By: Ken Chase.

Estimated reading time: 2 minutes

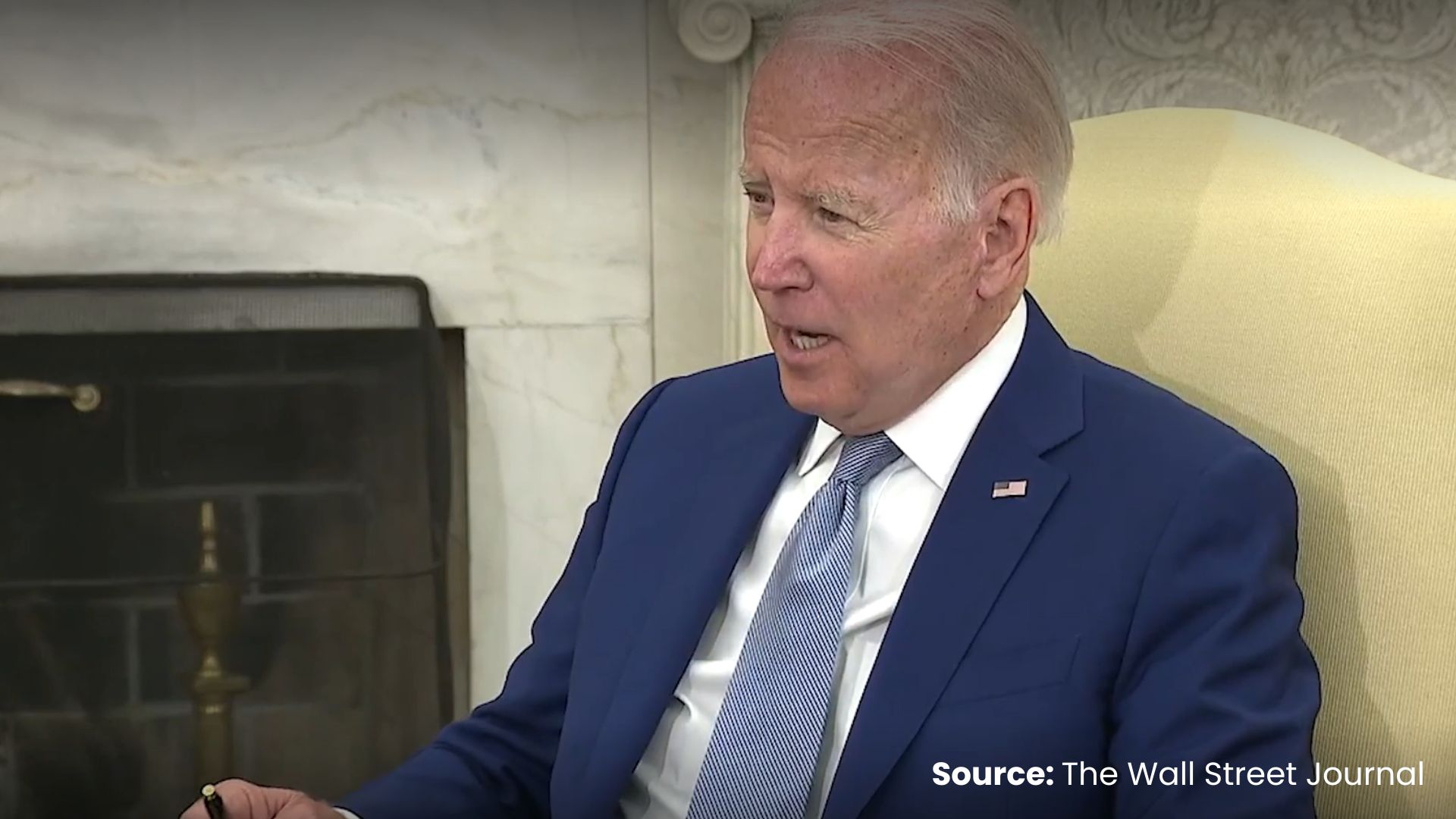

The Senate Banking Committee voted 17-7 on Wednesday afternoon to approve President Joe Biden’s nomination of Michael Barr to serve as the vice chair of banking supervision at the Federal Reserve. The bipartisan vote saw five committee Republicans join with 12 Democrats to send Barr’s nomination to the full Senate, where his confirmation is likely to receive final approval.

Biden’s first pick for the post, Sarah Bloom Raskin, was forced to withdraw her nomination after opposition from the entire Republican caucus and West Virginia Democrat Joe Manchin left her without the confirmation votes needed in an evenly divided Senate. Raskin had drawn fire for various controversial actions, including her perceived support for using the Fed’s regulatory powers to influence lenders to boycott loans to energy firms.

During Senate testimony, Barr seemed to discount any major Fed role in addressing climate change and instead focused on its important mission of fighting rising prices and “bringing down inflation to the Federal Reserve’s target of 2%.” When asked about the Fed’s role in forcing the banking industry to confront climate change concerns, Barr suggested that central bank had no power to tie credit allocation to that industry’s climate change contributions.

If, as expected, Barr is confirmed by the full Senate, he will become the Fed Board of Governors’ top regulator. As the vice chair for supervision of the banking industry – a position created by the 2010 Dodd-Frank financial regulations, which he helped to design while working for former President Obama’s Treasury Department – Barr would be charged with overseeing regulation for the complex U.S. financial sector, while also exercising a permanent vote in future Federal Reserve policy meetings.

With apparent bipartisan support for his confirmation, most analysts expect his final confirmation to come within the next few weeks. If confirmed, Barr would receive a four-year appointment and supervise regulations affecting major financial firms like Bank of America, J.P. Morgan Chase, and others. He is currently employed at the University of Michigan, where he serves as a law professor.