A Guide to Strategic Bank Capital Planning

Brian's Banking Blog

Effective bank capital planning is not a regulatory chore; it is the engine for sustainable growth and the bedrock of institutional resilience. For bank executives and directors, treating capital as a strategic asset—not merely a compliance metric—is what separates market leaders from the laggards.

This guide moves beyond the basics of regulatory adequacy. We will explore how to design a capital structure that fuels strategic objectives, leverage stress testing as a forward-looking tool, and use peer data to build a competitive advantage. This is about transforming your bank capital planning from a defensive posture into a decisive offensive strategy.

Why Proactive Capital Planning Is a Strategic Imperative

In a fluctuating economic environment, capital is the ultimate strategic resource. It is the fuel for every critical decision, from funding organic loan growth and overhauling digital infrastructure to executing a strategic acquisition. A static capital plan is a profound missed opportunity. A dynamic plan, however, becomes the central framework informing every major decision made by the executive team and the board.

This is not theoretical. Banks are actively recalibrating their capital strategies for 2025. As interest rates are expected to fall, the strategic landscape is shifting. After a period of locking in high yields on bond portfolios, leadership teams are refocusing. Projections show loan growth accelerating from a sluggish 2% in 2024 to a healthier 6% globally in 2025, driven by lower borrowing costs for businesses and consumers. More details on this outlook are available in the latest EY research.

From Defense to Offense

A purely defensive capital plan—one focused solely on clearing regulatory minimums—cripples decisive action. Shifting to an offensive strategy means asking more powerful questions:

- Do we have the capital capacity to expand our C&I lending portfolio by 15% next year?

- How can we fund a critical technology upgrade to improve efficiency without diluting shareholder value?

- How does our capital allocation to key business lines compare to the top-performing banks in our peer group?

Answering these questions demands forward-looking data intelligence. It is no longer sufficient to know your own balance sheet; you must understand the competitive landscape.

It is easy to feel secure with a 10% Tier 1 capital ratio. But if your direct competitors are operating at 11.5% and expanding their loan books at twice your rate, that 10% is not stability—it is a competitive handicap.

Data-Driven Decisions in Practice

This is the point where executive judgment must be augmented by hard data. Financial intelligence platforms like Visbanking are no longer optional; they are essential for modern banking strategy.

By benchmarking capital levels, composition, and deployment against a curated peer group, you eliminate guesswork. This data-driven approach allows you to enter a board meeting or a regulatory review with unshakeable confidence, turning your capital plan from an internal compliance document into a powerful narrative. It is a narrative that proves to your board, regulators, and investors that your capital position is not merely "adequate"—it is a strategic advantage. Explore our data to benchmark your bank.

Designing a Capital Structure for Strategic Growth

Your bank's capital structure is the foundation of your strategic plan. A thoughtfully designed structure does more than satisfy compliance—it fuels growth, funds innovation, and provides the strength to seize market opportunities. The critical decision is selecting the right instrument for the right objective, whether common equity, preferred stock, or subordinated debt. The answer must be driven by strategy, not just the rulebook.

For instance, raising Common Equity Tier 1 (CET1) capital is the move when preparing for a major acquisition or bracing for a significant economic downturn. Conversely, issuing subordinated debt can be a more targeted, cost-effective tool for funding a specific project, such as a major technology platform overhaul, without diluting existing shareholders. These decisions require foresight, ensuring the right funding is available at the right cost when opportunity arises.

From Theory to Strategic Execution

Consider a practical example: a $5 billion community bank, historically concentrated in commercial real estate (CRE), identifies an opportunity to aggressively expand into Commercial & Industrial (C&I) lending over the next three years. This strategic pivot requires a new capital approach.

Their current capital base, primarily CET1, was prudent for a stable CRE market. However, leadership understands that attracting top C&I talent and building the necessary infrastructure requires a capital injection that does not penalize shareholder returns. The CFO uses a data intelligence platform like Visbanking to analyze a peer group of banks that successfully executed a similar pivot. The data reveals two critical insights:

- Successful peer banks maintained a Tier 1 Leverage Ratio approximately 50 basis points higher than our subject bank's current level during their transition.

