Top 9 New Banking Technology Trends to Watch in 2025

Brian's Banking Blog

The Future of Finance is Now

This listicle provides a concise overview of nine new banking technologies reshaping financial services. Understand how these innovations impact operations, customer experience, and the industry's future. We'll cover Open Banking APIs, Blockchain, AI/Machine Learning, Biometric Authentication, Neobanks, RPA, Cloud Banking, Real-time Payments, and Quantum Computing. Explore these key trends and their practical applications to stay ahead in the evolving world of finance driven by new banking technology.

1. Open Banking APIs

Open Banking APIs are transforming the financial landscape, representing a significant advancement in new banking technology. Open Banking is a banking practice that securely shares financial information and services with third-party providers through Application Programming Interfaces (APIs). This allows authorized third-party developers to build innovative applications and services around financial institutions, offering customers greater financial transparency and control. By enabling access to account information, transaction history, and other financial data, Open Banking empowers customers to make more informed decisions, compare financial products, and manage their finances more effectively.

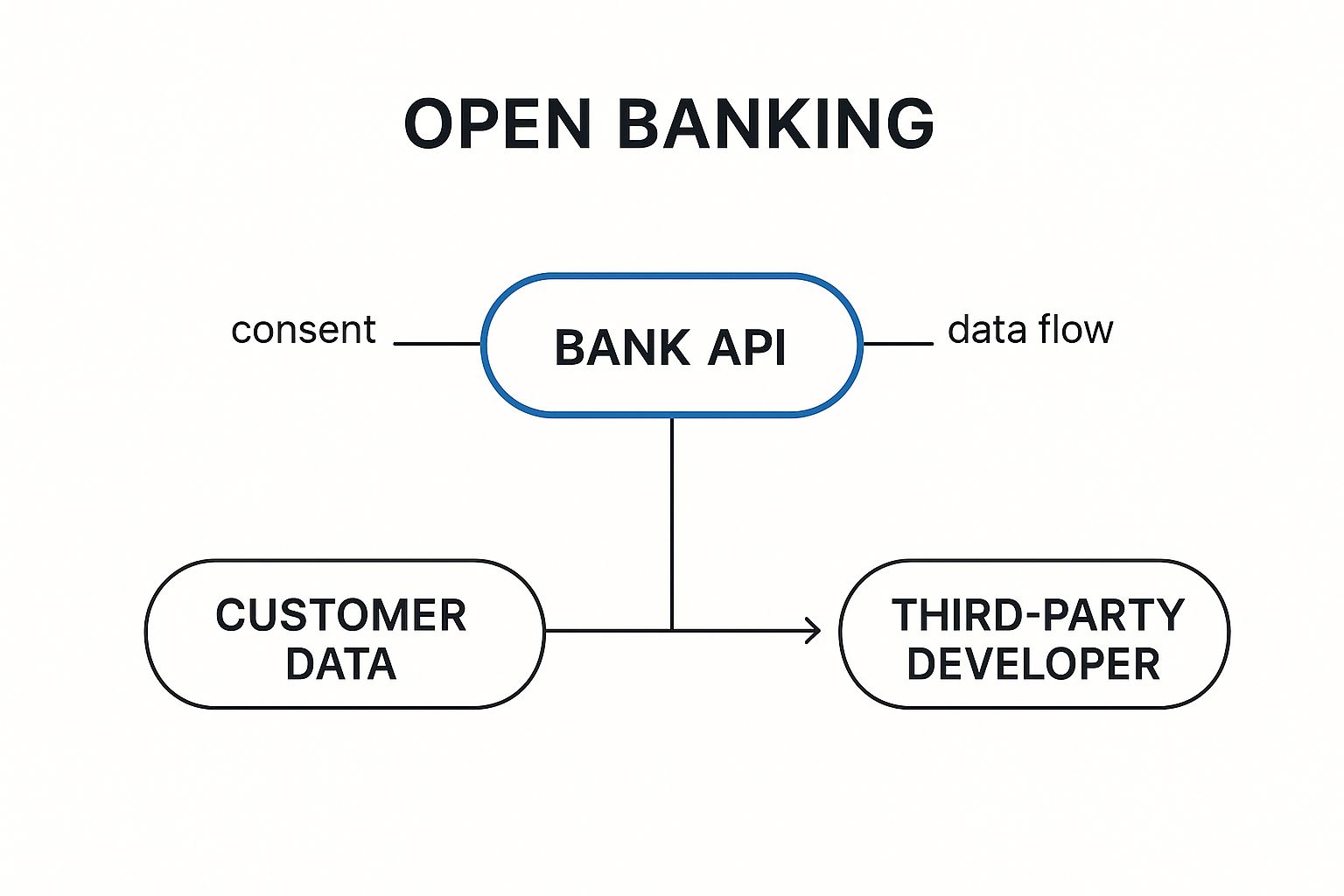

The infographic above visualizes the key components of Open Banking. The central concept, Open Banking, is surrounded by related concepts like Data Sharing, Third-Party Apps, Customer Consent, and Security. These concepts are interconnected, highlighting how data sharing enables third-party apps to offer innovative services, all while prioritizing customer consent and robust security measures. The infographic also showcases benefits like Increased Competition and Personalized Services, driven by the core functionality of Open Banking. The most important relationship shown is between Open Banking and Customer Consent, emphasizing the user-centric nature of this technology.

As the infographic illustrates, the flow of data is secure and predicated on customer consent. This fosters trust and ensures transparency within the Open Banking ecosystem.

Open Banking APIs utilize standardized APIs for data sharing, secure authentication frameworks, customer consent management systems, and real-time data access capabilities to ensure security and efficiency. This creates a thriving third-party developer ecosystem, fostering innovation and competition. Examples of successful Open Banking implementations include the UK's Open Banking Implementation Entity (OBIE), Plaid's integration with major US banks, BBVA's API Market, DBS Bank's developer portal in Singapore, and Australia's Consumer Data Right (CDR) implementation. These initiatives demonstrate the global adoption and transformative potential of Open Banking.

Features of Open Banking APIs:

- Standardized APIs for data sharing

- Secure authentication frameworks

- Customer consent management systems

- Real-time data access capabilities

- Third-party developer ecosystems

Pros:

- Promotes innovation through third-party service development

- Enhances customer experience and financial transparency

