Mastering Regulatory Compliance in Banking for Strategic Advantage

Brian's Banking Blog

Regulatory compliance is not an operational burden; it is a critical component of institutional strategy. For bank executives and directors, it represents a framework of laws and standards governing everything from capital adequacy to financial crime prevention. The objective is not merely adherence but leveraging compliance to protect customers, fortify the financial system, and drive superior performance.

Treating compliance as a check-the-box exercise is no longer a viable strategy.

Beyond Checkboxes: Compliance as a Strategic Imperative

A reactive, siloed approach to compliance is a significant business risk in today's dynamic financial landscape. With shifting global standards, the digitization of banking, and heightened shareholder scrutiny, a "check-the-box" mentality is a direct threat to profitability and market position.

Consider the cost of this legacy mindset. A bank invests months and several hundred thousand dollars developing a new commercial loan product. Just before launch, a siloed compliance team flags a critical regulatory conflict. The result is a costly overhaul, wasted resources, and a significant delay in market entry—a direct, measurable impact on the bottom line.

From Cost Center to Competitive Edge

The strategic imperative is to reframe compliance from a defensive cost center to a potent competitive advantage. Integrating compliance into core strategy from inception does more than mitigate fines; it builds institutional trust, strengthens the balance sheet, and uncovers opportunities hidden within risk data.

The challenge for banking leadership is not simply to follow rules. It is to architect an intelligent compliance framework that prevents penalties while driving smarter, more profitable business decisions.

Executing this strategy requires mastery of your data. Most institutions possess vast amounts of data, but it remains fragmented across risk, finance, and compliance functions. This fragmentation creates blind spots. For instance, a credit risk model for a loan portfolio may appear sound, yet parallel compliance data could reveal a troubling concentration of clients in a sector known for money laundering. Without a unified data intelligence layer, these critical connections are missed.

Data as the Foundation for Action

A modern, forward-thinking compliance strategy is built upon high-quality data intelligence. This enables leadership to ask—and definitively answer—the questions that drive performance:

- How does our risk profile and capital adequacy compare to our top five peer institutions?

- Are our capital reserves aligned with the latest identified regulatory and market risks?

- Which business lines deliver the highest risk-adjusted returns?

Answering these questions is impossible with siloed spreadsheets. A single source of truth is required. With data intelligence tools like Visbanking’s BIAS platform, executives can visualize these connections in real time, transforming abstract risk metrics into concrete action plans. To move beyond a reactive stance and gain a competitive edge, leaders must evaluate top compliance management solutions.

This data-first approach enables an institution not just to meet minimum requirements, but to strategically outmaneuver the competition. The initial step is clear: benchmark key performance and risk metrics to identify where your true advantages lie.

Decoding Modern Global Regulatory Frameworks

For a bank's leadership, the global regulatory environment is a dynamic system with direct impact on balance sheet strategy and risk appetite. Mastery requires moving beyond rote compliance to a deep understanding of the business implications of foundational frameworks. These are not obstacles, but guardrails designed to strengthen the entire financial system.

The final implementation of the Basel III framework, for example, represents a significant global compliance challenge for 2025. Major financial hubs, including the European Union, Canada, and Singapore, are adopting these reforms, compelling banks to overhaul risk measurement, capital management, and financial reporting. Tighter standards necessitate holding more high-quality capital and achieving greater precision in risk quantification, which in turn demands investment in modern data aggregation and reporting technology.

The Unforgiving Cost of AML Lapses

Beyond capital adequacy, regulations governing Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) are expanding in scope and severity. Failure here results not in a minor penalty, but in significant financial and reputational damage.

Consider a mid-sized regional bank that fails to detect a subtle pattern of structured cash deposits across several branches, all seemingly tied to a legitimate import-export business. A legacy system, with its siloed data, would likely miss the connections. If regulators subsequently uncover a trade-based money laundering scheme, the bank could face a penalty exceeding $30 million, plus a consent order that can cripple growth for years. This is not a hypothetical; it is the reality of modern enforcement.

In today's regulatory climate, ignorance is not a defense. Regulators expect banks to have the systems in place to see the entire board, not just the individual pieces. A fragmented data strategy is a direct invitation for multimillion-dollar enforcement actions.

Understanding these interconnected frameworks is the first step. The table below outlines critical global regulations and their direct impact on operations and strategy.

