Winning Customer Retention Banking Strategies

Brian's Banking Blog

When we talk about customer retention in banking, we're really talking about one thing: keeping the customers you already have from walking out the door and into the arms of a competitor. It’s about building relationships that go beyond simple transactions and shifting from a reactive "oh no, they left" mindset to a proactive one that stops them from leaving in the first place.

Why Your Bank Is Leaking Customers And How to Fix It

Think of your bank as a bucket. Every day, you pour time, money, and energy into filling it with new customers. But if that bucket has holes—like high fees, a clunky mobile app, or cold, impersonal service—you're just losing your most valuable assets out the bottom. That's the leaky bucket problem, and it's plaguing banks everywhere.

In today's market, just getting more customers is a race to the bottom. It’s not sustainable. With new digital options popping up all the time, it's never been easier for people to take their money elsewhere. The real solution isn't to keep pouring more water into the bucket; it's to patch the holes.

The Widening Cracks in Customer Loyalty

The challenge of customer retention in banking is getting tougher. Recent data shows the retention rate for multichannel banks has already slipped from 78% to 76%. Even more telling is that nearly 23% of people worldwide say they are likely to switch banks in the next year.

What's driving this? Cost is a huge factor, with 31% pointing to high bank charges as their main reason for leaving. This trend sends a clear message: customers don't feel locked in anymore. They expect more than a vault for their money; they demand a smooth digital experience, smart advice, and to feel like they actually matter.

The real issue is that too many banks are still stuck in an acquisition-first mindset. But the path to long-term, sustainable profit is through understanding and preventing customer churn before it happens.

Key Drivers of Customer Churn

A few consistent problems push customers toward the exit. If you can spot these, you’re already on your way to building a solid retention strategy.

Below is a quick look at the main reasons customers decide to leave, the damage they cause, and how you can start fighting back.

Key Drivers of Customer Churn in Banking

| Churn Driver | Impact on Retention | Strategic Response |

|---|---|---|

| Poor Digital Experience | A clunky, confusing, or limited mobile app is a major source of daily frustration and a top reason customers look for alternatives. | Invest in a user-friendly, feature-rich digital platform. Make banking simple, intuitive, and fast. |

| Impersonal Service | When customers feel like an account number, loyalty evaporates. They crave proactive support and personalized interactions. | Use customer data to anticipate needs and offer tailored advice. Make every interaction feel valuable and personal. |

| High or Hidden Fees | Nothing erodes trust faster than unexpected charges. Transparency in pricing is non-negotiable for today's consumers. | Be upfront and clear about all fees. Structure products to be simple and fair, building trust through transparency. |

| Lack of Proactive Support | A major pain point is when banks are absent during financial hardship. This is a critical moment where you either win or lose a customer for life. | Offer targeted help during difficult times, such as support for customers navigating bankruptcy, to help them rebuild their financial future. |

Fixing these leaks is infinitely more profitable than just chasing new accounts. By focusing on customer retention banking strategies, your institution can build a more resilient, profitable, and customer-focused business model that will actually stand the test of time.

The Real Value of a Loyal Banking Customer

Forget the expensive chase for new customers for a second. Let's talk about the leaky bucket. Plugging those holes isn't just a defensive play—it's one of the smartest offensive moves you can make for real, sustainable growth.

The numbers don't lie. Hunting for a new banking customer can cost five to seven times more than simply keeping an existing one happy. But the real kicker? The probability of selling to a customer who already knows and trusts you is a whopping 60% to 70%. Compare that to the 5% to 20% chance of landing a sale with a brand-new prospect. That massive gap is where your profit margins live or die. Focusing on customer retention banking is a direct line to a healthier bottom line. If you're looking for more on this, pragmaticcoders.com has some great insights on retention strategies for banks.

The Compounding Value of Trust

Think of a loyal customer like a high-yield investment. Their value isn't static; it compounds. A college grad opens their first checking account, and at first, the relationship is pretty basic. But as they move through life, that single account can bloom into something much more significant.

