Greenfield Banking Company: Essential Strategies for Success

Brian's Banking Blog

Understanding The Greenfield Banking Company Revolution

The financial services industry is experiencing a major shift. At the center of this change are greenfield banking companies. These institutions are built from scratch using modern technology, challenging traditional banking and changing what customers expect. Instead of relying on outdated systems, they prioritize agility and a customer-centric approach.

This allows them to react to market changes quickly and efficiently. It also means they can focus on excellent customer service from day one.

Why start from scratch? The answer lies in the problems with legacy systems. Traditional banks often struggle with complex systems that are expensive to update. Integrating new technologies into these systems can be extremely difficult. Greenfield banking companies, free from these old systems, can create adaptable platforms that meet changing customer needs.

Greenfield banking also means using the best technology from the start. This includes strong security, user-friendly interfaces, and powerful data analytics. These new banks can also adopt a mobile-first strategy, appealing to the growing number of people who bank on their phones. This difference positions greenfield banks to attract digitally savvy customers.

Greenfield banking—creating a brand-new, digital-only bank—has significantly changed finance, especially in the United States, Europe, and Asia. Industry analysis shows that in recent years, more than 30 greenfield banking initiatives have launched globally. Most focus on customers underserved by traditional banks or those seeking innovative, digital-first experiences. Find more detailed statistics here: Oliver Wyman This trend shows the potential of greenfield banking to disrupt financial services. But what makes these new ventures so appealing?

Key Advantages of the Greenfield Approach

Greenfield banking companies offer more than just new technology. They have key advantages traditional banks struggle to match:

- Agility and Speed: Greenfield banks quickly adapt to market shifts and add new features thanks to flexible technology.

- Customer-Centric Design: These companies prioritize the customer experience from the outset, creating easy-to-use interfaces and personalized services.

- Lower Operational Costs: Modern technology and efficient processes result in substantial cost savings compared to maintaining legacy systems.

- Targeted Market Focus: Many greenfield banks focus on specific niches or underserved groups, offering customized products and services.

These advantages position greenfield banking companies for rapid growth and market disruption. The ability to offer personalized, convenient, and cost-effective services is appealing to today's consumers. This creates opportunities for greenfield banks to gain market share and drive innovation in finance.

Strategic Advantages That Set Your Greenfield Banking Company Apart

Modern technology is a given in today's banking world. But what truly sets a greenfield banking company apart? Experienced banking executives are building market-leading institutions by leveraging some key advantages. Starting fresh allows for optimal architecture, smoother compliance processes, and customer-focused product development—all without the burden of outdated legacy systems. This directly results in lower operational costs and better customer experiences.

Agile Architecture and Streamlined Compliance

One major advantage for greenfield banking companies is the ability to build their technology infrastructure from scratch. This allows them to select the best solutions for their needs, instead of being limited by older systems.

For instance, a greenfield bank can choose cloud-based core banking platforms like Mambu, which offer scalability and flexibility that traditional on-premise systems can't match. Plus, integrating compliance processes into the architecture from the start, rather than adding them later, simplifies regulatory compliance and minimizes future issues. This proactive approach lays a strong foundation for future growth and innovation.

Customer-Centricity and Rapid Product Development

Greenfield banks put the customer first. They design user-friendly interfaces and personalized services. This customer focus enables faster product development cycles. These institutions can launch new products and features much quicker than traditional banks.

For example, they can rapidly implement mobile banking features and connect with third-party financial apps like Plaid to deliver a seamless and integrated experience. This agility attracts tech-savvy customers and fosters brand loyalty.

