A Guide to Regulatory Compliance Risk Management

Brian's Banking Blog

Think of your business as a ship navigating a vast, unpredictable ocean. The waters are full of opportunity, but they’re also dotted with hidden reefs, treacherous currents, and sudden storms. These dangers are the countless laws, regulations, and industry standards you have to follow. This is where regulatory compliance risk management comes in—it’s your captain, your map, and your compass all rolled into one.

It’s about turning compliance from a chore you have to do into a strategic advantage that protects your entire operation.

What Is Regulatory Compliance Risk Management, Really?

In today's business world, ignoring the rules isn't an option. Whether you're in finance, healthcare, or tech, a web of regulations governs everything you do. One misstep can lead to crippling fines, a damaged reputation, or even a complete shutdown.

Regulatory compliance risk management is the disciplined, proactive system you use to handle these threats. It’s not just about dodging penalties. It's about building a rock-solid foundation of operational integrity, earning the trust of your customers and stakeholders, and paving the way for sustainable growth.

The stakes are higher than you might think. U.S. companies spend, on average, a staggering $10,000 per employee every single year just to keep up with regulatory demands. On top of that, 35% of risk executives point to regulatory risk as a major barrier to business growth. You can dive deeper into these key compliance insights and trends to see just how critical this is. A wait-and-see approach just doesn't cut it anymore.

The Four Pillars of Compliance Management

A truly effective compliance program isn't a one-off project; it's a continuous cycle built on four core pillars. This framework ensures compliance becomes an integral part of your business strategy, not just a box-ticking exercise. It guides you from figuring out what rules apply to constantly strengthening your defenses.