What fuels this growth? Trust. Year after year of solid service and positive experiences builds a powerful bond. You stop being just "the bank" and become their trusted financial partner.

- Expanded Product Use: When it's time to buy a car, they naturally think of you for the auto loan.

- Major Life Milestones: When they're ready for their first home, your bank is the first call they make for a mortgage.

- Future Financial Planning: As their career takes off and savings grow, they'll look to you for wealth management.

Each step deepens the relationship and turns that small, initial account into a major source of revenue. It’s a far more profitable path than constantly chasing cold leads.

A loyal customer is more than just an account on your books. They are your most credible marketing asset, a source of predictable revenue, and a bulwark against market competition.

From Satisfied Customer to Vocal Advocate

Here's where it gets really powerful. The best outcome of strong customer retention isn't just what happens on your balance sheet. A truly loyal customer becomes your best salesperson—and they work for free. They don't just stay; they talk.

They tell friends, family, and coworkers about their great experiences. This kind of word-of-mouth referral is pure gold. It carries more weight than any ad campaign you could ever run. When a customer shares a story about how you helped them get a business loan or made a complex process simple, they’re building your reputation and feeding your growth engine.

This is how customer retention banking creates a virtuous cycle. You focus on your current customers, they stick around and do more business with you, and their positive stories bring in new, high-quality customers. Retention stops being a metric and becomes the very engine of your bank's growth.

Key Metrics to Track Your Retention Success

You can't fix what you don't measure. In the world of customer retention banking, that means getting past gut feelings and diving headfirst into the hard data. Tracking the right metrics is like giving your bank a regular health checkup—it shows you the real condition of your customer relationships and points you exactly where to focus for the biggest wins.

These numbers aren't just figures on a spreadsheet. They're the language your customers are using to tell you what they're thinking, how they're feeling, and what they plan to do next. Learning to speak this language is the first real step toward building a retention strategy that actually works.

