Grand Valley Bank | Trusted Colorado Community Banking

Brian's Banking Blog

The Story Behind Grand Valley Bank's Community Banking Success

In today's financial world, it's easy to feel lost in the shuffle. Big banks often prioritize huge transactions, leaving individual customers feeling like just a number. But at Grand Valley Bank, the experience is different. They've built their success on a simple idea: banking should be personal.

Think of it this way: instead of a massive, impersonal bank, imagine your local coffee shop. The barista knows your name, your usual order, and maybe even asks about your weekend. That's the kind of connection Grand Valley Bank aims for with its customers.

This commitment to community isn't just a slogan; it's the foundation of their entire operation. Since opening in Grand Junction, Colorado in 1983, Grand Valley Bank has focused on building relationships. This approach has helped them grow to nine branches across Colorado and Utah, serving over 21,964 account holders and managing $569 million in assets. And through it all, they've kept that personal touch. Discover more insights about Grand Valley Bank's history.

Building on a Foundation of Personal Connections

This personalized approach shapes everything Grand Valley Bank does. It influences who they hire, ensuring their team genuinely cares about customers. It guides their lending decisions, prioritizing individual needs over strict rules.

For example, imagine a small business owner looking for a loan. At Grand Valley Bank, they'll likely sit down with a loan officer who understands the local market and their specific industry. This allows for a deeper understanding of the business and leads to more flexible lending options.

Grand Valley Bank also invests in training its employees to truly understand their customers’ financial lives. It's not just about processing transactions; it’s about understanding a customer’s goals, challenges, and what they hope to achieve.

This allows the bank to offer solutions tailored to each individual. In a competitive market, this customer-centric approach has allowed Grand Valley Bank to thrive, proving that personal connections are still invaluable in the financial world. This dedication to relationships, community, and personal connection is the bedrock of Grand Valley Bank's success.

How Grand Valley Bank Evolved While Staying True To Its Roots

Evolving in banking isn't about chasing shiny new tech. It's about making smart choices that strengthen your core mission. For Grand Valley Bank, this meant some important behind-the-scenes decisions that shaped the customer experience we see today. These choices, often invisible to the everyday customer, have molded the bank's identity and its ties to the community.

From National To State Charter: A Change Of Heart

One of the biggest shifts for Grand Valley Bank happened in 2008. The bank moved from a national to a state charter. This wasn't just paperwork; it was a conscious change in how they operated. By going state-chartered, Grand Valley Bank gained flexibility in serving local communities and responding to their specific needs.

This also meant leaving the Federal Reserve System and moving under the supervision of the FDIC. This gave Grand Valley Bank more local control and the ability to react faster to community needs.

Strategic Acquisitions: Growing With Purpose

Growth can be tough, especially when you're dedicated to a community focus. Grand Valley Bank tackled this challenge head-on by acquiring Heber Valley National Bank in 2005. This wasn't just about getting bigger; it was about bringing another community-minded institution into the family. This strategic move let Grand Valley Bank expand its footprint while keeping its community values strong.

Grand Valley Bank has seen significant changes, particularly in how it's structured. Starting as Grand Valley National Bank in 1983, it transformed in 2008, changing its name to Grand Valley Bank and becoming a state-chartered bank. This also meant switching from the Federal Reserve System to the FDIC. In 2005, it acquired Heber Valley National Bank, growing its presence in the region. Learn more about Grand Valley Bank's transformation.

Navigating Change: Steady Leadership In Turbulent Times

The banking world has been a rollercoaster in recent decades. From economic dips to regulatory changes, Grand Valley Bank has faced its share of challenges. This demanded thoughtful leadership and a commitment to its founding principles.

By staying true to its core values and focusing on the long term, Grand Valley Bank has weathered these storms while continuing to serve its customers. This resilience not only kept the bank steady but also built its reputation for reliability and community support.

