Enhance Operational Efficiency in Banking: Proven Strategies

Brian's Banking Blog

The Urgent Reality of Banking Operations Today

The banking industry is at a crossroads. Financial institutions are under increasing pressure to optimize operations. However, many struggle to turn significant IT investments into actual improvements. This gap between spending and tangible results reveals a core problem: the traditional methods of balancing system maintenance and innovation are no longer effective for modern banks.

The Growing Gap Between Investment and Return

This struggle is apparent in how IT budgets are allocated. Banks are investing billions in technology, but a large portion of this spending goes towards maintaining existing systems instead of driving significant change. For example, global banks are predicted to spend $176 billion on IT in 2025. This represents a 5% increase from the $167 billion spent in 2024.

Yet, only 39% of this budget is dedicated to customer-facing improvements, such as better services and new products. This imbalance shows a worrying trend: banks are focusing less on initiatives that fundamentally change their business and more on simply keeping things running. This makes it hard to demonstrate a clear return on their technology investments, particularly as they prepare their data infrastructure for the growing use of AI by 2026. You can find more detailed statistics in the EY Global Banking Outlook.

Regional Disparities and Competitive Advantage

The uneven global adoption of modern banking infrastructure adds another layer of complexity. European institutions, pushed by regulations like cashless transactions and open banking, have modernized their core systems. This has enabled them to streamline operations and enhance customer experiences.

However, many Asia-Pacific banks still rely on legacy systems. This reliance makes it harder for them to compete, despite increased tech spending in countries like Australia and Singapore. This regional difference gives a significant competitive edge to those who have embraced modernization.

Visualizing the Divide: A Global Snapshot

The following data chart illustrates the differences in IT budget allocation between regions and its impact on operational efficiency in banking.

[Infographic will be inserted here]

The chart reveals stark differences in regional approaches to banking technology investment and their corresponding impact on operational efficiency.

- North America: Shows a somewhat even split between maintaining existing systems and investing in innovation, slightly favoring the former, resulting in moderate operational efficiency.

- Europe: Demonstrates a strong focus on innovation and modernization, leading to higher operational efficiency scores.

- Asia-Pacific: Reveals a significant allocation towards maintaining legacy systems, resulting in lower operational efficiency.

- Latin America: Shows a growing interest in innovation, but is still heavily invested in legacy systems, leading to mixed operational efficiency results.

This chart clearly links investment in innovation to improved operational efficiency. This highlights the importance of prioritizing core system modernization and customer-focused improvements for a competitive edge. Banks need to shift from simply maintaining existing systems to strategically investing in technologies that drive real, measurable improvements in efficiency. It's not about spending more, it's about spending smarter.

To further illustrate these regional differences, let's look at a more detailed breakdown:

Regional Comparison of Banking Technology Investment

This table compares how different regions allocate technology investments across operational efficiency initiatives.

| Region | Core System Modernization | Customer-Facing Improvements | Data Infrastructure | Key Focus Areas |

|---|---|---|---|---|

| North America | Moderate | Moderate | Moderate | Balancing maintenance and innovation |

| Europe | High | High | High | Innovation and customer experience |

| Asia-Pacific | Low | Low | Moderate | Maintaining legacy systems |

| Latin America | Moderate | Low | Moderate | Transitioning to modernization |

This table highlights the key disparities in regional investment strategies. While Europe prioritizes innovation and customer experience, the Asia-Pacific region focuses on maintaining legacy infrastructure. North America strives for a balance, while Latin America is in a transitional phase. These differences significantly impact each region's operational efficiency and competitiveness.

AI Transformation That Actually Delivers Results

Artificial intelligence (AI) is changing the banking industry. Institutions using AI strategically are seeing major improvements in their operational efficiency. This section explores how these changes create real, measurable improvements.

Real-World Impact: Eight-Figure Savings

Mid-sized banks are achieving significant cost reductions, sometimes reaching eight figures, by using AI effectively. These are real results, not just theory. They show how AI can optimize core banking processes. For instance, some banks are using AI-powered fraud detection systems that improve security and pay for themselves within months.

Targeting Processes for Maximum ROI

Which processes benefit the most from AI? Fraud detection offers quick returns, but AI’s impact goes much further. AI-powered customer service can increase customer satisfaction and reduce costs. This benefits both the bank and its customers.