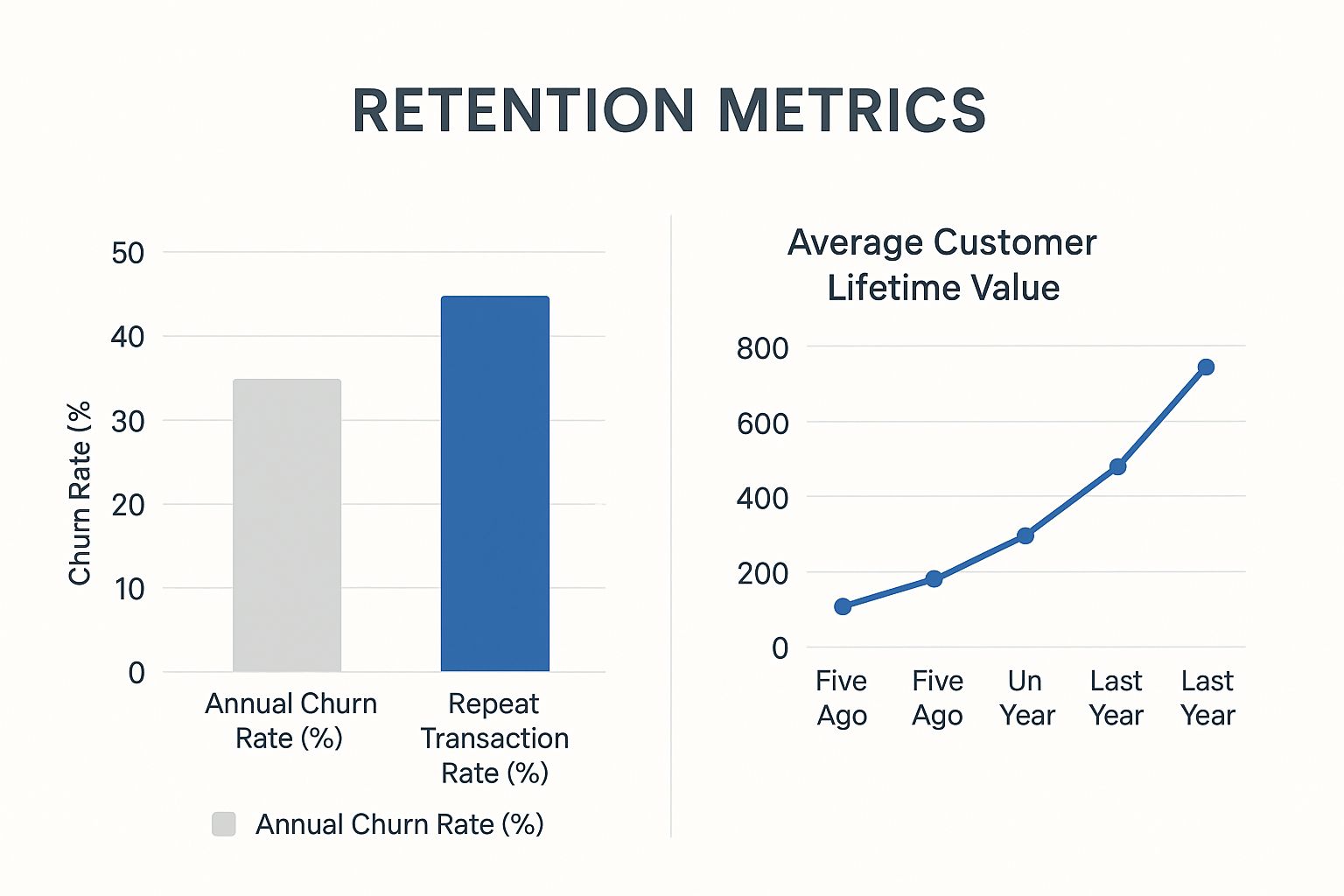

The image above paints a clear picture: as customers stick around longer (lower churn) and do more business with you (more transactions), their lifetime value soars. It's a direct relationship you can't afford to ignore.

To get a grip on retention, you need a solid dashboard of Key Performance Indicators (KPIs). Think of these as the vital signs for your customer base.

Here’s a breakdown of the essential metrics, what they mean, and how to calculate them.

Essential Customer Retention Banking KPIs

| Metric (KPI) | How to Calculate It | What It Tells You |

|---|---|---|

| Customer Churn Rate | (Lost Customers ÷ Total Customers at Start of Period) x 100 | The percentage of customers who left your bank in a given period. It's your most direct measure of customer attrition. |

| Customer Lifetime Value (CLV) | (Average Annual Profit per Customer) x (Average Customer Lifespan) | The total profit you can expect from a customer over their entire relationship with you. This helps you identify your most valuable clients. |

| Net Promoter Score (NPS) | % of Promoters - % of Detractors | A measure of customer loyalty and satisfaction, based on how likely they are to recommend your bank. It's an early warning for potential churn. |

Monitoring these KPIs gives you a 360-degree view of your retention health, blending financial outcomes with customer sentiment. Let’s dig a little deeper into what these numbers really tell you.

Customer Churn Rate

This is your most straightforward metric. The Customer Churn Rate is simply the percentage of customers who packed up and left your bank over a certain timeframe. A low churn rate is great, but a sudden spike is a massive red flag. It’s your earliest, loudest alarm bell that something is seriously wrong.

Imagine your bank's monthly churn quietly creeps up from 0.5% to 1.5% right after you roll out a new fee structure. That’s not a coincidence. This immediate feedback helps you pinpoint the problem and react before the fire spreads.

Churn is a lagging indicator—it tells you what already happened. The goal is to pair it with leading indicators that predict future churn, allowing you to be proactive instead of reactive.

