BankoftheWest: Key Insights into Its Strategic Transformation

Brian's Banking Blog

Understanding BankoftheWest's Strategic Position In Banking

The acquisition of Bank of the West by BMO Financial Group has reshaped the competitive landscape. This strategic move offers BMO substantial growth potential while presenting both opportunities and challenges for BankoftheWest. The partnership seeks to blend the strengths of a major international financial institution with the established regional presence of Bank of the West.

BMO's Strategic Rationale

BMO aimed to strengthen its presence in the U.S., specifically in the West and Southwest. Acquiring Bank of the West provided immediate access to a large customer base and an extensive branch network. This expansion allowed BMO to diversify its operations and enter new markets. The acquisition, in turn, granted Bank of the West access to BMO's significant resources and wider product offerings.

Integration and Value Creation

The integration centers around combining the best of both institutions. Bank of the West's established customer relationships and deep market knowledge are being merged with BMO's technological capabilities and financial strength. This involves providing new products and services to Bank of the West customers while preserving the community bank experience. The integration process generates value by streamlining operations and broadening service offerings.

Financial Performance and Reporting

Bank of the West's financial performance is closely tracked within BMO's corporate framework. It significantly contributes to BMO's overall financial results. In Q4 2024, Bank of the West earned $13 million, or $17 million pre-tax, within Corporate Services. This signifies a slight dip from Q3 2024's $16 million ($21 million pre-tax). This close monitoring underscores Bank of the West's importance to BMO's overall strategy. For a detailed breakdown, see the BMO Financial Group Fourth-Quarter and Fiscal 2024 Results.

Impact on Customers

The acquisition’s impact on customers is multifaceted. Customers now benefit from an expanded selection of financial products and services, such as international banking and improved digital tools. BMO's investments in technology also enhance the banking experience for Bank of the West customers. However, system conversions and potential branch closures require careful oversight to guarantee a smooth transition. The long-term success of this strategic positioning depends on successfully integrating both organizations while enriching the customer experience.

