US Bank Call Reports

Column National Association Reports – 3435948

Heritage Bank & Trust Reports – 3429219

BMO Harris Central National Association Reports – 3353154

Town Center Bank Reports – 3459216

Bridgewater Bank Reports – 3378773

Sallie Mae Bank Reports – 3394278

Belmont Bank & Trust Company Reports – 3391718

First Freedom Bank Reports – 3437148

Bank of Lexington, Inc. Reports – 3410141

Triad Bank Reports – 3374382

CenTrust Bank, National Association Reports – 3377235

NewBank Reports – 3472859

Oakstar Bank Reports – 3374412

First Vision Bank of Tennessee Reports – 3350658

Bank of Belleville Reports – 3374403

LCA Bank Corporation Reports – 3407084

HSBC Trust Company (Delaware), National Association Reports – 3357620

Flagship Bank Reports – 3404999

Esquire Bank, National Association Reports – 3447820

Merchants Commercial Bank Reports – 3487433

NobleBank & Trust Reports – 3385744

Metro City Bank Reports – 3437456

Riverland Bank Reports – 3374234

Signature Bank of Georgia Reports – 3390627

Idaho First Bank Reports – 3384952

Fresno First Bank Reports – 3398623

SouthPoint Bank Reports – 3386536

Austin Capital Bank SSB Reports – 3347911

Putnam 1st Mercantile Bank Reports – 3393851

Connections Bank Reports – 3357947

Visbanking Unveils Interactive Quarterly Banking Profile, Available One Month Ahead of FDIC Release

Oklahoma City, OK – Visbanking, a leader in banking intelligence, proudly announces the launch of its Quarterly Bank Performance Report (QBP), a game-changing resource providing banking industry insights one month ahead of the Federal Deposit Insurance Corporation (FDIC) data release. Spearheaded by Eda Mamus, this initiative reinforces Visbanking’s dedication to…

List of Credit Unions in the United States

Credit unions in the United States stand out in the financial landscape with their unique member-owned structure and not-for-profit status. They offer competitive financial services, emphasizing higher savings rates and lower loan rates compared to traditional banks. This comprehensive overview delves into the operational dynamics, benefits, and challenges faced by…

The world’s largest banks by assets, 2025

The global banking landscape is shaped by the world's largest financial institutions, whose sheer scale is measured by their vast asset portfolios. These banks play a crucial role in economic facilitation and growth through their diverse offerings in commercial, investment, and wealth management services. As we analyze the trends and…

Where can i find bank call reports?

Navigating the FFIEC Call Report System offers vital insights into the financial health of U.S. banks by providing detailed data on assets, liabilities, income, and expenses. It is indispensable for regulators, analysts, and investors aiming to assess banking performance and compliance. By understanding the structure and tools such as the…

Banking Market Reports 2024

The banking sector in 2024 is marked by a wave of innovation and transformation driven by advanced technologies such as artificial intelligence, blockchain, and quantum computing. As these technologies redefine traditional practices, banks are set to focus on personalized customer experiences through data analytics and machine learning. The rise of…

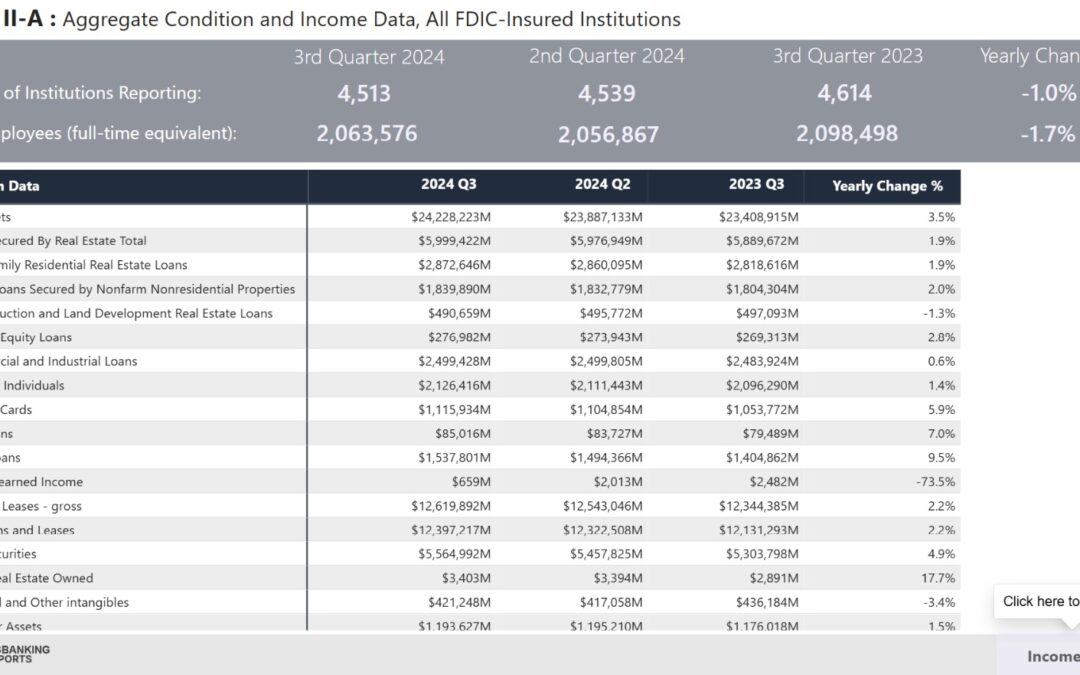

FDIC Quarterly Banking Profile 4570 Banks Reported

The FDIC Quarterly Banking Profile provides a critical analysis of the U.S. banking sector's health, evaluating data from 4,570 banks. This report highlights key financial metrics such as asset quality, profitability, and capital adequacy. The current landscape reveals significant challenges, with unrealized losses surging to $517 billion in Q1, largely…

Empowering Banks with Visbanking’s Enterprise Solution: Performance, Prospects, and Talent Insights

Key Takeaway Visbanking empowers businesses and banks with cutting-edge tools for performance analysis, prospect outreach, talent acquisition, and data-driven decision-making. With a robust suite of features including financial insights, people search, and bespoke consulting, Visbanking is the ultimate solution for organizations aiming to thrive in a competitive banking landscape. Table…

Bank Categories by Asset Size

In the banking industry, understanding bank categories by asset size is crucial for assessing financial health, market influence, and regulatory compliance, impacting stakeholders from policymakers to investors. These classifications, ranging from community banks to large international institutions, guide not only regulatory frameworks but also strategic decisions, risk management, and service…

Impact of Interest Rates on Bank Profitability in 2024

The anticipated gradual increase in interest rates in 2024 is set to significantly impact the banking industry across various dimensions. While higher rates tend to boost banks' net interest margins, they also present challenges such as decreased loan demand and heightened credit risks. To navigate these changes effectively, banks can…

What does FDIC insured mean?

FDIC insurance is a vital component of the U.S. banking system, providing a safeguard for depositors by insuring their funds in member banks. Established to bolster banking confidence, it covers specific deposit accounts up to $250,000 per depositor, per insured bank, with extended coverage for joint accounts. While primarily available…