Key Global Regulatory Frameworks and Their Business Impact

A high-level summary of major international banking regulations and their direct implications on strategic and operational decisions.

| Regulatory Framework | Core Focus Area | Primary Impact on Banking Operations | Data Intelligence Requirement |

|---|---|---|---|

| Basel III (Finalization) | Capital Adequacy, Risk Management | Requires higher capital reserves, standardized risk-weighted asset (RWA) calculations, and enhanced liquidity monitoring. | Granular data on credit, market, and operational risks. Ability to run complex stress tests and capital scenario analyses. |

| AML/CTF Directives | Financial Crime Prevention | Mandates rigorous customer due diligence (CDD), transaction monitoring, and suspicious activity reporting (SARs). | A unified view of customer data and transaction history across all channels to detect complex, multi-layered illicit schemes. |

| GDPR/Data Privacy | Consumer Data Protection | Governs how customer data is collected, stored, processed, and shared. Requires explicit consent and breach notifications. | Robust data governance, mapping of personal data flows, and secure data handling protocols to ensure compliance and avoid massive fines. |

| Dodd-Frank Act (US) | Financial Stability, Consumer Protection | Imposes "living wills," stress testing (DFAST), and consumer protection standards via the CFPB. | Comprehensive data aggregation for systemic risk reporting and the ability to model severe economic downturns accurately. |

Each framework demands a specific class of data intelligence. Managing them in silos is inefficient and highly risky. An integrated approach built on a single source of truth is the only sustainable path forward.

Data Privacy and Operational Integrity

The regulatory web extends beyond financial transactions into data privacy and consumer protection. For institutions with international operations, a comprehensive understanding of regulations like the GDPR compliance checklist is non-negotiable. These frameworks compel banks toward an integrated governance model where data intelligence is the connective tissue.

