Catskill Hudson Bank Guide: Community Banking Excellence

Brian's Banking Blog

From Mountain Vision To Banking Success Story

Picture a group of Sullivan County business leaders in the early 1990s. They’re sitting around a table, sharing a common frustration: none of the local banks truly understood their community. This sparked an idea – what if they built a bank that actually served its neighbors? That desire became the foundation of Catskill Hudson Bank.

This story isn't just about banking; it's about understanding the heartbeat of a community. The founders wanted to be more than just a place to deposit checks; they wanted to be woven into the fabric of Sullivan County. This meant building trust and offering personalized attention to both local businesses and residents.

This community-focused approach became the bank’s defining characteristic. It also set the stage for future growth, not just in size, but in extending that personalized service to a wider audience.

This commitment led to the grand opening of their first branch in Monticello, nestled in the Catskill Mountains, on December 6, 1993. This was a pivotal moment, turning their vision into a brick-and-mortar reality. Originally called Community Bank of Sullivan County, the bank was founded by those same Sullivan County business leaders.

Fast forward to 2018, and Catskill Hudson Bank had blossomed, with 13 branches across five counties: Sullivan, Orange, Ulster, Albany, and Saratoga. Nine branches were located in the Hudson Valley/Catskills, and 4 were in the Capital District. Moving into the Albany region was a strategic move, providing access to a larger population, more government and business activity, and greater opportunities for growth. Discover more insights about Catskill Hudson Bank's history

The screenshot below captures the bank's deep community roots:

This image perfectly illustrates the bank's emphasis on personal connections, highlighting their dedication to fostering genuine relationships. This focus on community wasn’t just a starting point; it was the engine driving every decision.

Their expansion wasn't about conquering the market; it was about bringing their unique brand of community banking to more people. This steady growth demonstrates the trust they've earned, transforming them from a small-town bank into a major regional player. But even as they grew, they never lost sight of their core values. This balance allowed Catskill Hudson Bank to navigate the financial world while staying true to its original mission.

Understanding Catskill Hudson Bank's Financial Foundation

Before you trust a bank with your hard-earned money, it's smart to peek under the hood and see how it's running. Just like a doctor checks your vital signs, we'll explore Catskill Hudson Bank's financial health, breaking down the complex stuff into plain English.

Decoding the Balance Sheet

A balance sheet is like a snapshot of a bank's financial position at a specific moment. It shows what the bank owns (its assets), what it owes (its liabilities), and the difference between those two (its equity). Think of it like your house: the house itself is your asset, your mortgage is a liability, and the portion you actually own is your equity.

For Catskill Hudson Bank, this balance sheet snapshot is key to understanding its stability. A healthy balance sheet means the bank can likely weather tough economic times and meet its obligations. A weaker one might signal some potential risks.

The Loan Portfolio and Deposits: A Balancing Act

A bank's loan portfolio is the money it lends out – its primary way of making money. Deposits, on the other hand, are the funds customers entrust to the bank. The relationship between these two is crucial.

One important measure is the loan-to-deposit ratio. This compares the amount of loans a bank has given out to the total deposits it holds. A high ratio can mean the bank is lending aggressively, which could be risky. A low ratio suggests more cautious lending, but it might also limit profits. Finding the right balance is essential for long-term success.

A Closer Look at the Numbers

To really understand Catskill Hudson Bank's financial position, let's look at some key figures. As of the latest data, the bank held $525,725,000 in total assets, with $487,296,000 in liabilities and $38,429,000 in equity capital. Total deposits reached $448,616,000, while net loans and leases were $422,535,000. This paints a picture of a bank focused on its core lending business, with a solid loan-to-deposit ratio.

