First National Bank of Grayson: Your Local Banking Partner

Brian's Banking Blog

Why Community Banking Still Matters In Today's World

Choosing a bank is a big decision. While massive national chains are everywhere, their one-size-fits-all service can feel cold and inflexible. Have you ever felt like just another account number?

Community banks are different. They operate less like a giant corporation and more like a helpful neighbor who actually knows your name. Their foundation is built on understanding the local community because they are part of the local community.

Decisions Made by Neighbors, Not Algorithms

At a big bank, your loan application often gets crunched by a computer hundreds of miles away. An algorithm decides your fate based on pure data, with no room for context.

A community institution like First National Bank of Grayson sees the person behind the application. Decisions are made by people who live and work in your town. They can consider important things an algorithm can't, like your character, the potential of your business, and your standing in the community. This means a local business owner or a family with a unique situation gets a fair and thoughtful review.

The True Value of a Community-First Approach

This local focus creates a powerful feedback loop. The money you deposit doesn't get shipped off to a corporate headquarters; it's put right back to work in your town. It becomes the mortgage for a new family down the street or the small business loan that helps a local shop expand.

This directly fuels your local economy. You can see a detailed breakdown of the role of community banking in local economies to learn more. This trust is also built on a solid commitment to security. For businesses that need an extra layer of defense for their digital assets, looking into solutions like Managed Network Security is a smart move.

The Story Behind Your Neighborhood Bank

What makes a bank more than just a place to deposit a check? It's the story—the decades of decisions, challenges, and commitments that build lasting trust in a community. The journey of the First National Bank of Grayson started nearly a century ago, and its history is key to understanding its role in the region today.

A Foundation Built on Local Trust

Think of the bank like a deeply rooted oak tree. While economic storms come and go, its strong foundation in the local soil keeps it standing firm. Since its beginning, the bank has navigated countless challenges by sticking to one simple rule: serve the community first. This isn't just about surviving; it’s about providing consistent, reliable support to local people and businesses.

This community-first approach is embedded in its official structure. Founded in 1926, The First National Bank of Grayson is a wholly-owned subsidiary of First Grayson Bancorp, Inc., a one-bank holding company. This setup provides the stability of a larger entity while ensuring that important decisions are made by local leaders who know the area's needs firsthand. You can review the bank's official structure with the OCC.

This deep community connection is what allows a historic institution to adapt to modern times without losing its personal touch. Staying relevant means listening, a principle that applies to all successful organizations. For example, many companies now use strategies like B2B social listening to better understand their customers. For the bank, this dedication to listening is how it has evolved from its small-town origins into a modern financial partner for Grayson.

Ultimately, this history shapes a philosophy that prioritizes relationships over rigid corporate policies. It’s an approach that continues to resonate with local families and businesses who want a banking partner invested in their success. This focus on community is a quality shared by other strong local institutions, such as the First Bank of Ohio.

Banking That Fits Your Schedule And Lifestyle

What good is a bank if you can never get there in time? Life is busy, and your financial tasks don’t always fit neatly between 9 a.m. and 5 p.m. First National Bank of Grayson understands this reality. Their services are built around the lives of working families and local business owners, providing practical solutions that respect your time.

Making Banking Work For You

Whether you're coming home after a day at Grayson Lake State Park or simply need to deposit a check after work, convenience is essential. The bank has intentionally designed its locations and hours to serve the community effectively. Think of their services as tools to make your financial to-do list a little shorter and your day a little smoother.

This commitment to real-world accessibility is evident in how they operate:

- Bank from your car with extended drive-through hours that help you handle most transactions without slowing down your day.

- Access your cash anytime with a network of strategically placed ATMs available 24/7.

- Enjoy a welcoming environment in branches designed to be easy to navigate for everyone, including those with mobility challenges.

- Take care of business on the weekend with Saturday hours, offering a crucial window for those with packed weekday schedules.

To help you plan your visit, here’s a clear guide to the hours and services available at each First National Bank of Grayson branch.