BankoftheWest Services That Actually Make A Difference

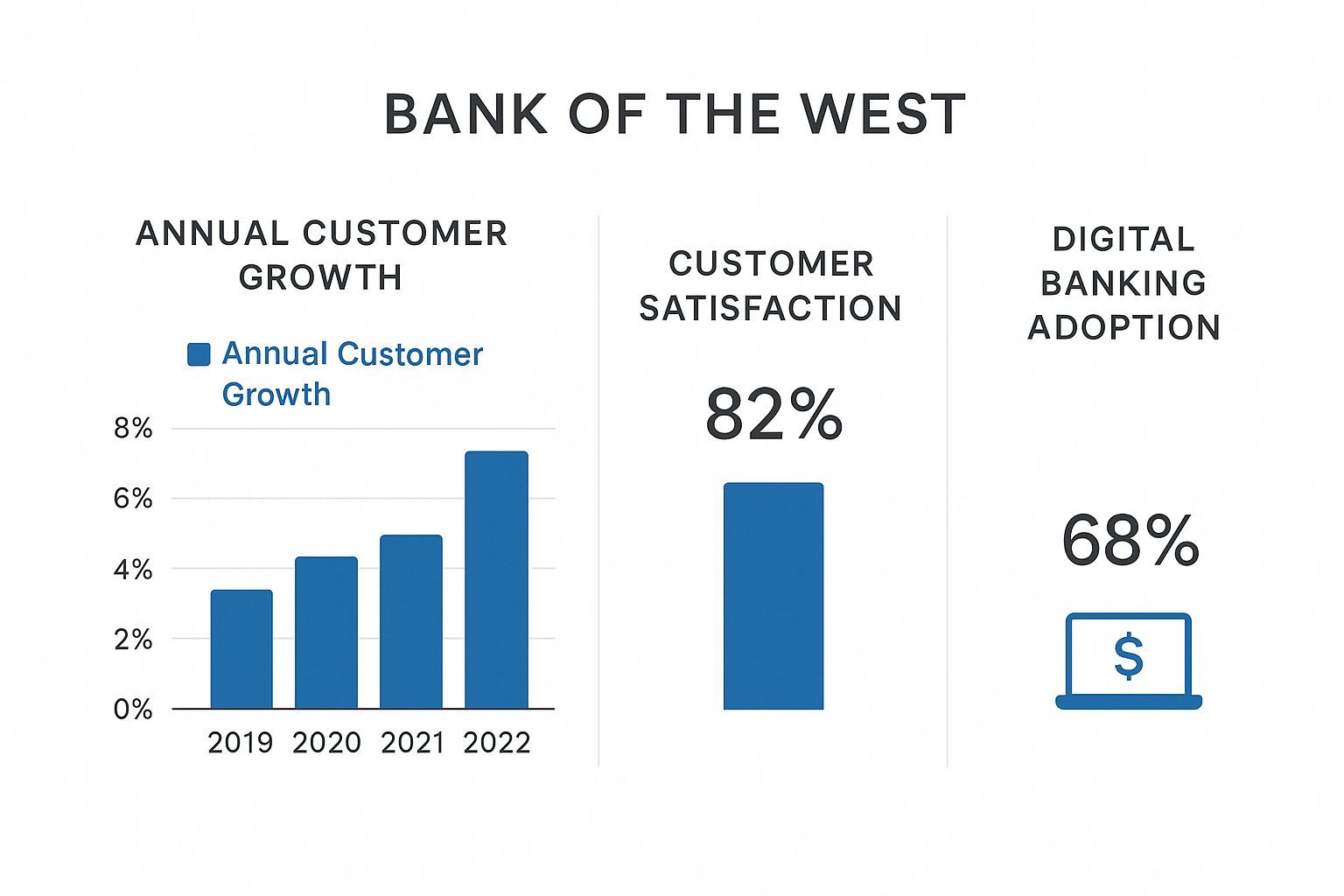

This infographic illustrates Bank of the West's growth. From 2019-2022, they saw increases in customer numbers, achieved a strong customer satisfaction score, and tracked their digital banking adoption rate. These metrics offer a glimpse into Bank of the West's overall performance.

The data reveals steady growth in users, combined with high customer satisfaction. This suggests that Bank of the West is effectively meeting customer needs. However, the data also indicates a need to further emphasize digital platform adoption to maintain a competitive edge.

Bank of the West offers a variety of financial services. These services cater to both individual and business clients, going beyond basic banking to address a wider range of financial requirements. For instance, personal banking customers can access checking and savings accounts, loans, and credit cards.

In addition to personal banking, Bank of the West provides specialized services for businesses. This includes commercial lending and treasury management solutions.

To help you understand the breadth of Bank of the West's services, we've compiled a comparison table detailing their key features, target customers, and digital access across their main service categories.

The following table compares Bank of the West's main service offerings. It highlights key features, target customers, and digital access across personal, business, and wealth management categories.

| Service Category | Key Features | Target Customers | Digital Access |

|---|---|---|---|

| Personal Banking | Checking & Savings Accounts, Loans, Credit Cards, Financial Advice | Individuals and Families | Online and Mobile Banking |

| Business Banking | Commercial Lending, Treasury Management, Merchant Services | Businesses of all sizes | Online and Mobile Banking, Specialized Business Platforms |

| Wealth Management | Investment Management, Financial Planning, Trust & Estate Services | High-net-worth individuals and families | Online portal, dedicated advisor access |

As shown in the table, Bank of the West strives to offer a range of services to suit diverse financial needs. Their commitment to digital access allows customers to conveniently manage their finances. The specialized services available for business and wealth management clients further demonstrate their focus on providing comprehensive financial solutions.

Personal Banking Options at BankoftheWest

Bank of the West offers several convenient features for personal banking customers. These features are designed to improve the banking experience and make managing finances easier.

- Online and Mobile Banking: Access your accounts 24/7, from anywhere.

- Debit and Credit Cards: Select a card that aligns with your spending habits and preferred rewards.

- Personalized Financial Advice: Work with advisors to develop a secure financial plan for the future.

These options empower customers with the tools and resources they need for effective financial management. They also provide access to personalized services and support.

Business Banking Solutions

Bank of the West also provides comprehensive business banking solutions. These are tailored to meet the demands of businesses of all sizes, offering essential financial tools and services.

- Commercial Lending: Secure the capital needed to expand operations and invest in future growth.

- Treasury Management: Effectively manage cash flow and optimize financial operations for efficiency.

