A Data-Driven Strategic Decision Making Process for Bank Leadership

Brian's Banking Blog

Strategic decisions were once the domain of gut instinct and tenure. That era is over. Today, a modern strategic decision making process is a rigorous framework for navigating market complexity. It demands methodical problem identification, validated intelligence gathering, data-driven option analysis, and flawless execution against measurable objectives.

For bank executives and directors, this shift provides a powerful mandate: use validated data—not just intuition—to answer your most critical questions. An effective process provides definitive answers on market position, profitability, and risk, transforming market volatility into a distinct competitive advantage.

The Old Way vs. The New Way

In today's financial landscape, an intuition-led approach to strategy is a significant liability. Facing technological disruption, regulatory shifts, and fierce competition, guesswork is a risk your institution cannot afford. Top-performing banks have already institutionalized a data-first framework to build resilient, defensible growth.

This is not about replacing executive judgment. It is about augmenting it with objective intelligence to ensure that major strategic commitments are grounded in market reality, not internal assumptions.

The table below outlines the fundamental shift in how banks must approach strategic decisions.

The Evolution of Bank Strategic Decision Making

| Attribute | Traditional Approach (Intuition-Led) | Modern Approach (Data-Driven) |

|---|---|---|

| Foundation | Executive gut feelings, experience, historical anecdotes | Verified market data, peer benchmarks, predictive analytics |

| Risk Assessment | Subjective, based on past events and assumptions | Objective, based on quantitative models and scenario analysis |

| Speed & Agility | Slow, reactive, tied to annual planning cycles | Fast, proactive, continuous adaptation to real-time data |

| Focus | Internal perspective, "what we've always done" | External market reality, "what our data tells us is possible" |

| Outcome | High-risk, inconsistent results, missed opportunities | Calculated risk, resilient growth, competitive advantage |

This evolution is a prerequisite for survival and outperformance in an increasingly complex market.

What's Forcing the Change?

The pressure to adapt is driven by tangible market forces. Geopolitical instability, economic headwinds, and rapid technological advancements demand greater foresight and agility from leadership. Research from HEC Paris confirms that these dynamics necessitate a more nimble decision-making capability. The World Economic Forum projects that 22% of jobs will be fundamentally disrupted by 2030, underscoring the pace at which leadership teams must adapt.

For example, when evaluating market expansion, a critical strategic decision may involve entering underserved communities. A data-driven analysis of demographics and competitors, such as reviewing data on Top Banks That Accept ITIN, can quantify the opportunity. This decision must be supported by hard numbers, not intuition.

The primary challenge for bank leadership is separating signal from noise. Is a 15-basis-point compression in your Net Interest Margin an anomaly, or the leading edge of a structural shift in your funding costs? Without a disciplined, data-driven process, the answer is a guess.

A modern approach, powered by a robust business intelligence system, provides the necessary structure to:

- Set Clear Goals: Utilize benchmark data to define critical challenges and quantify the largest opportunities.

- Generate Actionable Intelligence: Move beyond raw data to uncover insights that dictate specific actions.

- Evaluate Options: Model the financial impact of different scenarios to clarify risk and potential ROI.

- Execute and Measure: Track performance against strategic targets in real-time, not in quarterly arrears.

Implementing this structured methodology is the essence of effective banking strategic planning. At Visbanking, our platform is designed to embed this data-driven discipline into your bank's core operations, enabling you to benchmark performance and convert complex market data into decisive strategy.

Step 1: Pinpoint the Strategic Imperative

Every sound strategic decision begins not with an answer, but with the correct question. The initial step is to identify the strategic imperative—the single, critical issue that will materially impact your institution's trajectory.

It is easy to become consumed by operational urgencies. The essential executive skill is distinguishing these from true strategic inflection points. A failure at this stage directs valuable resources toward solving the wrong problem.

Is a 15-basis-point dip in your Net Interest Margin (NIM) a cyclical fluctuation, or is it a symptom of systemic pressure on your core deposit franchise, indicating an urgent need to re-evaluate your funding strategy?

