Mapping the Future of Banking Industry Trends

Brian's Banking Blog

Let's get real for a moment. The banking world as we knew it is being shaken up, and it's not just a passing trend. Three powerful currents are pulling the industry in a new direction: digital disruption, sky-high customer expectations, and relentless economic pressures. These aren't just boardroom buzzwords anymore; they are the day-to-day reality we all have to navigate.

The New Blueprint for Modern Banking

The very foundation of banking is being rebuilt from the ground up. Not long ago, success was all about the number of branches you had. Now? It’s about the strength and usability of your digital presence. This isn’t just about slapping together a mobile app; it’s a fundamental rethinking of how we deliver services, talk to our customers, and ultimately, stay profitable.

Think of it this way: the old banking model was like a paper map—reliable, but static and with fixed routes. The new model is more like a live GPS. It’s dynamic, constantly updating based on what's happening, and always finding the most efficient path for the user to reach their financial goals.

Core Drivers of Change

What’s powering this shift? It's a perfect storm of a few key factors:

- Digital Disruption: Let's face it, nimble FinTechs and all-digital banks have completely changed the game. They don't have the baggage of old-school systems, so they can innovate faster and offer a level of convenience that has customers flocking to them.

- Evolving Customer Expectations: Our customers now expect the same slick, personalized experience from their bank that they get from Amazon or Netflix. They want 24/7 access, smart advice that feels like it was made just for them, and apps that just work.

- Economic and Regulatory Pressures: With interest rates bouncing around, new compliance rules popping up, and a shaky global economy, there’s simply no room for guesswork. We have to be smarter, more efficient, and more strategic. Data isn't a nice-to-have; it's essential for survival.

The real challenge for every bank today isn't if we should change, but how fast and how well we can adapt. It's no longer a game of who has the most assets. It's about who is the most agile and the most obsessed with their customers.