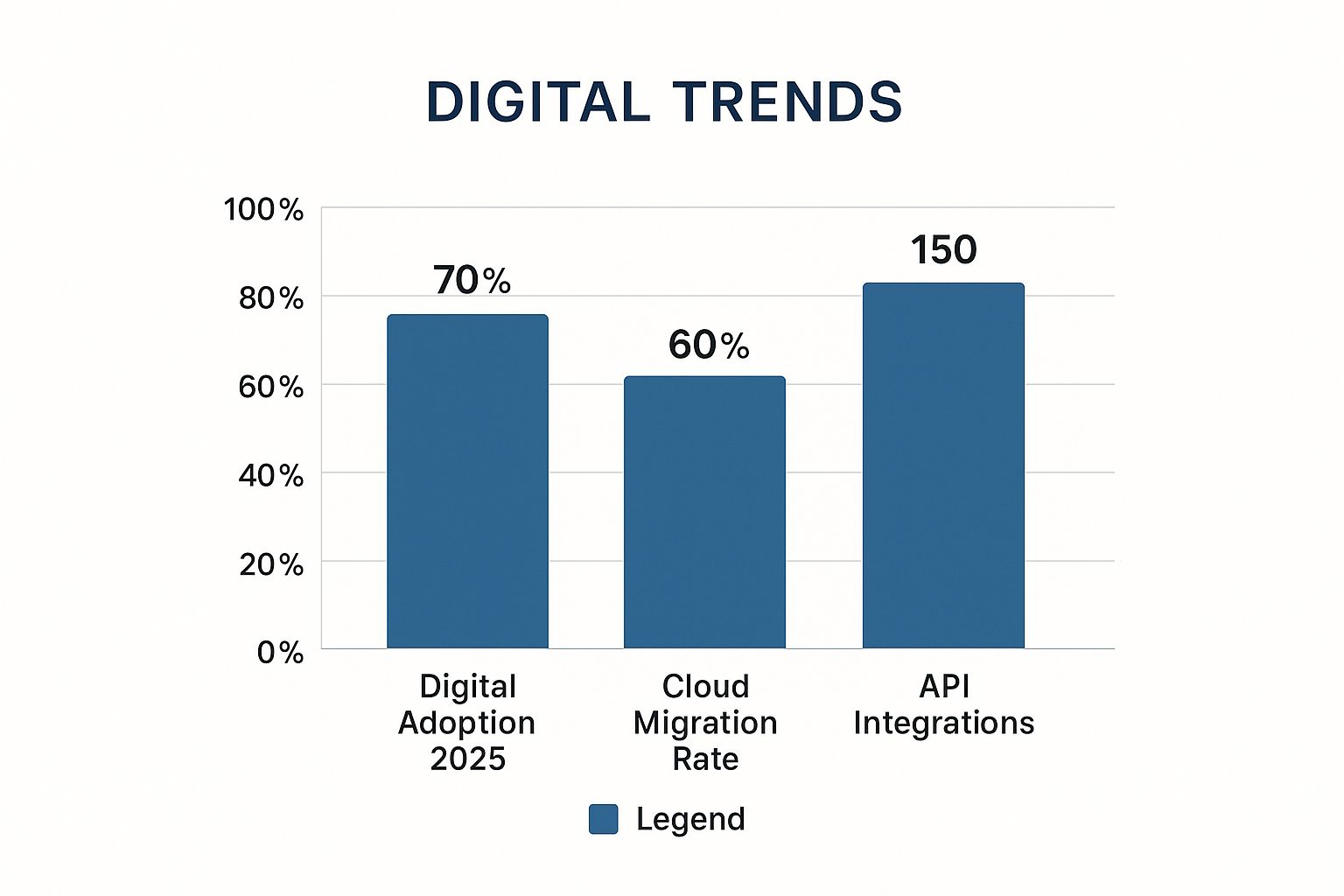

The infographic above illustrates projected growth and integration within the financial technology sector. It highlights the opportunities available to greenfield banks that utilize modern solutions. As the data shows, digital adoption, cloud migration, and API integrations are predicted to grow significantly. This reinforces the need for a flexible and adaptable technology infrastructure for greenfield banking companies. These projections clearly demonstrate the fast-paced evolution of financial technology and the importance for new institutions to embrace these changes to remain competitive.

Embracing New Technologies

Greenfield banking companies can integrate new technologies like AI and blockchain from the outset. This provides a major edge in areas like fraud detection, risk management, and personalized financial advice. By using these technologies, they can boost efficiency, lower costs, and provide more advanced services to their customers.

