9 Key Trends in the Fintech Industry: An Executive Briefing

Brian's Banking Blog

The financial services landscape is in a state of perpetual transformation, driven by relentless technological innovation. For bank executives and directors, understanding the primary trends in the fintech industry is not an academic interest; it is a strategic necessity. The line between traditional banking and technology has dissolved, creating both existential threats and unprecedented opportunities for market leadership. Decisions made today, informed by precise data, will determine which institutions thrive tomorrow.

This briefing cuts through the noise to analyze the nine most consequential fintech shifts impacting your institution. We will examine not only what these trends are but how to quantify their impact and leverage them for competitive advantage. The core challenge is no longer about accessing data, but about translating it into decisive action. To successfully navigate this new frontier, bank leadership must embrace a data-driven imperative, leveraging the power of real-time data analytics to inform every strategic move.

This is the principle at the heart of Visbanking's Bank Intelligence and Action System (BIAS), a platform designed to provide the clarity needed for such high-stakes decisions. The following analysis provides a clear-eyed view of the forces shaping the future of finance and the data-backed responses required to win. Let's explore the trends that demand your attention now.

1. Embedded Finance: The Disappearing Bank

Embedded finance represents a fundamental paradigm shift, moving financial services from a distinct destination to a native function within non-financial platforms. This trend is a core component of the evolving trends in the fintech industry, as it dissolves the traditional boundaries of banking. Consumers now secure point-of-sale loans from platforms like Shopify or pay via Uber's app without consciously interacting with a bank.

For bank executives, this trend is a double-edged sword. It threatens to relegate traditional institutions to a commoditized utility provider while simultaneously opening massive B2B opportunities. The strategic imperative is to become the licensed, regulated engine powering these non-financial experiences.

The Strategic Decision: Compete or Enable?

The most viable path for most institutions is not to compete with the seamless user experience of tech giants but to enable it. By acting as the Banking-as-a-Service (BaaS) partner, banks can create scalable, low-cost revenue streams. For instance, a regional bank could partner with a large agricultural equipment dealer to offer integrated financing at the point of purchase.

Key Insight: The conversation must shift from "if" to "how." The critical first step is identifying which non-financial sectors show the highest propensity for adopting embedded financial products and offer the best risk-adjusted returns.

