7 Sources for a Comprehensive Banks in Florida List [2025]

Brian's Banking Blog![7 Sources for a Comprehensive Banks in Florida List [2025]](https://cdn.outrank.so/a3158354-b714-419c-ba0c-19c8bfd04278/featured-image-44823e69-a8fd-47d4-ae5c-87450e0b2fb0.jpg)

In Florida's dynamic, nearly trillion-dollar deposit market, a simple directory of financial institutions is insufficient for strategic decision-making. Executives and directors require a multi-dimensional view, one that moves beyond static names to reveal market share, competitive positioning, and growth trajectories. The challenge is not finding a list, but rather compiling an actionable one from authoritative, often disparate, sources.

A granular understanding of the competitive landscape is the foundation for sound strategy, whether for M&A, branch expansion, or talent acquisition. For instance, knowing that the top five banks control over 50% of deposits statewide is a high-level fact; identifying the community bank that quietly grew its commercial real estate loan portfolio by 18% in the Tampa MSA is a strategic insight. This is the difference between data and intelligence. A comprehensive banks in Florida list must do more than identify players; it must equip leadership to assess performance, benchmark against peers, and uncover specific market opportunities.

This analysis outlines seven primary sources for constructing such a list, transforming raw regulatory data into a powerful tool for competitive intelligence and decisive action. For each resource, we provide a direct link, a screenshot for navigation, and a practical guide on extracting the most valuable information. The goal is to move beyond mere compliance checks and toward a sophisticated, data-driven approach to market analysis that informs every aspect of your bank's strategy in one of the nation's most competitive financial arenas.

1. FDIC BankFind Suite

For any executive team compiling a list of banks in Florida, the first and most authoritative stop must be the Federal Deposit Insurance Corporation's (FDIC) own database. The FDIC BankFind Suite is not a consumer-facing review platform; it is the definitive, regulator-maintained source of truth for all FDIC-insured institutions operating in the United States, including every single one with a presence in Florida. This tool provides the foundational data necessary for strategic analysis, competitive intelligence, and market mapping.

The platform’s power lies in its comprehensive and verifiable data. Executives can filter institutions by state to generate a complete banks in Florida list, then drill down into granular details such as branch locations, charter information, and structural history, including mergers and acquisitions. This is crucial for understanding the competitive landscape and identifying potential M&A targets or expansion opportunities. As the official data source, it is also the best place to confirm deposit insurance status and understand the basics of what that coverage entails. For a deeper analysis of this crucial topic, you can learn more about how the FDIC protects depositor funds and maintains financial stability.

Access and User Experience

The BankFind Suite is a free public resource, reflecting its role as a government transparency tool. There are no access fees or subscriptions required. However, the user interface is utilitarian and data-centric, designed for research rather than casual browsing. While powerful, its government-style design can feel clunky compared to modern commercial analytics platforms. It excels at delivering raw data but requires users to perform their own analysis to derive strategic insights.

Key Features and Strategic Use Cases

For banking professionals, the BankFind Suite is indispensable for several core functions:

- Market Footprint Analysis: Generate a definitive list of all competing branches in a specific Florida county or MSA. A bank looking to expand in the Tampa-St. Petersburg-Clearwater MSA can export a complete list of every competitor's branch, down to the street address and establishment date.

- M&A Due Diligence: Instantly access an institution's history, including name changes, charter conversions, and past mergers. This provides a clean, regulator-verified timeline of a potential target's structural evolution.

- Website Verification: A unique security feature allows users to search for a bank by its official website URL. This is a critical first step in verifying the legitimacy of an institution and mitigating risks from fraudulent or imposter sites.

| Feature | Description | Strategic Value for Executives |

|---|---|---|

| Institution Search | Find banks by name, FDIC certificate number, city, or state. | Quickly validate targets and get a high-level overview of their scale. |

| Branch Locator | Map and list all physical branch locations for a specific institution or within a geographic area. | Assess competitor network density and identify underserved markets. |

| History & Structure | View a detailed log of mergers, acquisitions, and charter changes. | Understand a competitor's growth strategy and M&A history. |

| Data Export | Download search results as CSV or other formats for external analysis. | Integrate raw data into proprietary models for deeper competitive analysis. |

Website: https://banks.data.fdic.gov

2. FDIC Deposit Market Share (Summary of Deposits) in BankFind Suite

While the general BankFind Suite provides a directory, its Summary of Deposits (SOD) tool is where executives can access the most potent strategic data for competitive analysis. This specific feature within the FDIC's data portal transforms a simple directory into a powerful market intelligence engine. It allows leaders to move beyond a basic banks in Florida list and instead analyze the granular deposit market share of every institution, from statewide down to a specific county or Metropolitan Statistical Area (MSA). This is the regulator-sourced data that underpins strategic growth, branch network optimization, and performance benchmarking.

