transforming a field of uncertainty into a managed, predictable process. Each step logically flows into the next, creating a complete cycle of oversight.

Risk Identification: The "What Could Go Wrong?" Stage

First up is Risk Identification. This is essentially a structured brainstorming session. You’re asking the most important question of all: “What could possibly go wrong with this new app?” The idea is to cast a wide net and flag every potential threat you can think of, no matter how minor it might seem at first.

For our digital lending app, the risk list might look something like this:

- Cybersecurity Risks: A data breach could leak sensitive customer data.

- Credit Risks: What if the app's automated underwriting logic starts approving bad loans?

- Operational Risks: A simple tech glitch could crash the app right when customers need it most.

- Compliance Risks: The app might not perfectly align with every consumer lending regulation.

This isn't about being pessimistic; it's about being prepared. This proactive discovery process stops the bank from getting blindsided by predictable issues later on.

Risk Assessment: Sizing Up the Threats

Once you have your list of risks, it’s time for Risk Assessment. This is where you get down to the nitty-gritty of analyzing and quantifying the potential damage. It’s about figuring out both how likely a risk is to happen and how bad it would be if it did. Suddenly, your long list of worries becomes a prioritized action plan.

A real assessment isn’t just a gut feeling. It's a data-driven process that separates the minor bumps in the road from the catastrophic failures that need senior management's immediate attention.

Looking at our app, you'd weigh the financial and reputational fallout of a data breach against the impact of a temporary system outage. You can dive deeper into this critical stage with a detailed guide to a banking risk assessment. This analysis is all about focusing your time and money where they matter most.

Risk Mitigation: Creating the Playbook

With risks identified and measured, we move to Risk Mitigation. This is the action phase where you build your game plan to control the threats. The goal isn't always to eliminate risk—that’s usually impossible—but to wrestle it down to a level that your bank is comfortable with, as defined by its risk appetite.

For the app, your playbook might include:

- Acceptance: For a low-impact risk, you might just decide to live with it.

- Avoidance: If a new feature is simply too risky, you might scrap it altogether.

- Transfer: You could buy cybersecurity insurance to offload the financial risk to a third party.

- Control: Implementing things like multi-factor authentication and rigorous testing directly controls the risk of breaches and glitches.

Finally, the whole process comes full circle with Monitoring and Reporting. This acts as your live dashboard. It keeps an eye on the risks you’ve identified, checks if your mitigation strategies are working, and feeds clear, timely updates to decision-makers. It ensures the framework is a living, breathing system, not some static document gathering dust on a shelf. This allows the bank to pivot quickly as the world changes and new risks pop up.

How the Three Lines of Defense Model Works

At the heart of any solid bank risk management framework is a crystal-clear governance system. Everyone needs to know who is responsible for what. The most common and effective way to achieve this is a model called the Three Lines of Defense.

This structure isn't about creating bureaucracy. It's about building layers of accountability so that managing risk becomes a shared mission, not just a task for a single department.

Think of it like a championship sports team:

- First Line: These are your players on the field—the loan officers, traders, and product managers. They are closest to the action, making daily decisions that create risk. They have to own it.

- Second Line: These are the coaches. This group includes your risk management and compliance functions. They aren't playing the game, but they're setting the strategy, providing oversight, and making sure the players follow the rules and stay within the bank's risk appetite.

- Third Line: These are the impartial referees. This is your internal audit team. They are completely independent and give the board objective assurance that the whole system—both players and coaches—is actually working the way it's supposed to.

When this model clicks, it fosters a culture where everyone gets their role in the bigger picture of managing risk.

From Effective to Credible Challenge

What’s fascinating is how this model has evolved. Over the last 25 years, regulators have pushed for more than just process; they want genuine, meaningful oversight. This has shifted the focus from a simple "effective challenge" to a much more demanding "credible challenge."

