Bank Risk Assessment Template: Transform Your Strategy Today

Brian's Banking Blog

Mastering Bank Risk Assessment Fundamentals

A strong bank risk assessment template is essential for any resilient financial institution. It provides a structured way to identify, analyze, and mitigate potential threats across all banking operations. This proactive approach not only protects financial stability, but also improves strategic decision-making.

Key Risk Categories Demanding Immediate Attention

Modern banking involves a complex web of interconnected risks. A comprehensive risk assessment template needs to address key areas:

Credit Risk: Evaluating the likelihood of loan defaults. This includes looking at credit scores, debt-to-income ratios, and collateral.

Market Risk: Analyzing how market fluctuations—like interest rate changes, currency shifts, and stock market volatility—affect the bank's portfolio.

Operational Risk: Examining potential losses from internal processes, human error, system failures, or external events such as natural disasters.

Liquidity Risk: Assessing the bank's capacity to meet short-term obligations without significant losses. This involves forecasting cash flows and maintaining adequate reserves.

Structuring Assessments for Obvious and Hidden Vulnerabilities

Capturing both obvious and subtle risks requires a multi-layered approach. Leading banks structure their assessments to include:

Risk Identification Matrices: These tools systematically map potential risks against business units, processes, and external factors.

Control Evaluation Frameworks: These frameworks assess the effectiveness of existing controls, both preventative and detective, in mitigating identified risks.

Quantitative and Qualitative Factors: Combining numerical data (like financial ratios and loss data) with qualitative assessments (such as management expertise and the regulatory environment) provides a complete view of the bank's risk profile.

To understand the essential parts of a bank risk assessment template, take a look at the table below:

Key Components of a Bank Risk Assessment Template

| Template Component | Purpose | Regulatory Requirement | Implementation Complexity |

|---|---|---|---|

| Credit Risk Assessment | Evaluates the likelihood of borrowers defaulting on loans. | Basel II, Dodd-Frank Act | Moderate |

| Market Risk Assessment | Analyzes the impact of market fluctuations on the bank's portfolio. | Basel III, Volcker Rule | High |

| Operational Risk Assessment | Examines potential losses arising from internal processes, human error, or external events. | Basel II, Sarbanes-Oxley Act | Moderate |

| Liquidity Risk Assessment | Determines the bank's ability to meet short-term obligations. | Basel III, LCR requirements | High |

| Risk Identification Matrix | Maps potential risks against various business units and processes. | Generally Accepted Risk Principles | Low |

| Control Evaluation Framework | Assesses the effectiveness of existing risk controls. | COSO Framework | Moderate |

This table summarizes the key components often found in a bank risk assessment template, connecting each to its purpose and relevant regulations. It highlights the varying complexities of implementation, ranging from relatively straightforward matrices to more intricate market and liquidity risk assessments.

The Office of the Comptroller of the Currency (OCC)'s model risk management guidelines emphasize historical data validation. They note that 15–20% of bank models have significant errors without proper backtesting. A risk assessment template might include data-cleaning protocols to address gaps. For example, pre-2008 datasets often lacked subprime mortgage correlations, which skewed risk models. Modern templates now standardize adjustments for 'survivorship bias,' ensuring datasets include failed institutions (e.g., over 500 U.S. bank failures from 2008–2015). Basel III's liquidity coverage ratio (LCR) requirements, calculated using 30-day stress scenarios from historical liquidity crunches, are another template staple. Banks have maintained LCRs of 100%+ since implementation (2019–2025 averages: 120–130%).