To provide further context, let's take a look at a snapshot of key financial metrics:

Catskill Hudson Bank Financial Snapshot: Key financial metrics showing the bank's current position and capital strength

| Financial Metric | Amount | Industry Context |

|---|---|---|

| Total Assets | $525,725,000 | Shows the total value of everything the bank owns |

| Total Liabilities | $487,296,000 | Shows the total amount the bank owes |

| Equity Capital | $38,429,000 | Represents the bank's net worth |

| Total Deposits | $448,616,000 | Shows the total amount customers have deposited |

| Net Loans & Leases | $422,535,000 | Represents the bank's core lending activity |

This table summarizes the bank's overall financial position, highlighting its assets, liabilities, and the funds entrusted to it by customers.

The bank also maintained a Tier 1 risk-based capital ratio of 11.37%, well above what regulators require. This strong capital position provides a cushion against potential losses. However, profitability metrics like return on assets (ROA) at -0.47% and return on equity (ROE) at -6.5% indicate some challenges during that period. Want to dig deeper? Explore their financial data in detail: Discover more insights about Catskill Hudson Bank's financials. You might also find this interesting: Data Governance in Banking.

Capital Adequacy: A Safety Net

Capital adequacy is a bank's ability to absorb losses and keep operating. Think of it as a financial safety net. Regulators set minimum capital requirements to ensure banks can handle unexpected downturns. Catskill Hudson Bank's strong capital ratio suggests a healthy safety net, offering more security for depositors.

Understanding these fundamental elements provides a clearer picture of Catskill Hudson Bank's financial stability. By examining these indicators, customers can make informed decisions about their banking relationship.

Breakthrough Moments That Shaped Banking Excellence

Catskill Hudson Bank's story isn't just about balance sheets and interest rates; it's a story of growth, adaptation, and deep community connections. Think of it like a tree adding rings, each marking another year of weathering storms and reaching for the sun. The bank's journey is full of these "rings," moments that show its growing strength and impact.

A Silver Anniversary Marked by Gold

The year 2018, Catskill Hudson Bank's 25th anniversary, was a particularly celebratory year. Instead of just cake and candles, they celebrated with record-breaking achievements. In October of that year, they hit two major milestones.

First, their loan portfolio reached a peak of $300 million. This wasn't just a number; it showed the growing trust the community had in them. More businesses and individuals were choosing Catskill Hudson Bank for their lending needs, a powerful sign of their expanding influence.

Second, October 2018 became the most profitable month in the bank's history up to that point. This underscored the success of their strategies and their ability to make the most of opportunities in the market. If you’re interested in tracking your own financial progress, tools like this net worth tracker app can be helpful.

These achievements showed Catskill Hudson Bank's successful evolution from a community-focused startup to a real player in the regional banking scene. They weren't just a local lender anymore; they were a growing force in the Hudson Valley and Capital District. Explore further details on Catskill Hudson Bank's achievements.

From Monticello to Regional Powerhouse

These successes weren't just luck. They came from smart decisions, strong customer relationships, and a willingness to adapt to the changing market. Expanding beyond their Monticello roots showed their commitment to serving a wider range of customers and finding opportunities in key regional markets. Their community-first approach wasn’t just a feel-good philosophy; it was a core part of their growth.

Building on a Legacy of Growth

These breakthrough moments are important markers in Catskill Hudson Bank’s history. They show the bank's resilience, its focus on the community, and its ability to grow sustainably. This history gives us valuable clues about where they're headed and reinforces their promise to deliver excellent banking services for years to come. These successes build a solid foundation for future growth and innovation, positioning Catskill Hudson Bank for continued success in the ever-changing world of finance.

Banking Products That Actually Make Sense For You

Choosing the right banking products can feel like navigating a maze. But what if you had a trusted guide to help you find your way? Let's explore Catskill Hudson Bank's offerings and see how they can simplify your financial life.

Personal Banking: Everyday Solutions

Catskill Hudson Bank offers a variety of personal banking options designed for different life stages. Think of it as a toolbox filled with different tools for different jobs. Whether you're a student opening your first account or preparing for retirement, they aim to have something for you. Their commitment to community banking means personalized service and a focus on local needs.