The SOD data is the definitive measure of a bank's retail and commercial footprint. For any bank operating in Florida, this tool provides the raw numbers needed to answer critical questions: Who are the dominant players in the Orlando-Kissimmee-Sanford MSA? How has our market share in Miami-Dade County shifted year-over-year? Where are smaller, community banks successfully capturing deposits against national competitors? This data is the foundation for any serious market penetration or expansion strategy.

Access and User Experience

Like the broader BankFind Suite, the Summary of Deposits is a free public resource provided by the FDIC. There are no fees or subscriptions required to access or download the data. The user interface is functional but dated; it is designed for generating specific data reports rather than for interactive visualization or dashboarding. Users must navigate a series of menus to define their report parameters (state, county, year) and then download the data, typically in a CSV format. The experience is report-generation-focused, requiring significant external analysis to uncover strategic insights from the raw numbers.

Key Features and Strategic Use Cases

For banking executives, the SOD reports are an essential tool for performance measurement and strategic planning:

- Competitive Benchmarking: A community bank can generate a report for its home county, such as Collier County, to see its exact deposit market share (e.g., 4.5%) and rank relative to every other competitor, from large national banks to local credit unions. This provides a clear, objective performance metric.

- Market Opportunity Analysis: By analyzing year-over-year deposit growth trends in a target expansion market like Jacksonville, an executive team can identify which banks are losing share. This data can signal market disruption or customer dissatisfaction, highlighting an opportunity to enter and capture deposits.

- M&A Target Identification: A bank looking to acquire a specific deposit base can use the SOD to pinpoint institutions with a strong, concentrated presence in desirable demographics or high-growth corridors within Florida. It helps quantify the scale of a potential target’s customer base.

| Feature | Description | Strategic Value for Executives |

|---|---|---|

| Market Share Reports | Generate reports showing every institution's total deposits and market share for Florida, an MSA, or a county. | Objectively measure your bank's standing and identify dominant or vulnerable competitors. |

| Branch Office Deposits | View the specific deposit totals for every individual branch in a selected geographic area. | Analyze hyper-local competition and assess the performance of your own branch network. |

| Year-Over-Year Comparisons | Access historical SOD data to track market share changes and deposit growth trends over time. | Uncover market dynamics, evaluate the success of past strategic initiatives, and forecast trends. |

| Data Export (CSV) | Download raw deposit and market share data for offline analysis in spreadsheets or business intelligence tools. | Integrate authoritative data into your internal models for deeper, customized strategic analysis. |

