When we talk about the "bank customer experience," what are we really getting at?

It’s not just about one transaction or a single phone call. It’s the cumulative feeling a person has about their bank, shaped by every single interaction—from a quick login on the mobile app to a face-to-face conversation in a branch. It's the overall story they would tell a friend, and that story is what determines their loyalty, their trust, and whether they’d ever recommend you.

In today's market, this experience has become the main event, often mattering more to customers than the interest rates or fees you offer.

What Is Bank Customer Experience Really About?

Think of the customer experience less like a series of isolated transactions and more like a long-term relationship. It’s the entire narrative a customer builds about their financial partner.

Every touchpoint adds another page to that story. A seamless mobile deposit? That’s a great chapter. A confusing, frustrating phone call to fix a simple problem? That chapter sours the whole book.

This is the new battleground for financial institutions. While competitive rates still have their place, the feeling of being valued and understood often wins the day. A Forrester study drove this point home, finding that just a one-point bump in a bank's CX score can translate to over $123 million in new revenue for a large multichannel bank. That’s not a small number. It’s a massive signal that experience is everything.

The Foundation of a Modern Banking Relationship

So what’s holding this relationship together? At its core, a strong banking experience is built on a foundation of trust and effortless engagement. It’s about making your customers feel seen, supported, and secure.

People aren't just comparing your bank to other banks anymore. They’re comparing your app to Netflix and your service to Amazon. The bar is set high.

A great experience builds unshakable trust and turns customers into your biggest fans. A bad one can destroy years of loyalty in a heartbeat. The stakes couldn't be higher.

This modern relationship rests on a few key pillars. Each one must be solid for the entire structure to stand.

Here's a quick breakdown of what makes up that solid foundation:

The Pillars of a Modern Banking Relationship

| Pillar | What It Means for the Customer | Example Interaction |

|---|---|---|

| Accessibility | "I can get help easily, whenever and however I need it." | Getting a quick, clear answer from a chatbot at 10 PM, then following up with a knowledgeable human in the branch the next day. |

| Consistency | "My bank feels like one bank, no matter how I interact with it." | Starting a loan application online and having a banker pull it up instantly to finish it in person, without asking for the same information twice. |

| Personalization | "My bank gets me. They offer things I actually need." | Receiving a timely alert about a better savings account option based on your current balance and goals, not just a generic ad. |

When these pillars are strong, the relationship thrives.

Ultimately, a superior customer experience isn't about flashy gimmicks. It’s about proactively solving problems and making people feel, without a doubt, that their financial well-being is your top priority. It's that simple, and that hard.

The Building Blocks of a Winning Banking CX

What separates a bank people tolerate from one they genuinely love and recommend? It’s never just one thing—not a low fee or a single flashy feature. It’s the result of carefully building the entire bank customer experience from the ground up.

The best banks get it. They know these building blocks aren't just about "customer service." They're the core of a modern financial relationship. When you get them right, banking stops feeling like a chore and starts feeling like a real partnership.

So, what are these non-negotiable pillars? They boil down to three things: true personalization, seamless consistency, and effortless accessibility. Drop one, and the whole structure starts to feel shaky.

Deliver True Hyper-Personalization

In banking, personalization used to mean plugging a customer's first name into an email template. Those days are long gone. Today, real hyper-personalization is about using data to offer guidance that is genuinely useful, timely, and relevant to that specific individual.

Think about the difference between a generic credit card ad and a proactive nudge about a new high-yield savings account that perfectly fits a customer's goals and recent activity. It’s about shifting from a sales-first mindset to an advice-first one. It's about seeing what your customer needs before they even ask.

This could be as simple as an app analyzing spending habits to offer smart budgeting tips or flagging an unusual subscription charge. That’s a bank looking out for its customer’s financial well-being, and that builds loyalty.

A global survey of over 75,000 consumers found that customer service is a critical component of the banking experience worldwide, with a satisfaction score of 3.97 out of 5. While that number looks pretty good, it shows there’s still plenty of room to improve—and personalization is the clearest path to closing that gap.

Ensure Seamless Consistency Across Channels

A customer's journey is rarely linear. They might start a mortgage application on their laptop, jump over to the web chat with a quick question, and then pop into a branch to sign the final papers. A winning experience means that entire journey feels like one single, smooth conversation.

