Unlocking Bank Data Governance a Practical Guide

Brian's Banking Blog

In the intricate world of finance, what exactly is bank data governance? Think of it less as a stuffy technical task and more as the formal choreography for how data moves, is kept safe, and is put to work across your entire institution. It’s a core business function, really—the bedrock that ensures your data is accurate, trustworthy, and compliant with a mountain of regulations.

Without it, you’re flying blind.

Why Bank Data Governance Is No Longer Optional

Let's use an analogy. A bank's data is its real currency in the modern age. Just as a central bank carefully manages a nation's money to guarantee stability and public confidence, a data governance program manages a bank's most critical information.

Operating without this structure is like running on an unregulated currency—it's unreliable, deeply vulnerable, and a massive liability just waiting to happen. An effective governance program sets the rules of the road, clarifying who does what to maintain the integrity of this "data currency." It's what keeps you clear of crippling fines, builds unshakable trust with your customers, and simply helps you run a tighter ship.

Once considered a "nice-to-have," it's now a fundamental requirement for survival and success.

The High Stakes of Ungoverned Data

When data runs wild without any formal governance, chaos isn't far behind. One department calls a metric one thing, another calls it something else entirely. The result? Flawed reports and strategic decisions built on a shaky foundation.

Customer information gets duplicated, becomes outdated, or sits incomplete, which tanks service quality and throws the doors wide open for security breaches.

The consequences are both severe and varied:

- Hefty Fines: Falling out of line with regulations like BCBS 239 or GDPR can lead to fines that stretch into the millions.

- Shattered Reputations: A single data breach can destroy public trust. Rebuilding it is a long, painful, and expensive process.

- Wasted Time: Teams burn countless hours just trying to clean up and validate data instead of using it to find real insights. Innovation grinds to a halt.

- Worthless Analytics: Your AI models and business intelligence tools are only as smart as the data you feed them. Garbage in, garbage out.

Shifting from a Cost Center to a Value Driver

For a long time, data governance was seen as a purely defensive move—a cost you had to swallow to stay compliant. But the smartest institutions are flipping that script. They now see it as a powerful engine for real growth.

A well-run data governance program turns data from a potential landmine into your most strategic asset. It provides the clean, reliable fuel for everything from hyper-personalized marketing to sophisticated risk modeling.

This shift in thinking is playing out in the market. The global data governance market, valued at around $4.35 billion, is expected to explode to $12.38 billion by 2029. Banks, in particular, are investing heavily to get their data house in order. You can find out more about these market projections and what drives them.

This isn't just about dodging penalties. It's about unlocking opportunity.

To get there, it’s crucial to understand the foundational elements that make up a strong governance framework.

Core Pillars of Bank Data Governance

A solid data governance strategy is built on several key components working together. Each pillar has a distinct role, but they are all interconnected, ensuring data is managed effectively from creation to retirement.

Here’s a breakdown of the core pillars and their primary objectives:

| Pillar | Objective |

|---|---|

| Data Quality Management | To ensure data is accurate, complete, consistent, and fit for its intended purpose. |

| Data Stewardship | To assign clear ownership and accountability for specific data assets across the bank. |

| Metadata Management | To define and manage data about the data (e.g., definitions, lineage, business context). |

| Data Security & Privacy | To protect data from unauthorized access, breaches, and misuse, while ensuring compliance. |

| Master & Reference Data | To create a single, authoritative source of truth for critical business entities (e.g., customers, products). |

| Policy & Standards | To establish the official rules, procedures, and standards for how data should be handled. |

By building out these pillars, banks establish the clear ownership, quality standards, and security protocols needed to empower their teams. This confidence is the bedrock of modern banking, allowing institutions to innovate faster, serve customers better, and navigate a rocky economic environment with far greater precision.

The Building Blocks of a Strong Data Framework

Alright, we’ve covered why data governance is critical. Now let's get into the what. Think of building a fortress for your bank's data. It’s not just one big, thick wall. It’s a sophisticated system where every single piece has a job to do, and they all have to work together perfectly.

If you skimp on one part, the whole structure becomes vulnerable. So, let’s break down the essential components that make up a truly solid data framework.

Defining Your Architects and Guards

Before a single brick is laid, you need a blueprint and a crew. In the world of data, that starts with data stewardship. These are your architects and your guards—the people who actually know what the data means.

