What Are Core Deposits? A Guide for Bank Executives

Brian's Banking Blog

For any financial institution, core deposits are the bedrock of franchise value. These are the stable, low-cost funds from primary retail and commercial banking relationships—the operating accounts, savings, and local CDs that are insensitive to short-term rate fluctuations.

This is not "hot money" chasing yield. Core deposits are sticky. They provide a predictable funding base that drives net interest margin, strengthens the balance sheet, and provides critical resilience in volatile economic cycles. For bank executives and directors, mastering this funding source is not merely an operational goal; it is a fundamental component of long-term strategic success.

This stability is precisely why these funds are so valuable. A superior core deposit base creates a tangible competitive advantage that is recognized as a key intangible asset in M&A transactions—the Core Deposit Intangible (CDI). For deeper analysis, you can review insights about CDI valuation from industry experts.

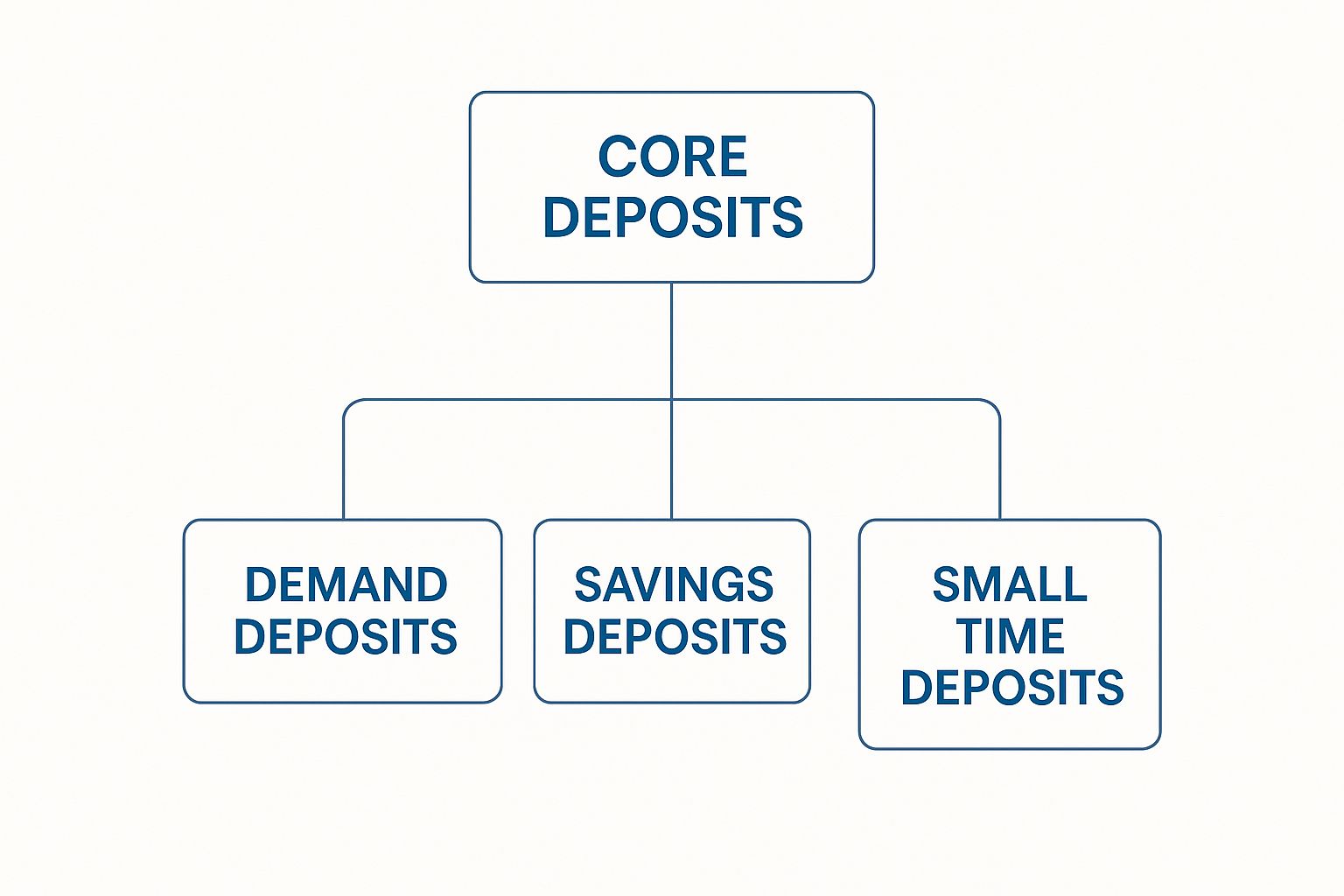

The image below breaks down the main categories that comprise this foundational funding base.

