POST-MORTEM ON FIRST REPUBLIC FAILURE

COVID-19 & government stimulus

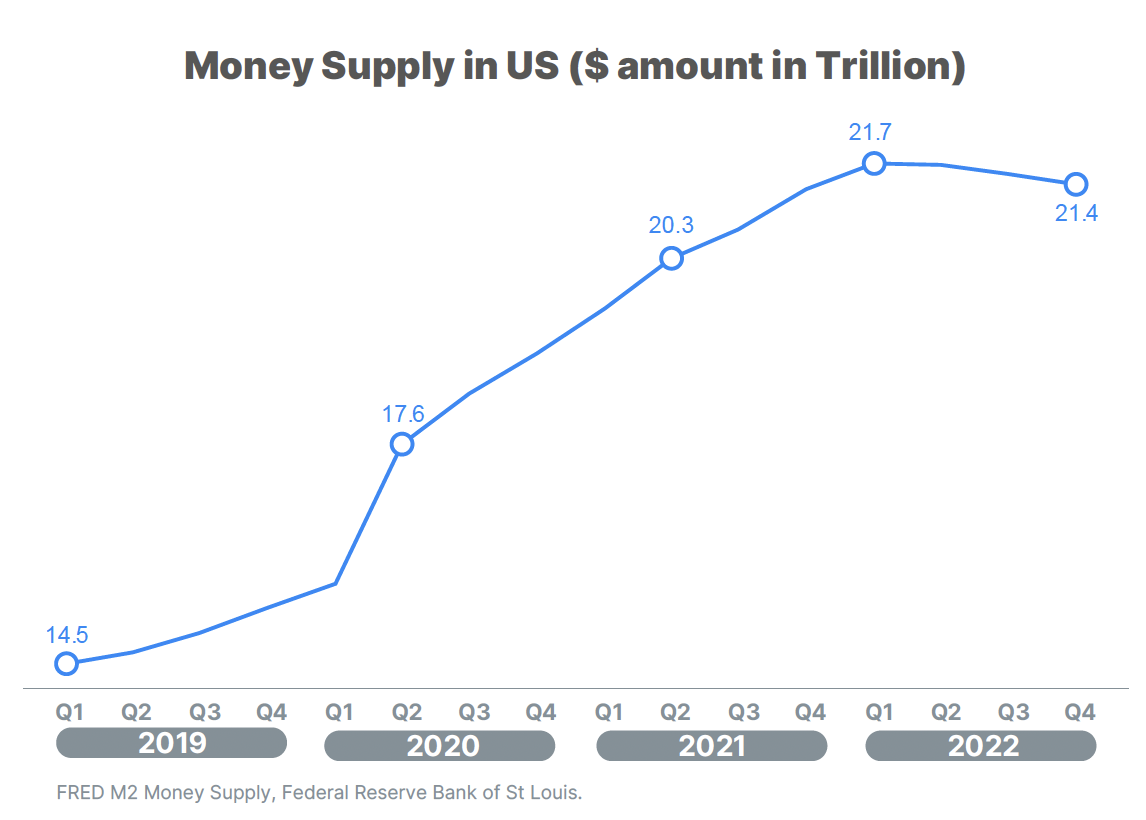

In reaction to the COVID-19 pandemic, the United States government pursued policy of dramatically increasing the money supply in the United States. As seen in this graph (left), this increased the money supply from just over $15T in 2019 to over $21T in 2022. The injection of this liquidity, combined with the eventual increase in inflation and subsequent interest rate increases, set into motion the course of events which led to First Republic’s demise. The $6T of additional money supply was created in such a shortened time horizon which had never been seen in the history of US Monetary Policy.

