Deconstructing the Fifth Third Bank Growth Strategy

Brian's Banking Blog

For bank executives and directors, analyzing a competitor’s strategy is not an academic exercise. It is a critical intelligence-gathering operation designed to sharpen your own strategic execution.

The Fifth Third Bank growth strategy offers a compelling case study in disciplined execution. It is not a pursuit of fleeting trends, but a methodical blueprint for expanding high-quality loan segments, deploying capital with precision, and capturing market share in high-value verticals like commercial payments and wealth management. This is a strategy built on hard data, not intuition, engineered to deliver stability and growth in volatile economic conditions.

The Blueprint for Fifth Third's Strategic Growth

A granular analysis of Fifth Third’s strategy reveals a masterclass in building a resilient institution. For any bank leadership team, this model warrants close examination. It is a proactive framework, grounded in data, that prioritizes deliberate execution over reactive market responses.

Their approach is not simply about asset growth; it is a calculated balancing act. Aggressive moves in targeted areas are counterweighted by conservative risk management in others, creating a powerful equilibrium that protects the balance sheet while enabling strategic market share capture. Let's examine the data to understand why this approach is effective.

Core Strategic Pillars

Fifth Third's performance is not accidental. It is the outcome of several interdependent strategic pillars, with each decision informed by deep data analysis.

Disciplined Loan Portfolio Expansion: The bank does not pursue indiscriminate loan growth. It targets specific, high-quality segments. For example, a strategic decision might be to expand the commercial and industrial (C&I) loan book by 5% while systematically reducing exposure to more speculative commercial real estate. This is not a guess; it is a calculated action dictated by internal risk models and market data.

Targeted Market Penetration: The expansion into high-growth Southeastern markets is more than branch openings. It is a full-scale deployment of integrated services—from consumer banking to wealth management—designed to capture significant market share in economically vibrant regions.

Focus on Fee-Based Income: With net interest margins under perpetual pressure, growing non-interest income is a strategic imperative. Fifth Third has concentrated efforts on expanding its treasury management platform for commercial clients and scaling its wealth and asset management division. This builds a durable, high-margin revenue stream less susceptible to interest rate fluctuations.

The key takeaway for executives is how a balanced, data-driven strategy enables an institution to play both offense and defense. Competitor analysis transforms from a historical review into a tool for architecting your own future success.

As part of this forward-thinking approach, leading institutions are leveraging new technologies for a competitive edge. For instance, developing capabilities in AI for Sustainability Reporting is becoming essential for operational efficiency and stakeholder confidence.

Ultimately, the power behind this blueprint is its foundation in data. Decisions are driven by quantitative analysis, not supposition. Platforms like Visbanking provide the granular data necessary to benchmark your own institution against these strategic moves, transforming analysis into actionable intelligence. Before you can execute a winning playbook, you must first know precisely where you stand.

Building Revenue Resilience Through Diversification

The true measure of a bank's strategic strength is revealed not in favorable conditions, but during economic turbulence. For any bank director, analyzing a peer's performance through a downturn provides a masterclass in building resilience. The Fifth Third Bank growth strategy is a prime real-world example of how to construct an income structure that can absorb shocks and capitalize on recovery.

This resilience was not an accident; it was the result of a deliberate strategy to diversify income streams. This model acts as a finely tuned counterweight system. When one revenue source, such as consumer lending, is compressed by rising rates, another segment—like commercial treasury management—generates stable fee income to offset the pressure.

The evidence is in the data. An examination of Fifth Third’s recent performance reveals this resilience in action. Even while navigating a market-driven revenue dip of 2.99% in one year, the bank generated a formidable $7.95 billion in total revenue.

This followed a remarkable 26.63% revenue surge during the post-pandemic recovery, which itself came after a 16.99% contraction at the height of the disruption. That rebound was not happenstance; it was propelled by a disciplined focus on consumer households, commercial clients, and wealth management—a model proven to be effective.

The Power of a Diversified Engine

A diversified model breaks the dependency on net interest margin (NIM). It involves building multiple growth engines that perform differently across various economic cycles.

For Fifth Third, this strategy is built on three key pillars:

- Consumer Households: This extends beyond basic deposit accounts to encompass mortgages, auto loans, and credit cards—creating deep, multi-product relationships that are significantly more profitable over the long term.

- Commercial Relationships: A primary source of non-interest income. By delivering sophisticated treasury management, payments, and capital markets services, the bank becomes integral to a client's operations, locking in consistent, high-margin fee revenue.