As illustrated, demand deposits, savings accounts, and smaller-denomination time deposits form a bank's most dependable liquidity source.

Anatomy of a Core Deposit Base

A strategic assessment of your deposit composition is the first step toward effective management. These funds are typically a mix of:

- Non-interest-bearing demand deposits: Foundational business and personal checking accounts.

- Interest-bearing transaction accounts: Such as NOW accounts held by primary banking clients.

- Savings and money market accounts: Funds from customers who view your institution as their principal bank.

- Small-denomination time deposits: CDs under the FDIC insurance limit, typically held by local, relationship-driven customers.

A superior deposit strategy is not about chasing volume. It is about constructing a stable, low-cost funding structure that directly enhances shareholder value and fortifies your competitive position.

Achieving a precise understanding of this mix is non-negotiable. Modern data intelligence platforms like Visbanking empower executives to segment accounts by behavioral characteristics, distinguishing genuinely loyal funds from rate-sensitive capital that poses a flight risk.

This level of clarity enables more accurate risk modeling and data-driven decision-making. Building a stronger balance sheet begins with a granular understanding of its most fundamental components.

Core vs. Non-Core Funding: A Strategic Comparison

A direct comparison clarifies the strategic value of core deposits against more volatile, market-rate funding sources.

| Characteristic | Core Deposits (Checking, Savings) | Non-Core Funding (Brokered CDs, FHLB Advances) |

|---|---|---|

| Stability | High; low sensitivity to interest rate changes. | Low; highly sensitive to market rates and conditions. |

| Customer Relationship | Strong; anchored in a primary banking relationship. | Transactional; often lacking a direct customer relationship. |

| Cost | Low and predictable cost of funds. | Higher, market-driven cost subject to volatility. |

| Liquidity Risk | Lower risk due to stability and predictability. | Higher risk; funds can exit rapidly as rates shift. |

The table highlights a critical trade-off. While non-core funding is a necessary tool for managing short-term liquidity, over-reliance introduces significant cost and stability risks. A strong foundation of core deposits, conversely, provides a reliable and cost-effective funding engine that supports sustainable, profitable growth.

The Strategic Value of Your Deposit Base

Core deposits are far more than a line item on the balance sheet. They are the engine of a bank's competitive advantage and a direct driver of shareholder value. A robust core deposit base provides a predictable, low-cost funding source that fuels profitable lending and serves as a natural hedge against rising interest rates.

This is not theoretical. The stability inherent in these deposits directly impacts a bank's valuation and its strategic flexibility.

Consider two institutions, both with $1 billion in assets. Bank A is funded 80% by stable core deposits. Bank B relies on them for only 50% of its funding, sourcing the rest from brokered CDs and FHLB advances. Bank A will consistently deliver a stronger net interest margin, exhibit a lower risk profile, and command a higher franchise value. The conclusion is unequivocal.

This demonstrates that building a superior deposit franchise is not an operational task—it is a critical imperative of executive leadership.

From Balance Sheet Item to Strategic Asset

The stability of your core deposits directly translates into a more reliable and consistent lending strategy. Research from the Federal Reserve confirms that banks with a higher share of core deposits are better positioned to smooth their loan rates through credit cycles. You can dig into the full Federal Reserve analysis here, but the key takeaway is that institutions reliant on volatile "hot money" lack this crucial flexibility.

This relationship-driven funding does not just support lending; it strengthens the entire enterprise.

In mergers and acquisitions, the premium paid for a high-quality deposit franchise is quantified as the Core Deposit Intangible (CDI). The fact that this is a recognized, monetizable asset underscores a fundamental truth: a loyal deposit base is one of the most powerful drivers of a bank’s market value.

Effectively managing this asset requires a disciplined, objective view of how your institution stacks up against its peers. This is where data intelligence platforms become indispensable. They provide the necessary context to benchmark your deposit mix, cost of funds, and stability against a relevant peer group.

Armed with such insight, leadership can transition from simply understanding what core deposits are to actively leveraging them as a tool for strategic dominance.

How to Accurately Measure Your Core Deposits

What is not measured cannot be effectively managed. While regulators like the FDIC provide a baseline definition for core deposits, relying solely on these classifications is a strategic error. It provides a dangerously incomplete picture of your true funding stability.