Banking Services That Actually Match Your Real Life

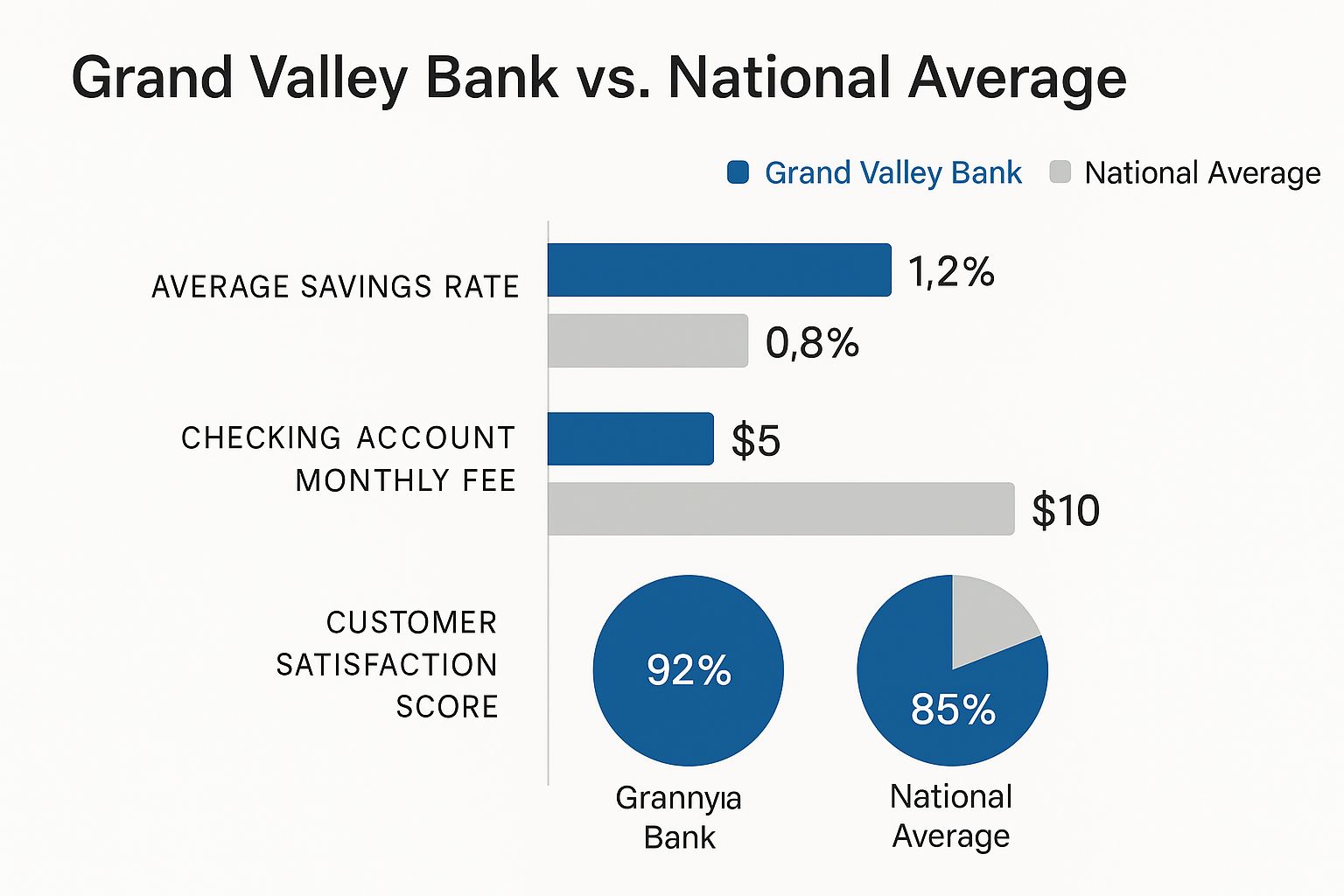

This infographic gives you a quick snapshot of how Grand Valley Bank stacks up against the national averages. They’re outperforming in key areas, boasting a higher average savings rate, lower checking account fees, and—this is a big one—a significantly better customer satisfaction score. It really showcases their commitment to providing real value and personalized service.