The banking industry's average customer retention rate sits around 75%, which means the annual churn rate is a staggering 25%. That number alone shows just how fierce the competition is and why keeping customers happy is a constant battle.

Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) represents the total profit your bank expects to make from a single customer over their entire relationship with you. This is a game-changing metric because it pulls the focus away from one-off transactions and puts it on long-term health and profitability.

Think about it. One person might have a simple checking account. Another might have that checking account plus a mortgage, a car loan, and an investment portfolio. Both are "customers," but their CLV is worlds apart. Calculating CLV helps you spot and prioritize your most valuable relationships.

- High-CLV Customers: These are your VIPs, the clients you absolutely cannot lose. Your retention strategies need to be tailor-made to keep them loyal.

- Low-CLV Customers: Figuring out why their value is low can uncover huge opportunities to cross-sell or upsell, boosting their value over time.

Net Promoter Score (NPS)

While churn and CLV are about the money, Net Promoter Score (NPS) measures something just as crucial: customer sentiment. It all boils down to one simple question: "On a scale of 0-10, how likely are you to recommend our bank to a friend or colleague?"

Based on their score, customers fall into one of three buckets:

- Promoters (9-10): Your biggest fans. They’re loyal, enthusiastic, and drive growth through positive word-of-mouth.

- Passives (7-8): They're satisfied but not thrilled. These customers are easily swayed by a better offer from a competitor.

- Detractors (0-6): Unhappy customers. They can actively harm your brand with negative feedback and drag down growth.

A dip in your NPS is a powerful early warning. It signals that customer satisfaction is dropping, often months before those customers actually walk out the door. By monitoring NPS, you can step in to help detractors and turn them into promoters before they become another churn statistic.

Of course, tracking all of this effectively hinges on clean, reliable numbers. Sharpening your bank's approach to financial data quality management is non-negotiable if you want insights you can actually trust.

Proactive Strategies to Build Unbreakable Loyalty

Knowing your retention metrics is like checking your bank's pulse. That's the easy part. Now, it's time to move from diagnosis to action.

Building real, lasting loyalty isn't about sending a generic birthday email anymore. It’s about getting ahead of your customer's needs and proving your value before they even think about looking elsewhere. This means switching from a reactive stance—fixing problems after they happen—to a predictive one that solves issues before they even exist.

Leverage Data for Hyper-Personalization

The most powerful tool you have for retention is the data you're already sitting on. Every transaction, every app login, and every call to your service center tells a story. The real trick is learning how to listen.

Think about it. A customer starts making small, regular transfers to a savings account they’ve named "New Car Fund." A traditional bank sees nothing. A proactive bank sees a flashing neon sign.

Instead of waiting for them to start shopping for auto loans somewhere else, you can send them a helpful article on car buying or, even better, a pre-approved loan offer. Just like that, you’ve gone from being a utility to being a partner in their financial life.

Hyper-personalization is not just using a customer's name. It's about using their own data to anticipate their next move and giving them the right support at the perfect time. You become indispensable.

Design a Seamless Omnichannel Journey

Your customers don’t care about your internal departments. Your mobile app, your website, your call center, and your branches are all just "the bank." A clunky handoff between any of these is a major source of frustration—and a huge reason people leave.

An omnichannel strategy makes sure the journey is smooth, no matter how a customer interacts with you.

- Start a mortgage application online? They should be able to book an in-person meeting right from the app, and the loan officer should already have their info pulled up. No starting from scratch.

- A chatbot can't solve their issue? The switch to a live agent should be instant, with the agent seeing the entire chat history.

This isn't just about convenience; it's about respecting your customer's time. For a deeper dive, banks need to get serious about customer experience optimization to lock in that loyalty.

Build Proactive Feedback Loops

Why wait for an annual survey to find out you have a problem? By then, it’s too late. You need to capture customer sentiment in the moment, before a minor annoyance turns into a closed account.