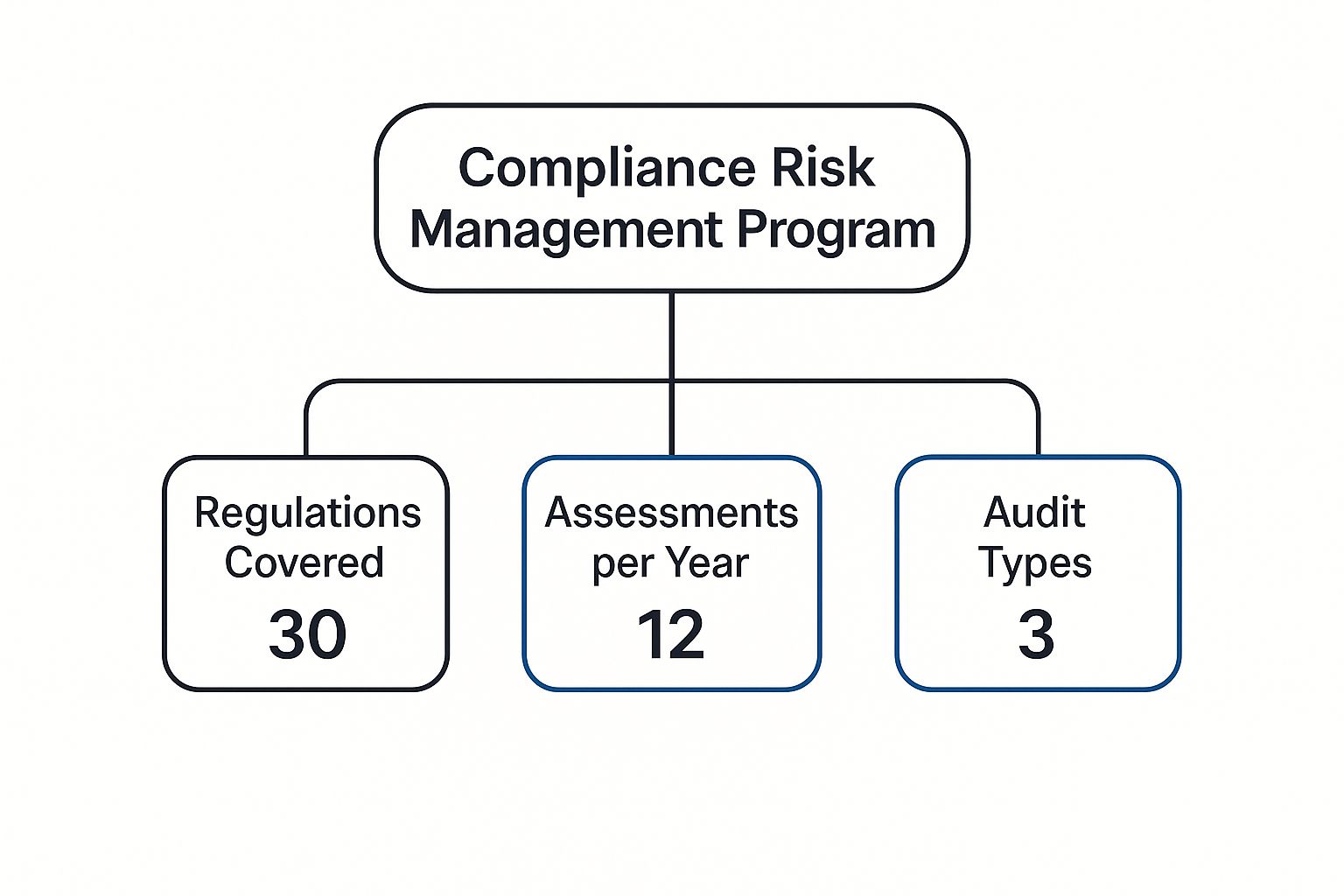

The image below gives you a sense of the scale of a modern compliance program—we're talking about managing hundreds of regulations with constant assessments.

This kind of structured, data-heavy approach is exactly what’s needed to navigate today’s complex regulatory environment.

To really get a handle on how this works, let's break down the process into its essential parts.

The Four Pillars of Regulatory Compliance Risk Management

This table outlines the four-stage lifecycle that forms the backbone of any strong compliance risk management strategy.

| Pillar | Objective | Key Activities |

|---|---|---|

| Identification | To know every single rule and potential risk that applies to you. | Building an inventory of regulations, keeping an eye on changes, and mapping out potential risk scenarios. |

| Assessment | To figure out how likely a risk is and how badly it could hurt your business. | Running risk assessments, ranking risks by severity, and putting a dollar figure on the potential impact. |

| Mitigation | To put controls in place that reduce or eliminate those identified risks. | Writing clear policies, implementing strong internal controls, and training your team. |

| Monitoring | To constantly check that your controls are working and watch for new threats. | Performing regular audits, tracking key risk indicators (KRIs), and keeping leadership in the loop. |

By mastering these four pillars, you're not just playing defense. You’re building a resilient business that has compliance baked into its DNA. This is what allows you to move with confidence, seizing opportunities while others are stuck putting out fires. It’s what separates the leaders from the laggards.

The Shift From Reactive to Proactive Compliance

It wasn't that long ago that "compliance" was a word that made people groan. It felt like a chore, a box-checking exercise done with a rearview-mirror mentality to keep the auditors happy. It was a cost center, managed with dusty checklists and addressed only after a fire had already started.

This reactive mindset left businesses wide open to disaster. And then, disaster struck.

The 2008 global financial crisis wasn't just a market downturn; it was a brutal wake-up call. It was the moment the world saw, in painful detail, what happens when compliance risk is ignored.

The crisis proved that failing to manage regulatory risk wasn't just a departmental problem. It could trigger a systemic collapse that would ripple through the entire global economy.

The meltdown exposed profound weaknesses in how financial institutions handled risk, from paper-thin capital reserves to a staggering lack of transparency. The old way of doing things was officially dead. A new era of accountability had begun, completely redrawing the map for regulatory compliance risk management.

The Regulators Strike Back

In the aftermath, governments and global bodies didn't just tweak the rules; they tore up the old playbook and wrote a new one. These weren't minor edits. They were foundational reforms designed to hardwire risk management into the very DNA of corporate governance.

Two pieces of legislation, in particular, changed the game forever:

- The Dodd-Frank Act (2010): A massive overhaul of the U.S. financial system, this act created new agencies and slapped strict new rules on everything from derivatives to executive pay.

- Basel III Accords: This international framework demanded that banks hold significantly more capital, maintain bigger liquidity buffers, and meet new leverage ratios to fortify the entire global banking system.

These new regulations forced a complete change in thinking. The sheer complexity and severity of the rules meant compliance could no longer be an afterthought handled in a forgotten corner of the office.

From Chore to Strategic Imperative

Suddenly, organizations had to look forward. They needed to anticipate risks, not just clean up after them. This proactive approach demanded a deep understanding of the regulatory landscape and, crucially, the right technology to turn massive amounts of data into clear, actionable insights.

The question was no longer, "What are the rules?" It was, "How do we build a resilient organization that can master these rules?"