This early adoption of advanced technologies also positions them as innovators in the financial industry, attracting both investors and customers. These institutions aren't just building banks; they are shaping the future of finance.

Maintaining Speed-to-Market Advantage

Perhaps one of the biggest advantages of greenfield banks is their inherent speed-to-market. Free from the restraints of outdated systems and processes, they can roll out new products and services faster than traditional banks. This speed is essential in today's financial environment, where customer preferences and market demands can change rapidly. This allows them to seize new opportunities and stay ahead of the competition. This constant agility keeps greenfield institutions at the forefront of financial innovation. The ability to adapt quickly and efficiently is what truly distinguishes them in the competitive banking industry.

To further illustrate the key differences, let's examine a comparison table:

Greenfield vs Traditional Banking: Key Advantage Comparison Comparative analysis showing the strategic advantages of greenfield banking companies over traditional banking models

| Aspect | Greenfield Banking Company | Traditional Bank | Advantage |

|---|---|---|---|

| Technology | Modern, cloud-based systems | Legacy systems | Greenfield: Flexibility and Scalability |

| Compliance | Integrated from the start | Often retrofitted | Greenfield: Easier and more efficient compliance |

| Customer Focus | Personalized services, intuitive interfaces | Often standardized services | Greenfield: Enhanced Customer Experience |

| Product Development | Rapid development cycles | Slower, more complex processes | Greenfield: Faster time-to-market |

| Innovation | Early adoption of new technologies | Slower adoption due to legacy systems | Greenfield: Competitive edge through innovation |

| Operational Costs | Typically lower due to efficient technology | Higher due to legacy system maintenance | Greenfield: Cost savings |

This table summarizes the core advantages that greenfield banks possess. Their ability to leverage modern technology, prioritize the customer, and adapt quickly allows them to thrive in the evolving financial landscape. These institutions are not just participating in the financial industry; they are actively reshaping it.

Building Technology Infrastructure That Scales

The technology a new banking company chooses has a significant impact on its future. This section offers advice from CTOs who have built banking platforms for millions of customers. We'll explore essential parts of a modern banking technology stack, like cloud-native core systems and API-first architectures.

Core Systems and API-First Architecture

Building scalable technology for a new bank requires careful planning, especially when choosing a core banking system. A cloud-native core banking system offers the flexibility and scalability needed to meet changing market demands and customer expectations. This foundation allows for quick growth and easy integration of new features.

An API-first architecture is also key. This approach allows seamless integration with third-party services, expanding the bank's product and service offerings. It also speeds up development and reduces time-to-market. Greenfield banks looking for a robust technology infrastructure should check out providers of Laravel web development services. Analyzing successful new banks shows a big performance difference based on architecture. Banks with cloud-native, API-first architectures get new features to market 67% faster and have 43% lower operational costs than banks using older methods. Learn more about banking technology performance here.

Building vs. Buying: Strategic Decisions

New banks face a key decision: build technology in-house or use third-party vendors. Both options have pros and cons. Building in-house offers more control and customization, but requires significant investment and expertise. Using vendors can be cheaper and faster, but might limit flexibility. The best approach often combines both, strategically choosing where to focus internal development and where to integrate external solutions.

Microservices and Containerization

Modern new banks often use microservices architecture and containerization. Microservices break down complex applications into smaller, independent parts, offering greater flexibility and scalability. Containerization, using tools like Docker, simplifies deployment and management of these microservices. These technologies together allow for fast development, easier maintenance, and improved resilience. Individual services can be updated or scaled without impacting other system parts.

Real-Time Fraud Detection and AI

Real-time fraud detection and AI-powered customer service are essential for modern greenfield banks. These technologies improve security, enhance the customer experience, and allow for personalized financial advice. You might be interested in: How to master banking data analytics. It’s crucial, however, to implement these features while staying compliant with regulations. Balancing innovation with regulatory needs is a key challenge for any new bank. Finding the right balance ensures long-term sustainability and builds trust with customers.

