Bank Liquidity Management: Optimize Your Financial Stability

Brian's Banking Blog

Mastering Bank Liquidity Management Fundamentals

Effective bank liquidity management is the cornerstone of a stable and profitable financial institution. It's all about finding the right balance between having enough cash on hand (liquidity) and making smart investments to generate returns.

This careful balancing act is crucial. It's what allows banks to handle day-to-day operations, weather unexpected market storms, and meet regulatory requirements. For a broader perspective on business strategy, check out this bank liquidity management blog classic. It offers a good foundation for understanding wider financial concepts.

Understanding the Dual Nature of Liquidity

Successfully managing a bank's liquidity hinges on understanding two key concepts: funding liquidity and market liquidity.

Funding liquidity is a bank's ability to meet its financial obligations using available cash and credit. This means having access to money when it's needed, whether from deposits, borrowing, or selling assets.

Market liquidity, on the other hand, is how easily a bank can buy or sell assets without significantly affecting their price. This ensures they can quickly convert assets to cash if necessary. Both types of liquidity are essential for a bank's overall stability.

The Evolution of Liquidity Management

Bank liquidity risk management has come a long way, particularly after recent global economic challenges. Banks are increasingly turning to advanced tools like AI analytics, real-time monitoring, and integrated treasury solutions.

These tools help banks assess their liquidity buffers more effectively. Traditional metrics, such as liquidity ratios, are now combined with predictive analytics and scenario-based testing. This allows banks to better navigate the ever-shifting market landscape.

This proactive approach is more important now than ever. Market conditions can change rapidly, and regulators are demanding more sophisticated stress testing and detailed reporting. For a deeper dive into the statistics, see this resource. By embracing these tools, banks are working to maintain stability, both for themselves and the wider financial system.

Key Metrics for Monitoring Liquidity

Effective liquidity management requires close monitoring and analysis of key performance indicators (KPIs). Several crucial metrics offer valuable insights into a bank's liquidity position.

One important metric is the Liquidity Coverage Ratio (LCR). This measures a bank's ability to meet its short-term obligations during a stressful financial period, such as a market crash. Another key metric is the Net Stable Funding Ratio (NSFR). The NSFR focuses on the availability of stable funding sources over a longer time frame.

To provide a comprehensive overview, let's look at a table summarizing some essential liquidity metrics.

Key Liquidity Metrics for Banks This table outlines the primary ratios and metrics banks use to assess and manage their liquidity position.

| Metric | Definition | Target Range | Regulatory Importance |

|---|---|---|---|

| Liquidity Coverage Ratio (LCR) | Measures a bank's ability to cover short-term obligations during a stress scenario. | > 100% | High |

| Net Stable Funding Ratio (NSFR) | Assesses the availability of stable funding over a longer time horizon. | > 100% | High |

| Loan-to-Deposit Ratio | The proportion of loans outstanding to customer deposits. | Varies depending on bank strategy and market conditions (Generally 80%-120%) | Moderate |

| Cash Ratio | The ratio of a bank's cash and cash equivalents to its total assets. | Varies depending on bank size and business model (Typically 1%-5%) | Moderate |

These metrics, along with others like the loan-to-deposit ratio and the cash ratio, paint a complete picture of a bank's liquidity profile. By understanding these metrics, banks can make more informed decisions. Successfully analyzing these metrics means understanding their individual importance as well as how they relate to each other. This comprehensive approach allows institutions to adapt to the constantly changing financial landscape.

Central Banks: The Hidden Force in Liquidity Management

Beyond a bank's internal treasury operations, central banks play a crucial role in shaping the overall liquidity landscape. Their policies directly influence how banks manage their liquidity daily. This impact is evident through various tools and mechanisms affecting fund management.

How Central Bank Policies Impact Bank Liquidity

Central banks use several tools to manage liquidity within the financial system. One key tool is the discount window, allowing banks to borrow directly from the central bank. Reserve adjustments, influencing the amount of funds banks must hold in reserve, are another important mechanism.

Additionally, central banks may offer emergency facilities during market stress to provide further liquidity support. Successful banks proactively position themselves to benefit from these tools, ensuring access to liquidity when needed.