Grand Valley Bank goes beyond the usual checking and savings accounts. They get that everyone's financial life is different, like a fingerprint. So, whether you're buying your first home, a seasoned investor, or running a local business, they have options tailored for you.

Home Financing Tailored to Your Local Market

Buying your first home is a huge milestone. It can feel like navigating a maze, especially the mortgage process. At Grand Valley Bank, their mortgage officers aren't just paper-pushers. They're your guides, helping you find the right loan for your budget and explaining the ins and outs of the local market. Think of them as local experts, offering insights into specific neighborhoods, connecting you with trusted real estate agents, and giving personalized advice based on their deep understanding of the area.

Business Banking That Moves at Your Pace

For business owners, time is precious. Grand Valley Bank gets this. They streamline the lending process, offering faster decisions and more flexible terms than many larger institutions. This agility allows businesses to jump on opportunities, manage cash flow effectively, and adapt to market changes. Plus, their local expertise means they understand the specific challenges and opportunities facing businesses in the area, providing valuable guidance and support.

Investing in Your Future With Trust and Expertise

Planning for retirement or managing complex estates isn't something you can do on a whim. It requires careful thought and planning. Grand Valley Bank offers trust services to help families navigate these intricate transitions. Their trust officers work closely with you, offering personalized guidance and developing strategies that align with your long-term goals. It’s like having a trusted advisor in your corner, helping you secure your financial future and protect your family.

Let's talk about community involvement. Grand Valley Bank goes the extra mile with specialized offerings like agricultural lending and support for local non-profits. This shows their dedication to serving the unique needs of their community, going beyond typical banking services. They focus on building lasting relationships and understanding each customer’s individual situation, making banking feel personal, not transactional.

To illustrate the breadth of their offerings, let’s look at a comparison of their key services:

Grand Valley Bank Service Comparison

Comparison of Grand Valley Bank's key services across personal, business, and investment categories

| Service Category | Key Features | Target Customers | Competitive Advantages |

|---|---|---|---|

| Personal Banking | Checking & Savings Accounts, Mortgages, Personal Loans | Individuals, Families | Higher average savings rate, lower checking account fees, personalized mortgage advice |

| Business Banking | Business Loans, Lines of Credit, Commercial Real Estate Loans | Small to Medium-Sized Businesses, Local Entrepreneurs | Streamlined lending process, flexible terms, local market expertise |

| Investment & Trust Services | Retirement Planning, Estate Management, Trust Administration | Individuals, Families, Businesses | Personalized guidance, long-term financial planning strategies, experienced trust officers |

This table highlights how Grand Valley Bank caters to a diverse range of customers with tailored solutions. Their competitive advantages stem from their commitment to personalized service, local expertise, and streamlined processes. This focus sets them apart from larger institutions and makes them a valuable partner for individuals, families, and businesses alike.

Where Convenience Meets Personal Touch: Branches and Digital Banking

This snapshot of Grand Valley Bank's website speaks volumes. Pictures of local businesses and families highlight their commitment to community. The clean, straightforward design, with easily accessible "locations" and "online banking" tabs, shows their focus on balancing personal connection with digital ease.

Grand Valley Bank gets it: today's banking needs both digital convenience and a human touch. They're not about blanketing the map with branches; they're strategically placed in communities where they can truly make a difference. Currently, they operate nine locations across Colorado and Utah.

Branching Out Strategically: Serving Distinct Communities

These branches aren't just brick and mortar; they're community anchors. Each one is staffed with local decision-makers who understand the pulse of the regional economy and the particular needs of their customers. This local knowledge is what sets Grand Valley Bank apart.

For example, a loan officer in Grand Junction, Colorado, has a much better understanding of the local housing market than someone far away. This allows for quicker, smarter lending decisions that benefit both the bank and the customer. It’s about building relationships and truly grasping the needs of each community they serve. This focus strengthens the bond between the bank and its customers.

