Eaglemark Savings Bank: Trusted Nevada Community Banking

Brian's Banking Blog

Understanding Eaglemark Savings Bank's Foundation and Heritage

Eaglemark Savings Bank occupies a unique position in Nevada's banking landscape. Its emphasis on community engagement sets it apart in a competitive financial industry. This focus allows Eaglemark to cultivate strong customer relationships built on personalized service and a deep understanding of the local community. This commitment to its community forms the basis for a closer look at the bank's history and operating philosophy.

A Nevada Banking Institution Rooted in Reno

Eaglemark Savings Bank first opened its doors on August 25, 1997, in Reno, Nevada. Operating from a single location allows the bank to concentrate its efforts on serving the local community. This localized approach fosters stronger relationships and a deeper understanding of the specific financial needs of Reno residents and businesses. Interested in learning more about the role of community banks? Check out this article: The Role of Community Banking in Local Economies.

This commitment to the community is further reflected in the bank's workforce. Eaglemark employs approximately 90 individuals, making it a significant local employer and contributing to the economic well-being of Reno (89521). This highlights Eaglemark Savings Bank's dedication to both its customers and the community it serves. Furthermore, operating under the supervision of the Federal Deposit Insurance Corporation (FDIC) underscores the bank’s commitment to financial stability and adherence to national banking standards. Find more detailed statistics here.

The Single-Branch Model: Advantages and Implications

Maintaining a single branch may seem unusual in today's world of extensive branch networks and online banking. However, Eaglemark Savings Bank has proven the effectiveness of this focused strategy. By concentrating its resources and expertise in one location, the bank delivers highly personalized service. This allows staff to cultivate stronger relationships with customers, understanding their individual financial needs and circumstances in a way that larger institutions often find challenging.

Regulatory Excellence and Community Focus

Eaglemark Savings Bank operates under a state charter, reflecting its focus on serving the specific needs of the Nevada community. The bank's deliberate decision to remain a single-branch institution further emphasizes its commitment to local engagement. This dedicated approach positions Eaglemark as a valuable partner for individuals and businesses seeking personalized financial solutions within the Reno area. It represents a distinct banking model that prioritizes relationships and local understanding over broad reach and corporate anonymity. This localized approach also allows Eaglemark to adapt quickly to changing local market conditions and offer products and services tailored to the needs of its community.

Banking Services That Actually Work For Nevada Residents

Eaglemark Savings Bank offers banking solutions designed for Nevada residents. Instead of overwhelming customers with complicated products and fees, Eaglemark focuses on simplifying personal and business banking. This approach makes managing finances easier and more straightforward.

Streamlined Services For Clarity And Efficiency

Eaglemark Savings Bank's focused product lineup helps eliminate confusion. Customers can access essential services without sifting through numerous options. This allows for quick, informed decisions.

For example, finding the right checking account can be difficult. Many banks offer multiple checking accounts with varying features and fees. This can be overwhelming. Eaglemark Savings Bank simplifies this with a clear selection of accounts for basic banking needs.

Competitive Interest Rates And Transparent Fees

Eaglemark Savings Bank offers competitive interest rates on deposit accounts, helping customers earn a solid return on their savings. The bank also maintains transparent fees.

This transparency builds trust. Customers can make informed decisions knowing the costs and benefits. This differs from some larger banks where hidden fees can be a problem.

To understand the range of services offered, let's take a look at the following table:

Eaglemark Savings Bank Service Comparison: A breakdown of key banking services and features offered by Eaglemark Savings Bank.

| Service Type | Key Features | Target Customers | Benefits |

|---|---|---|---|

| Personal Checking Accounts | Streamlined options, clear fee structures | Individuals, families | Simplified money management |

| Business Checking Accounts | Tools for managing business finances, lending options | Small business owners, entrepreneurs | Supports local business growth |

| Savings Accounts | Competitive interest rates | Individuals, families | Secure savings growth |

| Certificates of Deposit (CDs) | Fixed terms, competitive interest rates | Individuals, families seeking long-term savings | Predictable returns |

| Business Lending | Customized loan solutions | Small businesses | Access to capital for expansion |

| Merchant Services | Tools for processing payments | Businesses that accept card payments | Streamlined payment processing |

This table highlights Eaglemark Savings Bank's focus on core banking services, catering to both personal and business customers. The emphasis is on clarity, competitive rates, and support for local businesses.