For example, their checking accounts might come with perks like free online bill pay and mobile check deposit. These digital conveniences make managing your money easier while still maintaining the personal touch of a community bank. Their savings accounts are designed to help your money grow steadily and safely. And CDs offer guaranteed returns for specific time periods, a predictable way to build your nest egg.

This screenshot from Catskill Hudson Bank's website showcases their personal banking options. Notice how clearly they present the different account types. This reflects their effort to meet a wide range of customer needs.

Home Loans: Building Your Future

Catskill Hudson Bank's community focus extends to their mortgages. They offer a variety of home loan options to help people achieve the dream of homeownership. This commitment to local lending strengthens the communities they serve. Their mortgage products may include fixed-rate mortgages, adjustable-rate mortgages (ARMs), and possibly even special programs for first-time homebuyers. They strive to offer competitive rates and personalized guidance throughout the process.

Business Banking: Supporting Local Growth

Catskill Hudson Bank is also a vital partner for local businesses. From brand new startups to well-established companies, they provide the financial services businesses need to flourish. This includes business checking accounts, lending options, and merchant services. Their community banking model allows them to understand the specific challenges of local entrepreneurs and offer flexible solutions. This could include anything from small business loans to lines of credit, providing the essential capital for growth. Merchant services help businesses accept credit and debit card payments, streamlining transactions and expanding their customer base. For a better understanding of financial dashboards, check out this helpful resource: Examples of financial dashboards.

The Community Bank Advantage

What sets Catskill Hudson Bank apart is its community-focused approach. This can translate to quicker decisions on loans, more personalized service, and a level of flexibility you might not find at larger institutions. They focus on building relationships with their customers, understanding their unique circumstances, and offering tailored advice. This local connection often results in faster loan approvals.

Standing Out in a Crowded Market

In a market dominated by big national banks, Catskill Hudson Bank differentiates itself with personalized attention and a community-first philosophy. This personal touch fosters strong customer loyalty. They actively participate in community events and believe in supporting the local economy. This engagement builds trust and strengthens their bond with the communities they serve. Their goal is to be more than just a bank; they want to be a valued partner.

To help you understand the range of services offered, here's a handy table:

Catskill Hudson Bank Product Comparison

Comprehensive comparison of personal and business banking products with key features and benefits

| Product Category | Key Features | Best For | Competitive Advantage |

|---|---|---|---|

| Personal Checking | Online bill pay, mobile deposit | Everyday transactions | Convenient and accessible |

| Personal Savings | Competitive interest rates | Building a nest egg | Secure and reliable growth |

| Certificates of Deposit (CDs) | Guaranteed returns | Long-term savings | Predictable returns |

| Mortgages | Fixed-rate, adjustable-rate, first-time homebuyer programs | Purchasing a home | Local expertise and personalized guidance |

| Business Checking | Flexible options, tailored to business size | Managing business finances | Supports local business growth |

| Business Lending | Loans and lines of credit | Expanding a business | Access to capital |

| Merchant Services | Credit and debit card processing | Accepting payments | Streamlined transactions |

This table highlights the key features and benefits of each product category, showing how Catskill Hudson Bank aims to cater to different financial needs. Their commitment to personal service and community engagement underpins their product offerings, making them a valuable partner for individuals and businesses alike.

Where Convenience Meets Personal Connection

Think of your banking experience. Do you prefer the personal touch of a local branch, or the ease of managing your finances from your couch? Catskill Hudson Bank gets that everyone's different. They aim to give you the best of both worlds, catering to all sorts of banking styles and preferences.

Branch Network: Strategic Locations, Personalized Service

Catskill Hudson Bank has thoughtfully positioned its branches throughout the Hudson Valley and Capital District. This isn’t random; it’s about being accessible to the communities they serve. Think of it like a well-placed chess piece, ready to assist wherever needed. Each branch offers a full suite of services, tailored to meet the specific financial needs of its local area. This local focus allows the bank to really understand its customers, offering solutions that fit like a glove and building stronger relationships.