- Wealth & Asset Management: A high-margin business generating stable, fee-based revenue that is less correlated with interest rate cycles, providing an invaluable buffer during market volatility.

The critical insight for any bank board is that resilience is not reactive; it is built by design. It requires ensuring that a slump in one business line does not compromise the entire institution's profitability.

From Analysis to Action with Data Intelligence

Observing Fifth Third’s success is one thing; applying those lessons requires granular data. Bank executives must move beyond high-level summaries and ask specific, data-backed questions about their own institution.

For instance, what is your precise ratio of interest to non-interest income compared to a peer group of top performers? If 85% of your revenue derives from NIM while high-performing peers operate closer to 65%, you have just identified a significant strategic vulnerability.

This is precisely the insight a data intelligence platform like Visbanking is designed to provide. It allows you to model how adjustments to your business mix could directly enhance revenue stability.

This data-first approach fundamentally changes strategic planning. You are no longer operating on assumptions. You can pinpoint concentration risks and identify growth opportunities with precision before market pressures force a reactive response. For boards looking to fortify their institution's financial foundation, our guide on effective bank growth strategies offers additional frameworks for immediate application.

The Fifth Third case demonstrates that disciplined expense management and a diversified balance sheet are not merely defensive tactics. They are offensive weapons that enable a bank to absorb volatility and emerge from downturns positioned to capture market share. The first step is to benchmark your own performance and identify the opportunities hidden within your data.

Wielding Capital Management as a Strategic Weapon

Many institutions treat capital management as a regulatory compliance function. Fifth Third Bank demonstrates that it can be one of the most potent offensive tools for driving shareholder value and signaling market confidence.

This is not about simply meeting capital adequacy ratios. It is about actively using the balance sheet to reward investors and fund growth simultaneously. For bank executives, the takeaway is clear: a static capital plan represents a significant missed opportunity. Your capital strategy must be dynamic and tightly integrated with your core business objectives.

