Effective Bank Compliance Training to Reduce Risks

Brian's Banking Blog

Beyond Checkbox Compliance: The New Training Landscape

The financial world is constantly changing, and so are its regulations. This makes effective bank compliance training crucial for navigating today's complex regulatory environment. Simply checking boxes is no longer enough. Forward-thinking banks are transforming their compliance training programs from tedious requirements into valuable assets.

Moving Beyond the Basics: Engaging Employees

Traditional compliance training often fails to engage employees and truly instill an understanding of complex regulations. This leads to a "check-the-box" mentality, where employees prioritize completion over comprehension. But successful bank compliance training programs create dynamic learning experiences.

These programs resonate with staff at all levels. They move beyond generic modules and use interactive elements.

- Real-world scenarios

- Case studies

- Simulations

These methods connect theory and practice. They ensure employees understand not just what compliance is, but why and how it matters. This results in better risk management and a stronger compliance culture.

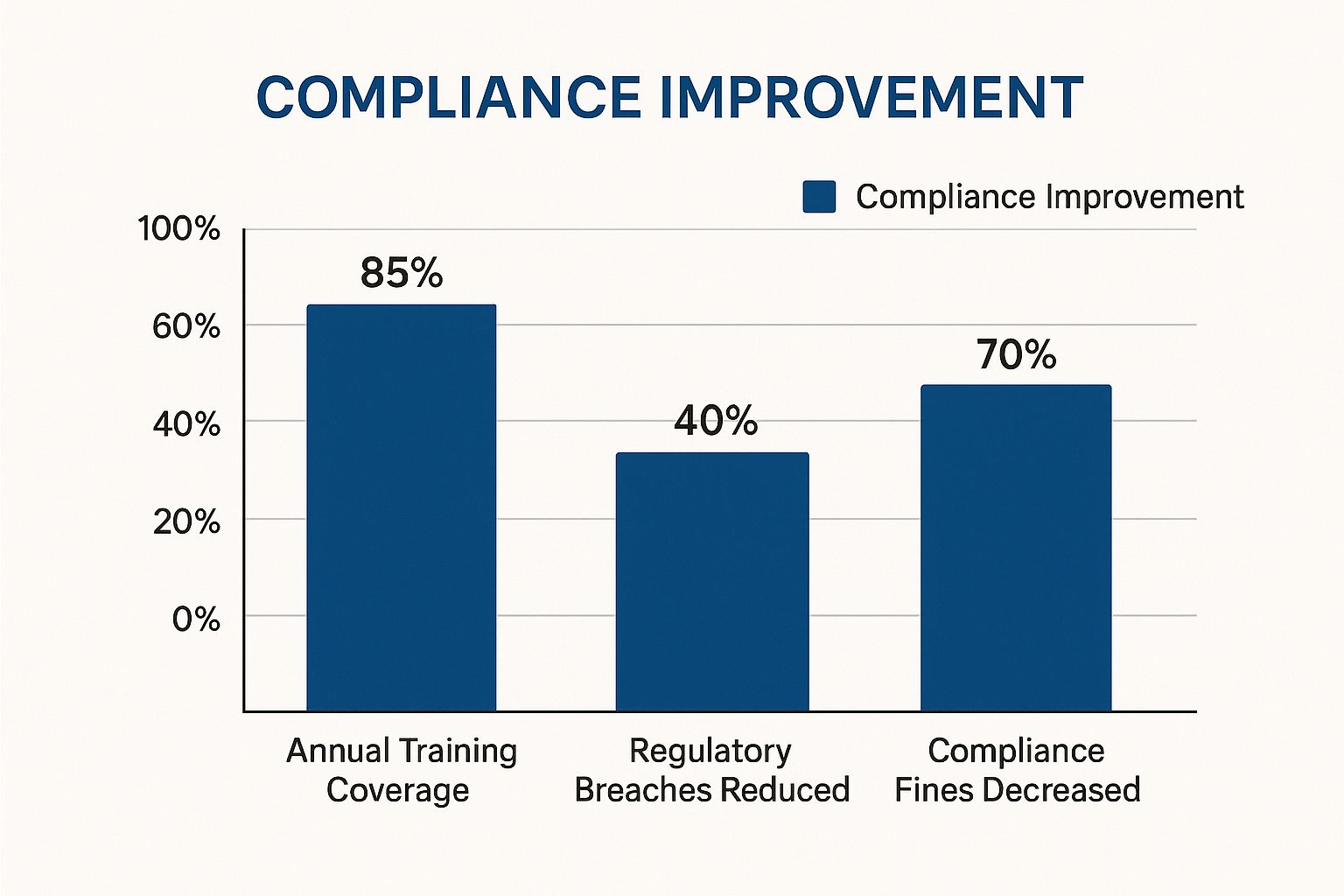

The following infographic shows the positive effects of effective compliance training:

Robust training programs can lead to 85% annual training coverage, a 40% reduction in regulatory breaches, and a 70% decrease in compliance fines. This highlights the importance of investing in high-quality bank compliance training.

To further illustrate the differences between traditional and modern approaches, let's examine the following table:

Evolution of Bank Compliance Training Methods

Comparison of traditional vs. modern compliance training approaches in banking

| Training Aspect | Traditional Approach | Modern Approach | Benefits of Modern Approach |

|---|---|---|---|

| Content Delivery | Lectures, printed materials | Online platforms, gamification, microlearning | Increased engagement, accessibility, and knowledge retention |

| Content Focus | Rules-based, theoretical | Practical application, real-world scenarios | Improved understanding and ability to apply knowledge |

| Assessment | Multiple-choice tests | Simulations, interactive exercises | More accurate assessment of competency |

| Feedback | Limited, delayed | Real-time, personalized | Facilitates continuous improvement and addresses individual needs |

| Tracking & Reporting | Manual, time-consuming | Automated, data-driven | Provides valuable insights into training effectiveness and identifies areas for improvement |

This table highlights how modern approaches offer significant advantages in engaging learners, improving comprehension, and providing valuable data for ongoing program improvement.

The Growing Importance of Compliance Training