- Creates new revenue streams for banks

- Enables personalized financial services

- Increases competition in financial services

Cons:

- Potential security and privacy concerns

- Regulatory challenges across different jurisdictions

- Implementation costs for banks

- Customer confusion about data sharing permissions

- Potential disintermediation of traditional banking services

When and Why to Use Open Banking APIs:

Open Banking APIs are ideal for banks looking to:

- Drive innovation and create new revenue streams

- Enhance customer engagement and personalize services

- Improve operational efficiency through data sharing

- Stay competitive in the evolving financial landscape

- Meet increasing regulatory demands for data transparency

Tips for Implementing Open Banking APIs:

- Focus on strong security protocols and user authentication.

- Create developer-friendly documentation.

- Implement robust consent management systems.

- Start with high-value use cases for customers.

- Continuously monitor for potential security vulnerabilities.

Open Banking APIs deserve a prominent place on this list of new banking technologies due to their transformative impact on the financial industry. By fostering innovation, enhancing customer experience, and increasing competition, Open Banking APIs are reshaping the way financial institutions operate and interact with their customers. For a deeper dive into the subject, learn more about Open Banking APIs. Open Banking has been popularized by organizations like The Competition and Markets Authority (CMA) in the UK, the European Union's PSD2 (Payment Services Directive 2), the Financial Data Exchange (FDX) in North America, Plaid, and BBVA's API Market team. They recognize the potential of open banking to revolutionize financial services.

2. Blockchain in Banking

Blockchain technology, a cornerstone of new banking technology, is a distributed ledger system that cryptographically records transactions across multiple computers. This decentralized approach ensures security, transparency, and immutability, making it virtually impossible to alter or tamper with recorded data. In the banking sector, blockchain is revolutionizing various operations, from payments and settlements to identity verification and smart contracts. Its potential to streamline processes, enhance security, and reduce costs positions it as a key driver of innovation in the financial industry.

How it Works: Blockchain operates on a distributed ledger architecture where each transaction is grouped into a "block." These blocks are chained together chronologically and cryptographically linked, forming a permanent and tamper-proof record. Each participant in the network maintains a copy of the blockchain, ensuring transparency and data integrity. Consensus mechanisms, such as Proof-of-Work or Proof-of-Stake, validate transactions and add them to the blockchain.

Features and Benefits:

- Distributed Ledger Architecture: Data is distributed across multiple nodes, eliminating single points of failure and enhancing resilience.

- Cryptographic Security: Transactions are secured using advanced cryptography, protecting against fraud and unauthorized access.