- Merchant Services: Streamline payment processing and accept credit card transactions seamlessly.

These services equip businesses with the tools they need to succeed in a competitive marketplace. They also highlight Bank of the West's dedication to supporting business growth.

Wealth Management Services

For those seeking long-term financial strategies, Bank of the West provides wealth management services. These are designed to help individuals and families build and protect their wealth over time.

- Investment Management: Develop and manage an investment portfolio aligned with your long-term financial goals.

- Financial Planning: Create a plan for major life events such as retirement and education.

- Trust and Estate Services: Ensure the secure transfer of wealth to future generations.

This comprehensive approach to wealth management offers a holistic perspective on financial well-being, helping individuals and families achieve long-term financial security and success.

Financial Performance Under BMO's Strategic Leadership

Bank of the West's integration into BMO Financial Group has significantly affected BMO's financial path. This acquisition has broadened BMO's market presence and fueled its revenue growth. Let's explore the financial outcomes of this key strategic move.

Impact on BMO's Revenue

The acquisition has clearly influenced BMO's overall financial results. The integration of Bank of the West played a major role in boosting BMO's net interest income.

In fiscal 2022, BMO's total revenue jumped $63 million (5%) higher than the last quarter. Net interest income saw an even bigger increase of $81 million (8%). This growth highlights the strategic importance of Bank of the West, especially in driving revenue through improved net interest margins.

For more detailed financial statistics, you can check out this SEC filing. You might also find this announcement interesting: BMO Announces Completion of Bank of the West Acquisition. This improved financial performance is partly thanks to Bank of the West's established customer base and branch network.

Market Positioning and Expansion

Adding Bank of the West strengthens BMO's foothold in important U.S. markets. It considerably expands BMO’s presence, particularly across the western United States. This expansion lets BMO compete more effectively with other large financial institutions.

It also creates a base for future expansion and growth in these areas. This strategic action enables BMO to offer a wider array of financial products and services to a larger customer base.

Operational Efficiency and Challenges

Integrating a large regional institution like Bank of the West creates operational hurdles. These include combining different technology systems and keeping existing customers happy during the changeover.

BMO has concentrated on minimizing disruptions to customer service while making the necessary system improvements. This includes investing in technology and employee training for a smooth transition.

Maintaining Service Quality During Integration

Making operations more efficient and achieving cost savings are important parts of a merger. However, keeping service quality high remains paramount. BMO understands the need to provide a consistent banking experience throughout the integration process.

This means maintaining branch access, offering steady customer support, and keeping online and mobile banking services reliable. Focusing on customer experience is key to retaining Bank of the West's customers and building a good reputation in the new markets. By putting customer satisfaction first, BMO wants to secure its spot as a leading U.S. financial institution.

Customer Experience Revolution In Digital Banking

Bank of the West is evolving its approach to digital banking, changing what customers expect from modern financial services. This transformation is significantly influenced by its integration with BMO. This partnership has fostered technological advancements, improving mobile app functionality and strengthening security.

Enhanced Mobile App Functionality

The upgraded mobile app provides customers with a more user-friendly banking experience. Managing accounts, transferring funds, and paying bills can be done with just a few taps. The app also delivers personalized financial insights and alerts, helping customers stay financially organized. These features demonstrate Bank of the West's commitment to a seamless and efficient digital banking experience.

Improved Security Protocols

Security is crucial in digital banking. Bank of the West has made significant improvements in this area, implementing enhanced security protocols like multi-factor authentication and biometric login options. These measures protect customer accounts from unauthorized access and build customer confidence in the safety of their financial information. These improvements demonstrate the bank’s proactive approach to evolving security threats. Learn more in our article about Banking Bias in the Digital Age.

Accessibility and Multilingual Support

Bank of the West prioritizes accessibility and inclusivity in its digital banking services. The bank's website and mobile app have been improved for users with disabilities. Additionally, Bank of the West offers multilingual support, catering to its diverse customer base. This commitment demonstrates the bank's dedication to serving all community members.

Adapting to Evolving Consumer Preferences

Bank of the West actively gathers customer feedback to understand and respond to changing preferences. This helps the bank identify areas for improvement and enhance the customer experience. By listening to its customers, Bank of the West aims to effectively meet their needs and deliver valuable services. The bank remains focused on maintaining personalized service, even in the digital realm. This includes providing tailored financial advice and personalized support so customers feel valued.