Personal Banking Designed For Nevada

Eaglemark Savings Bank's personal banking services are designed for individuals and families in Nevada. These include checking accounts, savings accounts, and Certificates of Deposit (CDs). Customers have multiple options to manage their funds effectively.

Business Banking Focused On Local Growth

Eaglemark Savings Bank understands the importance of small businesses. They offer specialized services like business checking accounts, lending solutions, and merchant services. These resources help fuel local economic growth. Eaglemark Savings Bank strives to be a partner invested in the success of Nevada businesses.

Building Trust Through Simplicity

Eaglemark Savings Bank's commitment to simplicity offers many benefits for Nevada residents. The streamlined products, transparent fees, and focus on customer relationships create a strong sense of trust. This distinguishes Eaglemark Savings Bank from large institutions and online-only banks. It demonstrates their dedication to customer value and community support.

Real Customer Experience: What Banking Actually Feels Like

Beyond marketing, what's it truly like to bank with Eaglemark Savings Bank? By analyzing customer feedback and service delivery, we'll paint a realistic picture of their customer experience. This includes examining the benefits and drawbacks of their single-branch model.

The Personal Touch of a Single-Branch Model

Eaglemark Savings Bank’s single-branch model offers a distinctive experience. This setup fosters closer relationships between staff and customers. For example, staff are more likely to know your name and financial history.

This personal touch can make banking feel less transactional and more relational. However, the single-branch model also presents some limitations. Customers are restricted to conducting business at that one location.

This can be inconvenient for those who live or work far from the branch. Accessing services requires more planning and effort compared to banks with multiple locations. However, for those within the Reno community, the personalized experience often outweighs this inconvenience.

From Routine Transactions to Complex Challenges

Eaglemark Savings Bank handles all types of banking needs. Customers can perform routine transactions, such as deposits and withdrawals, with personalized assistance. The bank also helps with more complex financial matters.

For example, Eaglemark can assist with securing loans or managing investments. This full-service approach makes Eaglemark Savings Bank a comprehensive financial partner for many Reno residents.

Problem Resolution and Accessibility

Customer service is paramount at Eaglemark Savings Bank. They strive to provide efficient and effective problem resolution. This commitment to customer satisfaction is a core value of their community-focused approach.

Furthermore, Eaglemark Savings Bank prioritizes accessibility. They make banking services easy to use and understand. This helps to make banking less intimidating, especially for customers new to financial management.

Eaglemark understands that a positive banking experience should be easy and convenient. They work to remove barriers and provide equal access to its services.

Building Lasting Relationships With Banking Professionals

At Eaglemark Savings Bank, personal relationships between customers and staff are common. This is a direct result of the single-branch model and the bank's community focus.

These relationships often extend beyond simple transactions. Banking professionals at Eaglemark get to know their customers' financial goals and offer personalized guidance. This fosters trust and supports long-term financial well-being.

This personal connection makes Eaglemark Savings Bank a cornerstone of the Reno community.

Digital Banking Solutions That Bridge Traditional And Modern

How does a community bank like Eaglemark Savings Bank balance personalized service with the demand for digital banking? This exploration delves into Eaglemark's approach, showcasing how they integrate technology while retaining their community focus. We'll examine their digital platform, mobile features, and security measures. Interested in learning more about the relationship between banks and tech? Check out this article: Banks and Tech Startups: Rivals or Teammates?

Digital Platform Capabilities

Eaglemark Savings Bank's online platform offers customers 24/7 account access. This provides convenient banking outside of normal branch hours. Customers can easily check balances, transfer funds, and pay bills online.

The platform also allows customers to view transaction history and statements electronically. This not only reduces paper waste but also gives easy access to financial records. This demonstrates how Eaglemark blends traditional banking with modern convenience.

Mobile Banking Functionality

Eaglemark Savings Bank understands the importance of mobile banking. Their mobile services allow customers to manage their accounts from their smartphones or tablets. This offers unparalleled accessibility for banking anytime, anywhere.

The mobile app likely mirrors the online platform's functionality. Customers can probably deposit checks, pay bills, and transfer funds remotely. This reflects Eaglemark's commitment to adapting to the growing use of mobile devices for financial management.

Security Protocols For Peace of Mind

Security is paramount for Eaglemark Savings Bank. The bank implements various security measures to safeguard customer information. These measures work to prevent unauthorized access and protect against fraudulent activity.

