Woori America Bank: Your Complete Community Banking Guide

Brian's Banking Blog

The Heritage That Defines Modern Community Banking

Woori America Bank embodies the true spirit of community banking. Its history reflects a deep understanding of the unique financial needs of the people it serves. This personalized approach sets Woori America Bank apart from larger, more conventional commercial banks.

This difference is deeply rooted in the bank's history and unwavering commitment to its customers. Woori America Bank was established in January 1984 as a wholly owned subsidiary of Woori Financial Group, one of Korea's largest financial institutions.

Beginning with a single branch in New York City, the bank has significantly broadened its services and reach. This growth showcases the bank’s successful navigation of the financial world. Learn more about the bank’s history: Woori America Bank History

Building a Legacy of Trust

This expansion hasn't changed Woori America Bank’s core principles. The bank maintains a sharp focus on personalized service and cultural awareness. This has allowed Woori America Bank to become a vital part of the Korean-American community and beyond.

For instance, Woori America Bank offers services tailored to immigrant families. These might include international money transfers and support for building credit history in the U.S. This commitment to addressing specific financial needs has fostered trust within the community.

Additionally, the bank provides specialized resources for small businesses, acknowledging their crucial contribution to economic development.

Community Engagement: More Than Just Banking

Woori America Bank’s dedication goes beyond typical banking services. The bank actively engages in community initiatives and programs, demonstrating a genuine commitment to the well-being of its customers.

This community involvement builds stronger relationships and contributes to the overall financial health of the areas where Woori America Bank operates. You may find this article insightful: The Role of Community Banking in Local Economies.

This approach recognizes the link between the bank’s success and the prosperity of its customers and their communities. This focus on building real relationships and providing culturally relevant financial solutions positions Woori America Bank as a valuable partner for both individuals and businesses.