From Ambiguity to Clarity

Attempting to make this distinction using only institutional memory and internal historical data is inadequate. Past performance is a rearview mirror; it offers no context on how you are performing against competitors vying for the same customers in the current environment.

This is precisely why high-performing banks anchor this process in external, validated data. The objective is to convert a vague concern like "our margins are compressing" into a concrete, quantifiable imperative. For instance: "Our cost of funds is 30 basis points above our peer median, directly compressing NIM and creating a significant competitive pricing disadvantage."

The most dangerous error in strategy is providing a brilliant solution to the wrong problem. Correctly identifying the imperative from the outset aligns the entire organization toward a goal that creates tangible shareholder value.

Achieving this clarity requires moving from high-level concerns to specific, measurable questions. This demands a structured workflow for gathering and validating initial data.

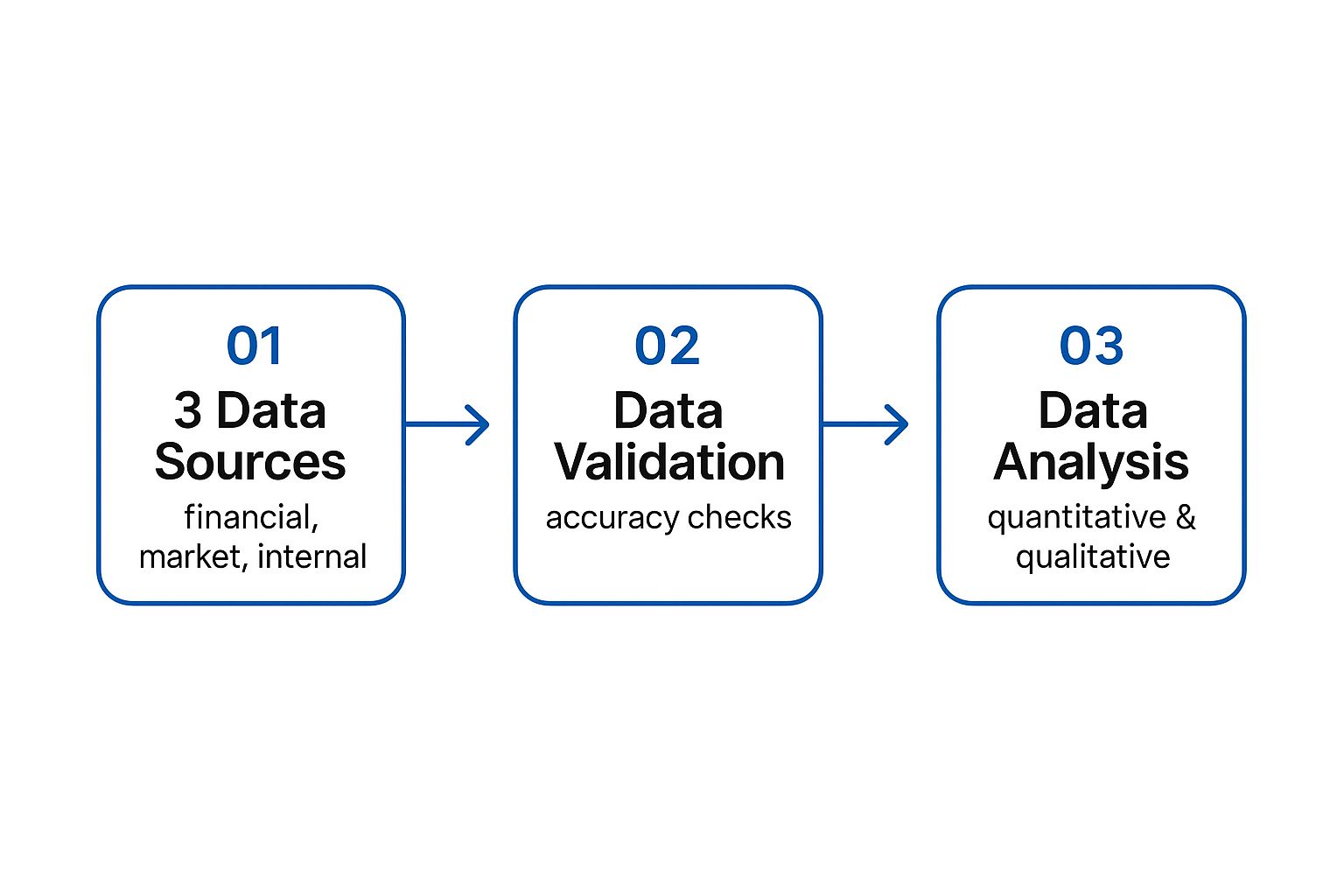

This workflow illustrates how to refine a vast amount of raw data into a focused starting point for your analysis.

Before insights can be derived, data must be aggregated from disparate sources and validated for accuracy. This foundational step builds institutional trust in the subsequent analysis and conclusions.

The Power of Peer Benchmarking

The most effective tool at this stage is peer benchmarking. It provides the essential external context required to validate or challenge internal assumptions.

By comparing your bank's performance against a carefully selected peer group, you can immediately identify areas of overperformance, underperformance, and parity.

Consider a hypothetical $750 million asset community bank concerned about loan growth. Internal reports show a 3% annual increase—a figure that may not trigger immediate alarm.

However, if a peer analysis via a platform like Visbanking's BIAS reveals that similarly sized institutions in its market are achieving 8% loan growth, the strategic imperative is immediately clarified. The question is no longer "How can we grow loans?" but "Why are we underperforming the market by 500 basis points, and which specific loan categories are driving this gap?"

This data-driven context enables you to frame more intelligent, incisive questions:

- ROA and ROE: Are our returns genuinely competitive, or is an underlying profitability issue being masked by other factors?

- Efficiency Ratio: Is our cost structure prohibitive, limiting our ability to compete on price and invest in technology?

- Loan and Deposit Composition: Is our balance sheet over-exposed to a specific asset class or overly reliant on volatile funding sources compared to our peers?