Ditch the long-form surveys and build micro-feedback opportunities right into your digital tools. After a mobile check deposit, hit them with a simple, one-click poll: "How easy was that?" If the answer is "not easy," you can immediately offer help.

This does two things:

- You solve individual problems on the spot.

- You get a crystal-clear roadmap for what to fix next.

A bank that constantly asks for and acts on feedback is a bank that customers will stick with. And with new regulations on the horizon making it easier than ever for customers to switch, building that loyalty is no longer a "nice-to-have." It's a must.

Why a Flawless Digital Experience Is Non-Negotiable

In banking today, your digital front door—your mobile app and online portal—is far more important than any physical branch. It’s where your customers "visit" you most. A clunky, slow, or confusing digital platform is the quickest way to lose trust and send a customer straight to your competition. For effective customer retention banking, a seamless digital experience isn't a bonus; it's the absolute minimum.

Think about it. A customer might walk into a branch a few times a year, but they’re logging into your app multiple times a week, maybe even daily. Every single one of those logins is a test. When a transaction goes smoothly, it builds confidence. But when a mobile deposit fails or the interface is a maze, a seed of doubt is planted. That seed can quickly grow into a decision to leave.

The New Digital Baseline for Banking

Here’s a hard truth: your customers aren't comparing your app to other banking apps. They're comparing it to the best, most intuitive apps they use every day—like Amazon, Spotify, and Uber. They expect that same effortless design and rock-solid functionality. A poor digital experience screams that your bank is stuck in the past.

The data backs this up. Globally, digital banking satisfaction averages 4.16 on an index scale, with some markets hitting 4.37. It shows just how much a good digital experience drives loyalty. What's more, financial institutions that get their digital transformation right have seen customer retention rates jump by 3 to 5 times. Why? Because it allows for more personal and responsive engagement. You can discover more customer retention statistics on g2.com to see the full picture.

A great digital experience makes banking feel effortless. A poor one makes it feel like a chore. In a competitive market, customers will always choose the path of least resistance.

Key Pillars of a Retention-Focused Digital Experience

To build a digital platform that keeps customers from walking, you have to nail the fundamentals. These aren't fancy features; they are the absolute essentials.

- Effortless Navigation: Can your customers find what they need in a few quick taps? If they have to hunt through confusing menus, you're creating friction and frustration.

- Robust Self-Service: Let customers handle things on their own. From disputing a charge to freezing a card, giving them control saves everyone time and makes them feel empowered.

- Frictionless Transactions: Every single payment, transfer, or mobile check deposit must be fast, simple, and dependable. One failed transaction can undo all the trust built from a dozen successful ones.

Bridging the Digital and Physical Worlds

A great digital strategy can't live on an island. It has to connect seamlessly with your physical branches to create one unified journey for the customer. The goal is to tear down the walls between online and in-person banking.

For example, a customer should be able to start a mortgage application on your website, then use the app to book a meeting with a loan officer who already has all their information. This simple integration shows you respect their time and that your bank works as a single, coordinated team. By using data-driven insights to anticipate what customers need, you can learn how predictive analytics in banking turns your digital tools from simple transaction channels into powerful engines for building lasting relationships.

Building the Human Connection in a Digital World

Sure, technology is non-negotiable. But it can never replace the real currency in banking: trust. A slick mobile app is the price of entry now, but that human element is what truly sets you apart and builds loyalty that lasts.

Think about it. It’s the understanding voice on the phone when a card is lost. It's the savvy advice from a branch manager who knows your goals. It’s the simple feeling that your bank actually has your back.

This is where your customer retention banking strategy either shines or fizzles out. One fantastic, memorable chat with an empowered employee can lock in a customer for life. On the flip side, one bad experience—feeling like just another number—can send them walking. Instantly.

The Foundation of Banking Trust

Trust isn't something you can just buy or build overnight. It’s earned through every single action your bank takes, proving you’re consistently looking out for your customer's best interests. This is especially true when you're managing their entire financial lives.

