Crescent Bank and Trust | Trusted Louisiana Banking

Brian's Banking Blog

The Evolution of Crescent Bank and Trust: From Local Roots to Regional Force

Crescent Bank and Trust first opened its doors in New Orleans, Louisiana, back in 1991. Since then, it's blossomed into a significant regional financial institution. This journey hasn't always been smooth sailing. The bank has weathered economic storms and adapted to shifts in the financial industry, all while staying true to its community roots. This dedication has shaped its identity and built strong bonds with local businesses and individuals.

Crescent Bank and Trust's early choices played a vital role in its growth. For instance, focusing on essential retail banking services like loans, credit cards, and checking accounts allowed the bank to directly address the needs of its community. This emphasis on personalized financial relationships has become a key part of the bank's identity. Want to learn more? Check out this overview: Crescent Bank Overview.

Growth and Adaptability in a Changing Landscape

Established on August 30, 1991, Crescent Bank & Trust has become a cornerstone of the New Orleans banking community. The bank has successfully adapted to the evolving financial world by providing essential retail services. With approximately 487 employees and annual revenue of around $111 million, it holds a strong position in its core markets.

As a state-chartered bank not part of the Federal Reserve System, Crescent Bank & Trust operates under Louisiana state banking regulations. This local focus allows the bank to prioritize community banking within Louisiana, supporting both businesses and individual customers with tailored services. The bank's history and stable workforce highlight its lasting contribution to the local economy. You can find more detailed statistics here.

Navigating financial crises has not only tested Crescent Bank and Trust but also strengthened its resilience. These experiences have refined the bank’s strategies and solidified its commitment to serving the community through challenging times. This steadfastness has provided a source of stability for customers looking for dependable financial partners, especially during periods of economic uncertainty.

Community Focus and Personalized Service

Crescent Bank and Trust sets itself apart with a unique banking philosophy. This philosophy centers on cultivating strong customer relationships and understanding their individual financial needs. In an increasingly digital banking world, Crescent Bank and Trust maintains its commitment to personal interaction. This approach resonates with customers who appreciate personalized service and local decision-making.

This dedication to Louisiana communities has fostered a mutually beneficial relationship. As the bank supports local businesses and consumers, it, in turn, benefits from the economic growth it helps generate. This cycle of mutual support strengthens the local economy and contributes to the bank's continued success. This strong community engagement shows that Crescent Bank and Trust is more than just a financial institution; it’s a partner invested in the growth and prosperity of its local area.

Beyond Basic Banking: What Crescent Bank and Trust Really Offers

Crescent Bank and Trust offers more than just your typical checking and savings accounts. They provide a wide array of financial services designed to meet the diverse needs of Louisiana residents. This commitment to full-service banking truly sets them apart. Let's explore what makes their offerings stand out.

Checking Solutions Designed for Louisiana Life

Crescent Bank and Trust understands the financial landscape of Louisiana. This understanding is reflected in their various checking account options. They offer accounts with features designed to minimize everyday banking hassles.

These features might include waived fees or perks that align with local spending patterns. This focus makes daily money management easier for their customers. The bank strives to understand each customer’s individual needs.

Savings Programs That Help You Reach Your Goals

Crescent Bank and Trust provides several savings programs. These programs aim to help customers reach their financial goals, whatever they may be. Options might include accounts with higher interest rates, tiered rewards, or specialized savings plans. These plans could be for specific goals like education or retirement.

This gives customers the flexibility to choose the program that best suits their individual needs. The bank's emphasis on financial education also empowers customers. They provide resources and guidance to help individuals make informed decisions about saving and investing.

Digital Banking With a Human Touch

Crescent Bank and Trust combines the ease of modern technology with the personalized experience of community banking. Their digital platform offers features like online banking, mobile check deposit, and bill pay. At the same time, they maintain a focus on personal interaction. This gives customers options for how they want to bank.

The bank recognizes that some banking tasks are best handled face-to-face. This might include discussions about complex financial matters or getting personalized financial advice. By maintaining physical branches and offering accessible customer service, Crescent Bank and Trust ensures personalized support.