Website: https://banks.data.fdic.gov

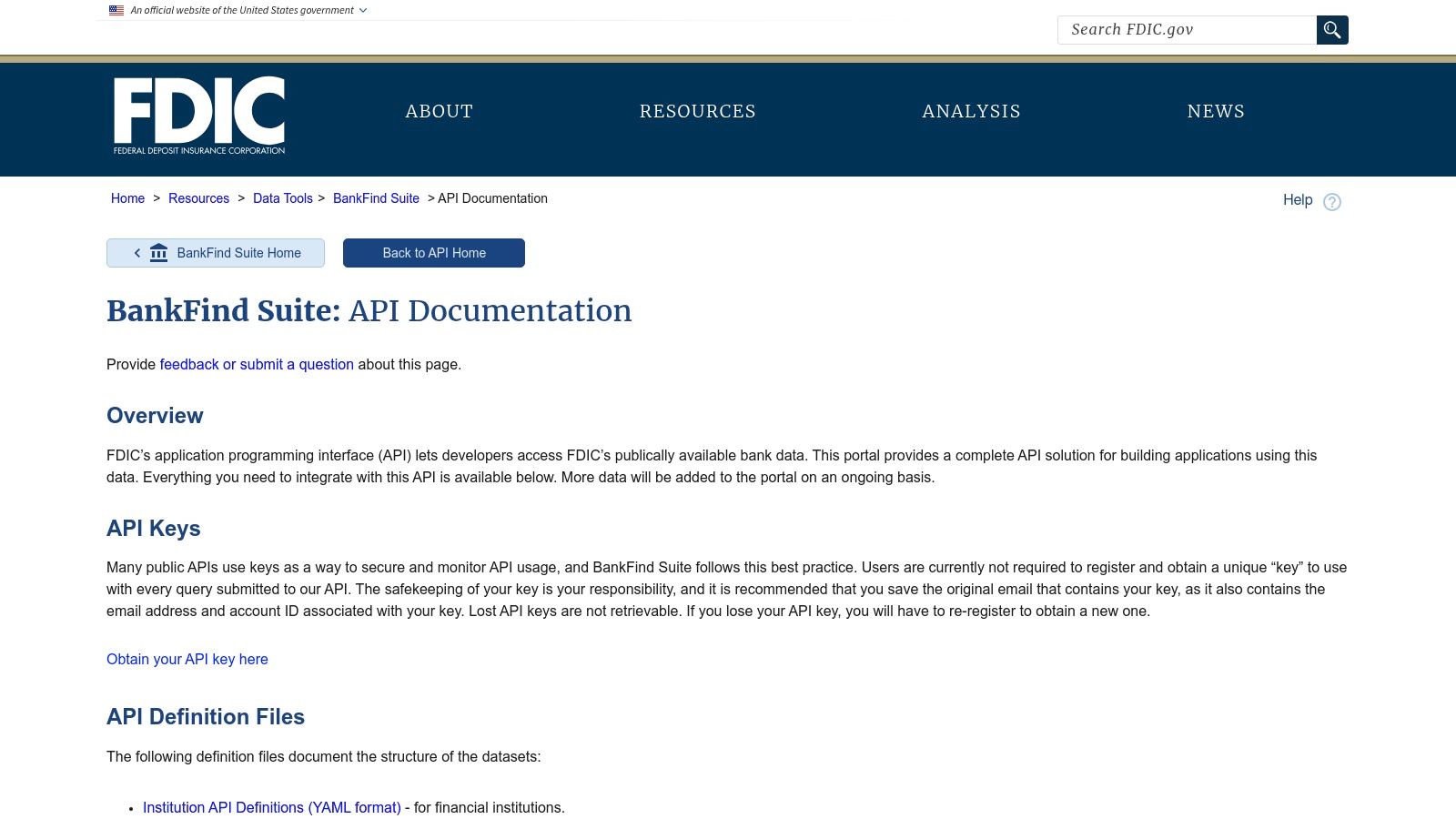

3. FFIEC National Information Center (NIC) – Search Institutions

While the FDIC provides the definitive record for insured depository institutions, executive teams require a broader view of the financial landscape, particularly regarding holding company structures and interagency oversight. The Federal Financial Institutions Examination Council (FFIEC) National Information Center (NIC) is the essential tool for this next level of analysis. It serves as an authoritative directory for entities regulated by the Federal Reserve, FDIC, and OCC, making it indispensable for mapping corporate hierarchies within the Florida banking market.

The NIC’s unique value lies in its focus on relationships between entities. When compiling a banks in Florida list, analysts can use this tool to trace a local community bank up to its multi-state holding company, revealing the true scope of a competitor's ownership and influence. This is critical for strategic analysis, risk management, and compliance, as it clarifies which primary federal regulator oversees each entity in a complex structure. For a deeper understanding of the FFIEC's role, you can explore how this interagency body works to ensure financial stability.

Access and User Experience

Like the FDIC's tool, the NIC is a free public resource. No subscription or login is required to access its vast repository of regulatory data. The user interface is functional and designed for research, reflecting its governmental origin. It may feel dated compared to commercial platforms, but its search capabilities are powerful and precise. The platform is engineered for accuracy and hierarchical data presentation, not for consumer browsing or product comparisons.

Key Features and Strategic Use Cases

For banking executives and analysts, the NIC is a non-negotiable tool for understanding the corporate structure of the Florida market.

- Holding Company Analysis: Identify the ultimate parent company of any Florida-based bank. This is crucial for M&A, as it clarifies who the ultimate decision-makers are and reveals the full financial and geographic scope of a potential target's parent organization.

- Regulatory Scoping: Quickly determine the primary federal regulator for a specific institution or holding company. This is vital for compliance teams and for understanding the regulatory environment a competitor operates within.

- Organizational Charting: Visually map out the subsidiaries and affiliates of a bank holding company. For instance, an analyst can see if a Florida bank's parent company also owns other non-bank financial service providers, revealing potential cross-selling strategies and competitive threats.

| Feature | Description | Strategic Value for Executives |

|---|---|---|

| Institution Search | Search by name, location (state, city), or RSSD ID to find specific entities. | Quickly pinpoint a target entity and access its core regulatory profile. |

| Hierarchy View | Displays the organizational chart, showing parent, subsidiary, and affiliate relationships. | Uncover complex ownership structures and understand a competitor's complete corporate family. |

| Attribute History | Provides historical data on an institution's structure, name changes, and key regulatory events. | Perform deep due diligence by tracing the corporate evolution of a potential partner or target. |

| Interagency Identifiers | Cross-references multiple regulatory identifiers (e.g., FDIC Certificate, OCC Charter) for a single entity. | Consolidate disparate data points for a unified, 360-degree view of an institution. |

Website: https://www.ffiec.gov/npw

4. OCC Financial Institution Lists

For executives focused on the federally chartered segment of the market, the Office of the Comptroller of the Currency (OCC) provides an essential resource. The OCC's Financial Institution Lists are official, downloadable rosters of all nationally chartered banks and federal savings associations. This makes it a critical tool for any team needing to create a specific banks in Florida list that isolates institutions under direct OCC supervision. Unlike broad databases, this source offers a focused view of national competitors, which is invaluable for regulatory analysis, peer benchmarking, and strategic planning.

