Boost Your Success with a Powerful Bank Digital Strategy

Brian's Banking Blog

The Digital Banking Revolution: Where We Stand Now

Consumer expectations are changing the banking industry. People want the same ease and access they have in other areas of their digital lives reflected in their banking experience. This desire for convenient, personalized, and always-available banking services is pushing traditional banking aside. Institutions must adapt and develop effective bank digital strategies.

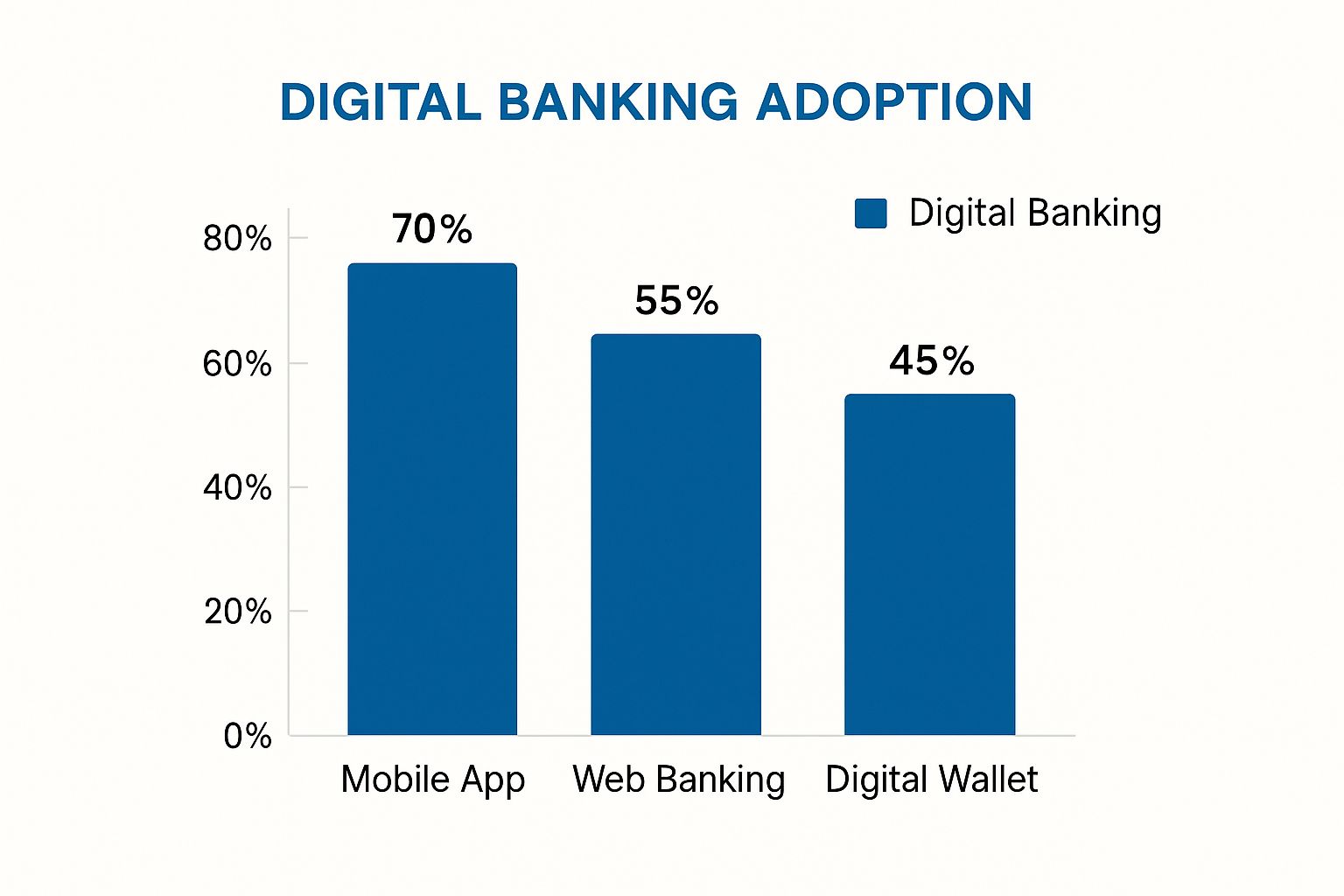

The Rise of Digital Banking Adoption

Mobile banking apps are a prime example of this shift. They're no longer a secondary tool but often the primary way people interact with their banks. The rise of Fintech companies, offering specialized digital financial products and services, adds to the pressure. This competition drives innovation and adoption of new technology.