The European Central Bank (ECB): A Case Study

The European Central Bank (ECB) significantly influences European banks' liquidity risk management. As part of its quantitative tightening program, the ECB maintains ample central bank reserves. It deploys these reserves through standard bank refinancing operations.

- Main Refinancing Operations (MRO): One-week refinancing facility

- Long-Term Refinancing Operations (LTRO): Three-month refinancing facility

- Marginal Lending Facility (MLF): Overnight funding

The ECB adopted full allotment procedures for these facilities. This ensures banks can borrow as much as needed against adequate collateral without specific limits. Furthermore, the ECB adjusted the pricing of MROs and LTROs. The spread was reduced to 15 basis points above the deposit facility rate from September 18, 2024. This incentivizes their use and helps banks meet short-term financial obligations more effectively. For further details, see this analysis from S&P Global.

Interpreting Central Bank Signals

Understanding central bank signals is vital for adapting a bank's liquidity stance. This means interpreting announcements, policy changes, and even subtle communication shifts. Banks that accurately interpret these signals can adjust their strategies, anticipating market condition changes.

This proactive approach helps them stay ahead of potential liquidity challenges. However, it requires continuous monitoring and analysis of central bank communications.

The Evolving Relationship During Market Stress

During market stress, the relationship between central banks and commercial institutions changes significantly. Central banks often become the primary liquidity source, providing support through various mechanisms. Banks with strong central bank relationships are better positioned to navigate these challenging times. This highlights the importance of ongoing communication and cooperation. Effective bank liquidity management hinges on understanding these dynamics and adapting to changing conditions. Adaptability and proactive planning are key to maintaining resilience, regardless of market fluctuations.

Navigating the Regulatory Maze of Liquidity Requirements

The financial world has changed significantly since the 2008 crisis, especially regarding how banks manage liquidity. This shift is largely thanks to Basel III, a global framework designed to make banks more resilient. This section clarifies these new rules and explores how banks can comply without sacrificing efficiency and profits.

Understanding the Core of Basel III: LCR and NSFR

Basel III introduces two crucial requirements: the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR). The LCR ensures banks have enough high-quality liquid assets to handle potential short-term outflows during a 30-day stress test. This helps them weather sudden market shocks.

The NSFR takes a longer view, assessing stable funding sources over a one-year horizon. This emphasizes sustainable funding for long-term stability. You might be interested in this article: How regulatory staff shortages played a role in bank failures. These ratios require banks to hold sufficient liquid assets and secure dependable funding, reducing the risk of liquidity problems during market turmoil.

Implementing LCR and NSFR: Strategies for Success

Implementing LCR and NSFR successfully goes beyond just hitting the required numbers. It requires changes to governance, reporting systems, and internal policies. Many banks found it helpful to integrate these requirements into their overall risk management.

- Strengthened Governance: Clearly defined roles and responsibilities for liquidity management are essential.

- Enhanced Reporting: Banks need real-time monitoring of their liquidity metrics.

- Proactive Policies: Developing stress testing scenarios and contingency plans is vital.

These changes are significant but can lead to better risk management and greater operational efficiency.

Global Variations in Liquidity Requirements

While Basel III sets a global standard, implementation varies by country. This creates challenges for international banks, who must navigate different interpretations and local rules.

For instance, some countries may have stricter LCR or NSFR requirements. Reporting deadlines and required data may also differ. Therefore, adapting liquidity management to local regulations in each market is crucial.

Turning Compliance into a Competitive Advantage

Instead of viewing regulatory compliance as a burden, some institutions see it as an opportunity. By proactively adapting, banks can demonstrate their financial strength and build trust with customers and investors.

This builds a stronger market position. This proactive approach creates a positive feedback loop: compliance enhances stability, which fosters growth and profitability.

Cutting-Edge Methods for Liquidity Risk Assessment

Traditional methods for assessing liquidity risk still have their place, but they are now being enhanced by advanced techniques. These newer methods offer a more detailed and responsive understanding of a bank's liquidity. This allows institutions to better anticipate and address potential shortfalls. This proactive strategy is key to maintaining stability in today's fluctuating financial markets.