This initial step is not about finding all the answers. It is about defining the single, most important question your leadership team must answer. Grounding this discovery phase in objective, comparative data ensures your entire strategic process is aimed at the right target from day one.

Step 2: Assemble Actionable Intelligence

With the strategic question defined, the next task is to generate the intelligence needed to answer it. This is a common failure point, where leadership teams are often inundated with contradictory reports, outdated spreadsheets, and siloed departmental data.

The objective is not to accumulate more data. It is to distill disparate information into actionable intelligence—a single, trusted version of reality that the entire executive team can use as a foundation for decision-making.

The banking industry is data-rich but often insight-poor. This gap forces leaders to revert to intuition when objective facts are most needed. Research shows that while data-driven organizations report a 3x improvement in decision outcomes, 62% of executives still default to gut instinct. The reason is a lack of confidence; 73% of C-suite leaders admit they do not fully trust their own data.

If you do not trust the numbers, you will not bet your institution's future on them.

This step is about transforming raw data into a single source of truth. The goal is to build the confidence to act by eliminating the paralysis that stems from questioning the integrity of your own information.

A centralized business intelligence platform like Visbanking’s BIAS is no longer a discretionary tool; it is a core strategic asset. It is engineered to consolidate fragmented data into a clean, reliable, and comprehensive view of your institution and its market.

From Raw Data to a Coherent Narrative

Actionable intelligence is not a spreadsheet; it is a narrative. It weaves together internal performance metrics with the external forces shaping your market.

Consider a $2 billion bank committed to defending its deposit base against digitally-native competitors. "Assembling intelligence" must go beyond a simple report on deposit outflows.

It requires a multi-faceted investigation:

- Internal Performance: Which specific products are experiencing outflows? High-yield money markets or non-interest-bearing DDAs? Are we losing tenured customers or new ones? Are outflows concentrated in specific branches or zip codes?

- External Market: Which specific competitors are winning those deposits? What are their current rate offerings and marketing campaigns? Are they targeting the same customer segments we are losing?

- Customer Behavior: What does our internal data reveal about departing customers? Are they heavy users of mobile banking or traditional branch clients?

