Top Banking Risk Management Software for 2025

Brian's Banking Blog

Navigating the Complexities of Modern Banking with Risk Management Software

Modern banking demands robust risk management. This listicle provides banking executives, financial analysts, and risk professionals with a concise overview of 8 leading banking risk management software solutions to address evolving challenges like fluctuating interest rates, market volatility, and regulatory compliance. Discover how these tools can mitigate risk, enhance decision-making, and drive growth. Explore key features and functionalities of solutions including Visbanking, SAS, Oracle OFSAA, Moody's Analytics, IBM OpenPages, Wolters Kluwer OneSumX, Finastra, and MetricStream.

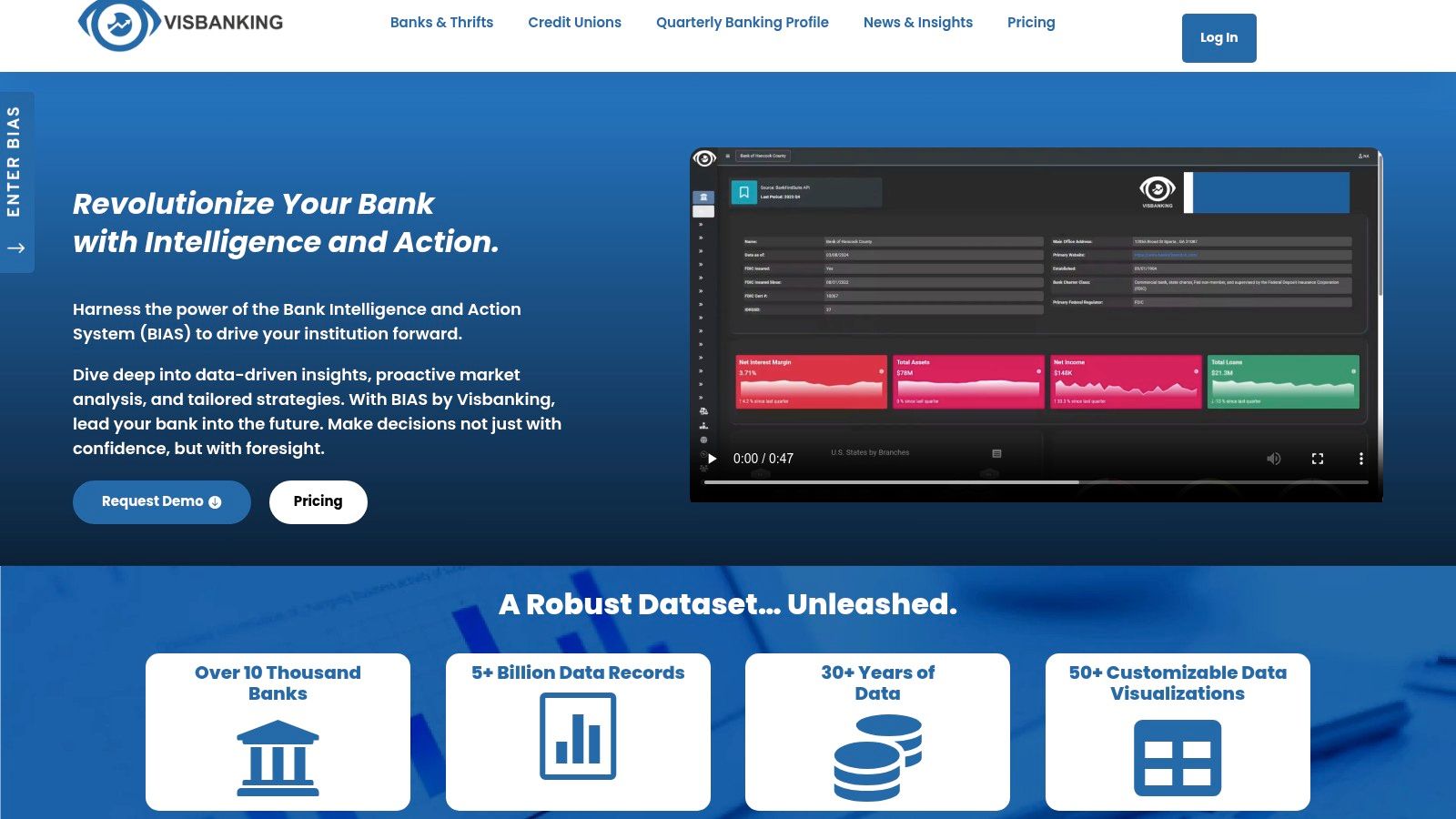

1. Visbanking: Proactive Banking Risk Management Software

Visbanking stands out as a leading banking risk management software solution, empowering financial institutions to make data-driven decisions through its innovative Bank Intelligence and Action System (BIAS). In today's volatile financial landscape, characterized by fluctuating interest rates and tightening margins, proactive risk management is no longer a luxury, but a necessity. Visbanking addresses this need by providing deep, historically informed insights derived from over 30 years of data encompassing more than 10,000 banks and trillions of data points. This wealth of information, combined with real-time regulatory updates, financial metrics, and market intelligence, allows banks to move beyond reactive responses and embrace proactive strategy execution.

A key differentiator of Visbanking is its focus on customization and accessibility. With over 50 customizable visualizations and diverse content delivery options—including PDF, Tableau, Power BI, SQL connections, and APIs—BIAS ensures that tailored, accurate, and timely intelligence is readily available to all stakeholders. Whether you're a banking executive assessing market trends, a financial analyst evaluating investment opportunities, a risk and compliance professional monitoring regulatory changes, or an IT leader seeking seamless integration, Visbanking provides the tools and insights you need. This comprehensive platform supports both crisis management, enabling rapid responses to unforeseen events, and day-to-day operational improvements, fostering greater transparency and risk mitigation across the organization. For example, imagine leveraging historical data to model the potential impact of a sudden interest rate hike on your loan portfolio, or using real-time market intelligence to identify emerging investment opportunities. Visbanking facilitates these kinds of proactive strategies.

Features and Benefits:

- Comprehensive Data Aggregation: Access to a vast database covering 10,000+ banks and 30+ years of historical data.

- Proactive Decision-Making: Real-time intelligence empowers proactive strategies and informed decision-making.

- Customizable Visualizations: 50+ customizable visualizations and diverse content delivery formats cater to specific needs.