- Many utilized subordinated debt to fund initial infrastructure and talent costs, preserving common equity to fuel subsequent loan growth.

Armed with this data, the bank develops a multi-year capital plan. They decide to issue $50 million in subordinated debt, timed to coincide with their technology spend and new C&I hires. This action bolsters Tier 2 capital, provides a healthy regulatory cushion, and signals strength to the market—a direct outcome of data-informed strategic planning.

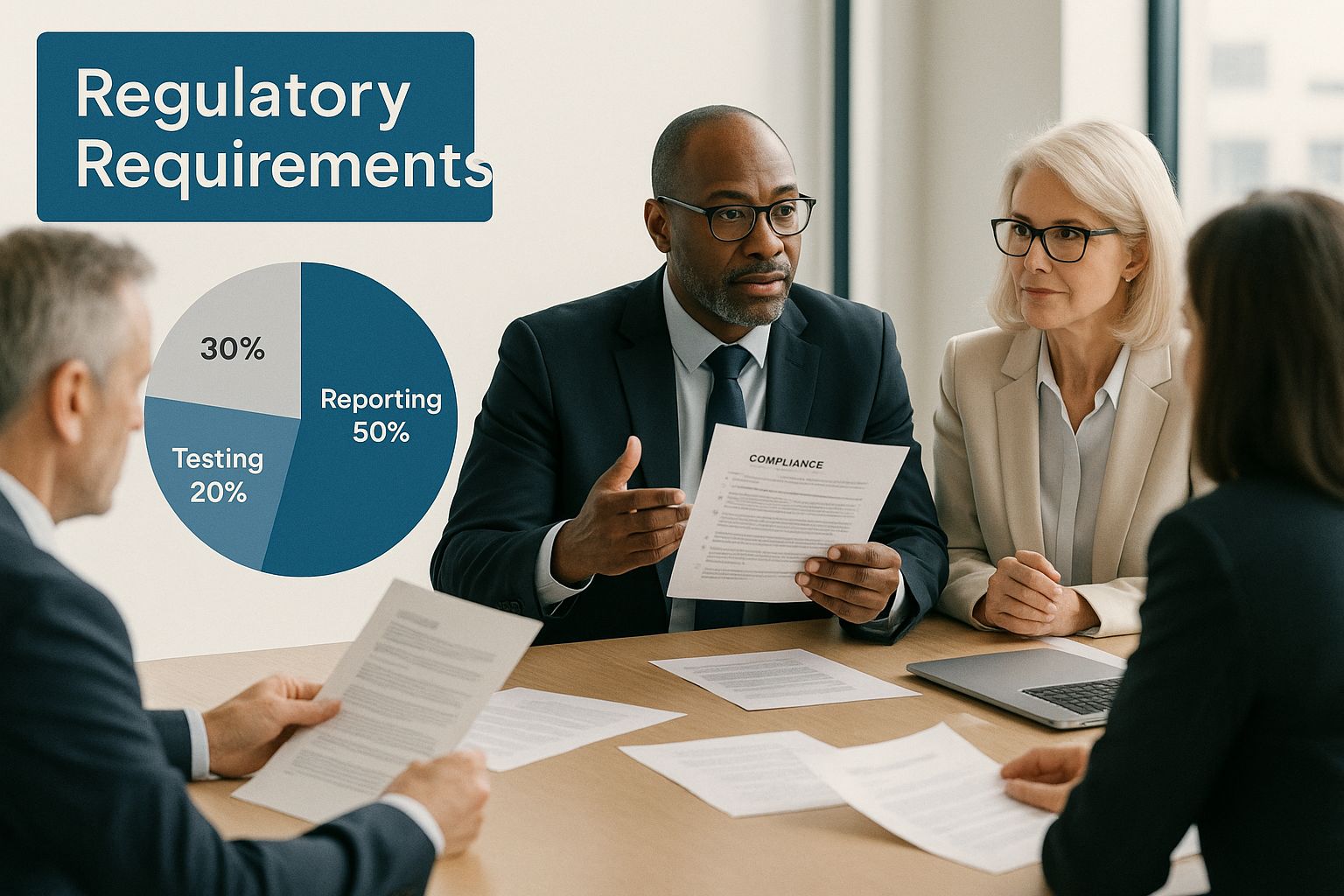

As the image suggests, every strategic discussion must be anchored in a deep understanding of the compliance landscape. It's non-negotiable.

