By: Ken Chase.

Estimated reading time: 2 minutes

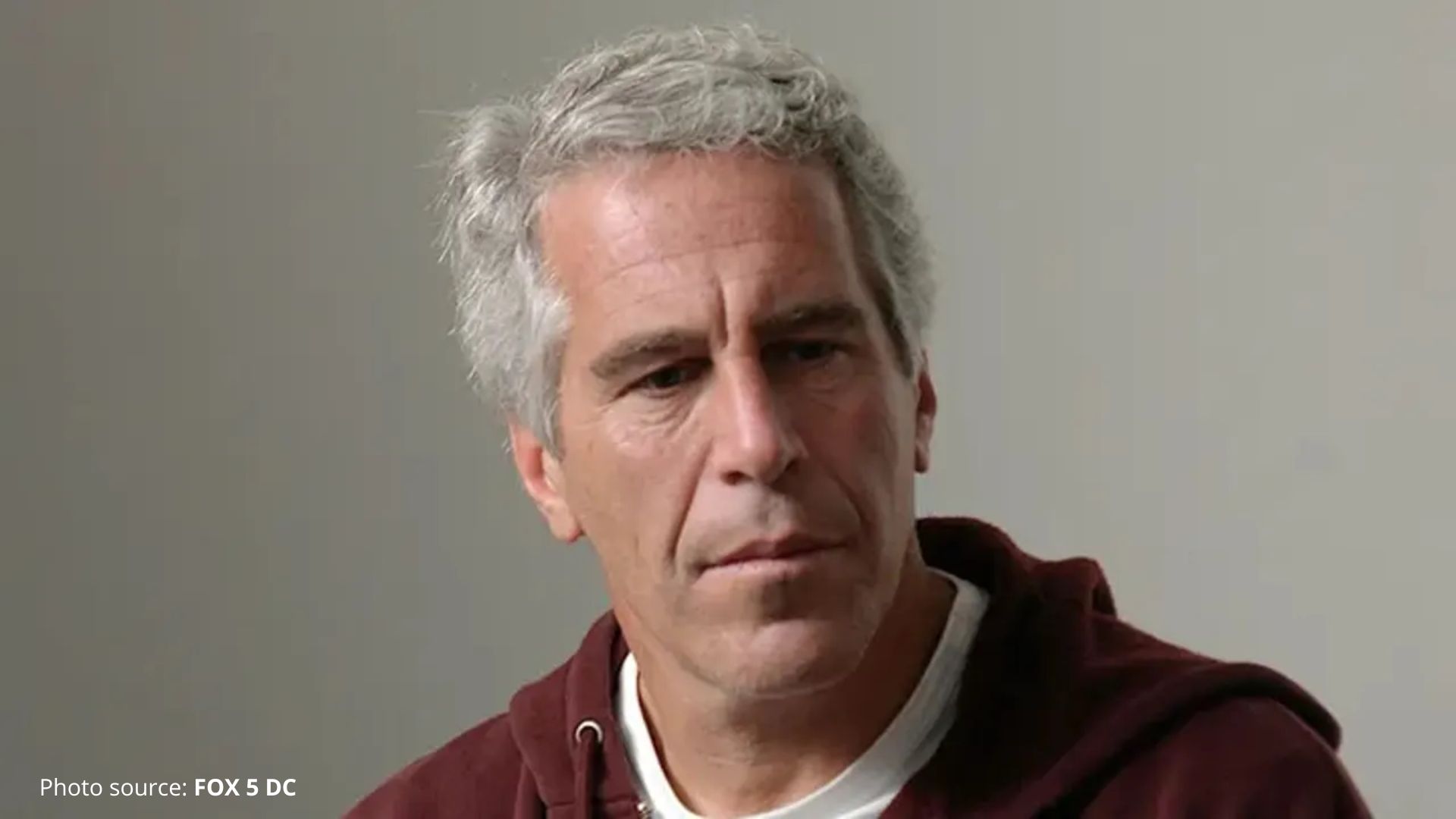

JPMorgan Chase and Deutsche bank are reportedly being sued by women who allege that the financial firms provided sexual abuser Jeffrey Epstein with financial support that enabled his international sex trafficking operation. The women, who claim to be victims of Epstein’s abuse, filed two lawsuits in the Southern District of New York late last week.

In the Deutsche Bank suit, the plaintiffs’ lawyer argued that “Epstein’s sex-trafficking venture was not possible without the assistance and complicity of a financial institution—specifically, a banking institution—which provided his operation with an appearance of legitimacy and special treatment to the sex-trafficking venture, thereby ensuring its continued operation and sexual abuse and sex-trafficking of young women and girls.”

The suits claim that the banks’ actions violate provisions of the Racketeering Influenced and Corrupt Organizations Act (RICO). That law has traditionally been used to prosecute organized criminal enterprises.

JPMorgan Chase representatives reportedly offered no comment to the Wall Street Journal when asked about the suits. For their part, however, Deutsche Bank issued a statement that cited the bank’s belief that the suits lacked merit. Deutsche Bank vowed to contest the plaintiffs’ claims in court.

The filings come five months after one of the firm’s shareholders was permitted to sue the bank for allegedly hiding its business with clients like Jeffrey Epstein. A Manhattan federal judge approved that lawsuit in June.

Epstein and associate Ghislaine Maxwell were charged with conducting a sex trafficking ring that recruited and groomed minor girls for more than a decade. Maxwell was tried and sentenced to a 20 year sentence for her part in the operation. Epstein died in his cell in 2019, prior to his trial.