Your data stewards are subject matter experts from the business side, not IT. They're the ones using the data day in and day out. A common mistake is thinking the central governance team should write every rule and definition. That's backward. The central team provides the playbook and the tools, but it's the stewards who bring the real-world context and accountability.

Data stewardship isn't about pointing fingers when something goes wrong. It's about assigning clear ownership so everyone knows who has the authority to make decisions about specific data. Accountability is no longer a fuzzy concept; it's built right into the business.

When people know exactly what they're responsible for, the entire system just works better. It's that simple.

Ensuring Every Asset Is Flawless

What’s the point of a secure vault if it’s full of junk? That’s where data quality management steps in. This is the nitty-gritty work of making sure every piece of data, from a customer's address to a transaction log, is accurate, complete, and trustworthy.

Bad data is a silent killer of productivity. A 2021 study found that knowledge workers waste a staggering 50% of their time just trying to find data, fix errors, and double-check sources. Think about that cost. It’s massive, and it completely erodes confidence in your reports and decisions. To avoid this trap, it pays to follow established best practices for data excellence and quality assurance.

Key activities for data quality include:

- Data Profiling: Getting a clear picture of your data's current condition to spot the hidden problems and inconsistencies.

- Data Cleansing: The actual hands-on work of correcting errors, filling in gaps, and getting rid of duplicate records.

- Ongoing Monitoring: Setting up automated checks to keep your data clean over the long haul, not just after a one-time cleanup project.

Securing the Vault and Keeping the Master Ledger

A fortress needs locks, and every valuable item inside needs to be tagged and tracked. Two final components handle these critical functions in your data governance framework.

First, you have Data Security and Privacy. These are the locks, alarms, and surveillance systems for your data vault. It's all the technical controls and procedures you put in place to shield data from cyberattacks, unauthorized access, and breaches, keeping you in line with regulations like GDPR.

Second is Master Data Management (MDM). Think of this as the vault's master ledger. It creates a single, undisputed "golden record" for your most critical data, like customers, products, and accounts. Without it, one customer might show up in ten different systems with slightly different names or details, which is a recipe for operational chaos.

MDM makes sure that when you pull up a customer's file, you're looking at the file—the single source of truth. Getting these pieces right isn't easy, but it’s absolutely necessary. For a deeper dive into the how-to, plenty of detailed guides on implementing data governance in banking can light the way forward.

Putting these blocks together builds a formidable framework that turns your data from a potential liability into your most powerful strategic asset.

The Forces Driving Modern Data Governance

So, why is everyone suddenly talking about bank data governance? What's the big deal?

It’s pretty simple, actually. Banks are getting squeezed from two sides. On one hand, you have regulators demanding more control and visibility than ever. On the other, the market is a battlefield where data-driven innovation is the only way to stay in the game.

Trying to ignore these pressures just isn't an option anymore. One is about managing risk and staying compliant. The other is about staying relevant and profitable. Put them together, and you see why solid data governance has become non-negotiable for any bank that wants to thrive.

The Unforgiving World of Regulatory Compliance

For bankers, regulations aren't just some background hum; they're a core part of the business. Rules like the Basel Committee's BCBS 239 or Europe's GDPR have completely rewritten the playbook. These aren’t friendly suggestions—they’re hard-and-fast rules with painful penalties for getting it wrong.

Take BCBS 239. It demands that major banks have airtight systems for adding up their risk data. When a regulator asks for a specific risk report, they expect it to be dead-on accurate, on time, and complete. A bank with messy, ungoverned data can't possibly deliver, leaving it wide open to huge fines and restrictions on how it operates.

Then there’s GDPR, which sets strict limits on how you handle customer data. A data breach or slip-up can trigger fines in the millions, to say nothing of the crater it leaves in your bank's reputation. Good data governance gives you the framework to enforce these rules, trace where your data has been, and prove you're compliant. It turns a massive risk into a managed process.

Gaining the Competitive Edge

While compliance is about playing defense, the market demands a strong offense. In this arena, your data is your best weapon. The bank with the cleanest, most trustworthy data is the one that comes out on top.

This is where data governance stops being a cost center and starts being a powerful engine for growth.

Think about how high-quality, governed data powers your most important work:

- Reliable AI and Machine Learning: AI models need a ton of good data to learn. If you want to build sharp fraud detection systems or predictive credit models, you need massive amounts of clean data. Garbage in, garbage out—bad data creates flawed models and leads to poor business decisions.

