Compliance Artificial Intelligence: The New Strategic Imperative for Banking

Brian's Banking Blog

For bank executives, Compliance Artificial Intelligence is no longer a theoretical concept—it is a critical tool for managing risk, driving efficiency, and securing a competitive advantage. It represents a fundamental shift from reactive, manual compliance processes to a proactive, data-driven defense system.

This is not about replacing human judgment; it is about augmenting it with machine-scale processing and analytical power.

Why AI in Compliance Is Now a Board-Level Issue

The regulatory landscape is expanding in complexity and velocity. For bank leadership, relying on legacy tools like spreadsheets and manual reviews is no longer a viable strategy—it is a direct liability. The sheer volume of data and the intricacy of modern regulations overwhelm traditional compliance frameworks, creating unacceptable risk.

Adopting compliance artificial intelligence is now a strategic necessity. It is the only effective means of managing regulatory risk in real-time, fulfilling fiduciary duties, and ensuring institutional survival in a data-intensive market.

From Cost Center to Strategic Asset

Viewing compliance as a mere cost center is a strategic error. When powered by AI, the compliance function transforms into a source of intelligence that informs better business decisions. The objective is to leverage regulatory data not just for defense, but for insight.

This is not a future trend; it is a present reality. A recent survey revealed that 57% of compliance professionals now rank AI as a top priority, placing it above traditional pillars like Anti-Money Laundering readiness and cybersecurity.

The core function of compliance AI is to convert vast quantities of raw data into decisive, risk-mitigating actions. This protects capital, drives operational efficiency, and safeguards the institution's reputation.

The escalating complexity of areas like fintech regulatory compliance underscores the urgent need for AI-driven solutions.

Effective, data-driven decisions begin with a clear understanding of your institution's position. How does your operational risk profile compare to your peers? This benchmark is the essential foundation for deploying AI where it will have the greatest impact. That baseline intelligence is precisely what Visbanking provides—illuminating the path from regulatory burden to strategic opportunity.

How Compliance AI Delivers Tangible Business Value

At its core, compliance artificial intelligence is a powerful business tool engineered to execute high-stakes tasks with an efficiency and accuracy that human teams cannot achieve.

Imagine an infinitely scalable team of expert analysts operating 24/7 without error or fatigue. This team can scrutinize every transaction, parse every communication, and cross-reference every action against the entire regulatory code simultaneously.

Beyond speed, this is about superior intelligence. The system identifies subtle patterns and anomalies that even the most diligent human analyst would miss. This capability is driven by three core technologies working in concert.

The Core Technologies Driving Compliance AI

Each component of a compliance AI system addresses a distinct challenge, transforming raw data into both a protective shield and a predictive tool. Understanding their function is key to unlocking their strategic value.

Machine Learning (ML): This is the pattern recognition engine. In Anti-Money Laundering (AML), an ML model analyzes millions of transactions to learn the subtle signatures of illicit activity. It can distinguish a legitimate high-value transfer from a transaction indicative of structuring—a distinction that rigid, rules-based systems frequently fail to make. For a bank processing 500,000 transactions daily, this means identifying three truly high-risk patterns instead of generating 1,000 low-value alerts.

Natural Language Processing (NLP): This technology enables AI to comprehend human language. In practice, it means the system can scan thousands of customer communications or internal chat logs for phrases, sentiment, or tones that signal misconduct or fraud. For example, it can flag a loan application where narrative inconsistencies suggest potential misrepresentation, a detail a human reviewer under time pressure might overlook.

Predictive Analytics: This component leverages historical data to forecast future risk. It can identify customers whose behavior is trending toward a high-risk profile before a compliance breach occurs. For example, the system could flag a commercial account as having a 30% higher probability of engaging in sanctioned trade activities next quarter based on evolving transaction patterns. This provides a critical window for proactive intervention.

By translating dense regulatory texts and voluminous transaction logs into clear risk signals, compliance AI enables swift, intelligent decision-making. It elevates the practice of regulatory compliance for banks from a defensive necessity to a source of operational intelligence.

However, these tools are only as effective as the data they are trained on. A predictive model is useless without clean, accurate historical data and—critically—a benchmark against peer performance. Before deploying AI, executives must ask: "How does our risk profile truly compare to the industry standard?"

This is where platforms like Visbanking become indispensable. By benchmarking your institution's key metrics against a curated peer group, you establish the robust data foundation required for AI to produce meaningful, trustworthy, and defensible outcomes.

Real-World Impact: Measurable Results for Your Institution

For bank executives, the decisive question is about tangible impact. How does this technology translate into measurable outcomes that strengthen the balance sheet and protect the franchise? The answer lies in targeted applications that address the most costly and vulnerable aspects of traditional compliance.