Data Visualization: Unveiling Trends and Patterns

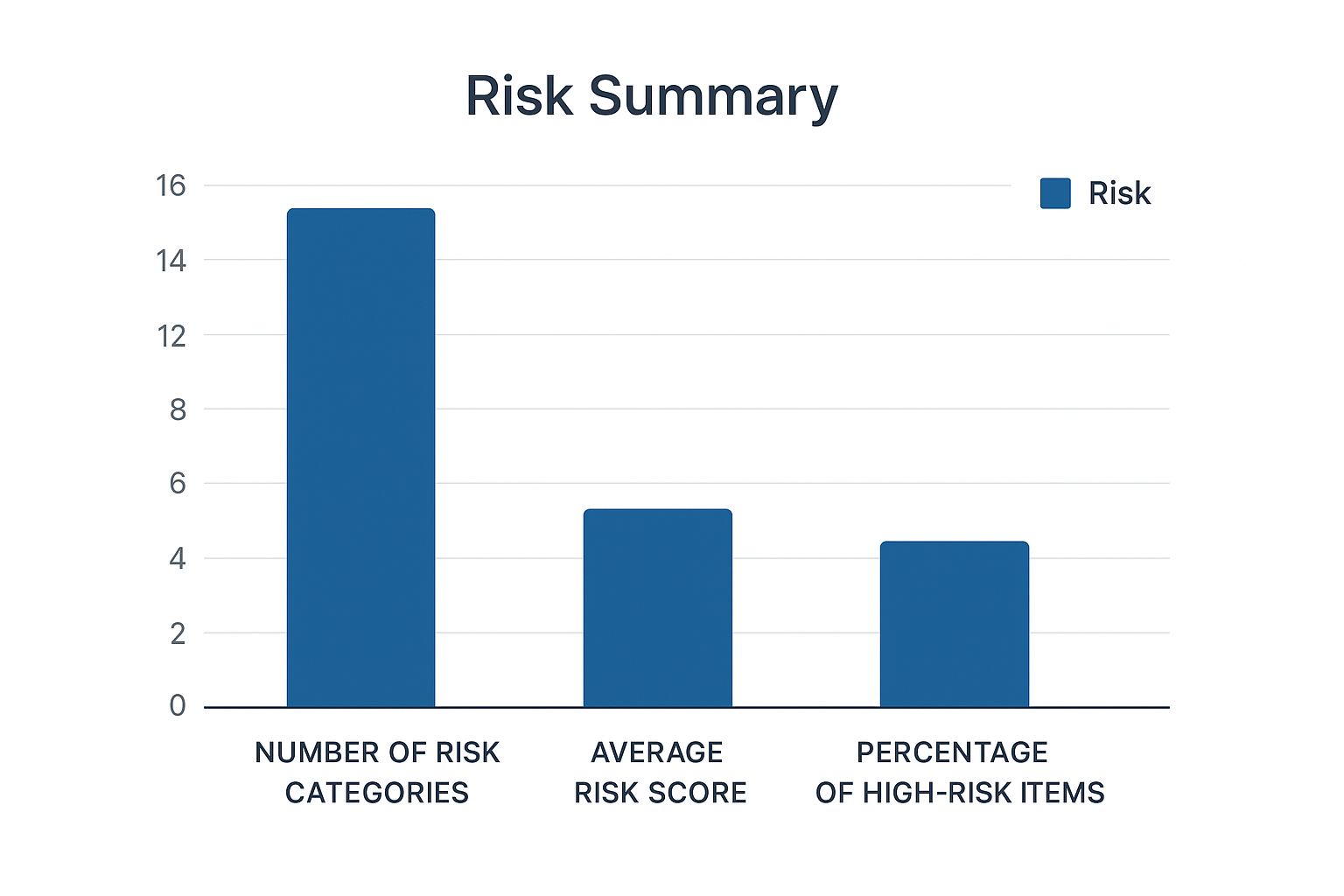

The following bar chart shows the average Liquidity Coverage Ratio (LCR) of banks from 2019-2025. This metric, a key indicator of a bank's ability to handle short-term liquidity stress, is a crucial part of many risk assessment templates.

As the data chart reveals, the LCR has consistently stayed above the 100% minimum requirement set by Basel III, showing a commitment to strong liquidity buffers. The trend also indicates a gradual LCR increase over time, reaching about 130% in 2023, before settling around 125% in 2025. This pattern may reflect an increased focus on liquidity risk management due to changing market conditions and regulatory expectations. This data underscores the importance of tracking key metrics like the LCR within a bank risk assessment template for ongoing monitoring and adjustments to liquidity strategies.

Blueprint for a Powerful Bank Risk Assessment Template

A strong bank risk assessment template isn't just about checking boxes for regulators; it's the foundation of a resilient and thriving financial institution. This blueprint explores the key elements of an effective template, balancing regulatory compliance with practical use. Real-world examples show how institutions achieve this balance, building templates that satisfy regulators and drive effective risk management.