- Hyper-Personalized Customer Experiences: To give customers tailored products they actually want, you need to know them inside and out. That requires a single, unified view of each person, scrubbed clean of duplicates and errors. That's a classic Master Data Management job, which is a core part of governance.

- Smarter Analytics and Insights: Every big decision, from choosing where to put a new branch to analyzing market shifts, relies on data. The insights you pull from banking data analytics are only as good as the information they’re built on.

This is why we're seeing a huge spike in data governance adoption. One recent industry survey showed that the number of organizations with a formal data governance program jumped from 60% to 71% in just one year. You can dig into the details behind this dramatic rise over on Precisely.com.

Let’s paint a picture. Imagine two rival banks.

Bank A goes all-in on data governance. Its teams trust their reports. Its AI models are spot-on. It can roll out personalized marketing campaigns that hit the mark every time.

Bank B, on the other hand, is drowning in data chaos. Its analysts spend more time arguing about whose numbers are right than finding actual insights. Its marketing is generic and falls flat, and it's always scrambling to meet regulatory deadlines.

Over time, Bank A pulls ahead, innovating faster, grabbing market share, and building real customer loyalty. Bank B gets left in the dust, weighed down by inefficiency and risk. This isn't just a story—it's what's happening in banking right now.

Navigating Common Data Governance Hurdles

Putting a bank data governance program into action is where the rubber meets the road. All the well-crafted strategies suddenly face the real-world friction of people, politics, and old tech. Knowing what hurdles are coming is half the battle.

Putting a bank data governance program into action is where the rubber meets the road. All the well-crafted strategies suddenly face the real-world friction of people, politics, and old tech. Knowing what hurdles are coming is half the battle.

The biggest headaches aren't always technical. They're human. You'll run into employees who resist change, departments fiercely guarding their data, and ancient systems that refuse to talk to anything new. Getting through this maze requires more than a plan; it demands a practical playbook.

Dismantling Data Silos and Taming Legacy Systems

One of the first brick walls you’ll hit is the data silo. For decades, departments like lending, marketing, and compliance built their own little kingdoms with their own data and systems. This isn't just inefficient; it creates a fractured view of the bank that makes enterprise-wide decisions nearly impossible.

Tangled up in this mess are the legacy systems—those aging mainframes and databases that are the bedrock of many banks. They hold decades of crucial history, but getting them to play nice with modern tools is a nightmare. A complete overhaul is usually too costly and disruptive, so you need a smarter approach.

This is where a cross-departmental Data Governance Council becomes your most valuable asset. It's about getting leaders from every corner of the bank into one room to make decisions together.

A Data Governance Council isn't just another committee. Think of it as the authoritative body that has the power to knock down walls, settle turf wars over data ownership, and get everyone marching in the same direction. It turns "that's my data" conflicts into "how do we solve this" collaborations.

By creating this forum, you give the bank a dedicated space to systematically tackle silos, prioritize which systems to integrate, and ensure that every new piece of tech is built with solid governance from the start.

Overcoming Organizational Resistance

Let’s be honest: the toughest challenge is often the culture. You'll hear the classic lines: "That's not my job," or the dreaded, "We've always done it this way." This isn't just stubbornness; it's a sign that people don't see how bad data in their department creates problems for everyone else.

Winning over hearts and minds is just as critical as rolling out new software. A powerful way to do this is by creating a network of "Data Champions." These are your allies on the inside—enthusiastic employees from different departments who actually get why data matters and can spread the word from the ground up.

Here’s why a "Data Champions" network works so well:

- They Translate the "Why": They explain governance in a way that makes sense to their colleagues, connecting it directly to their daily work and team goals.

- They Provide On-the-Ground Support: Champions become the go-to people for questions, making the central governance team feel less like an ivory tower.

- They Build Momentum: When people see their peers succeeding with the new approach, it creates a ripple effect. Success becomes contagious.

Securing and Maintaining Executive Buy-In

Getting the initial thumbs-up from leadership is one thing. Keeping them invested is the real challenge. Executives are juggling a dozen priorities, and they need to see a return on their investment—and fast. "Better data" is too abstract; you need to speak their language: ROI, risk reduction, and a sharper competitive edge.