- Enhanced Risk Mitigation: Supports both crisis management and daily operational enhancements, improving transparency and risk control.

- Trusted and Recognized: Extensive press coverage and customer testimonials validate its industry impact and thought leadership.

Pros:

- Aggregates extensive multi-source data for deep, historically informed insights.

- Enables proactive, data-driven banking decisions with real-time intelligence.

- Offers customizable visualizations and multiple content delivery formats tailored to diverse stakeholder needs.

- Supports both crisis management and day-to-day operational improvements.

- Widely recognized and trusted within the industry.

Cons:

- Pricing details are not publicly available, requiring a direct sales inquiry.

- The platform's complexity may necessitate dedicated training for optimal user adoption.

Implementation and Setup:

While the platform's complexity might require initial training, Visbanking likely offers onboarding support to facilitate smooth integration. Connecting existing data sources through SQL connections or APIs will be a crucial step in leveraging the platform's full potential. It's recommended to engage with Visbanking's sales team early in the process to determine the best implementation strategy for your specific needs.

Pricing and Technical Requirements:

Specific pricing details are not publicly disclosed and require contacting Visbanking directly. Technical requirements will likely depend on the chosen integration method (e.g., cloud-based access, on-premise installation, API integration). These details can be clarified during a demo request.

Why Visbanking Deserves its Place on this List:

Visbanking earns its spot on this list due to its comprehensive data aggregation, proactive intelligence delivery, and focus on customization. Its ability to support both crisis management and daily operational improvements makes it a valuable tool for banking executives, analysts, risk managers, and regulators looking to navigate the complexities of the modern financial landscape. While the lack of transparent pricing might be a minor drawback, the potential benefits of leveraging Visbanking’s BIAS system for enhanced risk management and strategic decision-making are significant.

Website: https://www.visbanking.com

2. SAS Risk Management for Banking

SAS Risk Management for Banking is a comprehensive banking risk management software solution designed to empower financial institutions with the tools they need to effectively manage credit, market, and operational risks. In today's volatile financial landscape, institutions face increasing pressure to not only identify and mitigate potential risks but also to demonstrate regulatory compliance. SAS addresses these challenges by offering advanced analytics, robust stress testing capabilities, and regulatory reporting tools specifically tailored for the banking industry. This allows for a proactive approach to risk management, going beyond simple identification to predictive modeling and strategic planning. For banking executives seeking a robust, albeit complex, solution, SAS offers a powerful platform for comprehensive risk oversight.