Without a unified view, the head of retail, the CMO, and the CFO will each arrive at the strategy session with their own version of the truth. The debate then degrades from "what is the right strategy?" to "whose numbers are correct?"—stifling progress.

Building Forward-Looking Intelligence

True strategic intelligence is predictive, not just descriptive. It illuminates the road ahead. This is the transition from basic reporting to advanced analytics. Understanding the power of predictive analytics in banking is crucial for anticipating market shifts rather than reacting to them.

For the bank defending its deposit franchise, predictive intelligence answers forward-looking questions:

- What is the modeled impact on our NIM if we increase our money market rates by 25 basis points to match a key competitor?

- What is the projected lifetime value of a new customer acquired through a high-yield savings offer versus a commercial DDA relationship?

- Can we predict which of our most valuable customers are at the highest risk of attrition over the next six months based on their transaction patterns?

By assembling intelligence that is not only accurate but also predictive, you provide your leadership team with a clear, data-backed view of potential outcomes. This builds the solid ground required to make confident, decisive moves in the next phase of the process.

Step 3: Evaluate Options with Data-Driven Foresight

With validated intelligence assembled, the critical task is to evaluate strategic options. This is the moment where data must inform foresight, providing a clear-eyed view of potential futures. The objective is to move beyond understanding the present to making a calculated investment in the future.

This is where strategy meetings often derail. Discussions become entangled in opinion, with decisions frequently driven by the loudest or most senior voice. Data-driven scenario modeling cuts through this subjectivity. It reframes the conversation from, "I feel this is the right move," to, "Our model indicates this option has a 70% probability of increasing NIM by 15 basis points within 24 months."

The impact of this approach is quantifiable. Research shows that data visualization tools alone can improve an organization's decision-making by up to 28%. When these visuals are paired with a compelling narrative, the strategic case becomes clear and memorable. You can read more about how data and storytelling can improve decision-making on TechnologyAdvice.com.

From Spreadsheets to Strategic Scenarios

Consider a $500 million community bank at a strategic crossroads. The board has mandated a plan to accelerate growth and secure long-term profitability. Two primary options have emerged from the initial analysis:

- Inorganic Growth: Acquire a smaller, $75 million competitor in an adjacent county to gain market share and physical branches.

- Digital Transformation: Execute a significant capital investment in a new digital banking platform to attract younger demographics and reduce operating costs.

The traditional approach involves disparate, cumbersome spreadsheets and siloed departmental presentations, making a true apples-to-apples comparison nearly impossible. A modern, data-first process, in contrast, models the financial trajectory of each option.

A business intelligence platform like Visbanking is instrumental here. Instead of static reports, the leadership team can dynamically model each path, visualizing the multi-year financial ripple effects side-by-side to answer the questions that truly matter.

This moves the analysis from a static assessment to a dynamic simulation of potential outcomes.

Modeling the Trade-Offs

Using a robust platform, the bank's leadership can map the multi-year impact of each choice across key performance indicators. This is not guesswork; it is a calculated forecast based on peer benchmark data and the bank’s own financial metrics.

Here is what that comparison looks like.

Scenario A: The Acquisition

- Initial Cost: A $12 million acquisition price.

- Projected ROA: Dips to 0.85% in year one due to integration costs, recovering to 1.10% by year three as synergies are realized.

- Efficiency Ratio: Spikes to 68% post-merger before declining to a projected 59% post-integration.

- Risk Profile: Acquiring a loan portfolio with higher CRE concentration introduces new risk management considerations.

Scenario B: The Digital Investment

- Initial Cost: A $5 million investment in platform development and marketing.

- Projected ROA: Remains stable at 1.05% in year one, then climbs steadily to 1.15% by year four as the new customer base matures and cross-sell opportunities increase.

- Efficiency Ratio: Improves gradually from 64% to 57% over five years as transaction volume shifts to lower-cost digital channels.

- Risk Profile: Trades credit risk for new operational and cybersecurity risks while diversifying the customer base.