This omnichannel consistency isn’t a nice-to-have; it's essential. Customers expect their bank to feel like one unified company, not a collection of siloed departments. Nothing is more frustrating than having to explain your problem all over again just because you switched from the app to a phone call.

When the data flows effortlessly between channels, the customer feels known and valued. They don't feel like a stranger every time they interact with you.

Balance Digital Tools and Human Accessibility

Finally, a top-tier customer experience hinges on effortless accessibility. This starts with intuitive, powerful digital tools that let customers handle everyday banking on their own terms, 24/7. But technology can't do it all.

When something gets complicated or goes wrong, people need to know they can reach a smart, empathetic human who can actually solve their problem. This is also about being accessible to everyone. A truly forward-thinking bank ensures it can serve all potential customers, which includes knowing how to work with different forms of identification. Being one of the banks that accept ITIN, for example, is a crucial part of building an inclusive financial ecosystem.

This blend of slick, self-service tech and readily available human expertise creates a powerful safety net. It’s that combination that builds deep, lasting trust.

How to Actually Measure Customer Experience

You can't fix what you don't measure. For the longest time, "customer experience" in banking felt a bit like smoke and mirrors—a fuzzy concept we all knew was important but struggled to pin down. That’s no longer the case. We now have real, data-backed ways to see exactly how customers feel about every interaction with us.

These aren't just acronyms on a report. They're the stories behind the numbers, giving you direct feedback on specific moments in a customer's journey. They show you where you're knocking it out of the park and, more importantly, where you're creating friction that slowly chips away at loyalty. Getting a handle on these metrics is the first real step toward building a bank people genuinely love.

Gauging Loyalty with Net Promoter Score

Think of the Net Promoter Score (NPS) as your long-term loyalty meter. It boils everything down to one powerful question: "On a scale of 0-10, how likely are you to recommend our bank to a friend or colleague?" This question cuts straight to the heart of brand health and whether your customers are true advocates.

Based on their answers, customers fall into three distinct camps:

- Promoters (9-10): These are your champions. They're not just loyal; they're enthusiastic evangelists driving new business your way.

- Passives (7-8): They're satisfied, but that's about it. They're not unhappy, but a slightly better offer from a competitor could easily lure them away.

- Detractors (0-6): These are your unhappy campers. They can actively harm your brand with negative reviews and bad word-of-mouth.

Your final NPS score comes from a simple calculation: subtract the percentage of Detractors from the percentage of Promoters. It's a high-level snapshot of your overall relationship with your entire customer base.

Capturing In-The-Moment Feedback

While NPS gives you the big picture on loyalty, other metrics are built for a close-up, capturing feedback right after a specific interaction. Customer Satisfaction (CSAT) is perfect for this. It asks a simple, direct question like, "How satisfied were you with your recent call center experience?" This gives you an immediate pulse check on individual touchpoints.

In the same vein, the Customer Effort Score (CES) asks a different but equally crucial question: how easy was it for a customer to get what they needed? A high effort score for something that should be simple, like a mobile check deposit, is a major red flag signaling friction that needs to be eliminated. Making things easier for customers is a proven path to keeping them around.

The real trick, however, is that while these scores are valuable, customer satisfaction with digital services is often where banks stumble. We did a deep dive on this issue, and you can explore more about the decline in customer satisfaction with digital services in our full analysis.