One of the key strengths of SAS Risk Management for Banking is its integrated approach. The platform seamlessly combines credit risk management and modeling, advanced stress testing and scenario analysis, and regulatory reporting for Basel III/IV compliance, all within a single, unified environment. This integration streamlines workflows, improves data consistency, and facilitates enterprise-wide risk aggregation and assessment. Furthermore, the platform leverages AI-powered risk analytics and predictive modeling, allowing institutions to anticipate potential risks and make data-driven decisions. For example, financial analysts can utilize the platform's sophisticated modeling tools to assess the potential impact of various economic scenarios on their loan portfolios, while compliance officers can generate automated reports to demonstrate adherence to regulatory requirements. Learn more about SAS Risk Management for Banking to see how this software can fit into a broader risk assessment strategy.

For innovation and IT leaders, the platform's seamless integration with existing banking systems is a significant advantage, minimizing disruption during implementation. However, it is important to note that while SAS boasts robust analytical capabilities with advanced statistical modeling and comprehensive coverage of multiple risk types, it comes with a higher cost compared to other solutions. The platform's complexity also results in a steep learning curve for non-technical users, and the implementation process requires specialized expertise. Therefore, organizations should carefully consider their budget and technical resources before committing to this solution.

Features:

- Integrated credit risk management and modeling

- Advanced stress testing and scenario analysis

- Regulatory reporting for Basel III/IV compliance

- AI-powered risk analytics and predictive modeling

- Enterprise-wide risk aggregation and assessment

Pros:

- Robust analytical capabilities with advanced statistical modeling

- Comprehensive coverage of multiple risk types

- Strong regulatory compliance capabilities

- Excellent data visualization and reporting tools

Cons:

- Higher cost compared to other solutions

- Steep learning curve for non-technical users

- Complex implementation process requiring specialized expertise

Website: https://www.sas.com/en_us/software/risk-management.html

While pricing and specific technical requirements aren't publicly available, SAS Risk Management for Banking deserves its place on this list due to its powerful analytics, comprehensive risk coverage, and robust regulatory compliance features. Its suitability is best evaluated by organizations with sufficient resources and a commitment to advanced risk management practices.

3. Oracle Financial Services Analytical Applications (OFSAA)

Oracle Financial Services Analytical Applications (OFSAA) is a robust suite of applications designed to address the complex banking risk management software needs of financial institutions. It provides a comprehensive approach to risk management, covering credit risk, market risk, liquidity risk, and operational risk, all within a unified platform. This integrated approach enables banks to gain a holistic view of their risk profile and make informed decisions to optimize risk-adjusted performance. OFSAA offers a significant advantage for institutions aiming to streamline their risk management processes and enhance regulatory compliance.

For banking executives seeking a comprehensive overview of their institution's risk exposure, OFSAA offers real-time risk monitoring dashboards and reporting tools. Financial analysts can leverage the platform's pre-built models and scenario analysis capabilities to assess the potential impact of various market conditions and economic downturns. Risk and compliance professionals benefit from the automated regulatory reporting features, ensuring adherence to global compliance requirements. The platform's scalable architecture also makes it a compelling solution for growing institutions, providing the flexibility to adapt to evolving business needs. Innovation and IT leaders will appreciate the strong integration with other Oracle systems, simplifying data management and reducing IT complexities. Finally, banking regulators can gain confidence in the accuracy and reliability of reported data, facilitating more effective oversight.

Key Features and Benefits:

- Unified Platform: OFSAA brings together financial crime, compliance, risk, and finance functionalities onto a single platform, streamlining workflows and improving data consistency.

- Pre-built Models & Scenarios: The platform offers a library of pre-built models and scenarios for various risk types, accelerating implementation and reducing the need for extensive customization. This feature is particularly beneficial for institutions looking to quickly deploy robust risk management capabilities.

- Regulatory Reporting: OFSAA simplifies compliance with international and domestic regulations by automating the generation of regulatory reports. This reduces the manual effort involved in reporting and minimizes the risk of errors.

- Stress Testing & Scenario Analysis: The platform's stress testing and scenario analysis capabilities allow banks to proactively assess their resilience to adverse market conditions and economic shocks, aiding in strategic planning and decision-making.

- Real-time Risk Monitoring: Real-time dashboards provide a clear and up-to-date view of key risk indicators, empowering institutions to respond quickly to emerging risks.