Bank Balance Sheets Ballooned

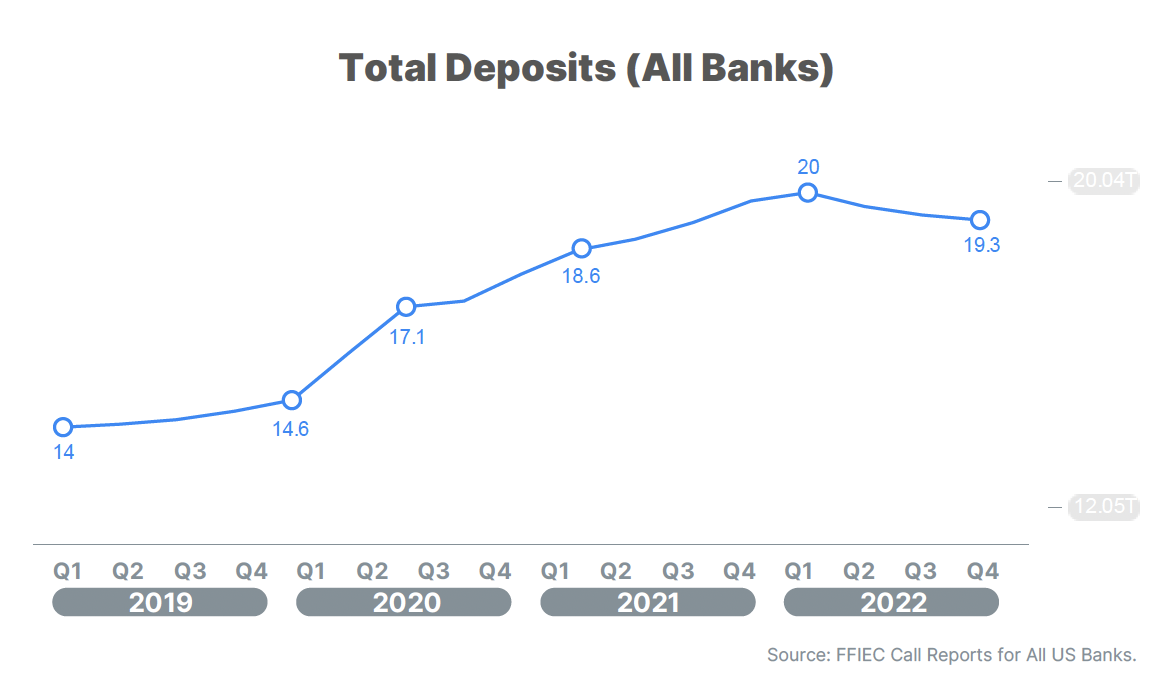

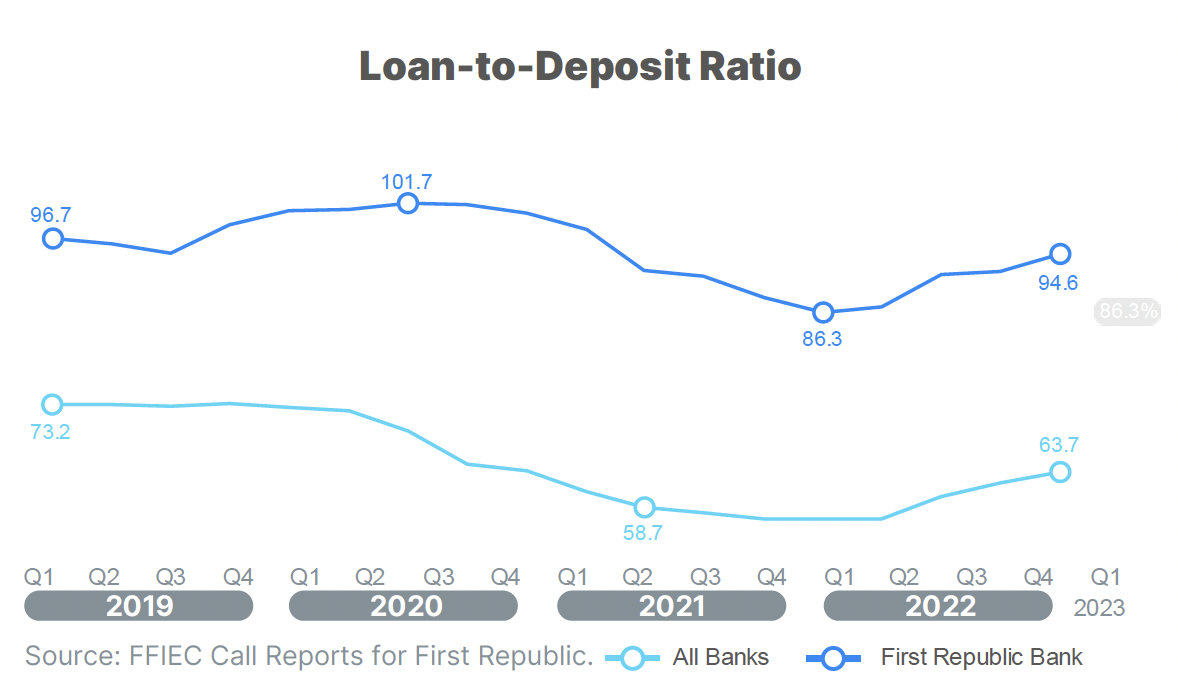

With this dramatic increase in the money supply, the dollars flowed into the banking system with the entire $6T reaching the deposit base of US banks. Total deposits of all banks was a bit over $14T in 2019 and reached a peak of $20T in 2022. In the face of modest economic activity, combined with the corporate and consumer balance sheets which ballooned due to government stimulus payments, loan demand was stagnant. Banks were seeking opportunities to deploy these surplus deposits. In the face of stagnant loan demand, it was difficult to deploy these deposits into traditional earning assets. The industry average for Loan-to-Deposit ratio reach a low in Q1’2022 of 64.1%.

