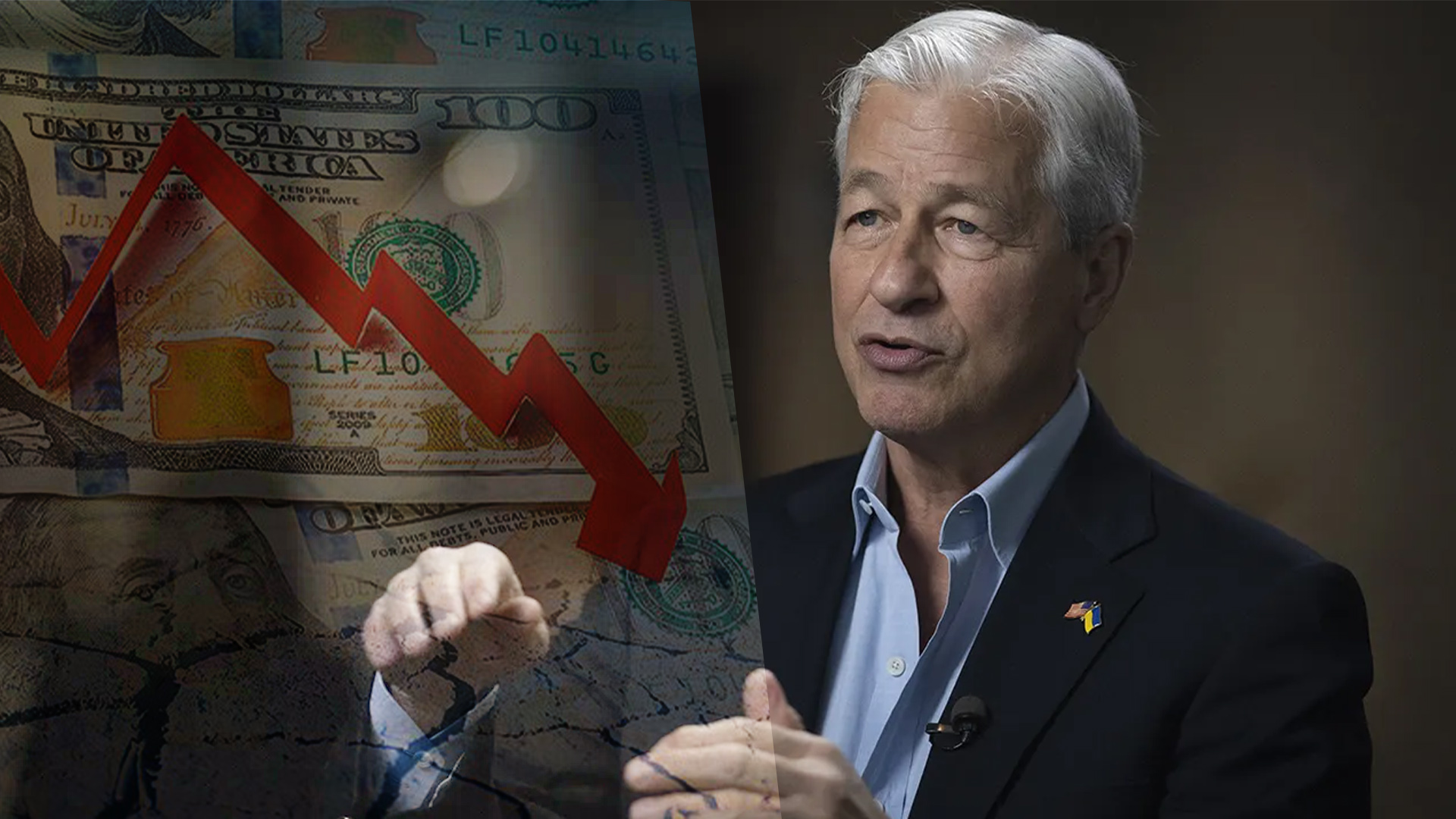

In his annual letter to JPMorgan Chase shareholders, longtime CEO Jamie Dimon argued that the current financial crisis in the banking sector is “not over yet.” Though he acknowledged that the recent shocks to the industry are in no way similar to those seen during the financial crisis of 2008, he did suggest that the effects of the current crisis will impact the sector for “years to come.”

Dimon’s comments come on the heels of recent turmoil in the banking industry that includes the closure by regulators of both Silicon Valley Bank and Signature Bank in the U.S. Meanwhile, troubled Credit Suisse was taken over by its rival UBS, in an acquisition deal forced through by the Swiss central bank and government officials.

Regional bank First Republic avoided SVB’s fate in large measure due to action taken by JPMorgan Chase and several other big banks. Those financial giants provided some $30 billion in deposits to First Republic to help it maintain liquidity. According to Dimon, his firm is intent on helping to reinforce other small banks in hopes that it will strengthen the entire financial sector.

Dimon urges regulators to not overreact to the crisis

While many politicians have called for increased regulatory powers in the aftermath of the recent turmoil, Dimon argued for a more proactive approach.

“The recent failures of Silicon Valley Bank (SVB) in the United States and Credit Suisse in Europe, and the related stress in the banking system, underscore that simply satisfying regulatory requirements is not sufficient. Risks are abundant, and managing those risks requires constant and vigilant scrutiny as the world evolves.”

He cited concerns about “held-to-maturity” bonds and the need to include factors like rising interest rates in future stress tests. At the same time, he pointedly noted that bank management could not be totally absolved of responsibility for the crisis. However, he stressed that there were many factors that contributed to the current situation and called for future regulation to be more collaborative.