Regional Differences in Digital Banking Penetration

Digital banking adoption isn't uniform globally. Some regions are embracing it rapidly, while others lag. This creates a complex and dynamic market. Let’s explore digital banking penetration across key global markets. The following data chart compares digital banking penetration, mobile banking usage, and growth trends across different regions.

North America (United States and Canada): Digital banking penetration is 70-75%, with mobile banking usage around 60%. Growth is steady, focusing on improving existing digital offerings and integrating new technologies like AI.

Western Europe: Digital banking penetration is around 65-70%, slightly behind North America, with mobile banking usage at 55%. Regulatory changes and consumer demand for digital-first solutions are driving growth.

Asia (China, Japan, South Korea): This region is varied. China’s digital banking penetration exceeds 80%, thanks to widespread mobile payment adoption. Japan and South Korea are catching up, with rates in the 60-70% range. Fast technological advancements and a tech-savvy population fuel growth.

Latin America: Showing strong growth potential, digital banking penetration is 50-60%. Mobile banking usage, a key driver, surpasses 45% in many countries. Growth is predicted to accelerate with increased internet access and fintech adoption.

This chart demonstrates that regions with higher smartphone penetration and better digital infrastructure usually have higher digital banking adoption. This emphasizes the importance of infrastructure in driving digital banking growth. The global digital banking market, valued at $10.9 trillion in 2023, is projected to grow at a CAGR of over 3% through 2032. Find more detailed statistics here.

To further analyze regional differences, let's look at the following table:

"Digital Banking Adoption Rates by Region" A comparison of digital banking penetration across different global markets, highlighting regional differences and growth patterns

| Region | Digital Banking Penetration | Mobile Banking Usage | Growth Trend |

|---|---|---|---|

| North America | 70-75% | ~60% | Steady, focus on enhancing offerings |

| Western Europe | 65-70% | ~55% | Driven by regulation and consumer demand |

| Asia | 60-80+% (varies significantly) | High, especially in China | Rapid growth, fueled by technology |

| Latin America | 50-60% | 45%+ | Accelerating growth, driven by mobile |

The table highlights the variations in digital banking adoption across different regions. While North America and Western Europe show mature markets with high penetration, Asia demonstrates rapid growth with varying levels depending on the specific country. Latin America represents a market with increasing potential.

The Future of Bank Digital Strategies

A robust digital banking strategy is now crucial. Banks must embrace digital transformation to stay competitive and meet evolving customer needs. The future of banking is digital, and those who fail to adapt will be left behind.

The Blueprint: Essential Elements of Your Digital Strategy

Creating a successful digital strategy for a bank requires a detailed plan. This plan needs to consider key factors essential for navigating the changing financial world. It means more than just making existing services digital; it requires a complete change in how banks work. This includes how they interact with customers and use technology.

Defining Your Digital Vision

A strong digital strategy starts with a clear vision. This vision should describe the bank's long-term goals for digital change. It should explain how these goals fit with the overall business objectives. The vision should address current needs and anticipate future trends and challenges.

For instance, a bank might aim to be the best provider of personalized mobile banking in its area. This vision guides all future digital projects.

Key Components of a Winning Bank Digital Strategy

Several key components contribute to a successful digital banking strategy. These components work together to create a unified and adaptable approach.

Customer-Centricity: Making the customer the focus is crucial. This means understanding what customers need and want, designing easy-to-use interfaces, and providing tailored experiences.

Data-Driven Decisions: Data analytics are essential. Analyzing data helps understand customer behavior, find opportunities, and measure how well digital initiatives are working.

Agile Technology Adoption: Quickly adopting new technologies is key. This means using cloud computing, APIs, and other modern tech for flexibility and scalability.

Robust Security: Security is vital. Banks must prioritize protecting customer data and finances with strong security protocols and fraud prevention.

Talent and Culture: A skilled team and a culture that supports innovation are essential for successful digital transformation.

To help illustrate the core aspects of building a winning digital strategy, let's examine the following table:

Key Components of Bank Digital Strategy

| Strategy Component | Implementation Priority | Business Impact | Typical Challenges |

|---|---|---|---|

| Customer Experience Enhancement | High | Increased customer satisfaction and loyalty | Integrating data across systems, personalizing at scale |

| Operational Efficiency Improvement | High | Reduced costs and improved productivity | Legacy system integration, change management |

| New Product and Service Development | Medium | New revenue streams and market expansion | Time to market, regulatory compliance |

| Risk Management and Security | High | Protection of customer data and financial assets | Evolving cyber threats, regulatory requirements |

This table shows the key components banks need to consider, how important they are to implement, the positive effects they have on the business, and the typical difficulties faced when putting them into practice. Successfully addressing these challenges is critical to realizing the full potential of each component.