More Than Its Fair Share

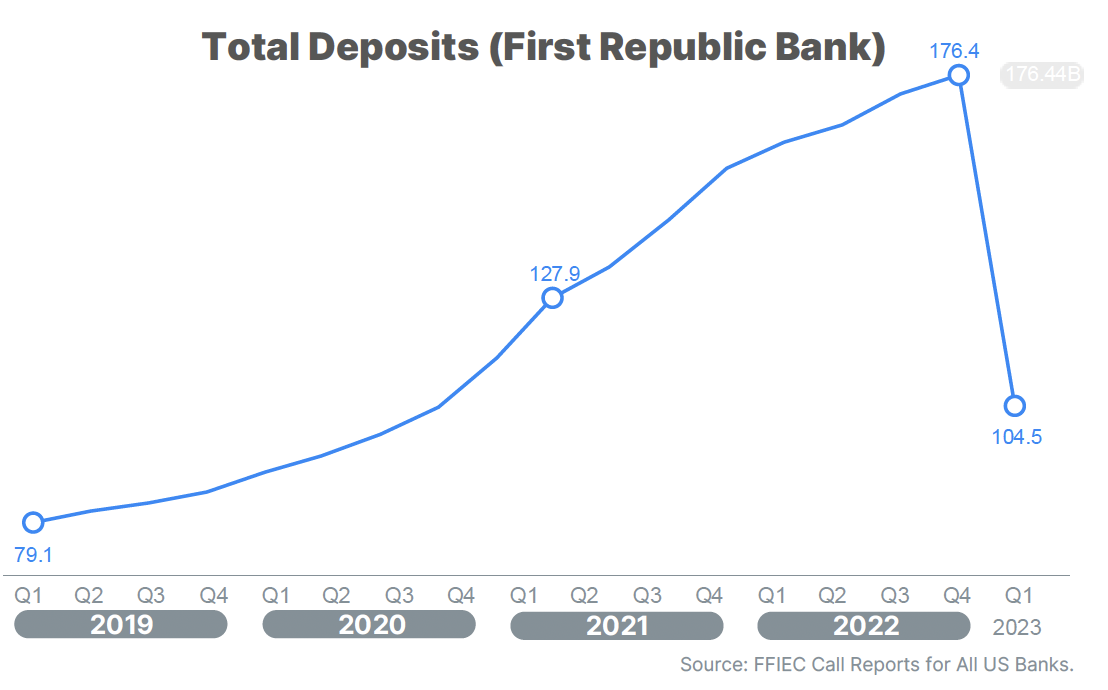

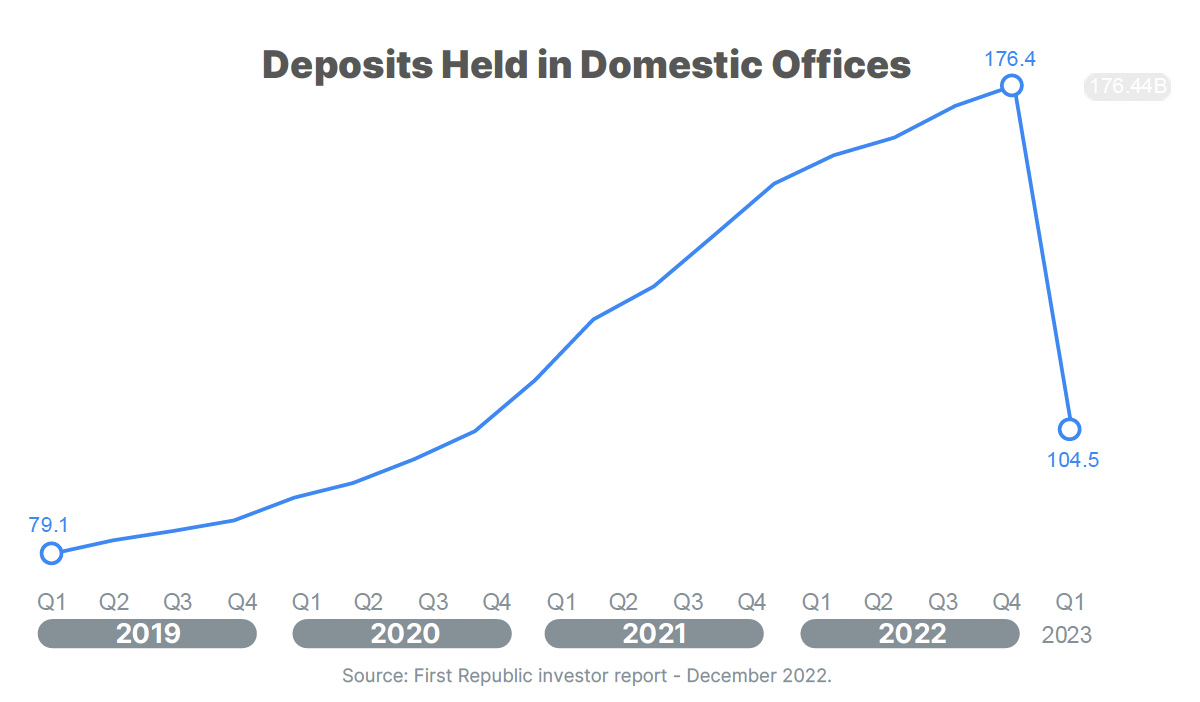

While the deposits across the industry were up dramatically, First Republic gained more than its fair share of deposits. Thanks to a customer base that had disproportionately more disposable income (high net worth segment), First Republic grew their deposit base from ~$79B in 2019 to over $176B at the end of 2022. This 100% growth over less than 3 years provided the gunpowder that would eventually cause quite an explosion.

Gotta Put It Somewhere

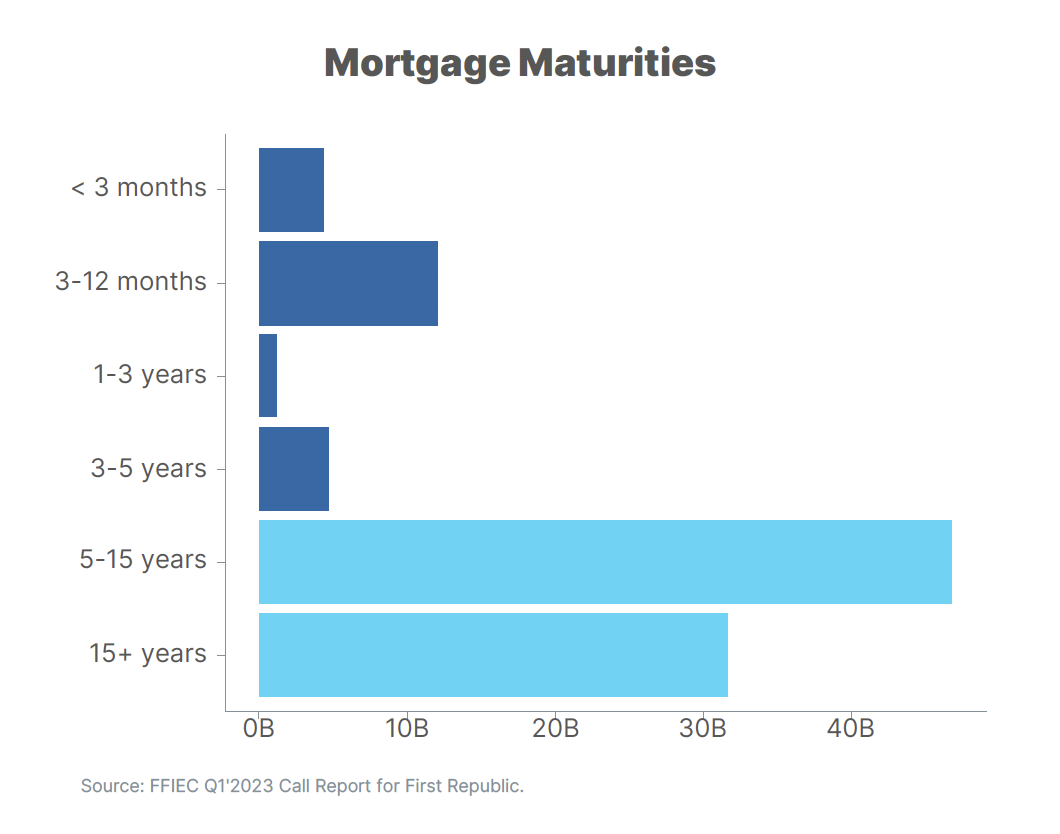

It was not the increase in deposits alone that led to First Republic’s demise. It was the decision-making that bank leadership took to deploy these deposits into long-term mortgages that led to their downfall. As seen in this chart (right), unlike their peers at Silicon Valley Bank, First Republic did not deploy their deposits primarily into Marketable Securities. Instead, they marketed residential mortgage products to their high-net-worth retail customers. With the ability to originate jumbo loans and with activity in the housing market being robust, First Republic originated long-term mortgages and held them on balance sheet. The inability to move these mortgages off balance sheet is primarily driven by the non-conforming nature of these loan products. Non-conforming loans will not be purchased by the government agency lenders like Fannie Mae, Freddie Mac, GNMA and HUD. As time went on in 2022 and the Federal Reserve pursued the most rapid series of interest rate hikes in recent times, these mortgages were not able to be moved off balance sheet since their interest rate yield was at a discount to current mortgage yields.