Structuring Risk Identification and Control Evaluation

Effective risk identification starts with a risk identification matrix. This matrix maps potential risks against different business units, processes, and external factors. It provides a complete view of the institution's vulnerabilities. For example, a bank could map the risk of a data breach against its online banking platform, considering factors like weak passwords or inadequate firewall protection.

A robust control evaluation framework is also crucial. This framework assesses how well existing controls—both preventative and detective—mitigate identified risks. This involves evaluating the strength of current security measures and finding any gaps that need attention. Imagine a bank assessing its anti-money laundering controls. The framework would evaluate the effectiveness of transaction monitoring systems, customer due diligence processes, and employee training programs.

Integrating Quantitative and Qualitative Factors

Leading banks know a complete risk picture needs both quantitative and qualitative insights. Quantitative metrics, like financial ratios and historical loss data, offer a data-driven view of risk exposure. Qualitative factors—such as management expertise, the regulatory environment, and reputational concerns—add important context and nuance.

For example, a bank's loan portfolio might look statistically sound based on quantitative data. However, a qualitative assessment might uncover underlying risks tied to concentrated lending in a declining industry. This mix of data and expert judgment creates a more comprehensive understanding of the risk landscape.

This approach empowers institutions to make smart decisions based on numbers and the bigger picture. It also ensures potential blind spots are addressed and the risk assessment doesn't rely solely on historical data.

Customization and Proportionality: Right-Sizing Your Template

A common mistake is using a one-size-fits-all risk assessment template. A template designed for a global megabank won't work for a community institution. Customization is essential, ensuring the template fits the institution's actual risk exposure. This means focusing on the specific risks relevant to the bank's size, business model, and customer base. It also means avoiding unnecessary complexity that wastes resources without adding value.

For example, a community bank focused on residential mortgages would prioritize credit risk assessment related to local real estate market conditions. A larger institution with international operations would need a more complex template. This template would incorporate currency fluctuations, geopolitical risks, and cross-border regulatory compliance. Banks increasingly use Monte Carlo simulations to quantify risk probabilities, generating thousands of outcomes using historical market volatility data. For example, a 2025 risk template might model loan defaults by incorporating 20+ years of historical default rates (e.g., 2001–2023 averages of 2.1–5.3% across major markets). Stress-testing templates, as recommended by regulators, often reference specific historical events: the 2008 crisis (global GDP contraction of 0.1%), the COVID-19 pandemic (market drops exceeding 30%), or localized shocks like the 2012 Eurozone crisis. These templates mandate 'failure post-mortems,' analyzing cases like Lehman Brothers (2008 bankruptcy with $639 billion in assets) to identify risk governance gaps. Learn more about bank risk assessment templates here.

By focusing on these key principles, banks can create risk assessment templates that meet regulatory requirements and serve as valuable tools. These tools enable proactive risk management and strategic decision-making, allowing banks to navigate the complex financial landscape with confidence and achieve sustainable growth.

Transforming Risk Assessment With Data Analytics

The difference between a bank risk assessment template that simply checks regulatory boxes and one that truly adds value lies in its integration with data analytics. Forward-thinking institutions are developing templates that don't just collect data; they generate actionable intelligence. This means building templates that incorporate historical trend analysis, predictive modeling, and even emerging AI capabilities. However, it's crucial to accomplish this without overwhelming your team.

Leveraging Historical Data For Predictive Insights

Historical data is foundational for effective data-driven risk assessment. Predictive modeling relies on past defaults, market trends, and operational failures to forecast future risks. Modern banks integrate detailed datasets, including decades of transaction histories, customer behavioral patterns, and real-time market feeds.

Banks leveraging data-driven risk assessment have seen significant improvements. They've reduced operational losses by up to 25% and improved decision accuracy by 15-20%. One key template component emphasizes "scenario analysis," such as stress-testing loan portfolios under recession conditions. This uses historical data, like information from the 2008 financial crisis, to simulate interest rate increases or unemployment surges. Learn more about leveraging historical data in risk assessments.

Regulatory frameworks, like Basel III, further institutionalize the use of historical data. These regulations require banks to maintain capital reserves based on historical risk-weighted asset calculations.