To keep your sponsors engaged, you have to deliver quick, tangible wins. Don't try to solve every data problem at once. Start small. Pick a high-impact pilot project, like cleaning up customer data to boost a marketing campaign or dramatically speeding up a painful regulatory report.

Then, measure everything and shout your successes from the rooftops. Show them the numbers they care about. "We cut the time spent on regulatory reporting by 40%" or "Our last campaign saw a 15% ROI lift thanks to cleaner data." Hard numbers like these are undeniable proof that bank data governance isn't a cost—it's a massive business advantage.

Your Roadmap for Implementing Data Governance

Thinking about bank data governance is one thing. Making it a reality in your institution is another challenge entirely. You need a clear, step-by-step plan that turns a massive undertaking into a series of wins. A phased rollout is the only way to go—it lets you show real value quickly, build momentum, and get people on board.

This isn't about trying to fix everything at once. Think of it as starting a small, controlled fire that spreads excitement and proves the program's worth, one department at a time.

The following steps are a practical roadmap to help you build a governance framework that actually works and sticks around for the long haul.

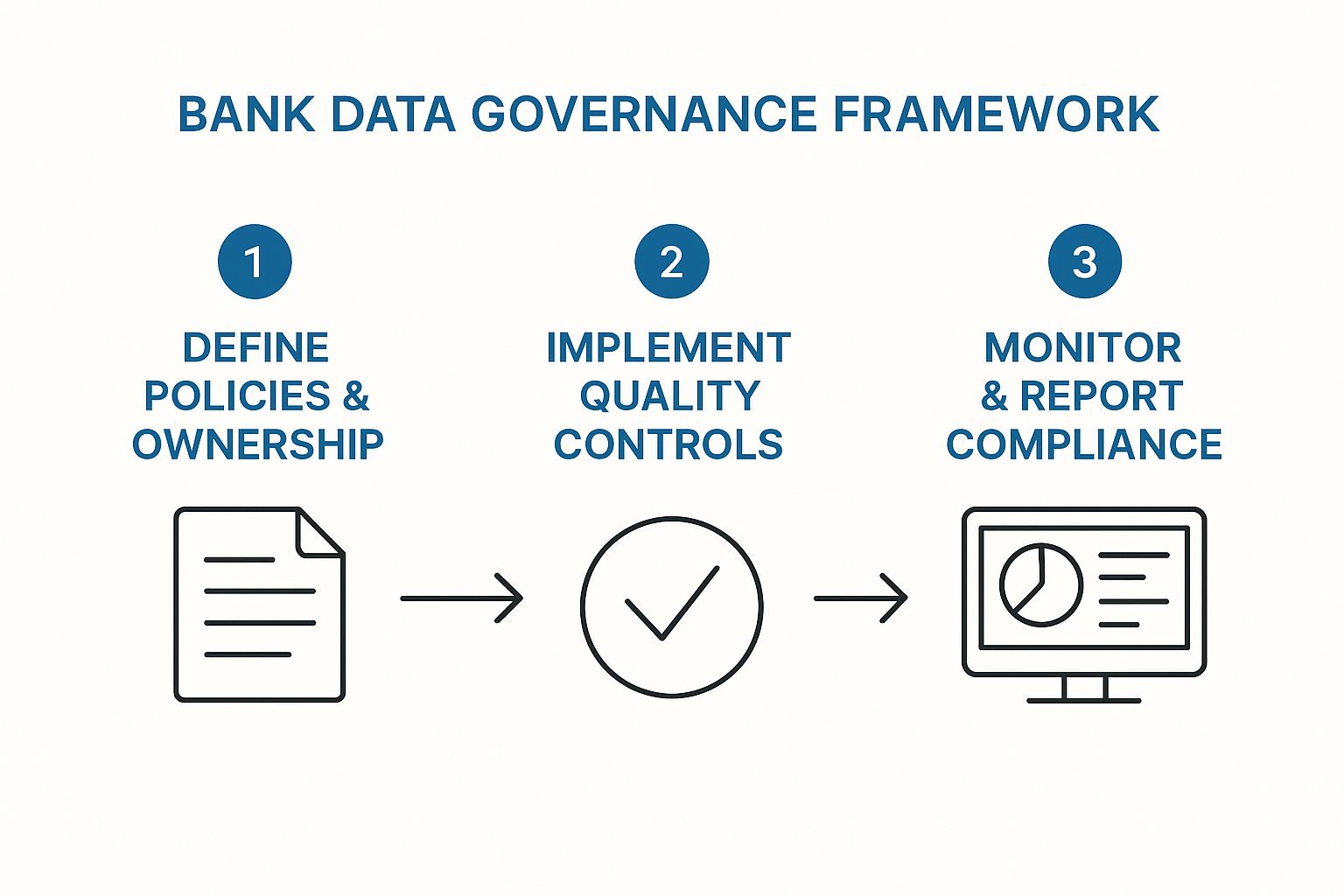

This visual really hammers home a key point: data governance isn't a "one and done" project. It’s a continuous cycle where every stage builds on the last, pushing for constant improvement.

