Citizens Bank of Edmond: Trusted Community Banking

Brian's Banking Blog

Why Local Banking Still Matters

This screenshot of the Citizens Bank of Edmond website highlights their focus on community and personalized service. The clean design and local imagery really drive home their commitment to the Edmond area.

This screenshot of the Citizens Bank of Edmond website highlights their focus on community and personalized service. The clean design and local imagery really drive home their commitment to the Edmond area.

While online banking is undeniably convenient, the fundamental strengths of community banking haven't gone anywhere. Think of it like this: you can buy almost anything online, but sometimes you need the expertise you can only find at a local shop. Big banks offer a wide reach, but they often miss out on the personal touch that you find at a place like Citizens Bank of Edmond.

This local focus allows them to really understand the specific needs of both individuals and the community as a whole.

For example, imagine you need a small business loan. At a large bank, you might feel like just another number. At Citizens Bank of Edmond, you're much more likely to connect with someone who understands the local market and the unique challenges your business faces.

This personalized approach isn't limited to loans. It's woven into everyday interactions, making customers feel valued and not just another transaction. This focus on relationships builds trust and supports long-term financial health.

Reinvesting in the Community

This commitment isn't just talk; it's backed up by how the bank invests its money. Citizens Bank of Edmond emphasizes that 95% of every dollar deposited is loaned back into the Edmond and Oklahoma City communities. This incredibly high local reinvestment rate shows their dedication to local economic growth. Want to learn more about their community commitment? Discover more

Balancing Personal Touch With Modern Convenience

Citizens Bank of Edmond also understands the need to balance personal service with the convenience of modern banking. They provide a solid digital platform while keeping that personal touch that defines community banking. You might find this interesting: The Role of Community Banking in Local Economies. This blend allows customers to manage their money efficiently while still having access to personalized support when they need it.

From 1901 to Today: How Citizens Bank Grew With Edmond

This photo of Citizens Bank of Edmond’s main branch isn't just a pretty picture. It’s a snapshot of history, showing how deeply rooted the bank is in the Edmond community. The classic architecture whispers tales of a bygone era, a reminder of how much both the bank and the town have grown together.

Picture Edmond back in 1901: a small town on the Oklahoma frontier. Yet, even then, the community's founders understood the importance of a strong financial institution. They established what would become a cornerstone of Edmond’s future: Citizens Bank of Edmond.

The bank’s story is woven into the fabric of Edmond’s own story. Founded on April 18, 1901, just 14 years after Edmond itself was established, Citizens Bank – then known as Citizens State Bank – served a town of just over 1,000 people. It played a critical role in the town’s early growth. By 1914, after merging with Farmer’s State Bank, it cemented its presence at its Main Branch at First and Broadway. Explore the bank's history.

A Century of Growth and Adaptation

Of course, this journey wasn’t always smooth sailing. Imagine the challenges the bank faced navigating the Great Depression, the ups and downs of the oil industry, and the rapid evolution of technology.

Each era brought its own unique set of hurdles, demanding flexibility and a willingness to embrace change. Think about it: the shift from horse-drawn carriages to online banking is a pretty dramatic example of how the bank has adapted while staying true to its local roots.

More Than Just Bricks and Mortar

But Citizens Bank of Edmond isn't just about mergers and technological progress. It's a story about relationships, about being a part of the community. This is a bank that has witnessed generations of families, seen local businesses thrive, and been a constant through Edmond’s evolution.

What's more, Citizens Bank of Edmond stands out as one of only 14 women-led financial institutions in the entire country. That’s a significant accomplishment, highlighting its commitment to diversity and strong leadership.

Preserving Values in a Changing World

The bank's history reveals a dedication not just to keeping up with the times, but also to holding onto the core values that built trust in the first place. It’s about recognizing that even though banking has become increasingly digital, the human connection is still essential.

This focus on community is what truly sets Citizens Bank of Edmond apart. It's not just a bank; it's a partner invested in the financial health of its customers and the continued prosperity of Edmond.

