But ultimately, all that money went BACK to the government.

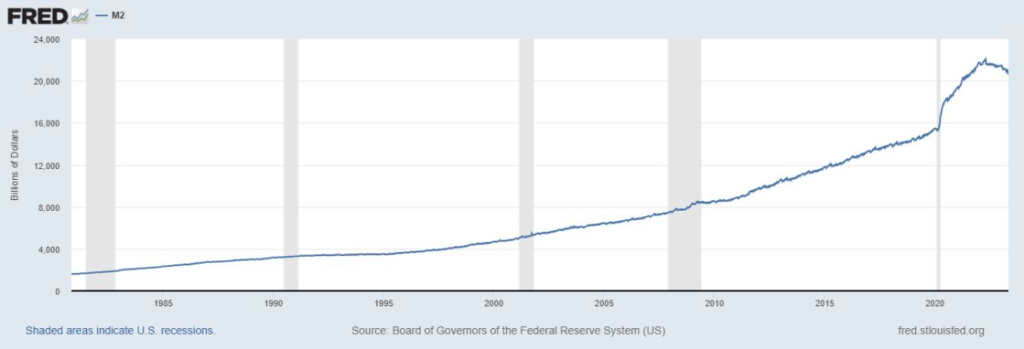

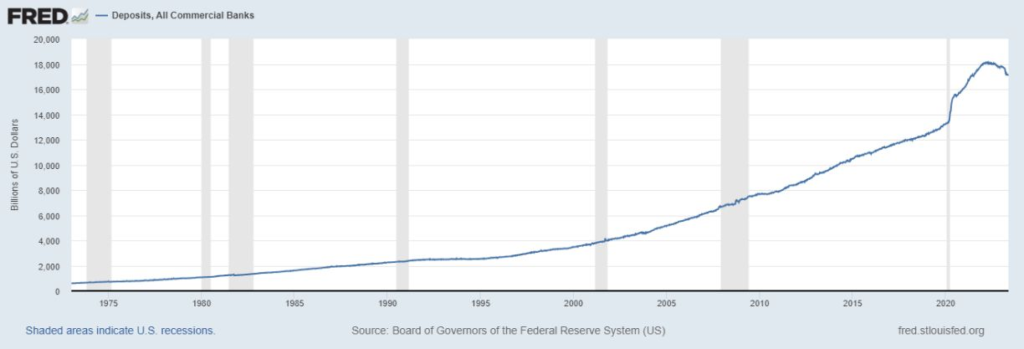

If you take a look at the charts below,

You can see both the money supply and the deposit curve increase by $5T in roughly the same time period.

So all that stimulus for the people ends up being held by the banks.

Makes perfect sense considering that’s where most people store their money.

The only problem is this put MASSIVE strain on banks’ balance sheets.

$5T of demand deposits—and nobody wants a loan.

So what do the banks do?

They buy bonds and invest in residential housing through government agencies.

AKA—loaning the money back to the government.

Then, when the government raised rates and forced the tide back out,

Everyone got to see which banks weren’t covering themselves and were swimming naked.

Unprecedented circumstances like these call for more diligence than ever from banks.

Do your due diligence.

Don’t get caught with your pants down.

—

Digging deep on banks is what I do.

🔔 Follow Brian on Linkedin: Brian Pillmore