Banking Services That Actually Serve Your Needs

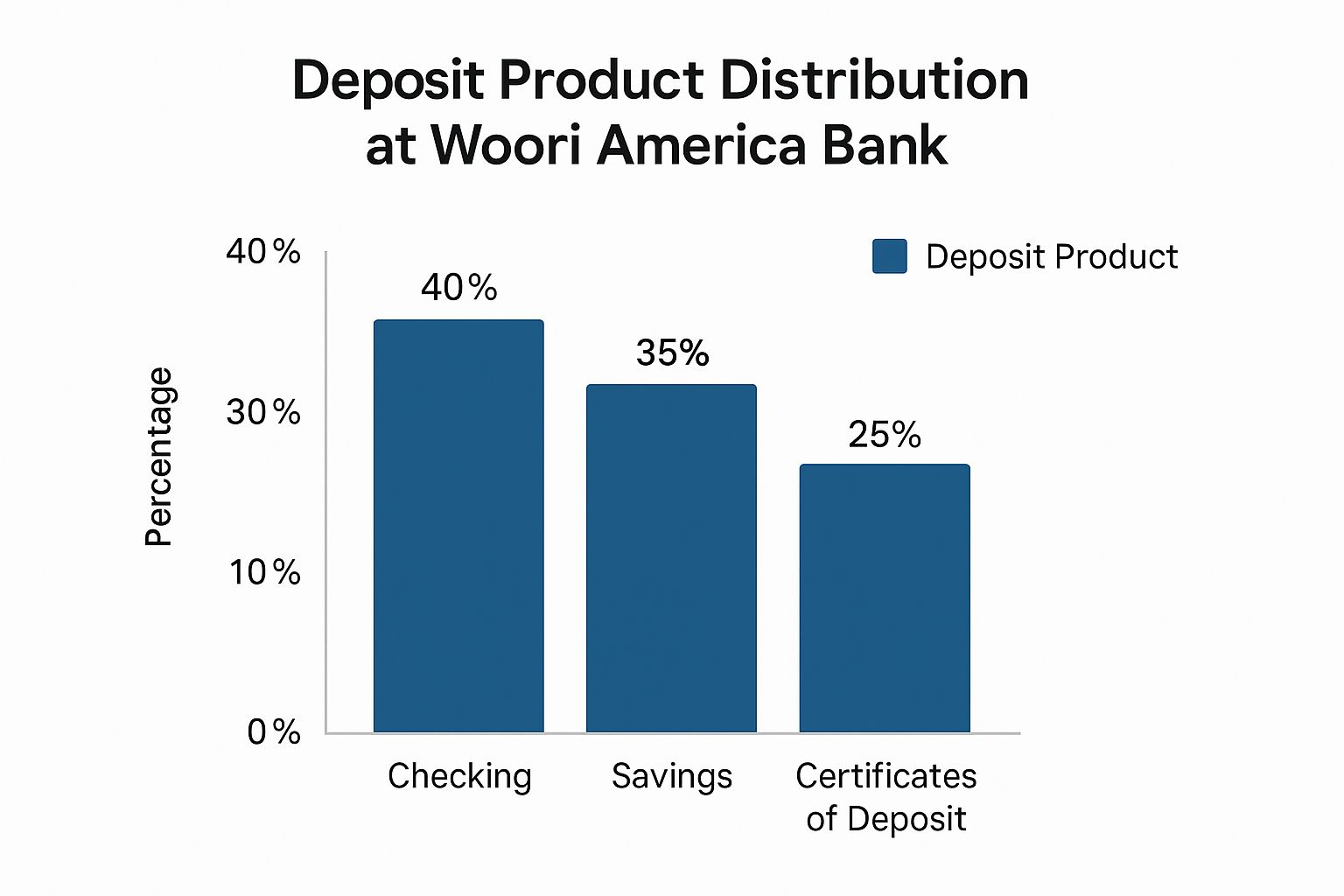

The chart above illustrates the distribution of deposit products at Woori America Bank. Checking accounts make up the largest portion at 40%, followed by savings accounts at 35%, and certificates of deposit (CDs) at 25%. This diverse product mix suggests Woori America Bank strives to meet a variety of financial needs, from daily transactions to long-term savings goals.

Woori America Bank understands that families and businesses need more than just basic checking accounts. They strive to be a true financial partner, recognizing the unique challenges faced by immigrant families and entrepreneurs.

Personal Banking Solutions

Woori America Bank provides personal banking solutions tailored to the needs of diverse communities, with a particular focus on Korean-Americans. One key service is facilitating international money transfers, essential for those with family and financial ties abroad.

Woori America Bank also helps individuals build and establish credit history in the U.S., a critical step towards financial security. By understanding the cultural nuances of its customer base, the bank offers relevant financial guidance and personalized support. This can make a substantial impact on a family's financial well-being. For more insights into managing your finances effectively, check out our guide on How to master bank liquidity management.

Supporting Entrepreneurial Ventures

Beyond personal banking, Woori America Bank offers a comprehensive suite of services for businesses. These include specialized lending programs designed to fuel entrepreneurial ventures. These loans can help with various needs, such as small business expansion or purchasing new equipment.

Woori America Bank also provides robust cash management solutions. These tools help businesses streamline financial operations, improve efficiency, track cash flow, and effectively manage expenses. This is particularly helpful for small business owners who often juggle multiple responsibilities.

Benefits and Eligibility

Woori America Bank prioritizes transparency and accessibility. Information on eligibility requirements and fee structures is readily available to potential customers. The bank believes in empowering individuals and businesses to make informed financial choices.

This open approach fosters trust and strengthens the bank-customer relationship. This commitment to clarity and accessibility sets Woori America Bank apart.

To help you further understand the offerings available, here's a comparison of personal and business banking services:

Woori America Bank Service Comparison

Comparison of personal vs business banking services and features offered by Woori America Bank

| Service Type | Personal Banking | Business Banking | Key Benefits |

|---|---|---|---|

| Accounts | Checking, Savings, CDs | Checking, Savings, Business Credit Cards | Secure and convenient options for managing funds |

| International Services | Money Transfers | Letters of Credit, International Payments | Facilitates global transactions |

| Lending | Personal Loans, Mortgages | Business Loans, Lines of Credit | Access to capital for various needs |

| Financial Advice | Financial Planning Assistance | Business Consulting Services | Personalized guidance for achieving financial goals |

This table highlights the breadth of services offered by Woori America Bank, catering to both individual and business needs. From managing daily transactions to securing financing for growth, Woori America Bank provides solutions to help customers achieve their financial objectives.

Smart Growth Through Strategic Market Expansion

Expansion for banks can be tricky. While growth offers the potential for increased market share and revenue, it also brings considerable challenges. Woori America Bank, however, has shown a real talent for expanding strategically while staying true to its community-focused values.

This careful approach is clear in Woori America Bank’s acquisition strategy. In 2003, the bank acquired Panasia Bank. This strategic decision significantly increased Woori’s presence in New Jersey and opened doors for expansion into Pennsylvania and Virginia. This move demonstrates the bank's commitment to well-planned, deliberate growth. For more information on Woori America Bank’s growth and acquisitions, see the report here.

Navigating the Complexities of Acquisitions

Bank acquisitions are complex. They require careful evaluation of several factors, including regulatory requirements, operational integration, and customer retention. Woori America Bank has consistently shown its ability to manage these complexities effectively.

Successfully integrating acquired entities means tackling the challenges of merging different systems, cultures, and customer bases. Woori America Bank emphasizes smooth transitions to minimize disruption for both existing and new customers. For further insights, check out this article: Adapting to New Tech is Crucial for Smaller Banks to Keep Up. This careful approach has been key to the bank's successful expansion across multiple states.