The platform's primary value is its precision. While the FDIC database covers all insured institutions, the OCC lists allow for the rapid identification of national banks and federal thrifts operating within Florida. This distinction is vital for understanding differences in regulatory frameworks, capital requirements, and permissible activities that impact competitive dynamics. Executives can use these lists to conduct peer analysis specifically against other federally chartered banks, providing a more direct comparison of performance and strategy within the same regulatory environment.

Access and User Experience

The OCC's lists are a free public service, aligning with its mission as a federal regulator. There are no subscription fees or access restrictions. The user experience is straightforward but not interactive. Users download static files, typically in PDF or Excel formats, which are updated periodically (e.g., quarterly or monthly). This "snapshot" approach means the data is not real-time, but it is regulator-verified as of its publication date. The interface is purely functional, designed for data retrieval rather than dynamic exploration.

Key Features and Strategic Use Cases

For banking leaders, the OCC lists serve several niche but important functions:

- Peer Group Identification: Quickly compile a list of all national banks in Florida to create a specific peer group for performance benchmarking. An executive at a Miami-based national bank can download the list, filter by state, and immediately have a roster of direct, like-regulated competitors for an apples-to-apples comparison.

- Regulatory Compliance Checks: Verify the charter status and official name of a federally regulated institution. This is a foundational step in compliance and third-party risk management.

- Targeted Market Research: Isolate national bank activity in specific Florida cities. This helps in understanding the competitive concentration of federally chartered institutions versus state-chartered banks or credit unions in a target market.

| Feature | Description | Strategic Value for Executives |

|---|---|---|

| National Bank Lists | Downloadable rosters of all active national banks and federal savings associations. | Create a definitive list of federally regulated peers for analysis. |

| State & City Sorting | Files are often presorted by state and city, allowing for easy filtering to isolate Florida data. | Efficiently narrow down the competitive landscape to a specific geography. |

| Timestamped Data | Each list is clearly marked with its "as-of" date, ensuring data transparency. | Provides a clear point-in-time reference for historical analysis or reporting. |

| Charter Information | Includes key identifiers like the institution's charter number and official name. | Essential for accurate regulatory filings and due diligence processes. |

Website: https://www.occ.gov/topics/charters-and-licensing/financial-institution-lists/