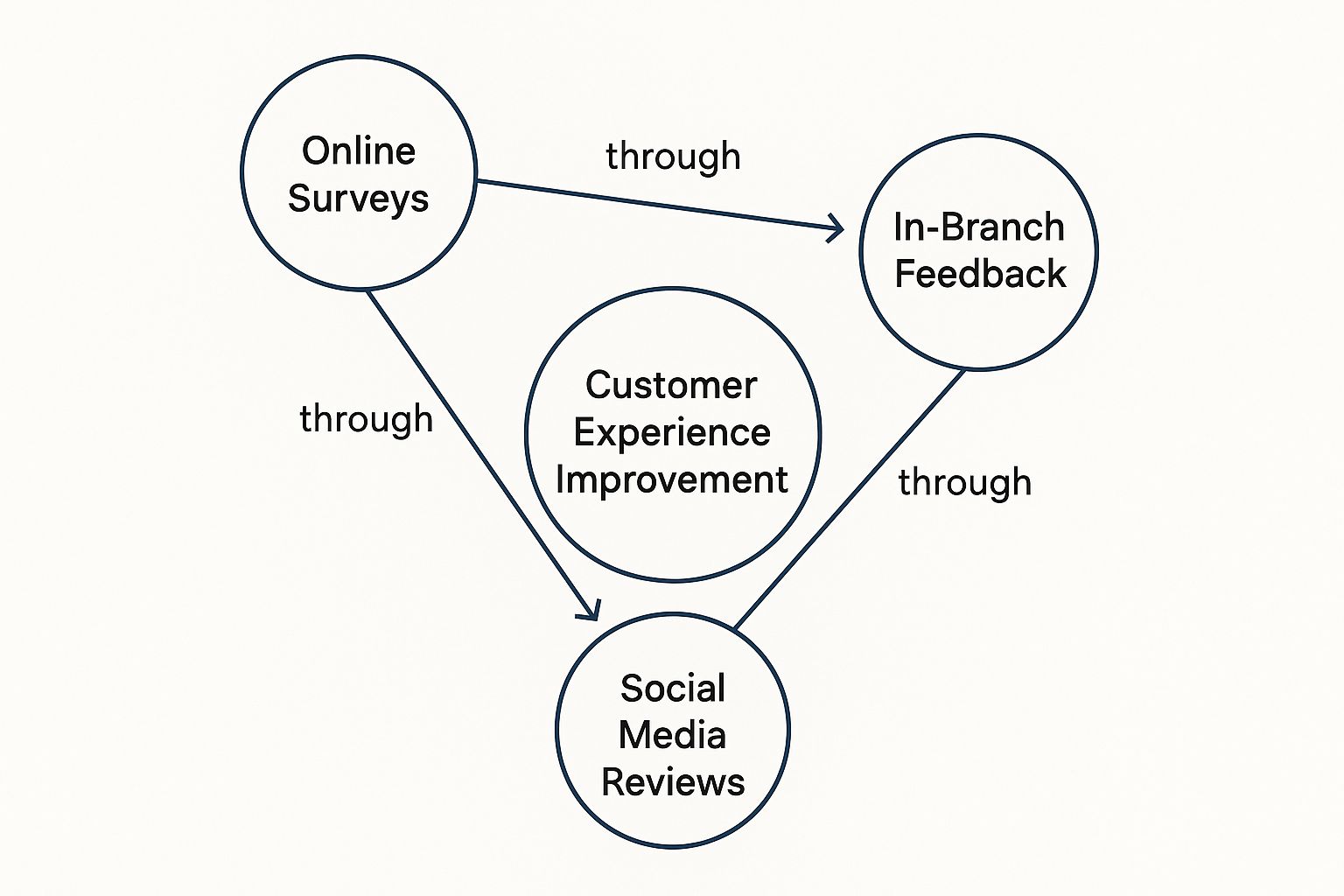

This infographic really drives home how these different feedback channels come together to shape a smart improvement strategy.

It's about listening to the "why" behind the scores, gathering real stories from surveys, face-to-face conversations, and social media to understand what the numbers truly mean.

And the data shows this focus works. Recent studies found that overall customer satisfaction with direct bank checking accounts climbed to a score of 692, a 4-point jump. A huge driver was the customer's feeling that the bank "completely supports me during challenging times." This proves that measuring—and acting on—that emotional connection is where the real wins are.

Solving the Most Common Customer Pain Points

Let's be honest. Every customer journey has bumps in the road—those little frustrations that can quickly turn a simple banking task into a massive headache. These pain points are the cracks in the foundation of your bank customer experience, and they're slowly chipping away at loyalty and sending customers looking elsewhere.

Whether it’s an agonizingly long phone queue or a digital app that feels more like a logic puzzle, these issues are far more than minor annoyances. They are loyalty killers. Think about it: a recent study found that a staggering 64% of customers felt their mobile banking app was useless for solving a problem quickly. That's a huge gap between what customers expect and what banks deliver.

But here’s the good news: these common problems aren't unsolvable mysteries. They have clear, actionable solutions.