This snapshot of their website shows how their branches span both the Hudson Valley and Capital District. The clusters of branches show a commitment to specific communities, while the broader coverage speaks to their desire to reach more people. It's like having a strong local presence with a wider regional net.

Digital Banking: Modernizing While Maintaining the Personal Touch

Catskill Hudson Bank knows that technology is key. They're constantly improving their digital banking platform, offering secure and easy-to-use online and mobile banking. Imagine managing your accounts, moving money, paying bills – all from anywhere, anytime. It’s about boosting convenience without losing that personal touch that community banks are known for.

Their mobile app takes this even further. Features like mobile check deposit and account alerts simplify everyday banking, making it smoother and more efficient. Think of it as having your bank in your pocket, ready whenever you are.

Need to explore different home loan options? An online mortgage calculator can help. You can plug in different loan amounts, interest rates, and terms to see what works for your financial situation.

Balancing Digital and In-Person Banking: Choosing the Right Approach

While Catskill Hudson Bank embraces the digital world, they understand that sometimes, you just need to talk to a real person. Opening a new account, discussing complex finances, or getting personalized advice often benefits from face-to-face interaction. Their branch network provides that opportunity, letting you build relationships with your bankers and receive tailored guidance.

On the other hand, everyday tasks like depositing checks or transferring funds can be handled quickly and easily online. This saves you time and lets you manage your money on your terms. Catskill Hudson Bank gives you the choice – digital or in-person – so you can pick what works best for you.

Ultimately, they empower you to combine the convenience of digital banking with the personal connection of a community bank. It’s the best of both worlds, meeting a variety of needs and making for a satisfying banking experience. This flexible approach is how they maintain a strong presence in the Hudson Valley and Capital District, serving a broad range of customers. As banking continues to change, Catskill Hudson Bank's commitment to blending personal connection with digital innovation is likely a big part of their ongoing success.

Community Impact Beyond Banking Transactions

Community banking isn't just a slogan; it's the core of how institutions like Catskill Hudson Bank operate. It affects everything from loan approvals to the overall economic health of the community. Think of it as a pebble dropped in a pond – the ripples spread far and wide.

Local Partnerships and Investments: Sowing Seeds of Growth

Catskill Hudson Bank invests in local initiatives that encourage growth and strengthen the community. This might mean teaming up with local organizations on development projects, sponsoring community events, or offering financial literacy programs. These actions demonstrate a real commitment to the well-being of the areas they serve, going above and beyond typical banking services. Interested in learning more? Check out this article: The Role of Community Banking in Local Economies.

Supporting Local Businesses: The Engine of Economic Growth

Catskill Hudson Bank's lending decisions directly impact the local economy. By providing loans to small businesses, they create jobs and boost economic activity. This dedication to local lending can be the deciding factor between a business flourishing or struggling, shaping the economic landscape of the community. Imagine a local bakery getting a loan to expand. This not only allows them to hire more people but also lets them better serve the community. Providing excellent customer service is crucial, and understanding key performance metrics is a big part of that. Learn more about the importance of tracking customer service performance indicators.

Hiring Practices: Investing in Local Talent

Catskill Hudson Bank also strengthens communities through its hiring. By prioritizing local talent, they create jobs and keep valuable skills within the community. This fosters a sense of ownership and pride among employees, as they directly contribute to the success of their own neighborhood. This approach builds a stronger, more tightly-knit community.

Customer Choice: Banking with a Purpose

Many customers choose Catskill Hudson Bank not just for convenient services, but because they want their financial choices to positively impact their community. This aligns with the increasing trend of conscious consumerism, where people support businesses that share their values. For these customers, banking is more than just a transaction; it’s a way to build a stronger local economy.