Pros:

- End-to-end Solution: Covers all major risk domains, providing a holistic view of an institution's risk profile.

- Oracle Integration: Seamless integration with other Oracle systems simplifies data management and streamlines operations.

- Robust Data Management: Offers powerful data management capabilities to handle large volumes of data efficiently.

- Scalable Architecture: Adapts to the growing needs of financial institutions, ensuring long-term value.

Cons:

- Implementation Costs: OFSAA can involve significant upfront investment in implementation and training.

- Complexity: Requires dedicated IT support due to its complex nature.

- Overwhelming for Smaller Institutions: The extensive functionality may be overwhelming for smaller banks with limited resources.

Pricing and Technical Requirements:

Specific pricing and technical requirements for OFSAA are not publicly available and typically require contacting Oracle directly for a tailored quote based on the institution's specific needs and size.

Implementation/Setup Tips:

Engaging with experienced Oracle implementation partners is highly recommended for successful OFSAA deployments. Careful planning and scoping of the project are crucial, along with thorough training for users to maximize the platform's benefits.

Comparison with Similar Tools:

While other banking risk management software solutions exist, OFSAA's strength lies in its comprehensive coverage of risk domains, integrated platform, and strong integration with other Oracle products. Competitors may offer specialized solutions for specific risk types, but OFSAA provides a more holistic approach for institutions seeking a unified platform.

Website: https://www.oracle.com/industries/financial-services/analytics/

OFSAA's position in this list is justified by its comprehensive risk management capabilities, integrated platform, and focus on regulatory compliance. While it may not be suitable for all institutions due to its complexity and cost, OFSAA offers a powerful solution for large and complex financial institutions seeking a robust and scalable banking risk management software solution.

4. Moody's Analytics Risk Authority

Moody's Analytics Risk Authority is a prominent player in the banking risk management software landscape, specifically designed to help financial institutions navigate the complex world of regulatory compliance and internal risk assessment. This robust solution deserves its place on this list due to its sophisticated credit risk modeling capabilities, leveraging Moody's extensive credit research and data, and its focus on adhering to evolving regulatory requirements. For banks seeking a powerful tool primarily for credit risk management, particularly those with significant credit portfolios, Risk Authority offers a comprehensive suite of features.

Risk Authority empowers banks to effectively manage their credit portfolios, conduct stress tests, and plan capital allocation strategies. Practical applications include:

- Credit Portfolio Optimization: The software allows banks to analyze their existing credit portfolio, identify concentrations of risk, and optimize the portfolio's composition to minimize potential losses while maximizing returns. This is crucial for maintaining a healthy balance sheet and making informed lending decisions.

- Stress Testing Under Various Economic Scenarios: Risk Authority facilitates the generation of diverse economic scenarios, enabling banks to assess the potential impact of adverse economic conditions on their credit portfolio. This forward-looking analysis helps institutions prepare for potential downturns and develop contingency plans. The integration of Moody's economic data provides a realistic and data-driven foundation for these stress tests.

- IFRS 9/CECL Compliance: Calculating expected credit losses (ECL) under IFRS 9/CECL can be complex. Risk Authority simplifies this process by providing automated ECL calculations, ensuring compliance with these crucial accounting standards.

- Meeting Regulatory Capital Requirements: The software assists banks in calculating regulatory capital requirements under Basel III/IV frameworks. This helps institutions maintain adequate capital levels, ensuring financial stability and compliance with regulatory mandates.

- Establishing and Monitoring Risk Appetite: Risk Authority supports the development and implementation of a robust risk appetite framework. This allows banks to define their acceptable levels of risk and monitor their exposure against these predefined limits, promoting a risk-aware culture throughout the organization.

Features:

- Credit portfolio management and optimization

- Economic scenario generation for stress testing

- Expected credit loss (ECL) calculations for IFRS 9/CECL

- Regulatory capital calculations (Basel III/IV)

- Risk appetite framework and monitoring

Pros:

- Access to Moody's proprietary credit research and data, providing valuable insights and a competitive edge.

- Strong focus on credit risk management, making it ideal for institutions prioritizing this area.

- Regular updates to align with changing regulations, ensuring ongoing compliance.

- Flexible deployment options (cloud or on-premises), catering to different IT infrastructure needs.

Cons:

- Premium pricing model, potentially making it less accessible for smaller institutions. Pricing details are typically available upon request from Moody's Analytics.