- Smart Contract Functionality: Blockchain enables the creation of self-executing contracts, automating agreements and processes.

- Immutable Transaction Records: Once a transaction is recorded on the blockchain, it cannot be altered, providing an auditable trail.

- Consensus Mechanisms: These mechanisms ensure the validity and integrity of transactions added to the blockchain.

Pros:

- Reduced Transaction Costs and Processing Times: By eliminating intermediaries, blockchain streamlines processes and reduces associated costs.

- Enhanced Security Through Cryptography: Cryptographic security measures protect against fraud and cyberattacks.

- Elimination of Intermediaries: Direct peer-to-peer transactions reduce reliance on third parties, increasing efficiency and speed.

- Improved Transparency and Auditability: The distributed ledger provides a transparent and auditable record of all transactions.

- Potential for Programmable Money Through Smart Contracts: Smart contracts automate and enforce agreements, opening up possibilities for innovative financial instruments.

Cons:

- Scalability Challenges for High-Volume Transactions: Processing large transaction volumes can be challenging for some blockchain networks.

- High Energy Consumption (Particularly for Proof-of-Work Systems): Some consensus mechanisms require significant energy consumption.

- Regulatory Uncertainty in Many Jurisdictions: The regulatory landscape for blockchain technology is still evolving in many regions.

- Integration Challenges with Legacy Banking Systems: Integrating blockchain with existing banking systems can be complex.

- Potential Privacy Concerns for Public Blockchains: Public blockchains can raise privacy concerns, particularly regarding transaction data.

Examples of Successful Implementation:

- JP Morgan's Onyx platform: A permissioned blockchain platform for wholesale payments.

- Ripple's RippleNet: A network for facilitating cross-border payments.

- HSBC's blockchain-based trade finance platform: Streamlining trade finance processes through blockchain.

- Santander's One Pay FX: An international money transfer service leveraging blockchain technology.

Tips for Implementation:

- Start with Specific Use Cases: Focus on specific use cases like cross-border payments or trade finance to pilot blockchain solutions.

- Consider Private or Permissioned Blockchains for Compliance: Private or permissioned blockchains offer greater control and compliance capabilities compared to public blockchains.

- Invest in Blockchain Talent and Education: Building internal expertise is crucial for successful blockchain implementation.

- Collaborate with Consortiums for Standardization: Participation in industry consortiums fosters standardization and interoperability.

- Develop Clear Governance Frameworks for Blockchain Networks: Establishing clear governance frameworks ensures the smooth operation of blockchain networks.

Why Blockchain Deserves its Place: Blockchain's transformative potential for the banking sector is undeniable. Its ability to enhance security, reduce costs, and improve efficiency makes it a crucial component of new banking technology. By addressing the challenges and embracing the opportunities presented by blockchain, banks can position themselves for success in the evolving financial landscape. This technology is relevant to Banking Executives, Financial Analysts, Risk and Compliance Professionals, Innovation and IT Leaders, and Banking Regulators seeking to understand and leverage cutting-edge solutions in the industry.

3. Artificial Intelligence and Machine Learning in Banking

Artificial intelligence (AI) and machine learning (ML) are rapidly transforming the banking industry, offering powerful new tools to analyze vast amounts of data, automate processes, and personalize customer experiences. These technologies represent a significant leap forward in new banking technology, enabling institutions to operate more efficiently, manage risk more effectively, and offer innovative services that meet the evolving demands of today's digital-first consumers. AI and ML power a wide range of applications, from chatbots and virtual assistants that provide 24/7 customer support to sophisticated fraud detection systems that identify and prevent illicit activities in real-time. They also underpin credit scoring models, personalized financial recommendations, and even algorithmic trading platforms.

At the heart of these advancements are several key features. Natural Language Processing (NLP) allows machines to understand and respond to human language, enabling the development of conversational interfaces like chatbots. Predictive analytics uses historical data to identify patterns and predict future outcomes, crucial for risk assessment and fraud detection. Computer vision automates document processing and identity verification. Reinforcement learning optimizes portfolio management strategies. Finally, deep learning tackles complex pattern recognition in areas like anti-money laundering and customer behavior analysis.

Several banks have already successfully implemented AI and ML solutions. Bank of America's virtual assistant, Erica, provides customers with personalized financial guidance and support. JPMorgan Chase uses COIN, a contract intelligence platform, to automate the review of legal documents. Wells Fargo leverages predictive banking features to anticipate customer needs. Capital One's Eno text chatbot provides account balance information and fraud alerts. HSBC utilizes AI-powered systems to enhance its anti-money laundering capabilities.