The building blocks are simple on paper, but they demand a relentless commitment:

- Transparency: No smoke and mirrors. Be straight up about fees, terms, and what to expect.

- Reliability: Your systems have to work, period. And when your team makes a promise, they need to deliver.

- Security: Prove you’re a fortress when it comes to protecting their sensitive data and hard-earned money.

- Empathy: Train your team to listen. To understand the person behind the account number and offer solutions that genuinely help.

Drop the ball on any one of these, and the whole relationship can start to crack. That's why investing in your frontline staff isn't just an HR line item; it's a direct investment in keeping your customers.

The High Stakes of Every Interaction

The banking world bleeds customers, with churn rates hitting around 25% annually. But here’s the kicker and the massive opportunity: customers who have good experiences spend about 140% more than those with bad ones.

Even more telling? 60% of customers say great service is a primary reason they stick around. This highlights the incredible power of that human connection.

A customer's view of your entire bank is often colored by their last interaction. Every call, email, or branch visit is a moment of truth. It can either cement the relationship or shatter it.

This means every single employee, from the teller to the loan officer, is on the front lines of profitability. When an employee is empowered to solve a problem right then and there, or offer advice tailored to that person's history, they become your best retention tool. This is exactly why effective bank customer segmentation is so crucial—it gives your team the intel they need to make every single interaction count.

At the end of the day, digital tools give customers the convenience they expect. But it’s the human touch that provides the reassurance they need. Nurturing these genuine, person-to-person connections is how you build profitable relationships that don't just survive, but thrive.

Got Questions About Customer Retention in Banking? We've Got Answers.

Trying to get a handle on customer retention can feel like a lot. Let's cut through the noise and tackle some of the biggest questions we hear from banking leaders. These are the practical, real-world answers you can put to work.

What's the Single Most Effective Retention Strategy?

If I had to pick just one, it's data-driven hyper-personalization. Hands down. This isn't about sending a generic "happy birthday" email; it's about showing your customers you genuinely understand where they are in their financial lives.

Think about it. By looking at a customer's behavior and transaction data, you can anticipate their next big move. Instead of waiting for them to start shopping around for a mortgage, you can be the first to offer helpful articles or tailored loan options right when they start showing signs of being in the market. That's how you make someone feel seen and valued, and it kills any reason they might have to look elsewhere.

How Can Smaller Banks Even Compete?

This is where community and smaller banks have a massive, often untapped, advantage. You might not have the mega-budgets of the national players, but you can win where they consistently drop the ball: superior, personalized customer service and real community ties.

Your frontline team is your secret weapon. Empower them to build actual relationships—to be problem-solvers who offer flexible, human-first solutions. That's how you build a fortress of trust and loyalty that the big, impersonal banks can't touch. A customer who knows their branch manager's name isn't going to jump ship over a small fee.

In a world of chatbots and automated phone trees, a real conversation with someone who cares is a game-changer. That's how community banks build loyalty that lasts.

How Often Should We Be Measuring Retention?

You can't just set it and forget it. A smart customer retention banking strategy needs a dynamic approach to measurement. You need to look at different things at different times to get the full picture.

Here's a simple rhythm:

- Monthly: Keep a close eye on your Customer Churn Rate. This is your early warning system, letting you spot problems and put out fires before they spread.

- Quarterly: Dig into relationship metrics like your Net Promoter Score (NPS) and Customer Satisfaction (CSAT). This tells you if your bigger-picture strategies are actually making customers happier over time.

This layered approach gives you a constant stream of feedback, helping you move from simply reacting to problems to proactively preventing them.

Ready to stop guessing and start knowing what your customers need? Visbanking's BIAS platform turns your bank's raw data into a powerful retention engine. Get the intelligence to anticipate customer needs, see how you stack up against the competition, and take decisive action. Discover how Visbanking can help you build unbreakable loyalty.