Increasingly complex regulations and rising customer expectations demand a better approach to training. This demand fuels the growth of the global corporate compliance training market. Valued at US$6.4 billion in 2024, this market is projected to reach US$12.0 billion by 2030, growing at a 13% CAGR. This growth emphasizes compliance training's crucial role in building trust, mitigating risks, and fostering ethical conduct. More detailed statistics can be found here: Assessment of the 12 Bn Corporate Compliance Training Market

Adapting to the Evolving Landscape: A Strategic Imperative

Banks must adapt their training to these changes. This means being proactive, not just reactive. Banks should anticipate future trends. They should equip employees with the knowledge and skills to navigate the evolving compliance landscape. Integrating technologies like artificial intelligence and machine learning can personalize training and enhance the learning experience. Data analytics can identify risk areas and tailor training content to address specific vulnerabilities. This proactive, adaptable approach is essential for staying ahead and maintaining strong compliance in banking.

Building Training That Actually Works: Essential Components

Effective bank compliance training isn't something that just happens. It requires careful planning and execution. It's a blend of regulatory knowledge and practical application. This section explores the key components of successful training programs that drive real results and foster a strong compliance culture within banks.

Balancing Knowledge and Application

Successful bank compliance training programs find the right balance between regulatory knowledge and practical application. It's not enough to simply list rules and regulations. The training needs to demonstrate how these rules play out in real-world banking situations. For example, instead of just outlining the Bank Secrecy Act, show employees how to identify and report suspicious activity.

Scenario-Based Learning: Bringing Compliance to Life

Scenario-based learning is a powerful tool. It bridges the gap between theory and practice. Employees work through realistic scenarios they might face in their daily roles. This helps them gain a deeper understanding of the regulations and how to apply them effectively. This active learning method boosts engagement and knowledge retention.

Customized Training Pathways: Addressing Specific Roles

Every role in a bank has different compliance responsibilities. A teller's needs aren't the same as a loan officer's or a branch manager's. Effective training programs acknowledge this. They offer customized training pathways. This ensures everyone receives training relevant to their job. This approach maximizes effectiveness and prevents information overload.

To illustrate the different training needs across various roles, let's look at some key compliance areas:

The table below summarizes crucial compliance training topics categorized by their regulatory importance, risk mitigation potential, and recommended training frequency.