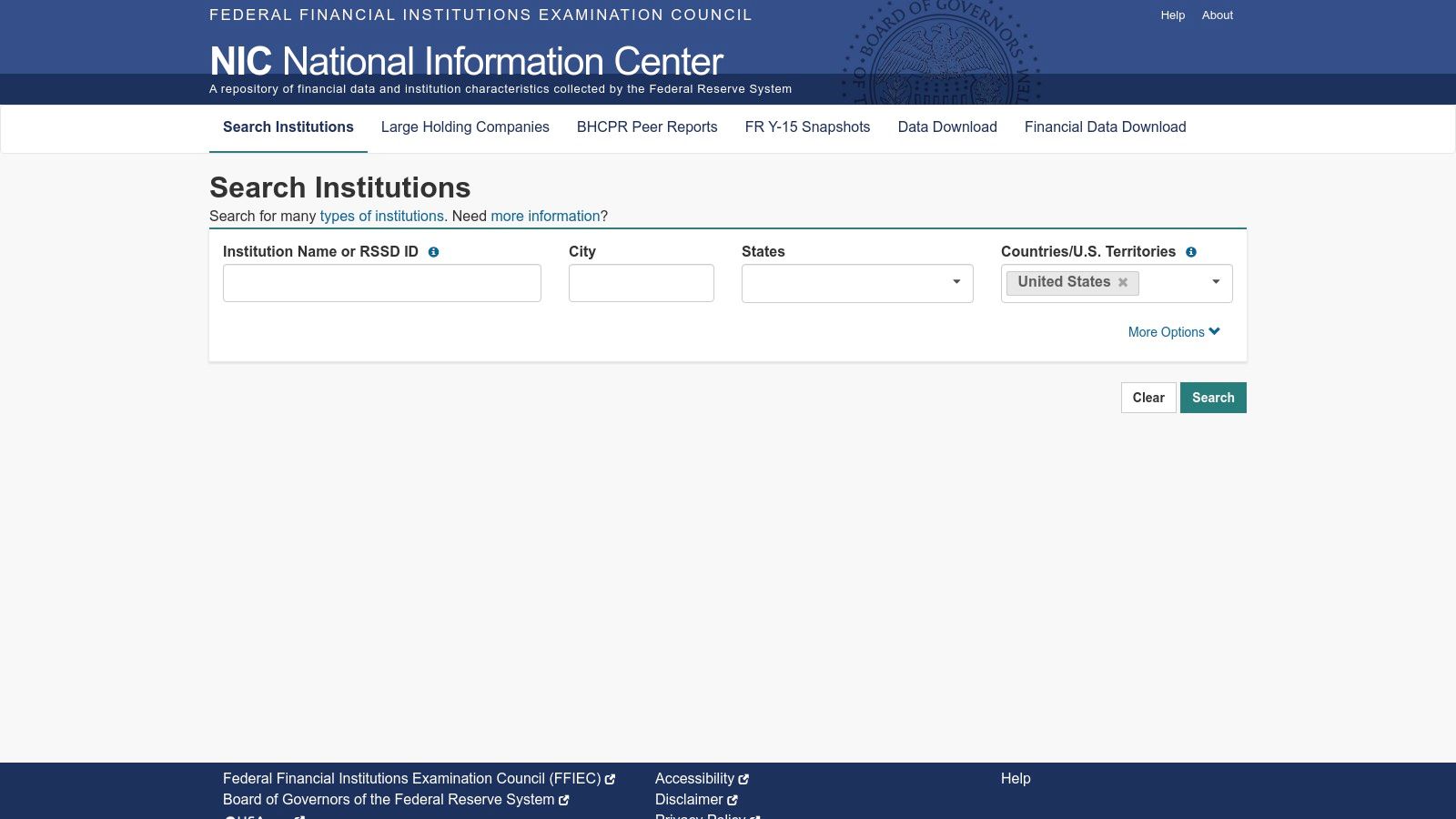

5. Florida Office of Financial Regulation (OFR) – Verify a License / REAL portal

While the FDIC provides a federal overview, executive teams must also engage with state-level regulatory data for a complete picture. The Florida Office of Financial Regulation (OFR) is the primary state regulator, and its "Verify a License" portal is the official source for confirming the status of state-chartered financial institutions. For any executive building a comprehensive banks in Florida list, this tool is essential for validating state-level charters and understanding the specific regulatory framework within Florida.

Unlike the FDIC's comprehensive database, the OFR's portal is designed primarily for license verification rather than broad market analysis. Its strategic value lies in its specificity. When conducting due diligence on a potential partner or acquisition target that is a state-chartered bank, this portal provides the definitive confirmation of its good standing with Florida regulators. It serves as a crucial compliance and risk management checkpoint, complementing the federal data from sources like the FDIC.

Access and User Experience

The OFR's verification portal is a free public service, accessible to anyone without a subscription. The user experience is straightforward but decidedly governmental and compliance-focused. It functions as a search tool rather than a browsable directory, requiring users to input the name of a specific entity to check its license status. This makes it less suited for generating a list from scratch but perfect for targeted verification. The interface is functional, prioritizing accuracy and regulatory transparency over a modern user interface.

Key Features and Strategic Use Cases

For banking executives, the OFR portal is a vital tool for state-level due diligence and compliance verification.

- State Charter Validation: Confirm that a Florida-chartered bank or credit union is actively licensed and in good standing with the state. This is a fundamental step in any partnership, vendor relationship, or M&A process involving state-regulated entities.

- Regulatory Research: Access direct links to Florida statutes and regulatory guidance. This provides context on the specific state-level rules governing a competitor or target, which can influence strategic decisions.

- Complementary Data Point: Use in conjunction with federal databases. An executive team can first identify a potential M&A target using FDIC data, then use the OFR portal to verify its state charter status and identify any Florida-specific regulatory actions or notes.

| Feature | Description | Strategic Value for Executives |

|---|---|---|

| License Verification | Search for specific state-chartered institutions to confirm their license type and status. | Provides definitive, state-level confirmation for compliance and due diligence checklists. |

| Link to NMLS | Connects to the Nationwide Multistate Licensing System & Registry for mortgage-related entities. | Streamlines verification for institutions with significant mortgage lending operations. |

| Statutes and Guidance | Provides access to the legal and regulatory documents that govern Florida's financial institutions. | Offers critical context for understanding the compliance landscape a target operates within. |

| Contact Information | Lists key contacts within the OFR's Division of Financial Institutions. | Creates a direct line of communication for specific regulatory inquiries. |

Website: https://flofr.gov/education/verify-a-license

6. Florida Bankers Association – Member Bank Directory

While regulatory databases provide raw data, understanding the community and political landscape of banking in Florida requires a different lens. The Florida Bankers Association (FBA) Member Bank Directory offers a curated list of institutions actively engaged in the state's banking community. This is less a tool for quantitative analysis and more a qualitative resource for networking, industry engagement, and understanding which banks are committed to a strong local presence.

For an executive team, this directory is a practical, human-readable guide. It provides a quick way to scan institutions that have chosen to be part of the state's primary trade association. This can be a signal of an institution's focus on local issues, regulatory advocacy, and peer networking within Florida, making it a valuable resource for identifying potential partners or understanding the key players shaping the state's financial sector.