We are doing what we have always done

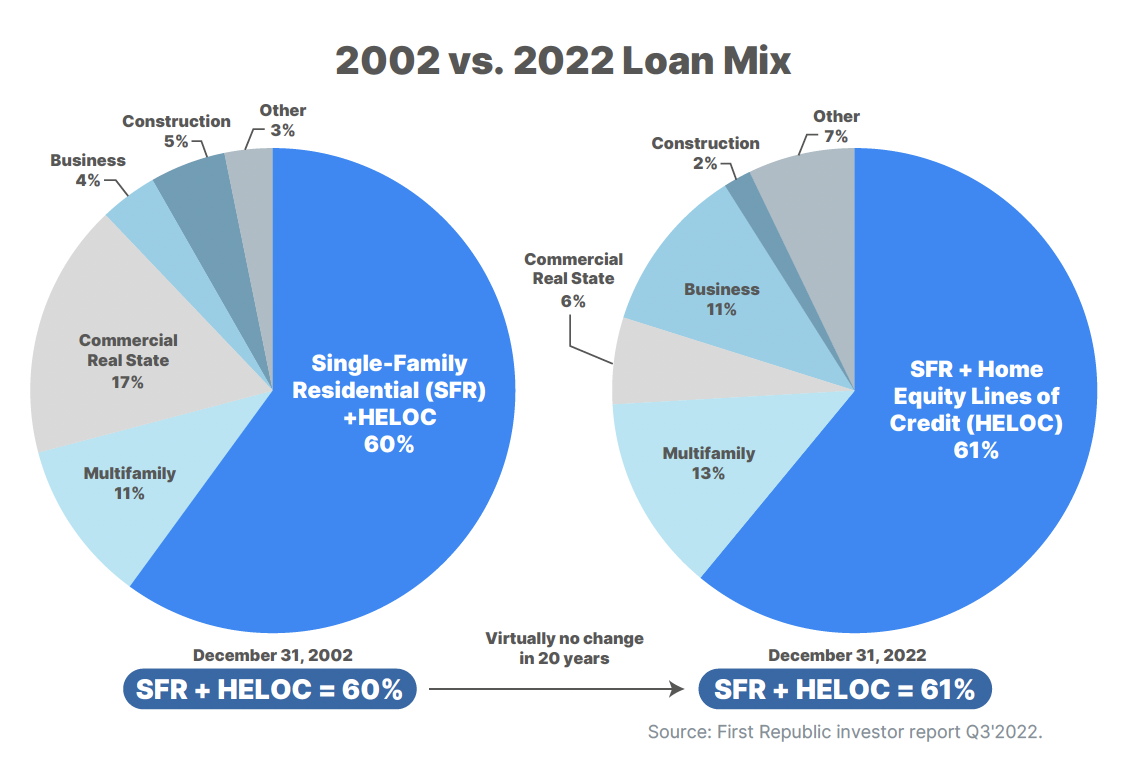

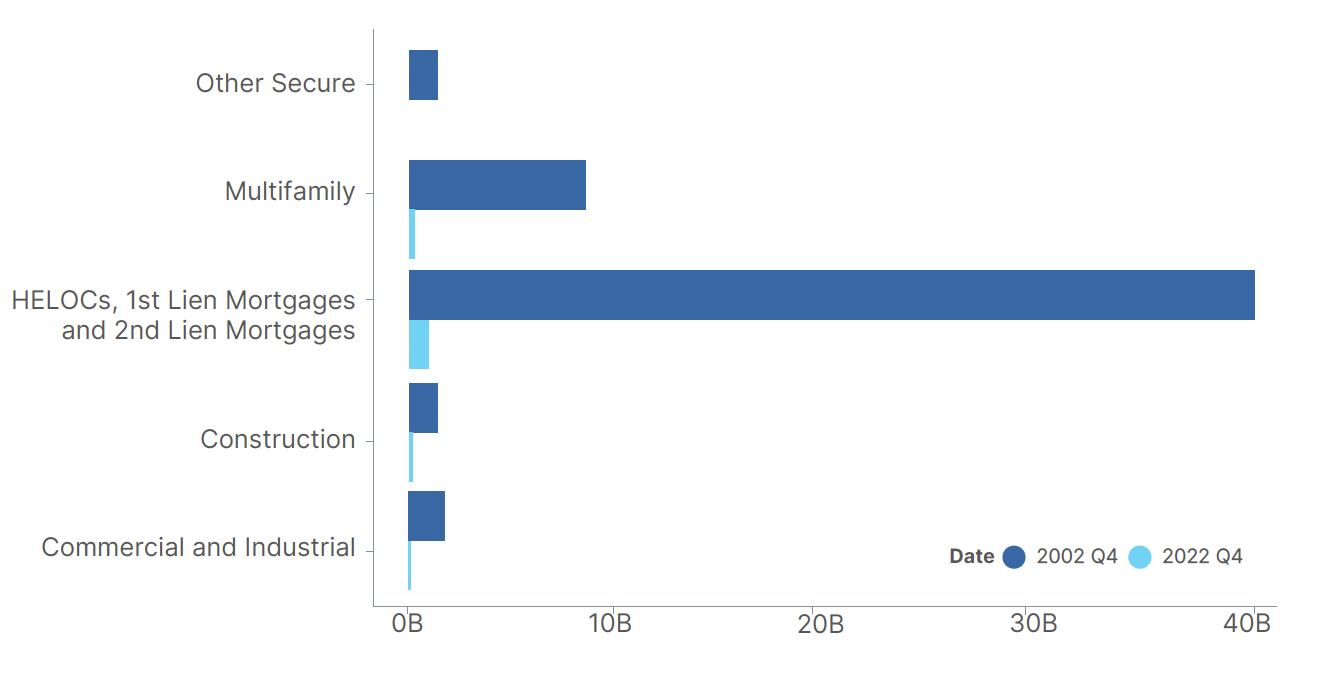

One of the more curious artefacts available for examination in the First Republic Bank saga is the chart on page 14 (of 53) in the Q3’2022 Investor Presentation (top left). This page uses two pie charts to draw an equivalency between the loan portfolio of First Republic in 2002 and 2022. To state it plainly, this page in the investor presentation was at a minimum misleading and at worst it was deceiving. While the percentages may be similar, the magnitude of the pie is completely dissimilar. Despite having similar percentage breakdowns between the various classifications of loans, the scale and magnitude of the portfolio alone should prevent anyone from drawing comparisons. (Did we mention how much we hate pie charts?) As you can see clearly from the bar chart (top right), the loan portfolio ballooned from 2002 to 2022 and was primarily concentrated in Residential Mortgages (HELOCs, 1st and 2nd lien Mortgages). This portfolio design flew in the face of prudent risk management both from interest rate risk and maturity/duration risk. The bank was truly swimming naked and unfortunately the tide went out quickly in 2022.

Don’t fly too close to the sun

First Republic managed their liquidity by adjusting their loan origination based on the available deposits. Relative to the average of all other banks, First Republic had a proclivity to “run hot” with typical loan-to-deposit ratios in the high 80’s to even over 100%. This is an aggressive approach to lending that seeks to maximize yield while sacrificing liquidity. The willful decision to run at this higher