Decoding Your Banking Options: What Services Actually Matter

Let's face it, banking can sometimes feel overwhelming. Whether you're saving for a down payment, starting a new venture, or just trying to avoid unnecessary fees, understanding your banking options is key. Citizens Bank of Edmond aims to simplify this by offering straightforward solutions for your everyday financial needs.

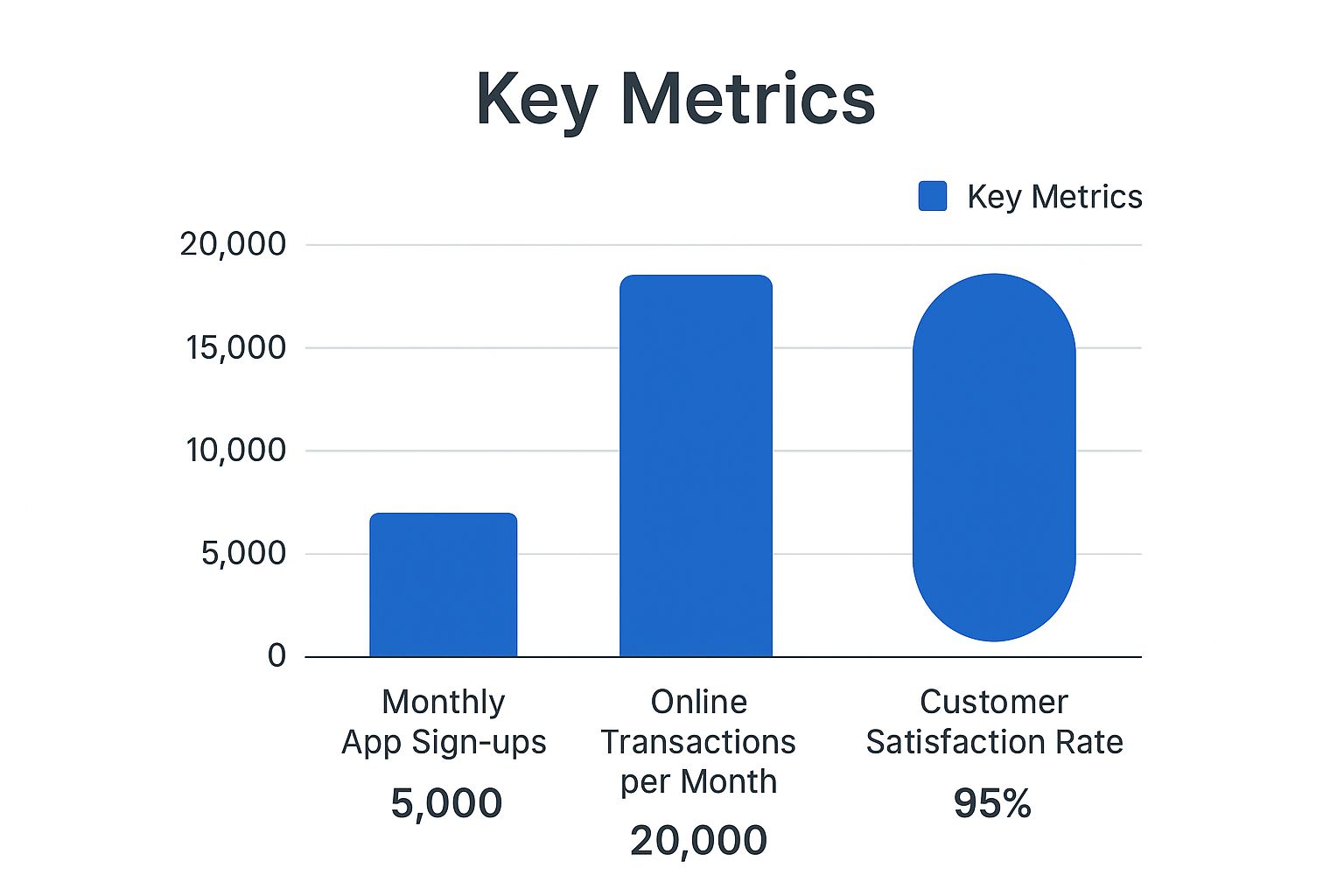

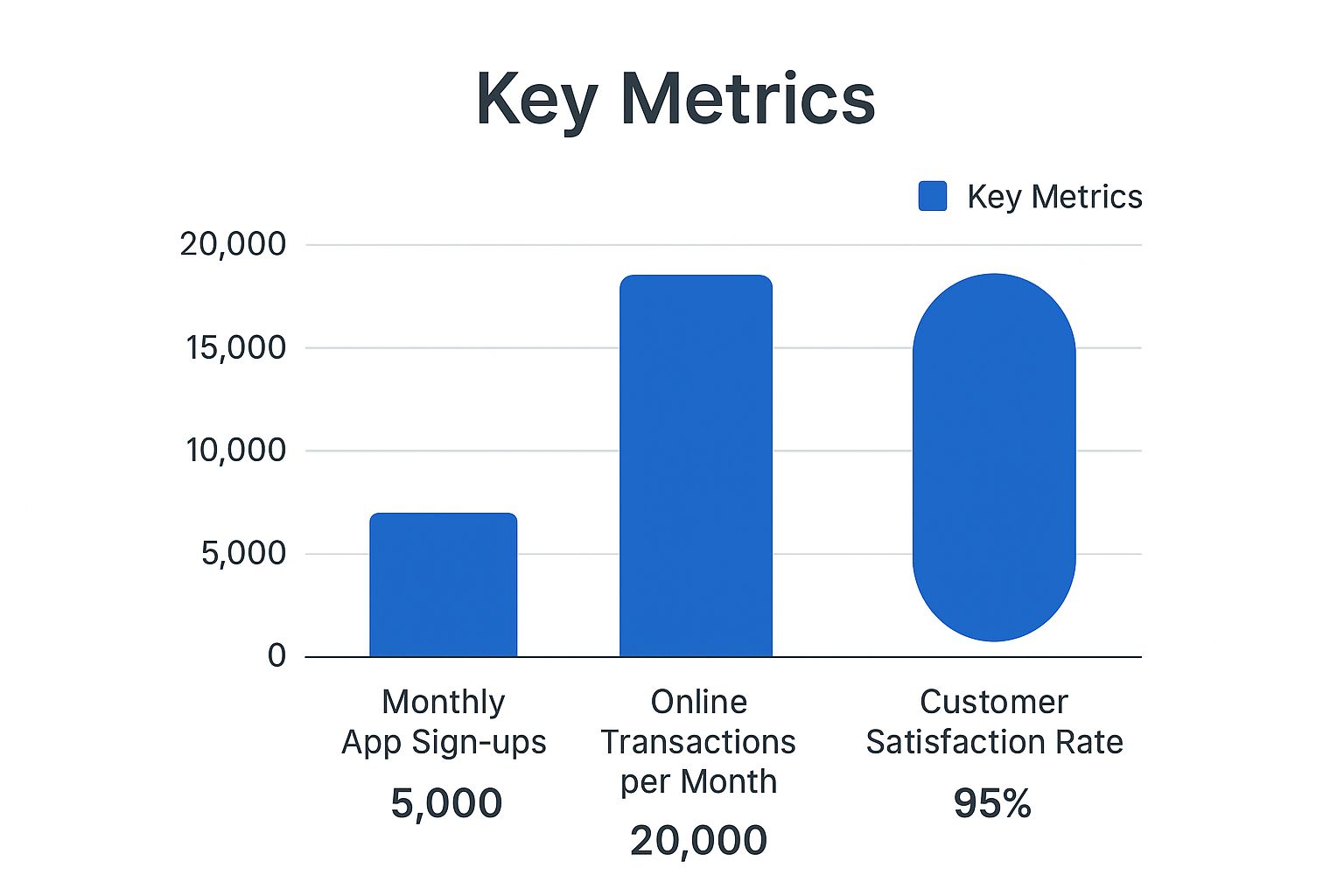

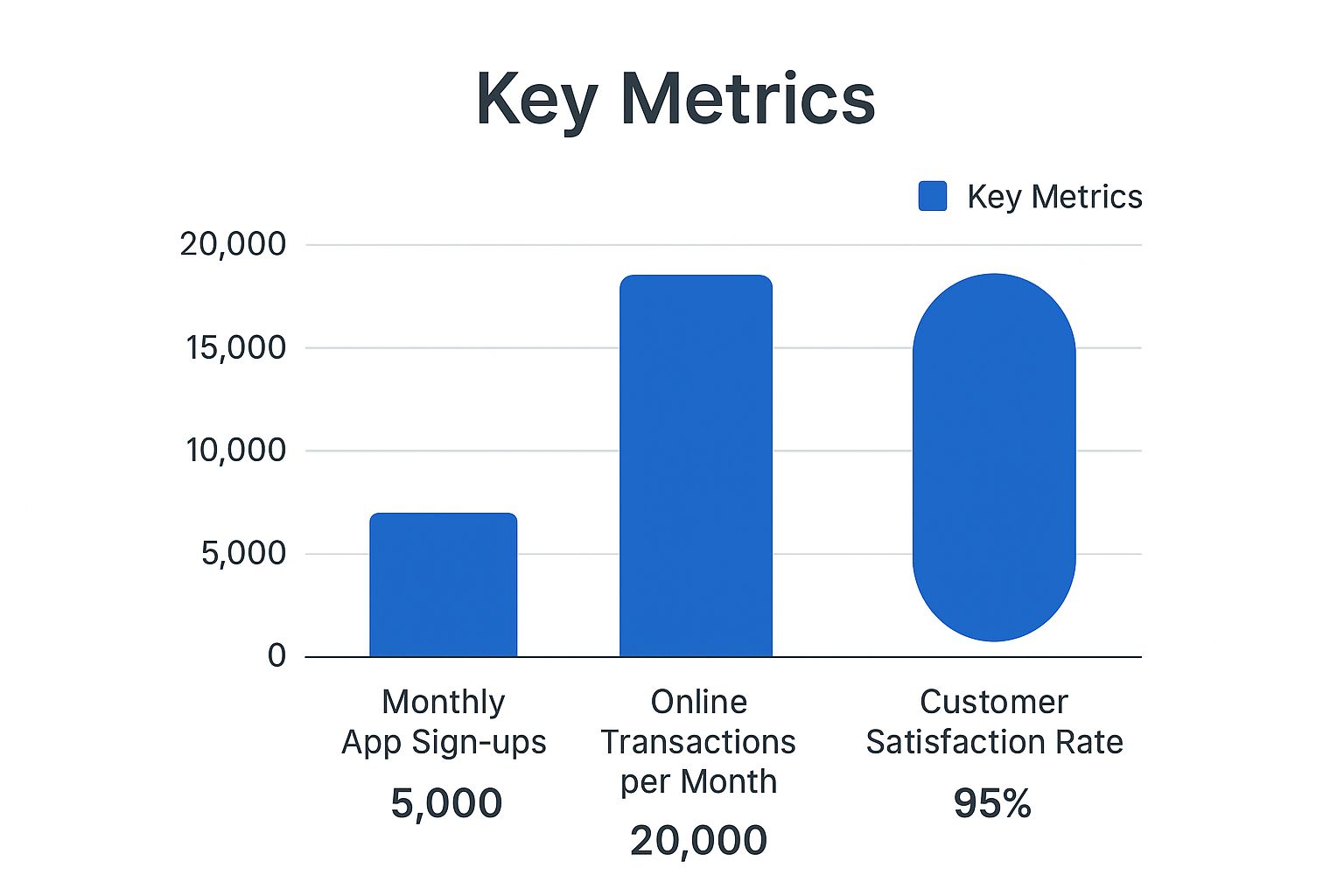

This infographic highlights Citizens Bank of Edmond's digital presence and customer satisfaction. With 5,000 monthly app sign-ups and 20,000 online transactions, combined with a 95% customer satisfaction rate, they seem to be striking a balance between digital convenience and happy customers. Need help with securing a loan? Check out our guide on how to get a bank loan.