Ensuring Data Quality and Choosing The Right Statistical Approach

Data quality is paramount. A bank risk assessment template must include data validation and cleaning processes to ensure accuracy. This includes addressing potential gaps in historical data, like missing information or inconsistencies.

Choosing the right statistical approaches for different risk types is equally important. For example, Monte Carlo simulations can be helpful for quantifying market risk, while regression analysis might be more appropriate for credit risk assessments.

Regulators Urge Banks to Address Crypto Liquidity Risks

Visualizing Risk Data For Clear Decision-Making

Transforming complex data analyses into actionable insights requires effective visualization. Bank risk assessment templates should incorporate visual dashboards that present key risk indicators clearly and concisely.

These dashboards should be tailored to different stakeholders. This includes everyone from board members who need a high-level overview to front-line managers who require granular information to implement risk controls. This empowers decision-makers at all levels to understand and act on the presented information.

Building A Data-Driven Risk Culture

Integrating data analytics into your bank risk assessment template isn't just about technology; it's about building a data-driven risk culture. This involves training staff to use and interpret data effectively and fostering collaboration between data analysts and risk managers. It also means embedding data-driven insights into decision-making processes across the institution. This cultural shift ensures that data analytics isn't just a technical exercise, but a core component of the bank's risk management strategy. By embracing these strategies, institutions can transform their bank risk assessment templates into powerful tools for proactive risk management and informed decision-making in today's complex financial environment.

Building Resilience Through Strategic Stress Testing

Many institutions view stress testing as just another regulatory requirement. However, leading banks recognize its potential. When effectively integrated into their bank risk assessment template, stress testing becomes a valuable tool for gaining a competitive edge. This section explores how to structure your template for meaningful scenario analysis, going beyond simple compliance.

Practical Approaches to Scenario Analysis

A robust bank risk assessment template should incorporate a variety of stress testing scenarios. This includes historical scenario analysis, examining past crises such as the 2008 financial meltdown or the market disruption caused by the COVID-19 pandemic. Analyzing historical loan performance during these periods can provide valuable insights into current lending practices and risk mitigation strategies.

Hypothetical scenarios are also essential. These explore emerging threats ranging from cyberattacks and data breaches to the impacts of climate change and geopolitical instability. Considering these potential future disruptions allows institutions to proactively adapt and enhance their resilience. Check out our guide on 23 Largest U.S. Banks Pass Fed Stress Test.

Reverse Stress Testing: Identifying Breaking Points

Beyond analyzing predetermined scenarios, reverse stress testing provides a different perspective. It identifies an institution's vulnerabilities by working backward from a hypothetical failure. This involves asking the crucial question: "What conditions would need to occur for our institution to fail?"

This approach helps uncover unexpected weaknesses and prioritize risk mitigation efforts. For example, reverse stress testing might reveal that a specific combination of interest rate shocks and deposit outflows could create a critical threat to liquidity.

Documentation and Governance: Ensuring Transparency and Accountability

A well-designed bank risk assessment template also prioritizes thorough documentation. All assumptions and model parameters used in stress testing should be clearly documented. This transparency is crucial for both internal risk management and meeting regulatory requirements. Documented assumptions allow for validation and peer review, strengthening the credibility of the stress test results.

Strong governance frameworks are also vital. Top-performing institutions ensure that stress test results directly inform strategic decisions. This means establishing clear responsibilities for implementing changes based on the test outcomes. It also means integrating stress testing into the broader risk management cycle. This proactive approach ensures stress test results drive continuous improvement, rather than simply fulfilling compliance obligations.

From Compliance to Competitive Advantage

By embedding these strategic stress testing principles into their bank risk assessment templates, institutions can move beyond mere compliance. They gain a deeper understanding of their vulnerabilities. This enhanced insight leads to better decision-making, proactive risk mitigation, and ultimately, greater resilience in the face of future challenges. This proactive approach can differentiate institutions, strengthening their competitive position and promoting long-term stability.

Tailoring Your Risk Template to Your Institution's DNA

A bank risk assessment template isn't one-size-fits-all. What works for a large, multinational bank might not be suitable for a smaller, community-focused institution. Just as every institution has unique characteristics, its risk assessment process should be tailored to its specific needs. This means customizing your template to accurately reflect your risk profile while maintaining regulatory compliance. Let's explore some practical approaches.