Digital Banking Done Right: Seamless Integration With Personal Service

But convenience shouldn't stop at the branch door. Grand Valley Bank provides a robust digital banking platform, too. It's not about replacing face-to-face interactions; it's about making them more meaningful. Customers can handle routine tasks online, freeing up time for more important discussions with their bankers.

Think of your local coffee shop. You can order your usual online, saving time in the morning rush. But if you want to discuss a new roast or ask about brewing techniques, you can still chat with your barista. Grand Valley Bank operates in the financial technology space; see how other companies are handling verification in Fintech. You might be interested in: Open Banking Is Innovating Finance. This blend offers the best of both worlds.

The Power of a Hybrid Approach: Benefits for You

This hybrid model offers several key advantages:

- Mobile Banking: Manage your money on the move.

- Online Tools: Access and manage your finances around the clock.

- Personal Support: Connect with real people for complex matters.

This combination of technology and personal connection is what modern community banking should be. It's about empowering customers with easy-to-use tools while ensuring expert help is always available.

What Grand Valley Bank's Rates and Terms Really Mean For You

Understanding Grand Valley Bank's rates and terms isn't just about comparing numbers. It's about seeing how their unique approach to pricing and terms translates into actual benefits for you. Let's explore how Grand Valley Bank structures its deposit rates, loans, and fees to offer advantages that might not be immediately obvious.

Beyond the Numbers: A Relationship-Based Approach

Grand Valley Bank's decision-making process distinguishes them from larger, automated institutions. Instead of relying solely on credit scores and algorithms, they emphasize understanding their customer's financial picture within the local community context. Think of it like this: a small business owner with varying income might find a more sympathetic ear at Grand Valley Bank compared to a national bank with strict lending rules. This personal touch can lead to better terms, particularly for those with strong local ties or unusual financial situations. For secure and easy digital banking, Grand Valley Bank also uses cloud hosting.

Specialized Products: Catering to Community Needs

Grand Valley Bank offers specialized products designed for the specific needs of their customers. From adaptable business loans tailored to the local economy to personalized investment options for individuals, their offerings reflect their community focus. This contrasts with larger banks that often offer one-size-fits-all products that may not suit everyone. These specialized services show Grand Valley Bank's understanding of their customers' particular circumstances.

Evaluating Your Financial Needs: Aligning with Grand Valley Bank

To decide if Grand Valley Bank is the right fit for you, think about your own financial goals and how their offerings match up. Do you value personal service and a local focus? Would you benefit from flexible loan options or specialized products? These questions will help you determine if Grand Valley Bank provides a real advantage over smaller community banks or national institutions. You can also explore automating your financial reports with Visbanking’s solutions. This can help you better understand and manage your finances, leading to informed decisions when choosing a bank.

Maximizing Your Banking Relationship: Building a Strong Connection

Developing a good relationship with your Grand Valley Bank team is essential to getting the most out of your banking experience. Understanding their decision-making process and community connections can provide financial advantages beyond just rates and terms. By actively engaging with your local branch, you can tap into valuable local insights and use their community knowledge to your benefit. This personalized approach can result in more tailored financial advice and better results over time, making banking a collaborative process that helps you reach your financial goals more effectively.

To give you a clearer picture of their offerings, here's a look at their current rates:

Grand Valley Bank Interest Rates Overview Current interest rates and terms for major deposit and lending products

| Product Type | Interest Rate Range | Minimum Balance | Key Terms |

|---|---|---|---|

| Checking Account | 0.01% - 0.10% | $0 - $500 | Varies based on account type |

| Savings Account | 0.10% - 0.25% | $1,000 | Tiered interest rates |

| Money Market Account | 0.25% - 0.50% | $5,000 | Limited transactions |

| Certificate of Deposit (CD) | 0.50% - 2.00% | $1,000 | Variable terms and rates |

| Auto Loan | 4.00% - 8.00% | N/A | Terms up to 72 months |

| Mortgage | 5.00% - 7.00% | N/A | 15 or 30 year terms |

| Personal Loan | 7.00% - 12.00% | N/A | Variable terms and rates |

| Business Loan | 6.00% - 10.00% | N/A | Terms and rates based on business needs |

This table represents example rates and may not reflect current offers. Please contact Grand Valley Bank for the most up-to-date information.