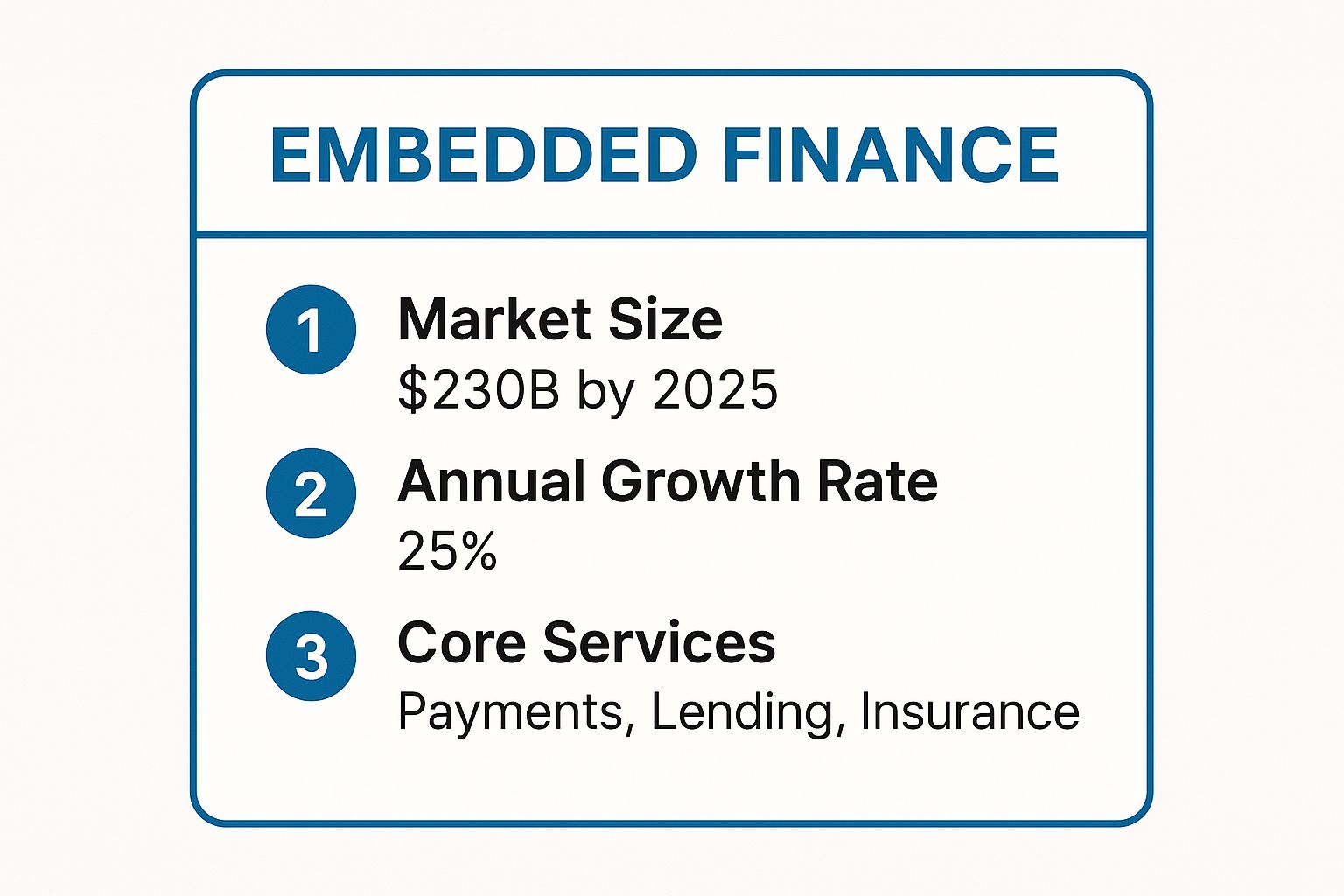

This data-backed approach transforms a strategic debate into a clear action plan. The infographic below highlights the immense scale of this opportunity.

The projected market size and growth rate signal that embedded finance is not a fleeting trend but a foundational shift in how financial services are distributed.

Leveraging Data for Implementation

To capitalize on this, executives must move beyond speculation and use concrete data. Using a platform like Visbanking, a bank can benchmark the loan portfolio growth and yield of peer institutions that have already entered such partnerships. Analysis might reveal a potential ROI of 150-200 basis points higher on these specialized portfolios compared to traditional commercial loans. This insight provides the board with a quantifiable business case, identifying exactly who to partner with and what returns to expect.

2. Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) has evolved from a niche e-commerce perk to a mainstream credit alternative, fundamentally altering consumer purchasing behavior. This model allows customers to acquire goods immediately while deferring payment through interest-free installments. For financial institutions, the rapid adoption of BNPL by firms like Klarna and Affirm is a critical signal of shifting consumer expectations and represents one of the most disruptive trends in the fintech industry.

For bank executives, the rise of BNPL presents both a competitive threat and a strategic opportunity. Fintechs have captured a significant segment of point-of-sale financing, often intercepting the transaction before a bank-issued credit card is even considered. The challenge is to respond effectively without simply mimicking a model that carries unique regulatory and credit risks.

The Strategic Decision: Integrate or Compete?

The primary path for banks is not to build a standalone BNPL brand from scratch but to integrate BNPL-like features into their existing product suites. This can be achieved by developing proprietary installment plan options for existing credit card holders or by acquiring a white-label technology provider. For example, a bank could offer a "post-purchase installment" feature within its mobile app, allowing customers to convert a recent large transaction into a fixed payment plan.

Key Insight: The opportunity for banks is not in replicating the zero-interest, merchant-subsidized model but in offering a trusted, transparent installment credit product to their existing customer base. This leverages the bank's primary advantages: established trust and a deep understanding of the customer's full financial picture.

This strategy transforms a defensive reaction into a proactive customer retention and engagement tool. The growing regulatory landscape also favors established, compliant institutions. For an in-depth analysis, learn more about how BNPL plans continue to draw increased regulatory scrutiny.

Leveraging Data for Implementation

To build a compelling business case, executives need to quantify the potential impact on their portfolio. Using a platform like Visbanking, a bank can analyze interchange fee data and transaction patterns to identify the volume of purchases susceptible to BNPL competition. An analysis might reveal that 15% of a bank's credit card volume over $100 is now at risk. Modeling the launch of an integrated installment feature could project a 5-7% lift in transaction volume and a material reduction in customer attrition to fintech competitors. This data-driven forecast provides the board with a clear ROI, justifying the investment and outlining a precise implementation roadmap.

3. Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is a radical departure from the centralized financial architecture that banks currently operate within. This trend, a significant force among the trends in the fintech industry, leverages blockchain technology to create peer-to-peer financial systems. DeFi protocols replace traditional intermediaries like banks with automated, self-executing smart contracts, enabling services such as lending, borrowing, and trading to occur directly between users.

For banking executives, DeFi is often viewed as a distant, esoteric threat, yet its underlying principles of automation, transparency, and efficiency represent a new competitive frontier. While mass adoption is still on the horizon, the core innovation challenges the high-cost, high-friction models of traditional finance. The strategic question is not whether to adopt DeFi protocols directly, but how to understand their impact on consumer expectations and operational efficiency.

The Strategic Decision: Observe, Learn, or Integrate?

Ignoring DeFi is a strategic risk. A proactive approach involves monitoring its evolution and identifying which elements could be adapted to improve existing banking operations. Early movers are not building on public blockchains but are exploring private, permissioned versions to streamline processes like trade finance or syndicated lending, drastically reducing settlement times and counterparty risk. For example, a bank could pilot a smart contract-based system to automate compliance checks for syndicated loans, cutting processing time from days to minutes.

Key Insight: DeFi's immediate value to traditional banks is not in replacing core services, but in providing a blueprint for radical process automation and cost reduction. The first step is to isolate specific, high-friction internal processes where blockchain's transparency and automation could deliver measurable ROI.

This data-driven approach moves the conversation from abstract technological debate to a concrete operational strategy, focusing on tangible efficiency gains.

Leveraging Data for Implementation

To understand DeFi's potential impact, executives need to quantify the inefficiencies in their current systems. Using a platform like Visbanking, a bank can analyze its non-interest expenses and operational costs relative to peers, pinpointing areas like loan syndication or trade finance where processing overhead is highest. This data might reveal that a specific operational unit's costs are 20-30% above the peer average. This insight provides a clear business case for exploring a DeFi-inspired pilot program, with a defined goal of reducing those specific costs and a benchmark to measure success against.

4. Central Bank Digital Currencies (CBDCs): The New Frontier of Monetary Policy

Central Bank Digital Currencies (CBDCs) represent the digitization of a nation's fiat currency, issued and backed directly by the central bank. Unlike decentralized cryptocurrencies, CBDCs are a centralized, government-guaranteed liability. This core distinction makes them one of the most transformative trends in the fintech industry, poised to reshape payment rails, monetary policy implementation, and the very definition of deposits.

For bank executives, the rise of CBDCs, such as China's DCEP and the ECB's Digital Euro pilot, is not a distant academic concept; it is a direct challenge to the traditional role of commercial banks as the primary intermediaries of money. The core threat lies in the potential for "digital bank runs," where consumers and businesses could instantly move deposits from commercial banks to the perceived safety of a central bank wallet, especially during a crisis.

The Strategic Decision: A Threat to Deposits or a New Utility?

The introduction of a CBDC forces a fundamental strategic question: will it disintermediate commercial banks or create new opportunities for partnership? While the direct-to-consumer model is a significant risk, a more likely scenario is a two-tiered system where banks act as the primary interface for CBDC distribution, account management, and value-added services.

Key Insight: The immediate focus for banking leaders should not be on fighting the inevitable but on defining their role within the future CBDC ecosystem. The conversation must shift from risk mitigation to value creation.

This involves architecting new products and services built on top of CBDC rails, such as programmable payments or streamlined cross-border transactions.

Leveraging Data for Implementation

To prepare, executives must model the potential impact on their deposit base and liquidity. Using a platform like Visbanking, a bank can analyze deposit volatility and customer segmentation to identify which accounts are most at risk of migrating to a CBDC. An analysis might reveal that 15-20% of non-interest-bearing retail deposits could be vulnerable. This data provides a clear business case for developing new, high-value services designed to retain these customers, turning a potential threat into a catalyst for innovation. The trend towards digital-only finance, seen in the rapid adoption of investment platforms like Robinhood and Etrade, proves customers will quickly embrace new digital channels when offered a superior experience.

5. AI-Powered Personal Finance Management

Artificial Intelligence is fundamentally reshaping personal finance management (PFM) by transforming raw transaction data into predictive, actionable intelligence. This evolution represents a critical one of the trends in the fintech industry, moving beyond simple spending categorization to offer automated budgeting, personalized investment advice, and real-time financial coaching. Consumers now use platforms like Mint and Personal Capital not just to see where their money went, but to understand where it should go next.

