US Bank Call Reports

Citizens Bank of Cumberland County, Inc. Reports – 2921622

Alpine Capital Bank Reports – 2889227

Four Corners Community Bank Reports – 2855866

Chino Commercial Bank, N.A. Reports – 2925620

Bank of Oak Ridge Reports – 2903123

Bank of Brookhaven Reports – 2877831

Five Star Bank Reports – 2867337

OptimumBank Reports – 2953418

Oak Bank Reports – 2857600

United National Bank Reports – 2914727

American Community Bank & Trust Reports – 2869162

Liberty Bank, National Association Reports – 2907439

Branson Bank Reports – 2861317

Yampa Valley Bank Reports – 2806635

FinWise Bank Reports – 2880019

TriStar Bank Reports – 2871099

Georgia Community Bank Reports – 2823221

Alamerica Bank Reports – 2877484

BankVista Reports – 2849285

The MassMutual Trust Company Reports – 2881445

Southern First Bank Reports – 2849801

United Trust Bank Reports – 2949970

Great American Bank Reports – 2815879

SEI Private Trust Company Reports – 2973386

Cornerstone Bank Reports – 2850768

Capital Bank, National Association Reports – 2808602

Freedom Bank of Southern Missouri Reports – 2835103

Blue Ridge Bank, National Association Reports – 233527

Twin City Bank Reports – 2905761

OPTUS Bank Reports – 2794732

Largest U.S. Credit Unions by Asset Size in 2025

In 2025, U.S. credit unions are experiencing substantial growth, driven by their member-focused ethos and adaptability to the evolving financial landscape. These institutions showcase financial resilience by leveraging technological advancements and community-centered values, outperforming traditional banks in various metrics. A global perspective highlights the influence of ethical banking and community…

Visbanking Unveils Interactive Quarterly Banking Profile, Available One Month Ahead of FDIC Release

Oklahoma City, OK – Visbanking, a leader in banking intelligence, proudly announces the launch of its Quarterly Bank Performance Report (QBP), a game-changing resource providing banking industry insights one month ahead of the Federal Deposit Insurance Corporation (FDIC) data release. Spearheaded by Eda Mamus, this initiative reinforces Visbanking’s dedication to…

List of Credit Unions in the United States

Credit unions in the United States stand out in the financial landscape with their unique member-owned structure and not-for-profit status. They offer competitive financial services, emphasizing higher savings rates and lower loan rates compared to traditional banks. This comprehensive overview delves into the operational dynamics, benefits, and challenges faced by…

The world’s largest banks by assets, 2025

The global banking landscape is shaped by the world's largest financial institutions, whose sheer scale is measured by their vast asset portfolios. These banks play a crucial role in economic facilitation and growth through their diverse offerings in commercial, investment, and wealth management services. As we analyze the trends and…

Where can i find bank call reports?

Navigating the FFIEC Call Report System offers vital insights into the financial health of U.S. banks by providing detailed data on assets, liabilities, income, and expenses. It is indispensable for regulators, analysts, and investors aiming to assess banking performance and compliance. By understanding the structure and tools such as the…

Banking Market Reports 2024

The banking sector in 2024 is marked by a wave of innovation and transformation driven by advanced technologies such as artificial intelligence, blockchain, and quantum computing. As these technologies redefine traditional practices, banks are set to focus on personalized customer experiences through data analytics and machine learning. The rise of…

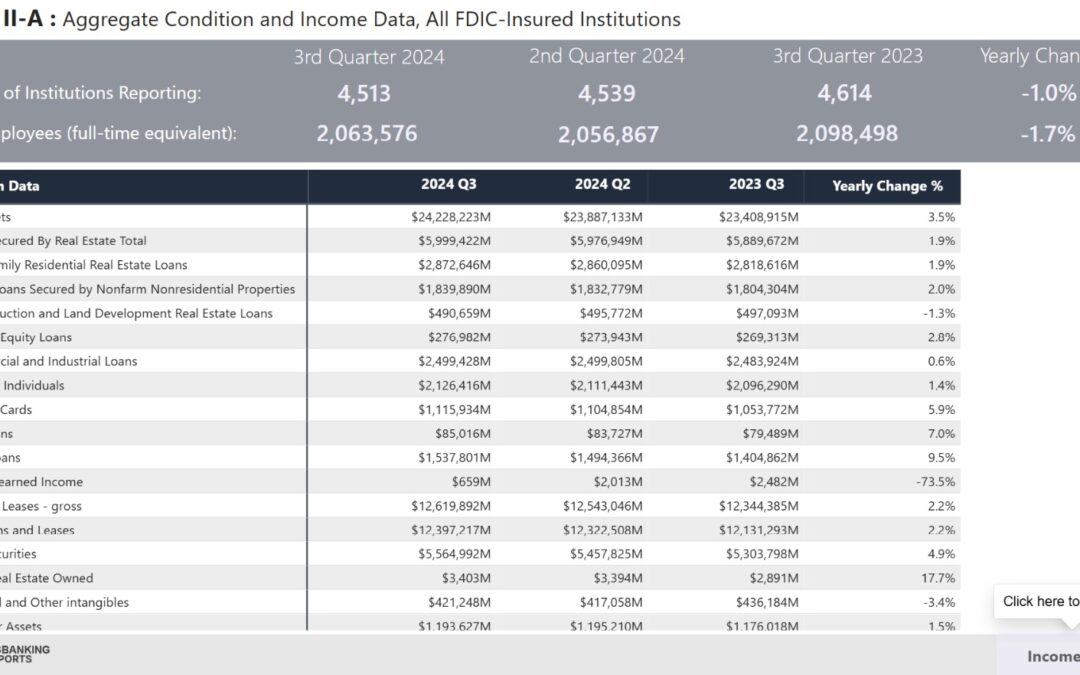

FDIC Quarterly Banking Profile 4570 Banks Reported

The FDIC Quarterly Banking Profile provides a critical analysis of the U.S. banking sector's health, evaluating data from 4,570 banks. This report highlights key financial metrics such as asset quality, profitability, and capital adequacy. The current landscape reveals significant challenges, with unrealized losses surging to $517 billion in Q1, largely…

Empowering Banks with Visbanking’s Enterprise Solution: Performance, Prospects, and Talent Insights

Key Takeaway Visbanking empowers businesses and banks with cutting-edge tools for performance analysis, prospect outreach, talent acquisition, and data-driven decision-making. With a robust suite of features including financial insights, people search, and bespoke consulting, Visbanking is the ultimate solution for organizations aiming to thrive in a competitive banking landscape. Table…

Bank Categories by Asset Size

In the banking industry, understanding bank categories by asset size is crucial for assessing financial health, market influence, and regulatory compliance, impacting stakeholders from policymakers to investors. These classifications, ranging from community banks to large international institutions, guide not only regulatory frameworks but also strategic decisions, risk management, and service…

Impact of Interest Rates on Bank Profitability in 2024

The anticipated gradual increase in interest rates in 2024 is set to significantly impact the banking industry across various dimensions. While higher rates tend to boost banks' net interest margins, they also present challenges such as decreased loan demand and heightened credit risks. To navigate these changes effectively, banks can…