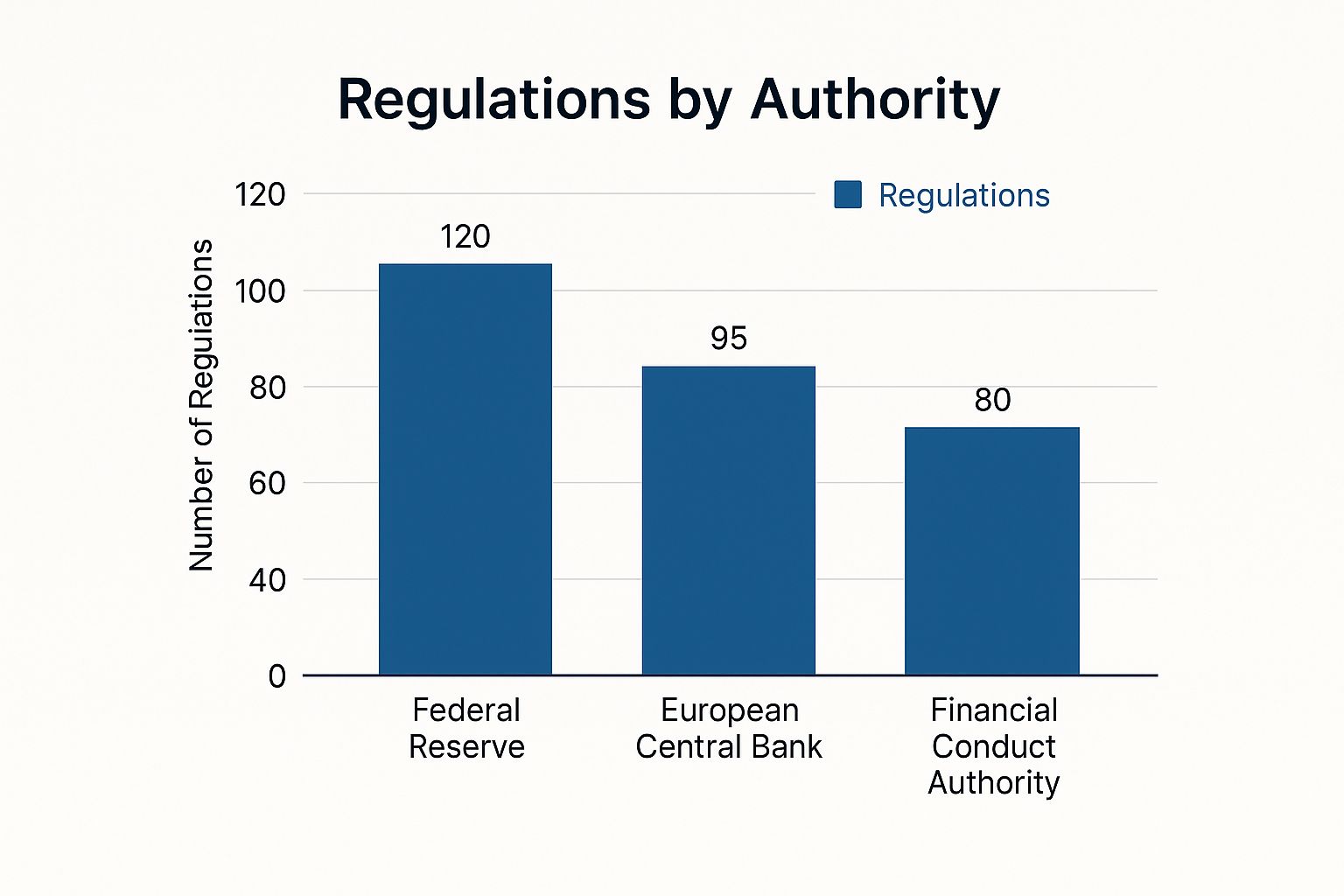

This chart illustrates the complexity of multi-jurisdictional compliance across key global authorities.

Operating across regions necessitates adherence to a dense and varied rule set. A centralized data strategy is the only way to ensure consistent compliance. These frameworks are not separate challenges; they are a unified mandate for superior risk management, fueled by superior data. The mission for executives is to build a single source of truth that enables the bank to see risks before they materialize, meet diverse regulatory demands concurrently, and convert compliance from a cost center into a strategic asset.

Navigating the Escalating War on Financial Crime

Financial crime compliance is no longer a back-office function; it is a high-stakes battlefield. For bank executives, the escalating demands of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) represent a primary source of operational and reputational risk. The consequences of failure are swift, severe, and directly impact the bottom line.

Regulators are levying multi-million-dollar fines, making it clear that a defense of ignorance is unacceptable. Banks now allocate 15-20% of their total compliance budgets to AML programs. Over the last decade, U.S. banks have incurred over $2 billion in fines for AML failures. This pressure is a direct response to the increasing sophistication of financial criminals, who exploit digital banking platforms and cross-border payment systems for illicit purposes.

Why Traditional Monitoring Is Failing

The core problem lies with legacy, siloed monitoring systems. These platforms were not designed for today's complex criminal playbook, which involves cryptocurrencies, shell corporations, and fraudulent trade invoices. They are easily circumvented by sophisticated laundering schemes. The result is a high volume of false positives that consume resources, while subtle but dangerous patterns of criminal activity go undetected.

A fragmented view of your customer activity is a direct liability. Regulators aren't just checking boxes anymore; they expect you to have the intelligence to connect the dots across your entire organization and spot sophisticated threats.

Consider a common scenario: a regional bank with $10 billion in assets. A criminal organization establishes dozens of small business accounts that appear unrelated and begins a complex trade-based money laundering scheme. Individual transactions are kept small to fly under standard alert thresholds. A legacy system, analyzing each account in isolation, sees nothing amiss. Months later, a regulatory forensic team uncovers a $200 million operation. The penalty for such a systemic failure could easily reach $50 million, erasing a significant portion of the bank's annual profit.

In this environment, robust cyber security risk management strategies are not optional; they are a primary line of defense.

Moving From Reactive Alerts to Predictive Intelligence

This is where data intelligence becomes a critical strategic asset. The objective is not merely to reduce false alerts, but to identify suspicious patterns before they escalate into regulatory crises. The shift is from reacting to alarms to proactively analyzing the complete picture.

An advanced data platform achieves this by integrating information from across the institution:

- Transaction Data: Analyzing flows based on velocity, geography, and counterparty risk, not just amount.

- Customer Profiles: Linking account relationships, beneficial ownership information, and adverse media intelligence.

- Peer Benchmarks: Comparing the bank’s alert patterns and SAR filings against industry peers to identify anomalous trends that could indicate a systemic vulnerability.

By consolidating this data, platforms like Visbanking’s BIAS can detect faint signals that legacy systems would miss—for example, flagging a cluster of new business accounts linked to a high-risk jurisdiction and sharing a common registered agent, even if their individual transaction volumes are low. This is the actionable intelligence that enables compliance teams to preemptively address risk, rather than reacting to a regulatory inquiry months or years later. The fight against financial crime is a data war. Victory belongs to those who equip their leadership with a complete, contextual, and forward-looking view of risk.

Closing the Gap Between Compliance Data and Strategy

The primary frustration for banking executives regarding compliance is often not the regulations themselves, but the gap between the vast amount of data collected and its conversion into actionable intelligence. Most banks operate with a fragmented architecture where risk, finance, and compliance data exist in isolated systems. This structure fosters a reactive, inefficient culture and obscures the very insights needed for sound strategic decisions.