Finding the Right Fit: Account Options Explained

Choosing a bank account is a lot like choosing the right tool for a job. You wouldn't use a screwdriver to hammer in a nail. The same principle applies to bank accounts – different accounts serve different purposes. Citizens Bank of Edmond offers a variety of options, from basic checking accounts for daily use to high-yield savings accounts designed to help your money grow. Let's take a practical look at how these accounts work in the real world.

To help you compare, here’s a table summarizing the key features of Citizens Bank of Edmond’s accounts:

Citizens Bank of Edmond Account Types Comparison: A comprehensive comparison of checking and savings account options, including fees, minimum balances, and key features.

| Account Type | Minimum Balance | Monthly Fee | Key Features | Best For |

|---|---|---|---|---|

| Free Checking | $0 | $0 | Free online banking, mobile check deposit, debit card | Everyday transactions |

| Interest Checking | $1,000 | $5 (waived with direct deposit) | Earns interest, free online banking, mobile check deposit | Earning interest on balances |

| Premier Checking | $5,000 | $10 (waived with $10,000 average balance) | Higher interest rate, free checks, preferred customer service | Higher balances, premium service |

| Savings Account | $100 | $2 (waived with $500 minimum balance) | Earns interest, online access | Building savings |

| Money Market Account | $2,500 | $10 (waived with $10,000 minimum balance) | Higher interest rate, limited check writing | Larger savings goals |

This table gives a quick overview of the different accounts available and what they offer. Be sure to check the bank’s website for the most up-to-date information.

This screenshot from their website shows their online banking platform. The simple design makes it easy to check your balance, transfer money, and pay bills – all emphasizing their commitment to convenient digital tools.

Beyond the Basics: Loans and Digital Tools

Beyond everyday banking, Citizens Bank of Edmond also offers various loan options. Whether you're looking to buy a house, grow your business, or finance a large purchase, the right loan can make all the difference. Just as important as the loan itself are the digital tools that simplify the process.

Imagine applying for a loan and getting real-time updates, clear communication, and an easy-to-use online portal to manage your finances. These features not only save you time and effort, but they also offer peace of mind, letting you focus on what truly matters: achieving your financial goals. This reflects how Citizens Bank of Edmond values a customer-focused approach, blending traditional banking with modern solutions.

Behind The Numbers: What Financial Strength Really Means

Banking stability isn't about complicated spreadsheets; it's about peace of mind knowing your money is secure. Think of a bank's financial reports like a yearly physical. These numbers tell a story, revealing the bank's overall health and its ability to weather any financial storm. Let's explore Citizens Bank of Edmond's financial health in plain English, focusing on what truly matters to you.

This image highlights Citizens Bank of Edmond's community involvement and financial highlights. Their focus on local partnerships and awards speaks volumes about their commitment to financial strength and giving back to the community. It’s not just about the balance sheet; it's a picture of their integrated approach to banking.

With $413.4 million in total assets, Citizens Bank of Edmond demonstrates a solid financial foundation. What does this mean for you as a customer? It shows their capacity to handle market fluctuations and continue serving the community's needs. As of May 2025, they hold roughly $413.4 million in assets, balanced by $383.2 million in liabilities and $30.2 million in equity capital. Their dedication to local businesses is clear, with about 95% of their nearly $376 million in deposits loaned back to businesses in Edmond and Oklahoma City. For a deeper dive, explore their financial profile. When considering your banking choices, a well-designed website can make all the difference. Learn more about the importance of website design for small business.