For banks, this meant a ground-up reevaluation of their entire operational framework. This evolution sets the stage for the sophisticated, data-driven tools that define modern compliance today. You can get a deeper dive into this transformation in our guide on regulatory compliance for banks.

How To Build a Robust Compliance Framework

So, you understand why regulatory compliance matters. Now for the fun part: mastering the how. This is where your regulatory compliance risk management program really comes to life.

Think of your compliance framework as the architectural blueprint for a skyscraper. You wouldn't just start stacking floors and hope for the best, right? A solid plan is everything. The framework is your documented system of processes and controls—a structured, repeatable way to handle all your regulatory duties.

It’s what separates a reactive, fire-fighting approach from a deliberate, integrated part of your business. This isn't just about good intentions; it’s about creating a defensible, auditable system that strengthens your entire organization from the inside out.

The Core Components of Your Framework

Every solid compliance framework rests on a few essential pillars. Get these right, and you'll have a system that can effectively spot, assess, and control regulatory risks.

First up, you need clear governance and oversight. This is all about defining who owns what. It means setting up a compliance committee, designating a Chief Compliance Officer (CCO), and making sure the board of directors has the ultimate accountability. Without clear ownership, compliance efforts drift aimlessly.

Next is the engine of your framework: the risk assessment process. This is where you systematically identify which regulations apply to your business and figure out the real-world risks of falling short. For instance, a fintech company would zero in on risks tied to data privacy (like GDPR), anti-money laundering (AML) rules, and consumer protection laws.

Finally, you put internal controls and procedures in place. These are the practical, day-to-day actions that tackle the risks you've uncovered. If your risk assessment flagged a data breach threat, your internal controls would include things like encryption, strict access rules, and training your team on how to handle sensitive data.

A compliance framework isn’t a "set it and forget it" document. It’s a living system that has to adapt as your business and the regulatory landscape change. Constant monitoring and tweaking are non-negotiable.

Applying Established Models Like COSO and ISO 31000

The good news? You don't have to reinvent the wheel. Established models like the COSO framework and ISO 31000 offer proven, globally recognized structures you can adapt to fit your needs. While they have different approaches, both provide fantastic roadmaps. These principles are so sound that even organizations in other sectors can learn from them; for more ideas on building a strong foundation, check out this comprehensive guide to nonprofit compliance for some broader insights.

To help you decide which model might work for you, let's compare the two heavyweights.

Comparing Popular Risk Management Frameworks

Choosing a framework is a big decision. This table breaks down the key differences between COSO and ISO 31000 to help you see which one aligns better with your organization's culture and regulatory demands.

| Framework Feature | COSO Framework | ISO 31000 Framework |

|---|---|---|

| Primary Focus | Internal controls, financial reporting, and fraud deterrence. It’s very structured and prescriptive. | A universal, principle-based guide for managing any type of risk across an entire organization. |

| Core Structure | Based on five interconnected components: Control Environment, Risk Assessment, Control Activities, Information & Communication, and Monitoring. | Based on three core elements: Principles, Framework, and Process. It’s more flexible and adaptable. |

| Best For | Organizations, especially public companies, that need a rigorous, audit-focused approach to internal controls and financial compliance. | Any organization looking for a flexible, scalable approach to integrate risk management into its overall strategy and decision-making. |

So, which one is right for you? It really boils down to your industry, size, and the specific regulatory heat you're facing. COSO is often the go-to in heavily regulated sectors like banking because of its sharp focus on controls. On the other hand, ISO 31000 gives you a broader, more strategic playbook that can fit almost any kind of business. Some organizations even create a hybrid model, taking the best of both worlds.

The Role of Technology in Modern Compliance

Let's be honest, manual checklists and once-a-year audits just don't cut it anymore. They’re relics. Trying to manage compliance in today's global regulatory maze without the right tech is like trying to navigate a superhighway on a bicycle—it’s slow, dangerous, and you’re going to get left behind. Technology, specifically Regulatory Technology (RegTech), has become the engine that drives modern regulatory compliance risk management.

These tools aren't some futuristic fantasy; they're essential for survival. The sheer speed and volume of regulatory updates make manual tracking a fool's errand. The right technology automates the tedious, error-prone work, freeing up your compliance pros to focus on what they do best: high-level strategy and analysis. It’s a shift from a reactive, "what just happened?" posture to one of continuous, real-time oversight.