Navigating Regulatory Compliance Without Breaking The Bank

Securing regulatory approval doesn't have to be a long, drawn-out process for new banking ventures. Understanding the correct approach can significantly expedite things. Successful new banks have proven this by efficiently obtaining approvals while simultaneously building robust compliance frameworks.

Choosing the Right Licensing Path

The initial step is understanding the available licensing options. Each license type has its own set of requirements and capabilities. Choosing the right one for your specific business model is crucial. This might involve applying for a full banking license, or perhaps partnering with an established bank for certain services. You might be interested in: How to master regulatory compliance for banks.

To help you understand the different options, we've compiled a comparison table:

Banking License Types and Requirements Comparison: Overview of different banking license options available to greenfield banking companies with key requirements and limitations

| License Type | Requirements | Capabilities | Timeline | Cost Range |

|---|---|---|---|---|

| Full Banking License | Substantial capital, detailed business plan, robust risk management | Offer full range of banking services | 12-24+ Months | High |

| Limited Purpose License | Lower capital requirements, focused business plan | Restricted services based on license type | 6-12 Months | Medium |

| Partnership with Established Bank | Less stringent requirements | Leverage partner's infrastructure and license | 3-6 Months | Low-Medium |

This table provides a simplified overview. Specific requirements and timelines vary depending on the jurisdiction. A full banking license offers the broadest range of services but comes with the highest cost and longest timeline. Partnering with an existing bank offers a faster and more affordable route, but with limited capabilities.

Working Effectively with Regulators

Proactive engagement with regulators is essential. Open communication and transparency build trust. This can involve regular meetings, sharing progress updates, and promptly addressing any regulatory concerns. By fostering a good working relationship, new banks can navigate the approval process more efficiently. Additionally, understanding the specific regulatory landscape of your target market is vital. Regulations can differ significantly between regions.

Building a Scalable Compliance Team

A dedicated compliance team isn't optional; it's a necessity. This team needs the expertise and resources to manage regulatory requirements effectively. The compliance team must also be scalable with the company’s growth. As the bank expands, the compliance function must adapt to handle increasing complexity.

Implementing Robust Compliance Policies

Strong compliance policies are fundamental to maintaining good standing with supervisory authorities. These policies should cover all areas of the bank's operations, including anti-money laundering (AML), know your customer (KYC), and data security. Regularly reviewing and updating these policies is critical to stay current with evolving regulatory expectations.

Strategic Partnerships and Cost Management

Partnering with established banks can offer numerous advantages, including faster launch times and access to existing infrastructure. However, careful consideration of the partnership model is key to ensure alignment with the long-term strategic goals of the new bank. Managing compliance costs is a critical factor in building sustainable operations. Implementing efficient processes, leveraging technology, and prioritizing compliance from the outset can help control costs while maintaining strong compliance. This approach allows new banks to invest in growth and build customer trust. A robust compliance framework isn't just about avoiding penalties; it's about building a foundation for long-term success and customer confidence.

Customer Acquisition Strategies That Actually Work

Building a customer base for a greenfield banking company requires a deep understanding of customer motivation. It's about building trust and offering genuine value. This section explores tactics used by successful greenfield banks that have scaled to hundreds of thousands of customers. We'll examine case studies, marketing approaches, onboarding processes, and customer retention strategies.

Identifying and Targeting Your Ideal Customer

One of the first steps is identifying your ideal customer. Who are you trying to reach? This involves market research and identifying specific customer segments. A greenfield bank might target small business owners, freelancers, or the underbanked.

Understanding the specific needs and preferences of these groups allows for more effective marketing and product development. This targeted approach ensures that resources are used efficiently and that the bank resonates with the right audience.

Developing a Compelling Value Proposition

Once you know your target audience, create a compelling value proposition. What differentiates your greenfield banking company? Why choose you over established banks or other Fintech companies?

This could be lower fees, better interest rates, a superior mobile app, or specialized financial services. This unique value proposition should be communicated clearly in all marketing materials and resonate with potential customers.

The Power of Referral Programs

Referral programs are highly effective for greenfield banking companies. They leverage existing customer relationships to acquire new customers organically. These programs often reward both the referrer and the new customer with benefits like cash bonuses or account credits.