Branch Services And Hours Overview

| Location | Weekday Hours | Saturday Hours | Drive-Through | ATM Access |

|---|---|---|---|---|

| Main Office (Grayson) | Lobby: 9 AM–4 PM; Drive-Thru: 8 AM–5 PM | Drive-Thru: 9 AM–12 PM | Yes | 24/7 |

| East Main (Grayson) | Lobby: 9 AM–4 PM; Drive-Thru: 8 AM–5 PM | Drive-Thru: 9 AM–12 PM | Yes | 24/7 |

| Olive Hill | Lobby: 9 AM–4 PM; Drive-Thru: 8 AM–5 PM | Drive-Thru: 9 AM–12 PM | Yes | 24/7 |

| Morehead | Lobby: 9 AM–4 PM; Drive-Thru: 8 AM–5 PM | Drive-Thru: 9 AM–12 PM | Yes | 24/7 |

As the table shows, with multiple locations, extended drive-through options, and weekend availability, the bank makes it much easier to fit your financial errands into your actual life.

This widespread physical presence isn't just about buildings and business hours. It represents a tangible commitment to being a dependable and accessible partner for every member of the community.

Finding The Right Account For Your Real Life

Choosing a bank account is a bit like packing for a trip. The gear you’d bring for a day hike through Grayson Highlands State Park is much different than what you'd need for a week-long expedition. In the same way, the right account at First National Bank of Grayson really depends on where you are in your financial journey.

Personal Accounts For Your Goals

Whether you're just starting out or managing a full household, there's an account built for your specific situation. The goal is to match the account's features to your lifestyle, so you can skip unnecessary fees and get the most out of your money.

- For the Recent Graduate or Student: A simple checking account is your foundation. You'll want to look for one that has no monthly maintenance fees or a low minimum balance requirement. The focus here is on easy, no-fuss access to your money for daily life without surprise costs.

- For the Growing Family: Your financial picture is getting bigger. An interest-bearing checking account helps your money work for you, while a high-yield savings account helps you plan for major goals like a down payment or college funds. A joint account can also make managing shared expenses much simpler.

Empowering Local Businesses

First National Bank of Grayson also focuses on providing the right tools for local entrepreneurs. Think of their business accounts as a financial toolkit, built with a true understanding of what it takes to run a company in our area.

These accounts are more than just a place to keep your money. They come with services that are essential for growth.

- Cash Management Solutions: These services help you optimize your cash flow so your money is always working efficiently.

- Higher Transaction Limits: As your business grows, you'll need to handle more payments and deposits, and these accounts are built for that.

- Merchant Services: This feature makes it easy for you to accept credit and debit card payments from customers.

By understanding the local market, the bank offers practical advice and account options that genuinely support a company’s success. This kind of local partnership is a powerful asset for any business owner.

Supporting Local Dreams Through Smart Lending

How a bank handles lending tells you a lot about what it really cares about. For many large institutions, it's a cold calculation based on algorithms. But for First National Bank of Grayson, lending is personal. It's about planting seeds in their own backyard and watching the community flourish.

Their loan decisions are guided by a deep knowledge of the Grayson area, focusing on choices that build a stronger town for everyone, not just on maximizing profit. This approach opens real doors for the people and businesses who call this region home.

A Portfolio That Builds The Community

You can see this commitment in the numbers. The bank’s loan portfolio isn't just a spreadsheet; it's a story of local support. As of 2018, an impressive 36.59% of their loans—totaling $60,658,000—went toward helping families buy homes. Another 23.25%, or $38,553,000, was dedicated to consumer loans for everyday needs.

These aren't just abstract figures. They represent a powerful cycle of reinvestment right back into the community, as most of these loans are for people living in the area. You can see the full breakdown for yourself in the bank's public performance evaluation.

This is how a local economy stays healthy. When you deposit your money here, it doesn't vanish into a national pool. It gets put to work funding your neighbor's mortgage or helping a local shop expand. To understand more about this important metric, you can learn more about the loan-to-deposit ratio and what it reveals.

The Advantage of Local Decision-Making

So, what does this local focus mean when you need a loan? It means you're a person, not just a data point. The loan officers at First National Bank of Grayson look beyond your credit score to understand your full story and your connection to the community. They know the local market and can see the potential in a new downtown business that a computer thousands of miles away would miss.

This human-centered approach often makes all the difference. It means:

- Your story gets heard: They listen to your specific situation and goals.

- They know the neighborhood: Decisions are based on a real-world understanding of local business trends and property values.

- Relationships count: Your banking history with them is a valuable part of the conversation.

Ultimately, this careful process does more than just approve loans. It helps build a more stable and prosperous Grayson for everyone.

Digital Banking Without The Digital Headaches

New technology should make your life simpler, not add another layer of complexity. The digital banking platforms from First National Bank of Grayson are designed with this philosophy at their core. They offer a full range of capable features without a steep learning curve, giving you complete control over your finances from your phone, tablet, or computer.