This fragmentation is a direct drag on the bottom line. For instance, a commercial lending team, driven by aggressive growth targets, originates $50 million in new loans in a single quarter. The credit risk appears acceptable. Two months later, the compliance team, using a separate transaction monitoring system, identifies a disturbing pattern: a significant portion of the new borrowers operate in a high-risk industry and exhibit transaction activity consistent with money laundering. The bank is now facing a costly and resource-intensive remediation effort.

The Real Cost of Flying Blind

This disconnect is a direct blow to the P&L, with immediate and painful consequences:

- Wasted Effort: Hundreds of man-hours were spent originating and underwriting loans that are now, at best, a significant liability.

- Regulator Scrutiny: The institution faces potential enforcement actions, substantial fines, and a reputation-damaging consent order for inadequate AML controls.

- Internal Warfare: The incident creates friction between revenue-generating teams and compliance, reinforcing the perception of compliance as a "business prevention unit" and undermining collaboration.

This is a failure of architecture, not personnel. Without a unified data intelligence layer connecting these functions, leadership is forced to manage by looking in the rearview mirror, reacting to crises that could have been prevented.

The root of the problem is simple: data is treated like a departmental possession, not a bank-wide asset. You can't have true strategic oversight when your view is blocked by the very systems designed to give you clarity.

A unified data platform is the only solution. It acts as the connective tissue, integrating disparate systems to create a coherent picture of risk and opportunity. This integration is not merely a technological upgrade; it is a fundamental shift in how the institution approaches regulatory compliance in banking.

Building a Framework for What’s Next

Looking toward 2025, the regulatory environment is set to become more complex. Leadership changes at agencies, evolving global standards, and heightened risk management demands require banks to build nimble, forward-looking compliance frameworks. This is where a solution like Visbanking’s BIAS is indispensable. It creates the single source of truth that allows an executive to see precisely how a lending decision in one department impacts the AML risk profile in another. Our comprehensive data intelligence platform empowers leaders to move from reaction to proactive inquiry, asking, "If we expand into this new commercial sector, what is the projected impact on our compliance workload and overall risk rating?"

This transforms the conversation from damage control to strategic planning. It closes the gap between data and strategy, converting compliance from a source of friction into an engine for intelligent, sustainable growth.

Turning Reactive Reporting Into Proactive Intelligence

For too long, regulatory compliance in banking has been a backward-looking exercise. Teams spend weeks manually aggregating data from disparate systems into static quarterly reports that arrive on an executive's desk long after the window for effective action has closed. This model is fundamentally broken. It forces leaders to manage by reacting to past events rather than anticipating future challenges.

The new standard is proactive intelligence—a paradigm shift from reporting what has happened to predicting what is likely to happen. This transforms compliance from a reactive cost center into a forward-looking, strategic function that creates tangible value. A modern data intelligence platform makes this transition possible.

From Historical Reports to Real-Time Alerts

Consider a standard scenario: a Q2 compliance report reveals a 35% spike in transaction monitoring alerts from a specific region. By the time this report is reviewed, it is mid-Q3, and the underlying issue has been festering for months, necessitating a frantic and costly response.

A proactive system changes this dynamic entirely. Instead of waiting for a quarterly summary, an intelligent platform identifies warning signs in real time. It might flag a sudden influx of 200+ new commercial accounts from a newly designated high-risk country within a single week, cross-referencing this with external data on relaxed corporate registration laws in that jurisdiction. This triggers an immediate alert to management, enabling investigation before these accounts generate thousands of downstream problems. One approach documents a past failure; the other prevents a future one.

Leveraging Data for Strategic Advantage

Meeting regulatory expectations is the minimum standard. Proactive intelligence allows executives to use compliance data as a powerful tool for superior business decisions.

The ultimate goal is to stop treating compliance as a separate, isolated task and start integrating it into the core of your business strategy. This means using risk and compliance data to drive smarter capital allocation, identify better growth opportunities, and outperform the competition.

A unified view of data enables leaders to answer the strategic questions that drive performance:

- Peer Benchmarking: How does our Fair Lending complaint rate per $1 billion in originations compare to our top five rivals? An outlier position signals not just a compliance issue, but a potential operational weakness or reputational threat.

- Emerging Risk Identification: Are we observing a deposit migration toward sectors showing early signs of economic distress? This insight allows the board to adjust credit policies and capital reserves proactively.

- Capital Allocation: Which product lines deliver the best risk-adjusted returns? A high-margin loan portfolio may appear profitable, but if it consumes a disproportionate share of compliance resources, its true contribution to the bottom line may be lower than assumed.