Defining Your Institution's Risk Appetite and Tolerance

Before customizing your template, clearly define your institution's risk appetite and risk tolerance. Risk appetite is the level of risk an institution is willing to accept to achieve its objectives. Risk tolerance is the maximum risk an institution can handle without significant negative consequences. A community bank focused on low-risk residential lending will likely have a lower risk appetite than a larger institution involved in more complex financial activities.

Identifying Key Risk Areas Based on Business Activities

The most important sections of your template depend on your primary business activities. A bank specializing in commercial real estate lending should have a detailed section on market risk related to property values. For example, its template might include stress tests for various interest rate scenarios. A bank heavily involved in international trade finance would emphasize operational risks associated with currency exchange and regulatory compliance in different jurisdictions, perhaps incorporating country-specific risk factors.

Streamlining Without Sacrificing Security

While customization is crucial, streamlining your template is equally important. Overly complex templates can be cumbersome and inefficient. Successful institutions learn to right-size their templates, focusing on relevant areas and eliminating unnecessary complexity. A community bank might streamline sections on market and operational risk if these pose minimal threats, while maintaining a robust section on credit risk, given their focus on lending.

Customization Strategies for Different Bank Types

Different financial institutions require varying levels of template customization.

Community Banks: These institutions should focus on local economic conditions and credit risk related to their specific customer base. Their templates can be relatively straightforward, emphasizing practical risk controls.

Regional Banks: Operating across multiple markets and engaging in more diverse activities than community banks, their templates should incorporate regional economic factors and address a broader range of risks.

Major National/International Institutions: Facing a wider range of complex risks, from market volatility and cybersecurity threats to regulatory changes, their templates need to be sophisticated, incorporating advanced analytics and stress-testing.

Credit Unions: These member-owned institutions often prioritize member lending and have a different risk profile than traditional banks. Their templates should reflect this unique focus and incorporate member-specific factors.

Specialty Lenders: Specializing in niches like auto or student loans, their templates must address the inherent risks in their chosen areas. This might involve adjusting credit scoring models or incorporating industry-specific regulations.

To illustrate these customization strategies further, let's examine the table below:

Template Customization by Bank Type and Size

| Institution Type | Risk Focus Areas | Template Complexity | Review Frequency | Key Considerations |

|---|---|---|---|---|

| Community Banks | Credit Risk, Local Economic Conditions | Low | Quarterly | Customer concentration, loan portfolio diversification |

| Regional Banks | Credit Risk, Market Risk, Operational Risk | Medium | Quarterly/Semi-Annually | Regional economic factors, regulatory compliance |

| Major National/International Institutions | Market Risk, Credit Risk, Operational Risk, Cybersecurity, Regulatory Compliance | High | Continuous Monitoring | Global economic factors, geopolitical risks, stress testing |

| Credit Unions | Credit Risk, Member-Specific Risks | Medium | Quarterly | Member concentration, loan portfolio diversification |

| Specialty Lenders | Industry-Specific Risks, Credit Risk | Medium to High | Monthly/Quarterly | Regulatory compliance, specialized credit scoring models |

This table highlights the varying risk focus areas and template complexities for different financial institutions. It also emphasizes the importance of regular reviews and key considerations specific to each institution type.

By aligning your bank risk assessment template with your institution's specific characteristics, you create a powerful tool for effective risk management. This ensures your template is not just a regulatory checklist, but a vital component of your institution's success and stability.

Connecting Your Template to Your Risk Ecosystem

A bank risk assessment template, no matter how well-designed, is ineffective on its own. It needs to fit seamlessly within a broader enterprise risk management (ERM) framework. This section explores how leading institutions integrate their templates, creating a cohesive risk ecosystem.

Integrating Your Assessment Process With Existing Systems

A key challenge is connecting the assessment process with current infrastructure. This includes governance structures, reporting systems, audit protocols, and regulatory filings. The goal is to streamline these connections, avoiding duplicate work and ensuring data consistency.

For example, assessment findings should automatically flow into reports for the board and regulators. This minimizes manual data entry and the risk of errors. You might be interested in: FDIC Proposes Expanded Deposit Insurance for Businesses. This integration ensures risk assessments directly inform decision-making at every level.