Matching Capital Instruments to Your Goals

The choice of a capital instrument has lasting consequences and requires a clear-eyed assessment of the trade-offs between cost, control, and flexibility.

Recent trends in evolving capital strategies show banks are becoming more sophisticated in their choices. Senior debt issuance in the U.S. climbed from approximately $63 billion in 2023 to nearly $70 billion in 2024, valued for its adaptability. Subordinated debt remains a workhorse, acting as Tier 2 capital at the holding company and often injected to bolster Tier 1 capital at the bank level.

To clarify these choices, consider the strategic application of each instrument.

Capital Instruments and Their Strategic Application

This table contrasts different capital instruments, outlining their regulatory treatment, typical use cases, and strategic advantages for bank capital planning.

| Capital Instrument | Regulatory Tier | Primary Strategic Use Case | Key Advantage |

|---|---|---|---|

| Common Equity | CET1 | Building a "fortress balance sheet" for major acquisitions or absorbing significant losses. | Highest quality of capital; provides maximum loss-absorption capacity. |

| Preferred Stock | Additional Tier 1 | Bolstering Tier 1 capital without diluting common shareholders' voting rights. | Non-dilutive to voting control; can be perpetual. |

| Subordinated Debt | Tier 2 | Funding specific growth initiatives or M&A; providing a capital buffer. | Cheaper than equity; non-dilutive to ownership. |

| Senior Debt | Not Regulatory Capital | Funding general corporate purposes and operational needs at the holding company. | Flexible terms and structures (term loans, lines of credit). |

Each instrument has a distinct role. The strategic imperative is to deploy the right one at the right time, grounded in a forward-looking model of how different capital combinations perform under various scenarios. When these decisions are informed by robust peer data, you move from speculation to a defensible, actionable plan. The first step is to know where you stand. Benchmark your capital structure against your true peers and identify your strategic opportunities.

Don't Just Check the Box—Turn Stress Testing Into Your Strategic Superpower

For too long, stress testing has been viewed as a compliance exercise. The most effective leadership teams, however, recognize it as a powerful simulation tool for the bank's future. Strategic insight comes not from generic, regulator-prescribed scenarios, but from custom-built stress tests that reflect your institution’s unique risk profile—your specific loan concentrations, key markets, and geographic exposures. This is where bank capital planning transitions from reactive to truly proactive.

From Compliance Drudgery to Strategic Wargaming

The objective is to answer the difficult "what-if" questions that are material to your institution's success. What if our region's largest employer relocates? How would a sudden spike in local unemployment impact our portfolio and liquidity? These are not theoretical exercises; they are essential questions for building a resilient institution. Custom scenarios transform the stress test into a dynamic wargame for your balance sheet, forcing a level of candid self-assessment that a standard compliance-first approach will never achieve.

A Real-World Example: Ag-Lending on the Ropes

Consider a $3 billion community bank with a heavy concentration in agricultural lending to corn and soybean producers. A generic stress test modeling a general recession is useful, but a custom scenario is far more powerful. We design a severe but plausible scenario combining two events:

- Event 1: A severe, prolonged drought impacts the bank's primary lending area, reducing crop yields by 30%.

- Event 2: Simultaneously, global commodity prices collapse, driving corn and soybean prices down by 25%.

This combination is devastating. Farm revenues plummet, loan delinquencies surge, and the value of farmland held as collateral becomes uncertain. This is no longer about checking a box; it's about defining a survival strategy.

The true value of a stress test is not the final capital number it produces, but the difficult conversations it forces. It is about defining the precise triggers for action—the point at which a capital buffer is breached, a dividend is suspended, or a contingency plan is activated.

Turning Numbers Into Action

The results of this agriculture-focused scenario must drive tangible decisions. The bank’s leadership can model the direct impact on capital and map out a clear action plan.