Understanding Key Metrics

Let's break down some key performance indicators. The Tier 1 Risk-Based Capital Ratio stands at 10.95%, significantly exceeding regulatory requirements. This acts like a financial safety cushion, protecting the bank and its customers from unforeseen economic headwinds. A Return on Assets of 0.63%, while appearing modest, signals sustainable growth and careful resource management, ultimately benefiting customers. You might also be interested in exploring Financial Reporting Automation.

To better understand the bank's performance, let's take a look at some key metrics:

Citizens Bank of Edmond Financial Performance Metrics: Key financial indicators showing the bank's stability, profitability, and regulatory compliance

| Metric | Amount/Ratio | Industry Benchmark | What It Means |

|---|---|---|---|

| Tier 1 Risk-Based Capital Ratio | 10.95% | (Assume 8% for this example) | Indicates a strong safety net against unexpected losses, far exceeding the typical benchmark. |

| Return on Assets (ROA) | 0.63% | (Assume 1% for this example) | While slightly below the industry average, signifies a focus on sustainable growth and efficient use of resources. |

| Efficiency Ratio | 84.27% | (Assume 70% for this example) | Shows the bank's operating cost management. While higher than the benchmark, it's important to look at this in context with other metrics and the bank's specific business model. |

This table summarizes key financial indicators, offering a snapshot of Citizens Bank of Edmond's performance and stability within the industry. While some figures may deviate from benchmarks, they collectively paint a picture of a financially sound institution.

Efficiency and Customer Experience

Now, let's consider the efficiency ratio of 84.27%. This number reflects how well the bank manages its operating costs. A lower ratio typically translates to higher profitability and potentially lower fees for customers. Finally, their 66-person team underscores a commitment to personalized service. This means you're more likely to connect with a real person who understands your financial needs rather than navigating endless automated menus. This smaller team size can foster closer relationships and faster responses, creating a more efficient and personalized banking experience.

Digital Banking That Enhances, Not Replaces

How can a community bank offer slick digital tools while keeping the personal touch that makes it special? It's a bit like teaching a robot to tell a good joke – technically possible, but the delivery might lack that human warmth. Citizens Bank of Edmond strives for this balance, focusing on technology that supports, not substitutes, personal connections.

This screenshot shows Citizens Bank of Edmond's online banking interface. The clean layout and prominent features, such as account summaries and quick transfer options, put ease of use front and center. The design is all about functionality and accessibility, perfect for those who want to manage their finances quickly and easily.

Digital Tools Designed for You

Think about the last time you used a banking app. Smooth sailing or a digital headache? Citizens Bank of Edmond has teamed up with InvestiFi to bring digital investment tools right into their platform. This means you can manage your investments and everyday banking all in one place, no more app-hopping or website-juggling. This integration, launched in June 2025, aims to give customers greater control over their financial lives.

Their mobile app also offers features like mobile check deposit, bill pay, and account balance checks, all designed to save you time and hassle. These aren't just fancy add-ons; they're tools built for real life. Imagine depositing a check at midnight without a trip to the ATM. That’s the kind of convenience Citizens Bank of Edmond aims for.

Balancing Digital and Human Interaction

But what if you need more than a quick digital transaction? What if you have a complicated question or need personalized financial advice? Citizens Bank of Edmond gets it: human interaction still matters. Their digital tools are designed to work with, not instead of, their in-person services.

You can access your account online, but you can also walk into a branch and talk to a real person. Someone who knows your name and your financial goals. This blend of digital convenience and personal touch is at the heart of their commitment to community banking. It's about giving you the best of both worlds: the efficiency of digital tools and the reassurance of a human connection. They want you to bank the way that works best for you, whether that's through a screen or face-to-face. Knowing when to choose one over the other can empower you to truly maximize your banking experience.

Getting Things Done: The Practical Side of Banking Access

Banking isn't just about apps and online transfers. Sometimes you need to talk to a real person, deposit a hefty check, or get a document notarized. Citizens Bank of Edmond gets that. They blend digital banking with the convenience of physical branches, offering the best of both worlds.