Critical Compliance Training Topics for Banking Professionals Key training areas ranked by regulatory importance and risk mitigation potential

| Training Topic | Regulatory Importance | Risk Mitigation Potential | Recommended Training Frequency |

|---|---|---|---|

| Bank Secrecy Act/Anti-Money Laundering (BSA/AML) | High | High | Quarterly/Annually |

| Know Your Customer (KYC) | High | High | Quarterly/Annually |

| Data Privacy and Security | High | High | Annually/Bi-Annually |

| Consumer Protection Laws (e.g., Fair Lending, Truth in Lending) | High | Medium | Annually |

| Fraud Prevention and Detection | Medium | High | Annually/Bi-Annually |

| Information Security Awareness | Medium | High | Annually |

| Ethics and Conduct | Medium | Medium | Annually |

This table showcases the variety of training topics and their respective importance and recommended frequency, highlighting the need for tailored programs. Focusing on these key areas will help banks build a strong compliance culture.

Designing Engaging Training

Employees are more likely to complete and retain training if it’s engaging. Ditch the dry lectures and dense manuals. Interactive elements, like quizzes, games, and simulations, can make learning fun and effective. Microlearning, using short, digestible modules, helps employees fit training into busy schedules and reinforces key concepts.

Measuring Comprehension Beyond Quizzes

Quizzes are good for assessing basic knowledge, but they don’t always show true comprehension. Simulations and case studies offer a more complete picture. These methods evaluate how employees apply knowledge in realistic situations, giving a better sense of their preparedness.

Demonstrating Training ROI

To ensure continued support and investment, it’s crucial to demonstrate the return on investment (ROI) of training. Track key performance indicators (KPIs) like reduced regulatory findings, improved customer satisfaction, and fewer compliance-related incidents. Connecting these outcomes to the training program proves its value and justifies budget allocation.

Tech-Powered Compliance: Tools That Transform Training

The era of dusty binders and generic compliance training is over. Modern banks are adopting technology to build engaging and effective training programs that significantly reduce administrative work. This shift isn't just about updating delivery; it's about fundamentally changing how employees learn and retain crucial compliance information.

AI-Powered Personalized Learning

Imagine training that adapts to each employee's individual learning needs. AI-powered learning platforms make this possible. These platforms analyze employee performance, identify knowledge gaps, and automatically adjust the training pathway.

This personalized approach ensures employees focus on areas needing the most support, maximizing learning and knowledge retention. For example, if someone struggles with anti-money laundering (AML) regulations, the platform might provide extra AML-focused modules, simulations, or resources.

Simulation Tools: Safe Practice For Complex Scenarios

Compliance isn't just about knowing rules; it's about applying them. Simulation tools offer a safe environment to practice handling complex compliance scenarios without real-world consequences. This helps employees develop critical thinking skills and builds confidence in navigating challenging situations.

Think of it like a flight simulator for pilots. It allows practicing emergency procedures without risk. Similarly, compliance simulations let bank employees hone skills and make better decisions under pressure.

Data Analytics: Identifying Risk Before It Becomes a Problem

One essential component of modern bank compliance training is incorporating video content. Learn how to create training videos that are both informative and engaging. Beyond training delivery, technology is vital in measuring program effectiveness and identifying potential risk areas. Data analytics tracks employee performance, identifies trends, and highlights areas where compliance knowledge is weak.

This allows compliance leaders to proactively address vulnerabilities before they become regulatory breaches or fines. This data-driven approach provides valuable insights for improving training content and delivery.

Practical Implementation and ROI

Adopting new technologies doesn't have to be expensive. Many solutions offer flexible pricing and integration options that fit within realistic budgets. The key is focusing on technologies that deliver genuine ROI.

While flashy presentations might impress, true value lies in solutions that demonstrably improve compliance knowledge, reduce risk, and enhance overall business performance. A survey found that 49% of respondents use technology for 11 or more compliance activities. Training is a crucial component, utilized by 82% of respondents. This highlights the efficiency technology brings to compliance management. Find more detailed statistics here.