loan-to-deposit ratio pleased investors with higher returns on assets but did not leave much room for error. As Buffet has said, “When the tide goes out, we see who is swimming naked.” That is exactly what we saw when the illiquidity of the loan portfolio was combined with historic withdrawals of deposits.

Running to the exits

When the interest rate hikes had taken full effect by the end of 2022, many customers and bank investors grew wise to the new reality that was haunting bank balance sheets. Longer-duration assets like >30-day Marketable Securities and Mortgages which were originated in a vastly lower interest rate environment, subjected banks to significant liquidity risks due to a mismatch in the maturity of the assets (securities, mortgages) and liabilities (deposits). Many of these banks were primarily funded by demand deposits, money-markets and short-term CDs. To exacerbate the issue, 68% of First Republic’s total deposits were beyond the $250,000 level of FDIC deposit insurance. With customers smelling something fishy and being fearful of losing their uninsured deposits, many began to withdraw deposits from First Republic.

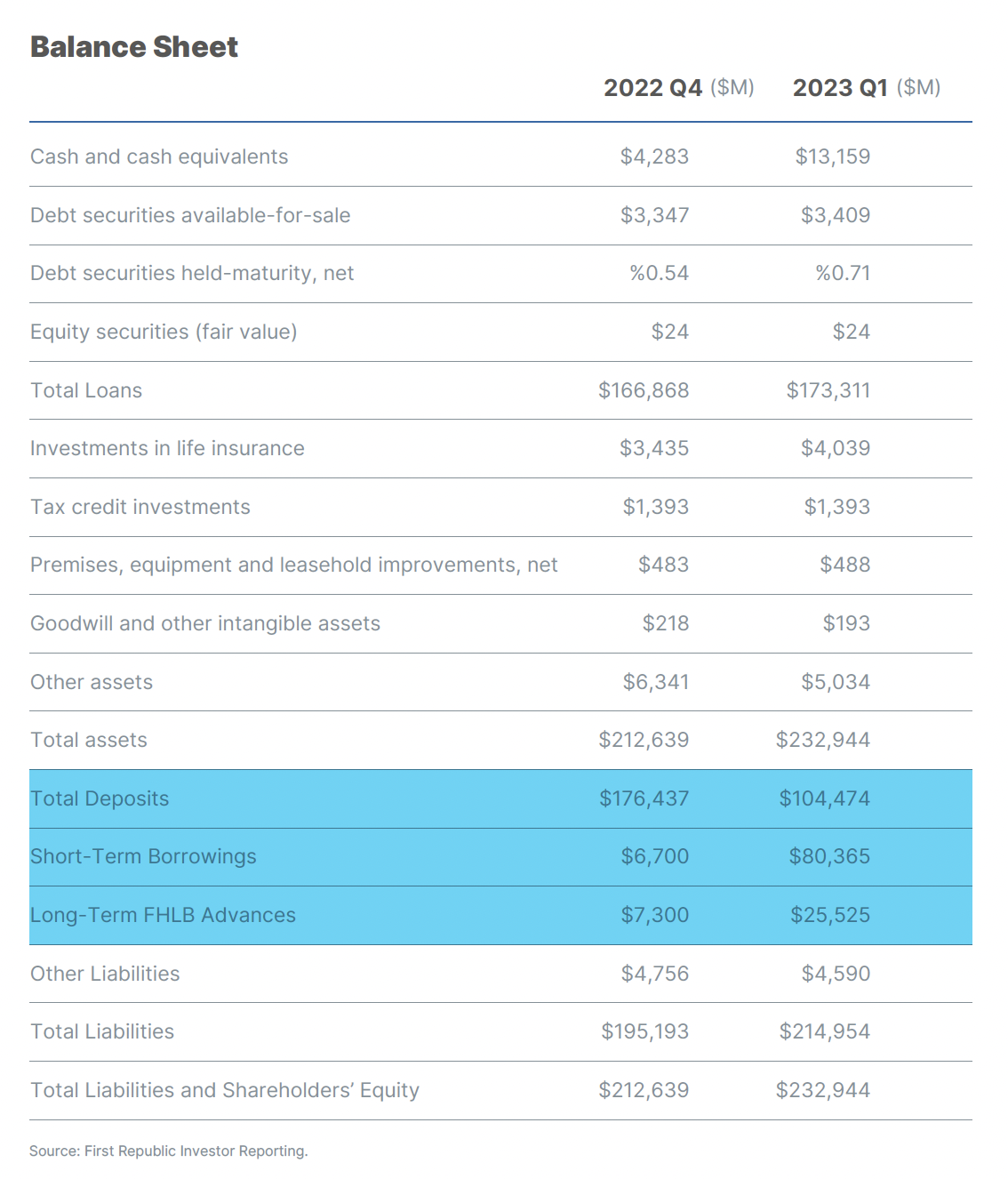

As seen in this graph (right), a run of over $70B of deposits occurred in Q1’2023. This run on the bank was historic and was 50x any liquidity demand the bank had seen in the past based on the confidence of the Asset Liability Committee (ALCO) to rely on a $1.5B credit facility from the Federal Home Loan Bank. The bank survived Q1’2023 and lived to fight another quarter thanks to the surge of $30B in deposits provided by a consortium of 11 banks led by JPMorgan, Citigroup and Wells Fargo in the middle of March.