Strengthening Community Ties Through Expansion

Woori America Bank’s growth strategy isn’t just about market share. It's also about strengthening its capacity to serve diverse communities. Every acquisition is a chance to connect with new customers and learn about their specific financial needs.

This commitment to understanding local communities helps Woori America Bank offer culturally relevant services and build trust. This localized focus has enabled the bank to maintain a high quality of service across all its branches. This approach sets Woori America Bank apart, demonstrating its dedication to community banking principles even as it expands. By thoughtfully integrating new markets and prioritizing customer needs, Woori America Bank consistently reinforces the importance it places on community relationships.

Building Authentic Community Connections Coast to Coast

Woori America Bank understands that true community banking goes beyond simple transactions. It's about understanding cultural nuances and building lasting relationships. This focus on community engagement has allowed the bank to become a vital part of Korean-American communities nationwide, from New York to California.

This commitment extends beyond providing standard banking services. Woori America Bank actively supports these communities through various initiatives, such as small business development programs designed to empower entrepreneurs and boost local economies. They've also adapted their services to meet the specific needs of both immigrant families and established Korean-American businesses. Woori America Bank has become a key financial partner for the Korean community in the United States, especially in the New York metropolitan area. The bank has expanded its reach to other states, including Georgia, California, and Texas, by establishing new branches and locations. Learn more about Woori America Bank here.

Cultural Engagement and Community Support

Woori America Bank recognizes the importance of cultural understanding in building trust. They offer culturally informed financial guidance that surpasses simple translation, helping families navigate the complexities of finance in a new country. This approach fosters loyalty and builds strong, multi-generational relationships. As Woori America Bank expands strategically, building strong relationships requires effective communication. Check out these client communication best practices.

Empowering Small Businesses

Woori America Bank understands the vital role small businesses play in the economy. They provide tailored resources, including access to specialized loan programs and mentorship opportunities, to help these businesses prosper. This support strengthens the entire community and demonstrates the bank's deep understanding of the unique financial landscape.

Impact on Family Financial Success

Woori America Bank's culturally sensitive approach directly impacts the financial success of families. By offering services and guidance that meet their specific needs, the bank helps families achieve financial stability and build a secure future. This includes assisting newcomers navigating the U.S. financial system and offering wealth management resources to established families.

Customer Stories and Community Feedback

The success of Woori America Bank's approach is evident in the consistent positive feedback from the community. Customers often praise the personalized service and the bank's understanding of their cultural context. This close connection fosters trust and mutual respect, the hallmarks of effective community banking. These relationships demonstrate the long-term value of the bank’s commitment.

International Banking Advantages That Actually Matter

Managing finances across borders is a growing need in our interconnected world. Woori America Bank, through its connection to the Woori Financial Group, offers distinct advantages, especially for those with ties between the U.S. and Asia.

This global network allows Woori America Bank to offer services beyond the scope of many domestic banks. For businesses and individuals alike, this opens up a world of financial possibilities.

Streamlined International Transfers and a Rich History

Woori America Bank excels in facilitating international wire transfers quickly and efficiently. This is crucial for businesses paying international suppliers or individuals sending money to family abroad. This speed and reliability simplifies cross-border transactions.

Woori's parent company, Woori Financial Group, boasts a long and impressive history, originating with the Daehan Cheon-il Bank in 1899. This evolved into Joseon Commercial Bank and ultimately became part of Woori Financial Group in 2001. Learn more about the history of Woori Bank. This established history underscores Woori's stability and experience.

Competitive Foreign Exchange and Trade Financing

Woori America Bank’s global network offers competitive foreign exchange services. Customers can exchange currency at favorable rates, reducing the costs of international transactions. This is especially valuable for businesses engaged in import and export activities.

Beyond currency exchange, Woori America Bank offers trade financing options. This support helps businesses manage the intricacies of global trade, providing financial assistance for importing and exporting goods. This can be invaluable for companies expanding their global reach.

Practical Benefits for Everyday Banking

The advantages extend to everyday banking needs. Woori offers practical solutions whether you’re supporting family overseas, managing multiple currencies, or importing goods for your business. Convenient online banking tools provide easy account and transaction management from anywhere.

Woori America Bank's international capabilities offer significant benefits in our interconnected marketplace. It’s a solid choice for individuals and businesses with global financial needs.

Customer Experience That Sets New Standards

Woori America Bank believes that exceptional customer service involves more than just processing transactions. It's about building strong relationships based on understanding and trust. This dedication to "Customer Delight" influences every part of their operations, shaping how they interact with customers and design their services.

Multilingual and Culturally Sensitive Support

Woori America Bank's multilingual customer service goes beyond simple translation. Their team offers culturally sensitive financial guidance, understanding that navigating a new financial system can be difficult. This support includes addressing the specific needs of immigrant families and business owners.