Eaglemark likely uses multi-factor authentication and encryption technology. These security protocols are industry standards, designed to protect sensitive data. This commitment underscores Eaglemark’s dedication to customer security in the digital space.

Digital Customer Support and Online Transactions

Eaglemark Savings Bank recognizes the changing needs of its customers. They offer digital customer support options to streamline assistance. This might include secure messaging, email support, and potentially even live chat.

This online support complements their existing in-person services, offering customers more choices for getting help. Furthermore, Eaglemark’s commitment to digital banking includes robust online transaction capabilities. Customers can conduct a variety of transactions digitally, from paying bills to transferring funds between accounts.

This online focus empowers customers to manage their finances effectively. It also provides easy access to their accounts without needing to visit a physical branch. This blend of digital solutions and traditional values allows Eaglemark to meet the needs of its community in today’s financial world.

Security, Protection, and Peace of Mind Banking

When choosing a bank, security is paramount. This section explores the safeguards protecting Eaglemark Savings Bank customers, including federal oversight, FDIC insurance, and internal protocols against fraud and data breaches. Understanding these protections is crucial for informed financial decisions.

Federal Oversight and FDIC Insurance

Eaglemark Savings Bank operates under the supervision of the FDIC. This means adherence to strict regulatory standards designed to ensure financial stability, providing an important layer of protection for customers.

Additionally, Eaglemark Savings Bank customer deposits are FDIC-insured. This insurance protects deposits up to $250,000 per depositor, per insured bank, for each account ownership category. This provides peace of mind knowing funds are safe, even in the unlikely event of bank failure.

Internal Security Protocols

Beyond federal regulations, Eaglemark Savings Bank implements its own security measures. These protocols protect against fraud and data breaches, essential for safeguarding customer information.

These likely include measures such as encryption, firewalls, and intrusion detection systems. These security features work together to create a multi-layered defense against cyber threats. Eaglemark Savings Bank uses customer service automation to improve processes. For more examples, check out these customer service automation examples.

Risk Management and Compliance

Eaglemark Savings Bank takes a proactive approach to risk management, regularly assessing and mitigating potential risks to the bank and its customers. This careful risk assessment helps safeguard the bank's financial stability.

Furthermore, the bank maintains a strong compliance track record, consistently adhering to all applicable laws and regulations. This commitment to compliance demonstrates a strong focus on ethical operations, further reinforcing the bank's dedication to security.

Federal Backing and Deposit Security

The federal backing provided by the FDIC plays a vital role in ensuring deposit security. It provides a safety net for customers, guaranteeing the security of their funds up to the insured amount. This backing instills confidence in the stability of the banking system.

This means that even if Eaglemark Savings Bank were to face financial difficulty, customer deposits remain protected. This level of security is a cornerstone of the FDIC's mission to maintain public confidence in the financial system.

Building Confidence Through Transparency

Eaglemark Savings Bank recognizes the importance of transparency in building customer confidence. By openly communicating their security practices and regulatory compliance, they demonstrate their commitment to protecting customer finances. This fosters a trusting relationship between the bank and its customers.

How Eaglemark Compares To Nevada's Banking Landscape

Choosing the right bank requires a good understanding of Nevada's financial landscape. This section compares Eaglemark Savings Bank to other banks in the state, both regional and national. We'll explore the differences between community banks and larger institutions, focusing on factors like service quality, fees, accessibility, and the importance of building a solid banking relationship. Through data-driven comparisons, we'll help you determine which banking approach best suits your needs, whether you prioritize personal attention, a wide branch network, robust online banking, or competitive interest rates. We'll also examine the trade-offs involved in different banking relationships and why some people prefer local banks.