You might be interested in: How to master banking compliance software. By focusing on practical implementation, measurable results, and employee-centric design, banks can transform compliance training from a burden into a strategic advantage. This not only protects the institution but also empowers employees to make informed decisions contributing to a stronger, more compliant organization.

Global Compliance Navigation: Training Across Borders

For banks operating internationally, compliance training presents unique challenges. Navigating various regulatory frameworks, often with conflicting requirements, adds complexity. This section explores how leading institutions develop training programs that address these diverse rules effectively.

Managing Multi-Jurisdictional Requirements

One of the biggest hurdles is managing the diverse compliance requirements across different jurisdictions. This complexity can create confusion and inconsistencies in training, potentially increasing the risk of regulatory breaches. A clear strategy for managing these multi-jurisdictional requirements is crucial.

This often involves developing a core curriculum that covers fundamental compliance principles. These principles should be applicable across all operating regions, establishing a baseline understanding of ethical conduct and risk management.

Balancing Global Standardization and Local Adaptation

A standardized core curriculum provides a solid foundation. However, adapting training to local laws and regulations is equally important. This requires a careful balance between global standardization and local adaptation.

For example, Anti-Money Laundering (AML) regulations may have variations in different countries. Training must reflect these nuances to ensure compliance.

Navigating Regulatory Gray Areas

The intersection of different legal frameworks often creates regulatory gray areas. Preparing employees to handle these uncertainties confidently is key. This may involve using case studies, simulations, or expert-led discussions. These methods can help explore how to analyze and respond to ambiguous situations ethically and compliantly.

For organizations operating across borders, incorporating global perspectives is crucial. Consider resources like: Global Leadership Training

Overcoming Cultural and Language Barriers

Delivering consistent training across diverse cultural and linguistic backgrounds presents another set of challenges. Successful banks address this by translating training materials. They also adapt content to resonate with local customs and practices. This localization goes beyond simple translation and considers cultural nuances for effective communication.

Furthermore, it’s important to consider time zone differences when scheduling training sessions. Offering flexible delivery methods maximizes accessibility for global teams.

In recent years, banking regulations have increasingly focused on global alignment and sustainability. Organizations like the Financial Stability Board (FSB) and the Basel Committee work towards harmonizing standards. This is particularly true for capital adequacy and AML/CTF rules. This push for international coordination requires banks to invest in compliance technology. They must also dedicate teams to monitor the changing global landscape. Explore this topic further: Learn more about bank regulatory trends.

Building a Consistent Compliance Culture

Despite the complexities of international operations, maintaining a consistent compliance culture is essential. This means fostering a shared understanding of compliance principles, values, and expectations. This shared understanding should span all locations and departments.

Open communication is vital for encouraging employees to raise compliance concerns. It also allows them to report potential violations and seek guidance when navigating unfamiliar regulatory territory. A robust, global compliance culture ensures ethical and responsible operations, regardless of location. This safeguards the bank’s reputation and protects it from potential legal and financial risks.

Proving Your Training Works: Measurement That Matters

Successfully implementing bank compliance training involves more than just checking off completion boxes. It requires demonstrating that the training leads to real behavioral changes and a stronger compliance culture. This means shifting the focus from mere participation to measuring the actual impact and demonstrating a return on investment.

Beyond Completion Rates: KPIs That Truly Matter

While tracking completion rates is a starting point, it doesn’t tell the whole story. Leading banks are now focusing on key performance indicators (KPIs) that genuinely reflect training effectiveness.

This includes analyzing metrics like a reduction in regulatory findings, fewer compliance-related incidents, and a decrease in customer complaints tied to compliance issues. These quantifiable results demonstrate the direct impact of training on mitigating risk.

For example, if a bank sees a 20% decrease in suspicious activity reports (SARs) filed incorrectly after implementing enhanced Anti-Money Laundering (AML) training, that’s a clear sign of improved employee understanding and application of the training material.

Assessment Techniques: Actionable Insights, Not Just Documentation

Effective assessment goes beyond simple multiple-choice quizzes. Incorporating practical exercises, simulations, and case studies allows for a more thorough evaluation of how well employees can apply their knowledge to real-world situations.

Additionally, gathering feedback through surveys and post-training evaluations provides valuable insights into the training program’s strengths and weaknesses. This data can then be used to refine content and improve future training initiatives.