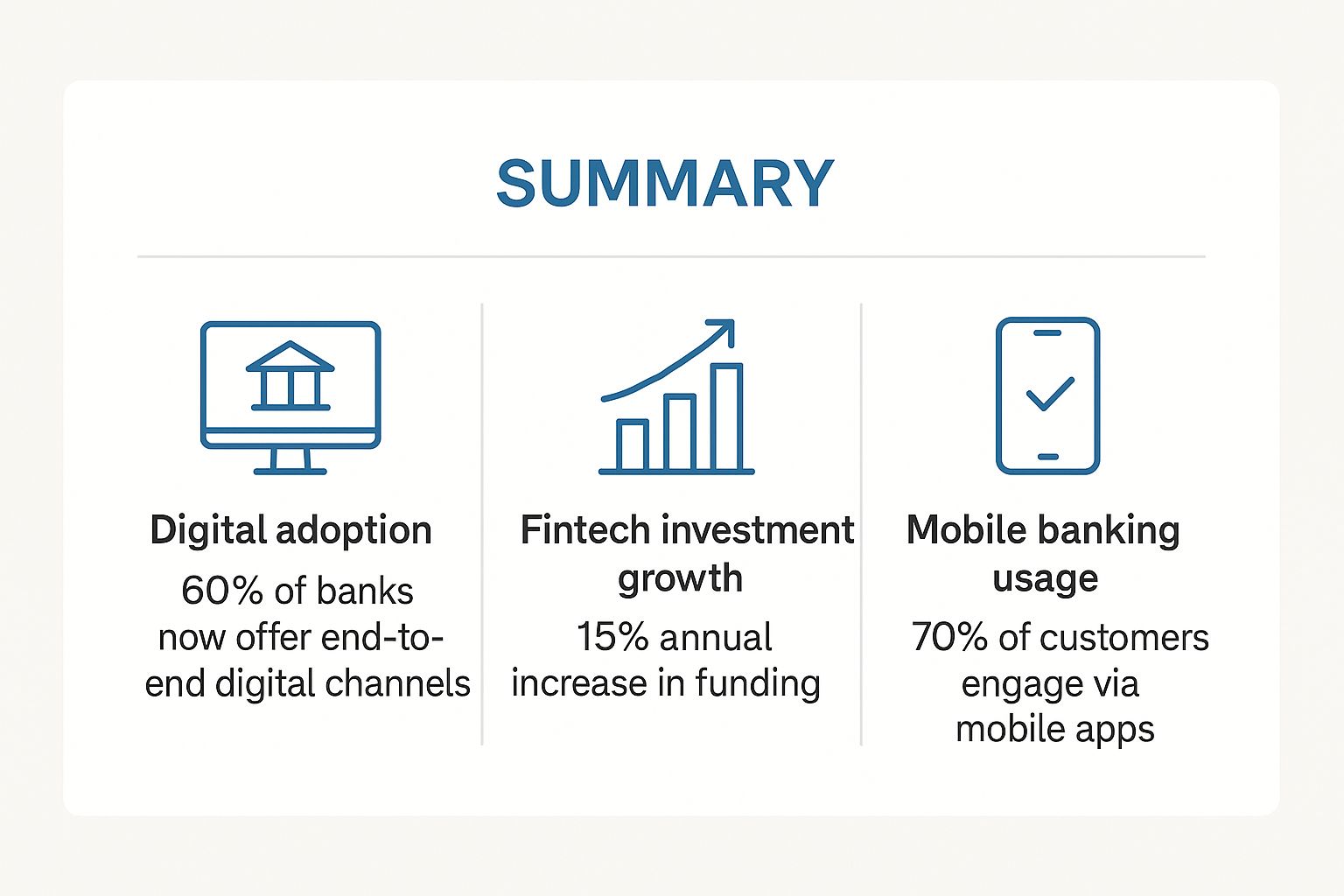

The image below paints a clear picture of just how powerful this digital wave is.

The numbers don't lie. With 70% of customers now doing most of their banking through mobile apps, the market has clearly made its choice.

Key Banking Industry Trends at a Glance

To help you get a handle on this new landscape, we’ve put together a quick summary of the major trends, what they mean for your institution, and where the real opportunities are.

This table serves as a high-level guide to the key themes we’ll dive into, providing a clear framework for turning these industry shifts into your next big win.

| Trend | Primary Impact | Strategic Opportunity |

|---|---|---|

| Digital-First Banking | Decline in branch traffic, pressure on legacy systems. | Develop a seamless, end-to-end digital customer journey that wows. |

| AI & Hyper-Personalization | Moving away from one-size-fits-all products to truly tailored solutions. | Use data to offer proactive, individualized advice that builds real loyalty. |

| Economic Volatility | Squeezed interest margins and increased credit risk. | Optimize your lending portfolios and get creative with diversifying revenue streams. |

| Embedded Finance | Banking services are popping up inside non-financial apps and platforms. | Partner with other companies to meet customers where they are and create new service points. |

Think of these trends not as threats, but as signposts pointing toward new avenues for growth and a stronger, more resilient future for your bank.

How Digital-Only Banks Are Redefining Service

Picture a bank with no address. No marble lobbies, no teller lines, and no 9-to-5 schedule. Instead, it lives on your phone, ready whenever you are with service that just works. This isn't some far-off idea; it’s the world of neobanks, and they’re one of the most powerful banking industry trends shaping our world right now.

These are not your grandfather's banks with a slick new app. They were built from the ground up with modern technology, giving them a huge leg up in speed and cost. Without the massive overhead of branches and clunky old systems, they can pass those savings directly to their customers.

This lets them tackle the things that drive people crazy about traditional banking. We're talking low (or no) monthly fees, pricing you can actually understand, and financial tools that are genuinely helpful. Their entire focus is on the customer experience, making banking feel less like a chore and more like a natural part of your digital life.

The Neobank Appeal to Modern Customers

So, what’s the big deal? Why are these digital upstarts, especially with younger, tech-first generations, gaining so much ground? It all boils down to a massive shift in what people expect. Today's customers want simple, fast, and personal service in everything they do.

A huge driver here is the simple preference for banking on the go. Neobanks are delivering groundbreaking services and user interfaces that many established players struggle to match. The pressure is on for the whole industry to either adapt or get left behind. You can dig into a full analysis of these banking shifts to see just how deep this trend runs.

The appeal is pretty straightforward:

- Frictionless Onboarding: Forget waiting days to open an account. With a neobank, you can often be up and running in minutes, all from your phone.

- Intuitive Design: Their apps are built for real people, making it simple to see where your money is going, set goals, and manage your finances without getting lost.

- Niche Specialization: Many focus on specific groups—freelancers, small business owners, even frequent travelers—offering features built just for them.

This intense focus on the customer has paid off, with some neobanks attracting millions of users in just a few short years. Their success is a wake-up call for the entire financial world.

The Pressure on Traditional Banking Models

The rapid rise of digital-only banks is putting a ton of pressure on the old guard. Traditional banks are often weighed down by ancient core systems that are a nightmare to maintain and even harder to update. This "technological debt" makes it tough to keep pace with their nimble, digital-first competitors.