A Framework for Implementation

Turning strategy into reality requires a structured approach. Here's a framework for putting a digital strategy into action.

Prioritize Initiatives: Focus on projects that align with the bank's vision and offer the highest return on investment. This ensures resources are used wisely.

Establish Key Performance Indicators (KPIs): Use measurable KPIs to track progress and assess the success of digital initiatives. Regularly review these KPIs to make improvements.

Foster Collaboration: Encourage communication and collaboration between different departments to stay aligned and avoid working in isolation. This creates shared responsibility.

You might be interested in this article about data's impact on credit unions: How Visbanking's data revolution transforms credit unions. A clear digital strategy gives banks a guide to navigate the changing financial world. It helps them adapt, innovate, and succeed. By focusing on customer needs, using data effectively, and adopting new technology, banks can gain a competitive edge and achieve long-term success.

Customer-First Banking: Beyond the Digital Interface

A successful bank digital strategy depends on being truly relevant to the customer. Technology by itself isn't enough; it needs to serve the customer in meaningful ways. This requires looking at the entire customer relationship through the lens of digital channels. It means understanding not only what services customers use, but how they use them and what they find valuable.

Journey Mapping for Meaningful Insights

Forward-thinking banks are using journey mapping to better understand how their customers interact with them. This goes beyond simply charting the steps a customer takes. It's about understanding the emotions, pain points, and motivations behind each interaction.

For example, a customer applying for a loan might be anxious. A well-designed digital experience can lessen this anxiety by providing clear information and progress updates. Effective journey mapping reveals these important emotional touchpoints.

This understanding allows banks to design digital experiences that are not just efficient, but also empathetic and helpful. These insights create a more human-centered bank digital strategy.

Personalization That Engages, Not Alienates

Personalization is key to a customer-centric bank digital strategy. But there’s a balance between helpful personalization and feeling intrusive. Successful banks use behavioral data to anticipate customer needs without crossing that line.

This might mean proactively offering relevant financial advice based on spending patterns. It could also include streamlining common tasks based on past behavior. The key is transparency and control.

Customers should understand what data is being used and be able to manage their privacy preferences. This builds trust and ensures personalization enhances, rather than diminishes, the customer experience.

Experience Design Principles for Financial Services

User experience in financial services requires a specific approach. Security is crucial, but it shouldn't compromise convenience. Leading institutions are finding ways to balance these priorities.

They’re implementing strong security measures behind the scenes while keeping a user-friendly interface. This allows customers to manage their finances easily and confidently.

For example, biometric authentication can provide robust security without complicated passwords. This seamless combination of security and convenience is essential for a successful bank digital strategy.

Building Trust and Loyalty Through Digital Channels

Every digital interaction is a chance to build a stronger customer relationship. Banks are moving beyond transactional interactions and focusing on relationships. This might involve offering personalized financial advice, providing proactive customer support, or even creating a sense of community through digital platforms.

By anticipating customer needs and providing value beyond basic banking services, institutions can turn digital channels into powerful tools. These tools build trust and encourage long-term loyalty. Ultimately, a customer-first bank digital strategy is about more than just technology; it’s about building meaningful relationships.

Technology Investments That Deliver Real ROI

Customer focus is essential for banks. But a strong digital strategy also depends on choosing the right technologies. This means ignoring the hype and focusing on solutions that deliver measurable results. It also requires banks to understand their specific needs and align technology choices with their business goals.

Modernizing Legacy Systems For A Digital Future

Many banks are stuck with outdated systems. These legacy systems can slow down progress and make it hard to adopt new technologies. Modernizing these systems is a crucial step for any successful digital strategy.

This might involve moving to cloud-based solutions or using API integration to connect older systems with newer platforms. However, modernization needs careful planning and execution. Banks must weigh the cost of upgrades against the long-term benefits of improved efficiency and flexibility.

Cloud Migration: Balancing Cost And Capability

Moving to the cloud is a popular choice for banks wanting better scalability and lower infrastructure costs. But it's not a universal solution. Banks must carefully assess their needs and choose the right cloud model.

For example, a hybrid cloud approach might work for institutions wanting to keep some control over sensitive data. A full cloud migration might be better for smaller banks wanting more flexibility and lower initial costs. Careful evaluation ensures the cloud strategy aligns with the overall digital plan.

Data Architecture Enhancement: The Foundation Of Insight

Data is crucial for any modern bank. Improving data architecture is essential for getting valuable insights and making informed decisions. This means creating a robust data infrastructure that can collect, store, and analyze large amounts of data from different sources.