Access and User Experience

The FBA Member Bank Directory is a public-facing resource, freely accessible without any subscription or login requirements. The interface is straightforward and user-friendly, presenting an alphabetized list of member banks that can be filtered by city. It is designed for quick reference rather than deep data analysis. The user experience is simple and direct, prioritizing ease of access to contact information and member status over the complex filtering capabilities of a regulatory database.

Key Features and Strategic Use Cases

For executives, the FBA directory serves a distinct, relationship-oriented purpose alongside data-driven tools. It helps connect the dots between raw institutional data and the active, on-the-ground banking community.

- Community Engagement & Partnership Identification: The list serves as a "who's who" of engaged Florida banks. A larger institution seeking a local community bank partner for a Community Reinvestment Act (CRA) initiative can use this directory to find banks that are already invested in the local association and its goals.

- Networking and Peer Benchmarking: Quickly identify key contacts and the headquarters of banks that are peers in the Florida market. Understanding who is part of the FBA provides context on which institutions are likely to be involved in state-level legislative and regulatory discussions.

- Initial Market Scan: While not exhaustive, the directory provides a rapid overview of a significant portion of the banks in Florida list, especially for community and regional banks that are deeply embedded in the local economy.

| Feature | Description | Strategic Value for Executives |

|---|---|---|

| Member Directory | An alphabetized, searchable list of FBA member banks, filterable by city. | Quickly identify engaged local and regional banks for partnership or networking. |

| Contact Information | Provides basic location and contact details for member institutions. | Streamlines outreach for business development or peer-to-peer discussions. |

| Sector Context | Implies which institutions are actively participating in the state's primary banking trade association. | Gauges a potential partner's or competitor's commitment to the Florida market. |

| Simple Interface | A clean, web-based list that is easy to navigate without specialized knowledge. | Allows for a fast, high-level review of the key players in Florida's banking scene. |