Tools That Truly Save You Time

Think about depositing a check without leaving your house or handling all your monthly bills in just a few minutes. This is the kind of practical convenience these digital tools provide.

- Mobile Check Deposit: Just take a picture of your check with your phone to deposit it straight into your account.

- Online Bill Pay: Set up single or automatic recurring payments to sidestep late fees and save yourself time and postage.

- Custom Alerts: Receive notifications for important activity, like low balances or large transactions, so you always know what's happening with your money.

To give you a clearer picture of how these tools work in practice, the table below compares the features available on the bank's online platform versus its mobile app.

Digital Banking Features And Capabilities

Comprehensive comparison of online and mobile banking tools, security features, and user experience elements

| Feature | Online Banking | Mobile App | Security Level | User Rating |

|---|---|---|---|---|

| Mobile Check Deposit | Not Available | ✅ | High | 4.8/5 |

| Online Bill Pay | ✅ | ✅ | High | 4.7/5 |

| Custom Alerts | ✅ | ✅ | High | 4.6/5 |

| Fund Transfers | ✅ | ✅ | High | 4.7/5 |

| Multi-Factor Authentication | ✅ | ✅ | Very High | 4.9/5 |

As the table shows, core banking functions are available on both platforms, giving you the flexibility to manage your finances however you prefer.