The Ripple Effect: Creating Value Beyond the Individual

The impact of Catskill Hudson Bank reaches far beyond individual accounts. Their actions create a ripple effect, fostering economic opportunity, supporting local businesses, and improving the overall quality of life in the communities they serve. This approach is what sets community banks apart and makes a lasting difference. It shows that banking can be a force for good, creating value far beyond individual transactions. This close relationship between the bank and the community is a core principle of community banking, creating a win-win situation for everyone involved. This generates a strong cycle of growth and prosperity, benefiting both the bank and the people it serves.

Is Catskill Hudson Bank Your Perfect Banking Match?

After exploring Catskill Hudson Bank's history, products, and community involvement, let's see if it truly aligns with your banking needs. Think of it as sitting down with a financial advisor, piecing together the puzzle to help you make a smart decision.

Who Thrives with Catskill Hudson Bank?

Catskill Hudson Bank truly shines for those who appreciate personal connections and a strong community presence. If you prefer building relationships with your bankers, knowing they understand your local economy and challenges, then Catskill Hudson Bank's community-focused approach might be a great fit. They prioritize lending locally and reinvesting in the areas they serve, which resonates with customers who want their banking choices to directly benefit their neighbors and businesses.

Competitive Advantages: Where They Shine

Catskill Hudson Bank’s core strength lies in its community-centric model. This can translate to potentially quicker loan approvals thanks to local decision-making, and a higher degree of personalized service. They understand the nuances of local markets, which allows them to tailor financial solutions to your specific circumstances. This personal touch often fosters stronger, more lasting customer relationships.