AI can also automate repetitive tasks, allowing employees to focus on more complex and strategic work. This increases efficiency and creates a more engaging work environment. A 2023 study showed banks using AI for operations saw productivity gains of 15-25% and profit margin increases of 14% within 18 months.

The following table shows the impact of AI implementation on various banking operations:

"AI Implementation Impact on Banking Operations" Statistical breakdown of how AI adoption affects various operational metrics in banking institutions

| Operational Area | Productivity Improvement | Cost Reduction | Implementation Timeline | ROI Metrics |

|---|---|---|---|---|

| Workflow Automation | 20% | $5 Million | 12 Months | 2x Investment |

| Fraud Detection | 15% | $3 Million | 6 Months | 4x Investment |

| Customer Service | 25% | $4.5 Million | 18 Months | 3x Investment |

This table illustrates how AI significantly impacts different areas within a bank, leading to increased productivity, substantial cost reductions, and strong returns on investment. The relatively short implementation timelines further highlight the practicality of AI adoption.

AI also improves product development. Banks with integrated data systems see 41% faster time-to-market and 37% higher cross-selling success. However, U.S. banks lead in cloud adoption, while others risk falling behind without similar technology investments. Learn more at IBM's Institute for Business Value.

Overcoming Implementation Hurdles

Integrating AI has challenges. Many banks face internal doubts about its value. Tracking key performance indicators (KPIs) is crucial to demonstrate AI’s positive impact. This provides concrete evidence to stakeholders, proving AI is a valuable investment. You might find this article interesting: How AI and Big Data Are Revolutionizing Industries.

The Power of Integrated Data

Banks with well-integrated data systems see significant benefits from AI. Their effective data analysis leads to greater efficiency and much higher cross-selling success. Investing in both AI and supporting data infrastructure is essential. These banks can better understand customer needs, personalize services, and offer relevant products. This results in higher customer satisfaction and revenue growth.