By delegating high-volume, repetitive data analysis to AI, compliance teams are liberated to focus on strategic risk management. This pivot improves efficiency, reduces human error, and fundamentally strengthens the bank's risk posture.

Revolutionizing AML and Reducing Operational Drag

Legacy AML systems are notorious for generating false positives at staggering rates—often exceeding 95%. Each alert requires manual investigation, consuming thousands of man-hours and creating significant operational drag.

AI delivers an immediate and quantifiable return on investment.

An AI-powered system learns from historical data to distinguish between anomalous-but-benign transactions and genuinely suspicious activity. For a mid-sized bank, this can reduce the false positive rate from 95% down to 60%. This is not an incremental improvement; it can translate directly into an estimated $1.2 million in annual operational savings by enabling investigators to concentrate on credible threats.

Mastering Regulatory Change Management

The constant influx of new regulations presents a significant challenge. A single new rule can span thousands of pages, requiring weeks for legal and compliance teams to interpret and operationalize. This process is slow, reactive, and fraught with risk.

AI, specifically Natural Language Processing (NLP), transforms this dynamic.

An AI model can ingest, analyze, and summarize new regulatory documents in hours, not weeks. It extracts specific obligations, maps them to existing policies, and flags potential gaps or conflicts. This compresses the implementation timeline from a multi-week project to a matter of days, allowing executives to focus on strategic response rather than manual interpretation.

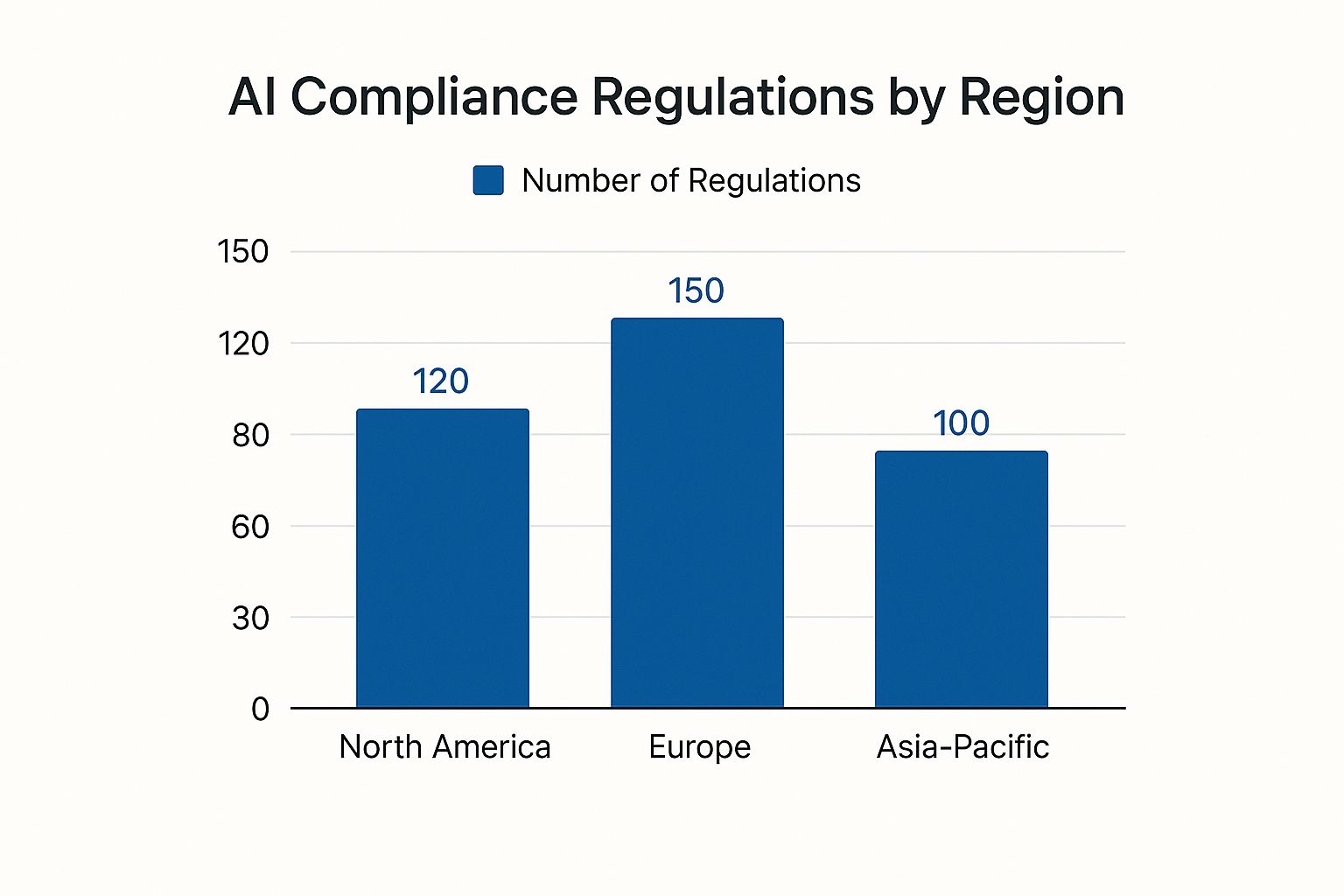

The chart below illustrates the escalating volume of AI-related regulations, making automated analysis a clear necessity.