For example, they may help customers open accounts, explore loan options, or manage international money transfers. This personalized approach makes sure clients feel supported and understood, which is particularly helpful for those unfamiliar with the American banking system.

Technology and Personal Touch

Woori America Bank uses technology to enhance, not replace, personal interaction. Online banking tools offer convenience, while the bank still prioritizes personal relationships with branch staff. This balanced approach gives customers access to the support they need, how they prefer it.

In addition, their customer service training programs emphasize cultural awareness and practical problem-solving. This empowers staff to effectively address the unique financial challenges customers from diverse backgrounds may face.

To further illustrate the bank's customer-centric approach, let's take a look at the following table:

Customer Service Features

Overview of multilingual support, cultural services, and customer satisfaction initiatives at Woori America Bank

| Service Feature | Language Support | Cultural Benefits | Availability |

|---|---|---|---|

| Opening Accounts | English, Korean, Chinese, Spanish | Assistance with documentation and understanding US banking practices | In-branch and online |

| Loan Applications | English, Korean, Chinese, Spanish | Guidance on loan options tailored to immigrant needs | In-branch and online |

| International Money Transfers | English, Korean, Chinese, Spanish | Support with navigating international regulations and currency exchange | In-branch and online |

| Financial Education Workshops | English, Korean, Chinese, Spanish | Seminars on topics relevant to immigrant communities, such as building credit history | Varies by branch and online availability |

This table highlights Woori America Bank's commitment to offering a wide range of services adapted to the diverse needs of its customer base. The availability of multilingual support across core services underscores the bank's dedication to accessibility and inclusivity.

Continuous Improvement Through Feedback

Woori America Bank maintains robust feedback systems to ensure consistently high service standards. This allows them to pinpoint areas for improvement and adapt to changing customer needs. This focus on continuous improvement demonstrates their dedication to excellent customer service.

They regularly gather feedback through surveys and personal interactions, actively listening to customer concerns and suggestions. This commitment to customer feedback strengthens trust and loyalty within the communities they serve. Woori America Bank also assists businesses with international banking; learn more about managing small business international payments.

Meeting Unique Financial Needs

Woori America Bank understands the particular financial hurdles faced by immigrant families and ethnic business owners. Their services are designed to address these challenges, helping customers build credit, access capital, and navigate international markets.

These tailored services reflect Woori America Bank's dedication to helping customers achieve their financial aspirations. This builds long-term relationships that go beyond simple transactions, solidifying their role as a true financial partner.

Your Strategic Banking Decision Made Clear

Choosing the right banking partner is a big decision that impacts your financial future. This guide will help you decide if Woori America Bank is the right fit for your needs and goals. We'll compare community banks with large commercial institutions, look at Woori's ideal customer, and outline the steps to open an account. We'll also cover the requirements, initial deposit expectations, and what your first interactions with the bank might look like. This practical advice will empower you to make a well-informed decision.

Community Banks vs. Large Commercial Institutions

Community banks, like Woori America Bank, focus on personalized service and local community involvement. They often offer products designed for the specific needs of the communities they serve. This might include specialized lending programs for small businesses or services designed for immigrant families. However, community banks may have fewer branches and less developed online services than larger institutions.

Large commercial banks offer a wider range of services and typically have a larger ATM network. Their online platforms are often more robust and feature-rich. But this can sometimes come at the cost of personalized attention. Their size can make it difficult to receive individual support.

Is Woori America Bank Right for You?

Woori America Bank is a good fit for individuals and businesses looking for a personalized, culturally understanding banking experience. Its focus on the Korean-American community is a significant benefit for those who need specialized services. This includes services like international money transfers or assistance navigating U.S. financial practices.

- Immigrant Families: Woori America Bank provides helpful resources for those new to the American banking system.

- Korean-American Businesses: The bank offers specialized lending programs and culturally sensitive business advice.

- Individuals Seeking Personalized Service: Woori America Bank emphasizes building strong relationships with its customers.

Getting Started with Woori America Bank

If Woori America Bank seems like a good fit, here's what you need to know about opening an account:

- Account Opening Requirements: You'll generally need identification, proof of address, and a Social Security number.

- Initial Deposit Expectations: The required initial deposit varies depending on the type of account. Check with the bank directly for specific amounts.

- Your First Interactions: You can expect friendly, personalized service from the bank's multilingual staff.

Making Your Decision

Use this checklist to see if Woori America Bank aligns with your needs:

- Do you value personalized service and cultural understanding?

- Do you need specialized services for international banking or business development?

- Is a strong community connection important to you?

- Do the bank’s branch locations and online services meet your accessibility needs?

By carefully considering these factors, you can make a strategic banking choice that supports your financial well-being. For more in-depth banking insights and data-driven decision-making, explore the resources available at Visbanking. Gain a competitive edge in today's financial environment.