The benefits of AI and ML in banking are substantial. They include enhanced customer service through 24/7 intelligent assistants, improved fraud detection capabilities, more accurate credit risk assessment, personalized financial recommendations, and significant operational cost reductions. However, there are also challenges. Algorithmic bias, data privacy concerns, the need for high-quality data, the "black box" problem of interpretability, and high implementation and maintenance costs are all factors that institutions must carefully consider.

To successfully leverage these new banking technology advancements, institutions should start with focused use cases that deliver clear ROI. Ensuring diverse training data minimizes bias and implementing explainable AI practices helps with regulatory compliance. Learn more about Artificial Intelligence and Machine Learning in Banking to understand the regulatory landscape surrounding AI in finance. Combining AI with human oversight for critical functions, and continuously retraining models to maintain accuracy are crucial for success. The increasing complexity of the software used in these systems also requires advanced security analysis techniques. Static Application Security Testing (SAST) is evolving with the help of AI. For further information on this important area, see a list of AI-powered SAST tools.

Several companies offer AI and ML solutions specifically for the financial sector, including IBM Watson Financial Services, Google Cloud's banking AI solutions, Palantir Technologies, DataRobot's automated machine learning platform, and Kasisto's conversational AI platform. By carefully navigating the opportunities and challenges, banks can harness the power of AI and ML to drive innovation, improve efficiency, and enhance customer experiences in this era of rapidly evolving financial services.

4. Biometric Authentication: The Future of Secure Banking

Biometric authentication is rapidly transforming the landscape of new banking technology, offering a robust and convenient alternative to traditional authentication methods. This technology leverages unique biological and behavioral traits for identity verification, making banking more secure and user-friendly. Instead of relying on easily forgotten passwords or vulnerable PINs, biometric authentication uses identifiers like fingerprints, facial features, voice patterns, iris scans, and even typing rhythm or gesture analysis. This positions it as a crucial element in modernizing banking security and improving customer experience, making it a deserving addition to any list of new banking technologies.

How it Works:

Biometric authentication systems capture a user's unique biometric data through specialized sensors. This data is then converted into a digital template, which is securely stored. When a user attempts to access a banking service, the system captures their biometric data again and compares it to the stored template. A match grants access, while a mismatch denies it. Modern systems incorporate sophisticated algorithms and "liveness detection" to prevent spoofing attempts using photographs, recordings, or masks.

Features and Benefits:

Biometric authentication systems offer a range of features designed to enhance security and usability:

- Multimodal Biometrics: The ability to use multiple biometric identifiers (fingerprint, face, voice, etc.) provides flexibility and redundancy.

- Liveness Detection: Anti-spoofing measures ensure that the system is interacting with a live person, not a fraudulent representation.

- On-Device Processing: Storing and processing biometric data on the user's device enhances privacy and reduces the risk of large-scale data breaches.

- Behavioral Biometrics: Continuous authentication using behavioral patterns like typing dynamics offers an additional layer of security and can detect anomalies in user behavior.

- Seamless Integration: Modern biometric systems seamlessly integrate with mobile banking apps, ATMs, and other banking platforms.

Pros and Cons:

| Pros | Cons |

|---|---|

| Enhanced security compared to passwords/PINs | Privacy concerns regarding biometric data storage |

| Improved customer convenience and faster authentication | Accuracy issues with certain demographics |

| Reduction in fraud and identity theft | Potential for false positives/negatives |

| Cannot be forgotten like passwords | Permanent compromise if biometric data is breached |

| Difficult to duplicate or steal | Regulatory compliance challenges across jurisdictions |

Successful Implementations:

Several leading banks have already embraced biometric authentication:

- HSBC's Voice ID: Allows customers to access their accounts using voice recognition.

- Wells Fargo's eyeprint ID: Utilizes eye vein patterns for secure verification.

- Barclays' finger vein authentication: Offers a highly secure method of authentication using vein patterns in the finger.

- DBS Bank's face verification: Enables customers to access services using facial recognition.

- Bank of America's fingerprint login: Allows mobile banking access via fingerprint scanning.

Actionable Tips for Implementation:

- Multi-Factor Authentication: Combine biometrics with other authentication factors (e.g., one-time passwords) for added security.