Website: https://web.floridabankers.com/Bank-Member

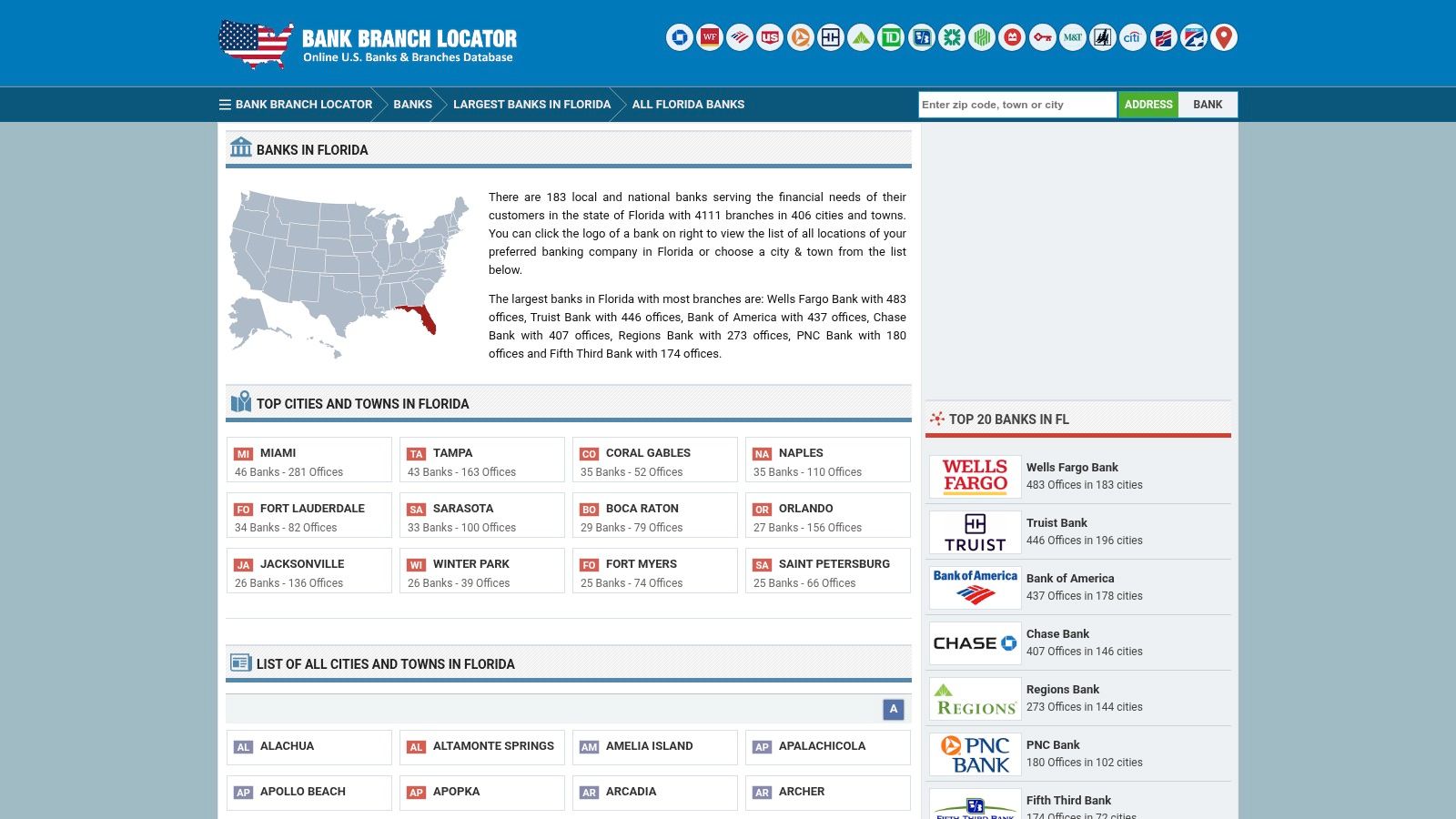

7. Bank Branch Locator – "Florida Banks" hub

While regulatory sources provide the official data, Bank Branch Locator offers a fast, consumer-centric interface for understanding the physical footprint of banks across the state. This platform serves as a highly practical directory, aggregating bank and credit union branch data into an easily navigable format. For executive teams conducting preliminary market scans or needing quick access to competitor branch details, this tool provides a valuable top-down view of the retail banking landscape in Florida.

The site’s primary strength is its simplicity and speed. It presents a comprehensive banks in Florida list, complete with branch counts for each institution, allowing for rapid size-ranking based on physical presence. From this high-level view, users can drill down into specific banks to see a full list of their Florida branches, each with addresses, contact information, hours, and an integrated map. This granular, on-the-ground detail is crucial for making informed decisions about site selection and understanding local market saturation. For a deeper, data-driven perspective on branch network strategy, you can explore this comprehensive analysis of the U.S. bank branch network.

Access and User Experience

Bank Branch Locator is a free, ad-supported public resource, requiring no subscription or login. The user experience is designed for quick, straightforward searches, prioritizing accessibility over deep analytical features. Its interface is clean and intuitive, making it significantly easier to browse than more data-heavy government portals. However, as it is not an official regulatory source, the data may occasionally lag behind real-time changes from mergers or branch closures, and its data provenance is not as transparent as that of the FDIC.

Key Features and Strategic Use Cases

For banking leaders, this platform excels at providing rapid, location-based intelligence:

- Quick Competitor Footprint Review: Instantly view a list of all banks in a specific Florida city, like Orlando or Miami, and see how many branches each competitor operates in that local market. This is ideal for initial assessments before committing to a deeper data analysis.

- Branch-Level Reconnaissance: Access specific branch details, including operating hours and direct phone numbers, which can be useful for tactical planning or local market research.

- Visual Market Mapping: Use the integrated maps to visualize competitor clustering in key commercial districts or residential growth areas, helping to identify potential gaps in service coverage.

| Feature | Description | Strategic Value for Executives |

|---|---|---|

| State & City Filters | Easily generate lists of banks and their branch counts at the state or city level. | Quickly gauge the scale of competitors' physical networks in target markets. |

| Branch Detail Pages | Provides specific addresses, phone numbers, hours, and map locations for individual branches. | Supports tactical decisions and on-the-ground competitive intelligence. |

| Largest Banks Lists | Offers summary lists ranking banks by asset size or number of branches within Florida. | Provides a fast, high-level overview of the key players in the state. |

| Simple Interface | User-friendly, browsable design focused on presenting location data clearly. | Enables rapid information retrieval without the need for data expertise. |

Website: https://www.bankbranchlocator.com/florida-banks.html

Comparison of 7 Florida Bank Listing Tools

| Tool | Implementation complexity 🔄 | Resource & efficiency ⚡ | Expected outcomes / Impact 📊 | Ideal use cases / Tips 💡 | Key advantages ⭐ |

|---|---|---|---|---|---|

| FDIC BankFind Suite | Moderate — structured regulatory UI | Low effort; web access + exports | Authoritative verification; detailed branch maps, history | Confirm FDIC insurance, drill into Florida footprint | Regulator‑maintained, routinely updated ⭐⭐⭐⭐ |

| FDIC Deposit Market Share (Summary of Deposits) | Moderate — report generation required | Moderate; downloadable tables for analysis | Market‑share by MSA/county; deposit distribution and trends | Prioritize banks by size/presence; trend analysis | Florida‑sliceable regulator data for sizing ⭐⭐⭐⭐ |

| FFIEC NIC – Search Institutions | Moderate — technical records and IDs | Low; searchable directory | Ownership/org charts and historical records | Cross‑verify parent/affiliate relationships and RSSD IDs | Interagency scope complements FDIC data ⭐⭐⭐ |

| OCC Financial Institution Lists | Low — static downloadable files | Low; PDFs/Excel, easy filtering by state/city | Authoritative roster of OCC‑chartered banks in Florida | Isolate national banks and federal savings associations | Direct regulator lists with timestamped updates ⭐⭐⭐ |

