Zelle Scam Refund Guide: How to Get Your Money Back Fast

Brian's Banking Blog

Your Real Zelle Scam Refund Options (And Why Most Fail)

Let's get real about getting a Zelle scam refund: the odds aren't in your favor. It's not impossible, but your success hinges on one critical detail: the difference between an authorized and an unauthorized transaction. This single factor often decides whether you get your money back or face a complete loss. We’ve all heard the advice to "just call your bank," but many victims discover that this is usually a fast track to a dead end.

The scale of this problem is staggering. A 2023 analysis found that about 0.1% of all Zelle transactions are fraudulent. With Zelle processing around 2.8 billion transactions a year, that adds up to a potential 2.8 million scam incidents, with losses approaching $800 million annually. This is exactly why understanding how the system actually works is your best shot at finding a way to recover your funds. You can find more details on how Zelle reimbursement policies are evolving as banks slowly begin to respond.

Authorized vs. Unauthorized: The Million-Dollar Distinction

The heart of the issue lies in how federal rules, specifically Regulation E, interpret these payments. An unauthorized transaction is when someone gets into your account without your consent—imagine a hacker nabbing your password and wiring money out. In these clear-cut situations, banks are typically required to refund you.

However, most Zelle scams are more personal. They use social engineering to trick you, the account owner, into sending the money yourself. This is considered an authorized transaction, even though it was done under false pretenses. From a legal standpoint, the bank's duty to refund you is much weaker, which is why most initial requests are shot down.

To understand your position, it’s helpful to see how these scenarios stack up against each other. This table shows the stark difference in recovery chances based on how the money was sent.

| Transaction Type | Regulation E Protection | Recovery Likelihood | Timeline | Required Evidence |

|---|---|---|---|---|

| Unauthorized Transaction | Strong | High | Typically 10-45 days for investigation | Login records, IP addresses, proof of no consent |

| Authorized Transaction | Weak to None | Very Low | Varies widely; often no set timeline | Screenshots, police reports, proof of deceit |

| Goodwill Refund | None | Low to Moderate | Depends on bank policy and discretion | Strong documentation of the scam, customer history |

| Bank Error | Strong | High | Usually corrected within a few business days | Transaction records showing the system glitch |

As you can see, unauthorized transactions have a clear path to resolution, but authorized ones are a tough fight.

Knowing this distinction is the first step in building a case that gets past the standard "no." While the chances are slim for authorized payments, some banks are starting to adopt new refund policies for certain types of scams. This is creating new, though limited, opportunities for victims to get their money back.

Building Evidence That Banks Actually Care About

When you report a Zelle scam, your complaint gets tossed into a massive pile with thousands of others. A simple "I was scammed" claim usually gets a quick, standardized denial letter. To actually get a Zelle scam refund, you need to build a case file that makes a bank investigator pause, read, and actually consider your situation. This isn't just about filing a complaint; it's about crafting a compelling story with solid proof.

Creating a Clear Timeline of Events

The first thing you need to do is get everything organized chronologically. Don't just send them a jumble of screenshots. Instead, put together a simple document that walks them through the story from beginning to end. Imagine you were tricked by a fake pet deposit scam—your timeline should lay out every single interaction.

- Initial Contact: Make a note of the date, time, and where it happened (e.g., "June 5, 2:15 PM: Responded to a Facebook Marketplace ad for a puppy.").

- Communication: Detail the back-and-forth. Include screenshots of texts, emails, or direct messages where the scammer was building your trust or pressuring you to act fast.

- The Transaction: Pinpoint the exact date, time, and amount of the Zelle payment you sent.

- The Aftermath: Document the moment you realized it was a scam and what you did immediately, like calling your bank or filing a police report.

This structured timeline transforms a confusing jumble of events into a clear narrative that an investigator can easily understand and follow.

The Power of Regulatory Language

Banks are bound by strict federal regulations. Dropping references to these rules in your claim shows you've done your research and you know your rights. The Electronic Fund Transfer Act (EFTA) is your most important tool here, as it sets the ground rules for consumer rights and bank responsibilities in electronic transactions.