For example, banks can use advanced analytics to spot customer trends, create personalized offers, and detect fraud. A strong data foundation allows for better use of data analytics and AI in future projects, leading to a more informed digital strategy.

API Integration: Connecting The Dots

Application Programming Interfaces (APIs) link different systems together. They let different software applications talk to each other and share data smoothly. API integration is essential for creating a truly flexible and connected digital banking ecosystem.

This integration allows for a more cohesive customer experience. For example, a bank’s mobile app can use APIs to connect with services like payment processors or personal finance management tools. This creates a more streamlined and valuable service for customers. Effective API integration greatly improves the flow and functionality of a bank’s digital strategy.

Build Versus Buy: Making Smart Technology Choices

Deciding whether to build or buy technology is a key strategic decision. Building custom solutions offers more control, but it also requires significant investment and development time. Buying ready-made solutions can be faster and cheaper, but may mean compromising on some features.

Banks must carefully evaluate the trade-offs, considering cost, time-to-market, and in-house expertise. For instance, if specialized software is needed but not available, building a custom solution might be the better choice. A careful build-versus-buy assessment contributes to a more effective digital strategy.

Technology Roadmaps: Balancing Innovation And Stability

Creating a technology roadmap is crucial for any bank's digital strategy. This roadmap outlines planned technology investments, prioritizing projects and ensuring alignment with business goals. It’s essential to balance innovation with operational stability.

Banks should prioritize projects with the biggest impact while minimizing disruption to existing operations. This means avoiding unnecessary risks and focusing on practical solutions that deliver real value. A well-defined roadmap ensures investments align with long-term goals and support a sustainable digital strategy.

Emerging Technologies Worth Your Attention (And Budget)

A successful bank digital strategy requires more than simply digitizing existing services. It demands embracing emerging technologies that can reshape operations, customer experiences, and how banks generate revenue. Choosing the right technologies is key. This means carefully evaluating innovations to determine which deserve a place in your bank's digital roadmap and budget.

Artificial Intelligence (AI) and Machine Learning (ML): Beyond the Hype

AI and ML are transforming banking, from fraud detection to customer service. Artificial Intelligence offers the potential to automate complex processes, personalize customer interactions, and identify new revenue opportunities. AI-powered chatbots can handle routine customer inquiries, freeing human agents to focus on more complex issues.

Machine learning algorithms can analyze vast amounts of data to identify patterns indicative of fraudulent activity. This allows banks to detect and prevent fraud more effectively than with traditional methods. Implementing AI and ML requires careful planning and execution.

Banks must invest in the necessary infrastructure, talent, and data governance frameworks to ensure responsible and effective use. This includes addressing ethical considerations and potential biases in algorithms.

Blockchain: Reimagining Financial Transactions

Blockchain technology, the foundation of cryptocurrencies, holds significant promise for banking. Blockchain has a decentralized and secure nature that can streamline transactions, reduce costs, and enhance transparency. For example, blockchain can facilitate faster and cheaper cross-border payments, eliminating intermediaries and reducing settlement times. This is particularly helpful in our globalized economy.

Blockchain can also improve the efficiency of know-your-customer (KYC) and anti-money laundering (AML) processes by creating a secure, shared record of customer information. However, widespread blockchain adoption in banking faces challenges, including regulatory uncertainty and scalability issues. Banks exploring blockchain should carefully assess the risks and benefits, focusing on practical applications.

Cloud Computing: Driving Agility and Scalability

Cloud computing has become essential for many bank digital strategies. By migrating to the cloud, banks can achieve greater agility, scalability, and cost efficiency. This allows them to adapt quickly to changing market conditions and customer demands. Cloud-based platforms enable banks to easily launch new digital products and services without heavily investing in on-premise infrastructure.

This reduces time-to-market and improves competitiveness. Cloud computing also enhances disaster recovery and business continuity by providing redundant data storage and processing. However, banks migrating to the cloud must prioritize security and data privacy. This involves robust security measures and complying with relevant regulations.

Integrating Innovations into Existing Systems

Integrating new technologies into existing banking systems can be complex. It requires careful planning, testing, and collaboration across departments. Banks should adopt a phased approach, starting with pilot projects to test new technologies before large-scale implementation. This minimizes disruptions to core operations. Learn more in our article about the future of banking technology and its impact on U.S. financial institutions.

Investing in training and development programs is crucial for upskilling the workforce. This ensures employees have the necessary skills to manage and use new technologies effectively. A strategic, phased approach ensures a smooth transition and maximizes the value of emerging technologies within your bank's digital strategy.