The Rise of AI and Machine Learning in Liquidity Management

Artificial intelligence (AI) and machine learning are changing how banks manage liquidity. They provide more accurate predictions and valuable insights. These technologies analyze large amounts of data to spot patterns and irregularities that traditional methods might miss. For instance, AI algorithms can identify early warning signs of a potential liquidity crisis, allowing banks to take action.

Predictive Analytics and Scenario Analysis

Predictive analytics and scenario analysis are essential for evaluating a bank's resilience in different market situations. These techniques utilize statistical models and simulations to project future liquidity needs and the potential effects of disruptions. This allows banks to develop contingency plans and fine-tune their reserves, which is especially important during uncertain economic times.

Integrating Liquidity Risk Assessment with Other Risk Domains

A complete approach to risk management requires connecting liquidity risk assessment with other risk areas, such as credit risk and market risk. This integration provides a broader perspective of a bank's overall risk profile, leading to better decisions and resource allocation. It acknowledges the interconnected nature of risks and how one event can cause a chain reaction.

Early Warning Systems for Proactive Liquidity Management

Banks focused on the future are adopting early warning systems. These systems monitor important metrics and market indicators in real-time, triggering alerts when certain limits are exceeded. A sudden increase in withdrawals or a sharp drop in asset values could activate an alert, prompting the bank to take action. You might be interested in: How to master bank liquidity management.

Visualizing the Impact of Advanced Techniques

The following data chart illustrates how integrating AI and machine learning improves liquidity risk detection. It compares the accuracy of traditional methods versus advanced methods in predicting liquidity events.

Traditional methods correctly predicted 60% of events, while advanced methods achieved an 85% accuracy rate. This 25% improvement highlights the benefits of advanced techniques.

To further illustrate the differences between traditional and advanced approaches, let's look at a comparison table. This table summarizes the key aspects of each approach and highlights their respective benefits.

Comparison of Liquidity Risk Assessment Methodologies

| Assessment Aspect | Traditional Approach | Advanced Approach | Key Benefits |

|---|---|---|---|

| Data Sources | Primarily internal data, limited market data | Internal and external data, including market signals and news sentiment | More comprehensive view of liquidity risk drivers |

| Modeling Techniques | Basic statistical models, static ratios | AI, machine learning, dynamic simulations | Enhanced predictive accuracy and early warning signals |

| Time Horizon | Short-term focus | Short-term and long-term forecasting | Better preparedness for future liquidity events |

| Scenario Analysis | Limited scenarios, often based on historical data | Wide range of scenarios, stress testing | Improved resilience to unexpected market conditions |

This table clearly shows how advanced approaches provide a more comprehensive and proactive way to manage liquidity risk, leading to better decision-making and improved financial stability. By incorporating AI and machine learning, banks can gain deeper insights and enhance their predictive capabilities. This shift allows for more effective risk management and strengthens financial stability.

Adapting Your Liquidity Strategy to Market Realities

Market conditions can change rapidly. This requires banks to adapt their liquidity strategies to maintain stability. It's a delicate balance between readily available liquid assets and the potential for higher returns from investments. Fluctuating economic cycles and interest rate changes add further complexity, demanding a dynamic approach to bank liquidity management.

Optimizing the Balance Between Liquidity and Yield

Maintaining adequate liquidity often means holding assets with lower returns. This poses a challenge for banks seeking to maximize profits. The key is to establish a framework for assessing the opportunity cost of holding liquid assets against the potential risks of insufficient liquidity.

For example, during stable economic periods, a bank might be tempted to invest heavily in higher-yielding, less liquid assets. However, this strategy can create vulnerability during market downturns. A more prudent approach involves establishing a liquidity buffer aligned with the bank's risk tolerance and anticipated market volatility.