Leveraging BMO's Technological Resources

Integrating with BMO has given Bank of the West access to valuable technological resources. This has enabled the bank to implement new features and enhance current services. BMO's technological infrastructure has supported the development of new digital tools for Bank of the West customers. This investment in technology highlights Bank of the West's commitment to improving the customer experience and leading in digital banking innovation. These advancements have created an improved banking experience for Bank of the West customers. The combined resources of the two institutions offer a more robust and feature-rich digital platform, allowing Bank of the West to better serve its customers with a more seamless banking experience.

Market Impact Of BankoftheWest's Strategic Evolution

The acquisition of BankoftheWest by BMO represents a significant shift in the banking landscape, particularly in the western U.S. This move goes beyond a simple merger, impacting customer choices, fostering market innovation, and influencing the strategies of other major financial institutions.

Enhanced Market Share and Competitive Strategies

The integration of BankoftheWest with BMO has significantly expanded their combined market presence in key regions. This increased market share empowers them to compete more effectively with other large banks.

One key advantage is the ability to offer a wider range of products and services. This broadened portfolio can attract new customers and provide more comprehensive solutions for existing clients. The acquisition has also spurred other banks to reassess their competitive strategies. This could lead to the development of new products and adjustments in pricing. Ultimately, this competition benefits customers by driving innovation and delivering better value.

Improving customer service in digital banking is a key focus. AI can play a significant role in enhancing the customer experience. To learn more about this, explore how an AI phone receptionist can improve financial planning services here.

Regulatory Considerations and Community Impact

Large acquisitions like this naturally attract regulatory scrutiny. Authorities must assess the potential impact on local banking options and the availability of services. Ensuring fair competition and preventing monopolies are key concerns.

The merger's impact on the community is also carefully evaluated. This involves assessing access to banking services in underserved areas and the potential for branch closures. This careful examination protects consumers and safeguards the stability of the financial system. The financial health of Bank of the West under BMO's management also plays a role in the overall market dynamics.

BMO reported a Q2 2024 profit of $1.87 billion, a substantial increase from $1.03 billion the previous year. This improvement, despite losses in some segments, highlights the complexity of integrating new assets. For more details on BMO's financial performance, read more here.

Influence on Merger Activities and Future Market Evolution

The BankoftheWest acquisition is likely to influence future merger and acquisition activity within the banking sector. Other financial institutions might now consider similar strategic combinations to expand market share or enhance their competitive position.

This trend could reshape the financial landscape, potentially leading to a market dominated by fewer, larger banks. Conversely, it could also encourage smaller banks and credit unions to form partnerships or develop innovative strategies to maintain their competitiveness. This dynamic environment keeps the banking sector constantly evolving.

Competitive Advantages and Positioning Against Fintech Challengers

The strategic advantages gained from this combination are substantial. BankoftheWest benefits from BMO's financial stability, technological resources, and extensive network. This stronger position allows them to compete more effectively against traditional banks and emerging fintech companies.

With increased resources, they can invest in new technologies and services to better meet evolving customer expectations. This enhanced ability to innovate could lead to new business models and the development of unique product offerings. The integration of Bank of the West with BMO creates a stronger, more competitive force in the financial market. This evolution presents exciting opportunities for both customers and the industry.

Future Outlook For BankoftheWest's Strategic Direction

Bank of the West's future is closely tied to BMO's North American growth strategy and its emphasis on responsible banking. This includes substantial investments in technology, adjustments to the branch network, and a dedication to improving customer service. Let's explore how BankoftheWest is preparing for the future of banking. For further reading on strategic planning in the banking sector, check out this helpful resource: How to master strategic planning for banks.

Technology Investments and Branch Network Optimization

BMO is making significant investments in Bank of the West's technology infrastructure. This includes upgrading existing systems and enhancing digital platforms to create a more modern and efficient banking experience.

BMO is also optimizing the branch network by evaluating current branch locations and potentially consolidating or relocating some branches to better align with customer preferences and create a more accessible network.