Proactive Surveillance of Internal Communications

Monitoring employee communications for misconduct like insider trading is an area where manual oversight is fundamentally inadequate. Human reviewers can only sample a small fraction of communications, leaving significant unmonitored risk.

AI surveillance tools leverage NLP to analyze 100% of communications in near real-time. They are trained to detect not just keywords but the context and nuance that may signal illicit behavior, identifying potential issues before they escalate into costly regulatory actions.

The following table provides a direct comparison of AI's impact versus traditional methods.

AI Impact on Key Banking Compliance Functions

This table breaks down the performance and financial impact of AI-driven compliance versus legacy approaches.

| Compliance Area | Traditional Method (Annual Cost/Risk) | AI-Powered Method (Annual Savings/Benefit) | Key AI Technology Used |

|---|---|---|---|

| AML Transaction Monitoring | High operational costs due to >95% false positives; risk of missed suspicious activity. | $1.2M+ in savings from reduced false positives (down to 60%); improved threat detection. | Machine Learning, Anomaly Detection |

| Regulatory Change Mgmt. | Weeks of manual review per regulation; risk of misinterpretation and delayed implementation. | Reduces review time to hours; ~90% faster implementation; improved accuracy. | Natural Language Processing (NLP) |

| Communications Surveillance | Manual sampling covers <5% of comms; high risk of missed misconduct. | 100% coverage in near real-time; prevents violations, avoiding multi-million dollar fines. | NLP, Sentiment Analysis |

The data clearly demonstrates that AI delivers a decisive advantage in both efficiency and risk mitigation.

Each of these use cases shows how compliance AI converts data into a primary defense mechanism. However, an AI model's intelligence is entirely dependent on the quality of its training data. Before an algorithm can identify an anomaly, it must have a clear definition of "normal."

This is where robust data intelligence is non-negotiable. Platforms like Visbanking provide the crucial peer and market data required to train and validate these AI systems. By benchmarking your bank’s performance against the industry, you provide the context necessary for your AI to deliver precise, actionable, and defensible insights.

Navigating the Governance of AI in Compliance

Integrating AI into compliance workflows is not merely a technological upgrade; it introduces a new and critical layer of governance. Bank directors face a dual mandate: using AI to manage compliance while ensuring the AI itself is compliant, transparent, and fully defensible.

This is a fundamental governance responsibility that rests with the institution's leadership, not the IT department. A poorly governed algorithm can accrue regulatory liabilities at a scale and speed far exceeding any human team. These are not abstract threats but tangible, balance-sheet risks that demand executive oversight from the outset.

The Risks of Ungoverned AI

Without a rigorous governance framework, even the most sophisticated AI can become a significant liability. Executive focus should be on three primary areas of risk that can silently erode the bank's compliance posture and expose it to severe penalties.

'Black Box' Algorithms: If an AI model's decision-making process is opaque, its conclusions cannot be explained to regulators. If a loan is denied and the only justification is "the model decided," the bank is on untenable ground with fair lending laws. Explainability is a prerequisite for regulatory acceptance.

Model Drift: Markets and customer behaviors evolve. An AI model trained on last year’s data can degrade in accuracy or develop biases over time. An AML model, for instance, might begin flagging legitimate transactions as it fails to adapt to new payment technologies, creating friction for customers and operational burdens for staff.

Data Bias: An AI model inherits and amplifies any biases present in its training data. If historical data reflects unintentional biases, the AI will codify and scale them, leading to discriminatory outcomes in areas like credit assessment and inviting regulatory action and severe reputational damage.

Effective governance is the essential control that prevents AI from introducing systemic risk. This requires clear internal standards, such as robust AI usage policies, to establish firm boundaries for its application and oversight.

Building a Defensible AI Framework

Establishing a defensible AI framework is non-negotiable. As AI becomes standard practice, regulatory scrutiny of its governance will intensify. Gartner predicts that by 2026, 60% of organizations will implement formal AI governance programs specifically to manage these risks.

A data-first culture is paramount. The quality of your AI is a direct function of the data used to build and validate it. A strong foundation in data governance in banking is the prerequisite for any successful and compliant AI implementation.

This is precisely the challenge platforms like Visbanking are designed to solve. We provide the foundational data integrity and essential benchmarking required to stress-test your AI models. By validating your AI's outputs against real-world peer performance, you can ensure your tools are effective, auditable, and defensible under regulatory examination.