The challenge for traditional banks is no longer about just adding digital features. It's about a complete philosophical change—from seeing banking as a place customers go to, to a service that is seamlessly integrated into their lives.

This pressure is forcing an evolution that’s long overdue. Many institutions are now getting serious about their own modernization plans. Our guide on digital transformation in finance dives into how banks are tackling this critical shift. The main goal is to deliver the kind of smooth, convenient experience that customers now see as the baseline.

It means investing serious money in technology, rethinking internal processes, and sometimes even launching their own digital-only offshoots to compete. This isn't just a battle over features; it's a fight for customer loyalty in an age where switching banks has never been easier. The neobank movement has permanently changed the definition of great service.

Using AI to Create Hyper-Personalized Banking

The days of one-size-fits-all banking are long gone. Let’s be honest, customers today expect far more than a vault for their money and a generic checking account. One of the biggest shifts we're seeing in banking is the move toward hyper-personalization, and it's all powered by artificial intelligence.

This isn't about slapping a customer's name on a marketing email. It’s about creating an experience that feels like having a personal financial concierge—someone who truly gets you and your financial goals. Banks that get this right are the ones that will win.

Think about it. AI can sift through mountains of data—transaction histories, spending habits, saving patterns—to build an incredibly sharp picture of each person. This is how you move from just holding a customer's money to actually helping them manage it.

From Data Points to Customer Profiles

The real magic happens when banks stop seeing data as just a collection of numbers and start connecting the dots. AI doesn’t just see a transaction; it spots patterns that signal major life events, turning raw information into a roadmap for helping your customer.

How does this work in the real world?

- Behavioral Analysis: An AI model can track spending habits to understand someone's lifestyle. Are they making frequent purchases at baby stores? That could mean a growing family, creating a perfect opportunity to talk about a high-yield savings account for the child's future.

- Life Event Prediction: By looking at income changes, savings rates, and even credit inquiries, AI can anticipate when a customer might be gearing up for a big purchase, like a home or a new car.

- Proactive Engagement: Instead of waiting for the customer to come to you, you can reach out with timely, relevant advice. This simple flip changes the entire relationship from a transactional service to a genuine partnership.

This is the difference between blasting out a generic mortgage ad to everyone and sending a personalized note with helpful guidance right when a customer starts house hunting. One is noise; the other is value.

Real-World Applications of AI Personalization

So, what does this look like day-to-day? AI-powered personalization can touch nearly every part of the customer journey, making banking feel more intuitive and genuinely useful.

The real goal of personalization isn't just to sell more products. It's to show you deeply understand your customer's financial life, building the kind of trust and loyalty that competitors simply can't touch.

Imagine a mobile banking app that tailors its dashboard to each user. A recent college grad might see options for student loan consolidation, while a retiree could see tools for managing their RMDs. This level of detail is only possible with platforms that can make sense of all this information. To pull this off, you absolutely have to master banking data analytics and turn your customer data into your biggest strategic asset.

Here are a few other powerful ways banks are putting this to work:

- Customized Rates: Offering interest rates on loans or savings accounts based on someone's full financial picture, not just a static credit score.

- Dynamic Financial Advice: Sending automated, real-time tips based on spending. An AI could ping a customer if they’re nearing their monthly budget or suggest a better savings strategy based on recent income.

- Targeted Product Recommendations: Suggesting a travel rewards credit card to a frequent flyer or pointing a customer toward investment products that match their stated risk tolerance.

By transforming customer data into deeply personal experiences, banks aren't just chasing a trend. They're fundamentally redefining their value in the eyes of a whole new generation of consumers.

Thriving Through Economic Shifts and Loan Growth

Beyond the flashy digital tools and talk of personalization, the real engine of any bank is its fundamental financial health. It all comes down to a delicate dance: balancing aggressive loan growth with solid profitability, especially when the economic ground feels like it's constantly shifting beneath your feet.

A bank's loan portfolio doesn't exist in a vacuum. It’s directly tied to the big economic levers, like central bank policy and interest rate swings. For most of us, the recent period of rapidly rising rates squeezed margins pretty tight.

But there’s a light on the horizon. The next big banking industry trend we’re all watching is the anticipated rebound in lending. As central banks start to ease up on rates, borrowing gets cheaper, and that's the classic signal for credit demand to wake up.

Forecasts are pointing to global loan growth bouncing back to around 6%, a huge leap from the roughly 2% we saw in 2024. This comeback is largely pegged to those expected rate cuts, which should get people and businesses moving on mortgages and financing again. This activity is what’s expected to kickstart net interest income growth of about 3% worldwide.