This creates a win-win situation and encourages organic growth. This can be especially valuable in the early stages of building a customer base.

Digital Marketing Channels That Deliver

Certain digital marketing channels consistently deliver strong results for customer acquisition.

- Social media marketing: Platforms like Facebook, Instagram, and LinkedIn allow for targeted advertising and community building.

- Search engine optimization (SEO): Optimizing your website and content for relevant keywords improves online visibility.

- Content marketing: Creating valuable content, like blog posts and educational resources, positions your bank as a trusted authority.

- Email marketing: Building an email list enables direct communication with potential and current customers.

The right mix of channels depends on your target audience and budget. A greenfield bank targeting young adults might prioritize social media, while one focusing on businesses might favor LinkedIn and content marketing. Successful greenfield banks often find that a combination of channels yields the best results. Greenfield banking companies using targeted digital marketing strategies acquire customers at 52% lower cost than traditional banks, with referral programs accounting for 34% of new customer growth within the first two years. Explore this topic further here.

Building Brand Trust and Credibility

Building trust is crucial for new banks. Customers need to feel confident about their financial security.

- Transparency: Be upfront about fees and terms.

- Security: Emphasize your security measures and data protection.

- Customer Service: Provide excellent customer support and be responsive to inquiries.

- Community Engagement: Participating in local events builds goodwill.

By focusing on these elements, greenfield banking companies can attract customers, build relationships, and establish a positive brand reputation, essential for sustainable growth in the competitive financial market.

Scaling Operations For Sustainable Growth

Rapid growth can be thrilling for a new banking company, but it can also present significant operational hurdles. Maintaining top-notch service and adhering to regulations during rapid expansion requires careful planning and execution. Let's explore how successful digital banks have tackled these challenges.

Building Customer Service Capabilities That Scale

As your customer base expands, so must your customer service capabilities. This goes beyond simply hiring more representatives. It's about implementing systems and processes to manage increased volume while delivering personalized service.

Investing in robust CRM systems: A strong CRM can help manage customer interactions, track issues, and personalize the support experience.

Developing self-service options: FAQs, online tutorials, and chatbots can handle common inquiries, freeing up human representatives for complex issues.

Implementing multi-channel support: Offer support via phone, email, chat, and social media to meet customers where they are.

These strategies ensure customers receive timely and effective support, even during periods of rapid growth.

Risk Management Frameworks for Growth

Effective risk management is crucial as a new banking company scales. Larger customer bases and transaction volumes introduce new and more complex risks. This requires robust frameworks to identify, assess, and mitigate these risks.

Real-time fraud detection: Implement advanced fraud detection systems to analyze transactions and identify suspicious activity in real time.

Strengthened KYC/AML procedures: As your customer base grows, so does the importance of robust know your customer (KYC) and anti-money laundering (AML) procedures.

Data security and privacy: Protecting customer data is paramount. Invest in strong security measures and comply with data privacy regulations.

These risk management practices protect both the bank and its customers as the company expands.

Strategic Partnerships: Accelerating Growth and Efficiency

Strategic partnerships can be invaluable for scaling operations. Partnering with established institutions or Fintech providers offers access to expertise, technology, and infrastructure that might be difficult or expensive to develop in-house.

Payment processing: Partnering with a payment processor can simplify transaction management and reduce costs.

Compliance and regulatory support: Compliance can be complex. Partnering with a specialized firm can help navigate regulatory requirements.

Technology integration: Integrating with third-party technology providers can offer access to innovative solutions.

By carefully selecting partners, you can accelerate growth and improve operational efficiency.

Maintaining Culture and Agility During Expansion

One common challenge for growing companies is maintaining the innovative culture and agility that defines startups. As a new banking company expands, preserving these qualities is essential.

Empowering employees: Encourage employee autonomy and ownership to foster innovation.

Streamlined decision-making: Implement efficient decision-making processes to avoid bureaucracy.

Continuous improvement: Embrace a culture of continuous improvement and feedback to adapt to changing market conditions.