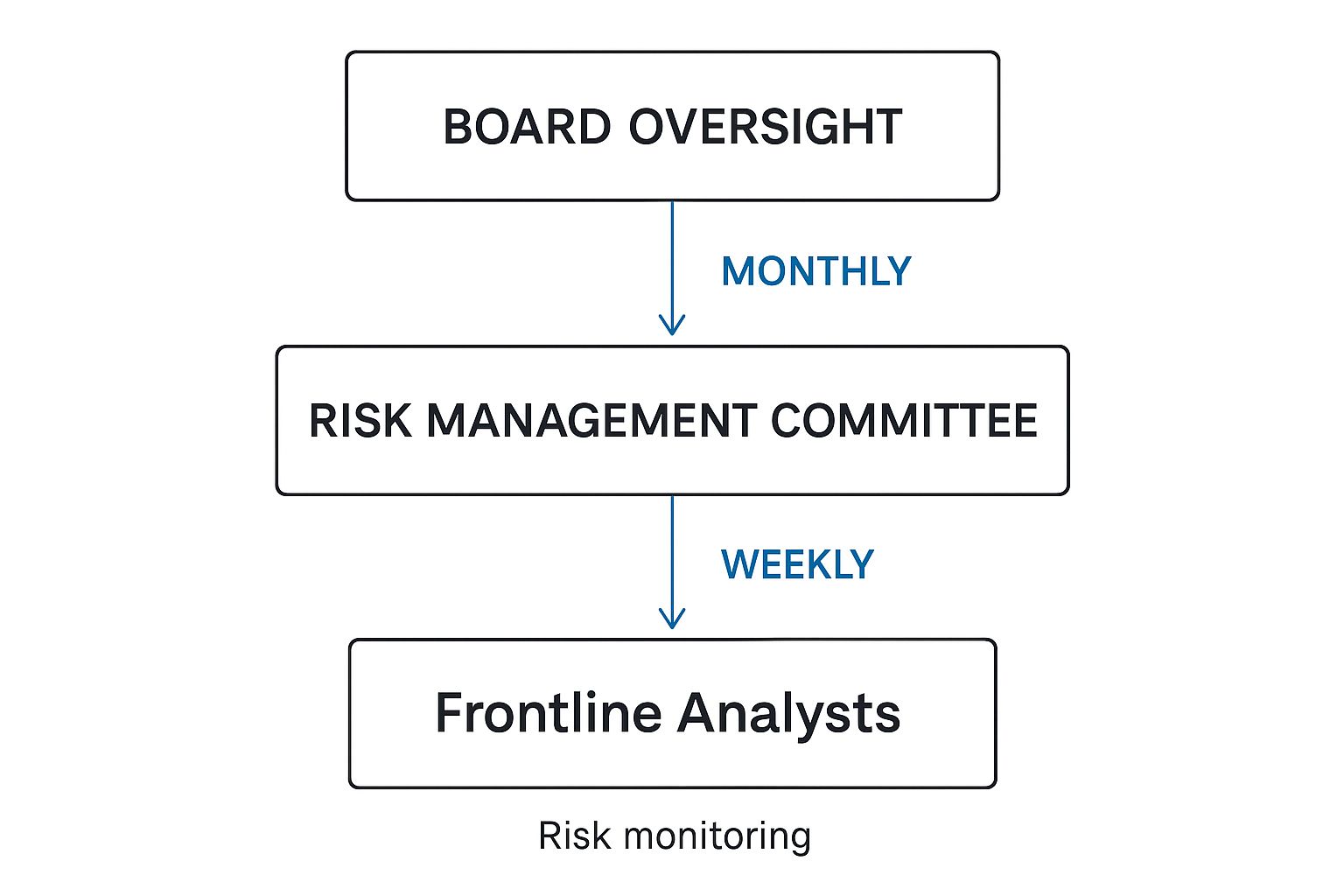

A credible challenge means the second line (the coaches) can't just ask questions. They need to have the expertise and practical insight to challenge the first line in a way that truly adds value and improves outcomes. This layered approach ensures that critical information flows up the chain logically and efficiently.

As you can see, frontline teams provide constant, detailed updates to risk committees. Those committees then boil it all down and report the most important findings straight to the board.

Making the Model Work in Practice

For this model to be more than just a chart on a wall, every line needs the right resources and real authority. The second line, especially, must be empowered to effectively challenge the first. This dynamic is what stops business units from going rogue and ensures their day-to-day activities align with the bank's strategic goals and risk limits.

The real point of the Three Lines model is to eliminate blind spots. By creating distinct but connected layers of oversight, you make it incredibly difficult for a major risk to go unnoticed or unmanaged.