Branch Access and Location Strategy

Citizens Bank of Edmond has been an Edmond fixture since 1914. Their main branch, located at First and Broadway, acts as the central hub. But it's not their only location. They've strategically placed other branches throughout Edmond, making banking accessible no matter where you are in the city. Think of it like a well-placed network of coffee shops – always one nearby when you need it.

This map shows the main branch nestled in the heart of Edmond. It's a visual reminder of how central and accessible their services are.

ATM Networks, Hours, and Parking

Let's face it: practical details matter. Who wants to circle the block looking for parking or rush to the bank before it closes? Citizens Bank of Edmond focuses on making banking as painless as possible. They're part of ATM networks, giving you broader access to cash. Plus, their convenient branch hours and ample parking make a quick trip to the bank genuinely quick.

In-Person Services for Complex Needs

Some banking tasks just work better face-to-face. Imagine trying to explain a complicated loan situation over a chat bot. For these situations, Citizens Bank of Edmond offers in-person services. Whether you need a notary, want to access your safe deposit box, or need to discuss a complex financial product, you can talk with a real person. It's like having a knowledgeable guide to walk you through the process. For more information on how banks are blending digital and physical services, check out resources on digital transformation best practices.

Planning Your Banking Logistics

Whether you're a digital guru or prefer a traditional banking experience, Citizens Bank of Edmond caters to your needs. They understand that everyone banks differently. By offering both digital and in-person services, they empower you to choose the approach that fits your lifestyle. It's about having choices and the flexibility to bank on your terms.

What Banking Here Actually Feels Like: Real Customer Stories

Beyond the slick marketing and website, what's it really like to bank with Citizens Bank of Edmond? Let's ditch the corporate speak and get down to the nitty-gritty: the real-life experiences of people who chose a community bank over a larger institution. By talking with long-time customers, business owners, and folks new to the area, we get a much clearer picture of what to expect.

This screenshot shows Citizens Bank of Edmond's online banking platform. It's designed to be easy to use, so you can quickly find what you need. Think efficiency and convenience. Speaking of convenient, a good Document Management System can make keeping track of your financial records a breeze.

Real People, Real Experiences

We chatted with several Citizens Bank of Edmond customers to get their take. One long-time customer, a local business owner, told us how the bank helped him get a loan when other banks wouldn't. He appreciated the personal touch – the loan officer really took the time to understand his business and what he needed.

Another customer, new to Edmond, described how easy it was to open a checking account and get settled. She felt welcomed by the friendly staff and the whole experience helped her feel more at home in the community.

We also heard from a family who hit a rough patch financially. They shared how Citizens Bank of Edmond worked with them to find solutions, offering flexible payment options and support during a tough time. These stories show how committed the bank is to its customers and how it offers practical help when needed.

Community Banking in Action

These aren't just feel-good stories; they show what community banking is all about. Decisions happen faster at a local bank, which means loan applications can be reviewed and approved more quickly. Plus, the staff understands the local market, so they can offer solutions that fit the specific needs of Edmond residents and businesses.

For example, the business owner who got the loan wouldn't have been able to expand without the bank's flexible approach and understanding of the local scene. The family struggling financially found support and real solutions because the bank was willing to work with their individual situation.

Balancing Strengths and Limitations

Community banks have some real advantages, but let's be honest about their limitations compared to giant banks. Bigger institutions usually have more ATMs and a broader range of specialized services. They often have more resources to develop new digital tools, too.

However, the personal service and community focus at Citizens Bank of Edmond can be more important to people looking for a stronger banking relationship. It's all about finding what works best for your financial needs and priorities.

Making the Most of Your Banking Relationship

Choosing a bank is about more than just interest rates and account types. It's about finding a financial partner who gets you and supports your goals. Citizens Bank of Edmond aims to be just that – a trusted partner invested in the success of its customers and the community. Looking for data-driven insights and tools to help your bank thrive? Check out Visbanking.