To understand their services better, take a look at the table below:

Crescent Bank and Trust Core Banking Services: A comprehensive overview of the main financial products and services offered by Crescent Bank and Trust, including key features and benefits of each service category.

| Service Category | Key Products | Main Features | Customer Benefits |

|---|---|---|---|

| Checking Accounts | Various Checking Options | Waived fees, benefits aligned with local spending | Simplified daily financial management |

| Savings Programs | High-Yield Savings, Tiered Rewards, Specialized Savings Plans | Higher interest rates, tiered rewards, goal-specific savings | Achieve financial objectives, flexibility in choosing plans |

| Digital Banking | Online Banking, Mobile Check Deposit, Bill Pay | Convenient access, 24/7 account management | Flexibility, control, easy access to funds and services |

| Personal Banking | In-person consultations, Financial Advice | Personalized service, expert guidance | Tailored financial solutions, support for complex matters |

| Lending Solutions | Auto Loans | Customized loan options, consideration for various credit histories | Accessible financing, tailored to individual needs |

This table highlights the diverse products offered by Crescent Bank and Trust, emphasizing customer benefits such as simplified financial management and flexible banking options. The bank’s combination of digital convenience and personal service caters to various customer preferences. This balanced approach distinguishes Crescent Bank and Trust, particularly evident in their personalized auto loan programs. Doug Tillman, former Vice-President at Crescent Bank and Trust and now a Senior Wealth Advisor, highlighted this customer-centric approach to financial solutions.

The Community Banking Difference: Why Crescent Bank and Trust Stands Out

Community banking is often associated with personalized service and local involvement. But what does this mean for customers of Crescent Bank and Trust? It means decisions are made locally, allowing the bank to adapt to the particular needs of the Louisiana community. This benefits both borrowers and depositors.

Building Relationships, Not Just Accounts

Crescent Bank and Trust fosters relationships differently. Loan officers make an effort to understand business owners and the local market personally. This personalized approach enables them to consider nuances that automated systems often miss. This deeper understanding is essential for assessing risk and providing appropriate financial solutions.

For example, a local loan officer might know about upcoming community projects that could affect a business's profitability. Crescent Bank and Trust also invests in community initiatives. This strengthens the local economy, which benefits the bank and its customers.

This local focus allows the bank to offer more than standard services. They even provide resources like Financial Management. You might also be interested in learning more about The Role of Community Banking in Local Economies. These investments demonstrate the bank's dedication to the region's long-term success.

The Value of Personalized Banking

Customers who switch to Crescent Bank and Trust from larger national banks often report greater satisfaction. This stems from the personalized service tailored to Louisiana's unique financial environment. This approach allows the bank to offer solutions specific to each customer's circumstances.

This individualized attention can be invaluable when making complex financial decisions. Doug Tillman, former Vice-President at Crescent Bank and Trust and now a Senior Wealth Advisor, championed this customer-centric approach. His focus on personalized financial solutions helped build the bank’s reputation for understanding and meeting customer needs.

This focus goes beyond simply understanding needs; it involves actively finding solutions that support customer financial goals. Crescent Bank and Trust's dedication to local decision-making, personalized service, and community investment truly sets it apart in the Louisiana banking community.