Live to fight another quarter

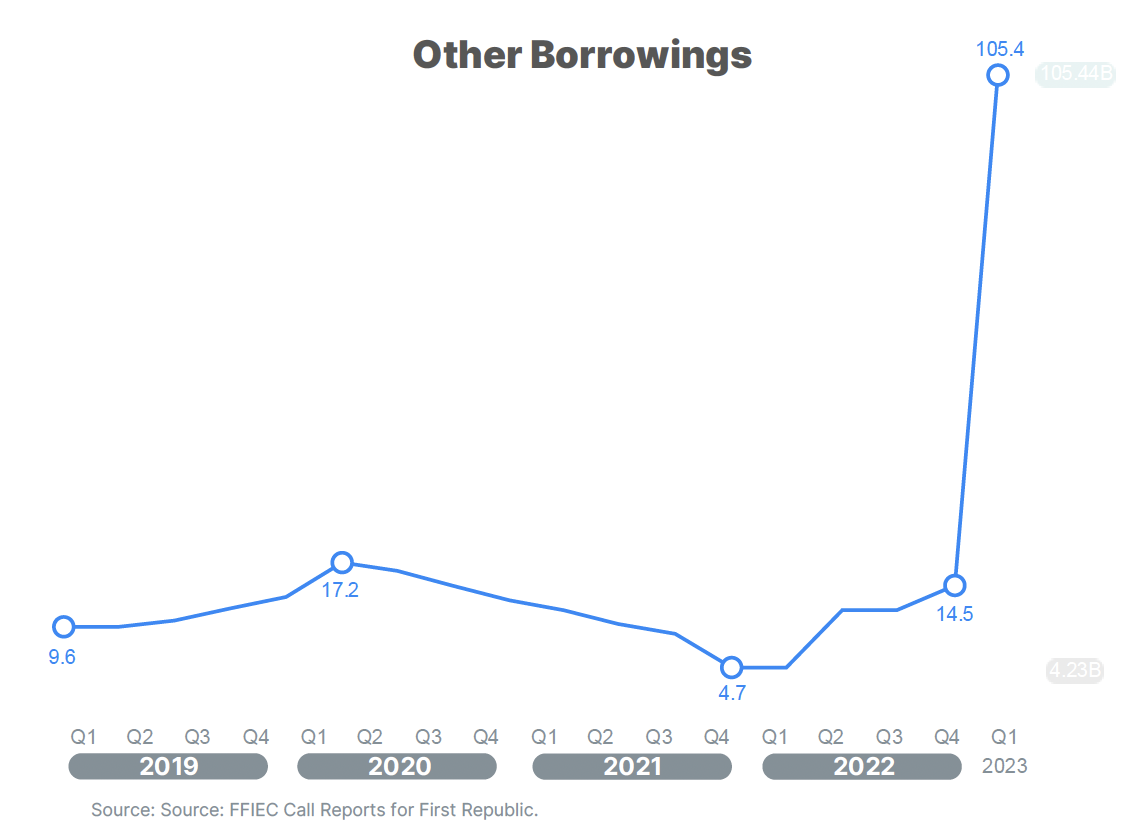

The other borrowings of First Republic skyrocketed when faced with deposit withdrawals and an illiquid loan portfolio mostly comprised of mortgage loans. First Republic went to the Federal home Loan Bank to borrow $35B and then borrowed $77.3B from other sources including the consortium of banks referenced previously. The majority of these borrowings occurred late in the 1st quarter as can be seen by the average balances of Other Borrowings reported for the entire quarter were only $37.5B. We will note that the $35B of borrowings from the Federal Home Loan Bank was a far cry from the $1.5B line of credit reported in the SEC 10-Q filing from Q3’2022. How things can change in less than 6 months!