A Strategic Roadmap for AI Implementation

Implementing compliance AI is a strategic business initiative that demands executive leadership. Success is achieved not through a single technological leap but through a phased, methodical approach that delivers demonstrable value while building long-term capability.

The first step is to identify a high-impact pilot project. Avoid a "boil the ocean" approach. Instead, target a specific, costly pain point where AI can deliver a clear and rapid win. For example, automating the initial review of Suspicious Activity Report (SAR) narratives can reduce investigator workload by 30-40% almost immediately. This provides a quantifiable ROI that builds support for broader implementation.

Assembling the Right Resources

With a target identified, the next step is assembling the right team. This is not a task for data scientists alone. Successful projects merge deep compliance expertise with technical talent to ensure the solution addresses a real-world regulatory challenge, not just an interesting technical problem.

Selecting the right technology partners is equally critical. Vendors must have a deep understanding of the banking regulatory environment. Solutions must be powerful, transparent, and auditable—designed to withstand intense regulatory scrutiny.

A 2025 PwC survey found that while 71% of executives see AI as a game-changer for compliance, 89% are concerned about data privacy and security risks. This underscores the necessity of choosing partners who prioritize governance alongside performance. More context on compliance statistics and their implications is available here.

Ensuring Data Readiness as the Critical Foundation

Ultimately, any AI system is only as good as the data it learns from. This is the most critical phase and where many initiatives falter. Training a model on incomplete or inconsistent data will produce flawed, indefensible results, creating new risks rather than mitigating existing ones.

This is where Visbanking's intelligence becomes essential. Before committing significant capital to predictive models, an institution must put its data house in order. Our platform provides the intelligence needed to understand your bank's operational metrics and its position relative to peers. This is not a preliminary step; it is the bedrock of a sound AI strategy and a core component of effective financial risk management strategies.

By establishing this clear, data-driven baseline first, you provide your AI initiatives with the solid foundation required to produce reliable and actionable insights.

The Executive's Next Move in the AI Compliance Era

To be direct, Compliance artificial intelligence is no longer an optional innovation. It is the new foundation for effective risk management, operational excellence, and sustainable growth. For executives and directors, the question is no longer if AI should be adopted, but how it can be deployed intelligently to generate measurable returns.

This journey does not begin with a massive technology investment. It begins with a commitment to data intelligence. A successful AI strategy must be built on a clear-eyed understanding of your bank's performance, risk profile, and competitive standing. Without this context, you are merely applying expensive tools to poorly defined problems.

From Insight to Action

Before an algorithm can be tasked with improving performance, leadership must first define performance. How does your loan portfolio's risk concentration compare to your ten closest peers? Is your operational overhead for AML compliance 15% higher than the industry average? Answering these precise questions provides the strategic clarity to direct AI where it will deliver the greatest value.

The most effective AI implementations are driven not by technology, but by a precise, data-backed business case. Define the problem before you architect the solution.

This is the central challenge facing every executive board. The first and most critical move is to ground your strategy in uncompromising data.

By benchmarking your compliance metrics and operational efficiency against peer institutions, you build the essential business case for AI. This is precisely the intelligence Visbanking provides, empowering you to make the data-driven decisions that will define your institution's future.

Common Questions Answered

What is the primary ROI for investing in compliance AI?

The return on investment is twofold: significant cost reduction and proactive risk mitigation.

Compliance artificial intelligence automates a substantial portion of manual, repetitive tasks, which can reduce associated operational costs by up to 40%. More importantly, it enhances the detection of complex threats—such as sophisticated money laundering schemes—that are difficult for human teams to identify. This capability helps avoid crippling regulatory fines and protects against severe reputational damage.

How do we manage the risk of incorrect AI-driven decisions?

This risk is managed through a robust governance framework. An AI system is never autonomous in a high-stakes environment.

Effective controls include a "human-in-the-loop" protocol for all material decisions, continuous model monitoring to detect performance degradation or bias, and regular validation of AI outputs against external, objective data. These guardrails ensure that models remain accurate, fair, and aligned with the bank's risk appetite.

Is AI-driven compliance feasible for smaller institutions?

Yes. The advent of specialized Regulatory Technology (RegTech) vendors offering AI-as-a-service has made these powerful tools accessible to institutions of all sizes.

The key is a phased implementation. Start with a single, high-impact use case, such as automating aspects of BSA/AML reporting. Demonstrating a clear and rapid return on this initial investment builds the business case for broader adoption. This approach allows the technology to fund its own expansion while immediately strengthening the bank's compliance posture.

Your first move in AI isn't about picking an algorithm—it's about knowing where you stand. At Visbanking, we give you the peer and performance data you need to build a smart AI strategy from day one. Explore our data and find your starting point today.