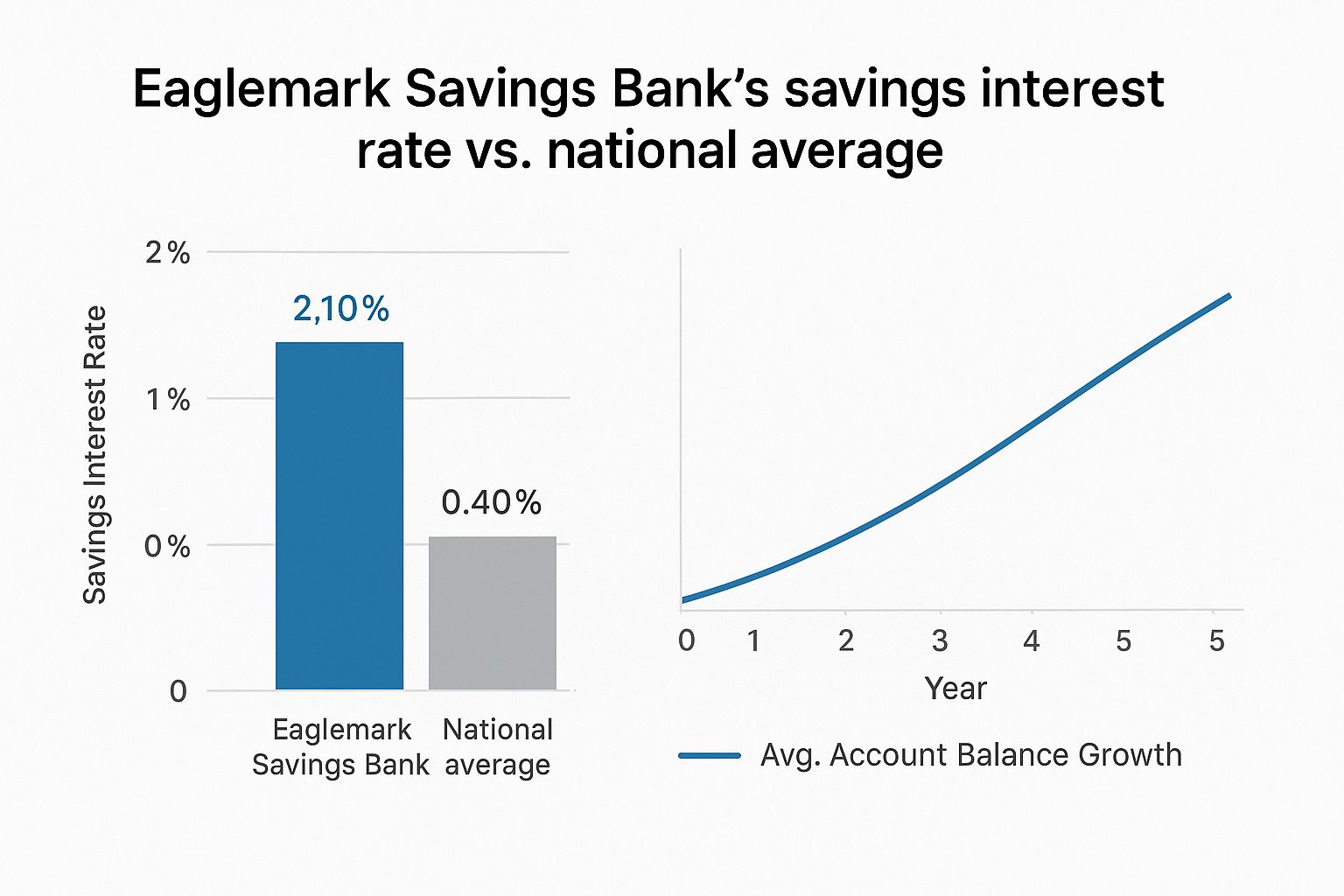

As the infographic above illustrates, Eaglemark Savings Bank provides a competitive savings interest rate, consistently exceeding the national average. Account balances have also shown a positive growth trend over the past five years. For more insights into banking options, you might find this resource helpful: What are the Best Credit Unions to Bank With?

Community Banking Versus Big Banks

Eaglemark Savings Bank operates on a community banking model, which differs significantly from national banks. Community banks emphasize personal relationships, local expertise, and community involvement. Larger banks, on the other hand, tend to focus on broader market reach, expansive branch networks, and a wider range of product offerings.

For instance, Eaglemark Savings Bank's single-branch model allows for close customer relationships. The staff is more likely to know you personally and understand your specific financial circumstances. Larger banks, however, might offer more convenient access through numerous branches and ATMs.

This highlights a key difference: personalized service versus widespread accessibility. The ideal choice depends on your individual preferences and what you value most in a banking partner. When evaluating banking options, consider the potential financial implications such as the taxation of earned interest, which shares similarities with how the UK handles taxes on prize money.

Service Quality and Fees

Community banks like Eaglemark Savings Bank are often known for their high service quality. This personalized approach can lead to greater customer satisfaction. However, they may sometimes have higher fees for certain services due to their smaller scale.

National banks, by contrast, might offer lower fees due to economies of scale. However, their customer service may be less personalized. This difference in service quality and fee structures is another important consideration when choosing a bank.