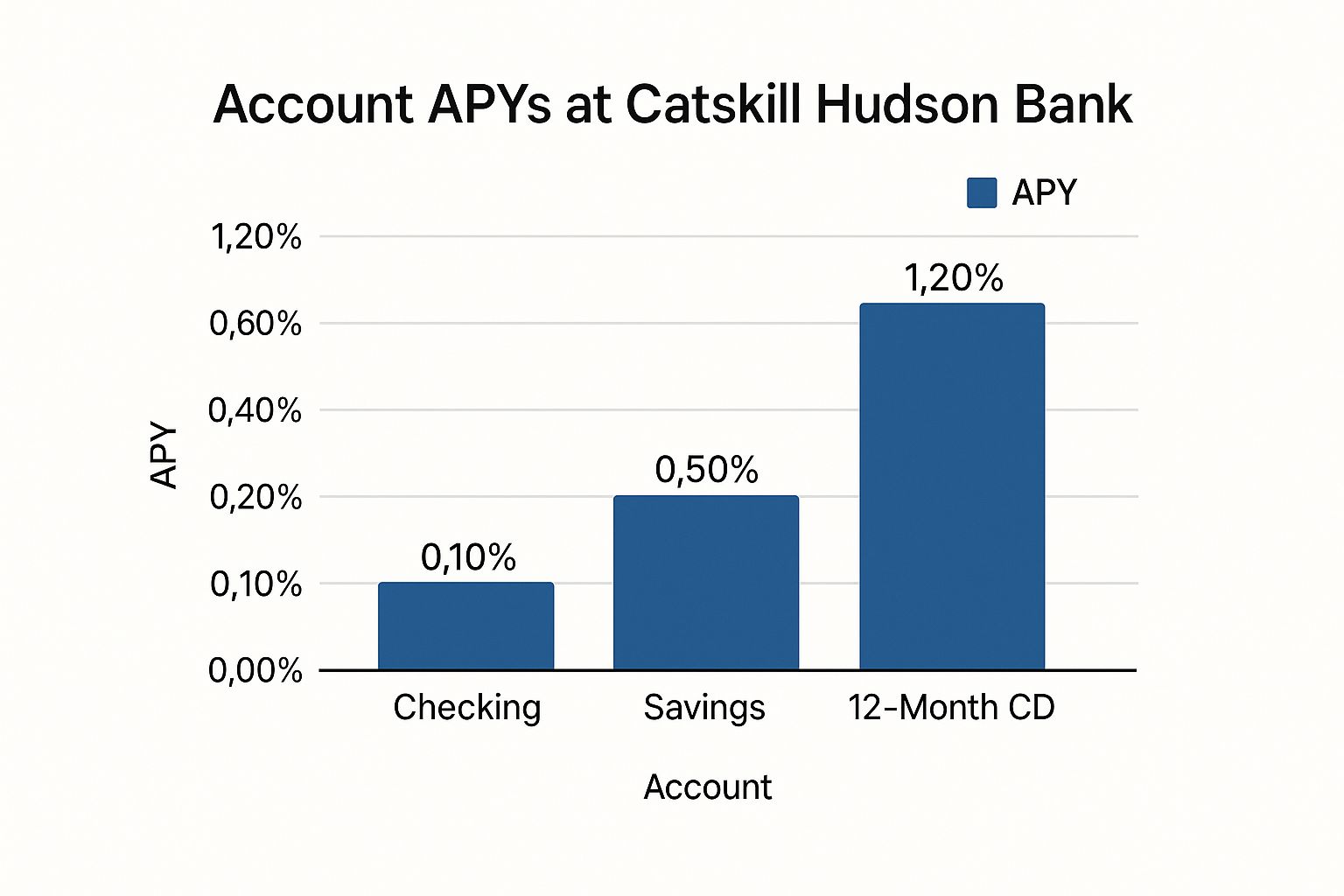

Let's take a look at how Catskill Hudson Bank's rates stack up. The infographic below shows the Annual Percentage Yield (APY) offered for Checking, Savings, and 12-Month CD accounts.

As you can see, Catskill Hudson Bank offers a competitive 1.20% APY on its 12-Month CD, exceeding the national average. While its checking and savings rates are 0.10% and 0.50% respectively, these are generally consistent with what other regional banks offer.

To give you a clearer picture of how Catskill Hudson Bank compares to its peers, we've compiled a handy table. This matrix highlights key differences and similarities across important factors like branch coverage, rate competitiveness, digital features, and community focus.

Regional Banking Comparison Matrix: Side-by-side comparison of Catskill Hudson Bank versus key regional competitors across multiple factors.

| Bank | Branch Coverage | Rate Competitiveness | Digital Features | Community Focus |

|---|---|---|---|---|

| Catskill Hudson Bank | Primarily Local | Competitive CD Rates, Average Checking/Savings | Developing | Strong |

| Competitor A | Regional | Varies by Product | Robust | Moderate |

| Competitor B | Broader Regional | Highly Competitive | Advanced | Limited |

As this table illustrates, Catskill Hudson Bank emphasizes community focus, while competitors may prioritize different aspects, such as digital features or rate competitiveness.

When Other Options Might Be Better

While Catskill Hudson Bank offers distinct advantages, it might not be the ideal choice for everyone. If your priority is a wide array of digital features or the absolute lowest fees, larger national banks might be a better fit. Their significant tech investments and larger scale often enable them to offer a broader range of digital services and highly competitive pricing. Also, if you travel internationally often or require access to a vast branch network across the country, a national bank may offer greater convenience. Understanding these trade-offs will empower you to make the best decision for your unique financial needs.

Making Your Decision: Next Steps

If you value community banking and personalized service, consider visiting a local Catskill Hudson Bank branch. This gives you the opportunity to experience their customer service firsthand and discuss your financial goals with a banker. Explore their website to compare their products and services against your personal requirements. Finally, research other regional banks for a direct comparison, focusing on factors like rates, fees, and digital tools. This thorough approach will equip you with the information necessary to choose the best banking partner for your financial journey.

Ready to explore data-driven banking decisions? Visit Visbanking to learn more about how data and insights can transform your institution.