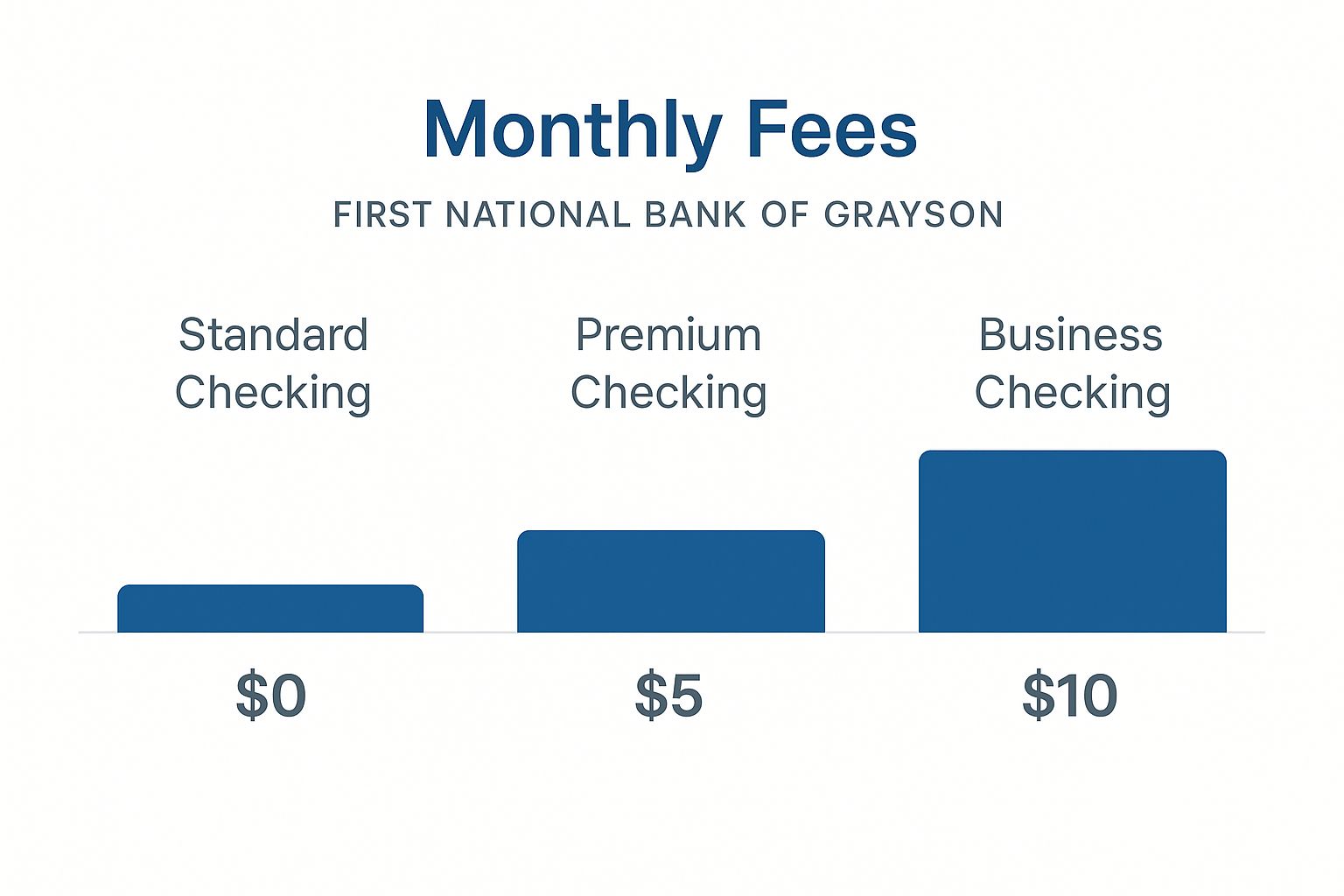

Another part of a straightforward banking experience is fee transparency. This chart breaks down the low monthly fees for the most popular accounts.

This visual makes it obvious that everyday banking can be very affordable, with some options starting at $0 per month.

Secure and Simple Access

While strong security is essential, it shouldn't feel like you're trying to break into a vault just to check your balance. First National Bank of Grayson uses modern security like multi-factor authentication, which acts like a second, unique digital key for your account. This approach safeguards your information without making the login process a chore.

If you ever hit a technical bump, real help from knowledgeable people is just a call away. This mix of easy-to-use technology and accessible human support delivers the best of both worlds: modern financial tools with a genuinely personal touch.

Financial Strength That Supports Community Growth

A bank's financial health is the foundation upon which its services are built. Think of it like the foundation of a house; a strong, stable base is essential to support the families and community it serves. For customers, this stability creates confidence—the peace of mind that your money is secure and the bank has the resources to back local needs.

How Financial Health Translates to Real-World Benefits

Financial reports might look like a jumble of numbers, but they tell a straightforward story about a bank's reliability. A healthy bank has the means to offer competitive loan rates and invest in improving its services. The First National Bank of Grayson shows this strength with a solid financial standing, holding approximately $361,935,000 in total assets.

Key performance indicators paint a clear picture of efficiency and profitability:

- Return on Assets (ROA): 1.73%

- Return on Equity (ROE): 17.02%

These strong figures, detailed in their latest financial call report, confirm the bank’s stability and its ability to provide lasting support to the community.

A Commitment Proven by Action

Beyond the balance sheet, a bank's dedication is measured by its actions. This is formally assessed through the Community Reinvestment Act (CRA), a regulation that grades how well a bank meets the credit needs of everyone in its service area, including low- and moderate-income neighborhoods.

A strong CRA rating is proof of a genuine commitment to fair lending and equitable local investment. It shows the bank is actively working to support the entire community, ensuring financial resources are available where they can make a significant impact. This financial muscle also allows the bank to invest in tools that improve the customer journey. For businesses looking at similar improvements, options like a WhatsApp Chatbot Integration can be worth exploring.

Ultimately, the financial strength of First National Bank of Grayson isn't just about its own success. It is the engine that powers reliable services, competitive products, and meaningful growth for the families and businesses that make the community what it is.

Service And Security That Actually Protects You

Great service is more than just a friendly greeting. It’s about having a real person in your corner who can help you solve problems, whether you have a quick question or need a guide for a major financial decision. At First National Bank of Grayson, support is built on a foundation of genuine help.

Getting Help When You Need It

The bank makes it simple to find support, so you’re never left searching for an answer. You have several clear paths to a solution.

- Phone Support: Call and speak with an actual person who is ready to listen and understand your needs.

- In-Person Consultations: Sit down face-to-face to discuss more complex financial situations and get personalized advice.

- Online Resources: Find clear information and answers to common questions anytime on their website.

A Proactive Approach to Security

Your financial security is the bank's top priority. Think of their security protocols as a vigilant watchdog for your accounts, not just a lock on the door. They use strong measures to protect your personal information.

This includes proactive fraud prevention and giving you clear steps to follow if you ever suspect unusual activity. The goal is to give you the knowledge you need to protect yourself and make smart, safe financial choices.

This commitment to the community's financial well-being is backed by real action. The bank originated an impressive 85% of its residential real estate loans and 84% of its consumer loans right within its local community. This focus shows a strong track record in meeting local credit needs, a fact you can review in their official performance evaluation.

That kind of local investment builds a level of trust that can't be bought. For banking professionals who want to build similar community-focused success, data-backed strategies are key. To see how data can help your institution achieve its goals, see what Visbanking can do.