It’s simply giving time back to employees in order for them to do higher leverage work.

With the vast improvements in AI and tech in general, there is growing risk of jobs being automated.

And it makes sense to think that tellers and other bank employees would be right in line with this—but that’s simply not the case.

All we have to do is look at the data.

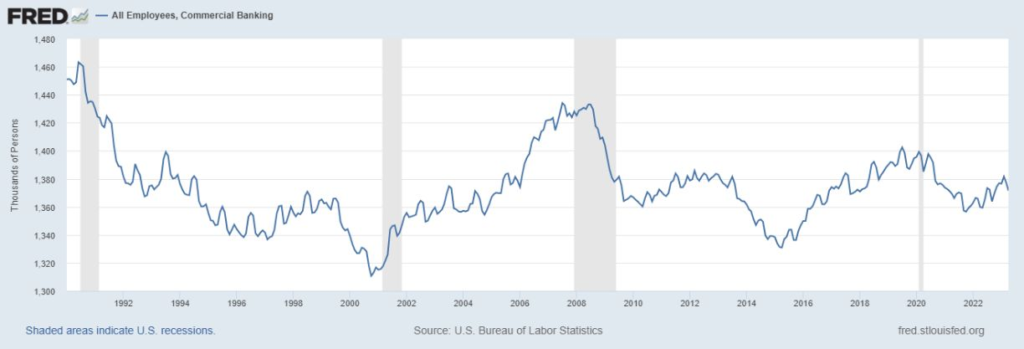

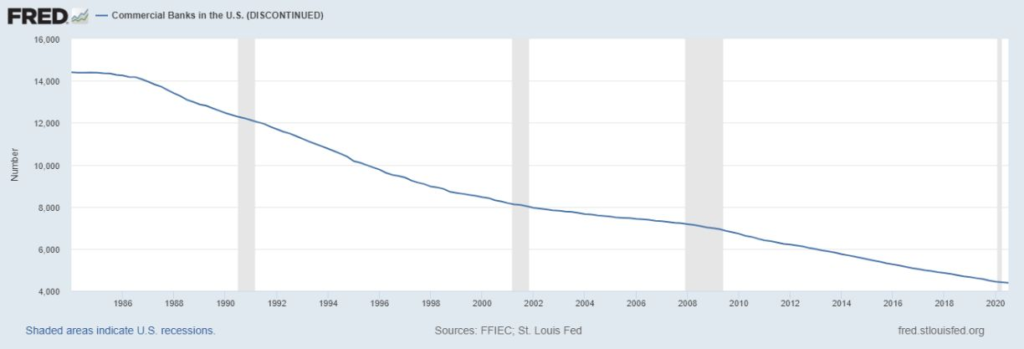

One quick glance at the 2 charts below and you can see that there is 0 correlation.

1 is very linear and downward trending.

The other is all over the place, and currently trending up.

Moving from a bit more than 14,000 banks to just under 5,000 banks is a gigantic consolidation.

Oscillating between 1.4M and 1.3M employees over the same time period shows little to no trend downward.

So just because the number of banks is going down, and the amount of automation is going up, doesn’t mean that people are losing their jobs.

They might be performing different roles than they were previously,

But they’re still working.

There may come a day when all of this changes,

But as of now,

There’s no sign of that happening.

—

Digging deep on banks is what I do.

🔔 Follow Brian on Linkedin: Brian Pillmore