Accessibility and Relationship Building

Eaglemark Savings Bank's single branch may limit physical accessibility. However, they likely offer online and mobile banking options to supplement in-person services. National banks provide greater branch access but may lack the same level of personal connection.

Community banks excel at building strong customer relationships. This fosters trust and can result in more personalized financial advice. This ability to cultivate relationships is yet another key distinction between community and national banks.

To further clarify these differences, let's look at a comparison table:

Nevada Banking Options Comparison

Comparative analysis of Eaglemark Savings Bank versus other major Nevada banking institutions

| Bank Name (Example) | Branch Count | Service Focus | Key Advantages | Best For |

|---|---|---|---|---|

| Eaglemark Savings Bank | 1 | Personalized Service, Local Focus | Strong Customer Relationships, Community Involvement | Customers valuing personal attention and local expertise |

| Bank of America | Multiple | Wide Range of Products, Large Network | Convenience, Accessibility, Diverse Offerings | Customers prioritizing convenience and a wide range of services |

| Wells Fargo | Multiple | National Reach, Digital Banking | Extensive ATM Network, Online Banking Tools | Customers valuing digital banking and a large branch network |

| Nevada State Bank | Multiple | Regional Focus, Business Banking | Local Expertise, Business Services | Businesses and individuals seeking regional expertise |

This table provides a simplified example. Choosing a bank requires careful consideration of your individual needs and priorities. Ultimately, the best bank for you is the one that aligns with your financial goals and preferences.

Your Practical Guide To Getting Started With Eaglemark

Ready to start banking with Eaglemark Savings Bank? This guide walks you through building a strong banking relationship. We'll cover everything from required documents and account opening procedures to minimum deposit requirements. Whether you prefer banking in person or online, we'll outline the steps, expected timelines, and how to seamlessly transition from your current bank. We'll also share helpful tips for a smooth onboarding, key questions to ask during your initial consultations, and how to immediately take advantage of community banking benefits. We'll provide contact information, branch locations, and answers to frequently asked questions so you can begin your banking journey with confidence.

Choosing the Right Account

Eaglemark Savings Bank likely offers a variety of accounts designed to meet different financial needs. These may include:

Checking Accounts: Perfect for daily transactions, paying bills, and ATM access. Be sure to ask about monthly fees, minimum balance requirements, and overdraft protection options.

Savings Accounts: A great way to earn interest on your deposits. Inquire about interest rates, how often interest is compounded, and any withdrawal limitations.

Money Market Accounts: These accounts often combine features of both checking and savings accounts, providing check-writing capabilities with higher interest-earning potential. Ask about any check-writing limitations and minimum balance requirements.

Certificates of Deposit (CDs): CDs offer higher interest rates compared to savings accounts in exchange for keeping your funds deposited for a specific period. Understand the different term lengths available and their corresponding interest rates.

Gathering Your Documents

Whether opening an account in person or online, you'll need certain documents. These typically include:

Government-Issued Photo Identification: This could be your driver's license, passport, or other state-issued ID.

Social Security Number or Individual Taxpayer Identification Number (ITIN): This is required for tax reporting purposes.

Proof of Address: A recent utility bill or bank statement clearly showing your current address will suffice.

Opening Your Account: In Person vs. Online

In-Person: Visit the Eaglemark Savings Bank branch in Reno. A bank representative will personally guide you through the application. This face-to-face interaction allows you to ask questions directly and establish a relationship with the bank staff.

Online: If Eaglemark offers online account opening, you can conveniently complete the process from your computer or mobile device. This option offers flexibility for those who prefer to manage their finances digitally.

Switching From Another Bank

Changing banks can be a hassle, but Eaglemark can help simplify the process. They may offer services to easily transfer your direct deposits and automatic payments. Also, consider using their online bill pay system for streamlined money management.

Maximizing Your Eaglemark Experience

Ask Questions: Never hesitate to ask questions during the account opening process. Clarify anything you're unsure about regarding fees, services, or account features.

Explore Online Banking: Familiarize yourself with Eaglemark's online and mobile banking platforms. These tools provide efficient and convenient financial management.

Connect With Staff: Eaglemark Savings Bank values its community focus. Take the time to get to know the bank staff and build relationships.

Get started with Eaglemark Savings Bank today and experience the advantages of community banking. Learn more about how Visbanking can empower your financial institution.