For financial institutions, this trend presents a direct challenge to their traditional role as the primary financial advisor. Fintech PFM tools are disintermediating banks from their customers' daily financial decisions. The strategic imperative is to integrate similar intelligent capabilities into proprietary banking platforms, re-establishing the institution as the central, trusted hub for a customer's financial life.

The Strategic Decision: Augment or Cede?

Banks must decide whether to cede this advisory relationship to third-party apps or augment their own digital offerings with sophisticated AI. Ceding this ground risks turning the bank into a simple repository for funds, while competitors build deeper, more engaged customer relationships. The smarter path is to leverage the vast, proprietary customer data banks already possess to deliver superior, hyper-personalized PFM insights. A bank, for example, could use AI to predict a customer's upcoming cash flow crunch and proactively offer a short-term credit solution.

Key Insight: The goal is not just to provide data but to provide guidance. The first step is analyzing customer transaction data to identify segments most likely to adopt and benefit from AI-driven financial advice, such as young professionals managing new income streams or families planning major life expenses.

This targeted approach ensures that development resources are focused on features that deliver the highest customer value and retention.

Leveraging Data for Implementation

To build a competitive PFM tool, executives need to understand what works. Using a platform like Visbanking, a bank can analyze the digital engagement metrics and product cross-sell ratios of peer institutions that have successfully launched AI-powered PFM features. The data might reveal that banks offering predictive budget alerts see a 15% higher user engagement rate and a 5% increase in savings account openings. This provides a quantifiable business case for investing in AI, highlighting the direct link between intelligent features and core business growth.

6. Open Banking and API Economy

Open Banking mandates that traditional financial institutions share customer data, with consent, via secure Application Programming Interfaces (APIs). This regulatory-driven shift dismantles the siloed data model of legacy banking, creating an interconnected ecosystem. This is one of the most transformative trends in the fintech industry, turning bank data into a platform for third-party innovation from companies like Plaid and Tink.

For bank executives, Open Banking represents a critical strategic juncture. It erodes the traditional monopoly on customer financial data, exposing banks to new competition from agile fintechs. However, it also creates an opportunity to become a central hub in a customer’s financial life by aggregating external data and offering more personalized, holistic services.

The Strategic Decision: Defend or Pioneer?

The defensive posture involves minimum compliance, treating APIs as a regulatory burden. The forward-thinking approach, however, is to pioneer, building an API-first strategy that not only complies but also commercializes data access. This allows banks to monetize their infrastructure, create new B2B revenue streams, and partner with fintechs to enhance their own product offerings.

Key Insight: Open Banking isn't just about sharing data; it's about receiving it. The real competitive advantage lies in using APIs to pull in external account information, creating a 360-degree customer view that enables superior underwriting, personalized advice, and higher-value product recommendations. Learn more about how open banking is innovating finance at an incredible rate.

This strategic pivot transforms a regulatory mandate into a powerful tool for customer acquisition and retention.

Leveraging Data for Implementation

To capitalize on this trend, executives need a data-driven roadmap. The first step is to analyze which customer segments are most likely to adopt third-party financial apps. A platform like Visbanking can help identify peer institutions that are successfully leveraging data aggregation to increase deposit stickiness or grow their wealth management AUM. For example, analysis might show that banks integrating with personal finance management (PFM) tools see a 15% lower attrition rate in their high-net-worth checking accounts. This quantifiable insight provides a clear business case for investing in API infrastructure, justifying the cost with a direct, measurable impact on core banking KPIs.

7. Sustainable and ESG Finance

Sustainable and ESG (Environmental, Social, and Governance) finance is a pivotal trend shifting capital allocation towards assets that generate positive social and environmental impact alongside financial returns. This macro-level movement, one of the most significant trends in the fintech industry, encompasses everything from green bonds that fund renewable energy projects to fintech platforms like Aspiration that offer consumers climate-conscious banking products. It reflects a growing demand from investors, regulators, and customers for greater corporate responsibility.

For banking executives, the rise of ESG is no longer a peripheral concern but a central strategic issue. It presents opportunities to attract a new generation of investors, develop innovative green financial products, and mitigate long-term climate-related portfolio risks. Failing to engage with ESG principles risks reputational damage and loss of market share to more forward-thinking competitors.