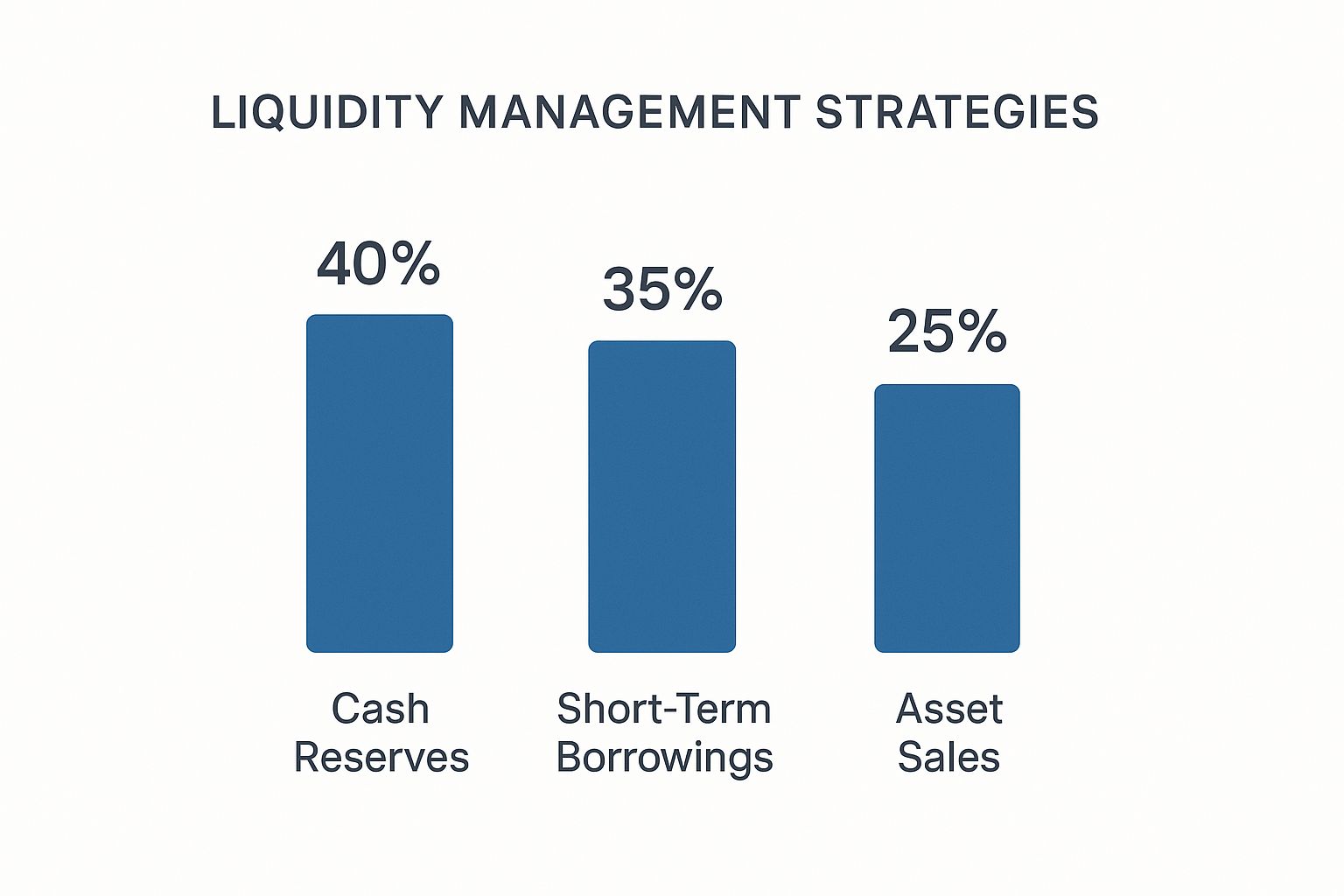

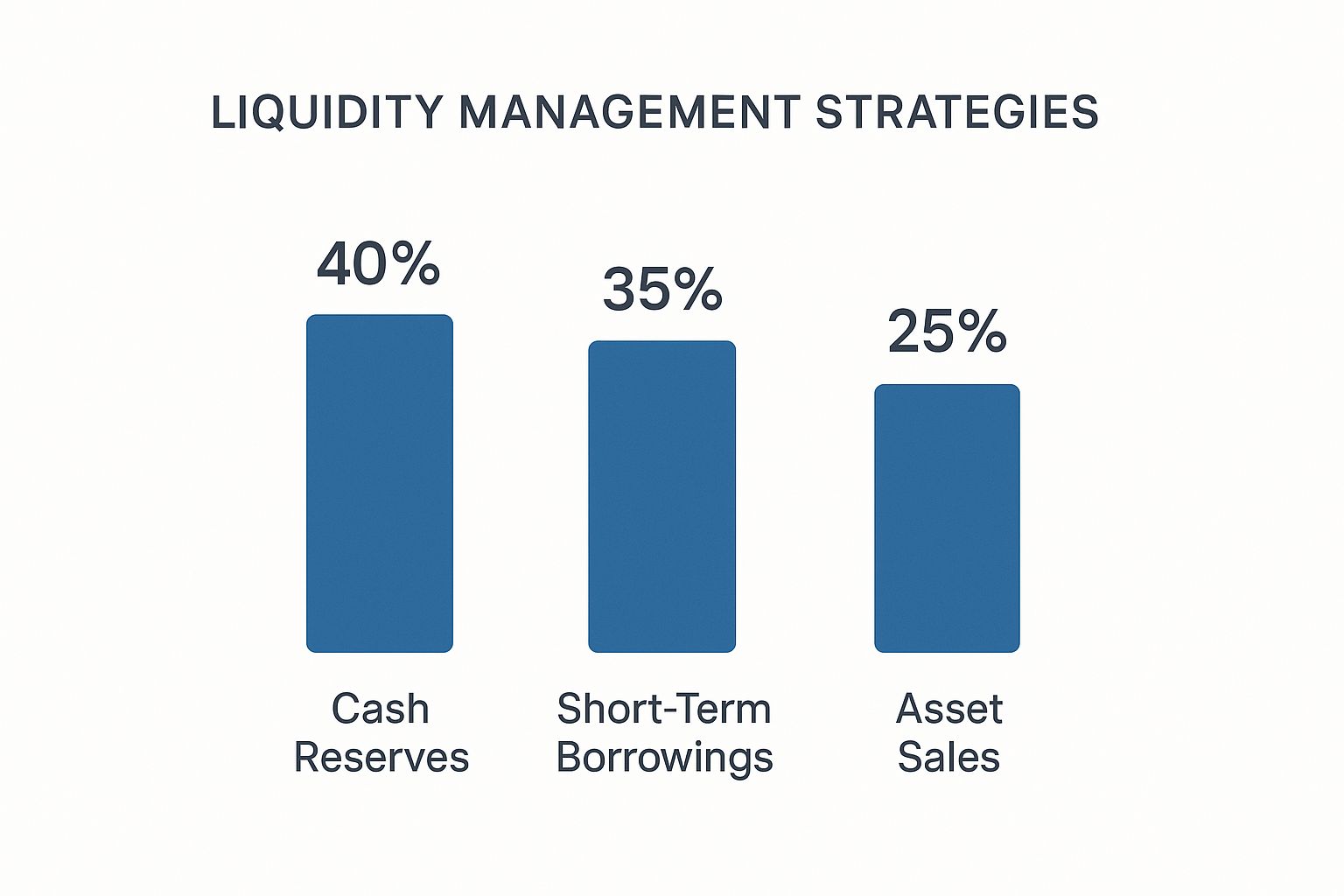

Diversifying Funding Sources for Greater Resilience

Relying on a single funding source, such as customer deposits, can create vulnerabilities. Diversifying funding sources enhances a bank's resilience. This might involve accessing the interbank lending market, issuing debt securities, or utilizing other funding channels.

Distributing funding across multiple sources reduces dependence on any single channel. This enhances stability, especially during times of market stress when certain funding sources might be disrupted.

Leveraging Market Intelligence to Anticipate Shifts

Leading banks proactively monitor market conditions and economic indicators. This allows them to anticipate potential liquidity shifts. They leverage market intelligence tools and expert analysis to identify emerging trends and risks.

Changes in central bank policies, economic growth forecasts, or market sentiment can all signal potential liquidity pressures. By proactively identifying these signals, banks can adjust their liquidity strategies in advance, minimizing the impact of market disruptions. The 2025 global banking outlook projects stability in funding and liquidity. However, potential rate cuts by central banks could influence these dynamics. Learn more about the global liquidity and the EMEA investment outlook for 2025.