- Secure Storage: Prioritize on-device storage of biometric templates whenever possible.

- Alternative Authentication: Provide alternative login methods for users who may have difficulty using biometrics.

- Anti-Spoofing Technology: Stay updated on the latest anti-spoofing techniques to mitigate risks.

- Transparency: Be transparent with customers about how their biometric data is collected, used, and stored.

When and Why to Use Biometric Authentication:

Biometric authentication is ideal for any banking application where security and user convenience are paramount. This includes mobile banking, online banking, ATM access, branch transactions, and even call center authentication. Its ability to enhance security while streamlining the customer experience makes it a valuable tool for banks seeking to modernize their operations and combat fraud.

Key Players and Influencers:

The widespread adoption of biometric authentication has been fueled by key players like Apple (Face ID and Touch ID), the FIDO (Fast Identity Online) Alliance, Mastercard's biometric card technology, Daon's IdentityX platform, and NEC's biometric identification solutions. These innovations have helped to popularize and standardize biometric technology, paving the way for its integration into the banking sector.

5. Digital-Only Banks (Neobanks)

Digital-only banks, also known as neobanks, represent a significant advancement in new banking technology, redefining how customers interact with financial services. These institutions operate entirely online, without any physical branches. Leveraging the latest technology, they offer a range of banking services accessible through sleek mobile apps and web platforms. This approach allows them to prioritize user-friendly interfaces, innovative features, and often significantly lower fees compared to traditional banks due to reduced overhead costs. This makes them a compelling option for today's digitally-savvy customer and a key area of interest for banking executives looking to innovate.

Neobanks function by leveraging cloud computing, APIs, and advanced data analytics to deliver seamless banking experiences. Customers can open accounts, transfer funds, pay bills, and even invest, all from their smartphones or computers. Fully digital onboarding and Know Your Customer (KYC) processes make account opening quick and easy. Real-time transaction notifications provide instant oversight of financial activity, while automated savings tools and spending analytics empower users to better manage their finances. Further enhancing their appeal, many neobanks offer seamless integration with third-party services, along with convenient card management features such as instant freeze/unfreeze and customizable spending limits.

Several successful neobanks have emerged globally, demonstrating the viability and disruptive potential of this new banking technology. Revolut, for example, has made a name for itself with its global financial super app, offering a multitude of services beyond traditional banking. Chime has disrupted the US market with its fee-free banking model. N26 provides digital banking services across Europe, while Nubank has experienced massive growth in Latin America. In the UK, Monzo has fostered a strong community around its platform through its customer-centric and transparent approach.

For those looking to understand the impact of neobanks in established markets, learn more about Digital-Only Banks (Neobanks).

When and why should you consider this approach?

Neobanks offer a compelling alternative for both customers and financial institutions. For customers, the appeal lies in lower fees, higher interest rates on savings accounts (in some cases), and the convenience of 24/7 access to banking services through user-friendly digital interfaces. For banking executives, neobanks represent an opportunity to streamline operations, reduce overhead costs, and reach new customer segments. Innovation and IT leaders can leverage neobank strategies to accelerate the development and deployment of new financial products and services. Risk and compliance professionals can benefit from exploring the streamlined KYC and AML processes employed by successful neobanks.

Pros:

- Lower fees and potentially better interest rates due to reduced overhead.

- Enhanced user experience through intuitive mobile interfaces.

- Faster innovation cycles compared to traditional banks.

- Greater transparency in fee structures.

- 24/7 access to banking services.

Cons:

- Limited physical presence for customers who prefer in-person service.

- Often restricted product range compared to full-service banks.

- Customer service can be limited to chat or email.

- Potential concerns about long-term sustainability, especially for newer players.

- May lack the trust associated with established banking brands.

Tips for Success:

- Focus on exceptional mobile user experience: A seamless and intuitive mobile app is crucial for attracting and retaining customers.

- Prioritize responsive customer service to build trust: Address customer queries promptly and efficiently, even without physical branches.

- Offer distinctive features that traditional banks don't provide: Differentiate yourself by offering unique services like integrated budgeting tools, international money transfers, or early salary access.

- Build community engagement with transparent communication: Foster a sense of community and trust through open communication and feedback mechanisms.

- Partner strategically to expand service offerings: Collaborations with fintech companies and other service providers can broaden your product portfolio and enhance the customer experience.