Enhanced Customer Service Capabilities

BMO is committed to elevating the customer service experience at Bank of the West. This includes new training programs for staff and the introduction of new customer service channels to enhance customer satisfaction and build stronger relationships. Interestingly, acoustics play a crucial role in a bank's marketing strategy. Learn more about the importance of sound in this article: achieving optimal sound.

Integrating ESG Initiatives

Environmental, social, and governance (ESG) factors are becoming increasingly important for both customers and investors. BMO is integrating ESG initiatives into Bank of the West's operations and lending decisions.

This includes offering sustainable financing options and promoting environmentally responsible practices to meet evolving customer expectations and contribute to a more sustainable future.

Adapting to Market Trends and Regulatory Developments

The banking industry is constantly changing. Bank of the West actively monitors market trends and regulatory developments to adapt its strategies and remain competitive. This includes analyzing consumer behavior, technological advancements, and changes in the regulatory environment. By staying informed and adaptable, Bank of the West aims to meet the evolving needs of its customers.

Shaping the Customer Experience Through Strategic Priorities

BMO has outlined key strategic priorities for Bank of the West, focusing on digital improvements, sustainable financial products, and a personalized customer experience. These priorities aim to create value for both individual and business customers.

To illustrate these priorities and their projected impact, the following table provides a detailed timeline:

BankoftheWest Strategic Priorities Timeline

Key strategic initiatives and milestones for Bank of the West under BMO ownership

| Initiative | Timeline | Expected Impact | Customer Benefit |

|---|---|---|---|

| Digital Banking Platform Enhancement | Ongoing - 2024 | Improved online and mobile banking experience | Enhanced convenience and accessibility |

| Expansion of Sustainable Finance Products | 2023 - 2025 | Increased portfolio of green loans and investments | More options for environmentally conscious customers |

| Personalized Financial Advice and Planning | Ongoing | Tailored financial guidance and solutions | Improved financial well-being |

| Branch Network Optimization | Ongoing - 2024 | More efficient and accessible branch network | Enhanced convenience and personalized service |

This table highlights BMO's commitment to enhancing the customer experience through digital improvements, sustainable finance options, and personalized financial advice. By prioritizing these areas, Bank of the West aims to remain competitive and relevant in the evolving financial landscape. These initiatives provide customers with more choices, improved service, and a more tailored banking experience.

Key Takeaways For Smart BankoftheWest Customers

The integration of BankoftheWest with BMO Financial Group presents both opportunities and challenges. Understanding these key takeaways will help you navigate this transition and make informed financial decisions.

Access to BMO's Expanded Network

The merger provides BankoftheWest customers with access to BMO's significantly larger network of branches and ATMs. This expanded reach offers greater convenience, particularly for those who travel frequently or reside near a BMO location.

Beyond physical locations, the acquisition also unlocks a wider array of financial products and services through BMO. This may include new investment opportunities, specialized lending programs, and enhanced digital tools not previously offered by BankoftheWest.

Understanding the Service Portfolio

BankoftheWest offers a diverse range of services, from basic checking and savings accounts to sophisticated wealth management strategies. Identifying the services that best align with your individual needs is crucial.

For those primarily focused on everyday transactions, exploring BankoftheWest's digital tools for online and mobile banking offers a convenient solution. If you require more comprehensive financial planning, consider investigating the wealth management services now available through the BMO partnership.

Navigating Digital Tools and Fees

Mastering BankoftheWest's digital platforms, including online and mobile banking, allows for efficient account management. These tools often provide valuable features such as account balance tracking, bill payment, and fund transfers.

Equally important is understanding the fee structure associated with your accounts. Carefully review the terms and conditions related to monthly maintenance fees, overdraft charges, and other potential costs. This proactive approach helps avoid unexpected expenses and maintain a clear understanding of your banking costs.

Accessing Customer Support Effectively

Knowing how to contact BankoftheWest's customer support is essential. Whether you have a simple question about a recent transaction or need assistance with a more complex financial matter, readily available support is invaluable.

Familiarize yourself with the various channels available for contacting customer service, such as phone, email, or secure online messaging. Having this information readily available can streamline communication and ensure a positive banking experience.

For deeper insights into the banking industry and emerging trends, explore the resources available at Visbanking. Their Bank Intelligence and Action System (BIAS) provides valuable information for both banking professionals and individuals looking to optimize their financial strategies.