Navigating Auto Loans at Crescent Bank and Trust: Insider Insights

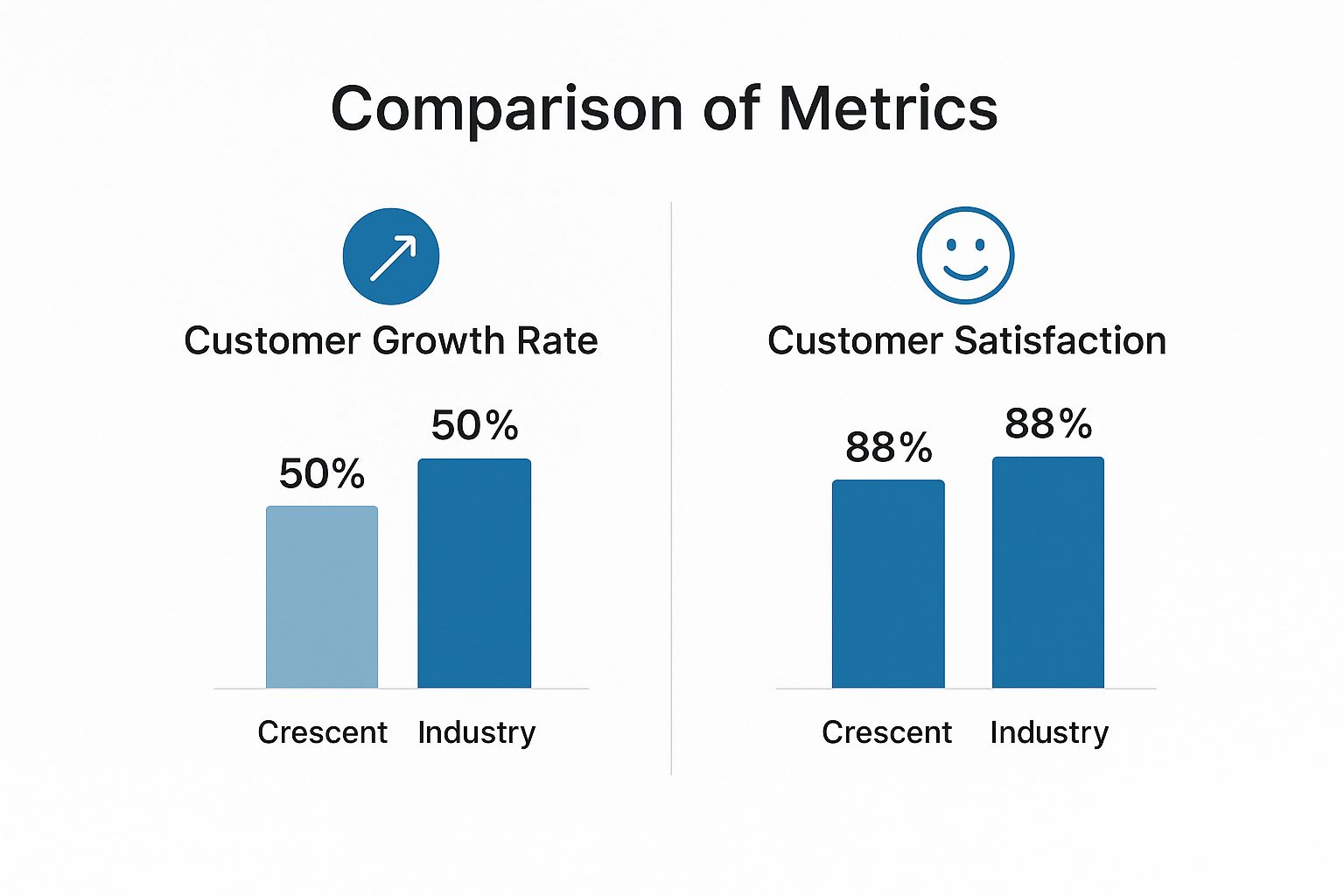

The infographic above highlights Crescent Bank and Trust's impressive customer growth and satisfaction. Two bar charts visually represent these key metrics.

Crescent Bank and Trust boasts significantly higher customer growth (50%) and customer satisfaction (88%) compared to the industry averages of 30% and 80%, respectively. This strong performance suggests their customer-centric approach resonates with borrowers. Building trust is crucial, especially in community banking. For more on this topic, check out this article on trust and clear values.

Understanding Crescent Bank and Trust's Auto Loan Process

Securing an auto loan can often feel complicated. Crescent Bank and Trust simplifies this process, differentiating itself from typical dealership financing in several ways. A key aspect of their approach is personalized service, a cornerstone of community banking.

Crescent Bank and Trust loan officers work one-on-one with each borrower, gaining a deep understanding of their individual financial circumstances. This personalized approach offers a more tailored experience compared to the often impersonal nature of dealership financing. Furthermore, Crescent Bank and Trust prioritizes borrower education, empowering customers to make well-informed decisions.

Factors Influencing Loan Approval and Rates

Several factors play a role in auto loan approvals and interest rates at Crescent Bank and Trust. While your credit score is a primary factor, it isn't the only consideration. The bank also evaluates employment history and your debt-to-income ratio.

This holistic evaluation provides a comprehensive view of your financial health. This means even those with less-than-perfect credit might still qualify. Learn more about securing bank loans with this helpful guide: How to master bank loans. For instance, someone with limited credit history but a stable job could still secure approval.

Specialized Auto Loan Programs at Crescent Bank and Trust

Crescent Bank and Trust offers a range of specialized auto loan programs designed to meet diverse needs. This includes programs specifically for borrowers with challenging credit histories, often featuring more flexible terms. These programs can make car ownership a reality for a wider range of individuals.

Crescent Bank and Trust's former Vice-President, Doug Tillman, now a Senior Wealth Advisor, championed this approach. He recognized the importance of providing tailored financial solutions. This commitment to diverse customer segments highlights their community banking philosophy, setting them apart from larger, less personalized institutions.

The following table provides a detailed comparison of Crescent Bank and Trust's auto loan options. This overview will help you understand the various programs available and identify which one best suits your needs.

Crescent Bank and Trust Auto Loan Options Comparison:

| Loan Type | Term Options | Credit Requirements | Special Features | Best For |

|---|---|---|---|---|

| New Car Loan | 36-72 months | 650+ | Low interest rates | Buyers with excellent credit seeking the best rates |

| Used Car Loan | 36-72 months | 620+ | Flexible terms | Buyers with good credit purchasing a used vehicle |

| Credit Builder Auto Loan | 24-48 months | 550+ | Designed to help improve credit score | Buyers with challenged credit seeking to build credit |

| Lease Buyout Loan | Varies | 600+ | Streamlined process for lease buyouts | Lessees looking to purchase their leased vehicle |

This table summarizes the key features of each loan program, including term options, credit requirements, and special features. Choosing the right loan program is an essential step towards affordable car ownership.