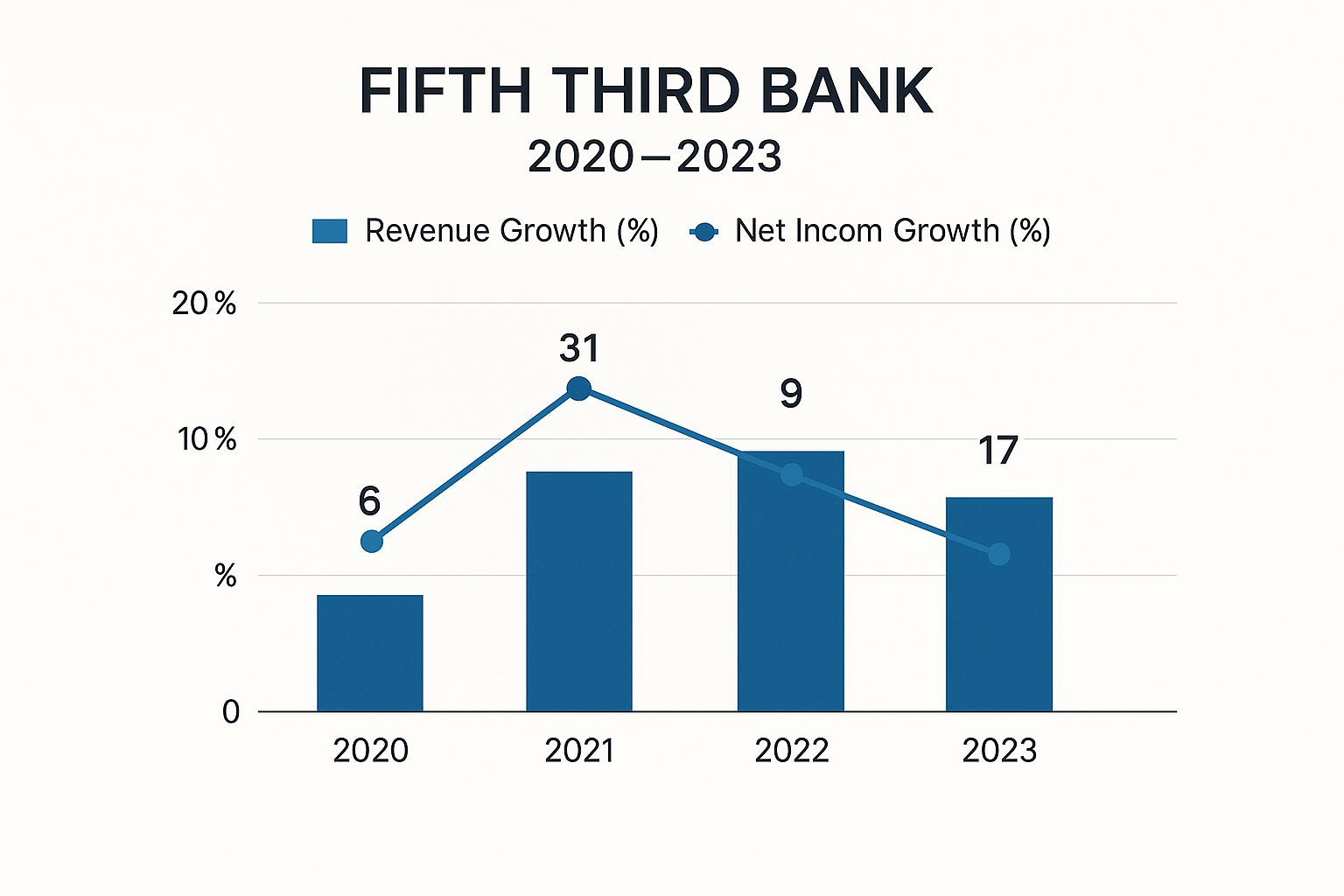

The chart below illustrates how Fifth Third’s strategic decisions translate into tangible results, showing a strong post-pandemic rebound in revenue and net income, supported by a steady expansion of its physical branch network between 2020 and 2023.

This visual underscores their balanced approach—pursuing digital innovation while concurrently investing in physical presence, all while maintaining robust financial performance.

Turning Capital Into a Growth Catalyst

A clear example of Fifth Third’s proactive capital strategy can be seen in its recent actions. In a single quarter, the bank generated $478 million in net income and immediately executed $225 million in share repurchases.

This is more than an accounting entry; it is a strategic declaration. A buyback of this magnitude signals deep conviction from leadership in the stock's intrinsic value and the bank's future earnings power.

This action directly rewards shareholders, contributing to a 5% year-over-year increase in tangible book value per share (excluding AOCI). As CEO Tim Spence has noted, it reflects a disciplined balance between stability, profitability, and growth. The full quarterly results and strategic commentary are available in Fifth Third's latest investor relations update.

The lesson for any board of directors is that returning capital to shareholders should not be viewed as competitive with business investment. Fifth Third proves they are two sides of the same strategic coin.

The Visbanking Perspective: Data-Driven Capital Decisions

Executing a sophisticated capital strategy requires more than intuition; it demands precise, granular data intelligence. How does your institution’s capital efficiency truly compare to a leader like Fifth Third? Are your capital returns generating measurable value, or could that capital be more effectively deployed to fund a new high-margin lending initiative?

These questions cannot be answered with hunches. They demand rigorous, objective comparison of your performance against a relevant peer group. This is where platforms specializing in financial data integration become indispensable.

To see how Fifth Third's strategies translate into hard metrics, consider this snapshot of their recent performance.

Fifth Third Bancorp Performance Metrics (Q1 Snapshot)

This table isolates key performance indicators from Fifth Third's recent reporting, demonstrating the direct outcomes of their strategic initiatives.

| Metric | Value | Strategic Implication |

|---|---|---|

| Net Income | $478 Million | Strong core profitability that fuels capital return programs. |

| Share Repurchases | $225 Million | Aggressive signal of confidence in undervaluation and future growth. |

| TBV per Share Growth | +5% YoY | Demonstrates direct value creation for shareholders from capital actions. |

| ROTCE (ex. AOCI) | 14.2% | High return on equity shows capital is being deployed efficiently. |

These figures are not vanity metrics; they are the result of a deliberate strategy. They prove that pairing operational excellence with shrewd capital management yields sustainable, profitable growth that the market recognizes and rewards.

Without this level of data-driven insight, strategic planning is speculative. To make your capital work more effectively, you must benchmark your efficiency.

- Benchmark tangible book value per share growth against peers to determine if buybacks are creating meaningful value.

- Analyze your return on tangible common equity (ROTCE) to ensure capital is deployed efficiently, not idly.

- Model different capital actions to quantify the potential impact on your KPIs before committing capital.