While the EFTA offers the strongest protection for unauthorized transfers (meaning someone used your account without your permission), you can still use its principles. Frame your scam experience within the context of deceptive practices to make your claim stand out. Saying you were "fraudulently induced" to send money sounds much more serious than simply saying you were "tricked."

To really challenge a bank's denial, you need compelling evidence. Learning about the core techniques private investigators use for evidence gathering, especially around digital forensics, can give you a good idea of what makes for strong documentation. As some major financial institutions explore new repayment options, a well-documented case becomes even more essential. In fact, seven U.S. banks are reportedly developing a plan to tackle this very problem. Your detailed evidence file is exactly the kind of thing these new programs will need.

Cracking Bank Dispute Systems That Actually Work

Knowing that each major bank has its own maze of internal rules for Zelle disputes is your secret weapon. This insight is what can turn a dead-end conversation into a successful Zelle scam refund. Your main objective is to move past the initial customer service team, who often work from scripts that lead to a quick "no," and connect with the departments that actually have decision-making power.

This isn’t about being loud or demanding; it's about being smart with your approach. When and how you escalate your claim, along with the specific words you use, can completely change the outcome. When it's time to escalate, ask to speak directly with the bank's fraud department or a compliance officer. These are the people who are tuned into regulatory pressures and have the authority to greenlight refunds that don't fit into the standard, rigid procedures.

Escalation Paths and Key Departments

When your first attempt to dispute the charge is denied, what you do next is crucial. Instead of just calling the same number and telling your story again, it's time to shift gears. Here’s a look at who you should be trying to reach:

- The Bank's Internal Fraud Department: This is your first stop for an escalation. They have better tools and more authority to investigate than the general support line. They can dig into the transaction details in a way others can't.

- The Compliance Department: This team's job is to make sure the bank is following all federal laws and regulations. Mentioning specific regulations like the Electronic Fund Transfer Act (EFTA) will definitely get their attention.

- A Bank Executive or Ombudsman: If you're still hitting a wall, a well-crafted letter to a high-level executive can sometimes prompt a review of your case from the top down.

Following this kind of structured escalation proves you're both serious and organized. It also helps to be aware of the regulatory heat banks are under. The Consumer Financial Protection Bureau (CFPB) has repeatedly flagged major issues in how banks handle Zelle scam claims. Although a 2025 lawsuit was dropped, the CFPB revealed that banks frequently overlook hundreds of thousands of fraud reports. This background pressure is something you can use to your advantage. You can read more about the CFPB's findings on Zelle scam issues to understand the full context.

Applying Strategic Pressure

The trick is to apply just the right amount of regulatory pressure without sounding hostile. Casually mentioning that you are preparing to file a formal complaint with the CFPB or the Office of the Comptroller of the Currency (OCC) can often be enough to have your case looked at again.

Understanding how seriously regulated industries take compliance can give you a major leg up. If you want to see how this works in other sectors, you can explore compliance management solutions to get a feel for the frameworks banks are working within. This knowledge helps you frame your dispute in language that speaks to their internal risk and compliance worries, which can seriously increase your odds of getting your money back.

Recovery Methods Banks Don't Want You to Know About

When your bank delivers that final, frustrating "no" on your Zelle scam refund claim, it's easy to feel like you've hit a brick wall. But this isn't the end of the road; it's just a detour. There are several powerful, legitimate paths you can take that many people never even find out about. These strategies move your fight beyond the bank's initial decision and force a fresh look at your case, often from a compliance or legal angle that the first line of customer service isn't equipped to handle.

Leveraging Consumer Protection Agencies

One of the most effective moves you can make is to file a formal complaint with a federal regulatory agency. This isn't just shouting into the wind; it's a strategic play that legally requires a response from your bank. Think of it as escalating your case to the principal's office.

Your main allies here are:

- The Consumer Financial Protection Bureau (CFPB): Filing a complaint with the CFPB is a surprisingly simple and effective process. Once you submit your case, the CFPB forwards it directly to your bank, which is then legally obligated to investigate and give you a formal, written response. This simple action often gets your case in front of a higher-level compliance team that has the authority to make a different decision.

- The Office of the Comptroller of the Currency (OCC): The OCC is the agency that supervises national banks and federal savings associations. If your bank falls under their watch, lodging a complaint here adds another layer of serious pressure.