The Rise of AI and Predictive Analytics

Artificial Intelligence (AI) and machine learning (ML) are leading the charge. These systems can tear through mountains of data—transactions, communications, regulatory updates—and spot patterns and red flags a human team could easily miss. This is what allows you to move beyond simple rule-following to a smarter, risk-based approach.

So, what does this look like in practice? An AI-powered system can:

- Automate Horizon Scanning: It constantly scans global regulatory sources to flag upcoming changes that will impact your business.

- Model Predictive Risk: By analyzing historical data, it can forecast potential compliance breaches before they happen, giving you a chance to act.

- Enhance Surveillance: It can monitor employee communications and trading activity for the subtle signs of misconduct that older systems would never catch.

This proactive approach isn't a luxury anymore; it’s a necessity. A 2023 survey found that 61% of corporate risk and compliance professionals see keeping up with regulatory change as their top priority. It's no wonder that nearly half (48%) believe AI can make their teams more efficient. In fact, a whopping 94% of corporations expect AI to be a core part of their future strategy, especially in risk and compliance.

The real goal of technology isn't to replace human expertise—it's to supercharge it. AI provides the data-driven insights, and skilled professionals use those insights to make smarter, more informed decisions. That's how you turn compliance from a cost center into a genuine competitive advantage.

Turning Data into a Strategic Asset

The true power of technology in compliance is its ability to transform mountains of raw data into actionable intelligence. Modern platforms pull in data from all over the place to give you a single, 360-degree view of your organization's risk profile. It’s this complete picture that makes for effective decision-making.

The image below gives you a sense of how a platform like Visbanking’s BIAS can boil down complex data into clean, intuitive dashboards.

This kind of visualization means leaders can instantly see how they’re performing, benchmark against their peers, and spot emerging risks without getting lost in endless spreadsheets.

By bringing together financial metrics, performance indicators, and regulatory insights, these tools help you connect the dots between market trends and your compliance obligations. Modern compliance depends on having the right tech stack; exploring tools like the Top Network Security Monitoring Tools can also seriously boost your ability to spot and respond to threats, protecting the very data your compliance program runs on. At the end of the day, adopting a data-driven approach is how you turn the relentless headache of regulatory change into a real strategic edge.

Putting Best Practices Into Play for Long-Term Success

Knowing the theory is one thing, but putting it into practice is a whole different ballgame. A solid regulatory compliance risk management program isn't just about frameworks on a whiteboard—it comes alive through the daily actions that weave compliance into the very fabric of your bank.

To get there, we have to move past generic advice. Real, lasting success comes from a deliberate strategy that flips the script on compliance. It stops being a defensive chore and becomes a forward-thinking business asset.

This isn't just a job for the compliance department anymore. It's about shared responsibility. When everyone, from the tellers on the front line to the executives in the C-suite, understands their part in managing risk, the whole organization gets stronger.

Build a Culture of Compliance, Not Just a Department

Real change always starts at the top. You absolutely need unwavering, visible support from your board and senior leadership. It's non-negotiable. When leaders consistently talk about the importance of compliance and actually put resources behind it, everyone else gets the message.

Compliance isn't an add-on you bolt onto your business strategy later. It has to be woven right in from the start.

By baking risk management directly into strategic planning, product development, and new market decisions, you make sure that growth never comes at the cost of your integrity. You stop reacting to new regulations and start anticipating them.

Real-World Strategies for a Lasting Impact

So, how do you make this vision a reality? Focus on a few high-impact strategies that will become the foundation of an effective program.

Keep a 'Living' Risk Register: Your risk register can't be a document that just gathers dust. Think of it as a dynamic tool that you're constantly updating with new rules, emerging threats, and changes in your own business. It keeps you honest about your risk-readiness.

Train, Train, and Train Again: Compliance isn't a one-and-done training session during onboarding. You need ongoing, role-specific training that keeps your team sharp on their duties and the latest regulatory shifts. An educated team is your best line of defense.

Open Up Communication: Your people have to feel safe flagging potential issues without fearing payback. Set up clear, confidential ways for them to raise concerns, and make sure every report is looked into quickly and seriously. It’s all about building trust.

Use Technology to Keep Watch: Trying to monitor everything manually just doesn't cut it anymore. Use RegTech solutions to automate tracking of regulatory changes, spot potential compliance slip-ups, and give decision-makers real-time data.

A huge piece of this puzzle is regularly assessing where you're most vulnerable. For any financial institution, doing a comprehensive banking risk assessment is a critical step to zero in on specific weak spots and ensure your compliance framework is built to last.