The Damage Report: The model reveals this perfect storm would reduce the bank's Tier 1 capital ratio from a solid 11.0% to 8.5% within 18 months.

The Tripwire: Management establishes a clear trigger. If projections show the Tier 1 ratio falling below 9.0% under this stress, a pre-defined set of capital preservation actions is automatically implemented—no debate, no delay.

The Escape Hatch: The scenario also identifies a potential liquidity crisis as distressed borrowers draw down lines of credit. This insight prompts the bank to secure additional contingent funding lines with its correspondent partners before a crisis materializes.

This detailed roadmap is critical for navigating a storm. For a deeper look at the mechanics, our guide on stress testing for banks provides further detail.

Context is Everything: How Do You Stack Up?

Running custom scenarios is a significant step, but it must be defensible. Every board member and regulator will ask the same question: "How do we know your assumptions are credible?" This is where peer benchmarking is indispensable.

Using a platform like Visbanking, you can demonstrate how your stressed capital ratios compare to a curated peer group of banks with similar agricultural concentrations. If your model shows capital falling to 8.5% while peers model a drop to 7.5%, you can confidently defend the rigor of your assumptions. That data-driven context changes the entire dynamic. It provides the board with confidence that your bank capital planning is not just internally sound but validated against the market, turning a regulatory burden into a demonstration of strategic mastery.

Leveraging Peer Benchmarking for a Competitive Edge

Relying solely on internal targets and historical performance to guide your capital plan is like driving while looking only in the rearview mirror. It shows where you have been, but not where the market—or your competition—is going. In today’s competitive landscape, context is everything. True strategic insight comes from understanding how your capital adequacy, composition, and deployment compare to the banks you actually compete with every day.

Without this external perspective, you are operating in a vacuum. A capital plan developed in isolation is disconnected from market reality, leaving your institution vulnerable to more data-savvy competitors.

The Danger of an Internal Echo Chamber

Consider a common scenario: a bank maintains a solid 10% Tier 1 Capital Ratio. Internally, this is viewed as a success—it is well above regulatory minimums and consistent with historical performance.

However, what if direct competitors—those fighting for the same loans and deposits—are operating at 11.5% and growing their loan portfolios 50% faster? That "safe" 10% ratio is no longer a sign of prudence; it is a strategic liability. It signals to the market that you may lack the capacity for aggressive growth or innovation.

A capital ratio is not an absolute measure of strength; its value is relative to the competitive landscape. What appears safe in isolation can be a signal of stagnation when you are being outmaneuvered by ambitious peers.

This is where sharp, data-driven intelligence transforms the conversation from, "Are we compliant?" to "Are we competitive?"

Defining Your True Peer Group

Effective benchmarking is not about comparing your institution to a generic, nationwide average. Strategic value is unlocked by building a custom peer group that mirrors your bank's specific competitive environment.

This is where a tool like Visbanking becomes indispensable. It allows you to define a peer set with precision based on criteria that matter, such as:

- Banks within a specific asset range (e.g., $10B to $20B).

- Institutions located in your primary geographic footprint.

- Competitors holding a similar concentration in a key lending area like commercial real estate (CRE).

This focused analysis provides hard evidence on how your competitors manage capital, their dividend policies, and their growth funding strategies—intelligence you need to defend your capital plan to regulators and the board. Broader market context is also valuable. For example, in 2025, the world’s top 25 global banks saw a 31.9% year-on-year increase in aggregate market capitalization, reaching approximately $5.3 trillion, tied to shifting central bank policies. You can discover more about these global banking trends on GlobalData.

From Data to Decisive Action

Armed with comparative data, your capital plan evolves from a static compliance document into a dynamic strategic weapon. Executive judgment is now grounded in market reality. For instance, if your team is debating a more aggressive dividend policy, peer data might reveal that direct competitors with similar earnings are retaining more capital to fund technology investments. This doesn’t automatically preclude a dividend increase, but it forces a more sophisticated discussion about the strategic trade-offs.