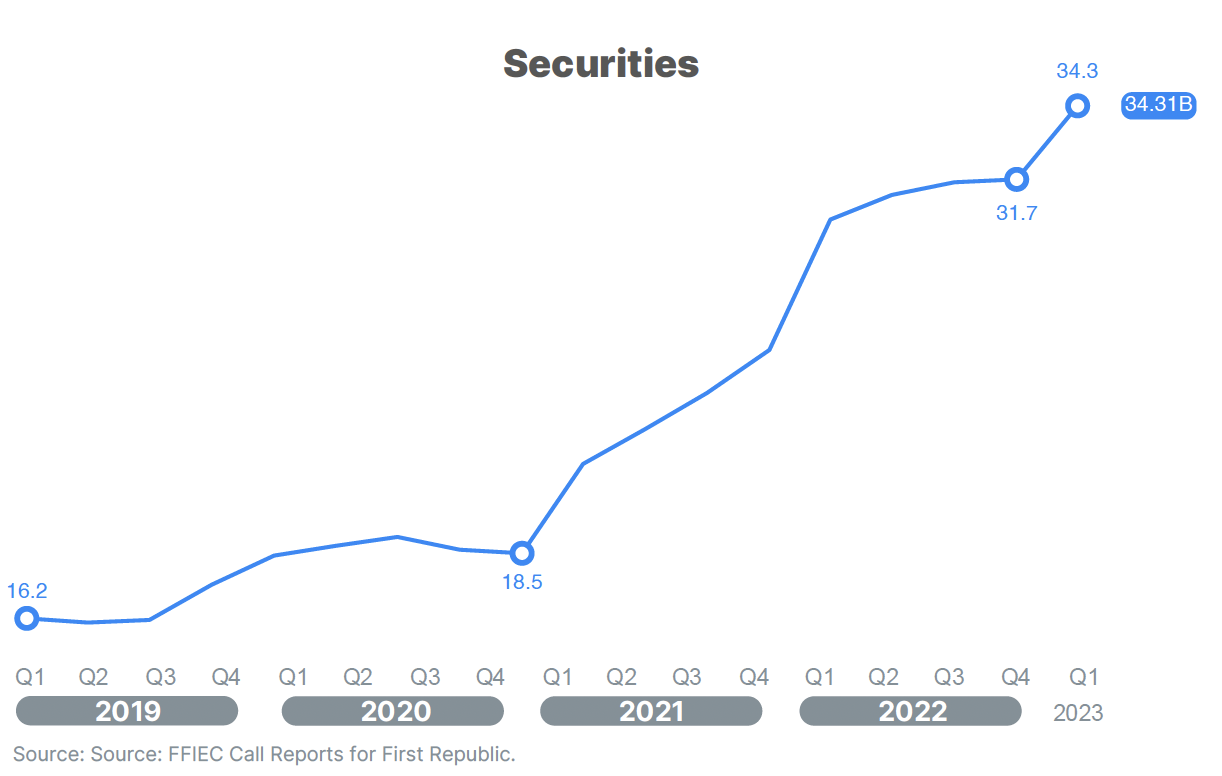

It wasn’t securities driven

While the illiquidity driven by the mortgage portfolio is the protagonist of the story, there were also significant amounts of marketable securities that were purchased from 2019 to 2022. Significantly less in magnitude than the mortgage portfolio, the securities portfolio was not the main contributing factor to the failure of First Republic. This securities portfolio was mostly composed of short-duration (< 3-month) government securities held at fair value with an Available-for-sale classification.

Lost profitability

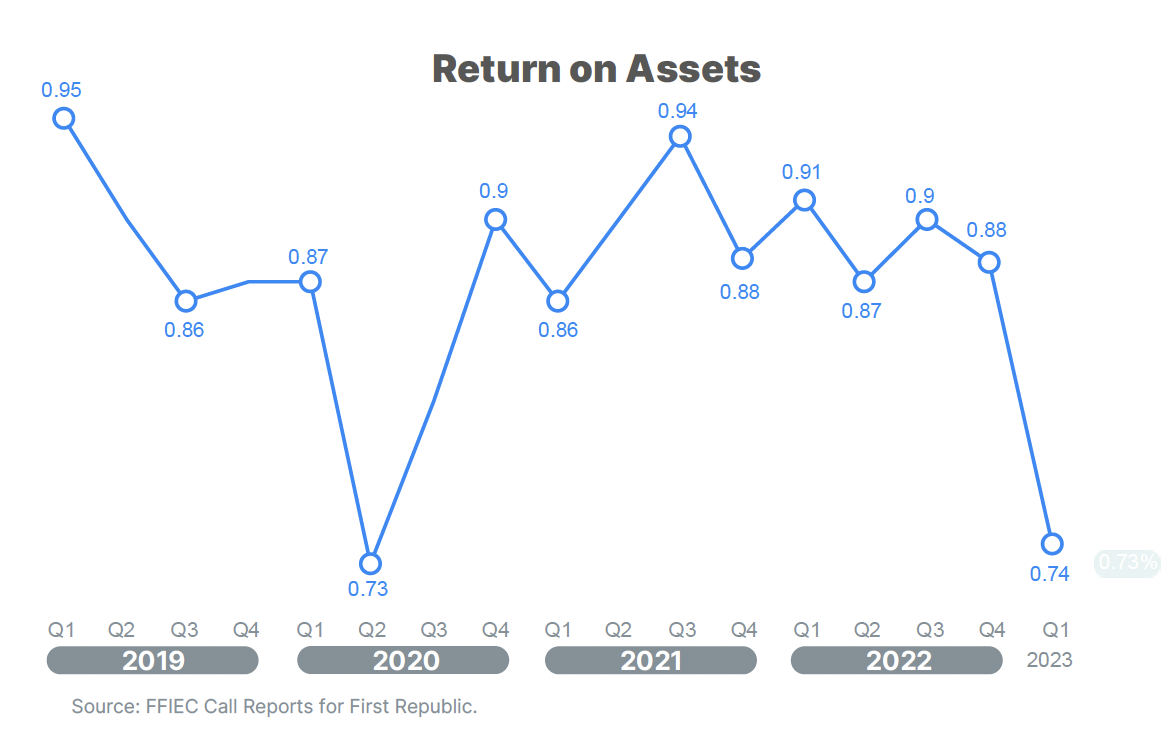

To make matters worse, while the bank was facing a liquidity crisis, their profitability was also being squeezed. With long-dated fixed-rate assets that were not re-pricing anytime soon combined with a deposit base of well-educated customers seeking yield on both demand and time deposits, the bank saw modest increases in interest income from new loan origination which did not come close to offsetting the dramatic increases in interest expense in this new world of interest rate hikes.

Capital is king and profitability is queen

In banking Capital is king (cash too but that is true for every business. Nothing eats into capital faster than income statement losses. It is said that in banking, equity holders take the first losses. In other words, leverage swings both ways – equity holders have the benefit of using depositor dollars to make a leveraged spread between deposit cost and loan yields but when the curve swings and the portfolio does not reprice quickly, then equity holders eat the first losses. As you can see, the Return on Assets for First Republic had turned south quickly and based on the high-cost borrowings from the Federal Home Loan Banks and increasing cost of funds with the remaining depositors, this was only going to get worse. Regulators hate losses – not because they hate to see shareholders take the hit – because losses impact bank capital which is the only insulator to protect depositors. While the bank squeezed by with a profitable quarter in Q1’2023, I can guarantee the income statement was a bloodbath in March 2023 and would have continued for quarters to come.

Who’s swimming naked?

Just how naked was First Republic? ~95% of their $100B mortgage portfolio was dated over 1 year in maturity with over 70% maturing in greater than 5 years. With the current interest rates, despite what prior behavior may have suggested, very few of these homeowners were going to refinance or sell a home which has a mortgage in the 3’s and 4’s when current mortgage rates are in the 5’s and 6’s. This maturity/duration risk had become a full-blown crisis and there was no easy way out – loans were non-conforming therefore no agency buyer, loans were priced at lower yields therefore no secondary market buyer, and loans were not refinancing since borrowers had rates below current market. All of this and the bank needed liquidity badly.