To help you visualize this journey, here’s a high-level look at the key phases involved in getting a data governance program off the ground and ensuring its long-term success.

Data Governance Implementation Phases

| Phase | Key Activities | Primary Goal |

|---|---|---|

| 1: Assessment & Strategy | Identify key data pain points, assess current capabilities, define the business case, secure executive sponsorship. | To get buy-in and align the governance program with strategic business objectives. |

| 2: Pilot & Foundation | Select a high-impact pilot project, form the Data Governance Council, draft initial policies with data stewards. | To prove the concept, demonstrate tangible value, and establish the core governance structure. |

| 3: Technology & Expansion | Select and implement enabling tech (data catalog, quality tools), roll out governance to new data domains. | To scale the program efficiently and embed governance practices across more business units. |

| 4. Optimization & Maturity | Continuously monitor KPIs, refine policies, automate processes, foster a data-driven culture. | To make data governance a self-sustaining, integral part of the bank's operations. |

This phased approach ensures you build a solid foundation before you start building the walls and the roof. Now let's break down how to get started.

Phase 1: Secure Executive Sponsorship

Before you even think about writing a policy, you need powerful allies in the C-suite. Executive sponsorship is not just a box to check; it’s the political and financial fuel for your entire initiative. Without it, you’re just spinning your wheels, fighting for resources and authority.

Your first job is to build a compelling business case that speaks directly to their goals. Don’t frame this as a technical IT project. Frame it as a strategic move that solves their biggest headaches.

- For the CFO: Talk about cost savings from streamlined operations and reducing risk in regulatory reporting.

- For the CRO: Focus on better risk modeling and a rock-solid stance for meeting complex compliance mandates. For a deeper dive, check out our guide on the complexities of regulatory compliance for banks.

- For the CMO: Paint a picture of hyper-personalized marketing and better customer loyalty, all powered by a single, trusted source of customer data.

Pro Tip: Don't just show up with problems. Bring solutions. Propose a pilot project that tackles a specific pain point they feel every day—like showing how you can cut the time spent on a critical regulatory report by 30%.

Phase 2: Define a Focused Pilot Project

Trying to govern every piece of data right out of the gate is a guaranteed path to failure. The secret is to start small, prove your point, and then expand. Pick a pilot project with a clear, tight scope and a high chance of success.

Good candidates often revolve around a critical data domain that's causing obvious pain across the bank. For instance, zeroing in on "Customer Master Data" can create a positive ripple effect, improving everything from marketing to fraud detection. As you map this out, looking into accounts payable automation best practices can also spark ideas for managing critical financial data more effectively.

Phase 3: Form Your Governance Council and Draft Policies

Once you have executive backing and a pilot project scoped out, it’s time to build the team. Form a Data Governance Council with senior leaders from different business units and IT. This group is your command center—they’ll settle disputes, sign off on policies, and champion the cause.

At the same time, start drafting your first set of data policies. But don't do this in an ivory tower. The best policies are created hand-in-hand with your Data Stewards—the people on the front lines who actually work with this data every single day.

Your first policy bundle should cover the basics:

- Data Stewardship Policy: Who owns the data? Who is responsible for its quality? Get it in writing.

- Data Quality Standards: What does "good" look like? Define the minimum acceptable quality for the data in your pilot.

- Data Access Policy: Spells out who gets to see what data and under what circumstances.

Phase 4: Choose Enabling Technology and Measure Success

Let’s be clear: technology won’t fix a broken governance process. But the right tools are essential for making it work at scale. Things like data catalogs, data quality platforms, and master data management (MDM) hubs can automate the grunt work and make governance manageable. The trick is to pick technology that supports the framework you’ve built, not the other way around.