Ultimately, peer benchmarking provides the external validation needed to build a capital plan that is not just safe, but smart. It helps you anticipate market shifts, justify strategic decisions, and allocate capital to its most productive use. The first step is knowing where you truly stand. Benchmark your bank against a custom peer group today.

Weaving Capital Planning into Your Bank's DNA

In a high-performing bank, capital planning, risk appetite, and financial performance are not separate functions; they are integrated components of a single strategic framework. Your capital plan must be a living document, constantly shaping and being shaped by your most critical business decisions. This requires moving beyond viewing capital as a safety net and treating it as a core metric for measuring risk-adjusted performance across the entire organization. When capital planning is disconnected from daily operations, it becomes a compliance exercise instead of a strategic roadmap.

Connecting Your Capital Plan to Your Risk Appetite

The most effective way to operationalize your capital plan is to link it directly to your bank’s risk appetite statement with hard-wired capital triggers. These triggers should automatically initiate pre-planned actions when a threshold is breached.

For example, your internal policy might mandate a Common Equity Tier 1 (CET1) ratio of 9.5%, providing a buffer above the regulatory minimum. The moment stress tests or actual results indicate that ratio could fall to 9.49%, a pre-approved playbook is activated immediately—no meetings, no debate, just execution.

This playbook could include:

- Dividend Policy Review: An immediate, formal review of the upcoming quarterly dividend is triggered.

- Share Buyback Suspension: All share repurchase programs are frozen until the CET1 ratio recovers above 9.5% for a full quarter.

- M&A Moratorium: The board is formally notified that any new M&A discussions requiring a significant cash outlay are on hold.

By pre-defining these tripwires, you remove emotion from high-stakes decisions. Management can focus on executing the plan, not debating it as conditions deteriorate. That is the hallmark of a resilient bank capital planning process.

This direct linkage transforms your risk appetite statement from a passive document into an active governor on the bank's engine, ensuring operations remain within the board-approved guardrails.

Making Capital a Core Performance Metric

Beyond risk management, capital must be integral to how you measure and incentivize performance. Every business line, lending team, and new product consumes capital. The critical question for leadership is whether they are delivering a return that justifies that capital consumption.

The concept of Risk-Adjusted Return on Capital (RAROC) is the ideal tool for this. RAROC moves beyond simple profitability by comparing a business unit's income to the risk-weighted capital it requires, creating a level playing field for evaluation.

Consider a $15 billion bank:

- The Commercial Real Estate (CRE) team generates $30 million in net income.

- The Small Business Lending team generates $15 million.

On the surface, CRE appears to be the stronger performer. A RAROC analysis reveals a different story. The CRE portfolio is capital-intensive, consuming $250 million in risk-weighted capital for a 12% return. The more diversified small business portfolio, however, uses only $100 million in capital to generate its profit—a superior 15% return.

This is a powerful insight. It demonstrates that the small business division is a more efficient engine of profitable growth. This data empowers leadership to make smarter decisions about where to invest the bank’s resources. A solid guide to bank financial planning can help you dig deeper into aligning these metrics with your big-picture strategy. Adopting this perspective ensures capital is not just adequate, but productive, encouraging business line leaders to think like owners.

It’s Time to Put Your Capital Plan into Action

The models are built, the scenarios are run, and the strategy is defined. Now comes the most critical phase: execution. A brilliant plan is worthless if it remains on a shelf. The objective is to transform your capital plan from theory into a living component of your bank's decision-making process. The goal is not merely to satisfy a regulatory requirement, but to craft a compelling narrative for your board, examiners, and investors—a narrative demonstrating that your capital position is a competitive weapon that fuels growth and ensures resilience.

Telling Your Story with Confidence

When you present to the board or meet with regulators, you need more than numbers; you need a coherent story. They must understand the why behind your capital levels, not just the what. Every assumption must be defensible and grounded in strategic logic.

For example, if you decide to maintain a 10.5% CET1 ratio while peers are at 10.0%, you must articulate the strategic rationale. Is that additional cushion intended to fund a major digital transformation without seeking external capital? Or is it a deliberate buffer against a higher-than-peer concentration in a specific loan category?