Taming Long Wait Times and Inefficient Support

We've all been there—stuck on hold, listening to terrible music, just to ask a simple question. It’s one of the most universal complaints. In an age of instant gratification, forcing customers to wait is a surefire recipe for a bad review. The fix lies in smarter channel management and automation.

AI-powered chatbots can instantly field the flood of common questions—balance checks, transaction lookups, password resets. This frees up your human agents to handle the complex, high-stakes conversations that actually require a personal touch. The trick is making it all feel seamless.

By truly listening to your customers—using sentiment analysis and feedback tools—you can figure out why they're so frustrated. Feeling valued is what keeps customers around, and nothing says "we value your time" like solving their problem before they have to escalate it.

Fixing Disjointed and Confusing Digital Interfaces

Another major source of friction is a clunky digital experience. How often do customers have to call support simply because the app is confusing, a feature is broken, or they have to re-enter information they just typed in on another screen? This is usually a symptom of siloed systems that don't talk to each other.

Fixing this means committing to solid User Experience (UX) design and a true omnichannel strategy.

- Simplify Navigation: Put the most common tasks front and center. Make them doable in just a few taps.

- Unify Systems: A customer who starts a loan application online should be able to walk into a branch and pick up right where they left off, without starting from scratch.

- Provide Contextual Help: Embed help options like a live chat or FAQ right inside the app. Let customers find answers without having to abandon what they're doing.

Tackling these issues head-on requires a deep understanding of process flows, which is, frankly, a blind spot for many banks. It's a tough pill to swallow, but as we’ve discussed before, many bankers struggle with effective problem-solving, which you can read more about in our analysis of why many bankers are bad at problem-solving.

By proactively hunting down and fixing these friction points, you can turn your customer experience from a liability into your most powerful competitive advantage.

What’s Next? The Future of the Bank Customer Experience

The ground is shifting beneath our feet. The future of banking isn't about small tweaks or chasing the latest buzzword; it's a fundamental overhaul in how we connect with customers, use technology, and what we stand for as institutions.

If you want to lead, you have to understand where the puck is going. These aren't just abstract ideas anymore—they are the new rules of the game being put into practice right now.

From Reactive Service to Predictive Guidance with AI

For years, we've heard about the promise of artificial intelligence. Well, that promise is finally being delivered. This isn't just about sticking a customer's name on a dashboard. It’s about using AI and machine learning to get ahead of their needs.

Think about it. Imagine your systems identifying a customer's spending patterns and flagging a potential cash crunch before it happens, then proactively offering a short-term credit line. Or noticing someone is saving up for a big goal and automatically presenting a plan to get them there faster. We’re moving from fixing problems to preventing them entirely.

The End of “Channels” and the Rise of One Continuous Conversation

We’ve all talked about “omnichannel” for what feels like a decade. The future isn't just having multiple channels—it's about making them disappear into one seamless experience.

A customer might start a mortgage application with a chatbot, get a follow-up call from a specialist, and then pop into a branch to sign the final papers. They should never have to repeat information. This means every single person on your team, from the teller to the loan officer, has the same, unified view of that customer's journey. The bank stops feeling like a collection of departments and starts feeling like a single, intelligent partner.

This shift toward proactive, supportive relationships is already paying off big time. A recent study found a huge jump in customer satisfaction when banks offered personalized, empowering support. In fact, customers who knew about these helpful tools reported satisfaction scores 96 points higher on average. It's clear that proactive help is a game-changer. You can see the full J.D. Power findings on this trend for yourself.

Banking with a Conscience: The ESG Factor

Finally, a powerful, and very human, trend is taking center stage: Environmental, Social, and Governance (ESG) principles. Customers, especially the younger generations, are voting with their wallets. They don’t just want a bank that’s good for their money; they want one that’s good for the world.

This is more than a PR move. It means being transparent about where you invest, your commitment to sustainability, and how you support your community. A strong ESG position is becoming a non-negotiable part of the brand, and it's absolutely critical for building real trust with the next generation of banking customers.

Building Your Actionable CX Strategy

So, you've got a handle on the building blocks of a great bank customer experience and you're measuring performance. That's a great start. But how do you actually connect those dots to make a real difference? This is where an actionable strategy comes in—it’s what separates you from the banks that just track metrics and those that truly understand what drives them.