Finally, you have to measure your progress. You need hard numbers to keep your sponsors happy and justify expanding the program. Track the metrics that the business actually cares about.

Key Performance Indicators (KPIs) to Track:

- Reduced Time on Regulatory Reporting: A direct win for efficiency and risk.

- Improvement in Data Quality Scores: Tangible proof that the data is becoming more trustworthy.

- Decrease in Data-Related Help Desk Tickets: A clear sign you’re reducing friction for employees.

- ROI of a Data-Driven Campaign: Directly connects your governance efforts to the bottom line.

By following this roadmap, you can transform a daunting, complex goal into a series of achievable wins. Each success builds credibility and creates the energy needed to make great data governance a reality across the entire bank.

The Future of Bank Data Governance

If you think bank data governance is still just about managing loan portfolios and customer accounts, think again. The game is changing, and fast. The very definition of a critical data asset is expanding, forcing old-school governance frameworks to either evolve or die.

If you think bank data governance is still just about managing loan portfolios and customer accounts, think again. The game is changing, and fast. The very definition of a critical data asset is expanding, forcing old-school governance frameworks to either evolve or die.

This isn't just about ticking compliance boxes anymore. It’s about being competitive and ready for whatever comes next. Data governance isn’t a project you finish; it's a living capability that needs to grow with your institution.

A huge part of this shift comes from the rising importance of Environmental, Social, and Governance (ESG) data. Investors, regulators, and even your customers now expect banks to report on their sustainability and social impact just as rigorously as their financials.

This means things like carbon emissions data, diversity metrics, and community investment figures need to be brought into the fold. These new datasets demand the same tough controls for quality, lineage, and security that we’ve always applied to financial information.

AI and Cloud: The Double-Edged Sword

At the same time, artificial intelligence and cloud computing are turning the governance world upside down. These aren't just fancy new tools; they are powerful forces creating both massive headaches and incredible opportunities for banks.

On one hand, the big push to the cloud opens up a Pandora's box of security questions. Your data is spread out everywhere, and protecting it requires a whole new level of vigilance. And don't get me started on AI models. They're often "black boxes," which creates its own governance nightmare. Making sure these models are fair, transparent, and built on clean data is a critical new responsibility on our shoulders.

But here's the flip side—these same technologies offer powerful fixes.

- Automated Governance: AI can be a workhorse, automatically classifying sensitive data, spotting quality issues in real-time, and even suggesting fixes. This cuts down on a ton of manual effort.

- Real-Time Policy Enforcement: Cloud-native tools can enforce data access rules instantly across the entire bank, making sure policies are actually followed, not just written down.

- Proactive Compliance: Smart analytics can flag potential compliance breaches before they happen. This flips the script, moving governance from a reactive cleanup crew to a proactive watchdog.

The key takeaway is simple: the future of bank data governance is all about being agile and intelligent. The frameworks of tomorrow have to be smart enough to handle new data like ESG and sophisticated enough to govern AI and the cloud effectively.

This really reflects a broader trend where governance is merging with corporate reporting and regulatory frameworks. As banks grapple with new privacy laws and sustainability demands, governance structures must adapt to manage all these different data streams while applying the same consistent rules across the board. You can get more insights on these trends over at Dataversity.net.

Ultimately, the banks that win in the years ahead will be the ones that treat data governance not as a static compliance chore, but as a living, breathing part of their strategy. It’s that forward-thinking approach that will help them navigate the future, jump on new opportunities, and build a truly resilient, data-driven bank.

Frequently Asked Questions

Let's cut through the noise. When you start talking about data governance in banking, a few key questions always come up. Getting these sorted is crucial for getting everyone, from the C-suite to the front lines, pulling in the same direction.

What’s the Difference Between Data Governance and Data Management?

This is a big one, and it's easy to get them mixed up.

Think of data management as the plumbing and the security guards. It's the practical, hands-on work of moving data, storing it securely, and keeping it running. It's the "doing."

Data governance, on the other hand, is the architect and the rulebook. It designs the blueprint for the entire system. Governance decides who gets the keys to the vault, what quality standards the contents must meet, and what the policies are for every single action.

Simply put, data management is the engine that handles the data. Data governance is the leadership team that tells the engine where to go and why.

How Can Smaller Banks Start With a Tight Budget?

You don't need a multi-million dollar budget to get started. Far from it. The trick is to be smart and focus your fire.

- Solve a Real Problem: Don't boil the o