President Joe Biden is now urging federal banking regulators to impose tougher regulatory requirements for the nation’s banks, suggesting that increased oversight is necessary to prevent banks like Silicon Valley Bank from collapsing in the future. The President’s call for additional banking regulations echoes that of many of his fellow Democrats in the nation’s capital.

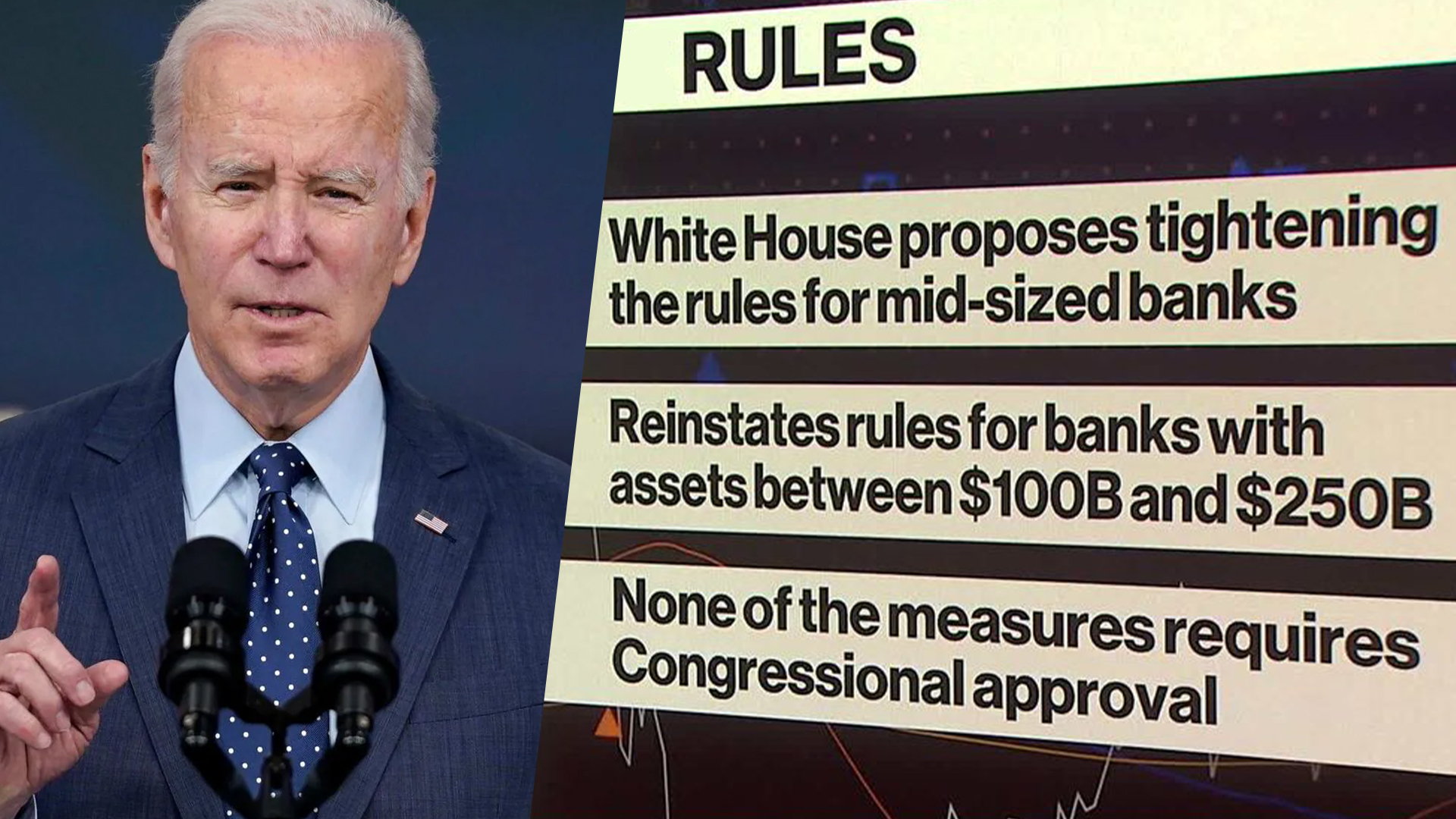

Among the proposals the White House has offered are an increase in required liquidity at mid-sized banks, more stress tests for those institutions, and requirements that their provide regulators with detailed plans about how they can prevent bank failures from increasing stress on the broader financial system.

Expanded banking regulations remain controversial

At the same time, Republicans in Washington, D.C. have argued that banking regulators already possess all the tools they need to prevent similar bank collapses. Houser Financial Services Committee Chair Patrick McHenry (R-N.C.) said as much in a statement released just days ago:

“As we heard from Biden’s own regulators at our hearing yesterday, supervisory incompetence was the leading cause of the failures. There is no evidence that the original Dodd-Frank would have prevented these bank runs.”

McHenry also suggested that the most recent stress tests conducted by regulators failed to consider rising interest rates and other current conditions that many experts say contributed to the recent turmoil in the banking industry. In addition, he argued that officials should be working to hold regulators accountable for their failure to use existing powers to prevent bank collapses, rather than rewarding them with new power.

Meanwhile, Democrats in both the Senate and House have been pushing for new bank capital requirements, while introducing legislation to hold bank executives accountable for failures by issuing penalties or using “clawbacks” to seize their compensation.

The White House has suggested that its proposals for tougher banking regulations can all be accomplished without Congress, through provisions within existing legislation.