Navigating the Nuances of Regional Economies

Here’s the thing: a one-size-fits-all approach to loan growth is a surefire way to get left behind. The global economy isn't one single picture; it's a mosaic of countless different local realities. The challenges and opportunities for a bank in a booming market look completely different from one in a region battling slow growth or high inflation.

Success hinges on your ability to read these local signals and pivot your lending strategy. A manufacturing boom in one county? That’s your cue to lean into commercial and industrial loans. A new housing development breaking ground across town? Time to double down on mortgage products.

This kind of granular strategy demands serious market intelligence. You have to look past the national headlines and get your hands dirty with data that shows what’s actually happening in your communities. This is where having the right tools to slice and dice market data becomes your real competitive edge.

Optimizing Your Loan Portfolio for Profitability

In this fluid environment, managing risk while chasing growth is the ultimate balancing act. You can't just look at a loan application in isolation anymore. Every lending decision has to be weighed against potential economic headwinds.

Proactive portfolio management isn’t just a best practice anymore—it’s a core survival skill. You have to constantly be analyzing your loan books to spot pockets of risk and opportunity before they turn into major problems.

Effective financial institution risk management is about seeing around the corner. It means stress-testing your portfolio against different economic what-ifs, watching your concentration risk like a hawk, and making sure you’re ready for any sudden shifts in credit quality. And as you navigate these changes, it’s also critical to understand how your deposit products are performing. For a deeper look at market specifics, you can check out the latest certificate of deposit rate trends to see how rate shifts are impacting deposit strategies.

The goal is to build a loan portfolio that's both profitable and resilient—one that can ride out the economic storms and capitalize on the sunny days. It’s a strategic mix of:

- Market Analysis: Pinpointing high-potential lending areas based on what’s really happening locally.

- Risk Assessment: Gauging borrower creditworthiness and the potential fallout from an economic downturn.

- Performance Monitoring: Keeping a constant pulse on the health of your portfolio and making smart adjustments on the fly.

When you can connect the dots between big-picture economic trends and your day-to-day lending decisions, you won't just survive the shifts. You'll thrive on them.

The Future of Embedded Finance

What if banking services could meet you exactly where you are, instead of you having to go find them? It’s a simple question, but it’s at the core of one of the biggest banking industry trends today: embedded finance. It’s all about making banking a feature, not a destination.

Think about the last time you bought something online. Maybe a new couch. As you’re checking out, a "pay in installments" option pops up right there. You click, get approved, and finish your purchase in seconds, all without ever leaving the furniture store’s website. That’s embedded finance, plain and simple.

The service is woven so seamlessly into a non-financial experience that it just feels like part of the process. This shift is fundamentally changing what a "bank" even is, pulling financial services out of their traditional boxes and into the everyday apps people already use.

The Technology Powering Integration

This isn't magic, of course. This smooth, integrated experience is made possible by a couple of key technologies that let different systems talk to each other safely and quickly. We’re talking about APIs and Banking-as-a-Service (BaaS).

Application Programming Interfaces (APIs): An API is like a waiter at a restaurant. It takes your order (a request for a service, like a loan application) to the kitchen (the bank's core systems) and brings back your food (the loan approval). It’s the messenger connecting a non-financial company with a bank’s capabilities.

Banking-as-a-Service (BaaS): This is the bigger picture. BaaS is a model where banks essentially rent out their regulated infrastructure. A BaaS provider packages up its services—payments, lending, account creation—so that FinTechs or other businesses can easily plug them into their own products using those APIs.

This is how an accounting software company can let its small business clients apply for a line of credit right from its dashboard. The software company builds the slick user interface, while a partner bank handles the actual lending and compliance behind the scenes.

For traditional banks, this isn't a threat. It's a monumental opportunity to partner up, innovate, and tap into entirely new revenue streams by showing up in customers' everyday digital lives.

By becoming the "engine" powering other brands, banks can grow their reach exponentially without having to build new customer-facing apps from the ground up. They gain access to a huge, built-in customer base and can earn money from transactions they never would have seen otherwise.

Capitalizing on the Embedded Finance Opportunity

For any financial institution, the rise of embedded finance is a clear call to action. It’s a chance to go from being a standalone provider to an essential, integrated partner in the digital economy. To do this right, though, requires a real shift in strategy.

The key is finding the right partners. A community bank, for example, could see massive success by embedding its business lending services into a local payroll provider’s platform. They’d be putting their financial products in front of business owners at the very moment they’re thinking about cash flow.