- Less comprehensive for operational risk compared to credit risk, requiring supplementary solutions for a holistic risk management approach.

- Integration with legacy systems can be challenging and may require dedicated IT resources.

Implementation & Setup: While specific technical requirements are not publicly listed, implementing Risk Authority typically involves collaboration with Moody's Analytics consultants for integration and customization based on the bank's specific needs. This ensures the software aligns with the institution's existing systems and workflows.

Comparison: Compared to other banking risk management software solutions like Oracle Financial Services Analytical Applications (OFSAA) or SAS Risk Management, Moody's Analytics Risk Authority stands out with its deep integration of Moody's credit ratings and research data. However, some competitors may offer broader coverage across different risk types.

Website: https://www.moodysanalytics.com/product-list/risk-authority

In conclusion, Moody's Analytics Risk Authority is a powerful banking risk management software solution specifically geared towards institutions looking to enhance their credit risk management capabilities. Its access to Moody's proprietary data and its focus on regulatory compliance make it a valuable tool for banking executives, financial analysts, risk and compliance professionals, and IT leaders in the financial industry. However, potential users should carefully consider the premium pricing and the focus on credit risk when evaluating its suitability for their organization's broader risk management needs.

5. IBM OpenPages with Watson

IBM OpenPages with Watson is a robust banking risk management software solution designed to help financial institutions navigate the complexities of regulatory compliance and risk mitigation. This AI-powered governance, risk, and compliance (GRC) platform offers a comprehensive suite of tools to manage financial and operational risks, providing a holistic view of risk across the entire organization. Its cognitive capabilities automate key risk processes, identify emerging threats, and provide actionable insights for proactive risk management. For banking executives seeking a sophisticated and scalable solution, OpenPages with Watson stands out for its advanced features and powerful analytics.

Specifically, OpenPages with Watson allows banks to move beyond traditional, reactive risk management approaches. Its AI-powered risk identification and assessment capabilities can analyze vast amounts of data to pinpoint potential risks before they materialize. This proactive approach is invaluable in today's dynamic financial landscape, where emerging threats like cyberattacks and regulatory changes can significantly impact a bank's stability. The platform's operational risk management framework helps establish consistent processes and controls, minimizing the likelihood of operational failures. Further strengthening its value proposition for banks is its dedicated module for model risk governance, crucial for validating and managing the risks associated with complex financial models. Integrated workflow and task management features streamline collaboration and ensure timely completion of risk-related activities.

Features and Benefits for Banking Professionals:

- AI-powered risk identification and assessment: Proactively identifies and assesses risks, allowing for timely intervention.

- Operational risk management framework: Establishes consistent processes and controls to minimize operational failures.

- Regulatory compliance management: Streamlines compliance with evolving regulatory requirements, reducing the risk of penalties and reputational damage.

- Model risk governance: Validates and manages risks associated with financial models, ensuring accuracy and reliability.

- Integrated workflow and task management: Improves collaboration and efficiency in risk management activities.

- Powerful analytics and reporting: Provides a clear and comprehensive view of risk across the organization, enabling data-driven decision-making.

Pros:

- Advanced AI and machine learning capabilities: Offers superior risk identification and prediction compared to traditional solutions.

- Highly customizable to specific bank requirements: Adapts to the unique needs and complexities of individual banking institutions.

- Strong operational risk management features: Provides a robust framework for managing operational risks effectively.

- Comprehensive audit trail and documentation: Ensures transparency and accountability in risk management processes.

Cons:

- Significant investment required for full implementation: The comprehensive nature of the platform can lead to high initial costs.

- Can require extensive configuration: Customization to specific bank requirements may necessitate significant configuration efforts.

- May need specialized IBM consultants for optimal setup: Specialized expertise may be required for initial setup and ongoing support.

Pricing and Technical Requirements:

Pricing for IBM OpenPages with Watson is typically based on the size and complexity of the implementation, including the number of users and modules required. Contacting IBM directly is recommended for a tailored quote. Technical requirements vary depending on the deployment model (on-premise, cloud, or hybrid).

Comparison with Similar Tools:

While other GRC platforms exist, OpenPages with Watson differentiates itself through its advanced AI capabilities and comprehensive coverage of banking-specific risks, like model risk governance. Competitors may offer simpler solutions, but often lack the depth and sophistication required by larger financial institutions.