Regulatory definitions evolve—the qualifying cap for a core deposit was raised from $100,000 to $250,000 in 2011 to align with updated insurance limits. The FDIC's detailed study on core deposit definitions provides historical context, but the critical takeaway for executives is this: regulatory compliance is not a substitute for strategy.

True measurement requires behavioral analysis. It demands moving beyond account types and balances to segment deposits by the depth of the customer relationship, transaction history, and price sensitivity.

Beyond Regulatory Classifications

Understanding true stability means measuring the behavioral metrics that expose which funds are loyal and which are merely hot money in disguise.

- Deposit Beta: This measures the sensitivity of your deposit rates to changes in market benchmarks like the Fed Funds Rate. A low beta is the hallmark of a stable, price-insensitive funding base and a key indicator of franchise value.

- Decay Rates: This metric quantifies the runoff rate of deposit portfolios over time. Lower decay rates signify stickier funds and greater customer loyalty.

Never assume that funds in a checking account are inherently core. A large commercial operating account may hold millions in rate-sensitive cash that will exit the moment a competitor offers a few additional basis points.

This is precisely why data intelligence platforms like Visbanking are no longer discretionary. They enable leadership to cut through the noise of standard call report data and see the underlying reality. By analyzing transactional behavior and benchmarking performance against peers, you can finally separate truly loyal, low-cost funds from transient cash.

This is the deep insight required for accurate risk modeling and sound liquidity management. Only when you measure what truly matters can you manage your core deposits as the strategic asset they are. See how Visbanking’s data intelligence can sharpen your analysis.

Data-Driven Strategies for Deposit Growth

Growing core deposits is not about aggregation; it is about strategic acquisition of stable, value-adding funding. The most effective path is to replace assumptions with data, identifying and targeting customer segments with surgical precision.

Consider a commercial lending client who maintains their primary operating account with a competitor. Analysis of their cash flow patterns can reveal their specific treasury management needs. With this data, you are no longer just a lender; you are positioned to become their primary financial partner, converting a single-product loan into a source of stable, low-cost core deposits.

This is where raw data translates into an actionable growth strategy.

Turning Insights into Actionable Strategy

Armed with granular data, you can deploy powerful levers to attract the right kind of deposits. The objective is to move beyond generic products and deliver targeted solutions that solve specific client problems.

Data-backed tactics that drive results include:

- Relationship-Based Pricing: Utilize data to identify clients with multiple products, such as a mortgage, business loan, and checking account. Offer preferential rates or fee waivers to reward and deepen their loyalty.

- Intelligent Product Bundling: Analyze customer behavior to design value-added bundles. For instance, a small business owner is a prime candidate for a package combining a business checking account with payroll services and an integrated line of credit. This solves a real-world problem and creates stickiness.

- Superior Digital Experience: Leverage user analytics to identify and eliminate friction points in your online and mobile banking platforms. A seamless digital experience is a critical driver of customer retention in the modern banking landscape.

This is not about increasing marketing spend; it is about allocating resources with precision. For further reading on this topic, review FundPilot's insights on deposit growth.

The paradigm shift is from "selling accounts" to solving clients' financial challenges. Data reveals what those challenges are, enabling you to become an indispensable partner.

The table below connects specific strategies to the required data insights.

Strategic Levers for Core Deposit Growth

| Strategy | Data Insight Required | Key Performance Indicator (KPI) |

|---|---|---|

| Targeted Onboarding Campaigns | Analysis of new customer profitability and product usage within the first 90 days. | Increase in products per new household; 90-day retention rate. |

| Relationship Deepening Offers | Identification of single-service households (e.g., loan-only customers). | Conversion rate of single-service to multi-service customers. |

| Digital Engagement Initiatives | User analytics showing drop-off points or underused features in online/mobile banking. | Higher digital adoption rates; increased mobile deposit volume. |

| Fee-Waiver Incentives | Data on customers who frequently incur specific fees but have high deposit potential. | Reduction in customer attrition; growth in total relationship balances. |

Executing these strategies is only half the battle. Measuring their effectiveness is essential. Adherence to clear financial reporting best practices is not optional—it is how you demonstrate a tangible return on investment to the board and shareholders.

Ultimately, a deep command of your data enables you to benchmark performance and build a resilient core deposit base with confidence.

Managing Liquidity Risk and Your Balance Sheet

For bank directors and executives, the connection between core deposits and liquidity risk is the foundation of a resilient balance sheet. A high concentration of stable, low-cost core deposits acts as a fortress against market volatility, reducing reliance on expensive and unpredictable wholesale funding.