The board is no longer debating philosophy. They are weighing concrete, data-backed scenarios. The discussion shifts to strategic risk appetite: Is the immediate market share gain from an acquisition preferable to the steadier, more organic growth of a digital transformation? Effective strategic decisions rely on foresight, which is why leveraging predictive analytics is so critical.

This stage is about creating absolute clarity. When you can model the precise impact of a 50-basis-point rate hike on your deposit beta under both scenarios, the optimal path becomes evident. With Visbanking, you can benchmark these potential outcomes against your peers, ensuring your chosen strategy is not just sound, but competitive.

Step 4: Put Your Plan in Motion and Keep Score

A brilliant strategy that is not executed is a worthless intellectual exercise. This stage is where boardroom objectives must translate into front-line action. It is also where most strategic plans fail.

The decision is the starting point, not the conclusion. Execution requires breaking down high-level objectives into specific departmental goals tied to measurable Key Performance Indicators (KPIs).

For bank executives, this necessitates a move away from the static annual plan. A modern strategy is a living document, subject to continuous monitoring and adjustment based on real-world data. Anything less is managing by looking in the rearview mirror.

Turning Strategy into Actionable KPIs

Let's operationalize this concept. A $1.5 billion bank decides its primary strategic objective is to increase its market share in local commercial lending over the next 18 months. The board approves the plan. What happens next?

The high-level goal is cascaded down into specific, measurable actions:

- Lending Team: Increase weekly C&I loan prospecting calls by 25%.

- Credit Department: Reduce the average application-to-decision time from 10 to 7 business days.

- Marketing Department: Generate 50 qualified commercial leads per month through targeted digital campaigns.

- Finance Department: Target $20 million in new C&I loan originations per quarter, with performance tracked weekly.

Each of these is a direct, measurable action that rolls up to the master strategy, aligning the entire organization toward a common objective.

A decision is only as good as its outcome. Without a robust system for measuring results, you cannot connect actions to performance, leaving you to guess whether the strategy was effective—and why.

This is precisely why a dedicated business intelligence platform is essential. Instead of waiting for stale quarterly reports, leadership needs a dashboard with a live view of these KPIs. This capability enables strategic agility.

Creating the Feedback Loop to Stay Agile

Return to our example bank. Two months into the initiative, new loan applications are up 30%, but the approval rate has fallen by 15%. With a legacy reporting process, this critical disconnect might not be identified for another quarter, by which time significant time, capital, and market momentum have been squandered.

A modern BI platform like Visbanking flags this discrepancy in real-time. It enables executives to ask the right questions immediately. Is the marketing campaign attracting unqualified applicants? Is the credit department's underwriting criteria too restrictive for this new market segment?

This is data-driven insight that facilitates surgical adjustments. Perhaps marketing needs to refine its ad targeting, or the credit team requires revised guidelines for this specific commercial loan product. These are not failures; they are expected course corrections that are only possible with real-time performance measurement.

This cycle—Execute, Measure, Analyze, Adjust—is the engine of modern strategy. It requires more than just data; it demands streamlined reporting. For many institutions, solving financial reporting automation is the first practical step toward building this capability.

Ultimately, this phase ensures that major strategic decisions deliver their intended financial results. By rigorously tracking performance against targets, you are not hoping for success—you are managing toward it.

The Common Traps That Derail Strategic Decisions

Even the most rigorous strategic process is vulnerable to failure. It is executed by humans, who are susceptible to cognitive biases and legacy habits that can derail a sound strategy, leading to costly errors or significant missed opportunities.

These are not abstract academic concepts; they are real-world traps that ensnare executive teams, often with severe financial consequences. Identifying these pitfalls is the first step; building a process that mitigates them is how you safeguard your institution's future.

1. Analysis Paralysis

This is the endless pursuit of more data before making a decision. While it feels prudent, it is often a mask for indecisiveness. Teams become so focused on eliminating every fraction of uncertainty that the window of strategic opportunity closes.

Consider a bank that spends a full year analyzing a potential fintech partnership. While it modeled every conceivable outcome, a more agile competitor, acting on 80% of the same information, made a decision. That competitor launched a comparable service in six months, capturing the target market. The opportunity was lost not due to a bad decision, but to no decision.