| Florida OFR – Verify a License / REAL portal | Moderate — compliance‑oriented search | Low; state portal with external links | State‑charter authorization and oversight contacts | Verify Florida charters, statutes, and regulator contacts | State‑level confirmation and official contacts ⭐⭐⭐ |

| Florida Bankers Association – Member Bank Directory | Low — user‑friendly directory | Low; browsable listings | Human‑readable member list; may omit non‑members | Find community/regional banks and association context | Practical in‑state coverage; membership focus ⭐⭐ |

| Bank Branch Locator – "Florida Banks" hub | Low — consumer‑oriented interface | Very fast; maps and branch details | Quick branch counts, addresses, hours; not authoritative | Fast branch lookup and maps for consumers | Fast, practical branch‑level detail; may lack provenance ⭐⭐ |

From Data Sourcing to Strategic Action

The journey to compile a definitive banks in Florida list reveals a critical truth for today's banking executives: raw data is abundant, but actionable intelligence is scarce. We have explored a range of valuable, publicly available resources, from the FDIC's granular deposit market share reports to the Florida OFR’s licensure verification portal. Each tool offers a unique lens, providing essential pieces of the competitive puzzle, such as regulatory standing, asset size, and physical branch distribution across the state.

However, the true challenge lies not in accessing this information but in synthesizing it. Manually collating data from the FFIEC, OCC, and various association directories is a labor-intensive process, prone to inconsistencies and version control issues. A static spreadsheet compiled today is outdated tomorrow, leaving strategic decisions vulnerable to incomplete or inaccurate market intelligence. The real value isn't found in the simple act of creating a list; it's discovered in the ability to dynamically analyze, segment, and act upon the insights that list contains.

Turning a Static List into a Strategic Asset

A forward-thinking executive team cannot afford to wait weeks for analysts to manually assemble and scrub data. The market moves too fast. The transition from manual data collection to strategic action requires a platform-based approach that unifies disparate sources into a single, decision-ready environment.

Consider these practical applications that become possible when data is centralized and accessible:

- Targeted M&A Scouting: Instead of a broad, statewide list, an analyst could instantly filter for all state-chartered banks in the Tampa-St. Petersburg MSA with assets between $500 million and $2 billion, a loan-to-deposit ratio below 85%, and a declining trend in commercial real estate loan originations over the past four quarters. This precision turns a fishing expedition into a surgical strike.

- Competitive Benchmarking: Your institution, a community bank based in Jacksonville, can move beyond simple asset-size comparisons. You can benchmark your net interest margin, efficiency ratio, and deposit composition against a curated peer group of the top 10 similarly sized banks operating specifically within the Northeast Florida region, all with a few clicks.

- Market Entry Analysis: Evaluating expansion into the Orlando market? A dynamic platform allows you to map every competitor branch, analyze deposit growth trends by zip code, and overlay demographic data to identify underserved areas with high-growth potential. This data-driven approach minimizes risk and maximizes the potential for a successful launch.

The core takeaway is that the list itself is merely the starting point. The competitive advantage is gained by the speed and sophistication with which you can query that data to answer critical business questions. This is the fundamental difference between data collection and data intelligence.

Act with Speed and Confidence

In a competitive landscape as dynamic as Florida's, the ability to act decisively is paramount. Relying on fragmented, manually compiled data sources introduces unnecessary delays and risks, hindering your ability to capitalize on emerging opportunities or respond to competitive threats. The most successful institutions are those that empower their leadership teams with unified, real-time intelligence. This allows for a shift in focus from tedious data assembly to high-value strategic analysis, ensuring that every major decision is grounded in a comprehensive and current understanding of the market. The ultimate goal is to spend less time building the banks in Florida list and more time leveraging the insights it can provide to drive growth, manage risk, and outperform the competition.

Transform your market analysis from a manual, time-consuming task into a strategic advantage. With Visbanking, you can instantly access, filter, and benchmark against the entire Florida banking landscape, turning complex data into clear, actionable intelligence. Explore Visbanking to see how our platform empowers executives to make faster, data-driven decisions.

Similar Articles

Visbanking Blog

Top Banks in Florida | Updated Quarterly

Visbanking Blog

Top Banks in Louisiana | Updated Quarterly

Visbanking Blog

Top Banks in South Carolina | Updated Quarterly

Visbanking Blog

Why Bank Financial Data Matters: Insights and Applications for Individuals and Businesses.

Visbanking Blog

Top Banks in Texas | Updated Quarterly

Visbanking Blog

Top Banks in Alabama | Updated Quarterly

Visbanking Blog

Top Banks in California | Updated Quarterly

Visbanking Blog

Top Banks in Georgia | Updated Quarterly

Visbanking Blog

Top Banks in Mississippi | Updated Quarterly

Visbanking Blog