This structure is also absolutely critical for processes like stress testing for banks. When your bank models its ability to withstand a severe economic crisis, each line of defense has a part to play—from designing the scenarios to executing the tests and reviewing the results. This collaboration is what makes the analysis truly robust and trustworthy.

Defining and Applying Your Risk Appetite

At the heart of any solid bank risk management framework lies a single, defining question: how much risk are we actually willing to take on to hit our targets? This is your risk appetite, and nailing it down is everything. It can feel like a fuzzy concept, but a simple analogy makes it crystal clear.

Think of your risk appetite as the speed limit for your bank. The goal isn't to crawl along at zero miles per hour—that's a surefire way to never get where you're going. Instead, it’s about the board setting a clear, well-understood limit on just how fast the institution can "drive" to make sure you're making good time without being reckless.

Building Your Risk Appetite Statement

This whole idea gets formalized in a document called a Risk Appetite Statement (RAS). A truly effective RAS isn't filled with vague, feel-good statements. It's a practical blend of hard numbers and clear qualitative guidelines that's specific enough to actually guide people's decisions day in and day out.

A strong RAS will always include:

- Quantitative Metrics: These are your non-negotiable hard lines in the sand. Think of things like a maximum loan loss ratio, a minimum capital adequacy ratio, or strict caps on how much exposure you'll take on from a single industry or borrower.

- Qualitative Statements: These add the "why" behind the numbers. They define the types of risks the bank is okay with and which ones it will actively sidestep. A common example is declaring zero tolerance for any compliance slip-ups or reputational hits from shady practices.

Over the last decade, we've seen a ton of change in how banks structure these frameworks, especially when it comes to defining and monitoring risk appetite. The industry has largely landed on a common approach: a RAS that mixes these quantitative and qualitative pieces, with clear roles for the three lines of defense. You can dive deeper into these learnings from risk appetite’s evolution on rmahq.org.

From a Document to a Daily Guide

Here's the real challenge: it's not writing the RAS, it's making it live inside the bank's culture. A risk appetite statement collecting dust in a binder is completely useless. It has to become a living, breathing guide for everyday choices, ensuring everyone from loan officers to product managers is playing within the same safe boundaries.

A well-applied Risk Appetite Statement acts as the guardrails for the entire organization. It empowers employees to take calculated risks that drive growth while preventing actions that could lead to catastrophic failure.

Making this happen takes relentless communication and training. When a loan officer looks at a new application, they should instinctively think about how it stacks up against the bank's stated credit risk limits. When the wealth management team cooks up a new investment product, they have to check that it aligns with the bank's appetite for market risk.

This kind of alignment is no accident. It’s the direct result of a deliberate push to cascade the RAS from the boardroom right down to the front lines. The framework must connect those high-level appetite statements to very specific risk limits and operational controls. This is how a bank can be both ambitious and safe—chasing profits while ensuring long-term stability.

Navigating the Modern Regulatory Landscape

Let's be honest, modern banking isn't happening in a vacuum. Financial institutions are tangled in a dense, constantly shifting web of rules and regulations. This isn't just red tape; it's a system designed to keep the entire financial world stable and protect consumers. A solid bank risk management framework isn't just a "nice-to-have" anymore—it's a direct answer to the immense pressure coming from global regulators.

Think of heavy-hitting regulations like Basel III/IV and the Dodd-Frank Act. They aren't just bureaucratic hurdles. They are fundamental forces that dictate the very architecture of how we manage risk. These rules were born from the ashes of past crises, created specifically to prevent future meltdowns by demanding more transparency, stronger capital reserves, and far more sophisticated risk modeling.

Simply reacting to these rules is a recipe for disaster. Banks that just "check the box" are always playing catch-up, leaving themselves open to fines and serious reputational damage. The real goal is to build a framework that can anticipate and adapt to these shifts, turning compliance from a painful chore into a genuine strategic edge.

Turning Regulation Into a Strategic Advantage

So, how do you do that? An effective framework weaves regulatory requirements into its very DNA.

This isn't about having a separate "compliance" department siloed off in a corner. It's about making risk management and following the rules one and the same. This kind of integration is absolutely critical to navigating today's complex environment.