The remedy for analysis paralysis is not less data; it is better, more trusted intelligence. When your team operates from a single source of truth, the focus shifts from perpetual data gathering to decisive action.

2. Confirmation Bias

This is our innate tendency to seek, interpret, and favor information that confirms our pre-existing beliefs. It is insidious because it is subconscious, creating an echo chamber where flawed assumptions go unchallenged.

For example, a leadership team is convinced that deposit outflows are driven solely by interest rates. They may subconsciously ignore internal reports showing a steep decline in mobile app satisfaction scores. Consequently, they invest millions in rate specials that fail to stem the outflows, while the true problem—a poor digital user experience—continues to drive valuable customers to competitors.

3. Forgetting About Buy-In

A strategically brilliant decision is operationally worthless if the people responsible for its execution are not aligned. A decision formulated in the C-suite and imposed upon department heads without their input is a classic recipe for failure. Data supports this: while nearly 75% of employers deem collaboration "very important," 39% of employees report that their organizations do not collaborate sufficiently.

Imagine a bank launching a $5 million initiative to centralize its underwriting process. If key regional chief lending officers were not involved in the decision, they will likely resist. The project stalls, internal friction builds, and the analytically correct decision fails due to a lack of buy-in.

The most effective defense against these biases is objective, third-party data. Grounding strategic discussions in external benchmarks and peer comparisons—the type of intelligence provided by a platform like Visbanking—forces an honest assessment of performance. It punctures internal myths and aligns the entire leadership team around a shared, fact-based view of the market.

To truly de-risk your strategic plans, you must implement a process that actively guards against these common failures. You can start by exploring how our BIAS platform provides the objective clarity needed to act with confidence.

Bank Strategy FAQs: Your Questions, Answered

Modernizing a bank's strategic process raises valid questions. As an advisor to bank leadership teams, I address these frequently.

How Can We Really Trust Our Data for Big Decisions?

You cannot—not when it is fragmented across conflicting departmental spreadsheets. A multi-million-dollar decision requires a single source of truth.

The solution begins with a business intelligence platform that ingests, cleanses, and standardizes all relevant data, from your core system to external market benchmarks.

When evaluating branch profitability, for example, one report might show high deposit balances while another shows declining transaction volumes. A unified platform reconciles these data points to provide a single, reliable performance metric. This eliminates internal debates over data integrity and builds the institutional confidence required for high-stakes decisions.

What's the First Step to Move Past "Gut-Feel" Decisions?

Start with a focused, high-impact objective where data can deliver a clear, early victory. Shifting an institution's culture from intuition to data-driven analysis is a long-term endeavor. The most effective first step is to select one critical, specific challenge for your pilot project.

For example, if the efficiency ratio is a concern, move beyond a vague mandate to "reduce costs." Use a benchmarking tool to precisely compare your ratio against a curated peer group.

Discovering that your institution is 500 basis points less efficient than its direct competitors is not just a data point; it's a call to action. It creates a tangible, data-backed imperative that focuses the entire team. This initial success demonstrates the power of objective insights and builds momentum for a broader cultural shift.

How Often Should We Be Reviewing Our Strategic Plan?

The annual strategic review is obsolete in the current market. While your long-term vision may be stable, the operational tactics required to achieve it must be dynamic. I advise a formal quarterly review of strategic initiatives, supported by continuous, real-time KPI monitoring.

Market volatility is the new normal. An unexpected 50-basis-point rate hike by the Federal Reserve can render the assumptions of an annual plan invalid overnight. When you use real-time dashboards to track KPIs against strategic goals, you identify deviations early. This allows for rapid, tactical pivots, ensuring your strategy remains relevant and effective.

The strategic decision-making process is no longer an academic exercise; it is a primary driver of competitive advantage. Success hinges on grounding every step, from problem identification to execution, in objective, reliable data. At Visbanking, we built the intelligence platform that empowers bank leaders to benchmark performance, model future scenarios, and execute with confidence.

See for yourself how Visbanking can sharpen your bank's strategic framework.