Learning From Real-World Examples

Examining how banks maintained liquidity during past market disruptions offers valuable lessons. For instance, during the 2008 financial crisis, some institutions fared better due to stronger liquidity management practices. These institutions typically had more diversified funding sources, larger liquidity buffers, and more robust contingency plans.

Analyzing these real-world examples reveals the decision-making processes that allowed these institutions to adapt quickly while staying strategically aligned. These insights provide a practical guide for developing effective bank liquidity management strategies. By studying past successes and failures, banks can refine their approaches and enhance their preparedness for future market challenges.

Best Practices That Elevate Bank Liquidity Management

What separates truly exceptional bank liquidity management from the merely adequate? This section distills actionable strategies from leading financial institutions and regulatory recommendations. We'll explore how top banks structure their governance, establish effective policies, and define appropriate limits to drive better decision-making. These elements combine to form a cohesive approach to managing available funds.

Building a Robust Governance Framework

Strong governance is the foundation of successful liquidity management. It provides the structure for clear roles, responsibilities, and accountability. High-performing banks establish dedicated committees focused on liquidity risk oversight, reporting directly to the board. This ensures liquidity concerns are addressed at the highest level, facilitating rapid decision-making, especially during market volatility.

- Clearly Defined Roles: Each individual involved in liquidity management must understand their specific responsibilities to avoid confusion and overlap.

- Board-Level Oversight: The board of directors plays a critical role in setting the overall liquidity strategy and monitoring its execution.

- Regular Reporting and Transparency: Frequent reporting on key liquidity metrics keeps the board informed and ensures transparency.

Developing Effective Liquidity Policies

Robust policies offer detailed guidance on all aspects of liquidity management. These policies outline procedures for measuring, monitoring, and managing liquidity risk. They also specify escalation procedures for handling potential shortages. Clearly defined policies ensure a consistent approach across the institution, minimizing inconsistencies and errors.

- Stress Testing: Regular stress tests help assess the bank's resilience against adverse market conditions.

- Contingency Planning: Contingency plans detail the steps to be taken in a liquidity crisis.

- Internal Limits: Internal limits on activities like lending or investing help manage and mitigate liquidity risk.

Establishing Meaningful Limits and Controls

Well-defined limits and controls prevent excessive risk and maintain stability. Limits might be placed on borrowing, lending, or investing in certain asset classes. This controls risk exposure while still allowing for strategic growth, acting as safeguards for prudent financial management.

- Concentration Limits: Limiting exposure to a single counterparty or industry reduces the impact of a potential default.

- Funding Limits: Setting limits on reliance on specific funding sources promotes diversification and reduces vulnerabilities.

- Maturity Mismatch Limits: Controlling the gap between asset and liability maturities helps avoid potential shortfalls.

Creating a Proactive Monitoring System

Effective monitoring provides early warnings of potential liquidity problems, enabling timely corrective action. Leading banks use sophisticated systems to track key metrics, market indicators, and even news sentiment. Real-time monitoring allows for quick responses to changing market conditions. Read also: How the FDIC proposes expanded deposit insurance for businesses.

- Real-Time Monitoring: Dashboards and reporting tools provide an up-to-the-minute view of the bank's liquidity position.

- Automated Alerts: Automated alerts trigger notifications when key metrics deviate from pre-set thresholds.

- Scenario Analysis: Regular scenario analysis allows banks to anticipate potential liquidity challenges and develop appropriate responses.

Integrating Liquidity into Business Planning

Successful banks incorporate liquidity considerations into every aspect of their operations. This ensures a cohesive approach to liquidity management. Integrating these considerations into product development, pricing, and strategic planning builds a framework for sustainable growth, promoting proactive strategies over reactive crisis management.

By adopting these best practices, banks can build a robust liquidity management framework that strengthens resilience and supports their strategic goals. This proactive approach allows institutions to navigate challenging market conditions and maintain stability while pursuing growth.

Take control of your bank's liquidity with Visbanking. Visit https://www.visbanking.com to learn more.