Achieving this level of insight requires robust financial data integration. Breaking down the silos between lending, deposits, and compliance systems is the foundation for converting raw data into strategic intelligence.

Platforms like Visbanking’s BIAS are engineered for this purpose. They provide the tools to not only meet regulatory demands but also to benchmark performance, identify market shifts before they become headlines, and make capital decisions with a clear view of the entire risk landscape. The transition from reactive reporting to proactive intelligence is no longer optional; it is what separates resilient, forward-thinking institutions from those perpetually trying to catch up.

Building an Unshakeable Compliance Culture

Technology and data platforms are merely tools. Their ultimate purpose is to foster a resilient compliance culture, which is the definitive competitive advantage. A strong culture transforms regulatory compliance in banking from a procedural burden into a source of institutional strength. This transformation must be led from the top.

A culture of compliance is not created through memos or mandatory training. It is forged in the boardroom when compliance has a strategic voice in every major decision, from new product development to M&A due diligence. It is realized when any manager feels empowered to raise a concern without being perceived as a roadblock to business.

From Silos to Synthesis

The journey from fragmented data and reactive fire-drills to integrated intelligence and proactive risk management is a profound cultural shift. It requires dismantling departmental data silos in favor of a unified vision where information flows freely, providing a complete picture of risk.

An institution’s culture is its ultimate control. When compliance is woven into the fabric of the organization, it becomes everyone’s responsibility, creating a powerful, self-reinforcing system that legacy reporting structures can never replicate.

Strategically, a bank with a deeply embedded compliance culture can execute faster than its peers. Risk assessments are not the final hurdle but an integral part of the process from inception. This prevents costly missteps and ensures that every strategic move aligns with the bank’s risk appetite from day one.

The Role of Leadership and Data Clarity

For executives and directors, the mandate is to champion this shift by demanding the quality of data intelligence that enables decisive action. It requires rewarding proactive risk identification and fostering an environment where growth and compliance are viewed as synergistic, not adversarial.

The Visbanking’s BIAS platform is designed to deliver this clarity. It provides the clean, unified data necessary for leadership to conduct these critical conversations with confidence. By translating complex regulatory and performance data into simple, actionable insights, it equips the C-suite with the foresight required to lead effectively.

The path to a future-ready institution is paved with data, but it is built on a foundation of culture. Take the first step by benchmarking your institution’s performance to gain the clarity you need.

A Few Questions We Hear a Lot

How Can Our Bank Justify The ROI On Advanced Compliance Technology?

Viewing the ROI of compliance technology solely through the lens of "fines avoided" is a limited perspective. The immediate, quantifiable ROI is derived from significant gains in operational efficiency. Automation can slash manual errors and reduce report generation times, saving thousands of man-hours annually. This frees high-value analysts to focus on strategic work rather than data aggregation. The strategic returns, however, are more substantial. Superior data intelligence enables improved risk-adjusted returns on capital. By analyzing unified compliance and performance data, a bank might discover that a specific commercial lending segment offers a 15% higher risk-adjusted return than previously understood—intelligence that directly informs capital allocation. This command of data also builds a stronger reputation with regulators and investors, creating durable franchise value.

What’s The Biggest Mistake Banks Make In Regulatory Compliance?

The single most costly mistake is treating compliance as an isolated function, disconnected from the institution's core business strategy. When the board and C-suite view the compliance department as a bureaucratic cost center or a "business prevention unit," the result is invariably siloed data, a reactive operational posture, and missed strategic opportunities. This represents a fundamental failure of governance. Leading institutions integrate compliance into their corporate DNA. From the initial concept of a new product to the final stages of M&A, compliance is a strategic partner, not a final checkpoint. This is only possible with integrated data that ensures growth and risk management are aligned.

How Do We Move From A Reactive To A Proactive Compliance Model?

The transition begins with an unambiguous mandate from leadership to dismantle data silos. This is a strategic imperative, not an IT project. The first practical step is a rigorous assessment of the current data infrastructure to identify precisely where risk, finance, and compliance information streams are disconnected. Once these gaps are identified, the next step is to invest in a unified data intelligence platform capable of integrating these disparate data sources into a "single source of truth." This is the non-negotiable foundation for predictive analytics. Only with this unified view can an institution generate the forward-looking intelligence required to move from a defensive posture to a proactive strategy that anticipates both risks and opportunities.

Ready to stop reacting and start leading? Visbanking turns your compliance data into your biggest strategic asset, giving you the clarity and peer benchmarks to move with confidence. Explore our data intelligence platform and see how your institution stacks up.