Small Claims Court: Your Secret Weapon

If the amount you lost falls within your state's small claims court limit—which is typically between $2,500 and $10,000—this can be your ace in the hole. The process is specifically designed so you don't need to hire a lawyer, making it accessible and low-cost. In many cases, the bank will be motivated to settle the moment they are served with a court summons. They often want to avoid the time, expense, and potential negative publicity of a court battle, especially if you have a well-documented paper trail.

A word of caution: be very skeptical of so-called "recovery services" that pop up promising to get your money back for a fee. The instant, irreversible nature of Zelle payments has unfortunately created a shadow industry where new scammers target desperate victims. These fast-paced transactions create a confusing situation for victims, which you can learn more about in this deep dive into Zelle fraud trends. Real help comes from accredited legal aid or from the direct actions you take yourself, not from an unsolicited online offer. Your backup plan should be about using the system to your advantage, not getting scammed a second time.

Strategic Timing That Multiplies Your Recovery Chances

When you're trying to get your money back from a Zelle scam, what you do is important, but when you do it can be the difference between success and failure. It's natural to panic, but taking a moment to be strategic about your timing can seriously boost your odds. The most crucial window is the first 24 hours. Reporting the fraud to your bank right away is a must—it gets the ball rolling and shows you're on top of it.

But the strategy doesn't stop there. It helps to think about the bank's own schedule. For example, did you know that some banks are more open to reviewing "goodwill" refund requests near the end of a financial quarter? Their compliance teams are often trying to close out cases and meet reporting deadlines, which can make them a bit more lenient on tricky situations like authorized payment scams.

The First 48 Hours: Your Golden Window

Your most effective actions happen immediately after the scam. Don't waste time trying to gather every single piece of paper or screenshot. The second you realize what's happened, jump into action.

Here's what you should do:

- Call Your Bank Immediately: Find the direct number for your bank's fraud department. Don't just call the main customer service line; you want to speak directly with the fraud team to get the process started correctly.

- File a Police Report: Yes, even for a small amount. A police report is an official document that adds a ton of credibility to your claim with the bank.

- Report to the IC3: File a report with the FBI's Internet Crime Complaint Center (IC3). This creates another official record of the event and helps federal agencies track these crimes.

