By: Ken Chase.

Estimated reading time: 2 minutes

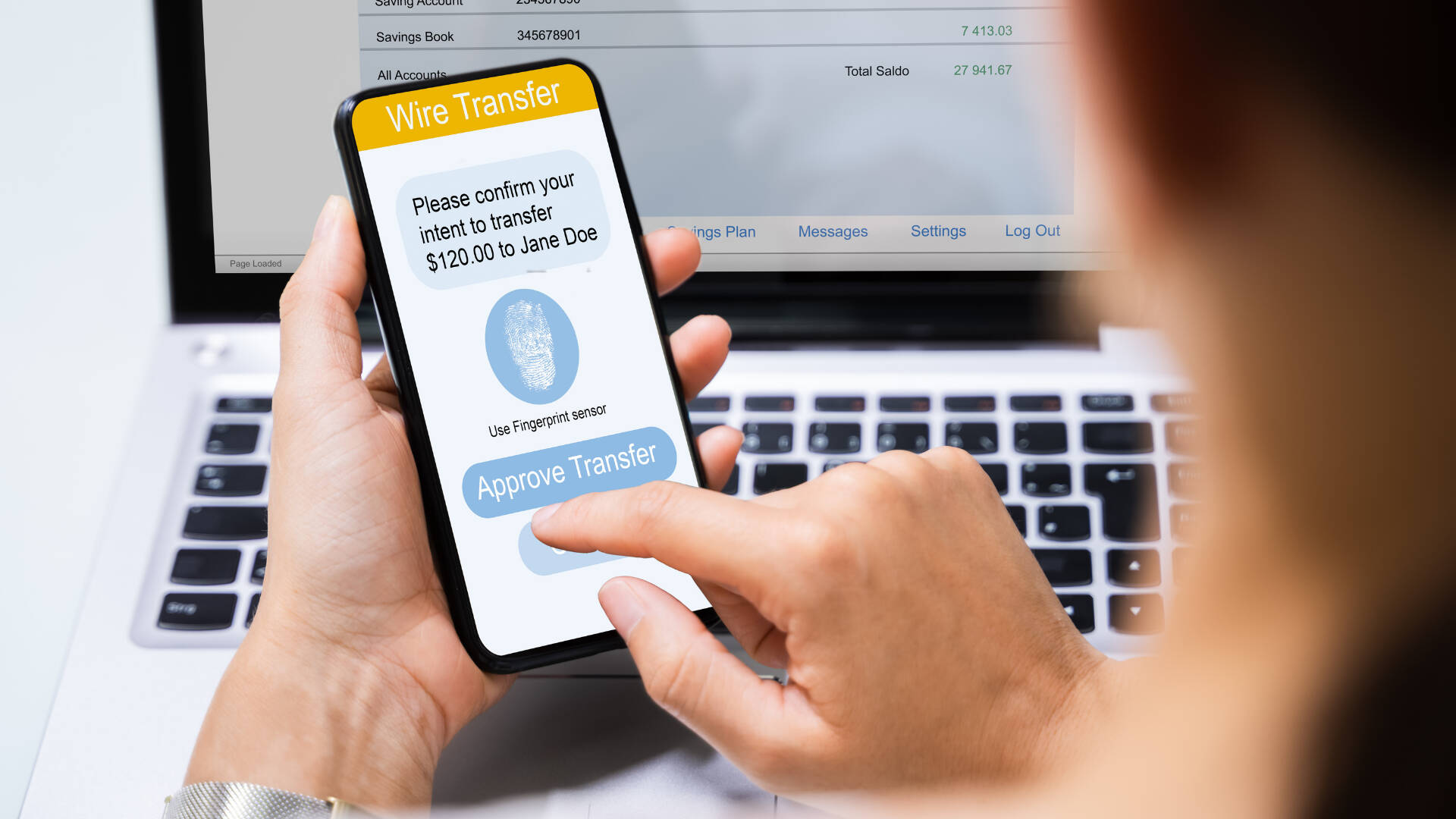

A new survey from Verint found that consumers are increasingly focused on the security of their personal information when choosing a new bank. The poll contacted 5,000 customers of the nation’s twenty largest banks and revealed that concerns about security now take priority over issues like lower fees as bank customers continue to adapt to the growing trends in digital banking.

The report notes that, “With the rise of digital-first engagement, customers are more aware of the vulnerability of their personal information, so having confidence in their financial institutions’ security measures is growing in importance.”

According to the findings, consumers ranked the security of personal information above all other concerns, followed by “low or no fees,” fraud protection, and fraud alerts. Other concerns, like the proximity of physical bank branches, easy-to-use mobile apps and websites, and low interest loan rates appear to be lower priorities at this time.

The survey also found that nearly a quarter of Baby Boomers and Gen X customers do not take advantage of their banks’ fraud alert options. Nearly half of those customers reported that they were not aware that they could receive those alerts.

The poll report offered some suggestions to banks that could help them ease those fraud concerns, while also helping to build brand loyalty with their younger customers. For example, the implementation of easier sign-up processes could help customers access fraud alerts on their preferred banking channel, and simultaneously increase their confidence in the security of their information.

As for younger consumers, the report recommended an increase in financial advice via digital channels, including cost-cutting suggestions, budget advice, and the ability to personalize financial tips and alerts. In addition, the report’s authors suggested that banks focus more on ensuring that their employees have the training and resources needed to resolve issues quickly and efficiently.