Leveraging Technology for Automation and Efficiency

Leading banks use technology to automate data flows between risk systems. This reduces manual effort and human error, while maintaining the integrity of the assessment process.

Imagine a system where data from loan applications automatically populates the credit risk assessment section of the template. This not only saves time but also minimizes inaccuracies. This automation allows risk professionals to focus on analysis and strategy, not administrative tasks.

Version Control, Access Controls, and Validation

Maintaining the credibility of your bank risk assessment template requires robust controls. Version control tracks changes and ensures everyone uses the latest version. This is crucial in collaborative environments.

Access controls protect sensitive information by restricting access based on roles. Only authorized personnel should view or modify specific template sections. Validation processes ensure data accuracy and reliability. This might involve automated checks for data consistency, as well as independent reviews. These processes reinforce the assessment's credibility across the organization.

Building a Cohesive Risk Culture

Connecting your template to your risk ecosystem isn't just about technology and processes; it’s about fostering a cohesive risk culture. This means everyone, from senior management to front-line staff, understands the importance of risk assessment.

It also means promoting open communication and collaboration between departments involved in risk management. This shared understanding ensures the risk assessment template isn't just a document but a living tool driving continuous improvement.

By focusing on integration, automation, and control, institutions maximize the effectiveness of their templates. This transforms the template into a powerful driver of improved risk management and informed decision-making. It creates a dynamic system where risk assessment is an ongoing process, adapting to the changing risk landscape. This proactive approach is vital for navigating the complexities of the modern financial environment.

From Template to Transformation: Implementing Your Strategy

A well-designed bank risk assessment template is only as good as its implementation. The difference between a template gathering dust on a shelf and one that truly transforms risk management often boils down to execution. This section draws on the experiences of successful institutions to provide a practical roadmap for putting your template to work.

Building Staff Capabilities and Fostering a Risk-Aware Culture

Effective implementation begins with your team. Invest in targeted training to build staff proficiency with the new template. This training should cover not only the technical how-to but also the underlying principles of risk assessment.

For example, workshops on identifying and analyzing different risk categories, coupled with practical exercises using realistic scenarios, can empower staff to contribute meaningfully. This also cultivates a risk-aware culture across the organization.

Establishing Meaningful Review Cycles and Driving Continuous Improvement

Implementation is not a one-time project; it's an ongoing process. Establish regular review cycles to ensure the template stays relevant and effective. These reviews should involve key stakeholders from various departments and focus on identifying areas for improvement.

Front-line staff feedback can highlight practical implementation challenges, while senior management input ensures alignment with strategic objectives. This feedback loop drives continuous improvement, adapting the template to evolving risks.

Defining Clear Escalation Paths and Ensuring Timely Action

Identifying risks early is critical, but equally important are clear escalation paths to ensure prompt attention. The template should define clear procedures for escalating critical risks to the appropriate management level.

This could involve automated alerts for high-risk findings or regular reports to senior management and the board. This ensures swift action, preventing potentially significant issues from being overlooked.

Engaging Stakeholders at All Levels

Successful implementation requires buy-in from everyone. Secure executive buy-in by emphasizing the template's strategic value in improving decision-making and protecting long-term stability. Simultaneously, ensure front-line understanding by clearly explaining how the template impacts daily operations and individual roles.

Open communication and transparency are key to creating a shared understanding of risk assessment's importance, fostering a collaborative environment.

Implementation Timelines and Pitfalls to Avoid

Real-world implementation demands realistic timelines. Account for factors like staff training, data collection, and system integration. Avoid pitfalls like launching the template without adequate preparation or failing to provide ongoing support and training.

Institutions that rush implementation or neglect the necessary groundwork often encounter staff resistance and risk collecting inaccurate or incomplete data.

Measuring Success and Demonstrating Value

Finally, establish clear success metrics beyond regulatory compliance. These could include improved risk identification rates, reduced operational losses, or enhanced decision-making processes.

Tracking these metrics showcases the template's tangible value, reinforcing the importance of risk assessment and securing ongoing support. Following these practical steps transforms a static document into a dynamic tool for sustainable growth and long-term stability.

Ready to transform your bank's risk management with actionable intelligence? Discover how Visbanking's Bank Intelligence and Action System (BIAS) can empower your institution to navigate the complex financial landscape and achieve sustainable growth.