The rise of neobanks signifies a fundamental shift in the banking landscape. While challenges remain, their innovative approach, driven by new banking technology, positions them as key players in the future of finance. Figures like Tom Blomfield (Monzo co-founder), Valentin Stalf and Maximilian Tayenthal (N26 founders), David Vélez (Nubank founder), Anne Boden (Starling Bank founder), and Chris Britt and Ryan King (Chime co-founders) have pioneered this movement, shaping the way we interact with our finances in the digital age.

6. Robotic Process Automation (RPA) in Banking

Robotic Process Automation (RPA) is rapidly transforming the banking landscape, securing its place as a crucial new banking technology. By deploying software robots, or "bots," banks can automate repetitive, rule-based tasks, leading to significant improvements in efficiency, accuracy, and cost-effectiveness. This technology allows banks to streamline operations, improve customer service, and enhance compliance efforts.

How RPA Works in Banking:

RPA bots act as digital workers, mimicking human actions within existing banking systems. They can log into applications, move files and folders, copy and paste data, fill in forms, extract structured data from documents, and even connect to APIs. Essentially, any high-volume, rule-based task currently performed by a human can be automated using RPA. This non-invasive nature of RPA is a key advantage, meaning it can be integrated with legacy systems without requiring significant changes to existing IT infrastructure.

Examples of Successful RPA Implementation:

Several leading banks have already embraced RPA, achieving impressive results. For instance, Deutsche Bank implemented RPA, reportedly saving 30% in operational costs. Bank of America's virtual assistant, Erica, handles routine customer inquiries, freeing up human agents to address more complex issues. ICICI Bank deployed over 1,000 RPA bots, streamlining various processes. BNY Mellon automated trade settlement processes, and HSBC leveraged RPA for anti-money laundering checks, showcasing the versatility of this new banking technology.

Actionable Tips for Implementing RPA:

- Start Small, Scale Up: Begin with well-documented, high-volume processes to demonstrate quick wins and build momentum.

- Center of Excellence: Establish a dedicated center of excellence to standardize RPA implementation and best practices.

- RPA + AI: Combine RPA with Artificial Intelligence (AI) and Machine Learning (ML) to handle more complex processes requiring judgment and decision-making.

- Governance Framework: Develop a clear governance framework for bot management, including access controls, security protocols, and performance monitoring.

- Employee Engagement: Involve employees in the automation journey to address concerns about job displacement and foster a culture of innovation.

When and Why to Use RPA:

RPA is ideal for processes that are:

- High-volume and repetitive: Tasks performed frequently and consistently.

- Rule-based: Processes with clear, defined steps and predictable outcomes.

- Manually intensive: Tasks that consume significant human resources.

- Prone to errors: Processes where human error is a significant risk.

- Data-heavy: Tasks involving large volumes of data entry and manipulation.

Features and Benefits of RPA in Banking:

- Non-invasive integration: Works with existing systems without requiring significant changes.

- 24/7 operation: Bots can work continuously without fatigue, increasing throughput.

- Scalability: Easily scale up or down bot deployments to handle fluctuating volumes.

- Detailed audit trails: Provides complete transparency and accountability for all bot actions.

- Cost reduction: Significantly reduces operational costs by automating manual tasks.

- Increased speed and accuracy: Processes transactions and data with greater speed and precision.

- Improved compliance: Ensures consistent process execution, reducing compliance risks.

- Redeployment of human talent: Frees up staff to focus on higher-value activities.

Pros and Cons of RPA:

Pros: Significant cost reduction, increased processing speed, reduced error rates, improved compliance, and redeployment of human talent.

Cons: Limited to rule-based processes, requires well-documented processes, can be disrupted by changes in underlying applications, initial investment in licenses and implementation, and potential employee resistance.

Popular RPA Platforms for Banking:

Several vendors offer robust RPA platforms tailored for the financial industry, including UiPath, Blue Prism, Automation Anywhere, NICE, and WorkFusion.

RPA’s ability to streamline operations, reduce costs, and improve accuracy makes it a vital component of any modern banking strategy. By embracing this new banking technology, financial institutions can unlock significant efficiencies, enhance customer experiences, and gain a competitive edge in the evolving digital landscape.

7. Cloud Banking: Reshaping the Financial Landscape

Cloud banking represents a significant shift in how financial institutions operate, store data, and deliver services. As a core component of new banking technology, it involves migrating core banking systems, applications, and data storage from traditional on-premises infrastructure to cloud-based platforms. This transition empowers banks to levera