This stability is your anchor in turbulent markets.

Consider a bank with 75% of its funding from core deposits. During a rapid rate-hike cycle, it will navigate the environment with far greater stability than a competitor heavily reliant on brokered funds and FHLB advances. While the latter is forced into a defensive posture, reacting to market swings, your institution can remain focused on its long-term strategy.

From Defense to Strategic Advantage

A stable funding base not only mitigates risk but also alleviates regulatory pressures related to liquidity coverage ratios and stress testing. However, achieving this requires moving beyond broad assumptions about deposit behavior.

A strong core deposit base transforms liquidity management from a defensive, compliance-driven exercise into a source of strategic advantage. It provides the stable, low-cost fuel required for profitable, long-term growth.

This is where granular data intelligence is a game-changer. By analyzing the behavioral DNA of your deposit segments, you can conduct stress tests that reflect reality, not regulatory fiction. For a deeper examination of these dynamics, see our guide on effective bank liquidity management.

Platforms like Visbanking provide the tools to model various scenarios, distinguishing truly loyal funds from rate-sensitive money that will flee at the first sign of pressure. This insight allows leadership to not just meet regulatory requirements, but to manage the balance sheet with confidence. It empowers you to convert a critical risk function into a competitive advantage, ensuring your institution is prepared for any market condition.

Knowing where you stand against your peers is the final component. Visbanking helps benchmark performance, turning these insights into decisive action.

Benchmarking Your Core Deposit Performance

A well-defined deposit strategy is necessary but insufficient. Its true effectiveness can only be measured relative to the competition.

Understanding the definition of core deposits is table stakes. The real strategic advantage comes from rigorously benchmarking your performance against a relevant peer group. Bank executives and directors cannot afford to operate in a vacuum; you must contextualize your performance within the competitive landscape.

This requires asking tough, data-driven questions. How does your cost of funds truly compare to banks of a similar asset size and business model? Is your percentage of non-interest-bearing deposits a strength or a weakness in the current rate environment? What does your core deposits-to-total-assets ratio signal about your risk profile?

From Data to Decisive Action

These questions cannot be answered with intuition. Without robust competitive intelligence, you are managing blind.

For example, discovering your bank's cost of funds is 15 basis points higher than the peer average is not merely a data point—it is a direct threat to your net interest margin and profitability. It is an insight that demands immediate strategic action.

Introspection alone is a recipe for being blindsided. Benchmarking against peers transforms raw data into a strategic roadmap, identifying vulnerabilities and illuminating competitive opportunities before they become obvious to the market.

This level of analysis is the bedrock of effective banking strategic planning. It ensures that high-level objectives are grounded in market reality.

Platforms like Visbanking deliver this essential intelligence, showing you precisely how your funding structure, costs, and stability compare. This empowers leadership to move beyond theory and convert insights into decisive actions that build tangible franchise value.

Common Questions Answered

How Has Digital Banking Changed The Game For Core Deposits?

Digital banking has fundamentally altered the competitive landscape. It is a double-edged sword: geographic barriers to entry have fallen, but so have customer switching costs.

Loyalty is no longer dictated by branch proximity but by the quality of the digital experience. A seamless mobile app and intuitive online platform are now primary drivers of deposit stability. The battle for sticky, low-cost funds has shifted decisively from the branch lobby to the digital interface.

What's The Biggest Mistake Banks Make When Valuing Their Core Deposits?

The most common and dangerous mistake is relying solely on regulatory definitions. Assuming every dollar in a checking account is stable is a critical error in judgment.

A bank may report a 65% core deposit ratio, but if 20% of that is comprised of rate-sensitive commercial funds, its true stability is far weaker. A proper valuation requires a deep dive into behavioral data—deposit beta, customer relationship depth, and decay rates—to get an accurate picture. Without this, your strategy is built on a flawed foundation.

Why Do Core Deposits Matter So Much Right Now?

In a volatile rate environment, core deposits are the ultimate anchor. They provide the stable, predictable, and low-cost funding that insulates a bank from market turmoil.

When competitors are forced to pay up for expensive wholesale funding, an institution with a strong core deposit base can protect its net interest margin and continue lending strategically. In today's market, it is the definitive competitive advantage.

Knowing how you stack up against the competition is the first step. Visbanking provides the intelligence to turn that knowledge into a stronger balance sheet. Benchmark your bank’s performance today.