The Fifth Third growth strategy is a powerful case study. The first step for your own institution is to conduct an honest assessment of your data. Identify where your capital is truly productive—and where it could be deployed to greater effect.

Connecting Strategy to Shareholder Value

Ultimately, the stock market is the final arbiter of strategic success. A brilliant strategy on paper is meaningless if it fails to translate into shareholder value.

This is where the Fifth Third Bank game plan demonstrates its full power. The bank has successfully drawn a direct line from its disciplined operational execution to a stock performance that rewards investors. For any bank director, this is the paramount objective: justifying strategic investments by proving that leadership is pulling the right levers for long-term value creation.

Turning Operations Into Investor Confidence

Investors in the regional banking sector value one attribute above all others: predictability. They seek institutions that can deliver steady, reliable growth without taking on undue risk. Fifth Third’s strategic blend of consumer banking, commercial services, and wealth management delivers precisely that.

This diversified model functions as a natural shock absorber. When rising interest rates compress consumer lending margins, stable fee income from wealth management and commercial treasury services provides a vital cushion. This smooths earnings volatility and sends a clear signal to the market: this institution is built to perform consistently, regardless of the economic climate.

The data confirms this narrative. Over a recent 12-month period, Fifth Third Bancorp’s stock climbed approximately 4.8%, with shares trading near $43.54. This is not an anomaly. It is the direct result of their deep-rooted presence in key markets and a resilient product mix, a story detailed in analyses of FITB's market performance. The stock's stability reflects investor confidence in the bank's management and strategy.

The core lesson is that durable market confidence is built on consistent, strategic growth in core business lines—not on the pursuit of short-term, speculative gains.

The Data Behind the Buzz

How can a board know with certainty that its strategy is what's driving shareholder value? The answer lies in the data. You must connect internal key performance indicators (KPIs) to the market outcomes they produce.

A sophisticated data intelligence system makes these connections transparent. For instance, a bank could track how a 10% increase in non-interest income from its wealth division correlates with its price-to-earnings (P/E) ratio relative to peers. This shifts the conversation from conjecture to evidence.

- Loan Growth vs. Stock Volatility: Analyze whether growth in your C&I loan book or your CRE portfolio has a greater impact on your stock’s beta. The data will reveal which type of growth the market perceives as "safer" and rewards accordingly.

- Fee Income and Valuation Multiples: Examine the relationship between your fee income as a percentage of total revenue and your price-to-book (P/B) value. A strong, stable fee income stream almost invariably commands a premium valuation from investors.

- Geographic Expansion and Analyst Ratings: As you enter new markets, monitor analyst ratings and price targets. This provides real-time feedback on how the investment community perceives your expansion strategy.

Without this level of deep analysis, strategic narratives lack empirical validation.

This is where a platform like Visbanking becomes a critical tool for governance and strategy. It gives you the ability to see these connections using your own data, benchmarked against top performers like Fifth Third. Instead of merely observing that their stock price increased, you can deconstruct the operational drivers the market rewarded. Armed with that intelligence, your board can make decisions with the confidence that they are directly tied to creating real, sustainable shareholder value.

Turning Competitor Insights into Actionable Strategy

Observing a competitor like Fifth Third Bank is insightful. The strategic value, however, is realized only when those observations are translated into decisive action for your own institution.

For banking leaders, the challenge is not just to identify what they did, but to determine how to adapt their core principles to your bank’s unique market position and balance sheet.

Fifth Third's success was not the result of a single brilliant maneuver, but the consistent application of three core disciplines.

The Three Pillars of Execution

A close examination of their framework reveals a few powerful, repeatable principles that any leadership team can study and adapt.

- A Diversified Revenue Model: They refuse to be over-reliant on net interest income. They aggressively build non-interest income streams, particularly in high-margin areas like commercial payments and wealth management, creating a resilient earnings base that performs across economic cycles.

- Disciplined Capital Management: They treat capital as an offensive tool. Share buybacks, like the recent $225 million repurchase, are executed from a position of strength, signaling confidence and directly enhancing shareholder value.

- Relentless Focus on High-Value Segments: Their growth is targeted, not diffuse. They concentrate resources on specific, profitable niches and high-growth geographies, ensuring maximum return on every dollar of invested capital.

The secret is not to simply copy these tactics. It is to understand the operating system that enables them: data intelligence. A winning growth strategy is always built on a foundation of granular, comparative data.