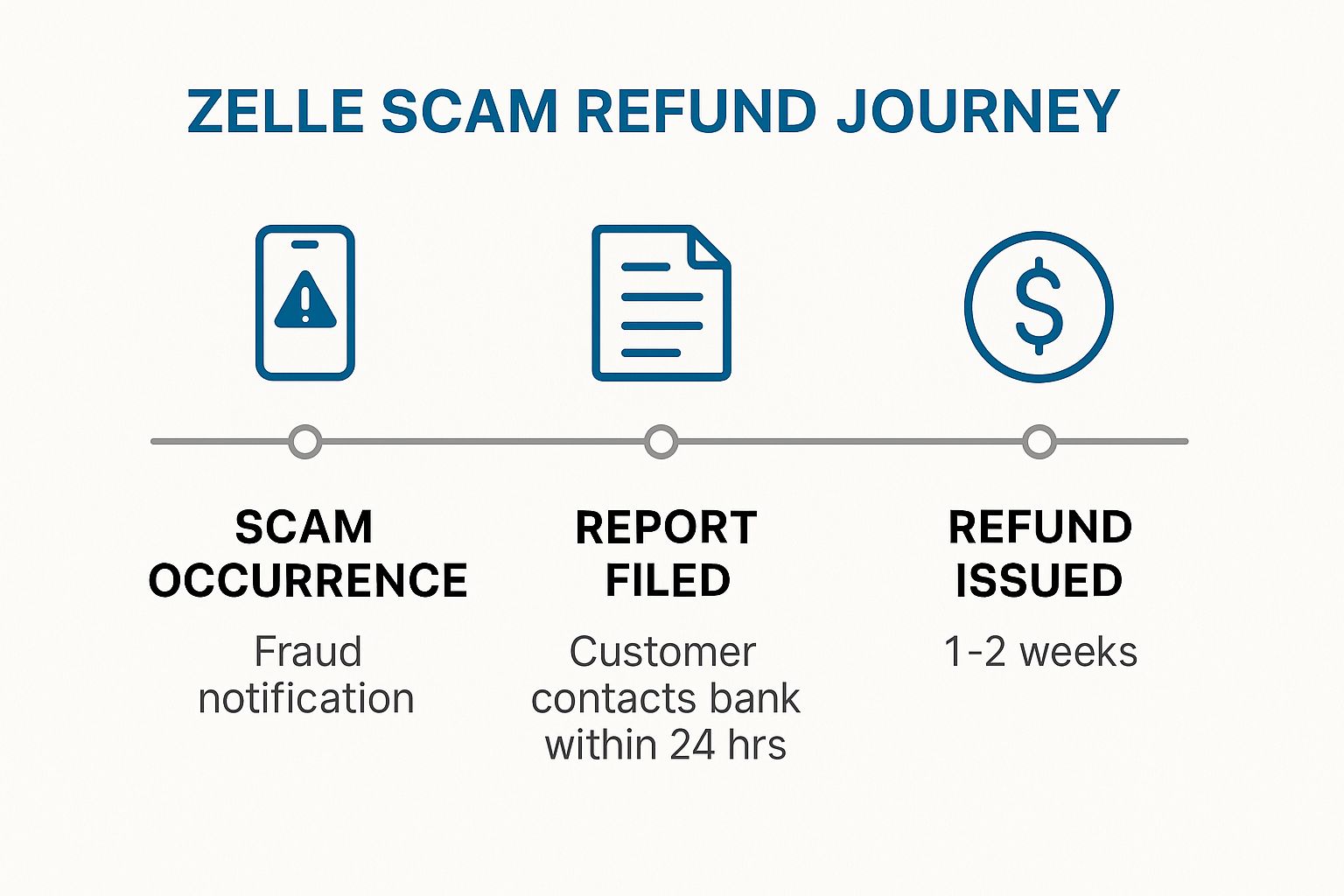

This infographic breaks down the ideal timeline for a Zelle scam claim, starting from the moment the fraud happens.

As you can see, quick reporting is the foundation for everything that follows. In some straightforward cases, acting fast could mean you see a refund in as little as one to two weeks.

To help you map out your plan, here’s a look at the critical deadlines and best times to take action.

| Action Type | Optimal Timing | Deadline | Success Rate | Notes |

|---|---|---|---|---|

| Initial Bank Report | Within 1-2 hours | Within 24 hours | High | The sooner, the better. This establishes the official start of your case. |

| Police Report | Within 24 hours | Within 72 hours | N/A (supports claim) | Provides critical documentation for bank appeals and CFPB complaints. |

| IC3 Complaint | Within 48 hours | Within 1 week | N/A (supports claim) | Adds another layer of official reporting to strengthen your case. |

| First Follow-Up Call | 3-5 business days after initial report | 1 week | Moderate | Check the status and show you are actively pursuing the claim. |

| Formal Appeal (if denied) | 20-25 days after denial | 60 days from statement | Moderate to High | Time your appeal to land near the end of the month/quarter. |

| CFPB Complaint | Immediately after a denied appeal | 90 days from incident | High | The CFPB process often gets banks to take a second, more serious look. |

This timeline shows that while the first day is a sprint, the overall process is a marathon. A denied claim isn't the end of the road.

Aligning with Bank and Regulatory Cycles

If your bank denies your first request, don't rush to appeal. Take a breath and think strategically. Instead of firing back an appeal immediately, gather your new evidence—like the police report and a formal complaint filed with the Consumer Financial Protection Bureau (CFPB).

Try submitting your appeal closer to the end of the month or quarter. This clever timing can put your escalated case in front of a manager who is trying to clear their desk for the next reporting period. By doing this, you're not just complaining; you're making a calculated move that works with the system, not against it.

Avoiding Recovery Scams While Fighting for Your Money

It’s a nasty twist, but just as you start the fight for a Zelle scam refund, a new kind of predator often appears: the recovery scammer. These criminals specifically target fraud victims, playing on their desperation with convincing promises to get their stolen money back—for a fee, of course. Falling for one of these schemes is like getting scammed all over again.