To spot these kinds of opportunities, you need solid intelligence on market movements and potential collaborators. This is where Visbanking's Bank Intelligence and Action System comes in. It helps institutions analyze market data to pinpoint promising non-financial sectors and potential FinTech partners. By understanding where their customers are spending their digital lives, banks can strategically place their services right where they're needed most, turning this powerful trend into a major source of growth.

Building a Smarter Bank with Intelligent Tools

Knowing about big banking industry trends like digital adoption, AI-driven personalization, and embedded finance is one thing. But turning that knowledge into action? That's the real game. How do you actually jump on these opportunities while also protecting your institution from a shaky economy and hungry new competitors?

It’s the classic gap between knowing and doing.

Stop Reacting and Start Anticipating

Trying to run a bank without real-time intelligence is like driving down the highway at rush hour while only looking in the rearview mirror. You’re constantly slamming on the brakes, reacting to what’s already happened—a competitor’s new rate, a sudden drop in loan applications—always a step behind. It's a recipe for getting left in the dust.

A proactive approach changes everything. It’s like having a live-traffic GPS that shows you the slowdowns five miles ahead, giving you plenty of time to take a better route. You stop just managing the day-to-day and start actively shaping your bank's future.

The goal is simple: stop reacting to the market and start anticipating it. A bank that can see what's coming holds an incredible advantage.

This foresight is what separates the leaders from the followers. It’s how you build a strategy for growth, not just survival.

The Power of a Bank Intelligence System

This is where a dedicated bank intelligence platform becomes your most valuable player. Think of it as your bank's command center, pulling in signals from all over the market and translating them into clear, actionable moves. It closes that gap between knowing a trend exists and knowing exactly what to do about it.

With a platform like Visbanking’s Bank Intelligence and Action System, you can get out of the weeds of generic trend reports and zoom in on the specific data that impacts your bank, right now.

Here’s how it helps you get ahead:

- See Your Competitors’ Playbook: Watch in real-time as your peers adjust their loan portfolios, deposit rates, and even their marketing spend. This lets you counter their moves or, even better, spot the gaps they're leaving wide open.

- Understand What’s Really Happening: Drill down into the nitty-gritty. See which specific products are catching fire in your local market and which customer segments are driving that growth.

- Benchmark Against Your True Peers: How do you actually stack up? Continuously measure your key metrics against a hand-picked peer group to find your strengths and, more importantly, uncover weaknesses before they turn into real problems.

When you arm your team with this kind of power, you’re not just giving them data; you're giving them the confidence to make smarter decisions. This is how you build a more resilient, more intelligent bank that's ready for whatever comes next.

Got Questions About Banking Trends? Let's Talk.

It’s only natural to have questions when things are moving this fast. Getting a handle on these major shifts is the first step to building a winning game plan.

What’s the Single Biggest Trend Shaking Up Banking Right Now?

If you had to pick just one, it's the massive migration to digital. This isn't just a single trend; it’s a seismic event that includes everything from the rise of digital-only banks to AI-driven personalization and the universal demand for mobile-first everything.

This shift completely rewires how customers think about and manage their money. It’s forcing traditional banks to question everything—their tech, their daily workflows, their entire approach to customer service—just to keep their seat at the table.

How Can Community Banks Possibly Keep Up?

Community banks can’t out-muscle the big guys on R&D spending, so they have to be smarter and more agile. The secret? Stop trying to build everything yourself and start embracing strategic FinTech partnerships.

By teaming up for specific solutions—like a killer mobile app, powerful data analytics, or AI-powered services—they can deliver the modern features customers expect without the crushing upfront cost. This frees them up to double down on their real superpower: delivering unparalleled, personal service to the communities they know inside and out.

For a community bank, the right technology is the ultimate equalizer. Smart partnerships let you punch way above your weight, blending modern convenience with the high-touch service that is your signature.

It’s about being focused and playing to your strengths.

Are We Watching the Physical Bank Branch Go Extinct?

Not extinct, no. But its job description is getting a complete rewrite.

The days of the branch being the go-to spot for simple transactions like cashing a check are over. That’s all moved to digital. The branch of the future is evolving into a high-value advisory center, a place for complex, relationship-driven conversations that just work better face-to-face.

Think about things like:

- Mortgage advising for a nervous first-time homebuyer.

- Wealth management discussions for mapping out a family's future.

- Small business financing strategy sessions.

Tomorrow’s branch will be smaller, smarter, and staffed with expert financial advisors, not just tellers.

Ready to stop reacting to these trends and start using them to your advantage? Visbanking gives you the real-time data and peer insights to make smarter, faster decisions. See how the Bank Intelligence and Action System can give your team the edge.