The Strategic Decision: Integrate or Isolate?

Institutions must decide whether to treat ESG as a niche product category or fully integrate its principles across all lending and investment activities. The latter approach is proving more resilient, creating a competitive moat by aligning the bank's entire balance sheet with long-term sustainable growth. For example, a community bank could develop specialized loan products for local businesses adopting energy-efficient technologies, securing a loyal customer base while improving its own risk profile.

Key Insight: The conversation around ESG in banking must evolve from a compliance and marketing exercise to a core driver of portfolio strategy and risk management. The key is to identify specific ESG criteria that correlate with lower long-term credit risk and higher profitability.

This data-driven approach moves ESG from a cost center to a value-creation engine. Banks that can quantify the financial benefits of their ESG initiatives will gain a significant competitive advantage.

Leveraging Data for Implementation

To build a credible ESG strategy, executives need granular data. Using a platform like Visbanking, a bank can analyze the performance of loan portfolios tied to green initiatives at peer institutions. This analysis might reveal that loans for certified energy-efficient commercial buildings have a default rate 30-40 basis points lower than conventional commercial real estate loans. This quantifiable insight provides a powerful business case for launching a targeted green lending program, demonstrating to the board that sustainability and profitability are not mutually exclusive goals. For a deeper analysis, learn more about how ESG and the banking industry are intersecting.

8. Digital-Only Banking (Neobanks)

Digital-only banks, or neobanks, represent a fundamental challenge to the branch-based model of traditional banking. Operating entirely through mobile and web platforms, they leverage a lower cost base to offer fee-free services, superior user experiences, and innovative features. This trend is a powerful force within the trends in the fintech industry, as neobanks like Chime and Nubank reset consumer expectations for what a bank should be.

For incumbent bank executives, neobanks are not just niche competitors; they are a direct assault on the primary customer relationship. Their growth signifies a clear market demand for digital-first, transparent, and highly responsive banking services, a demand that traditional institutions must meet or risk losing significant market share, especially among younger demographics.

The Strategic Decision: Compete or Co-opt?

Directly competing with the agile, tech-native culture of a neobank is a resource-intensive challenge. A more strategic path for many community and regional banks involves co-opting their best features and targeting underserved segments with a superior, digitally-enhanced value proposition. This could mean launching a distinct digital-only brand or overhauling existing mobile offerings to match neobank functionality.

Key Insight: The threat is not the technology itself, but the customer-centricity it enables. The critical step is to analyze which neobank features are driving the most significant deposit and transaction volume growth and replicate them within your own ecosystem.

This data-driven approach moves the strategy from a defensive reaction to a proactive, offensive maneuver to protect and grow your deposit base.

Leveraging Data for Implementation

To build a compelling business case, executives need concrete data on neobank performance and customer acquisition costs. Using a platform like Visbanking, a leadership team can benchmark their own digital channel's key performance indicators against the publicly available data of neobank holding companies. An analysis might reveal that a leading neobank acquires new checking accounts at a 40% lower cost per acquisition (CPA) but with an average deposit balance that is 60% smaller than a traditional bank's. This insight allows for a precise ROI calculation for investing in a new digital onboarding system, providing the board with a clear financial justification for prioritizing digital transformation.

9. Biometric Authentication and Security

Biometric authentication represents a crucial evolution in financial security, leveraging unique biological characteristics to verify user identity. This method, using fingerprints, facial recognition, or voice patterns, is rapidly replacing vulnerable password-based systems. As a core component of modern trends in the fintech industry, biometrics offer a dual benefit: fortifying security against fraud while dramatically improving the customer experience in mobile banking and payments.

For banking executives, the adoption of biometric security is no longer optional; it is a competitive necessity. Institutions like JPMorgan Chase and HSBC have integrated fingerprint and voice recognition, setting a new market standard. The technology not only reduces friction for legitimate users but also adds a powerful layer of defense against sophisticated cyber threats, directly impacting operational risk and customer trust.

The Strategic Decision: Integrate or Be Breached?

The primary decision is not whether to adopt biometrics, but how deeply to integrate them across all customer touchpoints. A phased rollout, starting with mobile app logins and progressing to high-value transactions and ATM access, allows institutions to manage implementation costs while demonstrating a clear commitment to security innovation. For example, a community bank could partner with a fintech provider to deploy facial recognition for new account openings, reducing both in-branch fraud and onboarding time.