This problem is so significant that major financial players are getting involved. For instance, you can learn more about how Mastercard is using AI to help banks combat payment scams, which highlights the seriousness of the issue. While the industry works on high-tech solutions, your best defense is knowing how to spot these fraudsters yourself.

Telltale Signs of a Recovery Scam

Recovery scammers are skilled manipulators, and their methods often feel familiar because they echo the original scam. They’re experts at creating a sense of urgency and false hope—a powerful mix when you’re already feeling vulnerable and desperate.

Be on high alert if you notice any of these red flags:

- Upfront Fees: This is the most obvious warning sign. A legitimate law firm or agency will never ask you to pay a fee with Zelle, gift cards, or cryptocurrency to start the recovery process. They use formal retainer agreements and professional billing, not instant payment apps.

- Guaranteed Returns: Nobody can guarantee they will recover your money from an authorized Zelle scam. The process is complicated, involving banks and legal channels. Anyone promising a 100% success rate is not being truthful.

- Unsolicited Contact: Be extremely suspicious if someone you don't know contacts you on social media or email claiming they can help. Scammers frequently search online forums and social media for public posts from people who've been scammed, then they make their move.

- Requests for Sensitive Information: A phony recovery agent might ask for your bank login details, Social Security number, or other private data, claiming they need it to "access" your funds. Never share this information with anyone.

Verifying Legitimate Help vs. Fraud

So, how can you tell the difference between a scam and real help? Legitimate assistance usually comes from licensed professionals or established organizations. Before you agree to anything, take a few minutes to check their credentials.

If they claim to be a lawyer, look them up on your state's bar association website. If it’s a credit counseling agency, check for their accreditation. Real professionals will have a verifiable history and will be upfront about their process and fees, which are never paid in the ways scammers demand.

Your Personal Recovery Action Plan That Works

So, you’ve been scammed. It’s a gut-wrenching feeling, but now is the time for action, not despair. Getting a Zelle scam refund isn't about firing off a single angry email; it's about executing a smart, persistent campaign. Think of this as your personal battle plan, tailored to your specific situation—how much you lost, the type of scam, and your bank's policies.

Decision Trees for Different Scenarios

Let's get practical. Not all scams are the same, and your response needs to match the scammer's playbook.

- Scammed on "Goods and Services"? (Fake Concert Tickets, Puppy Deposits): This is incredibly common. You sent money for something you never received. Your goal is to prove you were intentionally misled. Start by building an evidence file: screenshots of the original ad, every message between you and the scammer, and a clear timeline of events. When you call your bank, frame it as fraudulent inducement—you were tricked into authorizing the payment.

- Fell for an Impersonation Scam? (Fake Bank Alerts, Family Emergency): These scams prey on trust and fear, making the bank's initial reaction often one of skepticism. Your first move should be to file a police report and submit a complaint to the FBI's Internet Crime Complaint Center (IC3). These official documents are no joke; they add serious weight to your bank dispute and are essential if you need to escalate the issue to the Consumer Financial Protection Bureau (CFPB).

- Tricked by an Investment or "Cash Flipping" Scam?: These schemes usually involve bigger dollar amounts and the promise of quick, massive returns. A common trick is for the scammer to send a small amount back to you to build trust before asking for more. If this happened, document every single transaction. Point out to your bank's fraud team that this has all the hallmarks of a classic pyramid scheme. This can trigger a different set of internal protocols than a simple "goods not received" complaint.

Tracking Progress and Staying Motivated

This process is a marathon, not a sprint, and it can be emotionally draining. To keep your sanity and build a strong case, stay organized. Create a log of every phone call, email, and letter. Note the date, time, and the full name of every person you speak with.

Remember, every step forward is a small victory. Did you successfully file your CFPB complaint? Did you get a formal response from your bank, even if it wasn't the one you wanted? Acknowledge that progress. You're not just fighting for your money; you're taking back a sense of control. Banks are facing more and more pressure to handle these situations correctly, so your persistence truly matters.

Understanding how banks think is key to building a winning strategy. At Visbanking, we give financial institutions the intelligence they need to see risks and strengthen their systems. Find out how our Bank Intelligence and Action System helps banks make smarter, data-backed decisions by visiting Visbanking today.