Preserving these cultural elements is a key differentiator for new banking companies as they scale. You might be interested in: How to master bank growth strategies.

Key Performance Indicators and Sustainable Revenue Models

Tracking the right key performance indicators (KPIs) is vital for measuring progress and making informed decisions. These metrics should reflect the bank's strategic goals and align with its business model. Examples include customer acquisition cost, customer lifetime value, and revenue growth. Developing sustainable revenue models is equally important. This involves diversifying revenue streams and ensuring long-term profitability. To future-proof customer acquisition and retention, consider exploring omnichannel marketing strategies. By implementing these strategies, new banking companies can successfully navigate the challenges of rapid growth while maintaining a strong focus on service quality, regulatory compliance, and long-term sustainability. Learning from those who have already successfully scaled their operations is essential for avoiding common pitfalls and building a thriving business.

Key Takeaways

Starting a greenfield banking company requires a strategic approach, from selecting the right technology to understanding customer acquisition. This section offers practical advice from industry leaders who've successfully built digital banks from the ground up.

Technology Infrastructure: Build for Scale

The foundation of any successful greenfield banking venture is a scalable technology infrastructure. This begins with choosing a cloud-native core banking system that allows for flexibility and growth. An API-first architecture is also crucial for seamless integration with other services.

Deciding whether to build these systems in-house or partner with a vendor is key. A hybrid approach often provides the best solution. Microservices and containerization, using tools like Docker, can improve system resilience and development speed.

Real-time fraud detection and AI-powered customer service enhance both security and the customer experience.

Regulatory Compliance: A Proactive Approach

Navigating regulatory requirements is essential for any new banking venture. Your business model will influence your licensing path, whether it's a full banking license or partnering with an established bank.

Open communication with regulators builds trust and streamlines the approval process. A dedicated and scalable compliance team isn't a luxury; it's a necessity.

Robust compliance policies, covering areas like AML (Anti-Money Laundering) and KYC (Know Your Customer), are foundational for long-term stability. Managing compliance costs effectively is also key for sustainable growth.

Customer Acquisition: Targeted Strategies

Building a customer base requires more than marketing; it demands understanding your ideal customer. Targeted digital marketing campaigns are far more effective than blanket approaches. Consider leveraging:

- Social media

- SEO (Search Engine Optimization)

- Content marketing

- Email marketing

A strong value proposition differentiates your greenfield banking company from competitors. Referral programs can drive organic growth by leveraging existing customer relationships.

Building trust and credibility is crucial, especially for a new institution. Transparency, robust security, excellent customer service, and community engagement are essential for building customer confidence.

Scaling for Sustainable Growth

Rapid growth presents both exciting opportunities and operational challenges. Customer service capabilities need to scale alongside your customer base. This can be achieved through:

- CRM (Customer Relationship Management) systems

- Self-service options

- Multi-channel support

Risk management also becomes more complex with growth, requiring real-time fraud detection and strong KYC/AML procedures. Strategic partnerships can accelerate growth and provide access to needed expertise and technology.

Maintaining a startup's agile and innovative culture during expansion is key. This involves empowering employees, streamlined decision-making, and embracing continuous improvement. Tracking KPIs (Key Performance Indicators) and building sustainable revenue models are essential for measuring progress and ensuring long-term profitability.

Key Priorities for Success

- Customer-centricity: Design products and services around customer needs.

- Technology-driven innovation: Embrace new technologies to improve services and efficiency.

- Agile operations: Adapt quickly to changing market conditions and customer demands.

- Strong regulatory compliance: Build trust and ensure long-term stability.

- Sustainable growth: Plan for long-term profitability and responsible scaling.

By focusing on these priorities, greenfield banking companies can position themselves for success in the dynamic financial services industry. These institutions are not just building banks; they are shaping the future of finance.

Ready to gain a competitive edge in the financial industry? Visbanking offers powerful data-driven insights to optimize your banking strategies and achieve sustainable growth. Learn more about how Visbanking can empower your institution at https://www.visbanking.com.