As you can see, Grand Valley Bank offers a range of products with varying rates and terms. It's crucial to discuss your specific needs with a bank representative to find the best fit for your situation.

Beyond Banking: How Grand Valley Bank Shapes Communities

Community banking. It’s a phrase we hear a lot, but what does it truly mean? For Grand Valley Bank, it's about building genuine relationships and having a real impact on the lives of their customers and the local economy. It's about understanding the individual, not just their financial data.

Real-World Examples of Relationship Banking

Imagine you're a small business owner in Grand Junction looking to expand. You walk into Grand Valley Bank, not to face a cold algorithm, but a loan officer who actually understands the unique challenges of the local market. They get the nuances of doing business in your area. This local knowledge translates into loan decisions based on a real understanding of your potential, not just a credit score.

Now, picture a young family buying their first home. Navigating the real estate market can be daunting. At Grand Valley Bank, loan officers act as guides, sharing their insights into neighborhoods and local trends. It’s a personal touch that can make all the difference in such a significant life event.

Community Investment Initiatives

Grand Valley Bank's commitment goes beyond individual customers. They're actively involved in community investment initiatives, supporting local non-profits and financing projects like affordable housing. These are often the projects overlooked by larger institutions, but they are vital to the health and growth of the community. Want to dive deeper into this topic? Check out this article: The role of community banking in local economies.

Local Impact and Economic Development

Grand Valley Bank is deeply rooted in the community. They hire locally and participate in community boards. This ensures that decisions are made by people who are invested in the area's success. Their lending practices keep money circulating within the region, fueling local economic development and creating a ripple effect of positive impact.

Choosing a community bank like Grand Valley Bank means your deposits aren't just sitting in a vault. They're actively working to support local businesses, create jobs, and contribute to the overall economic health of your region. It's a symbiotic relationship. The bank thrives when the community thrives. That’s the power of community banking in action.

Making Smart Banking Choices: Your Grand Valley Bank Guide

Is Grand Valley Bank the right fit for your financial needs? This guide walks you through practical scenarios and strategies to help you decide. We'll explore the advantages and disadvantages, empowering you to make informed choices that align with your unique financial goals.

Evaluating Grand Valley Bank Against Your Needs

Choosing a bank isn't about flashy advertisements; it's about finding a financial partner who understands you. Think of it like choosing a family doctor – you want someone knowledgeable, easy to talk to, and attentive to your concerns. Grand Valley Bank’s strength lies in its community-focused approach. If personalized service and local expertise are important to you, this can be a huge plus.

However, if you prioritize having a wide array of digital tools or need access to a large international network, a bigger bank might be a better match. It’s all about finding the right fit for your specific circumstances.

Maximizing Your Banking Relationship

If you choose Grand Valley Bank, there are ways to make the most of your banking experience. Building a solid relationship with your banking team is essential. This involves open communication about your financial goals and any obstacles you might face. Their local knowledge can be incredibly valuable, offering insights and advice tailored to your community.

Grand Valley Bank’s commitment to the community goes beyond just financial services. This personal connection can be a powerful tool in helping you achieve your financial aspirations. Learn more about the importance of strong customer retention strategies.

Transitioning and Expectations

Switching banks can seem like a hassle, but Grand Valley Bank makes the process as smooth as possible. They offer support for transferring accounts and setting up online banking. When it comes to customer service, expect a personal touch. While they provide digital tools, their core focus remains on human interaction.

This means you can expect to talk to a real person when you need assistance, instead of navigating complicated automated systems. This commitment to personal service is a defining characteristic of their community banking philosophy.

For a deeper understanding of how community banks influence local economies, visit Visbanking and explore their resources. Their Bank Intelligence and Action System (BIAS) provides valuable data on how banks can effectively serve their communities, offering tools for strategic decision-making and operational enhancement. This system combines data analysis with practical solutions to help banks like Grand Valley Bank thrive in today’s financial world.