Let's be honest, the biggest hurdle is that your customer data is all over the place. The CRM has one piece of the story, your core banking platform has another, and your app analytics and survey results are living on their own separate islands. It’s impossible to see the whole journey for a single customer when the map is torn into a dozen pieces.

A modern strategy starts by taping that map back together.

Unify Data into a Single Source of Truth

The only way to build a strategy that works is to create a single source of truth for every scrap of customer-related data. This is exactly what a powerful Business Intelligence (BI) platform, like Visbanking’s BIAS, is built for. It reaches into all those separate systems and pulls everything into one central, unified view.

Having this complete picture is a total game-changer. Suddenly, you can see how a low CSAT score from a support call is directly linked to a friction point in your mobile app. You can connect the dots between a series of small, positive interactions and a sky-high NPS score.

Instead of just knowing that a customer is unhappy, you can finally understand why and pinpoint the exact moment their experience went sour. This flips the script from a reactive "fix-it" mode to a proactive "prevent-it" strategy, turning your insights into a real competitive advantage.

From Insights to Actionable Improvements

With a single, unified view of your customer, you can finally start making moves that are truly data-driven. This isn't about guesswork; it's about taking specific actions that directly improve the customer experience and show a clear return on investment.

- Identify Friction in Real-Time: By watching journey analytics, you can spot exactly where customers get stuck or give up. Is one particular screen in your loan application causing a ton of people to drop off? Now you know precisely where your UX team needs to focus.

- Segment for Impactful Personalization: Let's face it, not all customers are the same. A unified data platform lets you go way beyond basic demographics. To dive deeper, check out our guide on how to implement effective bank customer segmentation. This is how you start tailoring offers, messages, and support to what people actually need and do.

- Prove the ROI of CX Initiatives: When your customer experience data is tied directly to your financial metrics, you can draw a straight line from your improvements to the bottom line. Saw a drop in call center volume after an app update? You can now connect that directly to cost savings. Proving this kind of financial impact is critical for getting the buy-in to keep investing in your customer experience programs.

Common Questions About Bank Customer Experience

As we peel back the layers of bank customer experience, a few questions always seem to pop up. Let's tackle some of the most common ones to get a clearer picture of what really matters for banks of any size.

What Is the Single Most Important Factor in a Good Bank Customer Experience?

If I had to boil it all down to one thing, it would be trust. It's the bedrock of the entire relationship.

Trust isn't something you can create with a single fancy feature or one good interaction. It’s earned over time through consistent, reliable service and transparent communication. It's the gut feeling a customer gets that their bank is genuinely on their side, looking out for their financial well-being. A customer who trusts you will stick around, even if there's a minor hiccup.

Research from Forrester drives this home: a massive 87% of multichannel banking customers who feel valued say they will stay loyal. That feeling of being valued is a direct result of earning their trust.

How Does Digital Banking Affect the Overall Customer Experience?

Digital banking isn't just a "nice-to-have" anymore; it's a fundamental part of the modern banking experience. A smooth, secure, and powerful mobile app or website is now table stakes. A great digital experience gives customers the convenience and control to manage their finances whenever and wherever they want.

But here’s the catch: technology alone isn’t the whole story. The best digital tools need to be backed by easy access to real, human help for those complex or emotional moments. This creates a balanced “phygital” (physical + digital) approach, giving customers efficient self-service tools for everyday tasks and expert human support when it counts the most.

Can Small Banks Compete with Large Banks on Customer Experience?

Absolutely. It might seem like the big banks have an unbeatable advantage with their massive tech budgets, but that’s not the full picture.

Smaller community banks and credit unions can win by playing a different game. Their strength is in their deep community roots and their ability to offer truly personal, relationship-driven service. By focusing on knowing their customers as people, not just account numbers, and using smart, focused technology, smaller banks can create a high-touch experience that big institutions often can't replicate at scale. They can turn their size into their greatest asset.

It's time to stop letting your customer data sit in silos. Turn those scattered pieces into your most powerful strategic tool.

Visbanking’s BIAS platform pulls your performance metrics, customer feedback, and market insights into one clear picture. It gives you the single source of truth you need to build a CX strategy that actually wins. See how you can build real loyalty and drive growth by visiting https://www.visbanking.com.