The best capital plans answer the tough questions before they are asked. They create a seamless narrative connecting capital targets, strategic goals, risk appetite, and the competitive landscape. This demonstrates complete command of your strategy.

This is where data-driven proof points from a platform like Visbanking become invaluable. They ground your entire narrative in objective market reality. You are no longer defending an arbitrary number; you are confidently articulating a well-researched strategy.

The Executive's Checklist for a Killer Presentation

Before any presentation, run your plan through this checklist. If you can answer "yes" to each question, you are prepared.

- Is the story clear? Can you simply explain how your capital levels directly support the bank's primary goals for the next 1-3 years?

- Are your assumptions validated? Have you benchmarked your projections for loan growth, earnings, and dividends against a relevant peer group? Stating your targets are in the top quartile of your peers adds immediate credibility.

- Are your triggers crystal clear? Does the plan specify exactly what actions are taken if a capital threshold is breached (e.g., CET1 falls to 9.0%)? Pre-defined actions demonstrate foresight.

- Does it connect to the big picture? The capital plan must directly support your institution's long-term vision, as outlined in our guide to banking strategic planning.

- Is it actionable? Does every member of the leadership team understand their role and the key metrics they own to ensure the plan's success?

When you master the execution and support it with a data-backed narrative, capital planning ceases to be a chore. It becomes a powerful tool that demonstrates your bank's strategic discipline and foresight. Want to build that confidence? Start by understanding your competitive position. Explore Visbanking’s data to benchmark your performance and build a bulletproof capital plan.

Answering the Tough Questions on Bank Capital Planning

Bank executives and directors constantly walk the tightrope of balancing ambitious growth with the non-negotiable need for stability. Here are direct answers to the most common questions about bank capital planning.

"How Often Should We Revisit Our Capital Plan?"

While a formal, comprehensive review is typically conducted annually, the capital plan must be treated as a living document. Its core assumptions and key metrics should be monitored at least quarterly. Significant market events—a 25 basis point shift in Fed rates or a sudden surge in loan demand from a key local industry—demand an immediate reassessment.

For example, if your bank projected $50 million in annual loan growth but achieves that in the first quarter, your capital is being consumed far faster than planned. The plan must adapt in real-time. Proactive management, not rearview-mirror analysis, is the key.

"What's the Biggest Mistake You See Banks Make?"

The most significant mistake is treating the capital plan in isolation. Too many banks create a plan that satisfies regulators but has no tangible connection to their business strategy or competitive landscape. A capital plan that is not explicitly linked to strategic objectives—be it M&A, organic growth, or a major technology investment—is a squandered opportunity.

A capital ratio is a clear signal of your bank's ambition and risk appetite. A plan that merely aims to clear regulatory minimums signals a defensive posture, which is a competitive disadvantage in a dynamic market.

Your capital strategy must be the fuel for your business strategy. If the goal is a 15% expansion of your C&I portfolio, the plan must explicitly allocate the capital required and account for the impact on risk-weighted assets.

"How Do We Actually Defend Our Capital Levels to Regulators?"

Regulators expect to see a thoughtful, forward-looking process supported by data. Simply stating that your capital ratios exceed minimums is insufficient. A defensible position requires demonstrating:

- Tailored Stress Testing: Present stress tests customized to your bank’s unique risks, not generic scenarios. Model the impact of a major local employer shutdown and show how your capital would absorb that specific shock.

- Smart Peer Benchmarking: This is a critical differentiator. Using a tool like Visbanking, you can show regulators that your capital targets—for example, a 10.5% Tier 1 Capital Ratio—are aligned with, or prudently above, a curated peer group of banks with similar size and risk profiles. This external validation provides immediate credibility.

Ultimately, you must present a narrative of proactive leadership and rigorous strategic thinking. You must prove that your capital levels are not arbitrary, but the result of a disciplined, data-driven, and defensible plan.

At Visbanking, we deliver the data intelligence that turns capital planning from a chore into a competitive weapon. See how you stack up against your true peers and build a capital plan that’s grounded in reality. Explore the data at https://www.visbanking.com.