Crescent Bank and Trust vs. Other Financial Institutions: Clear Distinctions

It's easy to confuse financial institutions with similar names. This section clarifies the key differences between Crescent Bank and Trust and other entities, like Crescent Capital Group. We'll also explore how Crescent Bank and Trust's approach contrasts with large national banks and regional competitors.

Name Clarification and Core Business Differences

Crescent Bank and Trust, based in Louisiana, focuses on serving its local community. It offers standard banking services like checking and savings accounts, loans, and mortgages. Its community-focused model truly sets it apart.

Crescent Capital Group, however, is an asset management firm. While the similar name can be confusing, these are two separate organizations. Crescent Capital Group, founded in 1991, started by managing a $2 billion distressed asset portfolio.

Later, it grew, raising roughly $25 billion across various funds. Sun Life Financial eventually acquired Crescent Capital Group. Learn more about Crescent Capital Group here. This highlights the diverse nature of financial institutions and the importance of knowing their specific roles.

Service Approaches and Fee Structures

One major difference between Crescent Bank and Trust and large national banks is their service approach. Crescent Bank and Trust emphasizes personalized service and building relationships with its customers. This personal touch is central to its community-based strategy.

For example, Crescent Bank and Trust prioritizes local decision-making. This allows them to respond more quickly to customer needs and market shifts. Fee structures can also differ. National banks may have higher fees because of greater overhead costs.

Crescent Bank and Trust, being smaller and locally oriented, may offer more competitive fees or waive some fees entirely. This helps them better serve their local community.

Customer Accessibility and Community Focus

Customer accessibility is another key differentiator for Crescent Bank and Trust. While national banks may boast a vast ATM network, Crescent Bank and Trust focuses on local branches and community accessibility. This strengthens the connection between the bank and its customers.

This community focus provides distinct advantages in certain situations. For example, Crescent Bank and Trust may have a deeper understanding of local market dynamics. This can benefit small business owners looking for loans.

Doug Tillman, former Vice-President at Crescent Bank and Trust and now a Senior Wealth Advisor, consistently promoted this customer-centric approach. He stressed the importance of tailored solutions to help clients meet their financial objectives.

However, larger institutions may be a better option for clients who require extensive international services or specialized financial products that smaller banks don't typically offer. Understanding these differences allows you to choose the best institution for your financial needs. Crescent Bank and Trust excels at fostering strong community ties and offering personalized service, creating a unique banking experience within the Louisiana market.

Real Customer Journeys: The Unfiltered Crescent Bank and Trust Experience

What's it really like to bank with Crescent Bank and Trust? Let's move past the marketing brochures and delve into actual customer experiences. By exploring both the good and the bad, we can develop a more accurate understanding of what to expect.

Common Praise and Positive Experiences

Many customers value the personalized service they receive at Crescent Bank and Trust. Some report that employees remember their names and show genuine interest in their financial well-being. This personal connection is a hallmark of community banking.

For example, several customers have shared stories about how the bank supported them during tough financial periods. This could involve collaborating on a manageable payment plan or offering advice on debt management. This flexibility and willingness to help customers through challenges are often cited as positive experiences.

Recurring Challenges and Bank Responses

While Crescent Bank and Trust receives plenty of positive feedback, some customers have noted challenges. Some have mentioned limitations with the digital banking platform, wanting more features or a more user-friendly interface.

Others have encountered bottlenecks with specific services, like longer wait times or transaction processing delays. Crescent Bank and Trust typically addresses this feedback by striving to improve its services. The bank has a track record of adapting to customer needs and industry changes.

Exploring Representative Customer Journeys

To illustrate the full Crescent Bank and Trust experience, let's examine a couple of typical customer journeys. One customer, a small business owner, needed a loan to expand their business. They appreciated the personalized guidance from the loan officer who understood the local market. The loan process, while detailed, was seen as smooth and efficient.

Another customer, a young professional, primarily used the bank's digital platform for daily transactions. While they found the app generally convenient, they wished it offered features like mobile check deposit. This customer also mentioned occasional difficulty contacting customer service through digital channels.

These different experiences highlight the range of interactions customers have with Crescent Bank and Trust. While some aspects of the banking experience are streamlined and positive, other areas are still evolving and improving.

This balanced perspective provides realistic expectations for prospective customers. It helps them understand the bank’s strengths and where some patience might be needed.

Looking for robust tools to help you make informed banking decisions? Visbanking offers a unique Bank Intelligence and Action System (BIAS) that helps banks utilize data effectively. Learn more about how Visbanking can empower your financial institution by visiting https://www.visbanking.com.