From Insight to Implementation

Executing a similar game plan requires moving beyond high-level summaries and embedding data into every strategic decision. This is where a platform like Visbanking transitions from a reporting tool into a strategic weapon, designed to help you convert competitor analysis into a concrete action plan.

For example, do not just observe that Fifth Third excels in commercial fee income. Benchmark your own non-interest income as a percentage of revenue directly against theirs and a relevant peer group. If you identify a 15% gap, you have just uncovered a clear, quantifiable strategic objective.

This data-driven mindset applies equally to risk and capital allocation. Before shifting portfolio mix or returning capital, robust modeling is essential. A deep dive into modern stress testing for banks provides the framework to vet major decisions against adverse scenarios, enabling the pursuit of growth without risking the institution.

A banking intelligence platform gives you the power to:

- Benchmark Your Portfolio: Directly compare your loan composition, yield, and risk profile against top performers. This will immediately highlight underperforming segments and hidden strengths.

- Analyze Margin Trends: Deconstruct your net interest margin to understand its components and benchmark them against peers, revealing opportunities to optimize funding costs or asset pricing.

- Model Capital Decisions: Simulate the precise impact of a share buyback or strategic acquisition on your capital ratios and returns before committing capital.

The path to architecting your own powerful growth strategy begins with asking more intelligent questions. It is time to move beyond intuition and access the granular data required to make bolder, more informed decisions. Start by exploring the data to benchmark your performance and uncover your next best move.

Q&A for Banking Execs on Growth Strategy

As a bank leader, assessing the competition is a constant. The critical skill is translating those observations into a winning game plan for your institution. Let's address common questions from executives seeking to deconstruct and apply the principles behind a successful fifth third bank growth strategy.

How Can We Replicate Their Success in Diversifying Revenue?

To build multiple revenue streams like Fifth Third, you must begin with your own data. The objective is not to enter every new market, but to identify your most profitable client segments and determine their unmet needs.

Fifth Third did not expand indiscriminately. They focused on high-value verticals like commercial payments and wealth management, deepening existing relationships.

Use a data intelligence platform to identify the true sources of your revenue. If 80% of your non-interest income comes from commoditized consumer fees, you have a significant concentration risk. Analyze your commercial client base: are you merely a depository, or are you providing integrated treasury management services?

A targeted approach, backed by quantitative analysis of the potential ROI for each new service line, will always outperform a scattershot expansion. Benchmark your product penetration per client against peers to identify the most significant opportunities.

What are the Real Risks of Ramping Up Capital Returns?

The primary risk of an aggressive capital return strategy is sacrificing long-term growth for short-term shareholder appeasement. A large-scale buyback can deplete capital that could otherwise be used for strategic acquisitions, technology investments, or as a crucial buffer in an economic downturn.

The key is balance, driven by data. Fifth Third's repurchases are not made in a vacuum; they are supported by strong earnings and a clear growth forecast. They are not a reactive concession to market pressure.

Before proceeding, you must stress-test your institution. Use capital adequacy models to determine if you can withstand a severe adverse scenario after the buyback. The decision cannot be based on sentiment. It requires a hard-nosed, quantitative comparison: which action generates a superior return? Increasing tangible book value per share via a buyback, or reinvesting that capital into a high-growth, high-margin loan portfolio? Your board requires this data to make a defensible decision.

How Do We Use Data to Carve Out Our Own Niche?

Observing competitors like Fifth Third is necessary, but strategic victory comes from forging a growth path that leverages your unique strengths. This is where data intelligence platforms become indispensable.

First, they enable you to benchmark against the right peers—not just by asset size, but by business mix or geographic footprint. This can reveal where you are a true market leader. You might discover your bank possesses a superior Net Interest Margin (NIM) on commercial real estate loans in a specific metropolitan area. That is a niche to be defended and expanded.

Second, these platforms allow you to model "what-if" scenarios. You can run simulations to see the pro-forma financial impact of shifting your portfolio, entering a new market, or launching a new product, all based on real-world historical data. This transforms strategic planning from an exercise in educated guesswork into a data-driven process. You gain a much clearer picture of potential ROI, ensuring your growth strategy is built on a foundation of evidence.

Moving from analyzing the Fifth Third Bank growth strategy to building your own requires the right tools. Visbanking gives you the granular, comparative data you need to benchmark performance, model your next big move, and uncover where you can win. Explore the data and start building your actionable growth plan today.