Demonstrating Value and Driving Change

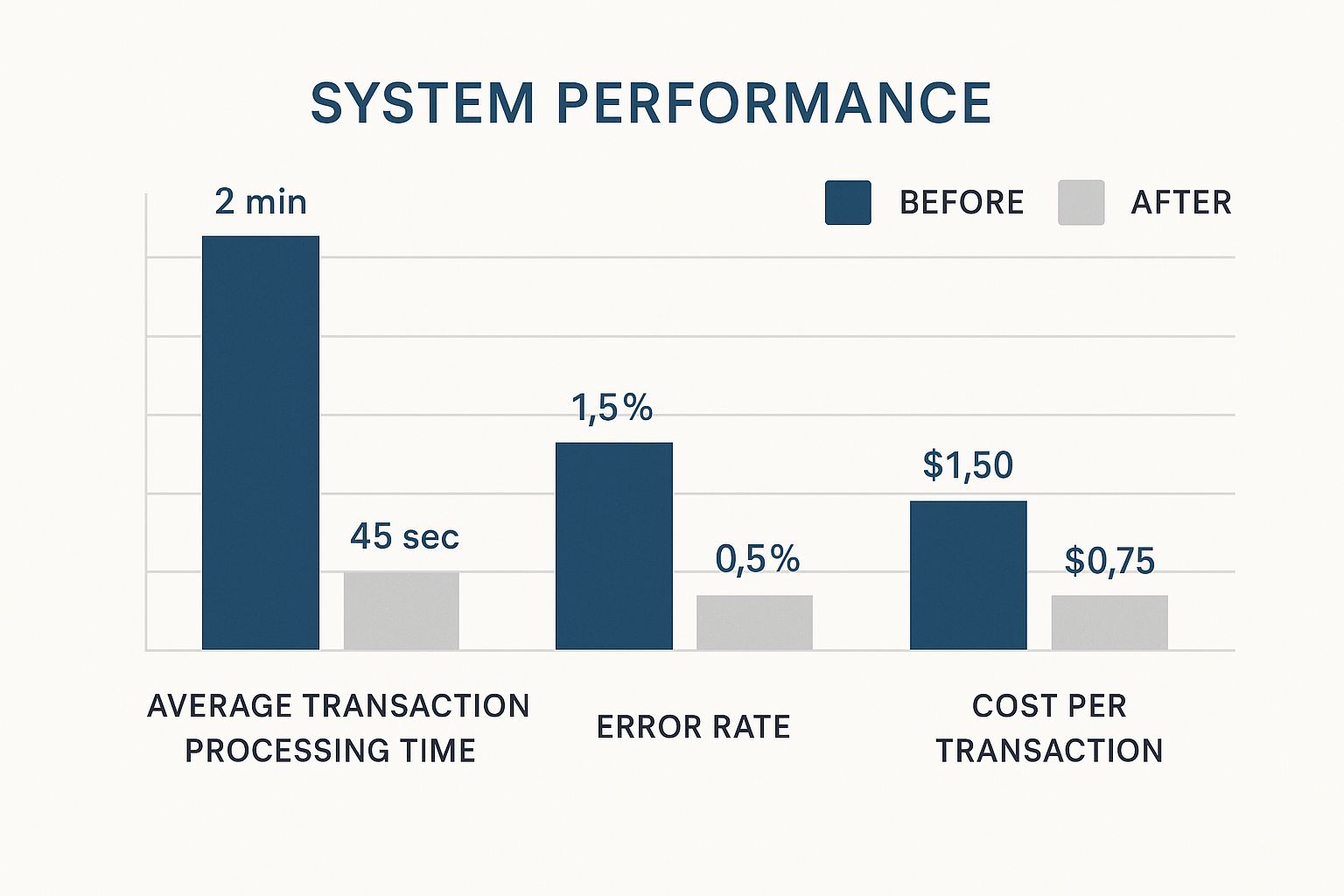

Measuring AI's true value requires more than basic metrics. Traditional efficiency ratios provide a general overview, but granular, process-specific metrics offer deeper insights. Tracking loan application processing time before and after AI implementation can show tangible improvements. These measurements demonstrate AI's impact and allow for continuous process improvement. By continuously evaluating and adapting AI strategies, banks can maximize this powerful technology's potential.

Breaking the Efficiency Paradox: Growth While Cutting Costs

Financial leaders in banking face a tough challenge: cutting costs while growing their business. This sounds contradictory, but achieving operational efficiency while expanding is the core paradox of modern financial management. Let's explore the key decisions that determine a bank's success in this balancing act.

Strategic Budget Allocation: Maximizing Returns

Successfully navigating this paradox starts with carefully examining budget allocation. Financial executives must differentiate between investments offering immediate profit gains and those focused on long-term growth. This means making tough choices and prioritizing high-impact initiatives.

For example, investing in robust Anti-Money Laundering (AML) compliance technology might seem expensive upfront. However, it mitigates the risk of significant regulatory fines and reputational damage, protecting long-term profitability. Automating repetitive tasks like data entry with Robotic Process Automation (RPA) can free up staff to focus on customer relationships and revenue generation.

Workflow Optimizations: Fueling the Virtuous Cycle

Leading banks understand that optimizing workflows is essential for reducing transaction costs. This goes beyond simply automating existing processes; it involves rethinking how operations are conducted. The banking industry's average efficiency ratio is expected to stagnate near 60% in 2025. This is because rising operational costs outpace revenue growth.

Deloitte's 2024 analysis found that noninterest expenses for large U.S. banks grew faster than net revenue. This led three major institutions to increase annual expense targets by $4 billion in mid-2024. For more detailed statistics, check out Accenture Banking Insights.

This increased expense necessitates focusing on high-impact areas like AI-driven cost reduction and regulatory compliance. Workflow improvements have already decreased transaction processing costs by 29% at institutions using advanced automation tools. This demonstrates the direct link between operational efficiency and profitability.

Customer-Centric Efficiency: Enhancing the Experience

Workflow enhancements shouldn't compromise the customer experience. In fact, optimizing processes often improves customer satisfaction. Banks should focus on changes that reduce friction for customers and streamline internal operations.

Consider a streamlined loan application process. By digitizing documents and automating verification steps, banks can significantly reduce processing time. This benefits both the institution and the customer, creating a virtuous cycle where operational efficiency drives a better experience, leading to increased business and revenue.