For instance, data privacy and security are huge regulatory hotspots. As banks deal with these issues, understanding specific rules like GDPR compliance is vital for managing both operational and reputational risk. A well-built framework makes sure these concerns are baked into every new product launch and system update from the very beginning.

This forward-thinking approach also builds a massive amount of trust with regulators, investors, and customers. A bank that can prove it has a deep, forward-looking grasp of the rules is seen as more stable and reliable. In a volatile market, that's a powerful way to stand out. If you want to go deeper, we have a detailed guide on https://visbanking.com/regulatory-compliance-for-banks/ that you'll find useful.

The Intensifying Pressure on Risk Modeling

The regulatory landscape is the main reason we're seeing a massive push to upgrade risk modeling. Regulators are looking closely, and today’s shaky macroeconomic environment demands models that are more detailed and dynamic than ever before.

This shift really shines a light on how regulatory demands are now a primary driver of risk management strategies. In many cases, they're even taking precedence over traditional business goals.

The pressure has ramped up significantly. In fact, 59% of banks now point to regulation as a key factor shaping their risk management approach. That's a huge jump from just 37% in 2021.

This has kicked off a major focus on technology. A whopping 67% of banks are planning to upgrade their risk modeling systems to improve quality and get them deployed faster. A modern bank risk management framework absolutely must have the tech agility to keep up with these escalating demands.

Frequently Asked Questions

When you start digging into the nuts and bolts of a bank risk management framework, a few practical questions always come up. It's one thing to understand the theory, but it's another to apply it in the real world, especially when you're watching the budget or staring down an outdated system. Let's tackle some of the most common ones.

What’s the Difference Between Risk Management and a Risk Management Framework?

It's a classic "chicken or egg" type of question, but the distinction is actually pretty simple.

Think of risk management as the action—the day-to-day grind of spotting, measuring, and reacting to risks. It's what your people do.

The bank risk management framework, on the other hand, is the playbook. It's the entire system that dictates how your team plays the game. It lays out the structure, the rules, the policies, and the governance (like the Three Lines of Defense) to make sure all that "doing" is consistent, smart, and actually supports the bank's goals and risk appetite.

You can't have one without the other, at least not effectively. The framework is the map; risk management is the journey.

How Can a Smaller Bank Implement a Framework Without a Huge Budget?

This is a big one. The good news? A solid framework isn't about outspending the competition; it's about being smart and scalable. Smaller banks can absolutely build a rock-solid framework without breaking the bank.

First, get your risk appetite down on paper. Even a simple, clear statement is a world better than having nothing. Next, formalize your Three Lines of Defense. Define who is responsible for what, even if people have to wear a few different hats. This creates accountability, which is priceless.

The goal isn’t to copy the sprawling, complex systems of a global giant. It’s to build a clear, documented, and repeatable process that zeroes in on the risks that truly matter to your institution.

From there, look into scalable risk management software that fits your size. Focus your energy and resources on your biggest threats, which for most community banks means credit and operational risk. This targeted approach puts your money where it has the most impact, building a strong foundation from the ground up.

What Are the First Steps to Update an Outdated Risk Framework?

Bringing a creaky old framework into the modern era requires a plan. Don't just start tearing things down.

- Run a Gap Analysis: First things first. Put your current framework side-by-side with today's regulatory standards and what the best in the business are doing. This will shine a spotlight on your biggest weaknesses and give you a clear to-do list.

- Get the Board on Board: You can't do this alone. You need genuine buy-in from your board and senior leaders. Their support is what unlocks the budget, resources, and cultural push needed for real change.

- Redefine Your Risk Appetite: Is your risk appetite statement still relevant? The market has changed, and your strategy has likely evolved. Make sure your RAS reflects today's reality, not yesterday's.

- Shore Up Your Governance: Finally, get back to basics. Solidify your governance structure. Make sure everyone knows their role in the Three Lines of Defense and that your risk committees are actually effective. Get these fundamentals right before you even think about fancy new models or tech.

At Visbanking, our Bank Intelligence and Action System (BIAS) is built to help your bank shift from putting out fires to playing offense. We integrate data from multiple sources so you can benchmark your performance, spot opportunities, and monitor the entire industry. It’s the kind of intelligence that supports a truly forward-thinking risk management framework. Discover how Visbanking can empower your decision-making.