This means training becomes a continuous improvement process, adapting and evolving to meet the organization's changing needs and the regulatory landscape. This approach provides actionable insights, not just documentation for regulators. It fosters a culture of continuous learning.

Connecting Training to Risk Reduction and Business Performance

Successful compliance leaders understand that training is an investment, not just a cost. They effectively link training outcomes directly to risk reduction and improved business performance. This data provides a compelling argument for securing executive buy-in and budget for ongoing training and development.

You might be interested in: Learn more in our article about regulatory compliance for banks. By showcasing how training contributes to a stronger bottom line, compliance becomes a strategic asset, not just an operational expense.

Demonstrating Training ROI: Frameworks for Success

Even when measuring intangible benefits is challenging, frameworks exist for demonstrating training ROI. One approach is calculating the potential cost savings from avoiding compliance violations. This could involve estimating the fines and legal fees that could have been incurred without effective training.

Additionally, tracking improvements in customer satisfaction related to compliance processes, such as faster account openings or smoother loan applications, can highlight the tangible business benefits of investing in training.

Building a Culture of Compliance: Sustaining Long-Term Impact

Training is most effective when it’s part of a broader strategy for building a strong compliance culture. This involves ongoing communication, reinforcement of key principles, and creating an environment where compliance is valued.

This also means encouraging employees to seek guidance and raise concerns. When compliance is everyone's responsibility, it becomes ingrained in the organization’s DNA, leading to lasting behavioral change and sustainable risk reduction.

Creating a Compliance Culture: Beyond the Training Module

Successfully navigating the complexities of bank compliance isn't simply about completing annual training. It's about fostering a compliance culture woven into every decision and action. This section explores building this culture, transforming compliance from a chore into a source of pride and a competitive edge.

Extending Learning Beyond Formal Sessions

Traditional annual training, while necessary, often fails to maintain year-round compliance awareness. Microlearning, delivered in short, engaging bursts, reinforces key principles in digestible portions. For example, a five-minute video on updated Know Your Customer (KYC) requirements or a quick data privacy quiz can regularly refresh employee knowledge. This keeps compliance top-of-mind.

Integrating compliance into daily operations and team meetings creates a continuous learning environment. This might involve discussing regulatory updates, analyzing real-world compliance scenarios, or sharing best practices. These discussions normalize compliance as a vital part of the workflow.

Peer Recognition and Leadership Modeling

Recognizing employees who exemplify compliance fosters a positive connection with adherence. This could be a formal awards program or an informal shout-out during a team meeting. Celebrating success stories motivates others and reinforces compliance's importance.

Leadership plays a vital role in shaping a compliance culture. When senior management actively champions compliance, participates in training, and visibly follows regulations, it sets a powerful example. This leadership modeling shows that compliance isn't just for junior staff.

Practical Strategies for Different Organizational Levels

Implementing these strategies requires a tailored approach. Frontline staff benefit from practical examples and clear guidelines for their daily tasks. Management needs a deeper understanding of risk assessment and compliance strategy. Executives should focus on the long-term impact of compliance on the bank's reputation and financial health.

| Organizational Level | Strategies |

|---|---|

| Frontline Staff | Microlearning modules, job-specific scenarios, peer recognition programs |

| Management | Risk assessment workshops, case studies, leadership training on compliance |

| Executives | Strategic compliance planning, industry benchmarking, board-level reporting |

Tailoring the approach allows banks to create a compliance culture that permeates all levels. Learn more in our guide on community-wide engagement.

Overcoming Resistance to Change

Creating a comprehensive compliance culture may encounter resistance. Some employees might see it as extra work. Addressing these concerns proactively is crucial. This could involve highlighting compliance's positive impact on the bank's reputation and long-term success.

It also means demonstrating how a strong compliance culture reduces regulatory fines and legal issues, benefiting everyone. Clearly communicating the benefits and providing support fosters buy-in. This creates a shared understanding that compliance enables sustainable business practices.

Visbanking empowers your institution to build a robust compliance culture through data-driven insights. Our platform helps you stay ahead of regulatory changes, identify potential risks, and foster proactive compliance. Visit Visbanking today to transform compliance into a strategic advantage.