Ultimately, these aren't just boxes to check. It's a continuous cycle of getting better. By getting leadership on board, building compliance into your strategy, and giving your team the right knowledge and tools, you’re not just meeting today's rules—you're getting ready for whatever comes next. That's the difference between a bank that's just compliant and one that's truly resilient.

Your Path to Proactive Compliance

The journey through regulatory compliance risk management is all about shifting from defense to offense. It’s about seeing compliance for what it really is: not a chore or a cost center, but a genuine strategic asset.

We've walked through the what, why, and how of building a solid compliance program. One truth stands out: in today's world, a forward-thinking, agile, and tech-savvy approach to compliance isn’t just a nice-to-have. It’s essential. This is the only real way to protect your organization, build rock-solid trust with stakeholders, and secure a real competitive edge. The old days of manual, periodic check-ins are gone. The future is all about continuous, data-driven insight.

Embracing Continuous Improvement

Here's the most critical takeaway: compliance is never "done." The regulatory environment is always shifting, and your business is always evolving. Your risk management has to be just as dynamic.

Think of your compliance program less like a fortress you build once and more like a living system—one that learns, adapts, and grows stronger over time. It’s a journey of constant improvement, not a final destination.

This mindset hinges on a few key actions:

- Foster a Learning Culture: Your team is your first line of defense. Give them the tools and knowledge they need to succeed. Investing in ongoing education, like focused banking compliance training, makes sure your people can spot and handle new risks as they appear.

- Make Technology a Partner: Tools like Visbanking’s BIAS are game-changers. They turn a flood of data into clear, actionable intelligence. Technology automates the grunt work, freeing up your experts to focus on strategy.

- Keep Leadership Engaged: Compliance has to be a board-level conversation. When it’s baked into every major decision, it becomes part of your organization's DNA.

When you adopt this philosophy, regulatory compliance stops being a burden and starts becoming one of your greatest strengths. It drives resilience, builds integrity, and fuels sustainable growth. You'll be ready to face the future with confidence. The path is clear—it's time to take the next step.

Got Questions? We've Got Answers.

Diving into regulatory compliance can feel like navigating a maze. A lot of questions pop up when you start applying these ideas to the real world. Let's tackle some of the most common ones to get you moving forward with confidence.

Where Do I Even Begin with a Compliance Program?

The absolute first step is a thorough risk assessment. You can't manage risk if you don't know what you're up against. This isn't just a box-ticking exercise; it's about digging deep to identify every single law, regulation, and standard that applies to how you do business.

Once you have that list, you have to connect the dots. How could these rules actually impact your operations? Think financial penalties, business interruptions, or a bruised reputation. This initial deep dive becomes the blueprint for your entire program, shaping every policy, internal control, and monitoring process you put in place.

It's not enough to just list the regulations. You have to grasp their real-world consequences. A bank, for instance, needs to do more than just acknowledge anti-money laundering (AML) laws. It has to specifically assess the risk of dirty money flowing through its shiny new digital payment platform.

How Can a Small Business Handle Compliance Without a Big Budget?

Small businesses can absolutely nail compliance, even on a shoestring budget. The secret sauce is relentless prioritization. Pinpoint the biggest risks—the ones that could truly hurt your business—and pour your limited resources into taming those first.

Technology is your best friend here. Many scalable RegTech solutions are surprisingly affordable and can automate grunt work like monitoring and reporting. And don't underestimate the power of culture. Fostering a strong compliance mindset is a high-impact, low-cost move. When every employee understands their role and feels safe to raise a flag, they become your first line of defense. It’s all about working smarter, not just harder.

How Often Should We Revisit Our Risk Assessment?

A compliance risk assessment is not a "set it and forget it" task. It's a living, breathing part of your business. As a rule of thumb, you should perform a full, formal review at least annually.

But that's the bare minimum. You need to dust it off and update it anytime something significant changes. This could be:

- New or updated regulations hitting the books.

- Expanding into a new city or country.

- Launching a new product or service.

- A major change in how your business is structured.

The goal is simple: your risk assessment must always reflect your reality right now. A dynamic approach keeps your strategy sharp and effective, preventing nasty surprises down the road.

Ready to stop reacting and start getting ahead of the curve? Visbanking gives you the data-driven intelligence to benchmark your performance, keep an eye on risks, and anticipate regulatory shifts. See how our BIAS platform can empower your institution by exploring Visbanking today.