Implementation Tips:

- Clearly define your bank's specific needs and objectives before implementation.

- Engage with IBM consultants early in the process to leverage their expertise.

- Prioritize training for your team to ensure effective utilization of the platform's features.

Why IBM OpenPages with Watson Deserves Its Place on the List:

In the complex world of banking risk management, IBM OpenPages with Watson offers a powerful and comprehensive solution. Its AI-driven insights, robust features, and focus on regulatory compliance make it a valuable tool for any bank seeking to enhance its risk management capabilities. While the investment can be significant, the potential benefits in terms of reduced risk exposure and improved regulatory compliance make it a worthy consideration for banking executives, financial analysts, risk and compliance professionals, IT leaders, and regulators.

6. Wolters Kluwer OneSumX

Wolters Kluwer OneSumX is a robust banking risk management software solution designed to address the complex regulatory landscape faced by modern financial institutions. This modular platform offers integrated governance, finance, risk, and compliance (GFRC) management capabilities, making it a comprehensive tool for banks looking to streamline their operations and enhance risk oversight. OneSumX helps financial institutions manage a wide range of risks, including credit risk, market risk, operational risk, and liquidity risk, all within a single platform. This integrated approach allows for a holistic view of risk and facilitates more informed decision-making.

One of the key strengths of OneSumX lies in its comprehensive regulatory reporting capabilities. The software covers a vast array of regulatory requirements across multiple jurisdictions, allowing banks to efficiently generate reports and ensure compliance with local and global regulations. This is especially crucial for international banks operating in various regulatory environments. For a deeper dive into compliance solutions, you can learn more about Wolters Kluwer OneSumX. This feature alone makes OneSumX a valuable tool for banking executives and risk and compliance professionals seeking to minimize regulatory burdens.

Furthermore, OneSumX offers advanced features for credit risk modeling and measurement, asset and liability management (ALM), stress testing, and scenario analysis. These capabilities empower financial analysts and risk managers to assess potential vulnerabilities, evaluate the impact of various economic scenarios, and optimize capital adequacy. The platform’s stress testing tools, for example, allow banks to simulate the effects of adverse market conditions on their portfolios, helping them proactively identify and mitigate potential losses.

Features:

- Comprehensive regulatory reporting across jurisdictions

- Integrated approach to finance, risk, and regulatory reporting

- Credit risk modeling and measurement

- Asset and liability management

- Stress testing and scenario analysis tools

Pros:

- Strong focus on regulatory compliance and reporting

- Regular updates to reflect changing regulations

- Modular approach allows for targeted implementation

- Global coverage of regulatory requirements

Cons:

- User interface can be less intuitive than competitors

- Implementation complexity for the full suite

- Higher cost for comprehensive deployment

While pricing information isn't readily available, it's important to note that the cost of OneSumX typically depends on the modules selected and the size of the institution. Implementing the full suite can be complex and may require significant resources. The user interface has also been noted as less intuitive compared to some competitors. However, Wolters Kluwer provides implementation support and training to assist clients with the onboarding process. For institutions prioritizing regulatory compliance and comprehensive risk management, the benefits of OneSumX often outweigh these challenges. OneSumX deserves its place on this list due to its robust functionality, global reach, and focus on regulatory compliance, making it a suitable choice for large, internationally active financial institutions dealing with complex regulatory demands. For targeted implementation advice, consult with Wolters Kluwer directly to assess your specific needs and tailor the implementation accordingly, focusing on the modules most critical to your institution's risk profile. You can explore OneSumX further on their website: https://www.wolterskluwer.com/en/solutions/onesumx-for-finance-risk-and-regulatory-reporting

7. Finastra Fusion Risk

Finastra Fusion Risk is a comprehensive banking risk management software solution designed to help financial institutions navigate the complexities of credit, market, liquidity, and operational risks. Its suite of tools empowers banks to make data-driven decisions, enhance regulatory compliance, and optimize financial performance. This makes it a strong contender for any institution seeking robust risk management capabilities.

This platform offers a unified view of risk across the organization, providing real-time risk analytics and financial modeling capabilities. For example, banks can utilize Finastra Fusion Risk to stress test their balance sheets under various economic scenarios, model potential credit losses in their loan portfolios, and monitor liquidity positions in real-time. This proactive approach to risk management allows institutions to identify and mitigate potential vulnerabilities before they escalate.

Key Features and Benefits:

- <