The Path to Sustainable Growth

Balancing cost reduction and growth requires a strategic approach that prioritizes both immediate needs and future opportunities. By focusing on high-impact workflow optimizations and smart budget allocation, banks can break the efficiency paradox and create a path to sustainable success. This involves embracing technologies that offer long-term advantages, even if they require upfront investment. It also means creating a culture that values continuous improvement and a customer-centric approach. By adopting this approach, banks can thrive in today's competitive financial landscape.

Workflow Reimagination: Beyond Basic Automation

Many banks are focused on simple automation to boost efficiency. But truly innovative institutions are looking beyond the basics. They're completely rethinking their workflows to achieve significant gains in operational efficiency in banking. This involves a deep dive into their processes and a willingness to fundamentally change how things operate.

Process Mining: Uncovering Hidden Inefficiencies

Leading banks use process mining to identify hidden inefficiencies. This powerful technique analyzes event logs from IT systems to create a visual representation of actual workflows. This reveals bottlenecks and deviations from the ideal process that traditional methods often miss.

For example, process mining can identify unnecessary steps in loan approvals. This can lead to faster approvals and happier customers. This data-driven approach provides a clear picture of what needs to be improved.

Prioritizing Workflow Improvements: A Practical Framework

Effective workflow improvement requires a structured approach. A clear framework for prioritizing changes is essential. This framework should consider potential ROI, implementation complexity, and customer impact.

Some improvements might offer high ROI but be difficult to implement. Others might be easy to implement but have less of an impact. Balancing these factors is crucial for success.

Here's an example framework:

- High ROI, Low Complexity: Implement these first for quick wins.

- High ROI, High Complexity: Plan these changes carefully, breaking them down into smaller, more manageable steps.

- Low ROI, Low Complexity: Consider these if resources allow, but don't prioritize them.

- Low ROI, High Complexity: Avoid these, as the effort required outweighs the potential benefits.

Overcoming Resistance to Change: A Key Challenge

Changing established workflows can often be met with resistance. Employees may be comfortable with existing processes, even if they are inefficient.

Successful banks address this by clearly communicating the benefits of the changes. They also involve employees in the redesign process, providing training and support. This helps create buy-in and makes for a smoother transition.

Identifying High-Impact Areas: Focusing on the Right Processes

Not all operational areas offer the same potential for improvement. Some processes, like customer onboarding or loan processing, typically have a greater impact on both efficiency and customer satisfaction.

Focusing on these high-impact areas first delivers faster, more significant results. This targeted approach ensures resources are used most effectively.

Building a Foundation for Continuous Improvement

Workflow redesign isn't a one-time project. It needs to be an ongoing process. By establishing a culture of continuous improvement, banks can constantly refine their operations.

This includes regular process reviews, gathering feedback from employees and customers, and implementing adjustments as needed. This creates a more dynamic and adaptable organization.

Workflow reimagination offers both immediate cost savings and a strong foundation for ongoing improvement. This dual benefit makes it essential for banks aiming for long-term success in a competitive market. By embracing change and continuously refining workflows, banks can achieve greater operational efficiency, improve customer experiences, and position themselves for future success. Learn more about optimizing banking operations at Visbanking.

Measuring What Actually Matters: Beyond Basic Metrics

The traditional efficiency ratio, a common metric in banking, often falls short. Calculated by dividing non-interest expenses by revenue, it provides a general overview but lacks the depth needed for actionable insights. This section explores how leading banks are moving beyond these basic metrics to continuously improve operational efficiency.

The Power of Granular Metrics

Leading banks are adopting measurement frameworks that focus on granular, process-specific metrics. For example, instead of just measuring the overall cost of customer service, they analyze metrics like average call handling time, first-call resolution rate, and customer satisfaction for each service channel. This pinpoints specific areas for improvement and allows for effective resource allocation.

These granular insights provide a level of detail that broad measurements miss. Banks can identify the root causes of inefficiencies and implement targeted solutions. It's similar to a doctor diagnosing a patient: a general symptom like fatigue is less helpful than specific blood test results. Learn more about data-driven decisions in banking.