What a difference a quarter makes

With the passing of one quarter, First Republic went from having a balance sheet which was proportional while albeit aggressive (see prior comments on Loan-to-Deposits ratio) to having a balance sheet which was a dumpster fire. The center of the dumpster fire is focused on 3 rows: Total Deposits, Short-Term Borrowings and Long-Term FHLB Advances. Total deposits shows the beginning of the end with a dramatic run on the bank. The only saving grace to preserve First Republic for one more month was the next two rows – borrowing from 11 fellow banks and the Federal Home Loan Bank. The writing was on the wall and First Republic would never recover. Confidence was shaken in their customer base and raising a fresh $100B+ in deposits from consumers and commercial customers would be an expensive proposition in this interest rate environment.

Conclusion: In summary, risk management for banks is broader than managing credit risk and perhaps interest rate risk. In fact, we would make the case that those risks are well covered by existing functions of the bank. Unfortunately, the maturity/duration risk that is caused by a mismatch in the tenor of loans and deposits is one that must be managed by any prudent Asset Liability Committee (ALCO). By its own admission, the First Republic ALCO was asleep at the switch. Their 10-Q disclosure for. Q3’2022 states states that their ALCO meets quarterly and more frequently as needed.

It is not acceptable to only require the ALCO to meet four times per year – ALCO should meet much more frequently than quarterly and the members of the committee should be receiving signal intelligence at least daily on the deposits and withdrawal activity. There should be a regular monitoring of duration mismatch that exists between the deposits and loans of the bank and the bank should assess the cost of both interest rate derivatives to hedge the interest rate risk component of this mismatch (deposits repricing in a higher rate environment before loans reprice) as well as the cost and feasibility of match-funding long-term loans. We recognize that 3+ year loans are very difficult to practically match-fund which is why many of these loans are packaged and securitized by government agency lenders and then sold to institutional investors. First Republic’s choice to focus their marketing and sales of loans to the jumbo mortgage products prevented the use of the agency or secondary markets for conforming mortgages. Bank reporting is transparent but it lacks an ease-of-use for the average customer or investor. Visbanking provides a service to quickly distill years of bank reporting into simple easy-to-understand reports. If we can help you in assessing the risks with your preferred banking institution reach out to our Founder, Brian at brian@visbanking.com

1. From Q3’2022 10-Q Filing from First Republic

Q3’2022 10-Q Note on Liquidity – Liquidity

A financial institution must maintain and manage liquidity to ensure it has the ability to meet its financial obligations. These obligations include: the payment of deposits on demand or at their contractual maturity; the repayment of borrowings as they mature; the payment of lease obligations as they become due; the ability to fund new and existing loans and other funding commitments; and the ability to take advantage of new business opportunities. Liquidity needs can be met by either reducing assets or increasing liabilities. Our most liquid assets consist of cash, amounts due from banks and federal funds sold and available for sale securities.

Regulatory authorities require us to maintain certain liquidity ratios in order for funds to be available to satisfy commitments to borrowers and the demands of depositors. In response to these requirements, we have formed an asset/liability committee (“ALCO”), comprised of certain members of Republic’s Board of Directors and senior management to monitor such ratios. The ALCO is responsible for managing the liquidity position and interest sensitivity. That committee’s primary objective is to maximize net interest income while configuring Republic’s interest-sensitive assets and liabilities to manage interest rate risk and provide adequate liquidity for projected needs. The ALCO meets on a quarterly basis or more frequently if deemed necessary.

Our target and actual liquidity levels are determined by comparisons of the estimated repayment and marketability of interest-earning assets with projected future outflows of deposits and other liabilities. Our most liquid assets, comprised of cash and cash equivalents on the balance sheet, totaled $52.5 million at September 30, 2022, compared to $118.9 million at December 31, 2021. Loan maturities and repayments are another source of asset liquidity. At September 30, 2022, Republic estimated that more than $170.0 million of loans would mature or repay in the six-month period ending March 31, 2023. Additionally, a significant portion of our investment securities are available to satisfy liquidity requirements through sales on the open market or by pledging as collateral to access credit facilities. At September 30, 2022, we had outstanding commitments (including unused lines of credit and letters of credit) of $597.4 million. Certificates of deposit scheduled to mature in one year totaled $93.4 million at September 30, 2022. We anticipate that we will have sufficient funds available to meet all current commitments.

Daily funding requirements have historically been satisfied by generating core deposits and certificates of deposit with competitive rates, buying federal funds, or utilizing the credit facilities of the FHLB. We have established a line of credit with the FHLB of Pittsburgh. Our maximum borrowing capacity with the FHLB was $1.5 billion at September 30, 2022. At September 30, 2022 and December 31, 2021, we had no outstanding term borrowings with the FHLB. At September 30, 2022, we had outstanding overnight borrowings totaling $442.5 million. We had no outstanding overnight borrowings at December 31, 2021. As of September 30, 2022 and December 31, 2021, the FHLB had issued letters of credit, on Republic’s behalf, totaling $100.0 million against our available credit line. Subsequent to September 30, 2022 and through the date of this report, outstanding overnight borrowings have increased by approximately $323.2 million. The letters of credit remain undrawn through the date of this report. We also established a Fed Funds line of credit with Zions Bank of $15.0 million to assist in managing

Disclaimer

The information provided in these materials is for general informational purposes only and is based on sources believed to be reliable. No content, including any data, research, model, software, or other application or output therefrom, may be modified, reverse engineered, reproduced, or distributed in any form by any means without the prior written permission of VB Inc. or its affiliates. The content shall not be used for any unlawful or unauthorized purposes.

VB Inc. and any third-party providers do not guarantee the accuracy, completeness, timeliness, or availability of the content. VB Inc. is not responsible for any errors or omissions, regardless of the cause, or for any results obtained from the use of the content. The content is provided on an “as is” basis. VB Inc. DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION.

In no event shall VB Inc. be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the content even if advised of the possibility of such damages.

The opinions, quotes, and analyses provided by VB Inc. are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.