Measuring What Matters: KPIs That Drive Action

How do you know if your bank's digital strategy is truly effective? The key is focusing on the right metrics. Forget about vanity metrics like simple website visits or app downloads. Instead, concentrate on Key Performance Indicators (KPIs) that actually reflect meaningful progress toward your strategic goals. This requires a practical framework for measuring the success of your digital transformation.

KPIs That Capture the Essence of Digital Success

Effective KPIs for a bank's digital strategy should encompass several key dimensions:

Customer Engagement: How actively are customers using your digital channels? Look at metrics like active mobile users, digital transaction volume, and customer satisfaction scores. These indicators reveal how well your digital offerings connect with your target audience.

Operational Efficiency: How is digitalization impacting your operational costs? Track metrics like cost per digital transaction, automation rates for key processes, and the reduction in branch visits. These provide concrete evidence of improved efficiency.

Innovation Velocity: How quickly are you developing and deploying new digital features and services? Measure time-to-market for new digital products, the number of successful pilot projects, and the adoption rate of new technologies. This shows your ability to innovate and stay competitive.

Cultural Transformation: How well is your organization embracing a digital-first mindset? Track metrics like employee engagement with digital tools, completion rates for digitally focused training programs, and internal advocacy for digital initiatives. This reveals how deeply digital transformation is embedded in your company culture.

Building Effective Dashboards and Feedback Loops

Once you've identified your key KPIs, you need to track them efficiently. Create dashboards that visualize your progress and highlight areas for improvement. Leading banks establish benchmarks by comparing their performance against industry averages and top competitors.

Regular feedback loops are also crucial. Gather input from customers, employees, and partners. These insights can inform adjustments to your digital strategy, ensuring it remains relevant and effective. Check out this helpful resource: How to master KPIs for banks.

Attribution Modeling and Communicating Digital Success

Connecting digital initiatives to real business outcomes is essential. Practical attribution modeling can help you accurately measure the impact of digital channels on revenue, cost reduction, and customer acquisition. According to the European Central Bank (ECB), many banks struggle to define granular KPIs to track the effectiveness of their digital strategies.

Finally, communicating your digital success to stakeholders is vital. Tailor your message to each audience, highlighting the specific benefits that resonate with them. Ensure everyone, from executives to frontline staff, understands the importance and impact of your digital transformation. This shared understanding builds a culture of support for your ongoing digital initiatives.

From Strategy to Reality: Making Digital Transformation Stick

A strong bank digital strategy needs successful execution. Turning a vision into reality requires a structured approach, strong leadership, and adaptability. This section offers a practical guide for making your digital transformation last, even with leadership changes and market fluctuations.

Governance and Change Management: Steering the Transformation

Effective governance is crucial for guiding a complex digital transformation. This means defining clear roles and responsibilities, scheduling regular progress reviews, and creating a framework for fast, efficient decision-making. Successful banks understand that change management is an ongoing process, not just a project phase. They invest in communication and training so employees understand and embrace the changes. Regular updates and feedback opportunities can create a sense of ownership among staff.

Capability Building and Organizational Alignment: Empowering Your Teams

Digital transformation demands new skills. Successful banks invest in training to upskill their workforce in areas like data analytics, cybersecurity, and agile development. Organizational alignment is equally important. Siloed departments hinder progress. Successful transformations encourage collaboration between teams, ensuring everyone works towards shared goals. This could involve cross-functional teams on digital initiatives, breaking down traditional barriers and fostering a shared vision.

Achieving Quick Wins and Managing Setbacks: Maintaining Momentum

Breaking large initiatives into smaller, manageable phases is key for maintaining momentum. Early quick wins demonstrate progress and build confidence. Planning for inevitable setbacks is equally important. A resilient bank digital strategy acknowledges challenges and builds in mechanisms for adapting and learning from mistakes. A pilot project that doesn't deliver expected results becomes a valuable learning opportunity, not a failure. The European Central Bank (ECB) notes many banks struggle to measure their digital strategies' effectiveness due to a lack of granular KPIs. This highlights the importance of not just defining KPIs, but ensuring they offer actionable insights.

The Human Element: Leadership, Culture, and Sustainable Innovation

Digital transformation isn't just about technology; it's about people. Leaders must show genuine commitment to change through actions, not just words. This means investing in employee development, celebrating successes, and creating a culture that embraces innovation. A culture of sustainable innovation encourages experimentation, learning from successes and failures, and constantly seeking improvement. This also means ensuring the bank digital strategy adapts to changing market conditions and evolving customer needs. Building a robust digital future requires a shift in mindset and a commitment to continuous improvement.

Ready to transform your bank's digital strategy into a growth engine? Discover how Visbanking empowers your institution with data-driven insights and actionable intelligence. Explore the power of Visbanking today.