Real-Time Monitoring for Proactive Intervention

Real-time efficiency monitoring helps banks identify and address potential problems before they escalate. This proactive approach minimizes disruptions and maintains optimal performance, addressing issues as they emerge instead of reacting after they’ve impacted operations.

Imagine a manufacturing plant with sensors that detect equipment malfunctions instantly. Technicians can intervene immediately, preventing costly downtime. Similarly, real-time monitoring of banking processes helps identify and quickly address bottlenecks.

Benchmarking for Meaningful Insights

Competitor benchmarking can be valuable, but focus on the right comparisons. Simply comparing efficiency ratios with the industry average isn’t very useful. Instead, banks should benchmark against competitors with similar business models and target markets. Focusing on process benchmarks, like loan origination time or account opening efficiency, provides more actionable data.

Balancing Short-Term Gains and Long-Term Objectives

Short-term efficiency improvements are important, but they must align with long-term strategic goals. Cost-cutting measures can sometimes undermine future growth. For instance, reducing staff training budgets might lower short-term expenses, but could decrease service quality and customer satisfaction over time.

Leading banks develop balanced measurement systems that consider both short-term performance and long-term sustainability. This ensures that efficiency initiatives support the bank's overall strategic objectives. It's about achieving a balance between maximizing current efficiency and building a strong foundation for the future. This nuanced view of operational performance enables strategic choices that support sustainable growth.

Creating an Efficiency Culture That Transforms Results

Even the most advanced efficiency technologies won't deliver the desired results without a supportive organizational culture. This section explores how successful banks shift their mindset from reactive cost-cutting to proactive efficiency gains. By understanding the experiences of banking leaders who have successfully navigated this change, you'll discover effective strategies for lasting improvement.

Securing Executive Sponsorship: A Critical First Step

Gaining genuine executive sponsorship is crucial for driving operational efficiency. This involves more than just getting a signature; it requires active engagement from leadership. Executives must champion efficiency initiatives, communicate their importance throughout the organization, and provide the necessary resources.

This top-down approach creates a sense of urgency and demonstrates that efficiency is a strategic priority. It also helps overcome internal resistance to change, which can often derail well-intentioned initiatives. You might be interested in: How to master change in the banking and financial services sector.

Aligning Incentives: Motivating the Team

Incentive structures must be aligned with operational excellence. If employee rewards are based solely on individual sales targets or short-term profits, efficiency improvements may be overlooked.

Instead, consider incorporating efficiency metrics into performance evaluations and reward systems. This encourages employees to prioritize efficiency and contribute to organizational goals. This could include bonuses for teams that reduce processing time or increase customer satisfaction scores.

Empowering Frontline Staff: Tapping into Valuable Insights

Frontline employees often have the best understanding of operational bottlenecks and customer needs. Empowering them to identify and suggest improvements can unlock valuable insights.

Create clear channels for feedback and suggestions. This could include regular meetings, online forums, or suggestion boxes. Actively listening to and acting upon employee input fosters a culture of continuous improvement and makes employees feel valued. This creates a sense of ownership and helps quickly pinpoint areas for improvement.

Overcoming Risk Aversion and Siloed Thinking: Fostering Collaboration

Risk aversion and siloed thinking can hinder efficiency initiatives. Banks often operate in a highly regulated environment, which can create a reluctance to explore new approaches. Furthermore, different departments might operate independently, without considering the impact on overall efficiency.

To overcome this, banks need to foster a culture of collaboration and experimentation. This involves encouraging cross-departmental communication and creating a safe space for trying new things. This could include pilot programs for new technologies or processes, with clear metrics for evaluating success.

Building a Culture of Continuous Improvement: Operational Excellence as DNA

Operational excellence should be embedded within the organization’s DNA, not treated as a one-time project. This requires ongoing effort and a commitment to continuous improvement.

Regularly review operational processes, gather feedback from employees and customers, and adapt strategies as needed. This creates a more agile and responsive organization, capable of adapting to changing market conditions and evolving customer needs.

By implementing these strategies, banks can create an efficiency culture that delivers tangible results. This goes beyond simply adopting new technologies; it requires changing mindsets and behaviors. It demands leadership commitment, employee engagement, and a willingness to challenge traditional ways of working.

Ready to transform your bank's operational efficiency? Learn more about how Visbanking can help you achieve your goals.