Key Insight: The conversation must move beyond a simple security upgrade to a strategic enhancement of the entire customer journey. The critical first step is analyzing transaction data to identify the highest-risk interaction points where biometric verification will deliver the greatest immediate security ROI.

This data-driven approach ensures that investment is directed toward areas with the most significant impact on fraud reduction and customer confidence.

Leveraging Data for Implementation

To build a compelling business case, executives need quantifiable proof of effectiveness. Using a platform like Visbanking, an institution can benchmark the fraud loss rates and customer satisfaction scores of peer banks that have already deployed multi-factor biometric systems. The data might reveal that competitors using biometrics see a 40-50% reduction in account takeover fraud. This hard data provides the board with a clear, quantifiable justification for the investment, outlining expected reductions in fraud-related losses and an uplift in digital channel engagement.

9 Key Fintech Trends Comparison

| Technology | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Embedded Finance | High – requires API integration and compliance | High – technical expertise and third-party partnerships | Seamless financial service integration; new revenue streams | Businesses seeking to embed payments, lending, insurance | Improved UX; reduced transaction friction; data insights |

| Buy Now, Pay Later (BNPL) | Medium – API integration with e-commerce | Medium – platform integration and credit risk management | Increased conversion and purchasing power | Retailers and e-commerce aiming to boost sales | Interest-free installments; instant approval |

| Decentralized Finance (DeFi) | Very High – blockchain and smart contract development | High – blockchain infrastructure & security expertise | Peer-to-peer finance; high yield opportunities | Users seeking decentralized, transparent, global finance | Transparency; global access; reduced intermediaries |

| Central Bank Digital Currencies (CBDCs) | Very High – government and regulatory coordination | Very High – infrastructure and compliance | Digital fiat with government backing; financial inclusion | National governments and monetary authorities | Faster payments; monetary policy tools; inclusion |

| AI-Powered Personal Finance Management | Medium – AI models and data integration | Medium – data processing and analytics | Personalized insights; automated budgeting | Consumers needing financial management and advice | Personalized recommendations; time-saving automation |

| Open Banking and API Economy | High – APIs, security, and compliance | Medium to High – API infrastructure and monitoring | Increased innovation and competition | Banks and fintech providers enabling data sharing | Enhanced products; competitive marketplace |

| Sustainable and ESG Finance | Medium – ESG data integration and reporting | Medium – analytics and sustainability reporting | Investment aligned with values; risk mitigation | Investors and institutions focused on responsible finance | Aligns finance with sustainability; long-term value |

| Digital-Only Banking (Neobanks) | Medium to High – full digital platform build | High – app development and customer support | Mobile-first banking; improved accessibility | Customers preferring digital-only banking services | Lower fees; better UX; fast innovation |

| Biometric Authentication and Security | High – biometric hardware/software integration | High – advanced technology and security | Strong authentication; reduced fraud | Financial services requiring secure, user-friendly login | Enhanced security; user convenience |

From Insight to Action: Executing a Data-Driven Fintech Strategy

The trends shaping the fintech industry are not isolated phenomena. They are deeply interconnected forces reshaping the competitive landscape of banking. From the seamless integration of embedded finance into non-financial platforms to the systemic potential of Central Bank Digital Currencies (CBDCs), each development demands a strategic response. The rise of neobanks, the ubiquity of BNPL, and the democratizing power of Open Banking are not future concerns; they are present realities altering customer expectations and revenue models.

Merely observing these shifts is a strategy for obsolescence. Leadership in this new era requires moving from passive awareness to decisive, data-informed action. The institutions that will thrive are those that can precisely quantify the opportunities and risks associated with each trend. This means going beyond high-level summaries and diving into granular analysis.

From Observation to Execution: Key Imperatives

To successfully navigate the trends in the fintech industry, executives must prioritize a new set of operational imperatives. The traditional cycle of annual strategic planning is no longer sufficient. It must be replaced with a dynamic approach that leverages real-time intelligence to inform tactical execution.

- Benchmark Against True Peers: Understanding how your institution’s loan portfolio, fee income structure, or digital adoption rates compare to direct competitors is foundational. For example, if a peer institution sees a 15% increase in non-interest income after launching a specific BNPL partnership, that is a quantifiable data point that demands investigation, not a generic observation.

- Model Financial Impact Proactively: Before committing significant capital to a new AI-powered personal finance tool, you must model its potential impact. This includes projecting the poten